Statistiques de base

| Propriétaires institutionnels | 352 total, 349 long only, 0 short only, 3 long/short - change of -3,81% MRQ |

| Allocation moyenne du portefeuille | 0.3152 % - change of -1,82% MRQ |

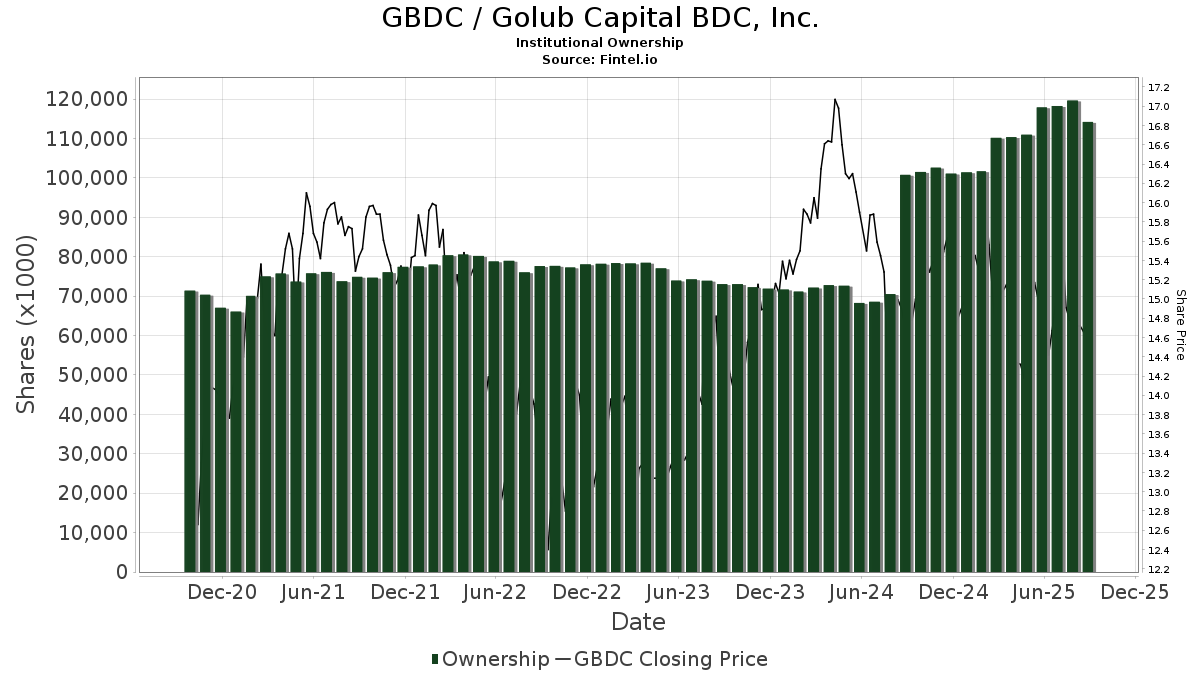

| Actions institutionnelles (Long) | 114 079 554 (ex 13D/G) - change of -3,80MM shares -3,22% MRQ |

| Valeur institutionnelle (Long) | $ 1 635 648 USD ($1000) |

Participation institutionnels et actionnaires

Golub Capital BDC, Inc. (US:GBDC) détient 352 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 114,079,554 actions. Les principaux actionnaires incluent Strs Ohio, Van Eck Associates Corp, Allen Investment Management LLC, BIZD - VanEck Vectors BDC Income ETF, Northeast Financial Consultants Inc, CI Private Wealth, LLC, Bank Of America Corp /de/, Sound Income Strategies, LLC, Sage Mountain Advisors LLC, and Lindbrook Capital, Llc .

Golub Capital BDC, Inc. (NasdaqGS:GBDC) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 5, 2025 is 14,75 / share. Previously, on September 9, 2024, the share price was 14,75 / share. This represents an increase of 0,00% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

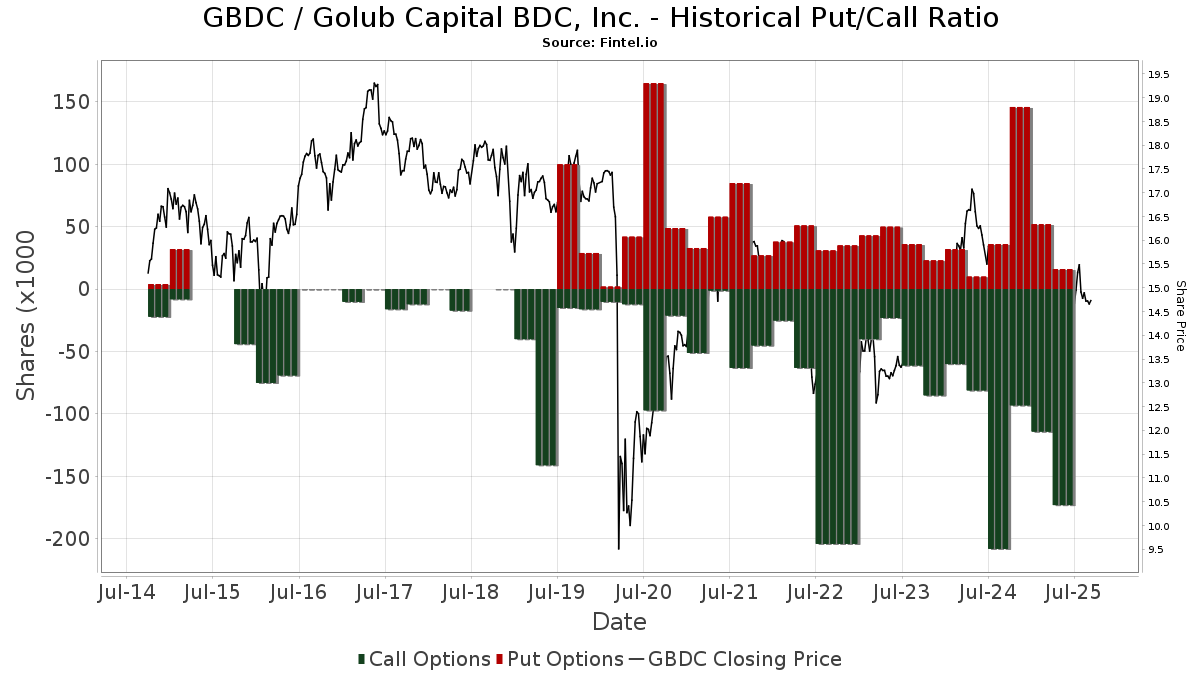

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13D/G

Nous présentons les dépôts 13D/G séparément des dépôts 13F en raison de leur traitement différent par la SEC. Les déclarations 13D/G peuvent être déposées par des groupes d'investisseurs (avec un leader), ce qui n'est pas le cas des déclarations 13F. Il en résulte des situations dans lesquelles un investisseur peut déposer une déclaration 13D/G indiquant une valeur pour le total des actions (représentant toutes les actions détenues par le groupe d'investisseurs), mais déposer ensuite une déclaration 13F indiquant une valeur différente pour le total des actions (représentant strictement ses propres actions). Cela signifie que l'actionnariat des déclarations 13D/G et des déclarations 13F n'est souvent pas directement comparable, c'est pourquoi nous les présentons séparément.

Note : À compter du 16 mai 2021, nous n'affichons plus les propriétaires qui n'ont pas déposé de déclaration 13D/G au cours de l'année écoulée. Auparavant, nous montrions l'historique complet des déclarations 13D/G. En général, les entités qui sont tenues de déposer des déclarations 13D/G doivent le faire au moins une fois par an avant de soumettre une déclaration de clôture. Cependant, il arrive que des fonds sortent de positions sans soumettre de déclaration de clôture (c'est-à-dire qu'ils procèdent à une liquidation), de sorte que l'affichage de l'historique complet pouvait prêter à confusion quant à l'actionnariat actuel. Pour éviter toute confusion, nous n'affichons désormais que les propriétaires "actuels", c'est-à-dire les propriétaires qui ont déposé des documents au cours de l'année écoulée.

Upgrade to unlock premium data.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-16 | 13F | Beaumont Financial Advisors, LLC | 14 356 | 1,86 | 210 | -1,41 | ||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Arnhold LLC | 1 447 589 | 0,00 | 21 208 | -3,24 | ||||

| 2025-07-15 | 13F | Accurate Wealth Management, LLC | 55 590 | 11,20 | 839 | 22,69 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 24 584 | -39,79 | 0 | |||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 37 876 | -5,02 | 555 | -8,13 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 7 908 | 31,78 | 116 | 27,78 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 12 716 | -20,66 | 186 | -23,14 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 18 446 | -12,71 | 270 | -15,36 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 47 361 | -44,53 | 694 | -46,36 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 275 353 | -13,71 | 4 034 | -16,52 | ||||

| 2025-08-01 | 13F | Pasadena Private Wealth, LLC | 38 100 | 5,83 | 558 | 2,39 | ||||

| 2025-07-21 | 13F | Catalina Capital Group, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-01 | 13F | First National Trust Co | 264 177 | 0,00 | 3 870 | -3,23 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 64 432 | 0,00 | 1 | |||||

| 2025-05-01 | 13F | Country Club Bank /gfn | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Private Trust Co Na | 2 000 | 0,00 | 29 | -3,33 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 82 696 | -80,30 | 1 211 | -80,95 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 25 | 0 | ||||||

| 2025-06-18 | NP | Putnam ETF Trust - Putnam BDC ETF - | 1 112 685 | 33,54 | 15 934 | 21,57 | ||||

| 2025-05-14 | 13F | Group One Trading, L.p. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-11 | 13F | Pin Oak Investment Advisors Inc | 460 | 0,00 | 0 | |||||

| 2025-07-25 | 13F | Tranquility Partners, LLC | 351 692 | -0,03 | 5 152 | -3,27 | ||||

| 2025-07-15 | 13F | Family Wealth Partners, Llc | 35 356 | 83,10 | 518 | 77,05 | ||||

| 2025-07-30 | 13F | Green Square Capital Advisors Llc | 166 740 | 2 443 | ||||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 3 313 649 | 4,08 | 48 545 | 0,71 | ||||

| 2025-07-22 | 13F | MAS Advisors LLC | 17 279 | 3,91 | 253 | 0,80 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 114 | 2 | ||||||

| 2025-05-15 | 13F | Aquatic Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 193 | 3 | ||||||

| 2025-08-14 | 13F | Brinker Capital Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 3 087 | 0,00 | 45 | -2,17 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 2 422 672 | 3,35 | 35 492 | 0,01 | ||||

| 2025-08-11 | 13F | United Advisor Group, LLC | 214 488 | 4,38 | 3 142 | 1,03 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 15 334 | 225 | ||||||

| 2025-05-02 | 13F | BluePointe Capital Management, LLC | 113 017 | 9,58 | 1 711 | 9,47 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F/A | Penbrook Management LLC | 24 955 | -26,34 | 366 | -28,71 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 11 777 | -10,04 | 173 | -13,13 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Signature Wealth Management Partners, LLC | 12 920 | 15,65 | 189 | 11,83 | ||||

| 2025-08-12 | 13F | Blueprint Investment Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Denali Advisors Llc | 542 148 | -2,23 | 7 942 | -5,40 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 99 000 | 57,39 | 1 450 | 52,31 | |||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 19 514 | -51,47 | 286 | -53,12 | ||||

| 2025-07-31 | 13F | CAP Partners, LLC | 10 215 | 150 | ||||||

| 2025-07-23 | 13F | Joel Isaacson & Co., LLC | 21 192 | 0,04 | 310 | -3,12 | ||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 34 355 | 0,00 | 503 | -3,27 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 2 806 192 | -30,50 | 41 111 | -32,75 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 253 965 | -40,23 | 3 721 | -42,17 | ||||

| 2025-07-14 | 13F | Westend Capital Management LLC | 970 | 0,00 | 14 | 0,00 | ||||

| 2025-08-15 | 13F | Manhattan West Asset Management, LLC | 28 448 | 0,00 | 417 | -3,26 | ||||

| 2025-08-27 | NP | Advanced Series Trust - Ast Small-cap Growth Portfolio | 128 503 | 2,80 | 1 883 | -0,53 | ||||

| 2025-08-04 | 13F | Strs Ohio | 15 787 656 | 2,65 | 231 289 | -0,68 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 18 636 | 12,02 | 273 | 8,76 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 123 | 2 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 2 829 | 1,29 | 41 | -2,38 | ||||

| 2025-08-07 | 13F | Allen Investment Management LLC | 4 238 538 | 2,49 | 62 095 | -0,83 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 726 187 | 211,85 | 10 639 | 201,79 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 21 461 | -24,28 | 314 | -26,81 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 2 789 | 41 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 1 310 340 | -4,66 | 19 196 | -7,75 | ||||

| 2025-07-11 | 13F | Eagle Bay Advisors LLC | 261 033 | 0,27 | 3 824 | -2,97 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 10 382 | 0,41 | 152 | -2,56 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 800 | -20,00 | 12 | -26,67 | |||

| 2025-06-26 | NP | LSVQX - LSV Small Cap Value Fund Institutional Class Shares | 187 200 | 0,00 | 2 681 | -8,97 | ||||

| 2025-08-07 | 13F | Navellier & Associates Inc | 18 030 | -0,81 | 264 | 3,13 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 7 000 | 32,08 | 103 | 27,50 | |||

| 2025-08-07 | 13F | Evoke Wealth, Llc | 56 153 | 0,00 | 823 | -3,29 | ||||

| 2025-08-14 | 13F | Jain Global LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-06-25 | NP | FNK - First Trust Mid Cap Value AlphaDEX Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 57 407 | -12,81 | 822 | -20,58 | ||||

| 2025-04-28 | NP | HCYAX - HILTON TACTICAL INCOME FUND Investor Class | 40 090 | -3,07 | 628 | -3,09 | ||||

| 2025-08-11 | 13F | Promethium Advisors,llc | 22 600 | 2,26 | 331 | -0,90 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 75 025 | 2,23 | 1 099 | -1,08 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 131 034 | -10,16 | 1 920 | -13,09 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 121 320 | 41,01 | 1 777 | 36,48 | ||||

| 2025-05-12 | 13F | Basso Capital Management, L.p. | 0 | -100,00 | 0 | |||||

| 2025-07-09 | 13F | Bruce G. Allen Investments, LLC | 39 | 0,00 | 1 | |||||

| 2025-08-06 | 13F | Shade Tree Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Focused Wealth Management, Inc | 11 310 | 2,59 | 166 | -0,60 | ||||

| 2025-06-09 | NP | Bmc Fund Inc | 918 | 0,00 | 13 | -7,14 | ||||

| 2025-08-04 | 13F | AMG National Trust Bank | 67 139 | 0,00 | 984 | -3,25 | ||||

| 2025-08-05 | 13F | Castlekeep Investment Advisors Llc | 340 352 | -0,61 | 4 986 | -3,82 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 26 409 | -3,82 | 387 | -6,99 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 45 381 | 5,83 | 1 | |||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 1 599 | 23 | ||||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | IFC Advisors LLC | 50 417 | 4,13 | 739 | 0,68 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 25 127 | -8,33 | 368 | -11,33 | ||||

| 2025-08-07 | 13F | Legacy Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | NP | First Trust Specialty Finance & Financial Opportunities Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 360 000 | 38,46 | 5 476 | 34,39 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 6 936 | 0,00 | 102 | -3,81 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 1 317 151 | -13,83 | 19 296 | -16,62 | ||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 39 980 | 49,18 | 586 | 44,44 | ||||

| 2025-08-05 | 13F | 5T Wealth, LLC | 22 391 | -6,21 | 328 | -9,14 | ||||

| 2025-07-16 | 13F | Colton Groome Financial Advisors, Llc | 10 165 | 149 | ||||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 92 004 | 77,45 | 1 348 | 71,81 | ||||

| 2025-07-02 | 13F | Neville Rodie & Shaw Inc | 53 238 | -14,36 | 1 | |||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 500 | 0,00 | 7 | 0,00 | ||||

| 2025-08-14 | 13F | State Street Corp | 254 131 | 257,75 | 3 723 | 246,33 | ||||

| 2025-08-13 | 13F | Wealthedge Investment Advisors, Llc | 72 995 | -39,28 | 1 069 | -41,26 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 13 538 | -59,41 | 198 | -60,71 | ||||

| 2025-08-06 | 13F | Modera Wealth Management, LLC | 19 690 | -6,15 | 288 | -9,15 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 37 616 | 6,36 | 551 | 2,99 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 64 186 | -7,48 | 928 | -11,71 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 468 678 | -2,38 | 6 866 | -5,53 | ||||

| 2025-08-11 | 13F | Greenland Capital Management LP | 79 421 | -25,07 | 1 164 | -27,49 | ||||

| 2025-07-28 | NP | FXED - Sound Enhanced Fixed Income ETF | 78 785 | 1,12 | 1 198 | -1,80 | ||||

| 2025-05-01 | 13F | Schechter Investment Advisors, LLC | 325 337 | 44,38 | 4 926 | 44,17 | ||||

| 2025-07-22 | 13F | Romano Brothers And Company | 12 125 | 0,00 | 178 | -3,28 | ||||

| 2025-07-29 | NP | SGMAX - SIIT Global Managed Volatility Fund Class A | 92 718 | 0,00 | 1 410 | -2,89 | ||||

| 2025-07-31 | 13F | Whipplewood Advisors, LLC | 67 149 | 14 788,91 | 984 | 14,44 | ||||

| 2025-08-14 | 13F | Tcw Group Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Stifel Financial Corp | 464 882 | 0,87 | 6 811 | -2,39 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 134 500 | -74,64 | 1 970 | -75,46 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 1 215 570 | 17,49 | 17 808 | 13,69 | ||||

| 2025-08-14 | 13F | BI Asset Management Fondsmaeglerselskab A/S | 2 494 | 0,00 | 0 | |||||

| 2025-06-25 | NP | FAB - First Trust Multi Cap Value AlphaDEX Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 10 172 | -12,33 | 146 | -20,33 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 7 457 | -29,44 | 109 | -35,12 | ||||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 35 987 | -22,25 | 527 | -24,71 | ||||

| 2025-08-14 | 13F | Oxford Asset Management Llp | 26 201 | 1,46 | 384 | -5,43 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 1 175 351 | -21,22 | 17 219 | -23,78 | ||||

| 2025-07-31 | 13F | Sage Mountain Advisors LLC | 3 033 453 | 10,47 | 44 440 | 6,89 | ||||

| 2025-08-14 | 13F | Family Management Corp | 63 833 | -9,67 | 935 | -12,54 | ||||

| 2025-05-07 | 13F | Pinnacle Wealth Management Advisory Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | M&t Bank Corp | 24 397 | 0,00 | 357 | -3,25 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 0 | -100,00 | 0 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 21 106 | 1,39 | 309 | -1,90 | ||||

| 2025-07-29 | 13F | TrueMark Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | General Partner, Inc. | 123 041 | 0,00 | 1 803 | -3,22 | ||||

| 2025-05-06 | 13F | Proficio Capital Partners LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Hirtle Callaghan & Co LLC | 13 569 | 6,15 | ||||||

| 2025-05-28 | NP | LUSIX - Lazard US Systematic Small Cap Equity Portfolio Institutional Shares | 5 892 | -11,99 | 89 | -11,88 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 4 442 093 | 3,28 | 65 | 0,00 | ||||

| 2025-08-08 | 13F | CFO4Life Group, LLC | 12 451 | 2,26 | 182 | -1,09 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 252 | 4 | ||||||

| 2025-07-22 | 13F | Grimes & Company, Inc. | 19 005 | -27,81 | 278 | -30,15 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 472 | -94,57 | 0 | |||||

| 2025-08-13 | 13F | Serenus Wealth Advisors, LLC | 17 068 | 0,00 | 250 | -3,10 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 3 100 | -53,03 | 0 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 1 600 | -87,10 | 0 | ||||

| 2025-08-05 | 13F | Next Capital Management LLC | 279 444 | -18,52 | 4 094 | -21,17 | ||||

| 2025-04-11 | 13F | First Affirmative Financial Network | 0 | -100,00 | 0 | |||||

| 2025-08-25 | 13F/A | Promus Capital, LLC | 3 400 | 0,00 | 50 | -3,92 | ||||

| 2025-05-15 | 13F | Balyasny Asset Management Llc | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Quent Capital, LLC | 15 311 | 0,00 | 224 | -3,03 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 402 458 | 22,05 | 5 896 | 18,11 | ||||

| 2025-08-14 | 13F | Douglass Winthrop Advisors, LLC | 35 987 | 0,00 | 527 | -3,12 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 8 826 | 0,00 | 129 | -3,01 | ||||

| 2025-08-14 | 13F | Cove Street Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Northstar Group, Inc. | 19 788 | 0,00 | 290 | -3,34 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 820 643 | -9,05 | 12 022 | -12,00 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 53 992 | 8,30 | 791 | 4,77 | ||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 1 080 551 | 17,15 | 15 830 | 13,36 | ||||

| 2025-07-24 | 13F | Shikiar Asset Management Inc | 443 605 | -0,47 | 6 | 0,00 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 9 | -98,84 | 0 | -100,00 | ||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 32 208 | 30,12 | 472 | 25,94 | ||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 31 118 | 179,89 | 182 | 8,33 | ||||

| 2025-06-27 | NP | LBO - WHITEWOLF Publicly Listed Private Equity ETF | 27 411 | 14,28 | 393 | 3,98 | ||||

| 2025-07-09 | 13F | Massmutual Trust Co Fsb/adv | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Core Wealth Partners LLC | 15 060 | 0,00 | 221 | -3,51 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 37 164 | -71,55 | 1 | -100,00 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 325 200 | 4 764 | ||||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 58 032 | 1,70 | 898 | 11,00 | ||||

| 2025-08-14 | 13F | Cura Wealth Advisors, Llc | 249 900 | -7,00 | 3 661 | -10,00 | ||||

| 2025-05-27 | NP | GAFCX - Virtus AlphaSimplex Global Alternatives Fund Class C | 3 482 | -1,08 | 53 | -1,89 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 381 458 | 0,12 | 5 588 | -3,12 | ||||

| 2025-07-17 | 13F | GraniteShares Advisors LLC | 184 735 | 6,67 | 2 706 | 3,20 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 31 975 | -2,10 | 484 | -2,22 | ||||

| 2025-08-14 | 13F | Williams Jones Wealth Management, LLC. | 11 717 | 0,00 | 172 | -3,39 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 20 997 | -47,13 | 308 | -40,62 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 322 | 2,88 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | New England Asset Management Inc | 232 876 | 0,00 | 3 412 | -3,23 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 500 | 0,00 | 7 | 0,00 | ||||

| 2025-07-30 | 13F | Eqis Capital Management, Inc. | 23 164 | -0,09 | 339 | -3,42 | ||||

| 2025-08-08 | 13F | Lgt Capital Partners Ltd. | 696 000 | -22,67 | 10 196 | -25,17 | ||||

| 2025-07-01 | 13F | Confluence Investment Management Llc | 451 191 | 28,97 | 6 610 | 24,79 | ||||

| 2025-05-06 | 13F | Kovack Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 495 | 147,50 | 7 | 133,33 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 59 194 | 35,97 | 867 | 31,56 | ||||

| 2025-05-08 | 13F | IFG Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Lansforsakringar Fondforvaltning AB (publ) | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 120 689 | 4,43 | 2 | 0,00 | ||||

| 2025-08-12 | 13F | New World Advisors LLC | 29 314 | 15,03 | 429 | 11,43 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 290 402 | 1,25 | 4 254 | -2,79 | ||||

| 2025-08-29 | 13F | Evolution Wealth Management Inc. | 1 218 | 18 | ||||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-29 | NP | Partners Group Private Equity (master Fund), Llc | 686 115 | 34,48 | 10 381 | 34,39 | ||||

| 2025-08-14 | 13F | Brevan Howard Capital Management LP | 17 108 | 251 | ||||||

| 2025-08-08 | 13F | Creative Planning | 12 375 | -84,12 | 181 | -84,65 | ||||

| 2025-05-15 | 13F | AlphaQ Advisors LLC | 17 886 | 271 | ||||||

| 2025-07-30 | 13F | Onyx Bridge Wealth Group LLC | 115 949 | 2,03 | 1 699 | -1,28 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 1 637 858 | 29,25 | 23 995 | 25,07 | ||||

| 2025-04-30 | 13F | Synergy Investment Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1 002 | 240,82 | 15 | 250,00 | ||||

| 2025-07-29 | NP | BPSIX - Boston Partners Small Cap Value Fund II INSTITUTIONAL | 189 610 | 17,60 | 2 884 | 14,13 | ||||

| 2025-08-11 | 13F | Ironsides Asset Advisors, LLC | 14 642 | 13,07 | 215 | 9,18 | ||||

| 2025-07-16 | 13F | Plancorp, LLC | 20 076 | 0,00 | 294 | -2,97 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 3 621 790 | 5,78 | 53 059 | 2,36 | ||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 24 847 | -1,77 | 364 | -4,71 | ||||

| 2025-08-29 | NP | GraniteShares ETF Trust - GraniteShares HIPS US High Income ETF | 184 735 | 6,67 | 2 706 | 3,20 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 79 660 | 2,25 | 1 167 | -1,02 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 13 800 | -1,43 | 202 | -4,27 | |||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 146 434 | -51,57 | 2 145 | -53,15 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 49 900 | 26,33 | 731 | 22,24 | |||

| 2025-07-16 | 13F | Pictet & Cie (Europe) SA | 13 847 | 2,57 | 203 | -0,98 | ||||

| 2025-07-16 | 13F | Prairiewood Capital, LLC | 341 092 | 6,17 | 4 997 | 2,73 | ||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-21 | 13F | J. Safra Sarasin Holding AG | 80 000 | 0,00 | 1 172 | -3,22 | ||||

| 2025-07-15 | 13F | Riverbridge Partners Llc | 45 840 | 3,64 | 672 | 0,30 | ||||

| 2025-07-24 | 13F | Columbia Advisory Partners Llc | 15 348 | 0,00 | 225 | -3,45 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 2 192 | 116,82 | 32 | 128,57 | ||||

| 2025-08-08 | 13F | MTM Investment Management, LLC | 2 800 | 41 | ||||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Mowery & Schoenfeld Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 2 408 886 | 90,76 | 35 290 | 84,58 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 11 116 | -70,15 | 0 | |||||

| 2025-07-18 | 13F | Union Bancaire Privee, UBP SA | 41 919 | 5,08 | 87 470 | 14 405,80 | ||||

| 2025-07-07 | 13F | Delphi Management Inc /ma/ | 29 898 | -1,82 | 0 | |||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 265 077 | 4,09 | 4 | 0,00 | ||||

| 2025-08-06 | 13F | OneAscent Wealth Management LLC | 30 725 | -92,29 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | Compass Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 264 428 | 14,42 | 3 874 | 10,69 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 8 000 | -44,19 | 117 | -46,33 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 3 782 | -0,68 | 55 | -3,51 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 36 645 | 16,41 | 537 | 12,61 | ||||

| 2025-07-18 | 13F | Generali Investments CEE, investicni spolecnost, a.s. | 68 630 | 5,02 | 1 005 | 1,62 | ||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 45 346 | 2,97 | 664 | -0,30 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 193 875 | -22,81 | 2 840 | -25,30 | ||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 19 287 | -1,15 | 283 | -4,41 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 452 735 | 67,44 | 6 633 | 62,03 | ||||

| 2025-08-14 | 13F | Advisor OS, LLC | 197 991 | 2,47 | 2 901 | -0,85 | ||||

| 2025-08-12 | 13F | Waterloo Capital, L.P. | 140 616 | 9,94 | 2 060 | 6,40 | ||||

| 2025-08-04 | 13F | Muzinich & Co., Inc. | 1 228 122 | 31,52 | 17 992 | 27,26 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 1 796 | 0,00 | 26 | -3,70 | ||||

| 2025-08-12 | 13F | OneAscent Financial Services LLC | 176 439 | -67,94 | 3 | -75,00 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 15 264 | -75,10 | 224 | -75,97 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 148 900 | 0,08 | 2 181 | -3,15 | ||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 310 | 0,00 | 5 | 0,00 | ||||

| 2025-08-13 | 13F | Kilter Group LLC | 181 | 3 | ||||||

| 2025-07-22 | 13F | Iron Horse Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Engineers Gate Manager LP | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 335 053 | -0,37 | 4 909 | -3,59 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 467 317 | -42,81 | 6 846 | -44,66 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 422 455 | -0,43 | 6 189 | -3,66 | ||||

| 2025-08-14 | 13F | Silvercrest Asset Management Group Llc | 0 | -100,00 | 0 | |||||

| 2025-05-09 | 13F | Hemington Wealth Management | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Generali Asset Management SPA SGR | 2 512 705 | 39,59 | 36 811 | 35,08 | ||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 15 830 | 232 | ||||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 2 354 112 | 2,65 | 34 488 | -0,68 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 18 568 | -46,48 | 272 | -48,19 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-09 | 13F | Triumph Capital Management | 52 018 | 1,99 | 762 | -1,30 | ||||

| 2025-08-04 | 13F | Simon Quick Advisors, Llc | 83 357 | 2,10 | 1 221 | -1,21 | ||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 11 010 | 0,00 | 161 | -3,01 | ||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 11 894 | 9,01 | 174 | 5,45 | ||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 604 | 2,72 | 9 | 0,00 | ||||

| 2025-07-31 | 13F/A | Avion Wealth | 13 | 0,00 | 0 | |||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-06-30 | NP | PSP - Invesco Global Listed Private Equity ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 80 995 | -16,30 | 1 160 | -23,85 | ||||

| 2025-08-14 | 13F | Ausdal Financial Partners, Inc. | 11 961 | 175 | ||||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 12 560 | 184 | ||||||

| 2025-04-28 | 13F | Mutual Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 14 165 | 28,96 | 208 | 24,70 | ||||

| 2025-08-13 | 13F | SCS Capital Management LLC | 397 201 | -6,06 | 5 819 | -9,11 | ||||

| 2025-08-14 | 13F | Fmr Llc | 445 | 340,59 | 7 | 500,00 | ||||

| 2025-08-28 | NP | SMVIX - Simt Small Cap Value Fund Class I | 6 686 | -71,12 | 98 | -72,29 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 241 741 | 10,54 | 3 542 | 6,95 | ||||

| 2025-08-06 | 13F | OneAscent Family Office, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Haven Private, LLC | 0 | -100,00 | 0 | |||||

| 2025-04-23 | 13F | Embree Financial Group | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Global Endowment Management, LP | 90 000 | 12,50 | 1 318 | 8,84 | ||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 43 167 | -2,32 | 632 | -5,53 | ||||

| 2025-08-08 | 13F | Advisors Capital Management, LLC | 330 628 | 1,33 | 4 844 | -1,96 | ||||

| 2025-04-29 | 13F | Raleigh Capital Management Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 12 625 | -20,64 | 185 | -23,33 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 175 000 | -0,10 | 2 564 | -3,36 | ||||

| 2025-07-28 | 13F | Naviter Wealth, LLC | 279 449 | 17,84 | 4 094 | 13,19 | ||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 25 005 | 366 | ||||||

| 2025-07-21 | 13F | Abundance Wealth Counselors | 76 558 | 9,94 | 1 | 0,00 | ||||

| 2025-07-17 | 13F | Albion Financial Group /ut | 69 834 | 5,68 | 1 023 | 2,30 | ||||

| 2025-05-12 | 13F | Entropy Technologies, LP | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 90 145 | 1 321 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 2 633 017 | 9,69 | 38 574 | 6,14 | ||||

| 2025-06-25 | NP | VPC - Virtus Private Credit Strategy ETF | 57 600 | 2,69 | 825 | -6,58 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 75 686 | -17,80 | 1 109 | -20,52 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 207 738 | -1,03 | 3 043 | -4,22 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 666 635 | -4,48 | 9 766 | -7,57 | ||||

| 2025-08-11 | 13F | Edgemoor Investment Advisors, Inc. | 69 215 | -1,42 | 1 014 | -4,61 | ||||

| 2025-07-14 | 13F | Golden State Equity Partners | 34 564 | 0,00 | 506 | -3,25 | ||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 5 128 | 2,56 | 75 | -1,32 | ||||

| 2025-08-11 | 13F | VSM Wealth Advisory, LLC | 2 633 | 2,65 | 39 | 0,00 | ||||

| 2025-05-12 | 13F | Virtu Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Castle Wealth Management Llc | 17 027 | 249 | ||||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 585 | 29,14 | 9 | 33,33 | ||||

| 2025-08-05 | 13F | Partners Group Holding AG | 0 | -100,00 | 0 | |||||

| 2025-04-30 | 13F | POM Investment Strategies, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 70 297 | -37,10 | 1 030 | -39,15 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 3 162 | -76,45 | 46 | -77,34 | ||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 31 071 | 17,93 | 455 | 14,32 | ||||

| 2025-05-15 | 13F | Dark Forest Capital Management Lp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 186 752 | 186,34 | 2 736 | 177,10 | ||||

| 2025-07-22 | 13F | McElhenny Sheffield Capital Management, LLC | 44 000 | 44 | ||||||

| 2025-08-06 | 13F | Nicholas Hoffman & Company, LLC. | 32 467 | -2,31 | 476 | -5,57 | ||||

| 2025-08-13 | 13F | Brown Advisory Inc | 119 246 | -60,03 | 1 747 | -61,35 | ||||

| 2025-07-22 | 13F | Global Assets Advisory, LLC | 11 105 | 161 | ||||||

| 2025-08-15 | 13F | Kensington Investment Counsel, LLC | 11 966 | 0,00 | 175 | -3,31 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 155 707 | 18,37 | 2 282 | 14,62 | ||||

| 2025-05-14 | 13F | Trexquant Investment LP | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Condor Capital Management | 351 113 | 2,65 | 5 144 | -0,68 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 51 340 | -18,58 | 752 | -21,17 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Wall Street Access Asset Management, LLC | 27 815 | 1,12 | 407 | -1,93 | ||||

| 2025-08-06 | 13F | Texas Yale Capital Corp. | 160 089 | -7,54 | 2 345 | -10,53 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Arcus Capital Partners, LLC | 45 010 | 2,36 | 659 | -0,90 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 314 | 5 | ||||||

| 2025-08-14 | 13F | Granite FO LLC | 504 535 | 0,00 | 7 391 | -3,23 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 32 361 | -4,50 | 0 | |||||

| 2025-08-14 | 13F | Quarry LP | 2 834 | 26,40 | 42 | 24,24 | ||||

| 2025-08-14 | 13F | TT Capital Management LLC | 75 077 | 1 104 | ||||||

| 2025-08-14 | 13F | Axa S.a. | 18 470 | 0,00 | 271 | -3,23 | ||||

| 2025-07-28 | NP | PEX - ProShares Global Listed Private Equity ETF | 40 495 | 0,36 | 616 | -2,69 | ||||

| 2025-05-28 | NP | OneAscent Capital Opportunities Fund | 365 | 15,87 | 6 | 25,00 | ||||

| 2025-05-30 | NP | ERNZ - TrueShares Active Yield ETF | 11 157 | -93,92 | 169 | -93,96 | ||||

| 2025-08-04 | 13F | Amplius Wealth Advisors, LLC | 52 158 | 1,96 | 764 | -1,29 | ||||

| 2025-05-15 | 13F | Colony Capital, Inc. | Put | 0 | -100,00 | 0 | ||||

| 2025-06-25 | NP | FNX - First Trust Mid Cap Core AlphaDEX Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 212 957 | -10,70 | 3 050 | -18,72 | ||||

| 2025-08-14 | 13F | Hurley Capital, LLC | 3 238 | 0,00 | 47 | -4,08 | ||||

| 2025-05-16 | 13F | Jones Financial Companies Lllp | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 24 508 | 45,28 | 359 | 40,78 | ||||

| 2025-08-15 | 13F | Keel Point, LLC | 39 845 | 2,68 | 584 | -0,68 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-06-30 | 13F/A | Deutsche Bank Ag\ | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 1 000 | 0,00 | 0 | |||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 34 605 | -11,88 | 507 | -14,81 | ||||

| 2025-08-14 | 13F | Ares Management Llc | 2 571 210 | 2,90 | 37 668 | -0,43 | ||||

| 2025-07-31 | 13F | Quest Partners LLC | 4 882 | -30,92 | 72 | -33,02 | ||||

| 2025-07-09 | 13F | Silverberg Bernstein Capital Management LLC | 86 200 | 36,39 | 1 263 | 32,01 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 331 207 | -4,70 | 4 852 | -7,77 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 14 900 | 20 594,44 | 215 | 65,38 | |||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 20 954 | -12,36 | 307 | -15,24 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 21 411 | 36,95 | 314 | 32,63 | ||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 184 492 | 0,00 | 2 703 | -3,26 | ||||

| 2025-07-11 | 13F | Mandatum Life Insurance Co Ltd | 35 566 | -23,44 | 521 | -25,89 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 85 833 | -28,39 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | Blueshift Asset Management, LLC | 12 954 | 190 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-12 | 13F/A | Boston Partners | 1 136 713 | 1,50 | 16 689 | 0,17 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 318 133 | 5,04 | 4 661 | 1,64 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 565 992 | 13,66 | 8 292 | 9,97 | ||||

| 2025-08-21 | NP | BIZD - VanEck Vectors BDC Income ETF | 3 912 974 | -2,30 | 57 325 | -5,46 | ||||

| 2025-07-17 | 13F | Mattern Wealth Management LLC | 14 000 | 0,00 | 205 | -2,84 | ||||

| 2025-05-28 | 13F | Silicon Valley Capital Partners | 1 202 | 0,00 | 18 | 0,00 | ||||

| 2025-08-14 | 13F | Cardiff Park Advisors, Llc | 10 000 | 0,00 | 146 | -3,31 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 44 036 | 4,99 | 645 | 1,57 | ||||

| 2025-08-14 | 13F | Comerica Bank | 12 208 | -2,44 | 179 | -5,82 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 95 933 | 371,81 | 1 405 | 357,65 | ||||

| 2025-08-05 | 13F | Crestwood Advisors Group LLC | 10 414 | 153 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 820 | 13 566,67 | 12 | |||||

| 2025-08-06 | 13F | Baillie Gifford & Co | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Callodine Capital Management, LP | 521 238 | -0,72 | 7 636 | -3,93 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 37 160 | -42,64 | 544 | -44,49 | ||||

| 2025-07-18 | 13F | O'ROURKE & COMPANY, Inc | 11 737 | 0,98 | 172 | -2,29 | ||||

| 2025-08-12 | 13F | OneAscent Investment Solutions LLC | 42 634 | -1,67 | 1 | |||||

| 2025-07-24 | 13F | Costello Asset Management, INC | 200 | -33,33 | 3 | -50,00 | ||||

| 2025-05-13 | 13F | Fox Run Management, L.l.c. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | Talon Private Wealth, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 35 356 | 83,11 | 518 | 77,05 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 147 119 | 2 155 | ||||||

| 2025-07-25 | 13F | LRI Investments, LLC | 118 986 | 0,00 | 1 743 | -3,22 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 43 826 | 0,00 | 642 | -3,17 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 280 435 | 0,36 | 4 108 | -2,88 | ||||

| 2025-07-29 | 13F | Beverly Hills Private Wealth, LLC | 19 316 | -14,59 | 283 | -17,54 | ||||

| 2025-07-29 | 13F | Sigma Investment Counselors Inc | 800 915 | 10,89 | 11 733 | 7,30 | ||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 37 008 | 1,11 | 542 | -2,17 | ||||

| 2025-07-30 | NP | HYIN - WisdomTree Alternative Income Fund N/A | 118 450 | 11,57 | 1 802 | 8,30 | ||||

| 2025-05-15 | 13F | Citadel Advisors Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 25 328 | 3,78 | 371 | 0,54 | ||||

| 2025-08-15 | 13F | Northeast Financial Consultants Inc | 3 887 089 | -5,65 | 56 946 | -8,71 | ||||

| 2025-08-21 | NP | MOFTX - Mercer Opportunistic Fixed Income Fund Class I | 87 000 | 1 275 | ||||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 3 648 809 | -13,13 | 53 455 | -15,95 | ||||

| 2025-07-30 | 13F | Klingman & Associates, LLC | 27 788 | -17,14 | 407 | -19,72 | ||||

| 2025-05-14 | 13F | Credit Agricole S A | 108 336 | 280,38 | 1 640 | 280,51 | ||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 273 490 | -0,14 | 4 007 | -3,38 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 47 769 | 21,46 | 700 | 17,48 | ||||

| 2025-07-24 | 13F | Comprehensive Money Management Services LLC | 11 600 | 8,72 | 170 | 4,97 | ||||

| 2025-08-07 | 13F | Global Wealth Management Investment Advisory, Inc. | 74 188 | 6,18 | 1 087 | 2,74 | ||||

| 2025-08-11 | 13F | EMC Capital Management | 12 729 | -25,65 | 0 | |||||

| 2025-08-14 | 13F | Evercore Wealth Management, LLC | 49 838 | 1,19 | 730 | -2,01 | ||||

| 2025-08-05 | 13F | Magnolia Capital Advisors Llc | 48 891 | 18,66 | 716 | 14,93 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 295 705 | 67,60 | 4 332 | 62,19 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 152 195 | -17,02 | 2 230 | -19,73 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 10 720 | 157 | ||||||

| 2025-05-28 | NP | VQNPX - Vanguard Growth and Income Fund Investor Shares This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 23 900 | -71,64 | 362 | -71,73 | ||||

| 2025-07-21 | 13F | Future Financial Wealth Managment LLC | 3 015 | 0,84 | 44 | -2,22 | ||||

| 2025-07-29 | 13F | Arista Wealth Management, LLC | 10 000 | 146 | ||||||

| 2025-08-14 | 13F | Port Capital LLC | 22 000 | 0,00 | 322 | -3,30 | ||||

| 2025-07-08 | 13F/A | Adams Asset Advisors, LLC | 137 723 | 71,75 | 2 018 | 66,14 | ||||

| 2025-08-11 | 13F | Lsv Asset Management | 1 223 018 | -1,07 | 18 | -5,56 | ||||

| 2025-08-11 | 13F | Universal- Beteiligungs- und Servicegesellschaft mbH | 253 360 | 0,14 | 3 712 | -3,11 | ||||

| 2025-06-26 | NP | LSVFX - LSV GLOBAL MANAGED VOLATILITY FUND Institutional Class Shares | 3 200 | 0,00 | 46 | -10,00 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 160 434 | -45,75 | 2 350 | -47,50 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 18 296 | -35,84 | 268 | -37,82 | ||||

| 2025-05-14 | 13F | Bbr Partners, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 25 340 | 9,39 | 371 | 6,00 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 0 | -100,00 | 0 | |||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 3 015 305 | -0,83 | 45 652 | -0,96 | ||||

| 2025-07-07 | 13F | RDA Financial Network | 34 367 | -3,93 | 503 | -7,02 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 41 210 | 25,11 | 604 | 21,08 | ||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 19 679 | 23,01 | 288 | 19,01 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 193 | 2,66 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 0 | -100,00 | 0 | |||||

| 2025-05-02 | 13F | Wealthfront Advisers Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | M Holdings Securities, Inc. | 369 488 | 6,00 | 5 | 0,00 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 1 891 937 | 1,67 | 27 726 | -1,56 | ||||

| 2025-08-13 | 13F | Legacy Capital Wealth Partners, LLC | 107 781 | -2,88 | 1 579 | -6,07 | ||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Hilton Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-06 | 13F | Pinnacle Associates Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 64 065 | -22,14 | 939 | -24,66 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Montag A & Associates Inc | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Border to Coast Pensions Partnership Ltd | 850 000 | 6,25 | 12 | 0,00 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 36 667 | 0,00 | 537 | -3,24 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 91 056 | 0,00 | 1 334 | -3,27 | ||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 |

Other Listings

| GB:0IZ6 |