Statistiques de base

| Propriétaires institutionnels | 212 total, 212 long only, 0 short only, 0 long/short - change of 3,92% MRQ |

| Allocation moyenne du portefeuille | 0.3177 % - change of -1,34% MRQ |

| Actions institutionnelles (Long) | 7 309 441 (ex 13D/G) - change of 0,74MM shares 11,30% MRQ |

| Valeur institutionnelle (Long) | $ 391 963 USD ($1000) |

Participation institutionnels et actionnaires

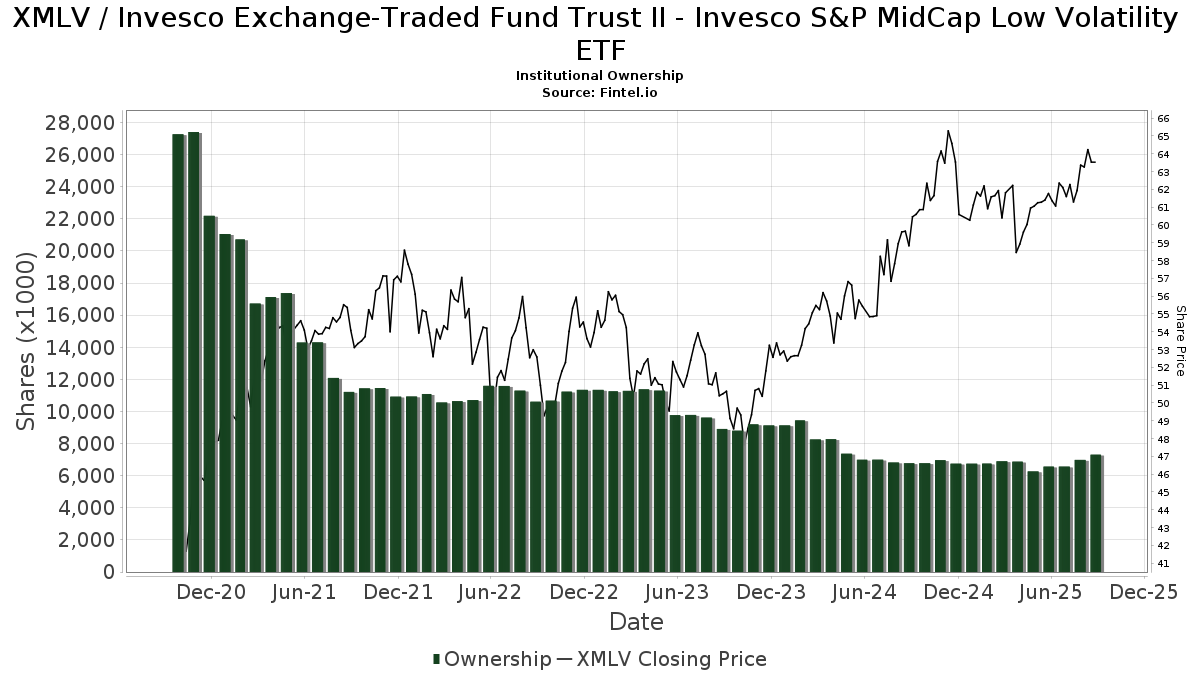

Invesco Exchange-Traded Fund Trust II - Invesco S&P MidCap Low Volatility ETF (US:XMLV) détient 212 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 7,309,441 actions. Les principaux actionnaires incluent LPL Financial LLC, Morgan Stanley, Cambridge Investment Research Advisors, Inc., Brookstone Capital Management, UBS Group AG, Envestnet Asset Management Inc, DORVAL Corp, Ameriprise Financial Inc, Commonwealth Equity Services, Llc, and Pnc Financial Services Group, Inc. .

Invesco Exchange-Traded Fund Trust II - Invesco S&P MidCap Low Volatility ETF (ARCA:XMLV) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 10, 2025 is 63,52 / share. Previously, on September 11, 2024, the share price was 58,83 / share. This represents an increase of 7,97% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

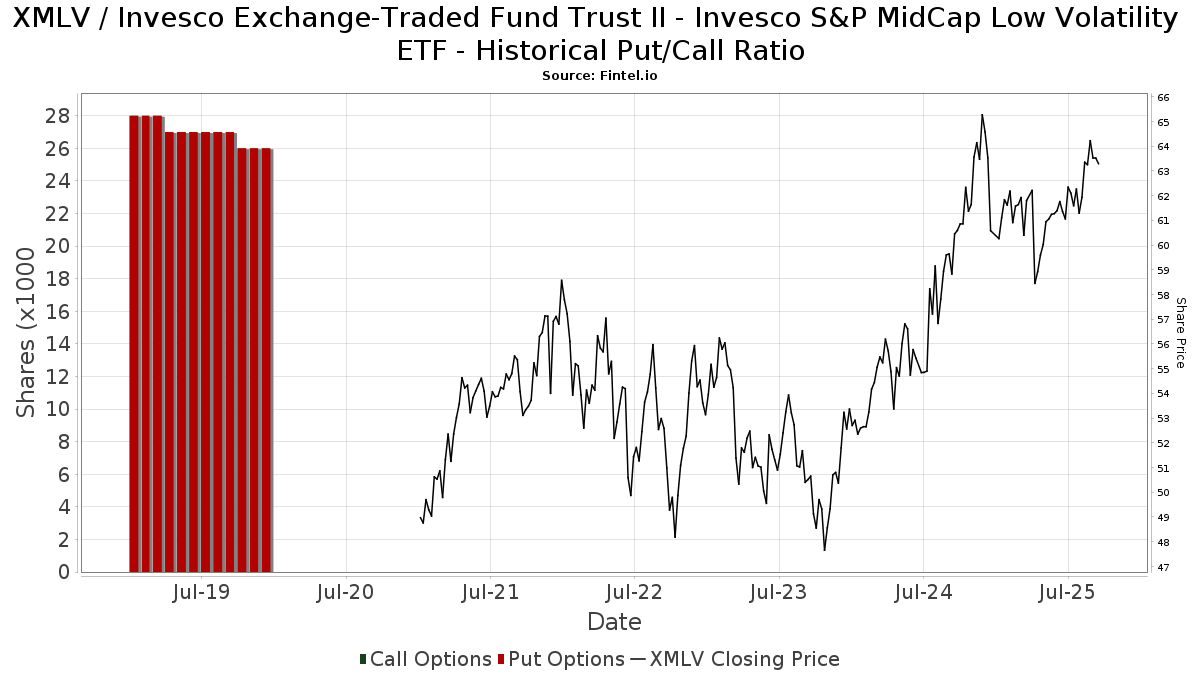

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-23 | 13F | Prime Capital Investment Advisors, LLC | 37 584 | -0,93 | 2 318 | -1,03 | ||||

| 2025-08-14 | 13F | Avid Wealth Partners LLC | 140 478 | 24,77 | 8 663 | 24,68 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 140 226 | 25,51 | 8 648 | 25,41 | ||||

| 2025-07-29 | 13F | Portland Financial Advisors Inc | 11 809 | 0,00 | 728 | 0,00 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 1 395 | -5,74 | 86 | -5,49 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 5 553 | 4,22 | 342 | 4,91 | ||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 11 460 | 707 | ||||||

| 2025-07-22 | 13F | Legacy Trust | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Change Path, LLC | 16 488 | -0,13 | 1 017 | -0,20 | ||||

| 2025-05-01 | 13F | Quest 10 Wealth Builders, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 14 826 | 5,04 | 1 | |||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 21 391 | 2,40 | 1 319 | 2,33 | ||||

| 2025-08-07 | 13F | Runnymede Capital Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 3 590 | 0,34 | 221 | 0,45 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 3 160 | 0,00 | 195 | -0,51 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 6 495 | 1,09 | 401 | 1,01 | ||||

| 2025-07-14 | 13F | Ridgewood Investments LLC | 2 925 | 0,00 | 180 | 0,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 87 488 | -4,28 | 5 395 | -4,36 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 4 275 | 0,00 | 264 | 0,00 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 10 110 | -24,34 | 623 | -23,56 | ||||

| 2025-07-22 | 13F | CPR Investments Inc. | 3 420 | 211 | ||||||

| 2025-08-14 | 13F | Ambassador Advisors, LLC | 4 118 | 0,00 | 254 | -0,39 | ||||

| 2025-07-24 | 13F | Lmcg Investments, Llc | 37 591 | 12,97 | 2 318 | 12,91 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 4 650 | -7,00 | 287 | -7,14 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 298 | -83,74 | 18 | -83,78 | ||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 3 285 | 0,00 | 0 | |||||

| 2025-08-29 | 13F | Total Investment Management Inc | 162 | 10 | ||||||

| 2025-07-10 | 13F | Marshall Financial Group LLC | 3 794 | -13,75 | 236 | -13,28 | ||||

| 2025-05-13 | 13F | Aptus Capital Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Comerica Bank | 1 358 | 0,00 | 84 | 0,00 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 21 997 | -1,34 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Money Concepts Capital Corp | 3 843 | 237 | ||||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 3 336 | 0,54 | 206 | 0,49 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 76 091 | -14,77 | 4 695 | -14,81 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 27 460 | -5,90 | 1 693 | -5,15 | ||||

| 2025-08-14 | 13F | Gen-Wealth Partners Inc | 1 833 | 0,00 | 113 | 0,00 | ||||

| 2025-06-24 | NP | TNWIX - 1290 Retirement 2050 Fund Class I | 3 374 | 0,00 | 203 | -3,35 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 8 879 | 3,05 | 548 | 3,01 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 338 | 9,39 | 21 | 5,26 | ||||

| 2025-04-29 | 13F | Bank of New York Mellon Corp | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Sovran Advisors, LLC | 4 046 | 251 | ||||||

| 2025-07-15 | 13F | Well Done, LLC | 11 926 | -1,91 | 735 | -0,54 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 9 403 | 152,36 | 580 | 152,84 | ||||

| 2025-08-29 | 13F | Evolution Wealth Management Inc. | 940 | 58 | ||||||

| 2025-07-25 | 13F | Commonwealth Financial Services, LLC | 6 525 | -0,91 | 402 | -0,99 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 470 | -11,82 | 29 | -12,50 | ||||

| 2025-08-08 | 13F | Financial Gravity Companies, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Avant Capital LLC | 8 248 | -10,47 | 509 | -10,56 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 112 625 | 24,93 | 6 934 | 25,68 | ||||

| 2025-06-24 | NP | TNIIX - 1290 Retirement 2020 Fund Class I | 593 | 0,00 | 36 | -2,78 | ||||

| 2025-07-15 | 13F | ACT Advisors, LLC. | 4 070 | -17,38 | 251 | -17,43 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-10 | 13F | High Net Worth Advisory Group LLC | 4 450 | 0,00 | 274 | 0,00 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 10 902 | 14,84 | 672 | 14,87 | ||||

| 2025-05-15 | 13F | Old Mission Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 10 835 | 668 | ||||||

| 2025-07-16 | 13F | Brown, Lisle/cummings, Inc. | 2 911 | 0,21 | 180 | 0,00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 114 559 | 9,47 | 7 065 | 9,38 | ||||

| 2025-08-14 | 13F | Harvest Investment Services, LLC | 6 082 | 0,91 | 375 | 1,08 | ||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 6 412 | 0,64 | 395 | 0,51 | ||||

| 2025-08-06 | 13F | Destiny Capital Corp/CO | 11 433 | -2,77 | 705 | -2,76 | ||||

| 2025-07-22 | 13F | Global Assets Advisory, LLC | 888 | 234 | ||||||

| 2025-06-24 | NP | TNLIX - 1290 Retirement 2035 Fund Class I | 1 286 | -1,53 | 77 | -3,75 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 205 206 | -12,27 | 12 655 | -12,34 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 8 373 | 1 | ||||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 165 | -25,34 | 10 | -23,08 | ||||

| 2025-08-14 | 13F | Win Advisors, Inc | 14 934 | -1,20 | 921 | -1,29 | ||||

| 2025-07-22 | 13F | Rocky Mountain Advisers, Llc | 4 075 | 0,00 | 251 | 0,00 | ||||

| 2025-08-13 | 13F | Dana Investment Advisors, Inc. | 6 107 | 0,00 | 377 | 0,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 9 756 | 602 | ||||||

| 2025-08-08 | 13F | Comprehensive Financial Planning, Inc./PA | 460 | 0,88 | 28 | 0,00 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 150 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Bravias Capital Group, LLC | 3 318 | 205 | ||||||

| 2025-08-13 | 13F | Milestone Investment Advisors LLC | 318 | 0,00 | 20 | 0,00 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 3 590 | 0,00 | 221 | 11,06 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 7 800 | -3,70 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 11 971 | -33,80 | 738 | -33,87 | ||||

| 2025-08-08 | 13F | Sculati Wealth Management, LLC | 46 068 | -67,64 | 2 841 | -67,66 | ||||

| 2025-08-12 | 13F | Jacobi Capital Management LLC | 6 957 | 0,56 | 429 | 0,70 | ||||

| 2025-07-21 | 13F | Monticello Wealth Management, Llc | 15 551 | -5,34 | 959 | -5,33 | ||||

| 2025-07-15 | 13F | LVZ Advisors, Inc. | 3 421 | 0,00 | 211 | -0,47 | ||||

| 2025-05-12 | 13F | Berger Financial Group, Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-18 | 13F | Trilogy Capital Inc. | 3 369 | 0,00 | 208 | 0,00 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 316 | 0,00 | 20 | 0,00 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 12 442 | -26,52 | 767 | -26,60 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-06-24 | NP | TNJIX - 1290 Retirement 2025 Fund Class I | 75 | -12,79 | 5 | -20,00 | ||||

| 2025-06-24 | NP | TNKIX - 1290 Retirement 2030 Fund Class I | 1 016 | 0,00 | 61 | -3,23 | ||||

| 2025-08-14 | 13F | Visionary Wealth Advisors | 14 271 | -2,23 | 880 | -2,22 | ||||

| 2025-06-24 | NP | TNOIX - 1290 Retirement 2045 Fund Class I | 3 053 | 0,00 | 183 | -3,17 | ||||

| 2025-07-16 | 13F | Meridian Financial, LLC | 4 511 | 0,00 | 278 | 0,00 | ||||

| 2025-08-08 | 13F | Ogorek Anthony Joseph /ny/ /adv | 100 | 0,00 | 0 | |||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 515 | 32 | ||||||

| 2025-07-21 | 13F | Creative Capital Management Investments LLC | 589 | 0,00 | 36 | 0,00 | ||||

| 2025-08-12 | 13F | Calton & Associates, Inc. | 30 619 | 1 888 | ||||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 46 004 | -25,01 | 2 837 | -25,07 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 14 762 | 34,03 | 910 | 34,02 | ||||

| 2025-08-14 | 13F | UBS Group AG | 315 912 | 5,67 | 19 482 | 5,58 | ||||

| 2025-07-31 | 13F | Briaud Financial Planning, Inc | 23 | 0 | ||||||

| 2025-08-08 | 13F | Petix & Botte Co | 7 726 | 0,00 | 476 | 0,00 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 147 427 | 3,21 | 9 092 | 3,12 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 8 417 | 134,26 | 1 | |||||

| 2025-07-29 | 13F | Signature Estate & Investment Advisors Llc | 36 785 | 2 269 | ||||||

| 2025-07-30 | 13F | Syntegra Private Wealth Group, LLC | 8 281 | 0,00 | 511 | -0,20 | ||||

| 2025-07-14 | 13F | IronOak Wealth LLC. | 0 | -100,00 | 0 | |||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 19 262 | -2,38 | 1 188 | -2,47 | ||||

| 2025-07-07 | 13F | Nova Wealth Management, Inc. | 6 335 | 4 849,22 | 391 | 5 471,43 | ||||

| 2025-07-31 | 13F | City State Bank | 427 | 0,00 | 26 | 0,00 | ||||

| 2025-08-12 | 13F | Laurel Wealth Advisors LLC | 39 346 | 6 067,08 | 1 | -100,00 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 4 200 | 0,00 | 259 | 0,00 | ||||

| 2025-08-08 | 13F | Creative Planning | 5 634 | 6,34 | 347 | 6,44 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 12 978 | -10,61 | 800 | -10,71 | ||||

| 2025-07-16 | 13F | PFS Partners, LLC | 128 846 | 0,28 | 7 946 | 0,19 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 3 702 | -0,59 | 228 | -0,44 | ||||

| 2025-06-24 | NP | TNNIX - 1290 Retirement 2040 Fund Class I | 2 713 | 0,00 | 163 | -3,57 | ||||

| 2025-04-21 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 16 932 | 30,34 | 1 045 | 32,28 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 622 | 18,70 | 38 | 18,75 | ||||

| 2025-08-14 | 13F | Harwood Advisory Group, LLC | 51 | -75,24 | 3 | -75,00 | ||||

| 2025-07-23 | 13F | Clear Creek Financial Management, LLC | 16 795 | -19,50 | 1 036 | -19,58 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 3 322 | -2,49 | 205 | -2,86 | ||||

| 2025-08-05 | 13F | EPG Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 9 456 | -67,70 | 583 | -67,74 | ||||

| 2025-05-15 | 13F | Integrated Wealth Concepts LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Synergy Investment Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-04-15 | 13F | Chris Bulman Inc | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 30 | 0,00 | 2 | 0,00 | ||||

| 2025-07-25 | 13F | Alpha Financial Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 1 945 | -34,02 | 0 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 84 | -98,46 | 5 | -98,51 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 53 289 | -2,59 | 3 | 0,00 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 2 000 | 0,00 | 123 | 0,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 193 541 | 9,94 | 11 936 | 9,85 | ||||

| 2025-07-22 | 13F | Accel Wealth Management | 6 198 | 4,94 | 382 | 4,95 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 217 510 | -15,55 | 13 | -13,33 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 11 712 | -18,18 | 734 | -16,99 | ||||

| 2025-07-30 | 13F | Pacific Sun Financial Corp | 21 200 | -0,38 | 1 307 | -0,46 | ||||

| 2025-08-14 | 13F | Fmr Llc | 7 294 | -9,30 | 450 | -9,48 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 864 | 234,88 | 53 | 253,33 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 8 853 | 0,00 | 546 | -0,18 | ||||

| 2025-08-14 | 13F | Redwood Financial Network Corp | 3 273 | -5,30 | 202 | -5,63 | ||||

| 2025-07-23 | 13F | REAP Financial Group, LLC | 444 | 0,45 | 27 | 0,00 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 4 305 | 1,97 | 266 | 4,74 | ||||

| 2025-08-11 | 13F | CFS Investment Advisory Services, LLC | 4 595 | -2,03 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 96 201 | 35,10 | 5 937 | 58,36 | ||||

| 2025-06-24 | NP | TNQIX - 1290 Retirement 2055 Fund Class I | 3 447 | 0,00 | 207 | -3,29 | ||||

| 2025-08-06 | 13F | Adviser Investments LLC | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Provident Wealth Management, LLC | 2 | 0,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 535 542 | 18,17 | 33 | 22,22 | ||||

| 2025-08-05 | 13F | Sensible Money, LLC | 4 275 | 0,00 | 264 | 0,00 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 178 | 0,00 | 11 | 0,00 | ||||

| 2025-05-15 | 13F | Two Sigma Securities, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Richmond Investment Services, LLC | 6 543 | 56,87 | 404 | 56,81 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 597 901 | 1,36 | 36 873 | 1,27 | ||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 4 382 | -6,25 | 270 | -6,25 | ||||

| 2025-07-17 | 13F | ERn Financial, LLC | 8 377 | 0,00 | 517 | -0,19 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 23 | 0,00 | 1 | 0,00 | ||||

| 2025-07-30 | 13F | Liberty One Investment Management, Llc | 40 328 | -2,89 | 2 487 | -2,97 | ||||

| 2025-07-07 | 13F | Roxbury Financial LLC | 303 | 0,33 | 19 | 0,00 | ||||

| 2025-07-16 | 13F | Investment Partners Asset Management, Inc. | 16 553 | 2,76 | 1 021 | 2,62 | ||||

| 2025-08-11 | 13F | Wbi Investments, Inc. | 51 249 | -0,63 | 3 161 | -0,72 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 10 448 | -2,12 | 644 | -2,13 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 8 037 | 64,52 | 496 | 64,45 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 76 | 0,00 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 18 406 | 0,17 | 1 135 | 0,09 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 9 618 | 0,00 | 593 | 0,00 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 6 593 | 0,66 | 407 | 0,74 | ||||

| 2025-08-13 | 13F | Avestar Capital, LLC | 15 176 | 25,48 | 936 | 25,34 | ||||

| 2025-07-17 | 13F | Johnson & White Wealth Management, LLC | 32 992 | 3,04 | 2 | 100,00 | ||||

| 2025-07-17 | 13F | Wagner Wealth Management, Llc | 25 | 4,17 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 860 | 53 | ||||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 102 | 0,00 | 6 | 0,00 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 322 262 | -6,19 | 19 874 | -6,26 | ||||

| 2025-07-15 | 13F | Sheets Smith Wealth Management | 12 331 | -7,50 | 760 | -7,54 | ||||

| 2025-08-06 | 13F | Atlas Legacy Advisors, LLC | 5 664 | -1,34 | 349 | -0,29 | ||||

| 2025-08-18 | 13F | Pacific Center for Financial Services | 4 379 | -3,01 | 270 | -2,88 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 5 033 | -3,90 | 310 | -4,02 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Marshall & Sterling Wealth Advisors Inc. | 695 | 0,87 | 43 | 0,00 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 4 556 | 0 | ||||||

| 2025-08-14 | 13F | Stifel Financial Corp | 180 580 | 397,66 | 11 137 | 397,36 | ||||

| 2025-07-07 | 13F | Whitaker-Myers Wealth Managers, LTD. | 7 775 | 0,80 | 479 | 0,63 | ||||

| 2025-07-24 | 13F | Mainstay Capital Management Llc /adv | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 393 | -63,61 | 24 | -63,64 | ||||

| 2025-07-16 | 13F | Moneywise, Inc. | 13 599 | -4,39 | 839 | -4,45 | ||||

| 2025-04-30 | 13F | Sofos Investments, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F/A | CX Institutional | 399 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | FineMark National Bank & Trust | 21 003 | -5,69 | 1 295 | -5,75 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 37 | 0,00 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 1 373 | -4,98 | 85 | -5,62 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 228 | 0,44 | 14 | 7,69 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 34 672 | -6,70 | 2 138 | -6,76 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 622 659 | 51,96 | 38 399 | 51,84 | ||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 10 613 | 0,06 | 655 | 0,00 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 4 492 | 0,00 | 277 | 0,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 81 746 | 6,45 | 5 041 | 6,37 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 4 417 | -59,42 | 272 | -59,46 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 225 465 | 1,26 | 13 903 | 1,13 | ||||

| 2025-08-11 | 13F | Inspire Advisors, LLC | 3 942 | 243 | ||||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 658 | 0,61 | 41 | 0,00 | ||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 15 323 | 0,00 | 945 | -0,11 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 11 061 | 22,61 | 682 | 22,66 | ||||

| 2025-08-01 | 13F | Ashton Thomas Private Wealth, LLC | 6 714 | -8,49 | 414 | -8,41 | ||||

| 2025-07-28 | 13F | DORVAL Corp | 234 236 | 14 445 | ||||||

| 2025-04-16 | 13F | Ipswich Investment Management Co., Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | ProVise Management Group, LLC | 59 435 | -0,71 | 3 665 | -0,79 | ||||

| 2025-08-12 | 13F | Spectrum Wealth Advisory Group, LLC | 8 344 | 0,06 | 515 | 0,00 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 70 | 0,00 | 4 | 0,00 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 64 683 | 0,90 | 3 989 | 0,83 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 7 012 | 5,32 | 432 | 5,37 | ||||

| 2025-05-16 | 13F | Laidlaw Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-05-02 | 13F | Transcendent Capital Group LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 2 439 | 0,62 | 150 | 0,67 | ||||

| 2025-08-01 | 13F | Biltmore Family Office, LLC | 100 | -50,00 | 6 | -50,00 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 22 078 | 0,35 | 1 362 | 0,29 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1 | 0,00 | 0 | |||||

| 2025-08-06 | 13F | North Capital, Inc. | 100 | 0,00 | 6 | 0,00 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 1 374 | 12,25 | 85 | 12,00 | ||||

| 2025-08-18 | 13F | Front Row Advisors LLC | 935 | 0,00 | 58 | 0,00 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 43 690 | 5,04 | 2 694 | 4,95 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 531 | -15,45 | 33 | -15,79 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 33 000 | -17,09 | 2 035 | -17,14 | ||||

| 2025-08-11 | 13F | Strategic Equity Management | 12 260 | 14,40 | 756 | 14,37 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 33 061 | 1,12 | 2 039 | 0,99 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 60 | 0,00 | 4 | 0,00 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 310 516 | 2,26 | 19 150 | 2,18 | ||||

| 2025-08-14 | 13F | Obsidian Personal Planning Solutions LLC | 124 851 | 2,21 | 7 700 | 5,02 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 38 144 | 23,94 | 2 352 | 23,85 | ||||

| 2025-08-01 | 13F | Petra Financial Advisors Inc | 6 192 | 0,21 | 382 | 0,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 112 925 | 3,10 | 6 964 | 3,02 | ||||

| 2025-07-09 | 13F | Massmutual Trust Co Fsb/adv | 17 385 | 5,40 | 1 072 | 5,30 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 128 227 | -3,73 | 7 908 | -3,82 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 4 620 | 0,00 | 285 | -0,35 | ||||

| 2025-08-01 | 13F | MorganRosel Wealth Management, LLC | 97 900 | 655,46 | 6 037 | 655,57 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 3 587 | 0,11 | 221 | 0,00 | ||||

| 2025-07-24 | 13F | Capital Advisors, Ltd. LLC | 525 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 5 579 | -9,23 | 344 | -9,23 |