Statistiques de base

| Actions institutionnelles (Long) | 318 276 987 - 69,03% (ex 13D/G) - change of -16,16MM shares -4,83% MRQ |

| Valeur institutionnelle (Long) | $ 10 167 476 USD ($1000) |

Participation institutionnels et actionnaires

Brookfield Infrastructure Partners L.P. - Limited Partnership (US:BIP) détient 355 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 318,276,987 actions. Les principaux actionnaires incluent Royal Bank Of Canada, Capital World Investors, Principal Financial Group Inc, Bank Of Montreal /can/, PMBMX - MidCap Fund (f/k/a MidCap Blend Fund) R-3, AMECX - INCOME FUND OF AMERICA Class A, 1832 Asset Management L.P., CIBC Asset Management Inc, CIBC World Markets Inc., and ANCFX - AMERICAN FUNDS FUNDAMENTAL INVESTORS Class A .

Brookfield Infrastructure Partners L.P. - Limited Partnership (NYSE:BIP) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 8, 2025 is 31,06 / share. Previously, on September 9, 2024, the share price was 31,83 / share. This represents a decline of 2,42% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

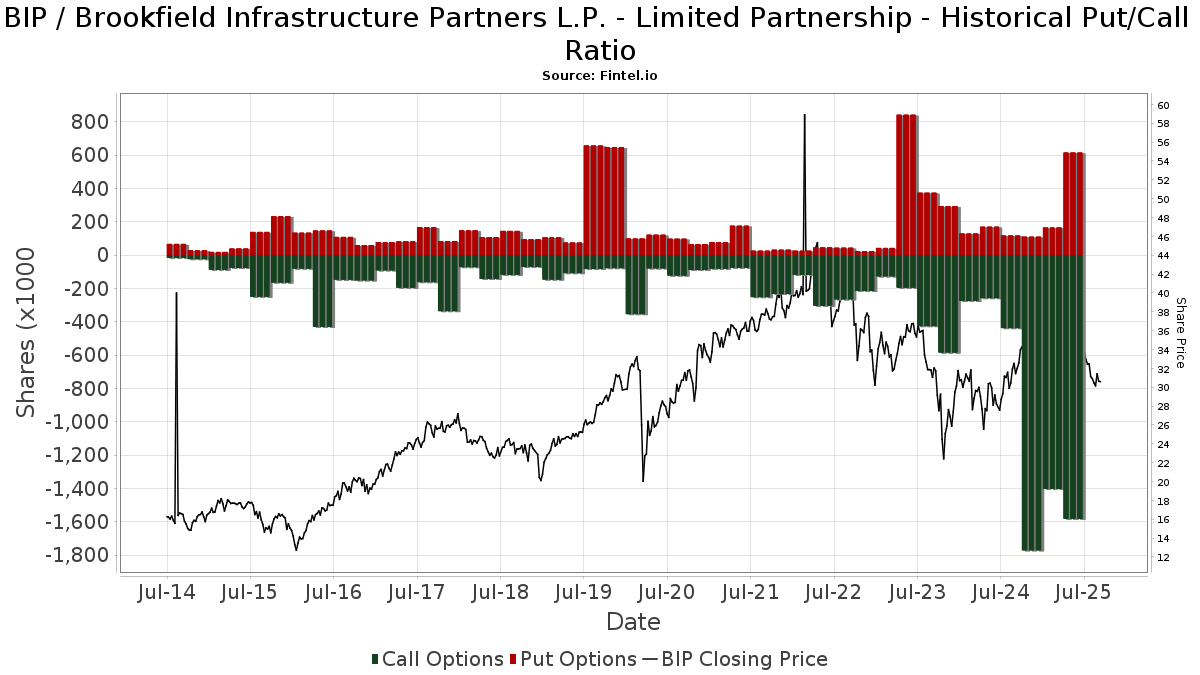

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13D/G

Nous présentons les dépôts 13D/G séparément des dépôts 13F en raison de leur traitement différent par la SEC. Les déclarations 13D/G peuvent être déposées par des groupes d'investisseurs (avec un leader), ce qui n'est pas le cas des déclarations 13F. Il en résulte des situations dans lesquelles un investisseur peut déposer une déclaration 13D/G indiquant une valeur pour le total des actions (représentant toutes les actions détenues par le groupe d'investisseurs), mais déposer ensuite une déclaration 13F indiquant une valeur différente pour le total des actions (représentant strictement ses propres actions). Cela signifie que l'actionnariat des déclarations 13D/G et des déclarations 13F n'est souvent pas directement comparable, c'est pourquoi nous les présentons séparément.

Note : À compter du 16 mai 2021, nous n'affichons plus les propriétaires qui n'ont pas déposé de déclaration 13D/G au cours de l'année écoulée. Auparavant, nous montrions l'historique complet des déclarations 13D/G. En général, les entités qui sont tenues de déposer des déclarations 13D/G doivent le faire au moins une fois par an avant de soumettre une déclaration de clôture. Cependant, il arrive que des fonds sortent de positions sans soumettre de déclaration de clôture (c'est-à-dire qu'ils procèdent à une liquidation), de sorte que l'affichage de l'historique complet pouvait prêter à confusion quant à l'actionnariat actuel. Pour éviter toute confusion, nous n'affichons désormais que les propriétaires "actuels", c'est-à-dire les propriétaires qui ont déposé des documents au cours de l'année écoulée.

Upgrade to unlock premium data.

| Date de dépôt | Formulaire | Investisseur | Actions précédentes |

Actions actuelles |

&Delta ; Actions (Pourcentage) |

Participation (Pourcentage) |

&Delta ; Participation (Pourcentage) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-07-31 | 1832 Asset Management L.P. | 17,141,574 | 15,451,475 | -9.86 | 3.35 | -9.96 | ||

| 2025-02-13 | PRINCIPAL GLOBAL INVESTORS | 26,675,618 | 5.80 | |||||

| 2025-02-12 | ROYAL BANK OF CANADA | 24,422,990 | 5.28 | |||||

| 2024-12-27 | BROOKFIELD ASSET MANAGEMENT INC. | 137,982,130 | 207,999,242 | 50.74 | 31.30 | 0.32 | ||

| 2024-10-10 | BANK OF NOVA SCOTIA | 27,099,482 | 5.90 |

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Capital World Investors | 31 692 263 | 0,26 | 1 061 723 | 12,90 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 2 451 | 0,00 | 82 | 12,33 | ||||

| 2025-07-29 | 13F | Roof Eidam & Maycock/adv | 6 750 | 0,00 | 226 | 12,44 | ||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 6 935 826 | 3,37 | 232 194 | 17,38 | ||||

| 2025-08-14 | 13F | Mufg Securities (canada), Ltd. | 783 254 | 11,14 | 26 202 | 25,00 | ||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 112 | -90,95 | 4 | -91,67 | ||||

| 2025-08-14 | 13F | Toronto Dominion Bank | Put | 12 800 | 29,29 | 429 | 45,58 | |||

| 2025-08-07 | 13F/A | Leith Wheeler Investment Counsel Ltd. | 382 053 | -2,60 | 12 799 | 9,53 | ||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 526 959 | -0,73 | 17 110 | 1,87 | ||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 2 493 405 | -16,41 | 83 585 | -5,82 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Toronto Dominion Bank | Call | 622 400 | -31,10 | 20 864 | -22,37 | |||

| 2025-07-29 | 13F | Mb, Levis & Associates, Llc | 2 932 | 0,00 | 98 | 12,64 | ||||

| 2025-08-06 | 13F | Agf Management Ltd | 2 475 583 | -9,06 | 82 935 | 2,41 | ||||

| 2025-08-12 | 13F | Picton Mahoney Asset Management | 1 384 662 | 46 | ||||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 151 044 | 0,02 | 5 065 | 12,71 | ||||

| 2025-07-23 | 13F | Indiana Trust & Investment Management CO | 562 | 0,00 | 19 | 12,50 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 7 503 | 36,15 | 251 | 57,86 | ||||

| 2025-08-07 | 13F | Guardian Capital Lp | 647 084 | 0,94 | 21 634 | 13,46 | ||||

| 2025-06-26 | NP | GYLD - Arrow Dow Jones Global Yield ETF | 4 472 | 134 | ||||||

| 2025-08-21 | NP | KINETICS PORTFOLIOS TRUST - Kinetics Paradigm Portfolio | 27 000 | -2,88 | 904 | 9,18 | ||||

| 2025-07-25 | 13F | Tranquility Partners, LLC | 83 438 | 1,12 | 2 795 | 13,76 | ||||

| 2025-07-29 | 13F | Cidel Asset Management Inc | 6 028 | -15,27 | 202 | -4,74 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 461 | 15 | ||||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 225 | 8 | ||||||

| 2025-07-29 | 13F | Huntleigh Advisors, Inc. | 10 620 | 7,13 | 356 | 20,34 | ||||

| 2025-08-13 | 13F | Sanibel Captiva Trust Company, Inc. | 108 424 | -0,29 | 3 632 | 12,13 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 426 616 | -8,74 | 14 292 | 2,62 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 91 100 | 54,93 | 3 052 | 74,24 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 23 400 | -42,36 | 784 | -35,24 | |||

| 2025-08-07 | 13F/A | Credit Industriel Et Commercial | 25 625 | -72,63 | 858 | -69,24 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 2 849 | 83,57 | 95 | 93,88 | ||||

| 2025-08-13 | 13F | Meketa Investment Group Inc /adv | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Bank Of Nova Scotia Trust Co | 47 475 | 1,53 | 1 590 | 14,22 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-04-25 | 13F | Albion Financial Group /ut | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Financial Perspectives, Inc | 6 154 | 0,00 | 206 | 12,57 | ||||

| 2025-08-14 | 13F | First Foundation Advisors | 77 402 | 11,53 | 2 593 | 25,40 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 26 700 | -37,47 | 1 | -100,00 | |||

| 2025-07-24 | 13F | Tandem Capital Management Corp /adv | 41 540 | -0,59 | 1 392 | 11,82 | ||||

| 2025-04-25 | 13F | Smallwood Wealth Investment Management, LLC | 64 | 2 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 2 100 | -90,62 | 0 | ||||

| 2025-04-10 | 13F | Arthur M. Cohen & Associates, Llc | 0 | -100,00 | 0 | |||||

| 2025-04-28 | NP | FMCE - FM Compounders Equity ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-25 | 13F | Pandora Wealth, Inc. | 2 700 | 0,00 | 90 | 12,50 | ||||

| 2025-07-21 | 13F | Qrg Capital Management, Inc. | 6 109 | 205 | ||||||

| 2025-04-28 | NP | FDLS - Inspire Fidelis Multi Factor ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 250 | 0,00 | 8 | 14,29 | ||||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 450 | 0,00 | 15 | 15,38 | ||||

| 2025-07-24 | 13F | Davis-rea Ltd. | 70 419 | -2,86 | 2 362 | 9,36 | ||||

| 2025-07-29 | 13F | Regions Financial Corp | 12 501 | 0,00 | 419 | 12,37 | ||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 74 052 | -4,20 | 2 481 | 7,73 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 7 807 | 248,06 | 262 | 283,82 | ||||

| 2025-08-07 | 13F | Montag A & Associates Inc | 160 | -52,10 | 5 | -44,44 | ||||

| 2025-08-12 | 13F | Harbor Advisory Corp /ma/ | 255 115 | 1,48 | 8 546 | 14,13 | ||||

| 2025-08-15 | 13F | Provenance Wealth Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Ing Groep Nv | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 172 | 0,00 | 6 | 0,00 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 12 842 | -12,74 | 430 | -1,83 | ||||

| 2025-07-09 | 13F | Mirador Capital Partners LP | 6 944 | 0,00 | 233 | 12,62 | ||||

| 2025-04-24 | 13F | Wingate Wealth Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Gluskin Sheff & Assoc Inc | 36 751 | -54,35 | 1 231 | -48,62 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 151 | 0,67 | 5 | 25,00 | ||||

| 2025-08-12 | 13F | Forge First Asset Management Inc. | 80 398 | -46,00 | 2 688 | -39,42 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 49 580 | -5,62 | 1 651 | 5,43 | ||||

| 2025-08-25 | 13F/A | Promus Capital, LLC | 820 | 0,00 | 27 | 12,50 | ||||

| 2025-07-22 | 13F | Jamison Private Wealth Management, Inc. | 58 619 | 0,00 | 1 964 | 12,43 | ||||

| 2025-07-28 | 13F | Td Asset Management Inc | 6 613 447 | -14,84 | 221 112 | -4,28 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 1 227 764 | 34,18 | 41 158 | 51,17 | ||||

| 2025-08-15 | 13F | Resources Management Corp /ct/ /adv | 450 | 0,00 | 0 | |||||

| 2025-07-11 | 13F | First PREMIER Bank | 7 582 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Stone Run Capital, Llc | 48 921 | 0,03 | 1 639 | 12,50 | ||||

| 2025-08-14 | 13F | Investment Management Corp of Ontario | 28 000 | -5,41 | 938 | 6,47 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 220 030 | 23,11 | 7 371 | 38,45 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 102 650 | 30,16 | 3 432 | 46,31 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 10 242 | 1,74 | 343 | 14,72 | ||||

| 2025-08-12 | 13F | Public Sector Pension Investment Board | 44 700 | 0,90 | 1 494 | 13,44 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 12 722 | 1,67 | 426 | 14,52 | ||||

| 2025-08-13 | 13F | Westerkirk Capital Inc. | 23 740 | 795 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 190 142 | 8,92 | 6 370 | 22,48 | ||||

| 2025-08-12 | 13F | Archer Investment Corp | 111 | 0,00 | 4 | 0,00 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 562 | 0,00 | 19 | 12,50 | ||||

| 2025-05-09 | 13F | Cumberland Partners Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | HHM Wealth Advisors, LLC | 4 287 | 0,00 | 144 | 12,60 | ||||

| 2025-08-08 | 13F | Principal Financial Group Inc | 29 042 315 | 5,15 | 972 918 | 18,24 | ||||

| 2025-07-14 | 13F | Bank & Trust Co | 1 125 | 0,00 | 38 | 12,12 | ||||

| 2025-08-14 | 13F | Vivaldi Capital Management, LLC | 11 250 | 0,00 | 377 | 12,24 | ||||

| 2025-08-01 | 13F | CCLA Investment Management Ltd | 3 889 923 | -32,88 | 130 | -24,42 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 36 205 | 55,81 | 1 213 | 75,14 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 11 878 | -82,30 | 398 | -80,13 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 10 900 | -51,34 | 365 | -45,28 | |||

| 2025-05-14 | 13F | Brown Brothers Harriman & Co | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 102 200 | 7,02 | 3 424 | 20,36 | |||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 67 371 | -5,90 | 2 257 | 5,82 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 5 626 228 | 7,51 | 188 008 | 21,66 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 129 884 | -4,14 | 4 351 | 7,80 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 6 760 | -35,98 | 226 | -28,03 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 7 151 292 | -0,83 | 239 568 | 11,52 | ||||

| 2025-06-27 | NP | PID - Invesco International Dividend Achievers ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 839 064 | 1,38 | 25 180 | -7,27 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 12 192 | 0,33 | 0 | |||||

| 2025-08-12 | 13F | Bowen Hanes & Co Inc | 744 748 | 0,00 | 24 949 | 12,45 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 40 542 | 66,18 | 1 358 | 87,05 | ||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 3 767 | 3 263,39 | 126 | 4 100,00 | ||||

| 2025-07-31 | 13F | Washington Trust Advisors, Inc. | 10 083 | 0,00 | 338 | 12,33 | ||||

| 2025-07-30 | 13F | Whittier Trust Co | 35 521 | 0,00 | 1 190 | 12,38 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 7 030 | 236 | ||||||

| 2025-05-13 | 13F | Cresset Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Evanson Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Avenir Corp | 23 071 | 0,00 | 773 | 12,37 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 12 069 | 9,50 | 405 | 23,85 | ||||

| 2025-05-08 | 13F | We Are One Seven, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Prosperity Consulting Group, LLC | 19 227 | 0,00 | 644 | 12,59 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 58 104 | -4,71 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | New South Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Pacifica Partners Inc. | 2 102 | -4,54 | 71 | 7,69 | ||||

| 2025-08-15 | 13F | Ewing Morris & Co. Investment Partners Ltd. | 17 826 | 52,67 | 597 | 37,64 | ||||

| 2025-05-15 | 13F | Grayhawk Investment Strategies Inc. | 1 656 | 0,00 | 49 | -5,77 | ||||

| 2025-08-12 | 13F | Aviso Financial Inc. | 383 100 | 30,24 | 12 832 | 46,57 | ||||

| 2025-08-15 | 13F | Chapman Financial Group, Llc | 26 103 | -1,68 | 874 | 3,68 | ||||

| 2025-05-23 | NP | XVOL - Acruence Active Hedge U.S. Equity ETF | 2 009 | -44,87 | 60 | -48,70 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 16 682 | -19,79 | 559 | -9,85 | ||||

| 2025-08-15 | 13F | Prevail Innovative Wealth Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Addenda Capital Inc. | 704 591 | 13,49 | 32 143 | 20,94 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 340 147 | 4,53 | 11 395 | 17,54 | ||||

| 2025-08-08 | 13F | Creative Planning | 65 536 | 1,00 | 2 195 | 13,61 | ||||

| 2025-08-05 | 13F | Tiaa Trust, National Association | 18 552 | -2,36 | 621 | 9,72 | ||||

| 2025-08-12 | 13F | Horizon Kinetics Asset Management Llc | 27 171 | -2,86 | 910 | 9,24 | ||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 2 277 | 6,55 | 76 | 20,63 | ||||

| 2025-07-09 | 13F | Sawyer & Company, Inc | 3 750 | 0,00 | 0 | |||||

| 2025-05-06 | 13F | Proficio Capital Partners LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 244 863 | 2,55 | 8 203 | 15,33 | ||||

| 2025-08-08 | 13F | Empower Advisory Group, LLC | 6 837 | 229 | ||||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 18 701 | -21,37 | 626 | -11,58 | ||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 2 189 | 0,00 | 73 | 12,31 | ||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 10 000 | 0,00 | 334 | 12,46 | ||||

| 2025-08-25 | NP | PRINCIPAL VARIABLE CONTRACTS FUNDS INC - MidCap Account Class 1 | 526 680 | -5,36 | 17 644 | 6,42 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 2 523 | 23,13 | 85 | 37,70 | ||||

| 2025-07-31 | 13F | Cardinal Point Capital Management, ULC | 35 120 | -3,10 | 1 174 | 23,84 | ||||

| 2025-08-07 | 13F | Guardian Partners Inc. | 84 033 | -1,43 | 2 772 | 15,17 | ||||

| 2025-08-12 | 13F | Clearbridge Investments, LLC | 284 359 | -1,04 | 9 526 | 11,29 | ||||

| 2025-04-23 | 13F | Horizon Bancorp Inc /in/ | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 9 910 | 332 | ||||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 77 071 | 4,33 | 2 582 | 17,32 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-14 | 13F | Visionary Wealth Advisors | 11 371 | 9,64 | 381 | 23,38 | ||||

| 2025-07-28 | 13F | Boston Trust Walden Corp | 6 050 | 203 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 18 912 | 16,79 | 634 | 31,33 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Colony Group, LLC | 29 074 | 17,55 | 974 | 32,34 | ||||

| 2025-07-07 | 13F | Value Partners Investments Inc. | 47 294 | 99,45 | 1 581 | 123,94 | ||||

| 2025-08-14 | 13F | Financial Network Wealth Advisors LLC | 424 | 0,00 | 14 | 16,67 | ||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 262 944 | 0,00 | 8 791 | 12,40 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 303 | 0,00 | 10 | 11,11 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 27 363 460 | -3,59 | 916 676 | 8,42 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 22 920 | 6,86 | 1 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 195 | 0,00 | 7 | 20,00 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 1 835 | 15,77 | 61 | 29,79 | ||||

| 2025-07-15 | 13F | Northside Capital Management, LLC | 78 723 | 2 637 | ||||||

| 2025-08-06 | 13F | North Capital, Inc. | 1 161 | 0,00 | 39 | 11,76 | ||||

| 2025-08-13 | 13F | Brown Advisory Inc | 373 503 | 2,43 | 12 512 | 15,19 | ||||

| 2025-07-25 | 13F | Lincluden Management Ltd | 576 851 | -2,28 | 19 | 11,76 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 2 867 | -93,01 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | Atlantic Trust, LLC | 37 544 | -1,16 | 1 258 | 11,14 | ||||

| 2025-05-29 | NP | CPAEX - Counterpoint Tactical Equity Fund Class A Shares | 12 471 | 372 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 8 358 | -9,90 | 280 | 1,09 | ||||

| 2025-07-24 | 13F | Stonebridge Financial Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Credential Qtrade Securities Inc. | 12 670 | -4,94 | 396 | -5,95 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 24 967 | 10,28 | 836 | 24,04 | ||||

| 2025-08-14 | 13F | Creegan & Nassoura Financial Group, LLC | 6 860 | -1,79 | 230 | 10,10 | ||||

| 2025-07-31 | 13F | Schneider Downs Wealth Management Advisors, LP | 15 057 | 0,00 | 504 | 12,50 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 2 041 573 | 13,26 | 68 393 | 27,37 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 825 | -14,24 | 28 | -3,57 | ||||

| 2025-08-25 | NP | ANCFX - AMERICAN FUNDS FUNDAMENTAL INVESTORS Class A This fund is a listed as child fund of Capital World Investors and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 6 980 868 | 0,00 | 233 866 | 12,61 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 8 101 | -1,76 | 271 | 10,61 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 33 099 | -0,93 | 1 | |||||

| 2025-07-30 | 13F | Rehmann Capital Advisory Group | 6 774 | 0,00 | 227 | 12,44 | ||||

| 2025-07-24 | 13F | Baskin Financial Services Inc. | 325 946 | -3,49 | 11 | 0,00 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 1 163 | -13,14 | 39 | -2,56 | ||||

| 2025-08-14 | 13F | Herold Advisors, Inc. | 95 194 | -4,76 | 3 189 | 7,09 | ||||

| 2025-08-14 | 13F | Prestige Wealth Management Group LLC | 355 | 0,00 | 12 | 10,00 | ||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 6 256 | 210 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 326 649 | 278,40 | 10 943 | 325,59 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 6 000 | -63,64 | 201 | -59,06 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 41 712 | -16,96 | 1 397 | -6,62 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 20 450 | 1 | ||||||

| 2025-07-10 | 13F | Focus Financial Network, Inc. | 6 740 | 226 | ||||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 45 | 0,00 | 0 | |||||

| 2025-07-25 | NP | MainStay CBRE Global Infrastructure Megatrends Fund | 670 827 | 4,68 | 22 211 | 9,27 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 2 875 | 0,00 | 96 | 12,94 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 45 280 | -0,60 | 1 517 | 11,72 | ||||

| 2025-07-21 | 13F | Compass Planning Associates Inc | 909 | 1,11 | 30 | 15,38 | ||||

| 2025-07-31 | 13F | Briaud Financial Planning, Inc | 63 | 0,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 1 068 | -59,59 | 36 | -55,13 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 18 624 | -4,17 | 687 | 5,86 | ||||

| 2025-08-04 | 13F | Buckhead Capital Management Llc | 11 072 | 0,00 | 371 | 12,46 | ||||

| 2025-06-26 | NP | AMECX - INCOME FUND OF AMERICA Class A | 22 376 603 | 0,00 | 669 058 | -8,92 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 14 410 | 483 | ||||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 28 962 | 5,02 | 970 | 18,15 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-12 | 13F | Wulff, Hansen & Co. | 49 327 | -11,65 | 1 652 | -0,66 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 7 606 | 1,44 | 255 | 13,90 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 6 609 938 | 3,35 | 221 430 | 16,22 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-05-12 | 13F | National Bank Of Canada /fi/ | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-13 | 13F | Bank Of Nova Scotia | 3 317 616 | -7,38 | 111 111 | 4,25 | ||||

| 2025-04-25 | 13F | Farmers & Merchants Trust Co of Chambersburg PA | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Arcadia Investment Management Corp/mi | 1 875 | 0,00 | 63 | 12,73 | ||||

| 2025-08-15 | 13F | Brookfield Asset Management Inc. | 4 686 497 | 0,00 | 156 998 | 12,45 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 6 882 | -28,56 | 231 | -19,58 | ||||

| 2025-08-08 | 13F | Avalon Trust Co | 187 080 | -9,18 | 6 267 | 2,13 | ||||

| 2025-07-21 | 13F | Credential Securities Inc. | 4 596 | -10,53 | 176 | -17,37 | ||||

| 2025-07-25 | 13F | Verdence Capital Advisors LLC | 7 064 | 0,41 | 237 | 12,92 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 1 324 | 164,80 | 44 | 214,29 | ||||

| 2025-07-18 | 13F | Chelsea Counsel Co | 39 150 | 0,00 | 1 312 | 12,34 | ||||

| 2025-08-27 | NP | FORH - Formidable ETF | 12 534 | -5,40 | 420 | 6,35 | ||||

| 2025-07-22 | 13F | Chung Wu Investment Group, LLC | 300 | 10 | ||||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 11 770 | 6,90 | 394 | 20,12 | ||||

| 2025-08-13 | 13F | SCS Capital Management LLC | 487 990 | -41,35 | 16 348 | -34,05 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 155 629 | -3,77 | 5 214 | 8,22 | ||||

| 2025-07-16 | NP | CGIC - Capital Group International Core Equity ETF Share Class | 29 069 | 165,11 | 963 | 177,23 | ||||

| 2025-08-14 | 13F | Glenview Trust Co | 6 000 | 201 | ||||||

| 2025-07-23 | 13F | Vontobel Holding Ltd. | 26 201 | 878 | ||||||

| 2025-08-05 | 13F | Sigma Planning Corp | 9 162 | 15,59 | 307 | 29,66 | ||||

| 2025-04-07 | 13F | Nexus Investment Management ULC | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Walnut Private Equity Partners, Llc | 102 000 | 2,00 | 3 417 | 14,70 | ||||

| 2025-08-13 | 13F | Custom Index Systems, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Eastern Bank | 4 499 | 0,00 | 151 | 11,94 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 3 430 | 11 333,33 | 115 | |||||

| 2025-04-16 | 13F | Farmers & Merchants Investments Inc | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 1 271 955 | -64,14 | 42 610 | -59,67 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 625 | 0,00 | 21 | 11,11 | ||||

| 2025-07-29 | 13F | Stratos Wealth Advisors, LLC | 9 516 | -9,55 | 319 | 1,60 | ||||

| 2025-07-22 | 13F | IFS Advisors, LLC | 675 | 0,00 | 23 | 10,00 | ||||

| 2025-08-14 | 13F | Select Equity Group, L.P. | 309 830 | -88,31 | 10 379 | -86,85 | ||||

| 2025-08-19 | NP | DBALX - Davenport Balanced Income Fund | 61 867 | 0,00 | 2 073 | 12,43 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 71 913 | 116,24 | 2 409 | 143,33 | ||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 2 025 | 0,00 | 68 | 11,67 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 724 975 | 8,78 | 24 287 | 22,33 | ||||

| 2025-07-21 | 13F | Sterling Investment Counsel, LLC | 6 269 | 210 | ||||||

| 2025-08-26 | NP | JXI - iShares Global Utilities ETF | 44 450 | 7,18 | 1 489 | 20,76 | ||||

| 2025-08-11 | 13F | Heritage Wealth Advisors | 950 | 26,67 | 32 | 40,91 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 3 980 353 | -28,06 | 133 270 | -19,16 | ||||

| 2025-08-08 | 13F | First Western Trust Bank | 9 039 | -7,22 | 303 | 4,14 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 23 616 | 1,35 | 791 | 13,98 | ||||

| 2025-07-22 | 13F | Mascoma Wealth Management LLC | 75 | 0,00 | 3 | 0,00 | ||||

| 2025-07-22 | 13F | Woodmont Investment Counsel Llc | 59 515 | 6,30 | 1 994 | 19,56 | ||||

| 2025-04-23 | 13F | Aspetuck Financial Management LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Dixon Mitchell Investment Counsel Inc. | 2 503 764 | 46,73 | 83 739 | 64,91 | ||||

| 2025-08-14 | 13F | Peapack Gladstone Financial Corp | 41 161 | -1,51 | 1 | 0,00 | ||||

| 2025-05-12 | 13F | Jarislowsky, Fraser Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 30 258 | 37,99 | 1 014 | 55,13 | ||||

| 2025-06-25 | NP | VRAI - Virtus Real Asset Income ETF | 5 421 | 14,66 | 163 | 4,52 | ||||

| 2025-07-16 | 13F | Formidable Asset Management, LLC | 12 534 | -5,40 | 420 | 6,35 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 81 870 | 1,29 | 2 743 | 13,92 | ||||

| 2025-08-14 | 13F | Hyperion Capital Advisors LP | 96 019 | 0,00 | 3 217 | 12,45 | ||||

| 2025-08-25 | NP | AMERICAN FUNDS INSURANCE SERIES - International Growth and Income Fund Class 1 This fund is a listed as child fund of Capital World Investors and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 37 345 | 0,03 | 1 251 | 12,70 | ||||

| 2025-07-16 | 13F | PFS Partners, LLC | 266 | 1,14 | 9 | 14,29 | ||||

| 2025-08-15 | 13F | Koesten, Hirschmann & Crabtree, INC. | 52 | 2 | ||||||

| 2025-08-08 | 13F | Kane Investment Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Quent Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Franklin Resources Inc | 77 595 | -0,58 | 2 600 | 11,83 | ||||

| 2025-08-11 | 13F | Novak & Powell Financial Services, Inc. | 19 675 | -1,01 | 659 | 11,32 | ||||

| 2025-07-23 | 13F | Triasima Portfolio Management inc. | 0 | -100,00 | 0 | |||||

| 2025-04-28 | 13F | Mutual Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 5 274 | 10,33 | 177 | 23,94 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 1 576 166 | 2,61 | 52 788 | 14,33 | ||||

| 2025-07-23 | 13F | Citizens National Bank Trust Department | 622 | 0,00 | 21 | 11,11 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 16 240 | -80,84 | 544 | -78,46 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 8 732 | 293 | ||||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 58 735 | 12,06 | 1 968 | 26,01 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 49 538 | 10,51 | 1 660 | 24,27 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 191 061 | 362,21 | 6 | 500,00 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | WFA Asset Management Corp | 1 141 | 0,00 | 31 | -11,43 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 3 180 | -72,77 | 107 | -71,43 | ||||

| 2025-04-21 | 13F | Beacon Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Birchbrook, Inc. | 340 | 100,00 | 11 | 120,00 | ||||

| 2025-08-14 | 13F | FIL Ltd | 3 722 880 | 57,86 | 124 720 | 77,78 | ||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 7 119 | 0,00 | 238 | 12,26 | ||||

| 2025-08-13 | 13F | Northwest & Ethical Investments L.P. | 112 041 | -1,73 | 3 768 | 11,05 | ||||

| 2025-04-14 | 13F | Beach Investment Counsel Inc/pa | 82 623 | -4,59 | 2 | 0,00 | ||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-04-17 | 13F | M. Kraus & Co | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Barclays Plc | 99 | -7,48 | 0 | |||||

| 2025-08-27 | 13F | Munro Partners | 168 180 | 5 634 | ||||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 4 725 | -5,97 | 158 | 6,04 | ||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 171 | 6 | ||||||

| 2025-08-04 | 13F | Bristlecone Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 69 084 | 5,89 | 2 314 | 19,09 | ||||

| 2025-08-25 | NP | IGAAX - International Growth and Income Fund Class A | 1 622 383 | 0,00 | 54 351 | 12,61 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-06-24 | NP | NLSAX - Neuberger Berman Long Short Fund Class A | 3 074 131 | 7,91 | 92 255 | -1,30 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 963 | 0,52 | 32 | 14,29 | ||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 15 403 263 | -6,15 | 516 009 | 5,54 | ||||

| 2025-05-12 | 13F | Sandy Spring Bank | 225 | 0,00 | 7 | -14,29 | ||||

| 2025-08-13 | 13F | Beutel, Goodman & Co Ltd. | 16 754 | -6,99 | 0 | |||||

| 2025-07-18 | 13F | Gold Investment Management Ltd. | 164 114 | 4,01 | 5 497 | 17,06 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 4 400 | 0,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 5 628 | 79,29 | 0 | |||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 250 | 0,00 | 8 | 14,29 | ||||

| 2025-04-25 | 13F | WASHINGTON TRUST Co | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 77 400 | 2 595 | ||||||

| 2025-08-15 | 13F | Morse Asset Management, Inc | 8 150 | 8,67 | 273 | 22,42 | ||||

| 2025-08-04 | 13F | Keybank National Association/oh | 37 868 | 1,51 | 1 269 | 14,13 | ||||

| 2025-08-06 | 13F | Texas Yale Capital Corp. | 34 897 | 0,00 | 1 169 | 12,51 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 1 263 | -38,24 | 42 | -35,38 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 11 048 | -46,42 | 370 | -39,74 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 136 629 | -2,20 | 4 577 | 10,00 | ||||

| 2025-07-30 | 13F | Princeton Global Asset Management LLC | 972 | -50,00 | 33 | -43,86 | ||||

| 2025-08-07 | 13F | Cahill Financial Advisors Inc | 75 586 | 0,70 | 2 532 | 13,24 | ||||

| 2025-08-12 | 13F | Bahl & Gaynor Inc | 8 837 | -11,11 | 296 | 0,00 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 127 562 | 7,43 | 4 276 | 21,06 | ||||

| 2025-08-05 | 13F | K.J. Harrison & Partners Inc | 24 555 | 0,52 | 821 | 12,93 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 415 | 0,00 | 14 | 8,33 | ||||

| 2025-05-07 | 13F | David R. Rahn & Associates Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Tritonpoint Wealth, Llc | 152 605 | 0,67 | 5 112 | 13,22 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | SC&H Financial Advisors, Inc. | 8 182 | 0,00 | 274 | 12,76 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 300 | 0,00 | 10 | 25,00 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Avantax Planning Partners, Inc. | 17 189 | 0,00 | 576 | 12,30 | ||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-19 | 13F/A | Kovitz Investment Group Partners, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 88 | 0,00 | 3 | 0,00 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 533 323 | -6,91 | 17 866 | 15,53 | ||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 40 333 | 0,47 | 1 351 | 13,05 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-07 | 13F | Tacita Capital Inc | 142 267 | -0,24 | 4 764 | 12,25 | ||||

| 2025-08-13 | 13F | JT Stratford LLC | 69 737 | 0,96 | 2 336 | 13,56 | ||||

| 2025-04-25 | 13F | Almanack Investment Partners, LLC. | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Canton Hathaway, LLC | 16 407 | 0,35 | 1 | |||||

| 2025-08-14 | 13F | Summit Trail Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Invesco Ltd. | 2 145 360 | -6,32 | 71 870 | 5,35 | ||||

| 2025-08-14 | 13F | SIG North Trading, ULC | Put | 204 600 | 357,72 | 6 854 | 414,95 | |||

| 2025-08-14 | 13F | SIG North Trading, ULC | 8 535 | 0,00 | 286 | 12,20 | ||||

| 2025-08-14 | 13F | SIG North Trading, ULC | Call | 329 900 | 76,98 | 11 052 | 99,05 | |||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 22 940 | 113,51 | 1 | |||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 67 151 | 0,44 | 2 250 | 12,96 | ||||

| 2025-08-14 | 13F | Evercore Wealth Management, LLC | 6 896 | 0,00 | 231 | 12,68 | ||||

| 2025-06-27 | NP | PASIX - PACE Alternative Strategies Investments Class A | 9 220 | -78,93 | 277 | -80,77 | ||||

| 2025-08-01 | 13F | Transcend Wealth Collective, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Spears Abacus Advisors LLC | 200 087 | 0,88 | 6 703 | 13,44 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 544 | 2,64 | 18 | 20,00 | ||||

| 2025-07-24 | 13F | Louisbourg Investments Inc. | 1 958 | 0,00 | 65 | 12,07 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 105 716 | -5,67 | 3 541 | 6,08 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 6 406 | 0 | ||||||

| 2025-06-30 | NP | PFM - Invesco Dividend Achievers ETF | 13 419 | -3,95 | 403 | -12,23 | ||||

| 2025-07-28 | 13F | Callahan Advisors, LLC | 25 276 | 9,77 | 847 | 23,50 | ||||

| 2025-07-30 | 13F | Evermay Wealth Management Llc | 3 200 | 0,00 | 107 | 12,63 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 3 736 | -3,36 | 125 | 8,70 | ||||

| 2025-07-17 | 13F | Lakewood Asset Management LLC | 14 369 | -6,92 | 481 | 4,79 | ||||

| 2025-08-14 | 13F | SWAN Capital LLC | 262 | 9 | ||||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 118 763 | -0,36 | 3 979 | 12,06 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 20 006 | -24,14 | 670 | -14,65 | ||||

| 2025-08-12 | 13F | Ci Investments Inc. | 2 698 017 | 0,34 | 90 | 12,50 | ||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 20 255 | 0,07 | 679 | 12,62 | ||||

| 2025-05-08 | 13F | Menard Financial Group LLC | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 28 441 | -1,16 | 953 | 11,09 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 1 552 018 | -3,87 | 51 955 | 9,14 | ||||

| 2025-07-25 | 13F | Montrusco Bolton Investments Inc. | 530 720 | -10,12 | 17 744 | 1,02 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 25 900 | -39,06 | 868 | -31,52 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | Put | 360 000 | 12 060 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 90 | 0,00 | 3 | 50,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 46 065 523 | 9,38 | 1 543 196 | 23,01 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | Call | 360 000 | 12 060 | |||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 22 449 | 6,38 | 765 | 21,66 | ||||

| 2025-08-21 | 13F | Pathway Financial Advisers, LLC | 31 957 | 2,85 | 1 071 | 15,68 | ||||

| 2025-08-13 | 13F | Empire Financial Management Company, LLC | 38 494 | 1,97 | 1 290 | 14,68 | ||||

| 2025-07-16 | 13F | American National Bank | 15 075 | 505 | ||||||

| 2025-08-14 | 13F | BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp | 2 191 946 | 32,37 | 73 479 | 49,14 | ||||

| 2025-06-26 | NP | AWYIX - CIBC ATLAS EQUITY INCOME FUND Institutional Class Shares | 109 577 | 0,00 | 3 288 | -8,54 | ||||

| 2025-07-17 | 13F | TBH Global Asset Management, LLC | 9 297 | 0,00 | 311 | 12,68 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Diversified Trust Co | 6 750 | 226 | ||||||

| 2025-08-13 | 13F | Natixis | 0 | -100,00 | 0 | |||||

| 2025-05-05 | 13F | Carmel Capital Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Huntington National Bank | 686 | 411,94 | 23 | 633,33 | ||||

| 2025-07-10 | 13F | Western Pacific Wealth Management, LP | 887 | -45,75 | 30 | -39,58 | ||||

| 2025-08-08 | 13F | Summerhill Capital Management lnc. | 233 844 | -0,54 | 7 834 | 11,85 | ||||

| 2025-06-23 | NP | PMBMX - MidCap Fund (f/k/a MidCap Blend Fund) R-3 | 25 058 456 | 5,34 | 752 004 | -3,65 | ||||

| 2025-07-07 | 13F | Investors Research Corp | 30 | 0,00 | 1 | |||||

| 2025-08-06 | 13F | Nvwm, Llc | 3 075 | 0,00 | 103 | 13,19 | ||||

| 2025-04-25 | NP | VCINX - International Growth Fund | 173 065 | -1,00 | 5 490 | -10,21 | ||||

| 2025-08-19 | 13F | State of Wyoming | 3 649 | 12,55 | 122 | 27,08 | ||||

| 2025-08-06 | 13F | Cbre Clarion Securities Llc | 670 827 | -6,29 | 22 473 | 5,38 | ||||

| 2025-08-07 | 13F | PCJ Investment Counsel Ltd. | 262 210 | -14,15 | 8 786 | -3,38 | ||||

| 2025-07-22 | 13F | Sage Investment Counsel LLC | 37 803 | 0,00 | 1 266 | 12,43 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 44 800 | 27,99 | 1 501 | 44,37 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 33 000 | 29,92 | 1 106 | 46,16 | |||

| 2025-07-14 | 13F | Toth Financial Advisory Corp | 50 | 2 | ||||||

| 2025-07-09 | 13F | Epiq Partners, Llc | 101 537 | -1,60 | 3 401 | 10,67 | ||||

| 2025-08-14 | 13F | CIBC Asset Management Inc | 7 301 691 | 7,80 | 244 531 | 21,31 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 14 684 | 492 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 68 076 | 2 281 | ||||||

| 2025-08-14 | 13F | ArrowMark Colorado Holdings LLC | 263 225 | -1,16 | 8 818 | 11,16 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 26 544 | -70,30 | 889 | -66,60 | ||||

| 2025-07-31 | 13F | Optimum Investment Advisors | 1 125 | -56,90 | 38 | -51,95 | ||||

| 2025-08-05 | 13F | Verity Asset Management, Inc. | 7 962 | -3,89 | 267 | 8,13 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 36 284 | 5,08 | 1 216 | 18,19 | ||||

| 2025-08-01 | 13F | GoalVest Advisory LLC | 1 697 | 0,00 | 57 | 12,00 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 9 996 | 0,00 | 335 | 12,46 | ||||

| 2025-07-28 | NP | TOLZ - ProShares DJ Brookfield Global Infrastructure ETF | 25 142 | 17,64 | 832 | 22,90 | ||||

| 2025-08-12 | 13F | Choate Investment Advisors | 8 475 | -11,72 | 284 | -0,70 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 16 800 | -74,35 | 563 | -71,19 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 1 700 | -76,71 | 57 | -74,19 | |||

| 2025-08-19 | 13F | MRP Capital Investments, LLC | 24 025 | 15,37 | 805 | 29,68 | ||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 25 192 | -5,26 | 844 | 6,44 | ||||

| 2025-08-07 | 13F | Gryphon Financial Partners LLC | 33 900 | -7,00 | 1 136 | 4,61 | ||||

| 2025-08-14 | 13F | First Manhattan Co | 1 920 635 | -0,75 | 64 342 | 11,61 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 6 858 976 | -12,11 | 229 926 | -0,96 | ||||

| 2025-08-14 | 13F | Intact Investment Management Inc. | 1 367 954 | -16,69 | 45 814 | -6,23 | ||||

| 2025-05-13 | 13F | Bank Of Montreal /can/ | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-04-23 | 13F | JCIC Asset Management Inc. | 4 821 | 5,93 | 143 | -0,69 | ||||

| 2025-08-08 | 13F | Ironwood Investment Counsel, LLC | 6 568 | 220 | ||||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 513 589 | -0,89 | 17 205 | 11,45 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 7 761 | 1,03 | 0 | |||||

| 2025-05-29 | NP | MFAIX - International Advantage Portfolio Class I | 1 217 942 | -8,63 | 36 282 | -14,37 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 22 867 | -8,96 | 766 | 2,41 | ||||

| 2025-08-14 | 13F | UBS Group AG | 165 030 | 4,23 | 5 529 | 17,22 | ||||

| 2025-08-13 | 13F | Fort Sheridan Advisors Llc | 61 508 | 0,00 | 2 061 | 12,45 | ||||

| 2025-08-12 | 13F | Laurel Wealth Advisors LLC | 40 200 | 3 250,00 | 1 | -97,14 |

Other Listings

| CA:BIP.UN | 42,90 $CA |