Statistiques de base

| Propriétaires institutionnels | 179 total, 179 long only, 0 short only, 0 long/short - change of 25,17% MRQ |

| Allocation moyenne du portefeuille | 1.1887 % - change of -8,19% MRQ |

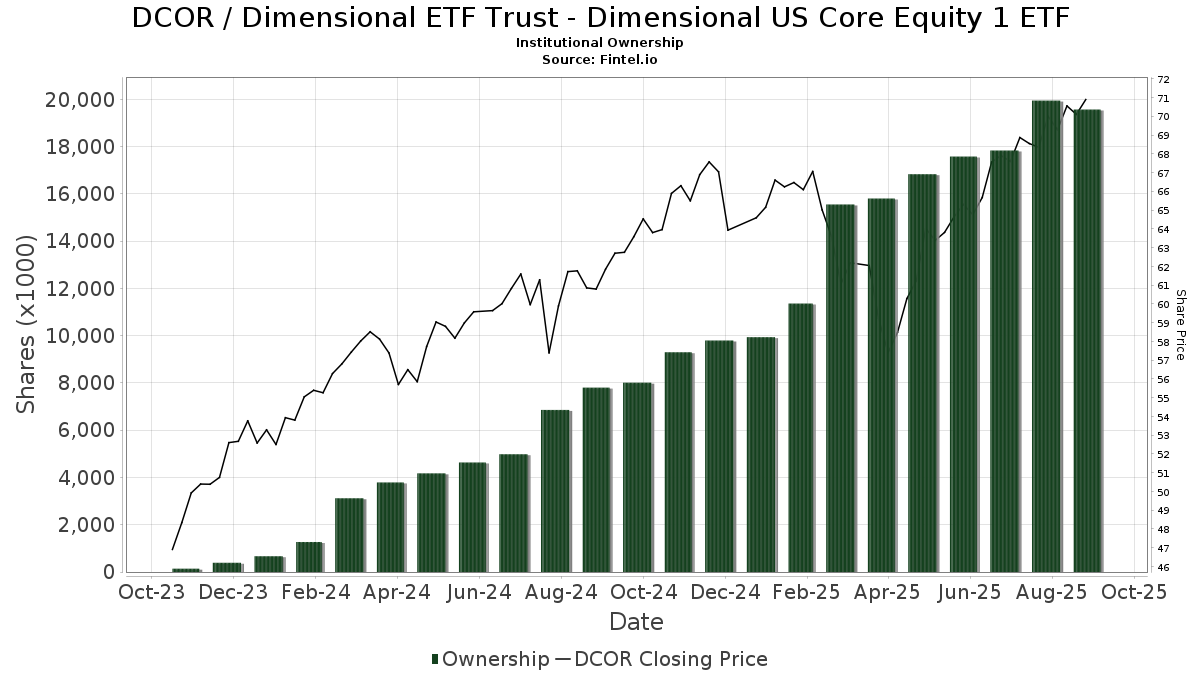

| Actions institutionnelles (Long) | 19 571 368 (ex 13D/G) - change of 1,98MM shares 11,25% MRQ |

| Valeur institutionnelle (Long) | $ 1 208 459 USD ($1000) |

Participation institutionnels et actionnaires

Dimensional ETF Trust - Dimensional US Core Equity 1 ETF (US:DCOR) détient 179 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 19,571,368 actions. Les principaux actionnaires incluent Pure Financial Advisors, Inc., DFAW - Dimensional World Equity ETF, Your Advocates Ltd., LLP, C2P Capital Advisory Group, LLC d.b.a. Prosperity Capital Advisors, Brighton Jones Llc, Private Advisor Group, LLC, Rather & Kittrell, Inc., Resources Investment Advisors, LLC., Monograph Wealth Advisors, Llc, and LRI Investments, LLC .

Dimensional ETF Trust - Dimensional US Core Equity 1 ETF (ARCA:DCOR) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 8, 2025 is 70,73 / share. Previously, on September 9, 2024, the share price was 60,18 / share. This represents an increase of 17,53% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 185 113 | 293,28 | 12 376 | 328,83 | ||||

| 2025-07-31 | 13F | Brighton Jones Llc | 644 970 | 19,73 | 43 116 | 30,51 | ||||

| 2025-06-26 | NP | DFAW - Dimensional World Equity ETF | 1 942 271 | 15,13 | 117 080 | 4,89 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 5 265 | 0,00 | 358 | 11,18 | ||||

| 2025-07-23 | 13F | Hardy Reed LLC | 282 278 | 16,42 | 18 870 | 26,90 | ||||

| 2025-07-11 | 13F | Colorado Capital Management, Inc. | 4 602 | 29,56 | 0 | |||||

| 2025-07-31 | 13F | Aspen Capital Management, LLC | 84 133 | -14,96 | 5 624 | -7,30 | ||||

| 2025-08-04 | 13F | Mesirow Financial Investment Management, Inc. | 22 647 | 0,16 | 1 514 | 9,16 | ||||

| 2025-08-08 | 13F | Your Advocates Ltd., LLP | 1 005 411 | 2,67 | 67 212 | 11,91 | ||||

| 2025-07-11 | 13F | Andrews, Lucia Wealth Management Llc | 6 647 | 444 | ||||||

| 2025-08-05 | 13F | C2P Capital Advisory Group, LLC d.b.a. Prosperity Capital Advisors | 853 734 | 3,84 | 57 072 | 12,77 | ||||

| 2025-08-11 | 13F | WPWealth LLP | 20 148 | 150,57 | 1 347 | 173,02 | ||||

| 2025-08-06 | 13F | Cloud Capital Management, LLC | 71 684 | -4,05 | 5 | 0,00 | ||||

| 2025-08-11 | 13F | Goodman Financial Corp | 23 600 | 0,00 | 1 578 | 8,98 | ||||

| 2025-08-01 | 13F | Ashton Thomas Private Wealth, LLC | 29 396 | 203,05 | 1 965 | 230,81 | ||||

| 2025-08-05 | 13F | WorthPointe, LLC | 3 465 | 0,26 | 232 | 9,48 | ||||

| 2025-07-11 | 13F | Quantum Financial Advisors, LLC | 239 017 | -11,46 | 15 978 | -3,49 | ||||

| 2025-07-28 | 13F | RCS Financial Planning, LLC | 10 104 | -1,44 | 675 | 7,48 | ||||

| 2025-07-17 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 3 434 | 0,00 | 230 | 9,05 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 117 732 | 7,93 | 7 870 | 17,64 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 66 336 | 1,13 | 4 435 | 13,23 | ||||

| 2025-07-25 | 13F | Investment Advisory Group, LLC | 43 982 | 24,68 | 2 940 | 35,92 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 8 540 | 571 | ||||||

| 2025-07-17 | 13F | SC&H Financial Advisors, Inc. | 327 338 | 88,93 | 21 883 | 105,93 | ||||

| 2025-07-25 | 13F | LRI Investments, LLC | 407 930 | 224,34 | 27 270 | 253,56 | ||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 5 440 | 11,68 | 364 | 21,81 | ||||

| 2025-04-15 | 13F | Signet Financial Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-03 | 13F | Fiduciary Financial Group, Llc | 10 511 | 0,35 | 706 | 17,89 | ||||

| 2025-08-07 | 13F | Prospect Financial Group LLC | 113 224 | 7 569 | ||||||

| 2025-08-14 | 13F | Essential Planning, LLC. | 45 014 | 44,33 | 3 009 | 57,37 | ||||

| 2025-07-23 | 13F | Morton Capital Management LLC/CA | 101 954 | 42,97 | 6 816 | 55,84 | ||||

| 2025-07-22 | 13F | Yardley Wealth Management LLC | 6 788 | 16,13 | 0 | |||||

| 2025-07-18 | 13F | BCO Wealth Management LLC | 358 149 | 3,75 | 23 942 | 13,09 | ||||

| 2025-08-08 | 13F | Truepoint, Inc. | 91 843 | 77,86 | 6 140 | 93,90 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 15 123 | 0,00 | 1 011 | 8,95 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-04 | 13F | Hutchinson Capital Management/ca | 4 180 | 279 | ||||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 8 031 | 537 | ||||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 137 | 9 | ||||||

| 2025-08-13 | 13F | American Investment Services, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 79 870 | 1,47 | 5 339 | 10,20 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 42 220 | 7,27 | 2 822 | 16,95 | ||||

| 2025-07-17 | 13F | XY Planning Network, Inc. | 13 178 | 86,18 | 881 | 102,76 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 895 | 60 | ||||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 33 181 | 54,74 | 2 218 | 68,67 | ||||

| 2025-04-18 | 13F | Global Trust Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Heritage Investment Group, Inc. | 134 163 | 614,89 | 8 969 | 679,83 | ||||

| 2025-07-21 | 13F | Sageworth Trust Co | 296 687 | 23,13 | 19 834 | 34,22 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 132 141 | -5,36 | 8 834 | 3,15 | ||||

| 2025-07-10 | 13F | Strathmore Capital Advisors, Inc. | 35 009 | 102,56 | 2 377 | 114,53 | ||||

| 2025-08-14 | 13F | UBS Group AG | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Mustard Seed Financial, LLC | 3 239 | 217 | ||||||

| 2025-08-13 | 13F | Millstone Evans Group, LLC | 12 044 | -65,50 | 805 | -62,40 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 328 949 | 26,25 | 21 990 | 37,61 | ||||

| 2025-08-14 | 13F | Betterment LLC | 279 263 | 1,37 | 19 | 12,50 | ||||

| 2025-07-24 | 13F | Wealth Advisors Northwest LLC | 13 428 | 51,88 | 898 | 65,50 | ||||

| 2025-08-07 | 13F | Keystone Financial Services | 3 582 | 0,11 | 239 | 9,13 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 35 978 | 49,24 | 2 405 | 62,72 | ||||

| 2025-07-29 | 13F | Financial Symmetry Inc | 3 061 | 205 | ||||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 626 | 0,16 | 42 | 10,81 | ||||

| 2025-08-12 | 13F | Eldridge Investment Advisors, Inc. | 54 423 | 4,14 | 3 638 | 13,51 | ||||

| 2025-07-09 | 13F | GEM Asset Management, LLC | 4 462 | 301 | ||||||

| 2025-07-22 | 13F | Firethorn Wealth Partners, Llc | 13 530 | 0,85 | 905 | 9,98 | ||||

| 2025-07-14 | 13F | ABLE Financial Group, LLC | 109 007 | 7 287 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 4 703 | 14,40 | 314 | 24,60 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 41 | 0,00 | 3 | 0,00 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 66 831 | -35,57 | 4 468 | -29,78 | ||||

| 2025-08-08 | 13F | CWS Financial Advisors, LLC | 6 134 | -1,98 | 410 | 7,05 | ||||

| 2025-08-08 | 13F | SageOak Financial, LLC | 262 918 | 15,15 | 17 576 | 25,52 | ||||

| 2025-08-14 | 13F | STAR Financial Bank | 17 804 | 3,55 | 1 190 | 12,90 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 5 567 | -58,74 | 372 | -55,02 | ||||

| 2025-07-14 | 13F | Kfg Wealth Management, Llc | 303 016 | 2,98 | 20 257 | 12,25 | ||||

| 2025-07-14 | 13F | Financial Harvest, LLC | 3 777 | 252 | ||||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 10 425 | -79,96 | 697 | -78,18 | ||||

| 2025-07-29 | 13F | Fundamentun, Llc | 351 460 | 608,07 | 23 495 | 671,85 | ||||

| 2025-07-21 | 13F | Triad Wealth Partners, LLC | 8 924 | 597 | ||||||

| 2025-08-12 | 13F | Rather & Kittrell, Inc. | 476 709 | 17,16 | 31 868 | 27,70 | ||||

| 2025-07-18 | 13F | Fmb Wealth Management | 43 097 | 1,22 | 2 881 | 10,34 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 45 442 | -1,88 | 3 038 | 6,94 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 339 | 23 | ||||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 69 131 | 4,00 | 4 621 | 13,37 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 1 878 | 0,00 | 126 | 8,70 | ||||

| 2025-07-15 | 13F | Maseco Llp | 7 029 | 470 | ||||||

| 2025-07-29 | 13F | Wealthstream Advisors, Inc. | 6 748 | -5,02 | 451 | 3,68 | ||||

| 2025-08-05 | 13F | Allodium Investment Consultants, LLC | 5 992 | 77,91 | 401 | 94,17 | ||||

| 2025-07-16 | 13F | Vestia Personal Wealth Advisors | 6 339 | 424 | ||||||

| 2025-07-15 | 13F | Great Oak Capital Partners, Llc | 374 113 | 5,56 | 25 361 | 12,27 | ||||

| 2025-07-17 | 13F | Archford Capital Strategies, LLC | 104 799 | 2,80 | 7 006 | 12,04 | ||||

| 2025-07-30 | 13F | Eqis Capital Management, Inc. | 15 112 | 1,85 | 1 010 | 10,99 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 6 720 | -0,18 | 449 | 8,98 | ||||

| 2025-07-24 | 13F | Vantage Point Financial LLC | 289 099 | 2,05 | 19 326 | 11,24 | ||||

| 2025-04-15 | 13F | Michael A. Dubis Financial Planning, LLC | 21 585 | 6,07 | 1 324 | 132 200,00 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 12 135 | -3,79 | 811 | 5,60 | ||||

| 2025-07-17 | 13F | Elser Financial Planning, Inc | 104 227 | 7 014 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 136 058 | 78,06 | 9 | 125,00 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 430 932 | 41,36 | 28 808 | 54,08 | ||||

| 2025-07-28 | 13F | RFG Advisory, LLC | 3 058 | -79,32 | 204 | -77,48 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 20 427 | 4,20 | 1 366 | 8,59 | ||||

| 2025-08-11 | 13F | Keyes, Stange & Wooten Wealth Management, LLC | 322 413 | -1,39 | 21 553 | 7,49 | ||||

| 2025-08-14 | 13F | DecisionPoint Financial, LLC | 113 578 | 415,23 | 7 626 | 464,40 | ||||

| 2025-07-21 | 13F | Onyx Financial Advisors, LLC | 21 266 | 107,74 | 1 422 | 126,63 | ||||

| 2025-07-21 | 13F | Sageworth Trust Co of South Dakota | 72 147 | 1,37 | 4 823 | 10,49 | ||||

| 2025-08-08 | 13F | Altiora Financial Group, LLC | 204 695 | 17,86 | 13 684 | 28,47 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 1 749 | 0,00 | 117 | 8,41 | ||||

| 2025-08-13 | 13F | B&D White Capital Company, LLC | 131 005 | 8 758 | ||||||

| 2025-07-15 | 13F | Evanson Asset Management, LLC | 9 827 | 34,71 | 657 | 46,76 | ||||

| 2025-07-23 | 13F | Woodside Wealth Management LLC | 3 039 | 0,00 | 203 | 9,14 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 26 270 | 1 756 | ||||||

| 2025-08-05 | 13F | Gould Asset Management Llc /ca/ | 22 782 | 19,46 | 1 523 | 30,20 | ||||

| 2025-07-18 | 13F | Pure Financial Advisors, Inc. | 2 107 446 | 3,67 | 140 883 | 13,00 | ||||

| 2025-08-05 | 13F | Dunhill Financial, LLC | 249 | 17 | ||||||

| 2025-08-13 | 13F | Vermillion & White Wealth Management Group, LLC | 232 | 0,00 | 16 | 7,14 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 406 | 27 | ||||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | TCI Wealth Advisors, Inc. | 63 037 | 4 214 | ||||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 62 609 | -23,56 | 4 185 | -16,68 | ||||

| 2025-07-22 | 13F | USAdvisors Wealth Management, LLC | 37 979 | 0,44 | 3 | 0,00 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 331 | 0,00 | 22 | 10,00 | ||||

| 2025-07-24 | 13F | Riverchase Wealth Management, Llc | 235 501 | -1,32 | 15 743 | 7,56 | ||||

| 2025-08-13 | 13F | Annandale Capital, LLC | 369 615 | 14,41 | 25 | 26,32 | ||||

| 2025-07-23 | 13F | Sax Wealth Advisors, Llc | 34 445 | 87,02 | 2 303 | 103,90 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 111 662 | 7 465 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 22 264 | 5,69 | 1 488 | 15,17 | ||||

| 2025-08-13 | 13F | Summit Wealth Group Llc / Co | 13 745 | 919 | ||||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 2 952 | 0,00 | 197 | 8,84 | ||||

| 2025-07-25 | 13F | Concord Wealth Partners | 2 030 | 32,85 | 136 | 45,16 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 10 650 | 4,15 | 712 | 13,40 | ||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 7 805 | -73,94 | 522 | -71,62 | ||||

| 2025-08-14 | 13F | Monograph Wealth Advisors, Llc | 408 744 | -10,82 | 27 325 | -2,79 | ||||

| 2025-07-16 | 13F | Plancorp, LLC | 86 025 | 5 751 | ||||||

| 2025-08-14 | 13F | Financial Engines Advisors L.L.C. | 19 070 | 23,77 | 1 275 | 34,92 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 6 349 | 16,50 | 424 | 26,95 | ||||

| 2025-07-08 | 13F | Apella Capital, LLC | 21 844 | 1 474 | ||||||

| 2025-07-25 | 13F | Hemington Wealth Management | 15 526 | 0,00 | 1 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 549 | -2,83 | 37 | 5,88 | ||||

| 2025-08-06 | 13F | Modera Wealth Management, LLC | 34 011 | 34,39 | 2 274 | 46,46 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 22 845 | -70,50 | 1 527 | -67,85 | ||||

| 2025-07-10 | 13F | Pacific Asset Management, LLC | 3 135 | 210 | ||||||

| 2025-08-14 | 13F | Comerica Bank | 57 | 4 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 5 064 | 339 | ||||||

| 2025-07-11 | 13F | Sprinkle Financial Consultants LLC | 5 645 | 0,28 | 377 | 9,28 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 14 947 | 999 | ||||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 88 522 | -1,47 | 5 918 | 7,41 | ||||

| 2025-07-24 | 13F | Drucker Wealth 3.0, LLC | 4 233 | -14,69 | 287 | -5,59 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Werba Rubin Papier Wealth Management | 17 589 | 79,41 | 1 176 | 95,51 | ||||

| 2025-07-02 | 13F | Doliver Advisors, Lp | 3 020 | -29,27 | 202 | -22,99 | ||||

| 2025-08-11 | 13F | Foundation Wealth Management, LLC\PA | 4 472 | -28,36 | 299 | -21,99 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 18 578 | 32,22 | 1 242 | 44,13 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 7 160 | 479 | ||||||

| 2025-08-14 | 13F | Note Advisors, LLC | 23 129 | 290,30 | 1 546 | 325,90 | ||||

| 2025-07-22 | 13F | Warwick Investment Management, Inc. | 3 214 | 215 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 10 590 | 133,16 | 1 | |||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 46 082 | 3 | ||||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 182 721 | 6,89 | 11 206 | 2,18 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 4 200 | -2,33 | 281 | 6,46 | ||||

| 2025-08-11 | 13F | Copperleaf Capital, LLC | 69 149 | 5,08 | 4 623 | 14,55 | ||||

| 2025-07-31 | 13F | BIP Wealth, LLC | 43 216 | 12,39 | 2 889 | 22,48 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 7 778 | 12 246,03 | 520 | 12 875,00 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 15 985 | 0,10 | 1 069 | 9,09 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 578 | 0,17 | 39 | 8,57 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Colony Group, LLC | 24 543 | 1 641 | ||||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 204 500 | 11,92 | 13 671 | 21,99 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 564 735 | 22,64 | 37 753 | 33,68 | ||||

| 2025-08-14 | 13F | Main Street Financial Solutions, LLC | 43 405 | -5,37 | 2 902 | 3,17 | ||||

| 2025-08-07 | 13F | Alpha Financial Advisors, LLC | 60 869 | 4 069 | ||||||

| 2025-09-02 | 13F/A | FSC Wealth Advisors, LLC | 3 497 | 234 | ||||||

| 2025-08-14 | 13F | Mariner, LLC | 107 895 | 40,55 | 7 212 | 53,19 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 298 528 | 4,02 | 19 957 | 13,39 | ||||

| 2025-07-09 | 13F | StrongBox Wealth, LLC | 4 192 | -19,57 | 280 | -12,23 | ||||

| 2025-08-05 | 13F | Hutchens & Kramer Investment Management Group, LLC | 203 353 | -0,38 | 13 653 | 9,06 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 228 977 | 18,48 | 15 | 36,36 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 414 | 28 | ||||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | SwitchPoint Financial Planning, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 83 352 | 67,47 | 5 572 | 82,57 | ||||

| 2025-07-09 | 13F | Divergent Planning, LLC | 4 192 | 280 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 8 438 | 12,87 | 1 | |||||

| 2025-07-10 | 13F | Cypress Point Wealth Management, LLC | 227 308 | 217,68 | 15 196 | 246,29 | ||||

| 2025-07-24 | 13F | Grand Wealth Management, Llc | 26 772 | 1 790 | ||||||

| 2025-07-23 | 13F | Elevate Wealth Advisory, Inc | 576 | 200,00 | 39 | 245,45 | ||||

| 2025-08-08 | 13F | Advyzon Investment Management, LLC | 4 008 | 268 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 5 384 | 360 | ||||||

| 2025-07-11 | 13F | Scratch Capital Llc | 11 529 | 771 | ||||||

| 2025-07-31 | 13F | Kathleen S. Wright Associates Inc. | 15 554 | 23,53 | 1 040 | 34,59 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 114 821 | 1,34 | 7 647 | 10,73 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 18 327 | 1 225 | ||||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 78 767 | 5 |