Statistiques de base

| Propriétaires institutionnels | 277 total, 277 long only, 0 short only, 0 long/short - change of 11,69% MRQ |

| Allocation moyenne du portefeuille | 0.8503 % - change of -4,97% MRQ |

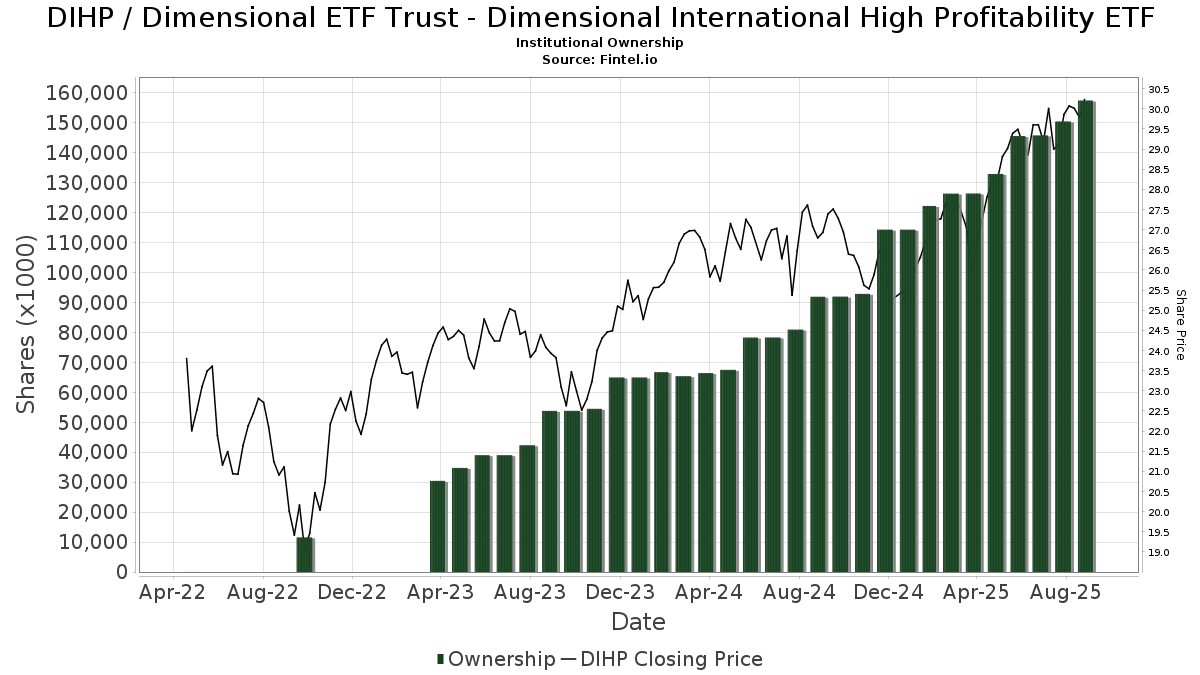

| Actions institutionnelles (Long) | 157 377 044 (ex 13D/G) - change of 11,65MM shares 8,00% MRQ |

| Valeur institutionnelle (Long) | $ 4 552 754 USD ($1000) |

Participation institutionnels et actionnaires

Dimensional ETF Trust - Dimensional International High Profitability ETF (US:DIHP) détient 277 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 157,377,044 actions. Les principaux actionnaires incluent Mercer Global Advisors Inc /adv, Envestnet Asset Management Inc, Savant Capital, LLC, Colony Group, LLC, Vista Wealth Management Group, LLC, Forum Financial Management, LP, Sequoia Financial Advisors, LLC, Clarius Group, LLC, Bank Of Montreal /can/, and HighTower Advisors, LLC .

Dimensional ETF Trust - Dimensional International High Profitability ETF (BATS:DIHP) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 12, 2025 is 30,41 / share. Previously, on September 13, 2024, the share price was 27,11 / share. This represents an increase of 12,17% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

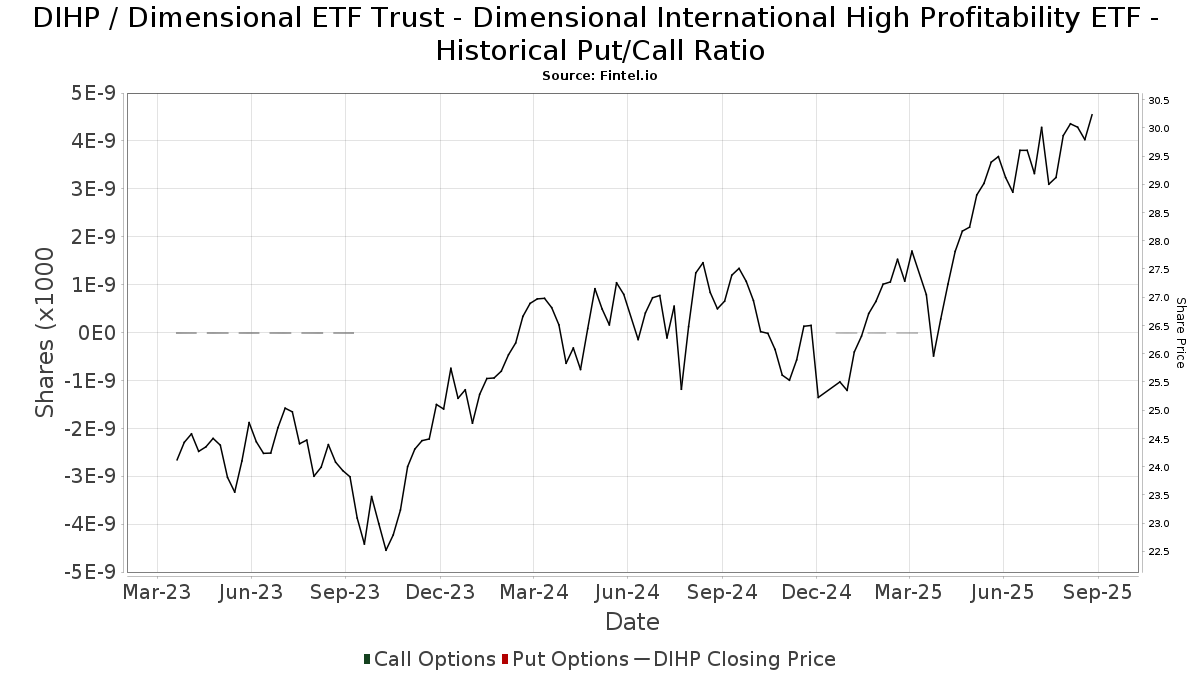

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13D/G

Nous présentons les dépôts 13D/G séparément des dépôts 13F en raison de leur traitement différent par la SEC. Les déclarations 13D/G peuvent être déposées par des groupes d'investisseurs (avec un leader), ce qui n'est pas le cas des déclarations 13F. Il en résulte des situations dans lesquelles un investisseur peut déposer une déclaration 13D/G indiquant une valeur pour le total des actions (représentant toutes les actions détenues par le groupe d'investisseurs), mais déposer ensuite une déclaration 13F indiquant une valeur différente pour le total des actions (représentant strictement ses propres actions). Cela signifie que l'actionnariat des déclarations 13D/G et des déclarations 13F n'est souvent pas directement comparable, c'est pourquoi nous les présentons séparément.

Note : À compter du 16 mai 2021, nous n'affichons plus les propriétaires qui n'ont pas déposé de déclaration 13D/G au cours de l'année écoulée. Auparavant, nous montrions l'historique complet des déclarations 13D/G. En général, les entités qui sont tenues de déposer des déclarations 13D/G doivent le faire au moins une fois par an avant de soumettre une déclaration de clôture. Cependant, il arrive que des fonds sortent de positions sans soumettre de déclaration de clôture (c'est-à-dire qu'ils procèdent à une liquidation), de sorte que l'affichage de l'historique complet pouvait prêter à confusion quant à l'actionnariat actuel. Pour éviter toute confusion, nous n'affichons désormais que les propriétaires "actuels", c'est-à-dire les propriétaires qui ont déposé des documents au cours de l'année écoulée.

Upgrade to unlock premium data.

| Date de dépôt | Formulaire | Investisseur | Actions précédentes |

Actions actuelles |

&Delta ; Actions (Pourcentage) |

Participation (Pourcentage) |

&Delta ; Participation (Pourcentage) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-08-07 | Savant Capital, LLC | 23,936,337 | 18.02 |

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-31 | 13F | Brighton Jones Llc | 13 453 | 8,54 | 397 | 18,92 | ||||

| 2025-08-05 | 13F | Centennial Bank/AR/ | 10 961 | -53,61 | 323 | -49,21 | ||||

| 2025-07-28 | 13F | RCS Financial Planning, LLC | 19 586 | -22,21 | 578 | -14,90 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 21 862 | -10,40 | 645 | -1,98 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 14 905 | 13,54 | 440 | 24,01 | ||||

| 2025-08-05 | 13F | Integrity Financial Corp /WA | 34 | 0,00 | 1 | |||||

| 2025-08-18 | 13F/A | Kestra Investment Management, LLC | 1 840 775 | 54 284 | ||||||

| 2025-07-22 | 13F | Awm Capital, Llc | 7 360 | 217 | ||||||

| 2025-07-17 | 13F | Applied Capital LLC | 145 384 | -0,40 | 4 287 | 9,03 | ||||

| 2025-08-12 | 13F | Intrepid Capital Management Inc | 60 631 | -8,50 | 1 788 | 0,17 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 64 431 | 9,20 | 1 900 | 19,57 | ||||

| 2025-07-29 | 13F | Aspiriant, Llc | 39 901 | 0,00 | 1 177 | 9,50 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | SageView Advisory Group, LLC | 24 448 | -2,38 | 716 | 6,08 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 65 478 | 9,32 | 1 925 | 18,53 | ||||

| 2025-08-12 | 13F | Tableaux Llc | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 403 | 1 200,00 | 12 | |||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 9 874 | -11,27 | 283 | -5,35 | ||||

| 2025-07-31 | 13F | Topsail Wealth Management, LLC | 1 135 | 1,07 | 33 | 10,00 | ||||

| 2025-08-14 | 13F | Mpwm Advisory Solutions, Llc | 1 450 | 0,00 | 43 | 7,69 | ||||

| 2025-04-15 | 13F | Paladin Advisory Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Discipline Wealth Solutions, LLC | 6 859 | 202 | ||||||

| 2025-07-10 | 13F | Websterrogers Financial Advisors, Llc | 537 932 | 0,92 | 15 864 | 10,47 | ||||

| 2025-07-17 | 13F | Northwest Wealth Management, Llc | 165 485 | 2,88 | 4 880 | 12,62 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 1 443 876 | -2,58 | 42 580 | 6,64 | ||||

| 2025-07-22 | 13F | Firethorn Wealth Partners, Llc | 23 759 | -5,41 | 701 | 3,55 | ||||

| 2025-08-12 | 13F | Landing Point Financial Group, LLC | 13 954 | 21,47 | 412 | 33,01 | ||||

| 2025-08-14 | 13F | Sentinel Wealth Management, Inc. | 36 041 | 1 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 25 252 358 | 11,71 | 744 692 | 22,28 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 12 006 | 354 | ||||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 296 694 | 12,13 | 8 750 | 22,74 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 6 055 | 0,00 | 179 | 21,09 | ||||

| 2025-07-11 | 13F | Andrews, Lucia Wealth Management Llc | 29 268 | 2,77 | 863 | 20,19 | ||||

| 2025-07-22 | 13F | Gemmer Asset Management LLC | 11 720 | 11,61 | 346 | 22,34 | ||||

| 2025-08-05 | 13F | Bridgewater Advisors Inc. | 771 597 | -6,88 | 22 554 | -2,02 | ||||

| 2025-05-02 | 13F | Capital A Wealth Management, LLC | 12 | 0 | ||||||

| 2025-07-14 | 13F | Shearwater Capital LLC | 6 978 | 206 | ||||||

| 2025-07-14 | 13F | Maryland Capital Advisors Inc. | 19 558 | 18,93 | 577 | 30,02 | ||||

| 2025-08-15 | 13F | Binnacle Investments Inc | 133 407 | 2,24 | 3 934 | 11,92 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 48 891 | -20,10 | 1 442 | -12,56 | ||||

| 2025-07-29 | 13F | Two West Capital Advisors LLC | 34 992 | 0,62 | 1 041 | 14,02 | ||||

| 2025-07-23 | 13F | Sax Wealth Advisors, Llc | 378 587 | -12,80 | 11 165 | -4,55 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 6 894 | 203 | ||||||

| 2025-08-07 | 13F | Nwam Llc | 31 763 | -4,47 | 937 | 4,58 | ||||

| 2025-08-11 | 13F | Summit Wealth Partners, LLC | 58 322 | 12,25 | 1 720 | 22,87 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 10 828 | -14,45 | 319 | -6,18 | ||||

| 2025-07-09 | 13F | Market Street Wealth Management Advisors Llc | 486 699 | 1,20 | 14 353 | 10,77 | ||||

| 2025-07-10 | 13F | Voisard Asset Management Group, Inc. | 222 066 | 11,76 | 6 549 | 22,35 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 126 046 | -4,14 | 3 717 | 4,94 | ||||

| 2025-08-14 | 13F | Envision Financial Planning, LLC | 390 041 | -2,30 | 11 502 | 6,96 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 7 351 | 217 | ||||||

| 2025-07-15 | 13F | Great Oak Capital Partners, Llc | 671 718 | 5,53 | 19 749 | 23,60 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 4 384 277 | 1,51 | 129 292 | 11,11 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 94 606 | 14,04 | 2 790 | 24,84 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 22 481 | 52,94 | 663 | 67,59 | ||||

| 2025-08-14 | 13F | Navigoe, LLC | 200 046 | 67,65 | 6 | 66,67 | ||||

| 2025-07-17 | 13F | Archford Capital Strategies, LLC | 98 344 | 25,99 | 2 900 | 37,96 | ||||

| 2025-07-15 | 13F | Family Wealth Partners, Llc | 315 038 | 2,18 | 9 290 | 11,85 | ||||

| 2025-07-25 | 13F | Tranquility Partners, LLC | 10 773 | 3,42 | 318 | 13,21 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 2 226 611 | -1,67 | 65 663 | 7,64 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 431 564 | -64,94 | 12 727 | -61,62 | ||||

| 2025-07-21 | 13F | Matauro, Llc | 8 267 | 1,09 | 244 | 10,45 | ||||

| 2025-07-11 | 13F | Diversified Trust Co | 7 500 | 0,00 | 221 | 9,41 | ||||

| 2025-07-17 | 13F | Claris Advisors, Llc / Mo / | 239 294 | -1,42 | 7 057 | 7,91 | ||||

| 2025-08-12 | 13F | Bedel Financial Consulting, Inc. | 9 172 | 0,22 | 270 | 4,65 | ||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 17 189 | -4,03 | 507 | 12,20 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 1 027 563 | 9,52 | 30 | 20,00 | ||||

| 2025-07-31 | 13F | City State Bank | 16 500 | 9 066,67 | 487 | 12 050,00 | ||||

| 2025-04-17 | 13F | Vista Wealth Management Group, LLC | 6 458 111 | 1,92 | 173 982 | 8,83 | ||||

| 2025-07-16 | 13F | TCI Wealth Advisors, Inc. | 995 438 | 16,57 | 29 355 | 27,60 | ||||

| 2025-07-15 | 13F | Maseco Llp | 4 751 | 140 | ||||||

| 2025-07-16 | 13F | Midwest Heritage Bank, FSB | 67 856 | -0,07 | 2 001 | 9,40 | ||||

| 2025-07-24 | 13F | Callan Family Office, LLC | 32 750 | 0,00 | 966 | 9,41 | ||||

| 2025-08-05 | 13F | Cherry Tree Wealth Management, LLC | 5 221 | 0,00 | 154 | 9,29 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 618 | -57,64 | 48 | -53,92 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 4 146 | 0,24 | 122 | 9,91 | ||||

| 2025-07-29 | 13F | Schubert & Co | 47 240 | -14,88 | 1 393 | -6,82 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 345 714 | 4,21 | 10 195 | 14,09 | ||||

| 2025-04-17 | 13F | Retirement Solution Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-21 | 13F | 25 Llc | 8 519 | 3,17 | 251 | 13,06 | ||||

| 2025-07-30 | 13F | Drive Wealth Management, Llc | 54 013 | 3,87 | 1 593 | 13,71 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 3 023 | 142,62 | 89 | 169,70 | ||||

| 2025-08-14 | 13F | Bragg Financial Advisors, Inc | 17 799 | 525 | ||||||

| 2025-05-12 | 13F | Providence First Trust Co | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 49 323 | 21,58 | 1 455 | 33,15 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 14 497 | 4 042,00 | 428 | 4 644,44 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 172 169 | 10,66 | 5 077 | 21,14 | ||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Truist Financial Corp | 25 456 | -0,31 | 751 | 9,17 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 11 893 | 0,00 | 351 | 9,38 | ||||

| 2025-07-22 | 13F | McElhenny Sheffield Capital Management, LLC | 103 000 | 103 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 186 072 | -12,25 | 5 | 0,00 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 9 332 | 3,07 | 0 | |||||

| 2025-08-14 | 13F | Mariner, LLC | 378 054 | 40,00 | 11 149 | 53,26 | ||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 168 825 | 2,93 | 5 066 | 9,63 | ||||

| 2025-08-11 | 13F | Dorsey & Whitney Trust CO LLC | 16 404 | 484 | ||||||

| 2025-07-17 | 13F | Oceanside Advisors LLC | 272 613 | -0,08 | 8 039 | 9,39 | ||||

| 2025-08-13 | 13F | Summit Wealth Group Llc / Co | 25 605 | 755 | ||||||

| 2025-07-17 | 13F | Lauterbach Financial Advisors, LLC | 11 245 | 332 | ||||||

| 2025-07-29 | 13F | Ifrah Financial Services, Inc. | 13 555 | 1,67 | 400 | 11,14 | ||||

| 2025-07-14 | 13F | Foster Group, Inc. | 1 213 688 | -2,23 | 35 792 | 7,02 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 4 585 | 0,00 | 135 | 9,76 | ||||

| 2025-08-06 | 13F | Spurstone Advisory Services, LLC | 67 | 0,00 | 2 | 0,00 | ||||

| 2025-07-30 | 13F | Rehmann Capital Advisory Group | 25 786 | 1,39 | 760 | 10,95 | ||||

| 2025-08-14 | 13F | Acorn Wealth Advisors, LLC | 18 577 | 4,98 | 548 | 14,92 | ||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 326 621 | 3,01 | 9 632 | 12,76 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 169 298 | 41,23 | 4 993 | 54,60 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 157 604 | 1 268,21 | 4 648 | 1 399,03 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 32 | -96,88 | 1 | -100,00 | ||||

| 2025-08-14 | 13F | Comerica Bank | 1 524 | -0,65 | 45 | 7,32 | ||||

| 2025-08-06 | 13F | Modera Wealth Management, LLC | 1 245 030 | 65,71 | 36 716 | 81,40 | ||||

| 2025-07-08 | 13F | Apella Capital, LLC | 930 719 | 31,48 | 27 224 | 48,14 | ||||

| 2025-08-13 | 13F | United Wealth Management, LLC | 320 686 | -0,21 | 9 457 | 9,24 | ||||

| 2025-08-14 | 13F | Financial Engines Advisors L.L.C. | 201 288 | 1,58 | 5 936 | 11,18 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 2 250 | 0,00 | 66 | 10,00 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 5 144 | 0,00 | 152 | 9,42 | ||||

| 2025-08-13 | 13F | Millstone Evans Group, LLC | 1 159 | -64,66 | 34 | -61,36 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 12 915 929 | 102,50 | 380 891 | 121,66 | ||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 199 066 | -0,69 | 5 870 | 8,70 | ||||

| 2025-08-11 | 13F | Foundation Wealth Management, LLC\PA | 124 502 | 16,72 | 3 672 | 27,78 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 16 001 | -27,30 | 472 | -20,44 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 4 945 | -68,70 | 146 | -65,88 | ||||

| 2025-07-22 | 13F | Simplicity Wealth,LLC | 56 264 | 84,65 | 1 659 | 102,32 | ||||

| 2025-07-08 | 13F | Dover Advisors, Llc | 9 729 | 2,64 | 287 | 12,16 | ||||

| 2025-07-30 | 13F | Mills Wealth Advisors LLC | 354 680 | 9,54 | 10 459 | 19,92 | ||||

| 2025-08-04 | 13F | Capital Performance Advisors Llp | 19 313 | -4,66 | 570 | 4,40 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 194 | 0,00 | 6 | 0,00 | ||||

| 2025-07-23 | 13F | Abel Hall, LLC | 104 878 | -3,12 | 3 093 | 6,04 | ||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 23 575 | -1,25 | 635 | 5,48 | ||||

| 2025-07-28 | 13F | Strategent Financial, LLC | 43 268 | 14,89 | 1 276 | 25,74 | ||||

| 2025-07-29 | 13F | Angeles Wealth Management, Llc | 4 565 | -46,68 | 135 | -41,74 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 18 783 | 59,87 | 506 | 70,95 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 283 031 | -34,03 | 8 347 | -27,79 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 105 561 | 462,00 | 3 113 | 515,02 | ||||

| 2025-07-16 | 13F | Strategic Investment Solutions, Inc. /IL | 48 639 | 509,51 | 1 434 | 570,09 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 85 143 | -14,69 | 3 | 0,00 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 12 196 | 0,00 | 360 | 9,45 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 97 295 | 13,28 | 2 869 | 24,04 | ||||

| 2025-08-07 | 13F | Efficient Advisors, LLC | 559 512 | -0,57 | 16 500 | 8,83 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 16 998 | 0,00 | 501 | 9,63 | ||||

| 2025-08-01 | 13F | Heritage Wealth Management, Inc./Texas | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 63 053 | 3,62 | 1 859 | 13,42 | ||||

| 2025-07-22 | 13F | Sutton Place Investors Llc | 36 049 | 13,00 | 1 063 | 23,75 | ||||

| 2025-07-09 | 13F | High Probability Advisors, LLC | 1 144 646 | -6,89 | 33 756 | 1,92 | ||||

| 2025-08-07 | 13F | Sollinda Capital Management LLC | 25 036 | 20,01 | 738 | 31,55 | ||||

| 2025-07-29 | 13F | Unison Advisors LLC | 10 448 | 0,91 | 308 | 10,79 | ||||

| 2025-08-08 | 13F | Pinney & Scofield, Inc. | 82 337 | 8,23 | 2 428 | 18,50 | ||||

| 2025-07-22 | 13F | Clarius Group, LLC | 2 888 479 | 0,79 | 85 181 | 10,34 | ||||

| 2025-07-22 | 13F | Iron Horse Wealth Management, LLC | 32 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 166 | 5 | ||||||

| 2025-08-14 | 13F | DecisionPoint Financial, LLC | 1 036 | 1,07 | 31 | 11,11 | ||||

| 2025-07-23 | 13F | Austin Asset Management Co Inc | 80 809 | 9,53 | 2 383 | 19,93 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 2 352 865 | 4,54 | 69 386 | 14,44 | ||||

| 2025-08-11 | 13F | von Borstel & Associates, Inc. | 462 206 | 0,04 | 13 | 8,33 | ||||

| 2025-07-14 | 13F | Friday Financial | 60 606 | -16,83 | 1 787 | -9,29 | ||||

| 2025-07-30 | 13F | Exencial Wealth Advisors, Llc | 410 683 | 18,60 | 12 111 | 29,83 | ||||

| 2025-07-07 | 13F | Kings Path Partners LLC | 130 | -24,86 | 4 | -25,00 | ||||

| 2025-08-08 | 13F | RAM Investment Partners, LLC | 9 300 | 274 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 318 748 | -3,73 | 9 400 | 5,38 | ||||

| 2025-07-28 | 13F | Wealthspan Partners, Llc | 35 685 | 16,56 | 1 052 | 27,67 | ||||

| 2025-08-13 | 13F | Virtue Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Tru Independence Asset Management 2, Llc | 30 580 | -5,14 | 902 | 3,80 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 5 930 | 0,00 | 175 | 9,43 | ||||

| 2025-08-05 | 13F | Hutchens & Kramer Investment Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | PBMares Wealth Management LLC | 296 255 | 4,40 | 8 737 | 14,29 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 24 378 | -0,83 | 719 | 8,46 | ||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 2 224 139 | 9,30 | 65 590 | 19,64 | ||||

| 2025-07-17 | 13F | SC&H Financial Advisors, Inc. | 59 296 | 0,19 | 1 749 | 9,66 | ||||

| 2025-07-23 | 13F | First Financial Group Corp | 8 612 | 254 | ||||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 855 214 | 112,11 | 25 220 | 132,19 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 29 065 | -7,93 | 857 | 0,82 | ||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 1 216 | 0,00 | 36 | 9,38 | ||||

| 2025-07-15 | 13F | Vestment Financial LLC | 119 328 | 7,27 | 3 525 | 17,11 | ||||

| 2025-08-13 | 13F | Satovsky Asset Management Llc | 1 697 956 | 0,87 | 50 073 | 10,42 | ||||

| 2025-08-14 | 13F | Aprio Wealth Management, LLC | 2 180 301 | 2,14 | 64 297 | 11,81 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 161 725 | 56,07 | 4 769 | 70,87 | ||||

| 2025-07-23 | 13F | HMV Wealth Advisors, LLC | 96 595 | -4,74 | 2 849 | 4,28 | ||||

| 2025-07-16 | 13F | Blue Oak Capital, LLC | 138 645 | -23,52 | 4 089 | -16,28 | ||||

| 2025-07-17 | 13F | CogentBlue Wealth Advisors, LLC | 217 593 | -0,59 | 6 417 | 8,82 | ||||

| 2025-07-17 | 13F | Mattern Wealth Management LLC | 9 218 | -5,15 | 272 | 3,83 | ||||

| 2025-04-28 | 13F | Milestone Investment Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 3 291 | -1,17 | 97 | 8,99 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 9 702 | -8,04 | 287 | 0,70 | ||||

| 2025-08-11 | 13F | Cascade Wealth Advisors, Inc | 20 948 | 616 | ||||||

| 2025-07-14 | 13F | Brady Martz Wealth Solutions, LLC | 257 652 | 67,32 | 7 598 | 83,17 | ||||

| 2025-07-18 | 13F | Benchmark Wealth Management, LLC | 20 652 | 45,05 | 609 | 59,01 | ||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 309 918 | -1,30 | 9 139 | 8,04 | ||||

| 2025-07-15 | 13F | Garrett Investment Advisors LLC | 12 078 | -7,14 | 356 | 1,71 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-04-15 | 13F | Corrigan Financial, Inc. | 585 894 | 15 784 | ||||||

| 2025-07-03 | 13F | Fiduciary Financial Group, Llc | 241 724 | 5,89 | 7 126 | 22,10 | ||||

| 2025-08-14 | 13F | UBS Group AG | 22 951 | -66,49 | 677 | -63,36 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 110 156 | 3 | ||||||

| 2025-08-04 | 13F | Hutchinson Capital Management/ca | 86 952 | 7,85 | 2 564 | 18,05 | ||||

| 2025-07-03 | 13F | CPA Asset Management LLC | 302 448 | -1,61 | 8 919 | 7,70 | ||||

| 2025-08-13 | 13F | M Holdings Securities, Inc. | 42 019 | 1 | ||||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 23 514 | 693 | ||||||

| 2025-07-28 | 13F | Delap Wealth Advisory, Llc | 11 020 | -63,69 | 325 | -60,34 | ||||

| 2025-07-09 | 13F | GEM Asset Management, LLC | 11 168 | -0,97 | 327 | 7,24 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 23 936 337 | 14,20 | 705 883 | 25,01 | ||||

| 2025-08-14 | 13F | Cardiff Park Advisors, Llc | 21 135 | 0,13 | 623 | 9,68 | ||||

| 2025-07-25 | 13F | Index Fund Advisors, Inc. | 13 957 | 8,16 | 412 | 18,44 | ||||

| 2025-07-22 | 13F | Noble Family Wealth, LLC | 8 181 | 241 | ||||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 595 | 0 | ||||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 8 600 | 254 | ||||||

| 2025-08-14 | 13F | Fmr Llc | 8 275 | -7,66 | 244 | 1,24 | ||||

| 2025-07-23 | 13F | Tcfg Wealth Management, Llc | 11 042 | 4,28 | 326 | 14,04 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 23 882 | -69,85 | 704 | -67,01 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 1 103 | 33 | ||||||

| 2025-07-24 | 13F | Wealth Advisors Northwest LLC | 160 009 | 0,12 | 4 719 | 9,59 | ||||

| 2025-05-02 | 13F | MB Generational Wealth, LLC | 204 511 | 0,88 | 5 510 | 7,72 | ||||

| 2025-07-30 | 13F | Eqis Capital Management, Inc. | 119 800 | -6,44 | 3 533 | 2,41 | ||||

| 2025-07-10 | 13F | Fortress Wealth Management, Inc. | 364 486 | 2,43 | 10 749 | 12,13 | ||||

| 2025-07-21 | 13F | Triad Wealth Partners, LLC | 7 675 | 226 | ||||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 59 581 | 4,60 | 1 757 | 14,54 | ||||

| 2025-05-13 | 13F | Quadrature Capital Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 10 695 | 32,99 | 315 | 45,83 | ||||

| 2025-07-22 | 13F | Team Financial Group, LLC | 330 | 10 | ||||||

| 2025-07-30 | 13F | Jackson Thornton Asset Management, Llc | 67 582 | 3,40 | 1 990 | 13,01 | ||||

| 2025-08-01 | 13F | Austin Private Wealth, LLC | 29 664 | 31,41 | 875 | 43,75 | ||||

| 2025-08-13 | 13F | Daner Wealth Management, LLC | 20 672 | -6,91 | 613 | 3,73 | ||||

| 2025-08-13 | 13F | Parkworth Wealth Management, Inc. | 1 849 | 55 | ||||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 19 046 | 6,04 | 562 | 15,43 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 4 537 | 0,00 | 134 | 9,02 | ||||

| 2025-07-11 | 13F | Quad-Cities Investment Group, LLC | 7 218 | 213 | ||||||

| 2025-08-04 | 13F | Waterfront Wealth Inc. | 141 280 | 8,79 | 4 166 | 19,10 | ||||

| 2025-07-21 | 13F | Yeomans Consulting Group, Inc. | 110 951 | 4,50 | 3 271 | 14,34 | ||||

| 2025-08-08 | 13F | Tortoise Investment Management, LLC | 97 370 | 3,48 | 2 871 | 13,25 | ||||

| 2025-08-13 | 13F | Brown Advisory Inc | 7 265 | 214 | ||||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 54 252 | -14,68 | 1 600 | -0,31 | ||||

| 2025-07-22 | 13F | Beacon Financial Advisory LLC | 8 687 | 256 | ||||||

| 2025-04-25 | 13F | Ameritas Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | CNB Bank | 1 854 | 0,00 | 55 | 10,20 | ||||

| 2025-08-08 | 13F | Emerald Investment Partners, Llc | 1 087 | 1,12 | 32 | 14,29 | ||||

| 2025-07-15 | 13F | Evanson Asset Management, LLC | 95 327 | 15,66 | 2 811 | 26,62 | ||||

| 2025-08-07 | 13F | PFG Advisors | 86 550 | 7,44 | 2 552 | 17,60 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 13 708 | 404 | ||||||

| 2025-08-14 | 13F | Betterment LLC | 47 597 | 23,61 | 1 | 0,00 | ||||

| 2025-07-11 | 13F | Kaufman Rossin Wealth, LLC | 190 974 | 12,38 | 5 632 | 23,00 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 271 247 | 0,48 | 7 999 | 10,00 | ||||

| 2025-07-25 | 13F | Astoria Portfolio Advisors LLC. | 9 960 | 0,00 | 297 | 9,59 | ||||

| 2025-08-07 | 13F | Timonier Family Office, LTD. | 265 197 | 12,41 | 7 821 | 23,05 | ||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 510 | 15 | ||||||

| 2025-07-16 | 13F | Meredith Wealth Planning | 435 299 | 2,55 | 12 837 | 12,25 | ||||

| 2025-07-17 | 13F | DiNuzzo Private Wealth, Inc. | 666 785 | -0,23 | 19 663 | 9,21 | ||||

| 2025-07-29 | 13F | Grunden Financial Advisory, Inc. | 376 040 | 0,39 | 11 089 | 9,89 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 1 926 | 18,74 | 57 | 30,23 | ||||

| 2025-07-17 | 13F | Poinciana Advisors Group, Llc | 12 745 | 376 | ||||||

| 2025-07-23 | 13F | Mraz, Amerine & Associates, Inc. | 44 386 | -0,29 | 1 309 | 8,37 | ||||

| 2025-08-12 | 13F | Quadcap Wealth Management, LLC | 315 333 | 12,53 | 9 299 | 23,18 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 4 136 | 0,00 | 122 | 9,01 | ||||

| 2025-07-30 | 13F | Forum Financial Management, LP | 5 996 961 | -0,22 | 176 850 | 9,22 | ||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 451 729 | -4,67 | 13 321 | 4,36 | ||||

| 2025-07-29 | 13F | BKD Wealth Advisors, LLC | 476 162 | -8,57 | 14 042 | 0,09 | ||||

| 2025-07-28 | 13F | RFG Advisory, LLC | 527 283 | -1,88 | 15 550 | 7,40 | ||||

| 2025-08-12 | 13F | Martin Worley Group | 149 782 | 14,16 | 4 417 | 24,99 | ||||

| 2025-07-29 | 13F | Master's Wealth Management Inc. | 151 974 | 1,50 | 4 482 | 11,11 | ||||

| 2025-07-31 | 13F | Curio Wealth, Llc | 10 038 | 50 090,00 | 296 | -5,13 | ||||

| 2025-07-30 | 13F | EnRich Financial Partners LLC | 7 124 | -10,74 | 210 | -2,33 | ||||

| 2025-07-18 | 13F | Meritas Wealth Management, LLC | 170 625 | 5,87 | 5 032 | 15,89 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 4 227 | 1 507,22 | 125 | 1 671,43 | ||||

| 2025-07-17 | 13F | Global Trust Asset Management, LLC | 31 390 | -27,14 | 926 | -20,26 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 13 643 | 20,91 | 402 | 32,67 | ||||

| 2025-05-15 | 13F | Hrt Financial Lp | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Financial Consulate, Inc | 832 618 | 24 554 | ||||||

| 2025-07-21 | 13F | Keb Asset Management, Llc | 25 788 | 16,29 | 760 | 27,30 | ||||

| 2025-07-18 | 13F | Bridge Generations Wealth Management Llc | 214 950 | -0,16 | 6 339 | 9,29 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-09 | 13F | Breakwater Capital Group | 46 835 | -4,87 | 1 381 | 4,15 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 182 | -25,10 | 5 | -16,67 | ||||

| 2025-08-01 | 13F | Liberty Wealth Management Llc | 258 409 | -5,06 | 7 620 | 3,93 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 25 780 617 | 5,86 | 760 270 | 15,88 | ||||

| 2025-08-05 | 13F | American Capital Advisory, LLC | 1 274 | 0,00 | 38 | 8,82 | ||||

| 2025-08-14 | 13F | Premier Financial Group | 662 876 | 19 648 | ||||||

| 2025-04-09 | 13F | Archer Investment Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-04-15 | 13F | Fifth Third Bancorp | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-24 | 13F | Edge Financial Advisors LLC | 70 209 | 33,98 | 2 070 | 46,70 | ||||

| 2025-07-24 | 13F | Riverchase Wealth Management, Llc | 27 396 | -3,42 | 808 | 5,63 | ||||

| 2025-07-10 | 13F | Stewardship Advisors, LLC | 7 727 | -0,14 | 228 | 9,13 | ||||

| 2025-07-17 | 13F | Dopkins Wealth Management, Llc | 66 953 | 39,45 | 1 974 | 52,67 | ||||

| 2025-08-05 | 13F | Everest Management Corp. | 22 730 | 670 | ||||||

| 2025-07-29 | 13F | Disciplined Investments, LLC | 112 834 | 29,23 | 3 327 | 41,45 | ||||

| 2025-07-14 | 13F | BetterWealth, LLC | 172 663 | -2,35 | 5 092 | 6,89 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 44 444 | -3,42 | 1 | 0,00 | ||||

| 2025-04-16 | 13F | Lam Group, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 3 546 | 0,00 | 105 | 9,47 | ||||

| 2025-08-08 | 13F | Altiora Financial Group, LLC | 58 979 | 10,01 | 1 739 | 20,43 | ||||

| 2025-07-31 | 13F | Planning Center, Inc. | 1 951 156 | -0,76 | 57 540 | 8,64 | ||||

| 2025-07-23 | 13F | Elevate Wealth Advisory, Inc | 7 286 | 30,18 | 215 | 42,67 | ||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 332 754 | -11,36 | 9 813 | -2,97 | ||||

| 2025-08-08 | 13F | Creative Planning | 22 643 | -3,68 | 668 | 5,37 | ||||

| 2025-07-09 | 13F | Reyes Financial Architecture, Inc. | 3 053 | 0,00 | 90 | 9,76 | ||||

| 2025-07-24 | 13F | Vantage Point Financial LLC | 8 154 | 240 | ||||||

| 2025-08-14 | 13F | Investmark Advisory Group LLC | 27 133 | -11,91 | 800 | -3,50 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 115 802 | -29,02 | 3 415 | -22,34 |