Statistiques de base

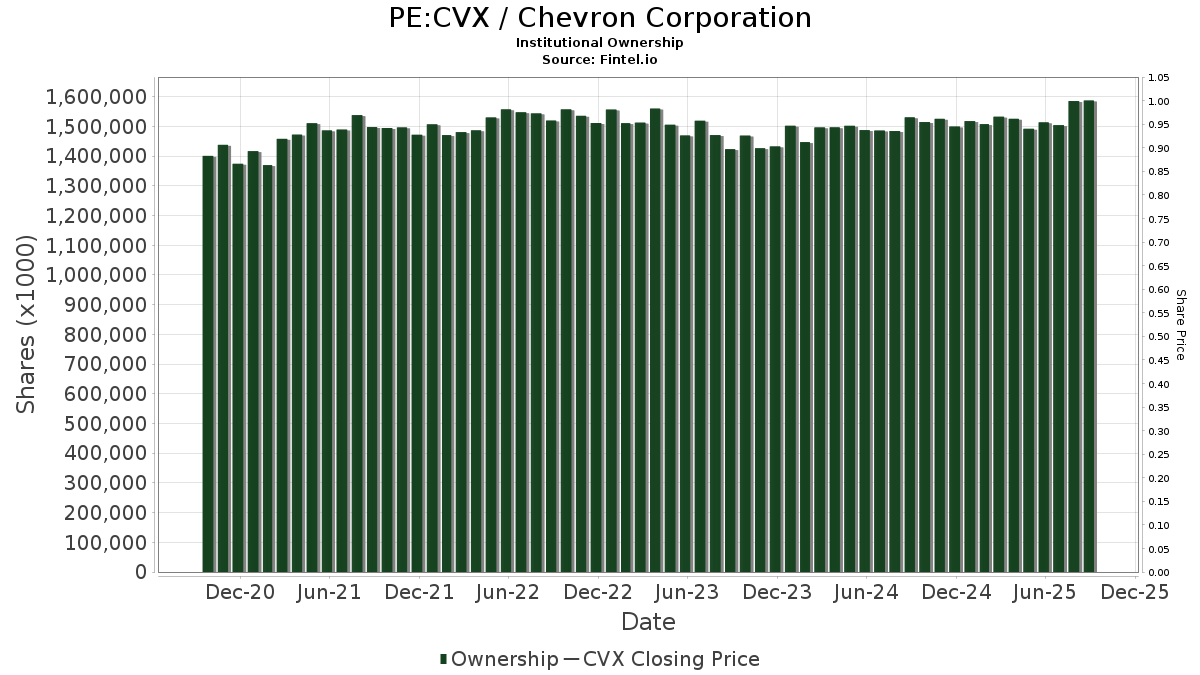

| Actions institutionnelles (Long) | 1 586 891 401 - 78,20% (ex 13D/G) - change of 71,87MM shares 4,74% MRQ |

| Valeur institutionnelle (Long) | $ 208 200 923 USD ($1000) |

Participation institutionnels et actionnaires

Chevron Corporation (PE:CVX) détient 5010 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 1,587,759,028 actions. Les principaux actionnaires incluent Vanguard Group Inc, State Street Corp, Berkshire Hathaway Inc, BlackRock, Inc., Kingstone Capital Partners Texas, LLC, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, VFINX - Vanguard 500 Index Fund Investor Shares, Geode Capital Management, Llc, Charles Schwab Investment Management Inc, and Morgan Stanley .

Chevron Corporation (BVL:CVX) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

Important Note

In an effort to reduce load times for our mobile users, we are testing some ways to deliver lighter pages.

In this first test, we will deliver only the most recent 750 transactions (out of 5513 for this stock). If you are interested in loading *all* the transactions for this company, click the "load all" button below. This is just a test and if you don't like it, please let us know by submitting some gentle feedback via the link at the bottom of this page.

Load All| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-15 | 13F | Alpha Omega Wealth Management LLC | 76 457 | 1,22 | 10 948 | -13,37 | ||||

| 2025-07-21 | 13F | Stock Yards Bank & Trust Co | 282 492 | -1,12 | 40 450 | -15,36 | ||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 21 246 | 12,51 | 3 253 | 26,87 | ||||

| 2025-08-14 | 13F | 10Elms LLP | 200 | 0,00 | 29 | -15,15 | ||||

| 2025-08-28 | NP | SPGM - SPDR(R) Portfolio MSCI Global Stock Market ETF | 22 041 | 2,96 | 3 156 | -11,87 | ||||

| 2025-08-11 | 13F | Tower Bridge Advisors | 57 875 | -2,47 | 8 287 | -16,52 | ||||

| 2025-08-06 | 13F | Agf Management Ltd | 47 976 | 53,39 | 6 870 | 31,29 | ||||

| 2025-05-29 | NP | KNGAX - CBOE Vest S&P 500 Dividend Aristocrats Target Income Fund Class A Shares | Short | -12 | -100,19 | -1 | -100,11 | |||

| 2025-06-25 | NP | COHOX - Coho Relative Value Equity Fund Advisor Class Shares | 33 054 | -15,49 | 4 497 | -22,93 | ||||

| 2025-07-11 | 13F | Adirondack Trust Co | 16 097 | 7,63 | 2 305 | -7,88 | ||||

| 2025-07-21 | 13F | Hudson Valley Investment Advisors Inc /adv | 21 596 | -5,16 | 3 092 | -18,82 | ||||

| 2025-07-30 | 13F | Citizens & Northern Corp | 8 041 | -8,16 | 1 151 | -21,38 | ||||

| 2025-08-14 | NP | BVPIX - Baywood ValuePlus Fund Institutional Shares | 700 | 7,69 | 100 | -7,41 | ||||

| 2025-08-05 | 13F | Fullcircle Wealth Llc | 12 395 | 5,52 | 1 872 | 13,80 | ||||

| 2025-07-25 | 13F | Pandora Wealth, Inc. | 3 065 | 0,00 | 439 | -14,45 | ||||

| 2025-08-13 | 13F | NEOS Investment Management LLC | 131 755 | 13,18 | 18 866 | -3,13 | ||||

| 2025-08-15 | 13F | Harvest Fund Management Co., Ltd | 215 | 42,38 | 0 | |||||

| 2025-08-25 | NP | MML SERIES INVESTMENT FUND - MML Equity Index Fund Class I | 19 673 | -7,05 | 2 817 | -20,45 | ||||

| 2025-07-29 | 13F | Hoese & Co LLP | 168 | 0,00 | 24 | -14,29 | ||||

| 2025-07-30 | 13F | Adams Diversified Equity Fund, Inc. | 133 500 | -3,19 | 19 116 | -17,14 | ||||

| 2025-07-22 | 13F | Red Tortoise LLC | 109 | -22,70 | 16 | -34,78 | ||||

| 2025-08-12 | 13F | SlateStone Wealth, LLC | 101 492 | 1,06 | 15 | -12,50 | ||||

| 2025-07-15 | 13F | Optima Capital Llc | 2 664 | 67,97 | 382 | 43,77 | ||||

| 2025-05-23 | NP | OHIO NATIONAL FUND INC - ON BlackRock Balanced Allocation Portfolio | 8 061 | 0,00 | 1 349 | 15,51 | ||||

| 2025-08-12 | 13F | Aldebaran Capital, Llc | 27 865 | -1,36 | 3 990 | -15,58 | ||||

| 2025-08-12 | 13F | Wayfinding Financial, LLC | 3 939 | 0,97 | 1 | |||||

| 2025-06-26 | NP | LQAI - LG QRAFT AI-Powered U.S. Large Cap Core ETF | 220 | 494,59 | 30 | 480,00 | ||||

| 2025-07-23 | 13F | WESPAC Advisors, LLC | 1 786 | 0,06 | 256 | -14,43 | ||||

| 2025-05-29 | NP | BEGIX - Sterling Capital Equity Income Fund Institutional Class | 193 782 | -9,80 | 32 418 | 4,18 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/AB Dynamic Aggressive Growth Portfolio Class IB | 11 253 | 0,00 | 1 611 | -14,40 | ||||

| 2025-07-22 | 13F | Carolina Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Canopy Partners, LLC | 6 728 | -3,19 | 963 | -17,13 | ||||

| 2025-08-13 | 13F | Bare Financial Services, Inc | 188 | 5,62 | 27 | -10,34 | ||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 39 424 | -33,96 | 5 645 | -43,48 | ||||

| 2025-08-11 | 13F | Pin Oak Investment Advisors Inc | 12 497 | -1,90 | 2 | 0,00 | ||||

| 2025-07-14 | 13F | Westend Capital Management LLC | 551 | -55,20 | 79 | -61,95 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 2 857 326 | -4,24 | 409 140 | -18,04 | ||||

| 2025-06-26 | NP | HAVGX - HAVERFORD QUALITY GROWTH STOCK FUND Haverford Quality Growth Stock Fund | 24 541 | 0,00 | 3 339 | -8,80 | ||||

| 2025-08-04 | 13F | REDW Wealth LLC | 1 469 | 1,80 | 210 | -12,86 | ||||

| 2025-08-14 | 13F | Clark Capital Management Group, Inc. | 325 769 | -32,24 | 46 647 | -42,00 | ||||

| 2025-06-25 | NP | ILCV - iShares Morningstar Large-Cap Value ETF | 68 670 | -0,96 | 9 343 | -9,68 | ||||

| 2025-07-16 | 13F | ORG Partners LLC | 9 171 | 3,02 | 1 270 | -7,97 | ||||

| 2025-08-14 | 13F | Brevan Howard Capital Management LP | 200 526 | 3 717,36 | 28 713 | 3 170,27 | ||||

| 2025-07-18 | 13F | Founders Capital Management | 35 470 | 0,69 | 5 079 | -13,83 | ||||

| 2025-03-12 | 13F/A | Private Capital Management Llc | 5 628 | 98,17 | 880 | 96,43 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 143 326 | 26,85 | 20 525 | 8,57 | ||||

| 2025-05-15 | 13F | Two Sigma Securities, Llc | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP JPMorgan Select Mid Cap Value Managed Volatility Fund Standard Class | 2 848 | 4,48 | 408 | -10,75 | ||||

| 2025-08-12 | 13F | Hillsdale Investment Management Inc. | 6 100 | 209,64 | 873 | 165,35 | ||||

| 2025-08-13 | 13F | Alpha Family Trust | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Argonautica Private Wealth Management, Inc | 13 791 | -4,67 | 1 975 | -18,43 | ||||

| 2025-07-22 | 13F | Signature Wealth Management Partners, LLC | 3 635 | 2,97 | 520 | -11,86 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/Franklin Rising Dividends Portfolio Class IB | 27 932 | 0,55 | 4 000 | -13,94 | ||||

| 2025-08-13 | 13F | Crescent Grove Advisors, LLC | 2 992 | -14,32 | 428 | -26,71 | ||||

| 2025-08-25 | NP | SBSPX - QS S&P 500 Index Fund Class A | 20 357 | -0,07 | 2 915 | -14,47 | ||||

| 2025-04-30 | 13F | Brown Financial Advisory | Put | 1 522 | 320,44 | |||||

| 2025-08-12 | 13F | Evelyn Partners Investment Management (Europe) Ltd | 1 410 | -81,16 | 207 | -14,46 | ||||

| 2025-08-12 | 13F | Associated Banc-corp | 164 689 | 2,49 | 23 582 | -12,28 | ||||

| 2025-08-12 | 13F | Catalyst Funds Management Pty Ltd | 18 200 | 170,83 | 2 606 | 131,85 | ||||

| 2025-07-28 | 13F | Tower Wealth Partners, Inc. | 2 952 | -6,70 | 423 | -20,23 | ||||

| 2025-08-04 | 13F | GAM Holding AG | 8 385 | -25,09 | 1 201 | -35,90 | ||||

| 2025-08-05 | 13F | Wellington Shields & Co., LLC | 12 476 | -3,11 | 1 786 | -17,05 | ||||

| 2025-08-27 | NP | VTMFX - Vanguard Tax-Managed Balanced Fund Admiral Shares | 135 342 | -0,00 | 19 380 | -14,41 | ||||

| 2025-07-18 | 13F | Ewa, Llc | 1 401 | 10,49 | 201 | -5,66 | ||||

| 2025-05-15 | 13F | Cyrus J. Lawrence, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Ellenbecker Investment Group | 3 498 | -0,57 | 501 | -14,97 | ||||

| 2025-08-05 | 13F | Hunter Associates Investment Management Llc | 21 912 | 1,74 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Bontempo Ohly Capital Mgmt Llc | 17 950 | 3,94 | 2 570 | -11,01 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 16 513 | -33,97 | 2 364 | -43,49 | ||||

| 2025-08-27 | NP | HIGJX - Carillon Eagle Growth & Income Fund Class I | 71 665 | -29,59 | 10 262 | -39,73 | ||||

| 2025-08-14 | 13F | Avant Capital LLC | 3 110 | 2,00 | 445 | -12,75 | ||||

| 2025-07-28 | 13F | Innova Wealth Partners | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 1 719 031 | -6,63 | 246 | -19,87 | ||||

| 2025-06-04 | 13F | Legacy Capital Wealth Management, Llc | 11 503 | 1 666 | ||||||

| 2025-07-22 | 13F | Wealthcare Capital Partners, LLC | 3 697 | -0,27 | 529 | -14,68 | ||||

| 2025-07-21 | 13F | Creative Capital Management Investments LLC | 628 | 0,00 | 90 | -15,24 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 65 798 | -31,31 | 9 422 | -41,21 | ||||

| 2025-05-27 | NP | AQEIX - LKCM Aquinas Catholic Equity Fund | 6 500 | 0,00 | 1 087 | 15,52 | ||||

| 2025-07-29 | 13F | Madison Wealth Partners, Inc | 2 548 | 0,08 | 365 | -14,35 | ||||

| 2025-07-28 | 13F | Mowery & Schoenfeld Wealth Management, LLC | 750 | 10,29 | 107 | -5,31 | ||||

| 2025-08-12 | 13F | Harbor Advisory Corp /ma/ | 10 742 | -2,79 | 1 538 | -16,77 | ||||

| 2025-04-18 | 13F | Wolf Group Capital Advisors | 1 382 | 231 | ||||||

| 2025-07-17 | 13F | Guardian Investment Management | 17 778 | -1,11 | 2 546 | -15,36 | ||||

| 2025-08-05 | 13F | Sulzberger Capital Advisors, Inc. | 2 064 | -0,96 | 296 | -15,23 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 9 057 | -7,25 | 1 297 | -20,64 | ||||

| 2025-08-08 | 13F | Woodley Farra Manion Portfolio Management Inc | 229 436 | 0,10 | 32 853 | -14,32 | ||||

| 2025-07-17 | 13F | Independence Bank of Kentucky | 40 545 | -0,11 | 5 806 | -14,51 | ||||

| 2025-08-14 | 13F | Paragon Private Wealth Management, LLC | 3 791 | -22,41 | 543 | -33,66 | ||||

| 2025-08-01 | 13F | Strategic Financial Services, Inc, | 2 632 | -1,13 | 377 | -15,51 | ||||

| 2025-08-14 | 13F | Broadleaf Partners, LLC | 1 953 | 0,00 | 280 | -14,42 | ||||

| 2025-07-22 | 13F | Appleton Partners Inc/ma | 2 769 | -24,84 | 0 | |||||

| 2025-07-30 | 13F | Cornerstone Advisory, LLC | 5 929 | 14,90 | 849 | 21,46 | ||||

| 2025-08-04 | 13F | AdvisorShares Investments LLC | 3 318 | 27,62 | 475 | 8,45 | ||||

| 2025-07-09 | 13F | Central Bank & Trust Co | 5 638 | 1,86 | 807 | -12,76 | ||||

| 2025-07-15 | 13F | Armis Advisers, LLC | 11 453 | 40,82 | 1 741 | 47,04 | ||||

| 2025-07-29 | 13F | Unison Advisors LLC | 18 116 | 1,21 | 2 594 | -13,36 | ||||

| 2025-08-13 | 13F | Avestar Capital, LLC | 11 225 | 3,11 | 1 607 | -11,75 | ||||

| 2025-07-28 | 13F | ForthRight Wealth Management, LLC | 1 492 | 0,00 | 214 | -14,46 | ||||

| 2025-07-29 | 13F | Schubert & Co | 3 274 | 11,63 | 469 | -4,49 | ||||

| 2025-08-25 | NP | MDDAX - MassMutual Select Diversified Value Fund Class A | 46 900 | -2,29 | 6 716 | -16,37 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 9 958 | 0,71 | 1 426 | -13,85 | ||||

| 2025-06-25 | NP | DVY - iShares Select Dividend ETF | 1 809 940 | 31,24 | 246 260 | 19,69 | ||||

| 2025-07-24 | 13F | Lindenwold Advisors | 11 071 | -26,47 | 1 585 | -37,05 | ||||

| 2025-07-17 | 13F | HCR Wealth Advisors | 20 113 | -0,03 | 2 880 | -14,41 | ||||

| 2025-08-19 | 13F | Wealth Group, Ltd. | 18 634 | -15,59 | 3 | -33,33 | ||||

| 2025-07-08 | 13F | Apella Capital, LLC | 14 680 | 40,12 | 2 164 | 41,47 | ||||

| 2025-07-16 | 13F | Exeter Financial, LLC | 26 666 | 0,05 | 3 818 | -14,36 | ||||

| 2025-08-07 | 13F | 1620 Investment Advisors, Inc. | 7 875 | 1,44 | 1 128 | -13,17 | ||||

| 2025-06-30 | NP | LGDX - Intech S&P Large Cap Diversified Alpha ETF | 24 | 3 | ||||||

| 2025-04-23 | NP | Voya Global Advantage & Premium Opportunity Fund | 1 501 | -2,09 | 238 | -4,03 | ||||

| 2025-07-16 | 13F | Motive Wealth Advisors | 1 440 | 14,38 | 206 | -1,90 | ||||

| 2025-06-20 | NP | RVRB - Reverb ETF | 150 | 0,00 | 20 | -9,09 | ||||

| 2025-05-30 | NP | PCFIX - PIMCO RAE PLUS Small Fund Institutional Class | 309 | -85,12 | 52 | -83,00 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 95 607 | -68,57 | 13 690 | -73,10 | ||||

| 2025-06-06 | NP | CCOR - Core Alternative ETF | 11 215 | -7,47 | 1 526 | -15,65 | ||||

| 2025-07-25 | 13F | Asset Planning,Inc | 9 642 | 0,49 | 1 381 | -14,02 | ||||

| 2025-07-09 | 13F | Westshore Wealth, LLC | 1 604 | 0,00 | 230 | -14,55 | ||||

| 2025-07-11 | 13F | Essex Savings Bank | 132 898 | -0,34 | 19 030 | -14,70 | ||||

| 2025-07-21 | 13F | Patriot Financial Group Insurance Agency, LLC | 10 051 | 4,34 | 1 439 | -10,68 | ||||

| 2025-08-11 | 13F | Greenland Capital Management LP | Put | 5 500 | -45,00 | 788 | -52,93 | |||

| 2025-07-09 | 13F | Gateway Investment Advisers Llc | 401 147 | -3,25 | 57 440 | -17,19 | ||||

| 2025-07-30 | 13F | OMC Financial Services LTD | 6 600 | -9,68 | 945 | -22,67 | ||||

| 2025-08-12 | 13F | Eisler Capital Management Ltd. | 1 213 | -65,90 | 174 | -70,88 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Eisler Capital Management Ltd. | Call | 200 500 | -4,66 | 28 718 | -18,34 | |||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 33 957 | -7,19 | 4 862 | -20,56 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-12 | 13F | Eisler Capital Management Ltd. | Put | 331 200 | -40,72 | 47 438 | -49,23 | |||

| 2025-07-22 | 13F | Aquire Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Jericho Financial, Llp | 30 968 | 1,39 | 4 434 | -13,21 | ||||

| 2025-08-01 | 13F | Delta Investment Management, LLC | 17 585 | -1,35 | 2 518 | -15,57 | ||||

| 2025-08-14 | 13F | Blue Capital, Inc. | 4 641 | -2,62 | 665 | -3,77 | ||||

| 2025-08-07 | 13F | Meeder Asset Management Inc | 674 | 11,59 | 97 | -4,95 | ||||

| 2025-07-31 | 13F | Moser Wealth Advisors, LLC | 37 | 5 | ||||||

| 2025-08-06 | 13F | Long Run Wealth Advisors, LLC | 1 945 | 7,64 | 278 | -7,95 | ||||

| 2025-08-11 | 13F | Synergy Investment Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Columbia River Financial Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Adams Natural Resources Fund, Inc. | 510 771 | -3,00 | 73 137 | -16,97 | ||||

| 2025-08-01 | 13F | Shilanski & Associates, Inc. | 3 718 | 0,76 | 532 | -13,78 | ||||

| 2025-06-26 | NP | Managed Account Series - BlackRock GA Dynamic Equity Fund Class K | 57 882 | -15,19 | 7 875 | -22,65 | ||||

| 2025-05-13 | 13F | Roanoke Asset Management Corp/ Ny | 6 464 | -0,39 | 1 | |||||

| 2025-07-24 | 13F | Villere St Denis J & Co Llc | 207 796 | -0,60 | 29 754 | -14,92 | ||||

| 2025-08-05 | 13F | Code Waechter LLC | 5 525 | -4,97 | 791 | |||||

| 2025-08-08 | 13F | Jupiter Asset Management Ltd | 35 312 | 5 056 | ||||||

| 2025-08-11 | 13F | Buckley Wealth Management, LLC | 120 625 | 3,25 | 17 272 | -11,62 | ||||

| 2025-07-30 | NP | QDISX - Fisher Investments Institutional Group Stock Fund for Retirement Plans | 30 | 0,00 | 4 | 0,00 | ||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 695 597 | -2,13 | 99 603 | -16,23 | ||||

| 2025-08-13 | 13F | Loomis Sayles & Co L P | 2 449 | -11,72 | 351 | |||||

| 2025-07-30 | 13F | Dudley Capital Management, Llc | 43 065 | -0,20 | 6 166 | -14,57 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 98 043 | 0,94 | 14 039 | -13,60 | ||||

| 2025-08-14 | 13F | Goldstream Capital Management Ltd | 2 687 | 0,00 | 385 | -14,48 | ||||

| 2025-06-27 | NP | PEY - Invesco High Yield Equity Dividend Achievers ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 137 606 | -7,74 | 18 723 | -15,86 | ||||

| 2025-08-26 | NP | GOLDMAN SACHS VARIABLE INSURANCE TRUST - Goldman Sachs U.S. Equity Insights Fund Institutional | 11 044 | 114,07 | 1 581 | 111,65 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 53 799 | 1,34 | 7 704 | -13,25 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - U.S. Large Cap Equity Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 64 902 | 0,00 | 8 831 | -8,80 | ||||

| 2025-05-15 | 13F | Hall Laurie J Trustee | 0 | -100,00 | 0 | |||||

| 2025-06-26 | NP | TILVX - TIAA-CREF Large-Cap Value Index Fund Institutional Class | 688 197 | -6,18 | 93 636 | -14,43 | ||||

| 2025-06-27 | NP | PWV - Invesco Dynamic Large Cap Value ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 226 118 | 3,33 | 30 766 | -5,76 | ||||

| 2025-07-17 | 13F | SeaBridge Investment Advisors LLC | 3 825 | -13,99 | 548 | -26,38 | ||||

| 2025-07-11 | 13F | Lincoln Capital LLC | 1 681 | 241 | ||||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 11 556 | -6,86 | 1 655 | -20,29 | ||||

| 2025-07-18 | 13F | Victrix Investment Advisors | 2 136 | -22,13 | 306 | -31,92 | ||||

| 2025-08-14 | 13F | Doheny Asset Management /ca | 10 013 | 0,00 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | LRT Capital Management, LLC | 18 900 | 0,00 | 2 706 | -14,39 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | Call | 100 | 0,00 | 14 | -12,50 | |||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 33 706 | 0,68 | 4 826 | -13,82 | ||||

| 2025-08-01 | 13F | Pettee Investors, Inc. | 14 082 | 0,00 | 2 016 | -14,39 | ||||

| 2025-08-12 | 13F | Mmbg Investment Advisors Co. | 6 050 | 132,69 | 866 | 99,54 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 755 | -31,11 | 108 | -40,98 | ||||

| 2025-07-29 | 13F | TrueMark Investments, LLC | 29 802 | 8,83 | 4 267 | -6,83 | ||||

| 2025-08-15 | 13F | Auxier Asset Management | 26 101 | 0,00 | 3 737 | -14,41 | ||||

| 2025-07-15 | 13F | Bfsg, Llc | 20 229 | -1,65 | 2 897 | -15,81 | ||||

| 2025-08-04 | 13F | L.m. Kohn & Company | 6 844 | -7,61 | 980 | -20,90 | ||||

| 2025-08-13 | 13F | Capital Group Private Client Services, Inc. | 4 313 | -88,53 | 618 | -90,19 | ||||

| 2025-08-12 | 13F | Fortem Financial Group, Llc | 1 719 | -16,59 | 246 | -28,49 | ||||

| 2025-08-06 | 13F | BNP Paribas Asset Management Holding S.A. | 467 246 | -1,60 | 67 | -16,46 | ||||

| 2025-07-29 | NP | SIXA - 6 Meridian Mega Cap Equity ETF | 83 380 | 50,58 | 11 398 | 29,77 | ||||

| 2025-04-25 | 13F | Kieckhefer Group Llc | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Falcon Wealth Planning | 2 086 | -9,19 | 299 | -22,40 | ||||

| 2025-09-04 | 13F | Abn Amro Investment Solutions | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 30 887 | 0,33 | 4 423 | -14,14 | ||||

| 2025-08-05 | 13F | Gladius Capital Management LP | Put | 8 300 | -52,57 | 1 188 | -59,41 | |||

| 2025-08-05 | 13F | Gladius Capital Management LP | 1 158 | -73,90 | 166 | -77,76 | ||||

| 2025-07-15 | 13F | Cranbrook Wealth Management, LLC | 1 157 | 1,49 | 166 | -13,16 | ||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 6 346 | 36,94 | 909 | 17,16 | ||||

| 2025-07-25 | 13F | Delaney Dennis R | 21 802 | 0,79 | 3 122 | -13,74 | ||||

| 2025-08-01 | 13F | Fairfield Financial Advisors, LTD | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Sawgrass Asset Management Llc | 7 927 | -0,01 | 1 135 | -14,40 | ||||

| 2025-08-08 | 13F | Atlantic Trust, LLC | 16 933 | 10,05 | 2 425 | -5,83 | ||||

| 2025-07-22 | 13F | Coastal Investment Advisors, Inc. | 3 383 | -55,53 | 484 | -61,95 | ||||

| 2025-07-18 | 13F | Brookmont Capital Management | 10 918 | -47,68 | 1 563 | -55,21 | ||||

| 2025-07-29 | 13F | Financial Advisors, LLC | 2 241 | 0,04 | 321 | -14,44 | ||||

| 2025-08-14 | 13F | Vista Private Wealth Partners. LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Prosperity Consulting Group, LLC | 10 692 | -8,18 | 1 531 | -21,42 | ||||

| 2025-05-30 | NP | PSPTX - PIMCO StocksPLUS Absolute Return Fund Institutional | 3 260 | -89,57 | 545 | -87,96 | ||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 1 507 | 16,64 | 216 | -0,46 | ||||

| 2025-07-17 | 13F | Stone Point Wealth LLC | 1 686 | 6,31 | 241 | -9,06 | ||||

| 2025-07-07 | 13F | Enterprise Bank & Trust Co | 20 868 | -1,84 | 2 988 | -15,97 | ||||

| 2025-07-14 | 13F/A | Seek First Inc. | 1 447 | 1,12 | 207 | -13,39 | ||||

| 2025-07-25 | 13F | Endowment Wealth Management, Inc. | 1 639 | -0,79 | 235 | -15,22 | ||||

| 2025-07-25 | 13F | G2 Capital Management, Llc / Oh | 1 606 | 0,00 | 230 | -14,55 | ||||

| 2025-08-13 | 13F | Portfolio Design Labs, LLC | 14 875 | -7,47 | 2 130 | -20,83 | ||||

| 2025-08-12 | 13F | Evelyn Partners Investment Management LLP | 88 593 | 19 456,95 | 11 929 | -18,86 | ||||

| 2025-07-30 | NP | ARCHX - Archer Balanced Fund | 6 300 | 0,00 | 861 | -13,81 | ||||

| 2025-08-08 | 13F | Islay Capital Management, Llc | 5 556 | 0,00 | 796 | -14,42 | ||||

| 2025-07-24 | 13F/A | TFR Capital, LLC. | 4 540 | -2,01 | 650 | -16,13 | ||||

| 2025-07-16 | 13F | Asset Allocation & Management Company, LLC | 2 900 | 0,00 | 0 | |||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP American Century Value Fund Standard Class II | 94 252 | -5,08 | 13 496 | -18,76 | ||||

| 2025-08-29 | 13F | Evolution Wealth Management Inc. | 344 | 49 | ||||||

| 2025-08-07 | 13F | Fagan Associates, Inc. | 70 187 | 1,38 | 10 050 | -13,22 | ||||

| 2025-07-10 | 13F | Marshall Financial Group LLC | 0 | -100,00 | 0 | |||||

| 2025-08-28 | NP | ELDFX - ELFUN DIVERSIFIED FUND Elfun Diversified Fund | 2 123 | -5,35 | 304 | -19,20 | ||||

| 2025-07-28 | 13F | Eq Wealth Advisors, Llc | 1 989 | 0,00 | 285 | -14,46 | ||||

| 2025-08-14 | 13F | Houlihan Financial Resource Group, Ltd. | 4 324 | 0,35 | 1 | |||||

| 2025-07-25 | 13F | Westchester Capital Management, Inc. | 932 | 0,00 | 133 | -14,19 | ||||

| 2025-07-28 | NP | SPXT - S&P 500 ex-Technology ETF | 10 080 | 4,60 | 1 378 | -9,88 | ||||

| 2025-08-15 | 13F | Cooksen Wealth, LLC | 271 | 0,00 | 39 | -9,52 | ||||

| 2025-07-24 | 13F | Cross Staff Investments Inc | 5 313 | -1,21 | 761 | -15,46 | ||||

| 2025-08-11 | 13F | Addison Capital Co | 9 813 | 18,72 | 1 405 | 1,66 | ||||

| 2025-07-09 | 13F | Graves-Light Private Wealth Management, Inc. | 39 322 | -4,85 | 5 630 | -18,56 | ||||

| 2025-08-01 | 13F | Facet Wealth, Inc. | 1 714 | 260 | ||||||

| 2025-08-13 | 13F | Haverford Trust Co | 967 665 | 0,46 | 138 560 | -14,01 | ||||

| 2025-07-31 | 13F | MQS Management LLC | 2 727 | 390 | ||||||

| 2025-08-12 | 13F | Prudential Plc | 38 587 | 355,63 | 5 525 | 290,18 | ||||

| 2025-08-29 | NP | FTWO - Strive FAANG 2.0 ETF | 8 559 | 29,27 | 1 226 | 10,66 | ||||

| 2025-07-11 | 13F | Oak Asset Management, LLC | 81 732 | 0,20 | 11 703 | -14,24 | ||||

| 2025-07-16 | 13F | First American Bank | 86 717 | 1,09 | 12 417 | -13,46 | ||||

| 2025-08-14 | 13F | Quarry LP | Call | 17 000 | 2 483 | |||||

| 2025-08-14 | 13F | Quarry LP | 170 | 24 | ||||||

| 2025-07-25 | 13F | Orca Investment Management, LLC | 1 778 | 0,00 | 255 | -14,48 | ||||

| 2025-08-27 | NP | BBVLX - Bridge Builder Large Cap Value Fund | 753 443 | 760,64 | 107 886 | 636,67 | ||||

| 2025-07-31 | 13F | Vaughan David Investments Inc/il | 328 655 | 0,91 | 47 | -12,96 | ||||

| 2025-08-13 | 13F | Greenwich Wealth Management LLC | 2 654 | -2,35 | 0 | |||||

| 2025-05-14 | 13F | Legend Financial Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Worth Asset Management, LLC | 2 110 | -21,79 | 302 | -33,04 | ||||

| 2025-07-24 | 13F | Zullo Investment Group, Inc. | 5 528 | 2,66 | 792 | -12,11 | ||||

| 2025-08-12 | 13F | Belmont Capital, LLC | 5 571 | 0,00 | 798 | -14,39 | ||||

| 2025-04-23 | 13F | Sabal Trust CO | 187 932 | -2,10 | 31 439 | 13,07 | ||||

| 2025-07-16 | 13F | American National Bank | 98 839 | 0,34 | 14 153 | -14,12 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 341 100 | -56,81 | 48 842 | -63,03 | |||

| 2025-08-05 | 13F | ADG Wealth Management Group, LLC | 8 851 | 0,00 | 1 267 | -14,39 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 327 500 | 7,20 | 46 895 | -8,24 | |||

| 2025-08-12 | 13F/A | Castellan Group, LLC | 20 405 | 10,66 | 2 922 | -5,29 | ||||

| 2025-08-05 | 13F | Cambiar Investors Llc | 259 001 | -25,43 | 37 086 | -36,17 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | 90 922 | 13 019 | ||||||

| 2025-07-18 | 13F | United Bank | 115 071 | 2,82 | 16 477 | -11,99 | ||||

| 2025-07-29 | NP | Invesco Exchange-Traded Fund Trust II - Invesco MSCI North America Climate ETF | 84 872 | 4,88 | 11 602 | -9,61 | ||||

| 2025-07-17 | 13F | Hanson & Doremus Investment Management | 5 492 | 0,00 | 1 | |||||

| 2025-07-31 | 13F | Cardinal Point Capital Management, ULC | 3 550 | 508 | ||||||

| 2025-08-14 | 13F | Utah Retirement Systems | 269 454 | -0,61 | 38 583 | -14,93 | ||||

| 2025-08-27 | NP | JNL SERIES TRUST - JNL/Mellon MSCI World Index Fund (I) | 18 703 | 80,71 | 2 678 | 54,71 | ||||

| 2025-07-21 | 13F | Credential Securities Inc. | 5 006 | -5,60 | 633 | 4,64 | ||||

| 2025-07-18 | 13F | Ami Asset Management Corp | 6 455 | -0,55 | 924 | -14,84 | ||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 2 290 | 0,00 | 328 | -14,62 | ||||

| 2025-08-11 | 13F | Harold Davidson & Associates Inc. | 2 869 | -12,34 | 411 | -25,05 | ||||

| 2025-05-14 | 13F | Groupe la Francaise | 0 | -100,00 | 0 | |||||

| 2025-08-26 | NP | INGIX - Voya U.S. Stock Index Portfolio Class I | 131 882 | 2,24 | 18 884 | -12,48 | ||||

| 2025-08-26 | 13F | Nautilus Advisors LLC | 2 261 | -8,31 | 324 | -21,60 | ||||

| 2025-07-29 | 13F | Curbstone Financial Management Corp | 13 510 | -16,15 | 1 934 | -28,24 | ||||

| 2025-06-26 | NP | DFVX - Dimensional US Large Cap Vector ETF | 29 101 | 13,29 | 3 959 | 3,31 | ||||

| 2025-06-30 | NP | AIM EQUITY FUNDS (INVESCO EQUITY FUNDS) - Invesco Oppenheimer Main Street All Cap Fund Class R6 | 123 206 | 0,00 | 16 763 | -8,80 | ||||

| 2025-07-29 | 13F | Accretive Wealth Partners, LLC | 9 893 | -0,72 | 1 417 | 4,81 | ||||

| 2025-07-21 | 13F | Trinity Legacy Partners, LLC | 38 834 | 4,67 | 5 822 | 10,23 | ||||

| 2025-08-15 | 13F | Synergy Financial Group, LTD | 2 733 | -1,41 | 391 | -15,55 | ||||

| 2025-07-14 | 13F | Argent Capital Management Llc | 165 655 | 3,29 | 23 720 | -11,59 | ||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 23 244 | -10,50 | 3 328 | -23,39 | ||||

| 2025-08-28 | NP | INDEX - S&P 500(R) Equal Weight No Load Shares | 4 538 | 2,14 | 650 | -12,65 | ||||

| 2025-04-28 | NP | LNGZ - Range Global LNG Ecosystem Index ETF | 1 065 | 369,16 | 169 | 366,67 | ||||

| 2025-08-08 | 13F | National Pension Service | 3 461 940 | 4,02 | 495 715 | -10,96 | ||||

| 2025-08-13 | 13F | Plan Group Financial, LLC | 19 970 | 9,58 | 2 859 | -6,20 | ||||

| 2025-08-12 | 13F | Cutter & CO Brokerage, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 9 393 | -50,32 | 1 357 | -57,12 | ||||

| 2025-07-24 | 13F | Kampmann Melissa S. | 17 455 | -0,98 | 2 499 | -15,23 | ||||

| 2025-07-14 | 13F | Abacus Wealth Partners, LLC | 1 883 | -7,06 | 270 | -20,41 | ||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 7 599 | -13,53 | 1 088 | -25,99 | ||||

| 2025-07-25 | 13F | Cerro Pacific Wealth Advisors LLC | 24 883 | -9,92 | 3 563 | -10,92 | ||||

| 2025-07-29 | NP | VRNIX - Vanguard Russell 1000 Index Fund Institutional Shares | 251 822 | 0,93 | 34 424 | -13,02 | ||||

| 2025-08-11 | 13F | Baldwin Investment Management, LLC | 8 610 | -1,43 | 1 233 | -15,67 | ||||

| 2025-08-13 | 13F | Hobbs Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Valmark Advisers, Inc. | 15 759 | 4,39 | 2 257 | -10,65 | ||||

| 2025-06-27 | NP | Invesco Exchange-Traded Fund Trust II - Invesco MSCI Global Climate 500 ETF | 29 177 | -29,99 | 3 970 | -36,16 | ||||

| 2025-04-09 | 13F | Selway Asset Management | 30 925 | -0,27 | 5 173 | 15,19 | ||||

| 2025-07-08 | 13F | Webster Bank, N. A. | 21 581 | 0,69 | 3 090 | -13,81 | ||||

| 2025-07-25 | 13F | Astoria Portfolio Advisors LLC. | 2 131 | 7,63 | 332 | 22,96 | ||||

| 2025-08-05 | 13F | Meixler Investment Management, Ltd. | 1 434 | -6,88 | 205 | -20,23 | ||||

| 2025-08-08 | 13F | Strategies Wealth Advisors, LLC | 3 715 | -9,76 | 532 | -22,67 | ||||

| 2025-07-18 | 13F | Newman Dignan & Sheerar, Inc. | 14 998 | -0,45 | 2 148 | -14,80 | ||||

| 2025-06-10 | NP | LFTPX - Lincoln U.S. Equity Income Maximizer Fund Class I | 933 | 0,00 | 127 | -9,35 | ||||

| 2025-07-16 | 13F | Plancorp, LLC | 11 428 | 0,04 | 1 636 | -14,35 | ||||

| 2025-08-13 | 13F | Bank Of Nova Scotia | 271 443 | 32,92 | 38 868 | 13,78 | ||||

| 2025-08-06 | 13F | Cetera Trust Company, N.A | 9 106 | 0,00 | 1 304 | -14,45 | ||||

| 2025-06-27 | NP | ERX - Direxion Daily Energy Bull 3X Shares | 146 321 | -24,43 | 19 908 | -31,08 | ||||

| 2025-07-21 | 13F | Yeomans Consulting Group, Inc. | 1 870 | -6,27 | 272 | -18,32 | ||||

| 2025-08-27 | NP | IPFCX - Poplar Forest Cornerstone Fund Investor Class | 5 000 | 16,28 | 716 | -0,56 | ||||

| 2025-07-16 | 13F | Cove Private Wealth, LLC | 11 800 | 16,39 | 1 690 | -0,35 | ||||

| 2025-07-22 | 13F | Inlight Wealth Management, LLC | 703 | -0,14 | 101 | -14,53 | ||||

| 2025-06-27 | NP | EIVPX - Parametric Volatility Risk Premium - Defensive Fund Institutional Class | 27 025 | 27,95 | 3 677 | 16,69 | ||||

| 2025-05-27 | NP | AZNAX - AllianzGI Income & Growth Fund Class A | 27 365 | -70,20 | 4 578 | -65,59 | ||||

| 2025-07-21 | 13F | Asset Advisors Investment Management, LLC | 2 757 | -5,26 | 395 | -18,93 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 145 461 | -6,29 | 22 058 | -15,05 | ||||

| 2025-08-27 | NP | Advanced Series Trust - Ast Academic Strategies Asset Allocation Portfolio | 8 500 | -10,53 | 1 217 | -23,41 | ||||

| 2025-07-11 | 13F | Bell Bank | 75 260 | 36,79 | 10 776 | 17,09 | ||||

| 2025-07-11 | 13F | Compass Ion Advisors, LLC | 5 462 | -0,47 | 782 | -14,81 | ||||

| 2025-07-22 | 13F | Financial Insights, Inc. | 0 | -100,00 | 0 | |||||

| 2025-04-17 | 13F | Great Lakes Retirement, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-30 | NP | GMLGX - GuideMark(R) Large Cap Core Fund Service Shares | 7 530 | 0,00 | 1 260 | 15,50 | ||||

| 2025-07-23 | 13F | Godsey & Gibb Associates | 132 789 | 4,84 | 19 014 | -10,26 | ||||

| 2025-08-11 | 13F | Bedell Frazier Investment Counseling, LLC | 19 474 | 6,54 | 2 788 | -8,80 | ||||

| 2025-07-30 | 13F | Parcion Private Wealth LLC | 59 687 | 5,12 | 8 547 | -10,02 | ||||

| 2025-08-28 | NP | TOPC - iShares S&P 500 3% Capped ETF | 363 | 52 | ||||||

| 2025-08-25 | NP | Eaton Vance Tax-managed Buy-write Opportunities Fund | 56 514 | 0,00 | 8 092 | -14,41 | ||||

| 2025-07-07 | 13F | Abner Herrman & Brock Llc | 93 239 | 0,70 | 13 | -13,33 | ||||

| 2025-05-12 | 13F | XY Capital Ltd | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-24 | 13F | Rice Partnership, LLC | 11 353 | 18,01 | 1 626 | 0,99 | ||||

| 2025-08-01 | 13F | James Investment Research Inc | 48 035 | -1,33 | 6 878 | -15,55 | ||||

| 2025-08-05 | 13F | EPG Wealth Management LLC | 12 428 | -1,58 | 1 780 | -15,77 | ||||

| 2025-08-27 | NP | JNL SERIES TRUST - JNL/Invesco Diversified Dividend Fund (A) | 141 523 | 12,61 | 20 265 | -3,61 | ||||

| 2025-07-31 | 13F | Peterson Wealth Services | 1 492 | -7,62 | 214 | -21,11 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 113 531 | 9,12 | 16 256 | -6,60 | ||||

| 2025-08-11 | 13F | Y.D. More Investments Ltd | 19 550 | -1,11 | 2 799 | -15,37 | ||||

| 2025-08-13 | 13F | Winslow Asset Management Inc | 11 790 | 2,03 | 2 | 0,00 | ||||

| 2025-07-28 | 13F | Copia Wealth Management | 549 | 2,04 | 79 | -13,33 | ||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 12 838 | 12,01 | 1 838 | -4,12 | ||||

| 2025-07-23 | 13F | Bellevue Asset Management, Llc | 1 285 | 0,63 | 184 | -13,62 | ||||

| 2025-08-14 | 13F | Silvercrest Asset Management Group Llc | 667 823 | -1,74 | 95 626 | -15,90 | ||||

| 2025-07-30 | NP | HLAL - Wahed FTSE USA Shariah ETF | 43 505 | -0,57 | 5 947 | -14,31 | ||||

| 2025-08-11 | 13F | Tidemark, LLC | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-14 | 13F | Godshalk Welsh Capital Management, Inc. | 10 375 | -0,60 | 1 486 | -14,95 | ||||

| 2025-08-11 | 13F | Tidemark, LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-06-18 | NP | RTDAX - Multifactor U.S. Equity Fund Class A | 13 574 | -7,21 | 1 847 | -15,40 | ||||

| 2025-07-28 | 13F | Courier Capital Llc | 53 129 | -14,41 | 7 607 | -26,74 | ||||

| 2025-08-04 | 13F | KLCM Advisors, Inc. | 27 680 | -0,33 | 3 964 | -14,70 | ||||

| 2025-08-05 | 13F | Tufton Capital Management | 66 540 | -3,53 | 10 | -99,92 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/Equity 500 Index Portfolio Class IA | 353 692 | 0,00 | 50 645 | -14,41 | ||||

| 2025-07-16 | 13F | Rebalance, Llc | 1 500 | -0,07 | 215 | -14,74 | ||||

| 2025-07-15 | 13F | Wealth Effects Llc | 15 317 | 0,37 | 2 193 | -14,07 | ||||

| 2025-08-27 | NP | DVND - Touchstone Dividend Select ETF | 4 405 | 8,74 | 631 | -6,94 | ||||

| 2025-07-25 | 13F | Prostatis Group LLC | 3 276 | -10,57 | 469 | -23,37 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 4 206 | -49,73 | 602 | -56,97 | ||||

| 2025-08-08 | 13F | Cornerstone Advisors, LLC | 117 200 | 45,77 | 16 782 | 24,77 | ||||

| 2025-06-23 | NP | UDPIX - Ultradow 30 Profund Investor Class | 3 942 | -15,95 | 536 | -23,32 | ||||

| 2025-07-07 | 13F | Somerset Trust Co | 15 066 | -0,36 | 2 157 | -14,71 | ||||

| 2025-07-29 | 13F | Stanley-Laman Group, Ltd. | 22 644 | -8,38 | 3 242 | -21,58 | ||||

| 2025-08-11 | 13F | Managed Asset Portfolios, Llc | 134 311 | 2,59 | 19 232 | -12,19 | ||||

| 2025-07-16 | 13F | Badgley Phelps Wealth Managers, LLC | 130 502 | -0,78 | 18 687 | -15,07 | ||||

| 2025-08-14 | 13F | Interval Partners, LP | 21 288 | -63,32 | 3 048 | -68,61 | ||||

| 2025-05-13 | 13F | ASB Consultores, LLC | 0 | -100,00 | 0 | |||||

| 2025-04-28 | NP | SIXL - 6 Meridian Low Beta Equity Strategy ETF | 5 562 | 4,57 | 882 | 2,44 | ||||

| 2025-06-24 | NP | FNCRX - Franklin Natural Resources Fund Class C | 39 100 | -35,90 | 5 320 | -41,55 | ||||

| 2025-07-28 | NP | Neuberger Berman Mlp Income Fund Inc. | 100 000 | 25,00 | 13 670 | 7,73 | ||||

| 2025-07-30 | NP | OMAH - VistaShares Target 15 Berkshire Select Income ETF | 72 477 | 9 908 | ||||||

| 2025-05-15 | 13F | Concorde Asset Management, LLC | 2 570 | 33,02 | 388 | 39,07 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 3 903 | -2,03 | 1 | |||||

| 2025-08-27 | NP | PFPFX - Poplar Forest Partners Fund Class A | 83 400 | 12,40 | 11 942 | -3,79 | ||||

| 2025-07-29 | 13F | Quotient Wealth Partners, LLC | 41 202 | -3,84 | 5 900 | -17,70 | ||||

| 2025-07-10 | 13F | Rockland Trust Co | 27 085 | -7,09 | 3 878 | -20,47 | ||||

| 2025-07-14 | 13F | Steigerwald, Gordon & Koch Inc. | 1 908 | -7,74 | 273 | -20,87 | ||||

| 2025-06-26 | NP | CAMX - Cambiar Aggressive Value ETF | 8 600 | -10,88 | 1 170 | -18,69 | ||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | 1 534 790 | -24,39 | 219 767 | -35,28 | ||||

| 2025-08-28 | NP | DGT - SPDR(R) Global Dow ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 16 457 | 20,85 | 2 356 | 3,42 | ||||

| 2025-08-12 | 13F | Wealth Dimensions Group, Ltd. | 7 722 | 8,11 | 1 106 | -7,45 | ||||

| 2025-08-13 | 13F | Te Ahumairangi Investment Management Ltd | 17 929 | 14,94 | 3 | 0,00 | ||||

| 2025-08-27 | NP | SEASONS SERIES TRUST - SA Columbia Focused Value Portfolio Class 2 | 47 693 | 7,32 | 6 829 | -8,14 | ||||

| 2025-08-14 | 13F | Axa S.a. | 107 985 | -56,88 | 15 462 | -63,09 | ||||

| 2025-07-18 | 13F | CHURCHILL MANAGEMENT Corp | 12 278 | -2,23 | 1 758 | -16,29 | ||||

| 2025-05-14 | 13F | West Chester Capital Advisors, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-26 | NP | IVGAX - VY(R) Invesco Growth and Income Portfolio Class ADV | 15 590 | -0,68 | 2 232 | -14,97 | ||||

| 2025-08-28 | NP | IVV - iShares Core S&P 500 ETF | 19 227 597 | -5,43 | 2 753 200 | -19,05 | ||||

| 2025-07-30 | 13F | Loring Wolcott & Coolidge Fiduciary Advisors Llp/ma | 72 296 | -0,40 | 10 352 | 4,34 | ||||

| 2025-07-14 | 13F | Edge Wealth Management LLC | 5 154 | 1,14 | 738 | -13,38 | ||||

| 2025-07-24 | 13F | VanderPol Investments L.L.C. | 1 768 | -1,94 | 253 | -15,95 | ||||

| 2025-07-14 | 13F | BetterWealth, LLC | 2 371 | -2,39 | 340 | -16,50 | ||||

| 2025-08-14 | 13F | Quartz Partners, LLC | 1 482 | 212 | ||||||

| 2025-08-04 | 13F | Bordeaux Wealth Advisors LLC | 5 357 | -1,63 | 767 | -15,81 | ||||

| 2025-08-08 | 13F | eCIO, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Aspen Wealth Strategies, LLC | 8 083 | -1,15 | 1 157 | -15,36 | ||||

| 2025-07-24 | 13F | Conning Inc. | 255 628 | 8,15 | 36 603 | -7,43 | ||||

| 2025-08-14 | 13F | Inspire Trust Co, N.a. | 41 000 | -22,64 | 5 871 | -33,79 | ||||

| 2025-07-25 | 13F | Means Investment Co., Inc. | 43 747 | 4,45 | 6 264 | -10,59 | ||||

| 2025-08-12 | 13F | Quantum Private Wealth, LLC | 3 696 | 2,70 | 529 | -12,13 | ||||

| 2025-08-27 | 13F/A | Impala Asset Management LLC | 10 000 | 1 432 | ||||||

| 2025-08-08 | 13F | Evolution Wealth Advisors, LLC | 1 521 | 0,00 | 218 | -14,57 | ||||

| 2025-08-01 | 13F | MorganRosel Wealth Management, LLC | 528 | 0,00 | 76 | -14,77 | ||||

| 2025-07-29 | NP | PRSIX - T. Rowe Price Spectrum Conservative Allocation Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 13 957 | 116,15 | 1 908 | 86,23 | ||||

| 2025-06-24 | NP | TILT - FlexShares Morningstar US Market Factor Tilt Index Fund | 46 001 | -2,91 | 6 259 | -11,46 | ||||

| 2025-04-23 | NP | Voya Global Equity Dividend & Premium Opportunity Fund | 4 595 | -1,82 | 729 | -3,83 | ||||

| 2025-07-21 | 13F | Sterling Investment Counsel, LLC | 2 181 | -41,90 | 312 | -50,32 | ||||

| 2025-08-26 | NP | IWL - iShares Russell Top 200 ETF | 62 080 | -2,53 | 8 889 | -16,57 | ||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 468 686 | -19,05 | 67 111 | -30,71 | ||||

| 2025-07-09 | 13F | Triumph Capital Management | 1 588 | 0,57 | 227 | -14,02 | ||||

| 2025-08-29 | NP | JGYIX - John Hancock Global Shareholder Yield Fund Class I | 50 784 | -2,29 | 7 272 | -16,38 | ||||

| 2025-06-27 | NP | DJD - Invesco Dow Jones Industrial Average Dividend ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 167 261 | -7,00 | 22 758 | -15,18 | ||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 39 580 | -9,97 | 5 667 | -22,94 | ||||

| 2025-07-25 | 13F | Welch Group, LLC | 419 880 | 2,37 | 60 123 | -11,75 | ||||

| 2025-06-23 | NP | Tax-Managed Value Portfolio - Tax-Managed Value Portfolio | 182 306 | 0,00 | 24 805 | -8,80 | ||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 90 771 | -1,64 | 12 997 | -15,81 | ||||

| 2025-06-23 | NP | LVPIX - Large-cap Value Profund Investor Class | 9 225 | 1 204,81 | 1 255 | 1 095,24 | ||||

| 2025-07-22 | 13F | Eads & Heald Wealth Management | 13 390 | 6,68 | 2 | -50,00 | ||||

| 2025-08-07 | 13F | David R. Rahn & Associates Inc. | 2 101 | -33,72 | 301 | -43,40 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 3 500 286 | -0,50 | 501 206 | -14,84 | ||||

| 2025-07-09 | 13F | Taylor Hoffman Capital Management LLC | 3 016 | 3,57 | 432 | -12,04 | ||||

| 2025-08-29 | NP | DRLL - Strive U.S. Energy ETF | 375 678 | -5,05 | 53 793 | -18,73 | ||||

| 2025-06-26 | NP | CAMWX - Cambiar Opportunity Fund Institutional Class Shares | 60 000 | -26,83 | 8 164 | -33,27 | ||||

| 2025-08-05 | 13F | Wellington Shields Capital Management, LLC | 4 155 | -58,68 | 595 | -64,68 | ||||

| 2025-08-11 | 13F | Intrust Bank Na | 38 171 | 1,69 | 5 466 | -12,96 | ||||

| 2025-08-12 | 13F | Country Trust Bank | 194 389 | 1,00 | 27 835 | -13,55 | ||||

| 2025-05-15 | 13F | Polar Asset Management Partners Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL Russell 1000 Value Index Fund Class 2 | 36 422 | -11,34 | 5 215 | -24,11 | ||||

| 2025-07-24 | 13F | Ramirez Asset Management, Inc. | 464 | 0,00 | 66 | -14,29 | ||||

| 2025-08-04 | 13F | Wealth Management Associates, Inc. | 7 333 | 0,01 | 1 050 | -14,44 | ||||

| 2025-04-10 | 13F | Bremer Bank National Association | 3 076 | -5,88 | 515 | 8,67 | ||||

| 2025-08-11 | 13F | Public Employees Retirement Association Of Colorado | 217 365 | -5,37 | 31 | -18,42 | ||||

| 2025-08-13 | 13F | Estabrook Capital Management | 83 100 | -2,35 | 11 899 | -16,42 | ||||

| 2025-08-14 | 13F | Peapack Gladstone Financial Corp | 346 998 | -0,00 | 50 | -15,52 | ||||

| 2025-08-20 | NP | AUENX - AQR Large Cap Defensive Style Fund Class N | 94 429 | -4,90 | 13 521 | -18,60 | ||||

| 2025-04-22 | NP | NEOS ETF Trust - FIS Bright Portfolios Focused Equity ETF | 6 966 | 1 105 | ||||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 306 855 | 18,32 | 43 939 | 1,27 | ||||

| 2025-07-07 | 13F | Bangor Savings Bank | 4 284 | -0,09 | 613 | -14,50 | ||||

| 2025-07-15 | 13F | Beacon Investment Advisory Services, Inc. | 52 802 | 6,45 | 7 561 | -8,89 | ||||

| 2025-08-12 | 13F | Bravias Capital Group, LLC | 2 078 | 19,98 | 298 | 2,77 | ||||

| 2025-07-30 | 13F | Cookson Peirce & Co Inc | 1 710 | -5,79 | 245 | -19,47 | ||||

| 2025-07-30 | 13F | Clifford Swan Investment Counsel Llc | 319 937 | -1,24 | 45 812 | -15,47 | ||||

| 2025-07-28 | 13F | Dixon Fnancial Services, Inc. | 6 418 | 0,09 | 919 | -14,37 | ||||

| 2025-08-05 | 13F | Corton Capital Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Pacitti Group Inc. | 13 140 | 3,68 | 1 882 | -11,27 | ||||

| 2025-08-05 | 13F | Milestone Asset Management, Llc | 8 800 | -35,22 | 1 260 | -44,54 | ||||

| 2025-07-29 | NP | SIXH - 6 Meridian Hedged Equity-Index Option Strategy ETF | 108 992 | 36,67 | 14 899 | 17,79 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 125 966 | 30,66 | 18 037 | 11,84 | ||||

| 2025-07-14 | 13F | Mechanics Bank Trust Department | 52 600 | -16,91 | 7 532 | -28,89 | ||||

| 2025-08-12 | 13F | Fidelity National Financial, Inc. This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 170 000 | 0,00 | 24 342 | -14,41 | ||||

| 2025-08-13 | 13F | Coco Enterprises, LLC | 5 322 | 2,94 | 762 | 7,64 | ||||

| 2025-07-24 | 13F/A | McElhenny Sheffield Capital Management, LLC | 4 378 | -0,09 | 627 | -14,60 | ||||

| 2025-08-08 | 13F/A | Prospect Financial Services LLC | 1 598 | 8,63 | 229 | -7,32 | ||||

| 2025-07-22 | NP | FLCV - Federated Hermes MDT Large Cap Value ETF | 294 | -62,36 | 40 | -67,48 | ||||

| 2025-08-11 | NP | CUSUX - Six Circles U.S. Unconstrained Equity Fund | 899 084 | 58,03 | 128 740 | 35,26 | ||||

| 2025-08-06 | 13F | Cornercap Investment Counsel Inc | 13 432 | -2,31 | 1 923 | -16,39 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 979 841 | 140 303 | ||||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 424 949 | 61 | ||||||

| 2025-07-17 | 13F | Park Place Capital Corp | 5 904 | -3,47 | 859 | -16,03 | ||||

| 2025-07-31 | 13F | Mcdaniel Terry & Co | 12 838 | 0,03 | 1 838 | 91 800,00 | ||||

| 2025-08-14 | 13F | Farringdon Capital, Ltd. | 0 | -100,00 | 0 | |||||

| 2025-08-27 | NP | Advanced Series Trust - Ast Prudential Growth Allocation Portfolio | 190 795 | -26,62 | 27 320 | -37,19 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 640 462 | 3,32 | 91 708 | -11,57 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 50 490 | 72,98 | 7 230 | 48,07 | ||||

| 2025-08-25 | NP | KNGZ - US Equity Dividend Select ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 3 351 | 11,92 | 480 | -4,20 | ||||

| 2025-08-05 | 13F | Aviance Capital Partners, LLC | 14 973 | 4,19 | 2 144 | -10,86 | ||||

| 2025-08-11 | 13F | Birchbrook, Inc. | 3 259 | 6,57 | 467 | -8,81 | ||||

| 2025-06-27 | NP | YOKE - Yoke Core ETF | 1 796 | 244 | ||||||

| 2025-07-28 | NP | NBSSX - Neuberger Berman Focus Fund Investor Class | 48 862 | 6 679 | ||||||

| 2025-04-14 | 13F | Beach Investment Counsel Inc/pa | 3 687 | 0,00 | 1 | |||||

| 2025-08-01 | 13F | Twin Lakes Capital Management, LLC | 1 352 | 0,00 | 194 | -14,60 | ||||

| 2025-08-14 | 13F | Bank Of Hawaii | 21 533 | -20,65 | 3 083 | -32,08 | ||||

| 2025-08-08 | 13F | Breed's Hill Capital LLC | 1 781 | -2,04 | 255 | -16,12 | ||||

| 2025-08-26 | NP | MASTER INVESTMENT PORTFOLIO - S&P 500 Index Master Portfolio | 1 544 884 | -0,83 | 221 212 | -15,11 | ||||

| 2025-08-28 | NP | SSPIX - SIMT S&P 500 Index Fund Class F | 30 889 | -3,86 | 4 423 | -17,71 | ||||

| 2025-05-12 | 13F | Kerusso Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-27 | NP | Brighthouse Funds Trust I - Schroders Global Multi-Asset Portfolio Class B | 7 202 | -15,23 | 1 031 | -27,45 | ||||

| 2025-08-15 | 13F | Howland Capital Management Llc | 139 238 | 3,43 | 19 937 | -11,47 | ||||

| 2025-07-18 | 13F | B.O.S.S. Retirement Advisors, LLC | 2 276 | -17,36 | 326 | -29,35 | ||||

| 2025-08-14 | 13F | Torno Capital, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-07-14 | 13F | Wealth Advisory Solutions, LLC | 9 714 | -1,90 | 1 391 | -16,06 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 629 739 | 2,98 | 90 172 | -11,85 | ||||

| 2025-07-07 | 13F | Vishria Bird Financial Group, LLC | 5 220 | 0,00 | 747 | -14,43 | ||||

| 2025-07-15 | 13F | Verum Partners LLC | 3 496 | 18,71 | 501 | 1,63 | ||||

| 2025-07-29 | 13F | Easterly Investment Partners Llc | 44 361 | 1,57 | 6 352 | -13,06 | ||||

| 2025-06-25 | NP | REVS - Columbia Research Enhanced Value ETF | 6 689 | 6,19 | 910 | -3,09 | ||||

| 2025-07-24 | NP | HNDRX - Horizon Defined Risk Fund Investor Class | 25 539 | 8,23 | 3 491 | -6,71 | ||||

| 2025-08-04 | 13F | Terril Brothers, Inc. | 1 988 | 3,97 | 285 | -10,97 | ||||

| 2025-07-29 | 13F | Crux Wealth Advisors | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | Put | 31 400 | 122,70 | 4 496 | 90,67 | |||

| 2025-06-26 | NP | TASHX - Transamerica Multi-Asset Income (formerly Transamerica Strategic High Income) A | 30 000 | -25,00 | 4 082 | -31,61 | ||||

| 2025-07-16 | 13F | Meridian Financial, LLC | 1 860 | 0,00 | 266 | -14,47 | ||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | Call | 40 800 | 77,39 | 5 842 | 51,86 | |||

| 2025-07-10 | 13F | American Financial Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | NP | JIEMX - Equity Income Fund Class NAV | 1 763 | -92,48 | 241 | -93,52 | ||||

| 2025-08-04 | 13F | Coign Capital Advisors LLC | 3 921 | 2,54 | 561 | -12,21 | ||||

| 2025-08-15 | 13F | Morse Asset Management, Inc | 10 765 | -39,47 | 1 541 | -48,20 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | Put | 407 600 | -72,39 | 58 364 | -76,36 | |||

| 2025-08-13 | 13F | Summit Wealth Group Llc / Co | 2 855 | 409 | ||||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | Call | 325 500 | 13,34 | 46 608 | -2,99 | |||

| 2025-07-21 | 13F | Cornell Pochily Investment Advisors, Inc. | 13 830 | 1,74 | 1 980 | -12,93 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 516 042 | 609,38 | 73 892 | 507,22 | ||||

| 2025-06-26 | NP | NSCR - Nuveen Sustainable Core ETF | 427 | -32,86 | 58 | -38,30 | ||||

| 2025-05-27 | NP | FTHI - First Trust BuyWrite Income ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 21 250 | 21,33 | 3 555 | 40,14 | ||||

| 2025-07-15 | 13F | Axis Wealth Partners, LLC | 1 475 | -10,33 | 211 | -23,27 | ||||

| 2025-08-05 | 13F | Freestone Capital Holdings, LLC | 55 218 | 2,53 | 7 907 | -12,24 | ||||

| 2025-06-25 | NP | FENY - Fidelity MSCI Energy Index ETF This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 302 738 | -4,70 | 177 251 | -13,09 | ||||

| 2025-07-22 | NP | LEIFX - FEDERATED EQUITY INCOME FUND INC Class A Shares This fund is a listed as child fund of Federated Hermes, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 64 090 | 0,00 | 8 761 | -13,81 | ||||

| 2025-06-23 | NP | PPSFX - LargeCap Value Fund III R-3 | 203 799 | 0,58 | 27 729 | -8,27 | ||||

| 2025-08-28 | NP | BlackRock Variable Series Funds, Inc. - BlackRock Global Allocation V.I. Fund Class I This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 62 736 | -17,13 | 8 983 | -29,07 | ||||

| 2025-08-29 | NP | SPXUX - WisdomTree 500 Digital Fund N/A | 408 | 200,00 | 58 | 163,64 | ||||

| 2025-08-13 | 13F | Nbw Capital Llc | 4 303 | 3,41 | 616 | -11,49 | ||||

| 2025-06-26 | NP | FYEE - Fidelity Yield Enhanced Equity ETF | 8 | -42,86 | 1 | -50,00 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 2 133 | -99,71 | 305 | -99,75 | ||||

| 2025-07-21 | 13F | West Financial Advisors, LLC | 886 | 0,00 | 127 | -14,86 | ||||

| 2025-08-11 | 13F/A | Purus Wealth Management, LLC | 4 787 | 24,86 | 685 | 6,86 | ||||

| 2025-07-24 | 13F | CarsonAllaria Wealth Management, Ltd. | 565 | 0,71 | 81 | -13,98 | ||||

| 2025-07-28 | 13F | Evernest Financial Advisors, LLC | 4 716 | -2,30 | 675 | -16,36 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 1 874 | -15,85 | 268 | -27,96 | ||||

| 2025-07-15 | 13F | Cigna Investments Inc /new | 16 017 | -3,09 | 2 | 0,00 | ||||

| 2025-08-26 | NP | DGAGX - BNY Mellon Appreciation Fund, Inc. Investor Shares | 326 035 | -3,44 | 46 685 | -17,35 | ||||

| 2025-08-06 | 13F | HORAN Wealth, LLC | 4 407 | 631 | ||||||

| 2025-07-17 | 13F | Investment Advisory Services Inc /tx /adv | 17 384 | -0,41 | 2 489 | -14,76 | ||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 41 | 0,00 | 6 | -16,67 | ||||

| 2025-07-28 | 13F | Jag Capital Management, Llc | 1 436 | 18,78 | 206 | 1,49 | ||||

| 2025-07-24 | 13F | Coordinated Financial Services, Inc. | 2 422 | 1,98 | 347 | 0,58 | ||||

| 2025-08-14 | 13F | Transamerica Financial Advisors, Inc. | 9 660 | -12,25 | 1 383 | 138 200,00 | ||||

| 2025-08-07 | 13F | SFE Investment Counsel | 15 017 | -11,55 | 2 150 | -24,30 | ||||

| 2025-07-17 | 13F | XML Financial, LLC | 45 658 | 0,17 | 6 538 | -14,27 | ||||

| 2025-08-14 | 13F | Redwood Investment Management, Llc | 13 747 | -1,09 | 2 | -50,00 | ||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 1 734 | -5,61 | 248 | -19,22 | ||||

| 2025-07-17 | 13F | Prepared Retirement Institute LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Capricorn Fund Managers Ltd | 19 182 | -4,61 | 2 747 | -18,35 | ||||

| 2025-08-05 | 13F | Main Street Research LLC | 9 534 | -17,94 | 1 365 | -29,75 | ||||

| 2025-08-13 | 13F | Rosenblum Silverman Sutton S F Inc /ca | 2 130 | -11,40 | 305 | -24,38 | ||||

| 2025-05-15 | 13F | Intrepid Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-05-22 | NP | FTCE - First Trust New Constructs Core Earnings Leaders ETF | 7 190 | 157,52 | 1 203 | 197,52 | ||||

| 2025-08-14 | 13F | Cibc World Markets Corp | 248 857 | 0,95 | 35 634 | -13,60 | ||||

| 2025-08-05 | 13F | Magnolia Capital Advisors Llc | 8 003 | -3,35 | 1 146 | -17,33 | ||||

| 2025-08-04 | 13F | Hutchinson Capital Management/ca | 17 350 | -9,45 | 2 484 | -22,50 | ||||

| 2025-07-10 | 13F | Carderock Capital Management Inc | 4 182 | 0,00 | 599 | -14,45 | ||||

| 2025-08-04 | 13F | Horizon Wealth Management, LLC | 3 100 | -3,00 | 444 | -17,04 | ||||

| 2025-07-25 | 13F | Wealth Architects, LLC | 5 436 | -1,15 | 778 | -15,34 | ||||

| 2025-08-08 | 13F | Tanglewood Legacy Advisors, LLC | 5 009 | 0,42 | 717 | -14,03 | ||||

| 2025-08-04 | 13F | Migdal Insurance & Financial Holdings Ltd. | 1 109 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Triune Financial Partners, LLC | 2 595 | 1,72 | 372 | -12,91 | ||||

| 2025-08-08 | 13F | EagleClaw Capital Managment, LLC | 68 190 | -0,55 | 9 764 | -14,87 | ||||

| 2025-07-23 | 13F | Trifecta Capital Advisors, LLC | 4 504 | 22,03 | 645 | 4,38 | ||||

| 2025-08-28 | NP | CFA - VictoryShares US 500 Volatility Wtd ETF | 8 656 | -2,43 | 1 239 | -16,51 | ||||

| 2025-07-22 | 13F | Relyea Zuckerberg Hanson LLC | 4 748 | -16,58 | 680 | -28,68 | ||||

| 2025-08-25 | NP | GONIX - Gotham Neutral Fund Institutional Class | 1 249 | 28,10 | 179 | 9,20 | ||||

| 2025-08-07 | 13F | Atala Financial Inc | 2 796 | 21,78 | 400 | 4,17 | ||||

| 2025-05-29 | NP | CBHAX - Victory Market Neutral Income Fund Class A | 33 653 | -3,43 | 5 630 | 11,53 | ||||

| 2025-08-07 | 13F | Gryphon Financial Partners LLC | 16 592 | 10,36 | 2 376 | -5,57 | ||||

| 2025-07-22 | 13F | Cedar Mountain Advisors, LLC | 215 | -13,65 | 31 | -26,83 | ||||

| 2025-07-18 | 13F | Montgomery Investment Management Inc | 43 185 | -6,49 | 6 184 | -19,96 | ||||

| 2025-08-14 | 13F | Erste Asset Management GmbH | 28 683 | -21,05 | 4 146 | -31,86 | ||||

| 2025-08-27 | NP | JNL SERIES TRUST - JNL Multi-Manager Alternative Fund (A) | Short | -5 523 | -791 | |||||

| 2025-07-25 | NP | MEIAX - MFS Value Fund A | 5 025 222 | -2,76 | 686 948 | -16,20 | ||||

| 2025-08-04 | 13F | Savvy Advisors, Inc. | 25 474 | 34,07 | 3 648 | 14,76 | ||||

| 2025-06-23 | NP | BLPIX - Bull Profund Investor Class | 1 297 | -5,95 | 176 | -14,15 | ||||

| 2025-07-30 | NP | ARDGX - Archer Dividend Growth Fund | 3 270 | 0,00 | 447 | -13,71 | ||||

| 2025-08-12 | 13F | Maripau Wealth Management Llc | 0 | -100,00 | 0 | |||||

| 2025-06-26 | NP | ITTAX - Hartford Multi-Asset Income and Growth Fund Class A | 9 728 | -5,75 | 1 324 | -14,04 | ||||

| 2025-08-13 | 13F | Menard Financial Group LLC | 11 962 | -4,91 | 1 713 | 0,41 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 18 877 | 9,94 | 2 703 | -5,92 | ||||

| 2025-08-22 | NP | Tri-continental Corp | 145 461 | 10,84 | 20 829 | -5,12 | ||||

| 2025-07-17 | 13F | Michels Family Financial, LLC | 11 015 | 0,27 | 1 577 | -14,15 | ||||

| 2025-07-11 | 13F | Baugh & Associates, LLC | 34 392 | -1,63 | 4 528 | -19,09 | ||||

| 2025-08-13 | 13F | M Holdings Securities, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-26 | NP | JAVA - JPMorgan Active Value ETF | 208 565 | -5,41 | 29 864 | -19,03 | ||||

| 2025-07-10 | 13F | Sharkey, Howes & Javer | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bridgefront Capital, LLC | 4 374 | 626 | ||||||

| 2025-07-25 | 13F | Cascade Investment Advisors, Inc. | 8 177 | -1,74 | 1 171 | -15,95 | ||||

| 2025-08-05 | 13F | Mission Wealth Management, Lp | 55 747 | -2,11 | 7 982 | -16,21 | ||||

| 2025-07-24 | NP | BLACKROCK BALANCED CAPITAL FUND, INC. - BLACKROCK BALANCED CAPITAL FUND, INC. Investor A This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 57 630 | -15,04 | 7 878 | -26,78 | ||||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 75 724 | 22,93 | 11 598 | 12,54 | ||||

| 2025-08-13 | 13F | Gardner Russo & Quinn Llc | 2 670 | -36,68 | 382 | -45,82 | ||||

| 2025-08-20 | NP | QSPIX - AQR Style Premia Alternative Fund Class I | 37 594 | 93,18 | 5 383 | 65,38 | ||||

| 2025-07-22 | 13F | Sutton Place Investors Llc | 1 604 | -3,20 | 230 | -17,33 | ||||

| 2025-07-09 | 13F | Procyon Private Wealth Partners, LLC | 37 747 | -12,53 | 5 405 | -23,53 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 959 | 5,50 | 137 | -9,87 | ||||

| 2025-04-23 | 13F | JCIC Asset Management Inc. | 5 | 0,00 | 1 | |||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 172 644 | -1,37 | 24 721 | -15,58 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 47 800 | -0,62 | 7 | -25,00 | ||||

| 2025-06-26 | NP | TLARX - Transamerica Large Core R | 8 596 | -18,58 | 1 170 | -25,78 | ||||

| 2025-07-15 | 13F | Aspire Capital Advisors LLC | 5 244 | 3,39 | 751 | -11,56 | ||||

| 2025-08-20 | NP | LSAAX - LoCorr Strategic Allocation Fund Class A | 422 | -8,26 | 60 | -21,05 | ||||

| 2025-08-04 | 13F | Wolverine Asset Management Llc | Call | 55 500 | 90,07 | 7 947 | 62,71 | |||

| 2025-07-23 | 13F | Slow Capital, Inc. | 2 000 | 0,00 | 286 | -14,37 | ||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 1 160 | 10,90 | 166 | -5,14 | ||||

| 2025-07-28 | 13F | Davidson Investment Advisors | 215 495 | 0,30 | 30 857 | -14,15 | ||||

| 2025-08-06 | 13F | Decker Retirement Planning Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Morgan Dempsey Capital Management Llc | 48 267 | -1,49 | 6 911 | -15,68 | ||||

| 2025-07-29 | 13F | Morgan Dempsey Capital Management Llc | Call | 100 | 0,00 | 14 | -12,50 | |||

| 2025-07-30 | 13F | Rehmann Capital Advisory Group | 16 091 | -17,47 | 2 304 | -29,35 | ||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 7 626 | -6,80 | 1 092 | -20,25 | ||||

| 2025-06-27 | NP | RSPG - Invesco S&P 500 Equal Weight Energy ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 137 240 | -13,97 | 18 673 | -21,55 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 121 789 | 8,56 | 17 439 | -7,08 | ||||

| 2025-07-29 | 13F | Lyell Wealth Management, Lp | 28 181 | -39,34 | 4 035 | -48,08 | ||||

| 2025-08-12 | 13F | Evelyn Partners Investment Management Services Ltd | 185 | -97,53 | 372 | 17,72 | ||||

| 2025-06-30 | NP | AIM SECTOR FUNDS (INVESCO SECTOR FUNDS) - Invesco Oppenheimer Value Fund Class C | 153 542 | -15,25 | 20 891 | -22,71 | ||||

| 2025-07-29 | NP | SPIAX - Invesco S&p 500 Index Fund Class A | 115 960 | -0,76 | 15 852 | -14,48 | ||||

| 2025-07-29 | 13F | Northeast Investment Management | 108 053 | -1,72 | 15 472 | -15,88 | ||||

| 2025-07-31 | 13F | SoundView Advisors Inc. | 2 723 | 3,54 | 0 | |||||

| 2025-07-08 | 13F | Davis Investment Partners, LLC | 6 228 | 5,45 | 907 | 13,39 | ||||

| 2025-08-04 | 13F | Roble, Belko & Company, Inc | 1 061 | 137,36 | 0 | |||||

| 2025-08-12 | 13F | First Long Island Investors, LLC | 97 050 | -0,98 | 13 897 | -15,24 | ||||

| 2025-07-31 | 13F | Allied Investment Advisors, LLC | 83 112 | 4,70 | 11 901 | -10,38 | ||||

| 2025-07-17 | 13F | Alpine Bank Wealth Management | 10 587 | 5,94 | 1 516 | -9,34 | ||||

| 2025-08-13 | 13F | Willis Johnson & Associates, Inc. | 22 484 | -4,17 | 3 220 | -17,99 | ||||

| 2025-07-16 | 13F | NovaPoint Capital, LLC | 18 781 | 8,76 | 2 689 | -6,89 | ||||

| 2025-07-28 | 13F | Revolve Wealth Partners, LLC | 2 811 | -13,03 | 402 | -25,56 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 101 302 | -0,38 | 14 506 | -14,74 | ||||

| 2025-08-13 | 13F | Idaho Trust Bank | 2 605 | 47,59 | 373 | 26,44 | ||||

| 2025-07-24 | 13F | MFA Wealth Services | 1 828 | -10,13 | 262 | -23,24 | ||||

| 2025-08-01 | 13F | Providence First Trust Co | 4 681 | 0,32 | 670 | -14,10 | ||||

| 2025-08-14 | 13F | Spears Abacus Advisors LLC | 177 735 | 0,13 | 25 450 | -14,30 | ||||

| 2025-07-22 | 13F | Sava Infond d.o.o. | 20 850 | 14,69 | 2 986 | -1,84 | ||||

| 2025-08-14 | 13F | Crawford Investment Counsel Inc | 249 287 | 19,44 | 35 695 | 2,23 | ||||

| 2025-07-25 | 13F | Mitchell Capital Management Co | 1 500 | -3,85 | 225 | -13,46 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 116 948 | 0,73 | 16 746 | -13,78 | ||||

| 2025-07-28 | NP | CSM - ProShares Large Cap Core Plus | 2 812 | 13,39 | 384 | -2,29 | ||||

| 2025-07-11 | 13F | Assenagon Asset Management S.A. | 542 775 | 687,94 | 77 720 | 574,47 | ||||

| 2025-07-14 | 13F | Financial Enhancement Group LLC | 1 323 | 205 | ||||||

| 2025-08-13 | 13F | Morton Community Bank | 27 172 | 4,00 | 3 891 | -10,98 | ||||

| 2025-08-04 | 13F | Clear Investment Research, Llc | 275 | 0,36 | 40 | -13,33 | ||||

| 2025-06-26 | NP | FDRR - Fidelity Dividend ETF for Rising Rates This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 25 356 | 2,94 | 3 450 | -6,12 | ||||

| 2025-05-09 | 13F | W.H. Cornerstone Investments Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Penney Financial, LLC | 5 335 | 0,00 | 764 | -14,46 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - S&P 500 2x Strategy Fund Variable Annuity | 2 512 | 275,49 | 360 | 223,42 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 36 182 | -1,24 | 5 181 | -15,47 | ||||

| 2025-08-13 | 13F | Pinkerton Retirement Specialists, LLC | 32 088 | 6,52 | 4 595 | -8,83 | ||||

| 2025-08-12 | 13F | Bank OZK | 12 022 | -0,90 | 1 721 | -15,18 | ||||

| 2025-07-29 | 13F | Spirit Of America Management Corp/ny | 48 390 | -23,90 | 6 929 | -34,87 | ||||

| 2025-08-27 | NP | TRANSAMERICA SERIES TRUST - Transamerica U.S. Equity Index VP Service | 38 518 | 0,48 | 5 515 | -13,99 | ||||

| 2025-08-28 | NP | TMMAX - SIMT Tax-Managed Managed Volatility Fund Class F | 178 | -97,57 | 25 | -97,96 | ||||

| 2025-08-11 | 13F | Raiffeisen Bank International AG | 0 | -100,00 | 0 | |||||

| 2025-06-25 | NP | FTLS - First Trust Long/Short Equity ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | Short | -5 808 | 272,31 | -790 | 240,52 | |||

| 2025-05-22 | NP | SAOOX - Overlay A Portfolio Class 1 | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | ROI Financial Advisors, LLC | 2 408 | 6,60 | 345 | -8,75 | ||||

| 2025-08-27 | NP | VSLU - Applied Finance Valuation Large Cap ETF | 5 254 | -44,63 | 752 | -52,61 | ||||

| 2025-07-11 | 13F | Ullmann Financial Group, Inc. | 3 856 | -5,61 | 552 | -19,18 | ||||

| 2025-08-05 | 13F | Centennial Bank/AR/ | 8 694 | 1,03 | 1 245 | -13,55 | ||||

| 2025-06-26 | NP | HNRIX - Hennessy BP Energy Fund Institutional Class | 5 157 | 0,00 | 702 | -8,84 | ||||

| 2025-08-14 | 13F | Voya Financial Advisors, Inc. | 4 114 | -11,26 | 592 | -23,15 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 46 072 | 16,19 | 6 597 | -0,54 | ||||

| 2025-07-07 | 13F | Good Steward Wealth Advisors,LLC | 3 963 | -31,80 | 567 | -41,67 | ||||

| 2025-07-25 | 13F | Carbahal Olsen Financial Services Group, LLC | 1 723 | 0,00 | 247 | -14,58 | ||||

| 2025-08-27 | NP | RYLDX - Dow 2x Strategy Fund A | 4 436 | -31,79 | 635 | -41,58 | ||||

| 2025-07-29 | 13F | Citizens Business Bank | 32 473 | 6,15 | 4 829 | -9,35 | ||||

| 2025-08-12 | 13F/A | Cozad Asset Management Inc | 5 367 | 16,65 | 769 | -0,13 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 456 508 | -7,76 | 65 367 | -21,05 | ||||

| 2025-07-10 | 13F | Sumitomo Mitsui DS Asset Management Company, Ltd | 608 901 | 3,01 | 87 189 | -11,83 | ||||

| 2025-07-29 | 13F | Wealthstream Advisors, Inc. | 1 737 | -0,69 | 249 | -15,07 | ||||

| 2025-06-27 | NP | CVSIX - Calamos Market Neutral Income Fund Class A | 384 617 | 1,13 | 52 331 | -7,77 | ||||

| 2025-08-29 | NP | DEW - WisdomTree Global High Dividend Fund N/A | 10 644 | -1,42 | 1 524 | -15,61 | ||||

| 2025-08-05 | 13F | Allstate Corp | 3 520 | -93,83 | 504 | -94,72 | ||||

| 2025-07-17 | 13F | Financial Partners Group, LLC | 70 529 | 173,18 | 10 099 | 133,83 | ||||

| 2025-07-28 | 13F | J.Safra Asset Management Corp | 3 174 | 8,14 | 456 | -6,94 | ||||

| 2025-08-06 | 13F | Paulson Wealth Management Inc. | 3 314 | 4,91 | 475 | -10,23 | ||||

| 2025-08-01 | 13F | Austin Private Wealth, LLC | 10 963 | 2,83 | 1 570 | -12,00 | ||||

| 2025-08-25 | NP | MFS VARIABLE INSURANCE TRUST - MFS Value Series Initial Class | 232 258 | -1,69 | 33 257 | -15,85 | ||||

| 2025-08-08 | 13F | Citizens Financial Group Inc/ri | 71 612 | 14,60 | 10 254 | -1,90 | ||||

| 2025-04-28 | NP | CGGE - Capital Group Global Equity ETF Share Class | 5 447 | 69,74 | 864 | 66,47 | ||||

| 2025-07-24 | 13F | Horizon Bancorp Inc /in/ | 3 043 | 122,12 | 0 | |||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 154 | 22 | ||||||

| 2025-08-26 | NP | NQGAX - Nuveen NWQ Global Equity Income Fund Class A This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 12 396 | -4,32 | 1 775 | -18,14 | ||||

| 2025-08-05 | 13F | Atlas Private Wealth Advisors | 6 612 | -21,93 | 946 | -33,24 | ||||

| 2025-06-26 | NP | FQAL - Fidelity Quality Factor ETF This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 44 257 | -2,58 | 6 022 | -11,16 | ||||

| 2025-05-14 | 13F | State of Wyoming | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Mason & Associates Inc | 2 202 | -2,70 | 315 | -16,67 | ||||

| 2025-08-12 | 13F | Ci Investments Inc. | 172 201 | 5,55 | 25 | -11,11 | ||||

| 2025-08-01 | 13F | Signature Wealth Management Group | 26 829 | -0,04 | 3 842 | -14,45 | ||||

| 2025-08-04 | 13F | Carret Asset Management, Llc | 93 191 | 11,17 | 13 344 | -4,85 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 1 534 575 | 76,69 | 219 736 | 51,24 | ||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 22 941 | 0,48 | 3 285 | -14,01 | ||||

| 2025-07-18 | 13F | Bridge Generations Wealth Management Llc | 3 | 0,00 | 0 | |||||

| 2025-07-10 | 13F | HWG Holdings LP | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Hartford Funds Management Co LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Man Group plc | Call | 42 100 | -57,04 | 6 028 | -63,23 | |||

| 2025-07-24 | 13F | Lokken Investment Group LLC | 3 060 | -7,52 | 438 | -20,80 | ||||

| 2025-08-14 | 13F | Man Group plc | Put | 74 700 | -28,45 | 10 696 | -38,76 | |||

| 2025-07-15 | 13F | Accurate Wealth Management, LLC | 25 882 | 4,83 | 3 990 | 19,18 | ||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP BlackRock Global Allocation Fund Standard Class | 30 711 | -17,61 | 4 398 | -29,49 | ||||

| 2025-08-04 | 13F | Buck Wealth Strategies, LLC | 10 033 | -2,38 | 1 437 | -16,46 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 20 320 | 2,72 | 2 910 | -12,09 | ||||

| 2025-07-16 | 13F | Independent Wealth Network Inc. | 31 221 | 4,47 | 4 471 | -10,58 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 106 107 | -4,00 | 15 | -16,67 | ||||

| 2025-08-14 | 13F | Man Group plc | 25 863 | -59,95 | 3 703 | -65,72 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 364 522 | -1,69 | 52 196 | -15,85 | ||||

| 2025-07-30 | 13F | Sonata Capital Group Inc | 2 020 | 5,21 | 0 | |||||

| 2025-07-23 | 13F | Klp Kapitalforvaltning As | 507 600 | -0,20 | 72 683 | -14,57 | ||||

| 2025-07-22 | NP | FSTBX - FEDERATED GLOBAL ALLOCATION FUND Class A Shares This fund is a listed as child fund of Federated Hermes, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 6 531 | -2,57 | 893 | -16,09 | ||||

| 2025-07-16 | 13F | Newton One Investments LLC | 327 | 1,24 | 47 | -14,81 | ||||

| 2025-08-08 | 13F | Cherokee Insurance Co | 55 299 | 0,00 | 7 918 | -14,40 | ||||

| 2025-04-21 | 13F | True Link Financial Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 8 121 | -84,05 | 1 166 | -84,39 | ||||

| 2025-07-23 | 13F | Traphagen Investment Advisors Llc | 10 732 | 2,64 | 1 537 | -12,18 | ||||

| 2025-08-12 | 13F | Atalanta Sosnoff Capital, Llc | 1 905 | 5,83 | 273 | -9,63 | ||||

| 2025-07-16 | 13F | BOS Asset Management, LLC | 8 862 | -2,66 | 1 269 | -16,74 | ||||

| 2025-06-26 | NP | USGRX - Growth & Income Fund Shares | 55 045 | 2,99 | 7 489 | -6,07 | ||||

| 2025-06-16 | 13F | Peterson Wealth Management | 8 014 | 1,48 | 1 341 | 17,24 | ||||

| 2025-06-27 | NP | GUSH - Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 3X Shares Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 3X Shares | 28 872 | -17,33 | 3 928 | -24,61 | ||||

| 2025-07-16 | 13F | Holland Advisory Services, Inc. | 2 712 | 123,95 | 388 | 92,08 | ||||

| 2025-07-31 | 13F | AF Advisors, Inc. | 4 370 | 0,00 | 626 | -14,50 | ||||

| 2025-07-29 | 13F | Portman Square Capital LLP | Put | 58 000 | -78,99 | 8 305 | -82,02 | |||

| 2025-07-17 | 13F | Worth Financial Advisory Group, LLC | 2 943 | 14,74 | 421 | -1,86 | ||||

| 2025-07-29 | 13F | Portman Square Capital LLP | Call | 38 300 | -75,16 | 5 484 | -78,74 | |||

| 2025-08-29 | NP | SA FUNDS INVESTMENT TRUST - SA U.S. Core Market Fund | 14 873 | 0,00 | 2 130 | -14,43 | ||||

| 2025-07-14 | 13F | Toth Financial Advisory Corp | 3 433 | -0,95 | 492 | -15,20 | ||||

| 2025-07-29 | 13F | Portman Square Capital LLP | 7 262 | 1 040 | ||||||

| 2025-07-30 | 13F | Brookstone Capital Management | 121 243 | 6,56 | 17 361 | -8,79 | ||||

| 2025-08-11 | 13F | Landaas & Co /wi /adv | 1 564 | 0,00 | 224 | -14,50 | ||||

| 2025-06-26 | NP | FEQHX - Fidelity Hedged Equity Fund | 15 553 | 40,57 | 2 116 | 28,24 | ||||

| 2025-07-10 | 13F | Burns J W & Co Inc/ny | 70 545 | -11,42 | 10 101 | -24,18 | ||||

| 2025-07-28 | 13F | Cutler Investment Counsel Llc | 63 757 | -0,36 | 9 129 | -14,71 | ||||

| 2025-07-21 | 13F | TFG Advisers LLC | 21 121 | 0,24 | 3 024 | -14,19 | ||||

| 2025-07-28 | 13F | Holistic Planning, LLC | 10 918 | 9,10 | 1 563 | -6,63 | ||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 119 856 | 0,19 | 17 162 | -14,25 | ||||

| 2025-07-17 | 13F | BFI Infinity Ltd. | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Manhattan West Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Westhampton Capital, LLC | 6 575 | -6,74 | 941 | -20,19 | ||||

| 2025-08-08 | 13F | Better Money Decisions, LLC | 3 011 | 0,00 | 431 | -14,31 | ||||

| 2025-08-27 | NP | Jnl Series Trust - Jnl/franklin Templeton Income Fund (a) | 185 000 | 0,00 | 26 490 | -14,40 | ||||

| 2025-07-23 | 13F | Gentry Private Wealth, Llc | 2 285 | 4,34 | 327 | -10,66 | ||||

| 2025-07-22 | 13F | Peoples Bank /oh | 23 634 | 0,02 | 3 384 | -14,37 | ||||

| 2025-07-28 | NP | NPRTX - Neuberger Berman Large Cap Value Fund Investor Class | 1 303 178 | 2,89 | 178 144 | -11,33 | ||||

| 2025-08-07 | 13F | Cincinnati Financial Corp | 35 139 | 0,00 | 5 032 | -14,41 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/AB Dynamic Growth Portfolio Class IB | 13 498 | 0,00 | 1 933 | -14,44 | ||||

| 2025-08-28 | NP | SVTAX - Simt Global Managed Volatility Fund Class F | 41 | 0,00 | 6 | -16,67 | ||||

| 2025-08-27 | NP | VANGUARD VARIABLE INSURANCE FUNDS - Equity Income Portfolio This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 39 277 | 0,00 | 5 624 | -14,40 | ||||

| 2025-08-12 | 13F | Diamond Hill Capital Management Inc | 168 969 | -11,43 | 24 195 | -24,19 | ||||

| 2025-07-22 | 13F | Iowa State Bank | 42 740 | -0,24 | 6 120 | -14,62 | ||||

| 2025-06-17 | 13F | Ridgepath Capital Management LLC | 1 792 | 1,01 | 300 | 16,80 | ||||

| 2025-08-06 | 13F | ZEGA Investments, LLC | 2 526 | -8,94 | 362 | -22,20 | ||||

| 2025-06-27 | NP | SUNAMERICA SERIES TRUST - SA JPMorgan Diversified Balanced Portfolio Class 1 | 3 738 | -8,04 | 509 | -16,17 | ||||

| 2025-08-14 | 13F | Mbb Public Markets I Llc | 1 563 | -19,35 | 224 | -31,17 | ||||

| 2025-07-24 | 13F | Grand Wealth Management, Llc | 2 022 | 290 | ||||||

| 2025-08-22 | NP | MUOIX - US Core Portfolio Class I | 32 848 | -25,72 | 4 704 | -36,42 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 307 339 | 3,87 | 44 008 | -11,09 | ||||

| 2025-04-01 | NP | PHDG - Invesco S&P 500 Downside Hedged ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 648 | -8,44 | 395 | -8,14 | ||||

| 2025-07-10 | 13F | Global Financial Private Client, LLC | 24 272 | 13,19 | 3 475 | -3,12 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | Call | 45 600 | -69,21 | 7 | -75,00 | |||

| 2025-07-31 | 13F | Warburton Capital Management, LLC | 1 308 | 0 | ||||||

| 2025-08-14 | 13F/A | Barclays Plc | Put | 362 200 | 50,85 | 52 | 27,50 | |||

| 2025-08-14 | 13F/A | Barclays Plc | 3 009 449 | -26,56 | 431 | -37,23 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 3 236 009 | -6,58 | 463 455 | -20,08 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | Call | 97 700 | -1,81 | 14 009 | -16,29 | |||

| 2025-08-13 | 13F | Hsbc Holdings Plc | Put | 133 500 | -42,31 | 19 145 | -50,84 | |||

| 2025-08-14 | 13F | First Wilshire Securities Management Inc | 1 705 | 3,33 | 244 | -11,59 | ||||

| 2025-08-13 | 13F | Brandes Investment Partners, Lp | 687 909 | 2,27 | 98 503 | -12,46 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 20 258 | -25,59 | 2 901 | -36,32 | ||||