Statistiques de base

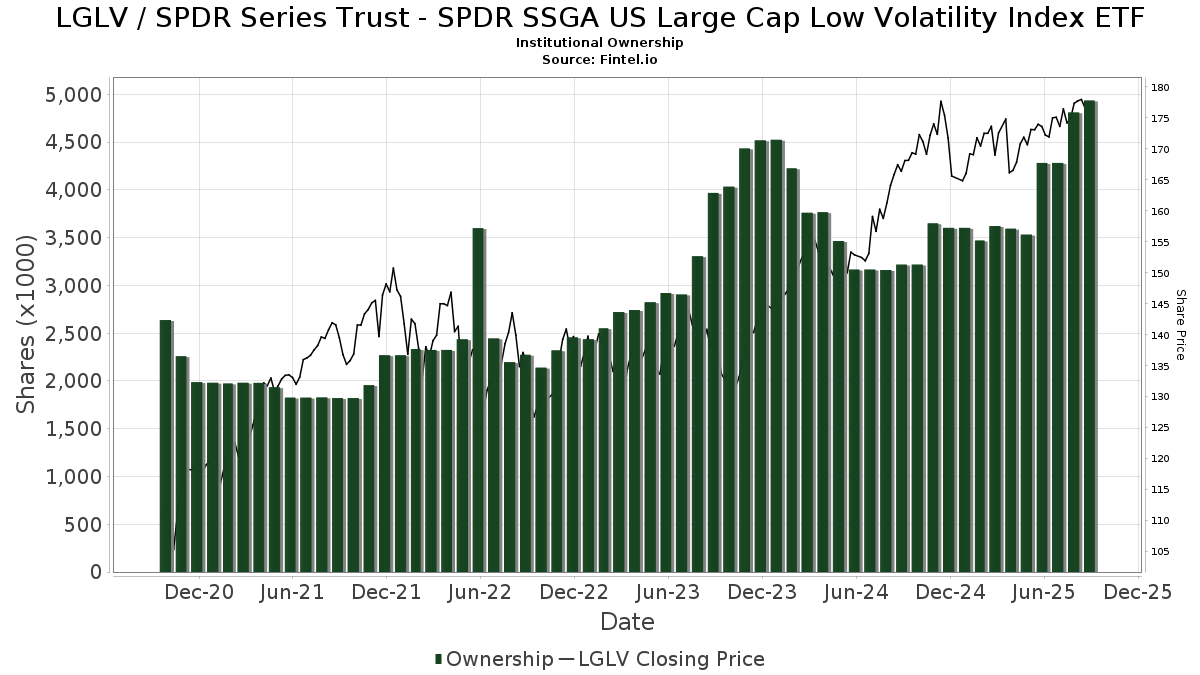

| Propriétaires institutionnels | 182 total, 182 long only, 0 short only, 0 long/short - change of 5,14% MRQ |

| Allocation moyenne du portefeuille | 0.2604 % - change of -21,08% MRQ |

| Actions institutionnelles (Long) | 4 936 891 (ex 13D/G) - change of 0,67MM shares 15,79% MRQ |

| Valeur institutionnelle (Long) | $ 609 608 USD ($1000) |

Participation institutionnels et actionnaires

SPDR Series Trust - SPDR SSGA US Large Cap Low Volatility Index ETF (US:LGLV) détient 182 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 4,936,891 actions. Les principaux actionnaires incluent Cwm, Llc, Syntegra Private Wealth Group, LLC, Baltimore-Washington Financial Advisors, Inc., Gerber Kawasaki Wealth & Investment Management, LPL Financial LLC, Congress Wealth Management LLC / DE /, Jpmorgan Chase & Co, Morgan Stanley, DORVAL Corp, and State Street Corp .

SPDR Series Trust - SPDR SSGA US Large Cap Low Volatility Index ETF (ARCA:LGLV) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 8, 2025 is 177,38 / share. Previously, on September 9, 2024, the share price was 166,91 / share. This represents an increase of 6,27% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

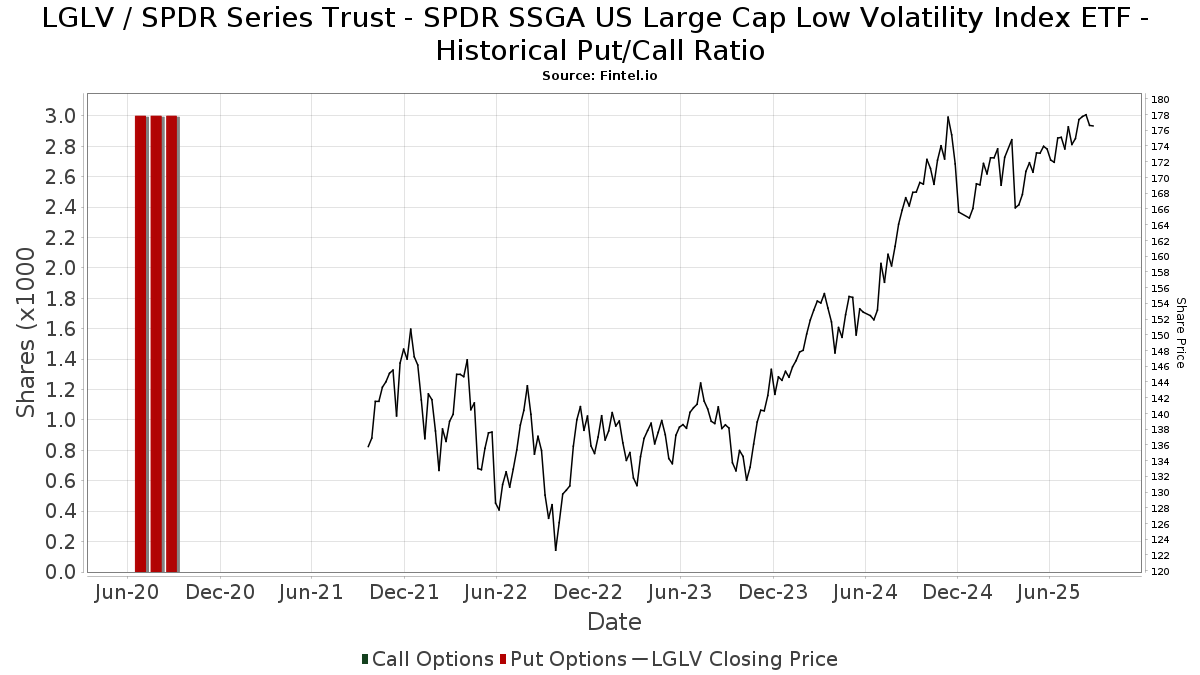

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-31 | 13F | Sage Mountain Advisors LLC | 18 958 | 0,00 | 3 310 | 0,33 | ||||

| 2025-08-05 | 13F | Hutchens & Kramer Investment Management Group, LLC | 3 209 | -5,09 | 564 | -4,25 | ||||

| 2025-07-16 | 13F/A | CX Institutional | 41 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Avant Capital LLC | 3 246 | 3,34 | 567 | 3,66 | ||||

| 2025-07-30 | 13F | Paul Damon & Associates, Inc. | 6 183 | -0,48 | 1 080 | -0,19 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 1 786 | -5,30 | 312 | -5,18 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 2 683 | -4,49 | 469 | -4,10 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 90 | 16 | ||||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 57 768 | -35,15 | 10 087 | -34,95 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 3 718 | -0,99 | 1 | |||||

| 2025-07-22 | 13F | Legacy Trust | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Private Trust Co Na | 901 | -6,24 | 157 | -5,99 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 91 | 0,00 | 16 | 0,00 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 12 828 | -42,54 | 2 | -33,33 | ||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 1 703 | 0,00 | 297 | 0,34 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 4 751 | -41,97 | 830 | -41,78 | ||||

| 2025-08-11 | 13F | Wealthgarden F.s. Llc | 1 665 | -3,42 | 289 | -4,00 | ||||

| 2025-08-27 | 13F | Barnes Wealth Management Group, Inc | 3 713 | 39,90 | 648 | 40,56 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 530 | 0,00 | 93 | 0,00 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 1 311 | 229 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 10 760 | -65,02 | 1 879 | -64,92 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 1 341 | 0,00 | 234 | 0,43 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 6 961 | -2,81 | 1 215 | -2,49 | ||||

| 2025-07-22 | 13F | Iowa State Bank | 1 660 | -31,09 | 290 | -31,03 | ||||

| 2025-07-29 | 13F | Portland Financial Advisors Inc | 6 062 | 0,00 | 1 058 | 0,28 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1 501 | -3,22 | 262 | -2,60 | ||||

| 2025-08-11 | 13F | Berkeley, Inc | 2 740 | 0,18 | 478 | 0,42 | ||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 8 270 | 3,79 | 1 444 | 4,18 | ||||

| 2025-07-16 | 13F | Independent Wealth Network Inc. | 5 970 | -2,56 | 1 042 | -2,25 | ||||

| 2025-08-14 | 13F | Harwood Advisory Group, LLC | 2 254 | -19,64 | 394 | -15,12 | ||||

| 2025-08-13 | 13F | Millington Financial Advisors, LLC | 1 734 | -2,42 | 306 | 3,39 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 91 399 | 4,63 | 15 959 | 4,98 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 3 890 | -4,14 | 1 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 369 | 5,43 | 64 | 6,67 | ||||

| 2025-07-31 | 13F | Moloney Securities Asset Management, LLC | 1 379 | -5,87 | 241 | -5,51 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 2 261 | 0 | ||||||

| 2025-08-11 | 13F | Vista Cima Wealth Management LLC | 3 044 | 0,00 | 532 | 0,38 | ||||

| 2025-08-14 | 13F | Comerica Bank | 311 | -1,27 | 54 | 0,00 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 9 500 | -5,19 | 2 | 0,00 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Advantage Trust Co | 219 | 38 | ||||||

| 2025-08-13 | 13F | Fisher Asset Management, LLC | 1 227 | 0,00 | 214 | 0,47 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 175 531 | 148,74 | 30 649 | 149,56 | ||||

| 2025-07-09 | 13F | Riversedge Advisors, Llc | 4 936 | -17,86 | 862 | -17,61 | ||||

| 2025-07-17 | 13F | ERn Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Fortis Group Advisors, LLC | 7 210 | -2,96 | 1 251 | -3,33 | ||||

| 2025-08-11 | 13F | First American Trust, Fsb | 32 117 | 3,78 | 5 608 | 4,10 | ||||

| 2025-08-06 | 13F | Paladin Advisory Group, LLC | 304 | 0,00 | 53 | 1,92 | ||||

| 2025-08-06 | 13F | Founders Financial Securities Llc | 74 041 | 81,50 | 12 928 | 87,44 | ||||

| 2025-08-14 | 13F | Abound Financial, Llc | 4 558 | -2,25 | 796 | -1,97 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 10 089 | 19,47 | 1 762 | 19,88 | ||||

| 2025-07-09 | 13F | Reyes Financial Architecture, Inc. | 40 | 0,00 | 7 | 0,00 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 2 409 | 44,25 | 418 | 45,30 | ||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 17 | 3 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 1 380 611 | 69,48 | 241 | 70,92 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 472 | -79,97 | 82 | -80,00 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 4 237 | 2,96 | 740 | 3,21 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 67 466 | 3,39 | 11 780 | 3,73 | ||||

| 2025-08-14 | 13F | Prestige Wealth Management Group LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Sei Investments Co | 25 127 | -6,77 | 4 387 | -6,46 | ||||

| 2025-07-22 | 13F | McNaughton Wealth Management, LLC | 15 834 | 4,38 | 2 765 | 4,70 | ||||

| 2025-07-21 | 13F | Investment Planning Advisors, Inc. | 1 300 | 0,00 | 227 | 0,00 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 619 | 0,49 | 108 | 0,93 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 667 | -76,93 | 116 | -76,94 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 17 | 0,00 | 3 | 0,00 | ||||

| 2025-07-28 | 13F | Cypress Wealth Services, LLC | 5 166 | 0,00 | 902 | 0,33 | ||||

| 2025-07-11 | 13F | Mallini Complete Financial Planning LLC | 430 | 2,63 | ||||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 6 537 | 0,23 | 1 141 | 0,53 | ||||

| 2025-07-24 | 13F | Stonebridge Financial Group, LLC | 1 330 | 232 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 13 241 | 14,52 | 2 312 | 14,91 | ||||

| 2025-08-08 | 13F | Thrive Capital Management, LLC | 5 256 | 918 | ||||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Stifel Financial Corp | 1 442 | -66,37 | 252 | -66,35 | ||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 2 350 | 410 | ||||||

| 2025-05-15 | 13F | Gts Securities Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 21 410 | 3 738 | ||||||

| 2025-04-11 | 13F | Signal Advisors Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 37 037 | 88,81 | 6 467 | 89,45 | ||||

| 2025-08-13 | 13F | Gateway Wealth Partners, LLC | 4 710 | 822 | ||||||

| 2025-08-18 | 13F | Front Row Advisors LLC | 60 | 0,00 | 10 | 0,00 | ||||

| 2025-08-14 | 13F | Win Advisors, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 2 353 | -4,31 | 411 | -3,98 | ||||

| 2025-08-07 | 13F | Efficient Advisors, LLC | 4 671 | -34,83 | 816 | -34,64 | ||||

| 2025-07-30 | 13F | Caliber Wealth Management, LLC / KS | 11 309 | -22,23 | 1 975 | -21,98 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 100 | 0,00 | 17 | 0,00 | ||||

| 2025-08-14 | 13F | Legacy Advisory Services, LLC | 10 813 | 0,30 | 1 888 | 0,64 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1 542 | 2,59 | 269 | 3,07 | ||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 1 067 | -0,74 | 186 | -0,53 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 1 967 | -0,56 | 343 | -0,29 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 3 171 | -52,56 | 554 | -52,49 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 3 518 | 8,48 | 614 | 8,87 | ||||

| 2025-07-25 | 13F | Commonwealth Financial Services, LLC | 2 311 | 0,00 | 403 | 0,25 | ||||

| 2025-05-19 | 13F | Heck Capital Advisors, LLC | 0 | 0 | ||||||

| 2025-07-22 | 13F | Miracle Mile Advisors, LLC | 7 168 | -8,66 | 1 252 | -8,35 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 2 186 | 0,09 | 382 | 0,26 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 3 561 | -0,28 | 629 | 4,49 | ||||

| 2025-07-15 | 13F | Norden Group Llc | 8 655 | -3,73 | 1 511 | -3,39 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 2 154 | 0,47 | 376 | 2,17 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 16 447 | -1,82 | 3 | 0,00 | ||||

| 2025-07-10 | 13F | High Net Worth Advisory Group LLC | 2 400 | 0,00 | 419 | 0,48 | ||||

| 2025-08-13 | 13F | VestGen Advisors, LLC | 50 039 | 8 740 | ||||||

| 2025-08-01 | 13F | Advisory Alpha, LLC | 1 362 | -3,75 | 238 | -3,66 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-30 | 13F | Insight Advisors, LLC/ PA | 2 740 | -7,40 | 479 | -7,18 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 92 605 | 0,00 | 16 170 | 0,33 | ||||

| 2025-08-14 | 13F | UBS Group AG | 13 564 | 8,24 | 2 368 | 8,62 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 2 812 | -10,62 | 491 | -10,24 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 31 | 0,00 | 5 | 0,00 | ||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 10 139 | -8,15 | 2 | 0,00 | ||||

| 2025-05-15 | 13F | WPG Advisers, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Rosenberg Matthew Hamilton | 97 | -17,80 | 17 | -20,00 | ||||

| 2025-08-11 | 13F | Blue Bell Private Wealth Management, Llc | 160 | 0,00 | 28 | 0,00 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 323 | 56 | ||||||

| 2025-07-30 | 13F | Syntegra Private Wealth Group, LLC | 698 710 | 8,15 | 122 002 | 8,50 | ||||

| 2025-08-14 | 13F | Horizon Investments, LLC | 73 961 | 76,78 | 12 914 | 77,37 | ||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 4 915 | -0,95 | 858 | -0,58 | ||||

| 2025-07-15 | 13F | Aspire Capital Advisors LLC | 1 912 | 54,32 | 334 | 54,88 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 27 248 | 468,38 | 4 623 | 454,20 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 1 639 | 0 | ||||||

| 2025-07-30 | 13F | Journey Advisory Group, LLC | 21 005 | 2,84 | 3 668 | 3,18 | ||||

| 2025-08-18 | 13F | Arq Wealth Advisors, Llc | 2 742 | 0,00 | 477 | 0,00 | ||||

| 2025-07-14 | 13F | Painted Porch Advisors LLC | 22 | 0,00 | 4 | 0,00 | ||||

| 2025-08-06 | 13F/A | Flagship Private Wealth, LLC | 6 445 | 1,72 | 1 125 | 2,09 | ||||

| 2025-07-30 | 13F | Pacific Sun Financial Corp | 1 150 | 0,00 | 201 | 0,00 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 346 | 0,00 | 60 | 0,00 | ||||

| 2025-08-13 | 13F | Vermillion & White Wealth Management Group, LLC | 37 | -21,28 | 7 | -25,00 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 43 | 2,38 | 7 | 0,00 | ||||

| 2025-08-07 | 13F | Hughes Financial Services, LLC | 1 155 | 0,00 | 202 | 0,50 | ||||

| 2025-07-23 | 13F | Valmark Advisers, Inc. | 26 132 | 12,29 | 4 563 | 12,64 | ||||

| 2025-07-30 | 13F | Prosperity Financial Group, Inc. | 1 621 | 283 | ||||||

| 2025-07-29 | 13F | Elevation Capital Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Apollon Financial, LLC | 5 155 | 106,61 | 900 | 107,37 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 1 400 | 0,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 28 001 | 37,27 | 4 890 | 37,71 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 60 | 10 | ||||||

| 2025-08-06 | 13F | RFG - Bristol Wealth Advisors, LLC | 4 960 | 866 | ||||||

| 2025-08-13 | 13F | Milestone Investment Advisors LLC | 8 967 | -4,59 | 1 566 | -4,28 | ||||

| 2025-05-12 | 13F | Sandy Spring Bank | 16 | 0,00 | 3 | 0,00 | ||||

| 2025-07-24 | 13F | Ulland Investment Advisors, LLC | 187 | 289,58 | 0 | |||||

| 2025-08-13 | 13F | BCJ Capital Management, LLC | 1 603 | 0,50 | 280 | 0,72 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 128 | -5,19 | 22 | -4,35 | ||||

| 2025-08-05 | 13F | Magnolia Capital Advisors Llc | 42 893 | 7 490 | ||||||

| 2025-07-21 | 13F | Empirical Financial Services, LLC d.b.a. Empirical Wealth Management | 3 855 | -1,28 | 673 | -0,88 | ||||

| 2025-07-28 | 13F | DORVAL Corp | 114 883 | 2,61 | 20 060 | 2,50 | ||||

| 2025-07-29 | 13F | Signature Estate & Investment Advisors Llc | 1 438 | -6,32 | 251 | -5,99 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | HF Advisory Group, LLC | 30 370 | 4,27 | 5 303 | 4,60 | ||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 11 617 | 2 028 | ||||||

| 2025-08-14 | 13F | Gerber Kawasaki Wealth & Investment Management | 259 539 | -0,60 | 45 318 | -0,28 | ||||

| 2025-07-15 | 13F | Sheets Smith Wealth Management | 4 798 | 0,00 | 838 | 0,24 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 408 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 294 | -23,24 | 51 | -22,73 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 1 364 | 238 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 168 069 | -0,08 | 29 347 | 0,25 | ||||

| 2025-08-14 | 13F | Cardiff Park Advisors, Llc | 2 719 | 0,00 | 475 | 0,21 | ||||

| 2025-08-12 | 13F | Calton & Associates, Inc. | 1 323 | 4,50 | 231 | 4,55 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Second Line Capital, LLC | 2 186 | 0,09 | 382 | 0,26 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 9 | 0,00 | 2 | 0,00 | ||||

| 2025-08-15 | 13F | WFA of San Diego, LLC | 6 | -96,15 | 1 | -96,15 | ||||

| 2025-07-22 | 13F | Olistico Wealth, LLC | 57 | 0,00 | 10 | 0,00 | ||||

| 2025-08-13 | 13F | JBR Co Financial Management Inc | 2 531 | 442 | ||||||

| 2025-08-13 | 13F | Baltimore-Washington Financial Advisors, Inc. | 279 627 | 1,46 | 48 826 | 1,79 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 1 678 | 8,40 | 293 | 8,55 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 2 360 | 0,00 | 412 | 0,49 | ||||

| 2025-08-11 | 13F | Tidemark, LLC | 33 | -42,11 | 6 | -44,44 | ||||

| 2025-08-14 | 13F | State Street Corp | 103 795 | 99,15 | 18 124 | 99,81 | ||||

| 2025-07-22 | 13F | Financial Insights, Inc. | 7 219 | -2,97 | 1 261 | -2,63 | ||||

| 2025-08-05 | 13F | Dunhill Financial, LLC | 0 | 0 | ||||||

| 2025-08-08 | 13F | Cornerstone Advisors Asset Management, Inc | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 21 295 | -22,48 | 3 747 | -21,65 | ||||

| 2025-04-15 | 13F | Eagle Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Barrett & Company, Inc. | 1 054 | 0,00 | 184 | 0,55 | ||||

| 2025-08-05 | 13F | Roffman Miller Associates Inc /pa/ | 12 094 | 0,40 | 2 112 | 0,72 | ||||

| 2025-07-22 | 13F | Accel Wealth Management | 1 375 | 0,00 | 240 | 0,42 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 2 883 | 21,19 | 1 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Mission Creek Capital Partners, Inc. | 5 816 | -4,40 | 1 015 | -4,06 | ||||

| 2025-08-05 | 13F | Flynn Zito Capital Management, Llc | 1 175 | 0,51 | 205 | 0,99 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 6 558 | -3,94 | 1 145 | -3,62 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 89 | 36,92 | 15 | 36,36 | ||||

| 2025-05-15 | 13F | Sykon Capital Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | Comprehensive Financial Planning, Inc./PA | 252 | 0,80 | 44 | 0,00 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 195 209 | 15,43 | 34 085 | 15,81 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 168 | 32,28 | 29 | 31,82 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 306 | 0,00 | 53 | 0,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 8 739 | 61,83 | 1 526 | 62,41 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 3 786 | -2,12 | 661 | -1,78 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 13 755 | 55,02 | 2 402 | 55,51 | ||||

| 2025-07-10 | 13F | ARS Wealth Advisors Group, LLC | 2 342 | 0,30 | 409 | 0,49 | ||||

| 2025-08-08 | 13F | Bouchey Financial Group Ltd | 1 400 | 0,00 | 244 | 0,41 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 4 796 | 0,99 | 837 | 1,33 | ||||

| 2025-04-23 | 13F | Fourth Dimension Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 2 525 | 14,15 | 441 | 14,29 | ||||

| 2025-08-14 | 13F | Harvest Investment Services, LLC | 3 272 | 0,62 | 571 | 1,06 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 378 | 0,00 | 66 | 1,54 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 1 525 | 7,02 | 266 | 7,26 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 31 507 | 0,83 | 5 501 | 1,16 | ||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 187 919 | -9,05 | 32 813 | -8,76 | ||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 64 | 0,00 | 11 | 0,00 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 3 531 | -2,99 | 617 | -2,69 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 1 375 | 49,62 | 240 | 50,94 | ||||

| 2025-07-15 | 13F | Regatta Capital Group, Llc | 5 639 | 985 | ||||||

| 2025-05-02 | 13F | Transcendent Capital Group LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | -100,00 | 0 |