Statistiques de base

| Propriétaires institutionnels | 130 total, 124 long only, 1 short only, 5 long/short - change of -5,80% MRQ |

| Allocation moyenne du portefeuille | 0.1310 % - change of -14,55% MRQ |

| Actions institutionnelles (Long) | 7 686 392 (ex 13D/G) - change of 0,63MM shares 8,85% MRQ |

| Valeur institutionnelle (Long) | $ 641 771 USD ($1000) |

Participation institutionnels et actionnaires

VanEck ETF Trust - VanEck Pharmaceutical ETF (US:PPH) détient 130 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 7,686,392 actions. Les principaux actionnaires incluent Goldman Sachs Group Inc, Morgan Stanley, Healthcare Of Ontario Pension Plan Trust Fund, Wells Fargo & Company/mn, Clal Insurance Enterprises Holdings Ltd, Jane Street Group, Llc, Avalon Trust Co, J.Safra Asset Management Corp, Jpmorgan Chase & Co, and Susquehanna International Group, Llp .

VanEck ETF Trust - VanEck Pharmaceutical ETF (NasdaqGM:PPH) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 8, 2025 is 88,97 / share. Previously, on September 9, 2024, the share price was 97,06 / share. This represents a decline of 8,34% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

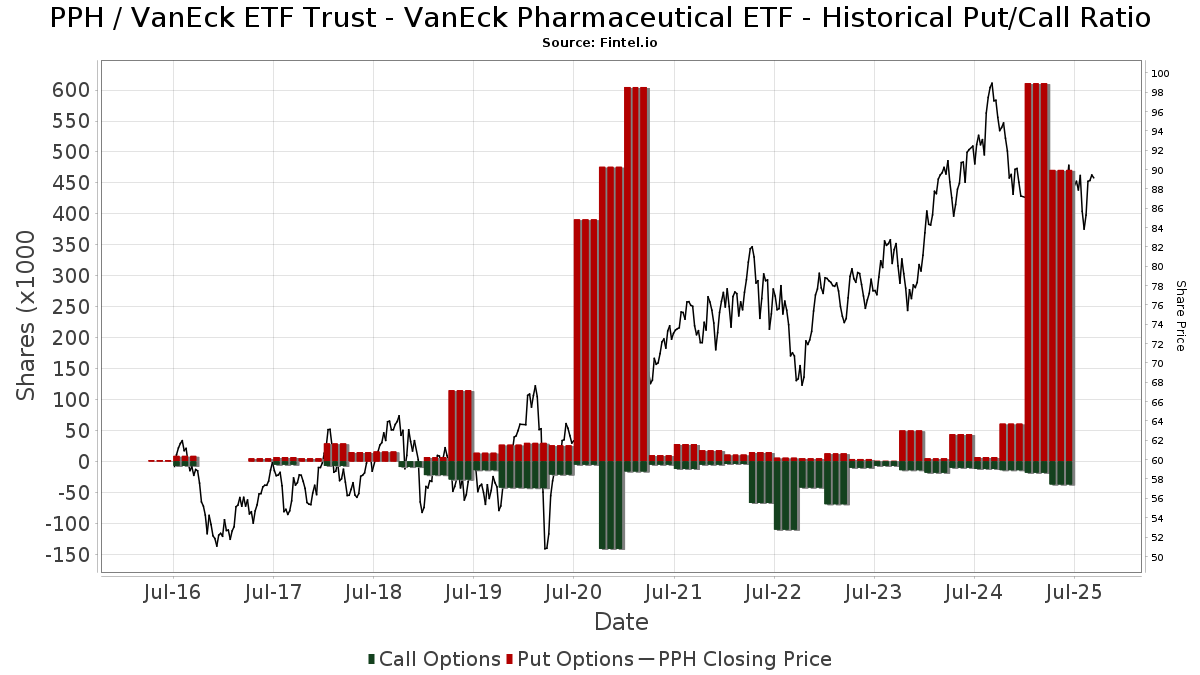

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 2 428 | 0,00 | 214 | -3,62 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 255 837 | 2 852,19 | 22 503 | 2 752,09 | ||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 37 495 | 3,11 | 3 298 | -0,45 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 284 | -16,22 | 25 | -20,00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 16 161 | 0,00 | 1 422 | -3,46 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-08 | 13F | Private Advisory Group LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 1 109 | 0,09 | 98 | -3,96 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 385 | 10,32 | 34 | 10,00 | ||||

| 2025-05-20 | 13F/A | Colony Group, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 3 240 | 13,68 | 283 | 9,69 | ||||

| 2025-05-14 | 13F | Oarsman Capital, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-29 | 13F | Stratos Wealth Advisors, LLC | 4 066 | -0,76 | 358 | -4,29 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 524 | 0,58 | 46 | -2,13 | ||||

| 2025-08-14 | 13F | DeepCurrents Investment Group LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-07-31 | 13F | Conservest Capital Advisors, Inc. | 5 059 | 0,16 | 445 | -3,48 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 11 398 | -26,88 | 1 003 | -29,44 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | MAI Capital Management | 938 | -6,11 | 82 | -9,89 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 30 254 | 2 661 | ||||||

| 2025-08-14 | 13F | Stifel Financial Corp | 11 456 | -0,05 | 1 008 | -3,54 | ||||

| 2025-07-22 | 13F | Bank Hapoalim Bm | 3 948 | -2,35 | 0 | |||||

| 2025-08-05 | 13F | Dunhill Financial, LLC | 2 833 | 249 | ||||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 36 017 | 4,01 | 3 168 | 0,41 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 232 | 0,00 | 0 | |||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 58 | 0,00 | 5 | 0,00 | ||||

| 2025-04-29 | 13F | Hm Payson & Co | 99 | 0,00 | 9 | 12,50 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 375 | 167,86 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 2 762 770 | 138,13 | 243 013 | 129,85 | ||||

| 2025-07-14 | 13F | Buska Wealth Management, LLC | 3 297 | -18,11 | 290 | -20,77 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 2 129 | 18,15 | 187 | 14,02 | ||||

| 2025-04-23 | 13F | Spirepoint Private Client, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 4 450 | 9,71 | 391 | 5,96 | ||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 51 519 | 11,24 | 4 532 | 7,37 | ||||

| 2025-08-14 | 13F | UBS Group AG | 163 718 | -26,26 | 14 401 | -28,82 | ||||

| 2025-07-16 | 13F | Twelve Points Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 14 400 | 1 267 | ||||||

| 2025-05-12 | 13F | Pura Vida Investments, Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 98 100 | 174,79 | 8 629 | 165,23 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 2 600 | -10,34 | 229 | -13,64 | |||

| 2025-08-04 | 13F | Canton Hathaway, LLC | 10 000 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 299 380 | 927,84 | 26 333 | 892,20 | ||||

| 2025-03-12 | 13F | Centaurus Financial, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 34 624 | 346 140,00 | 3 046 | |||||

| 2025-07-23 | 13F | Elm3 Financial Group, LLC | 2 439 | -22,08 | 215 | -24,91 | ||||

| 2025-07-28 | 13F | Copia Wealth Management | 5 429 | -11,90 | 478 | -14,97 | ||||

| 2025-08-08 | 13F | Avalon Trust Co | 280 477 | -1,13 | 24 671 | -4,57 | ||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 85 | 0,00 | 7 | 0,00 | ||||

| 2025-08-12 | 13F | Inscription Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-13 | 13F | SFI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 600 | 0,00 | 53 | -3,70 | ||||

| 2025-08-11 | 13F | Banque Cantonale Vaudoise | 629 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 402 987 | 35 447 | ||||||

| 2025-08-12 | 13F | Accredited Wealth Management, LLC | 100 | 0,00 | 9 | -11,11 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-16 | 13F | Signaturefd, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Kcm Investment Advisors Llc | 2 893 | -1,03 | 254 | -4,51 | ||||

| 2025-07-28 | 13F | J.Safra Asset Management Corp | 271 620 | 1,71 | 23 759 | -2,38 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 1 004 | -4,02 | 88 | -7,37 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 353 | 38,98 | 31 | 47,62 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 11 111 | 2,10 | 977 | -1,41 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 59 637 | -66,51 | 5 246 | -67,68 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | Put | 8 200 | 721 | |||||

| 2025-08-13 | 13F | Fisher Asset Management, LLC | 15 001 | -98,83 | 1 319 | -98,87 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 4 480 | 40,09 | 394 | 35,40 | ||||

| 2025-05-30 | NP | ERNZ - TrueShares Active Yield ETF | 5 579 | 508 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 22 417 | 11,78 | 1 972 | 7,88 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Aspen Grove Capital, LLC | 25 844 | 0,58 | 2 273 | -2,90 | ||||

| 2025-08-07 | 13F | Montag A & Associates Inc | 660 | 0,00 | 58 | -3,33 | ||||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | 3 262 | 287 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 22 125 | 82,35 | 1 946 | 75,95 | ||||

| 2025-07-29 | 13F | TrueMark Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 66 024 | 5 807 | ||||||

| 2025-07-23 | 13F | Fluent Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 434 | -20,37 | 38 | -20,83 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 102 | -98,85 | 9 | -99,01 | ||||

| 2025-08-06 | 13F | Miller Investment Management, LP | 181 536 | -4,27 | 15 968 | -7,60 | ||||

| 2025-07-23 | 13F | Prime Capital Investment Advisors, LLC | 96 870 | -26,43 | 8 521 | -28,99 | ||||

| 2025-08-05 | 13F | Telos Capital Management, Inc. | 4 516 | 2,08 | 397 | -1,49 | ||||

| 2025-04-24 | 13F | Nadler Financial Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Old Mission Capital Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-21 | 13F | Ntv Asset Management Llc | 7 957 | -13,25 | 700 | -16,29 | ||||

| 2025-05-15 | 13F | Marshall Wace, Llp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 1 000 | 86 | ||||||

| 2025-07-07 | 13F | Nova Wealth Management, Inc. | 3 097 | -21,26 | 272 | -24,02 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 414 | -48,64 | 36 | -50,68 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-04-16 | 13F | Wealth Enhancement Advisory Services, Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | CoreFirst Bank & Trust | 200 | 18 | ||||||

| 2025-08-04 | 13F | Assetmark, Inc | 16 | -76,12 | 1 | -83,33 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 500 | 44 | ||||||

| 2025-04-16 | 13F | Hoey Investments, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Blue Bell Private Wealth Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 3 593 | 0,00 | 316 | -3,36 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 538 398 | 489,05 | 47 358 | 468,58 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Capital Investment Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 3 153 | -6,96 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 48 228 | -0,53 | 4 242 | -3,98 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 14 241 | 1,61 | 1 253 | -1,96 | ||||

| 2025-08-11 | 13F | Tidemark, LLC | 486 | 8,00 | 43 | 2,44 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 4 075 | -8,39 | 358 | -11,60 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 2 750 | 5,77 | 242 | 2,12 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 4 805 | -1,03 | 0 | |||||

| 2025-07-30 | 13F | Phoenix Holdings Ltd. | 61 276 | 13,77 | 5 390 | 7,97 | ||||

| 2025-08-11 | 13F | HHM Wealth Advisors, LLC | 1 350 | 0,00 | 119 | -4,07 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 170 | 0,00 | 15 | 0,00 | ||||

| 2025-08-14 | 13F | DecisionPoint Financial, LLC | 1 000 | 0,00 | 88 | -3,30 | ||||

| 2025-08-26 | NP | LCR - Leuthold Core ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Tradition Wealth Management, LLC | 6 064 | -6,19 | 533 | -9,51 | ||||

| 2025-04-17 | 13F | Grimes & Company, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 2 510 | -11,96 | 0 | |||||

| 2025-08-13 | 13F | Leuthold Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-04-28 | 13F | Lansing Street Advisors | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-28 | 13F | Mowery & Schoenfeld Wealth Management, LLC | 13 | 0,00 | 1 | 0,00 | ||||

| 2025-08-12 | 13F | Verity & Verity, LLC | 131 320 | 11 551 | ||||||

| 2025-04-18 | 13F | Edge Financial Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 20 681 | 2 | ||||||

| 2025-07-24 | 13F | Blair William & Co/il | 12 295 | 34,30 | 1 081 | 29,62 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 3 151 | 277 | ||||||

| 2025-05-05 | 13F | Mivtachim The Workers Social Insurance Fund Ltd. (Under Special Management) | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 9 114 | 4,78 | 802 | 1,14 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 459 | 0,00 | 40 | -2,44 | ||||

| 2025-05-07 | 13F | Investment Management Corp /va/ /adv | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | AAFMAA Wealth Management & Trust LLC | 39 081 | -6,85 | 3 438 | -10,10 | ||||

| 2025-04-21 | 13F | SILVER OAK SECURITIES, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 3 364 | -1,38 | 296 | -4,84 | ||||

| 2025-07-23 | 13F | Vontobel Holding Ltd. | 3 800 | 0,00 | 334 | -3,47 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 4 275 | -14,45 | 376 | -17,36 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 33 513 | -5,57 | 2 948 | -8,87 | ||||

| 2025-08-08 | 13F | Hudock, Inc. | 9 217 | 811 | ||||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | 512 000 | 0,00 | 45 036 | -3,48 | ||||

| 2025-05-06 | 13F | WT Wealth Management | 51 692 | -8,82 | 4 711 | -3,70 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 4 044 | -20,06 | 356 | -22,99 | ||||

| 2025-07-09 | 13F | Sapient Capital Llc | 2 588 | 0,00 | 228 | -3,40 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 13 287 | -28,66 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 35 163 | -47,98 | 3 093 | -49,79 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 270 | -7,85 | 24 | -8,00 | ||||

| 2025-08-14 | 13F | Fmr Llc | 1 461 | -2,60 | 129 | -5,88 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 400 | 0,00 | 35 | -2,78 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 2 511 | 2,11 | 0 | |||||

| 2025-08-13 | 13F | StoneX Group Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | J. Goldman & Co LP | Put | 131 800 | -29,44 | 11 593 | -31,90 | |||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 7 780 | 684 | ||||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 5 704 | -1,60 | 502 | -5,11 | ||||

| 2025-05-02 | 13F | Apollon Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 13 000 | -77,89 | 1 143 | -78,67 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 214 400 | -34,81 | 18 859 | -37,08 | |||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 2 351 | 208 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 53 664 | 105,52 | 4 720 | 98,40 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 23 300 | 77,86 | 2 049 | 71,75 | |||

| 2025-07-31 | 13F | Burke & Herbert Bank & Trust Co | 8 865 | 0,00 | 780 | -3,47 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 6 100 | 165,22 | 537 | 156,46 | |||

| 2025-07-16 | 13F | Investment Partners Asset Management, Inc. | 4 219 | -0,28 | 371 | -3,64 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 31 277 | -24,47 | 2 751 | -27,09 | ||||

| 2025-07-24 | 13F | CarsonAllaria Wealth Management, Ltd. | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 285 | 0,00 | 25 | -3,85 | ||||

| 2025-08-13 | 13F | D L Carlson Investment Group Inc | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Warner Financial, Inc | 4 636 | 0,61 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 250 | 0,00 | 22 | -4,55 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 74 | 0,00 | 7 | 0,00 | ||||

| 2025-08-14 | 13F | Comerica Bank | 430 | -21,39 | 38 | -24,49 | ||||

| 2025-08-13 | 13F | Barclays Plc | 0 | -100,00 | 0 | |||||

| 2025-04-16 | 13F | Wealth Enhancement Advisory Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Camden Capital, LLC | 2 807 | 0,57 | 247 | -3,15 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Call | 5 700 | 501 | |||||

| 2025-08-13 | 13F | Financial Freedom, LLC | 9 006 | 0,17 | 792 | -3,30 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 5 700 | 501 | |||||

| 2025-03-28 | 13F/A | Berkeley, Inc | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Global Financial Private Client, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 108 629 | 0,00 | 9 555 | -3,48 | ||||

| 2025-05-15 | 13F | Blue Chip Partners, Inc. | 0 | -100,00 | 0 | |||||

| 2025-04-25 | 13F | Almanack Investment Partners, LLC. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 12 790 | 76,73 | 1 125 | 70,71 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 513 | 0,00 | 45 | -2,17 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 16 190 | 13 856,90 | 1 424 | 14 140,00 | ||||

| 2025-08-12 | 13F | Clal Insurance Enterprises Holdings Ltd | 325 000 | 29 | ||||||

| 2025-05-15 | 13F | Millennium Management Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-08 | 13F | Adamsbrown Wealth Consultants Llc | 195 976 | 12,05 | 17 238 | 8,16 | ||||

| 2025-08-06 | 13F | Nvwm, Llc | 38 | 3 | ||||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 2 739 | 0,00 | 241 | -3,61 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 35 490 | 18,78 | 3 234 | 25,45 | ||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 0 | -100,00 | 0 |