Statistiques de base

| Actions institutionnelles (Long) | 128 451 060 - 38,28% (ex 13D/G) - change of 8,88MM shares 7,42% MRQ |

| Valeur institutionnelle (Long) | $ 704 622 USD ($1000) |

Participation institutionnels et actionnaires

IHS Holding Limited (US:IHS) détient 128 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 128,451,060 actions. Les principaux actionnaires incluent Wendel SE, Korea Investment CORP, Millennium Management Llc, Quaker Capital Investments, LLC, Standard Life Aberdeen plc, Jpmorgan Chase & Co, Bnp Paribas Arbitrage, Sa, Siren, L.L.C., Helikon Investments Ltd, and Morgan Stanley .

IHS Holding Limited (NYSE:IHS) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 5, 2025 is 7,27 / share. Previously, on September 9, 2024, the share price was 3,02 / share. This represents an increase of 140,73% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

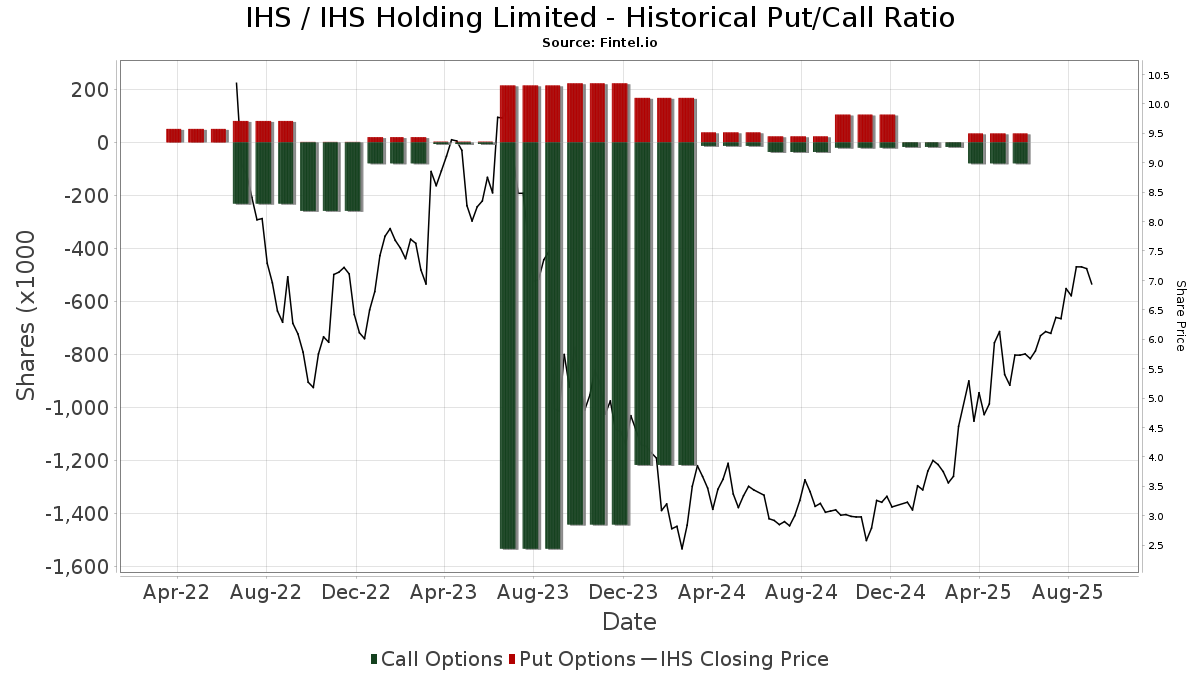

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | UBS Group AG | 1 004 113 | 161,20 | 5 583 | 178,27 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 31 237 | 183,87 | 0 | |||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 24 693 | 145,02 | 0 | |||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 44 508 | 127,01 | 247 | 142,16 | ||||

| 2025-08-13 | 13F | Siren, L.L.C. | 2 357 520 | 0,00 | 13 108 | 6,51 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 42 411 | 236 | ||||||

| 2025-08-13 | 13F | Hollow Brook Wealth Management LLC | 368 325 | 2 048 | ||||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 13 181 | 28,38 | 73 | 37,74 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 26 770 | 59,63 | 149 | 70,11 | ||||

| 2025-08-27 | NP | JNL SERIES TRUST - JNL/RAFI Fundamental U.S. Small Cap Fund (A) | 4 920 | 45,86 | 27 | 58,82 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 34 671 | 193 | ||||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 568 997 | 88,95 | 3 164 | 101,34 | ||||

| 2025-07-28 | 13F | Generali Asset Management SPA SGR | 180 000 | 0,00 | 1 001 | 6,50 | ||||

| 2025-08-29 | NP | PMJIX - PIMCO RAE US Small Fund Institutional Class | 35 607 | 198 | ||||||

| 2025-07-30 | 13F | Drive Wealth Management, Llc | 21 800 | 121 | ||||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 68 437 | 647,62 | 381 | 708,51 | ||||

| 2025-08-13 | 13F | Shelton Capital Management | 42 553 | -33,19 | 237 | -28,92 | ||||

| 2025-07-25 | NP | FNDA - Schwab Fundamental U.S. Small Company Index ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 394 744 | 2 191 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 1 260 483 | 94,63 | 7 008 | 107,34 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 303 143 | 346,25 | 2 | |||||

| 2025-08-11 | 13F | Semanteon Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 15 363 | 85 | ||||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 74 729 | 415 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 3 288 | 63,99 | 18 | 80,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 40 500 | 153,12 | 225 | 171,08 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 15 000 | 83 | |||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-01 | 13F | Zhang Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-06-24 | NP | SFSNX - Schwab Fundamental US Small Company Index Fund Institutional Shares | 81 815 | 401 | ||||||

| 2025-05-14 | 13F | Venture Visionary Partners LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | Paloma Partners Management Co | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 262 | 1 | ||||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 405 | 0,00 | 2 | 0,00 | ||||

| 2025-07-18 | 13F | Robeco Institutional Asset Management B.V. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 156 718 | 871 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 72 234 | 402 | ||||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 28 133 | -29,66 | 156 | -25,00 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 19 606 | -69,46 | 102 | -45,45 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 40 915 | 151,71 | 227 | 170,24 | ||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 128 800 | -27,40 | 1 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 413 550 | -42,55 | 2 299 | -38,81 | ||||

| 2025-08-28 | NP | Aberdeen Standard Global Infrastructure Income Fund | 1 484 900 | -6,87 | 8 256 | -0,80 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 306 078 | 639,64 | 2 | |||||

| 2025-07-18 | 13F | Truist Financial Corp | 18 556 | 0,00 | 103 | 7,29 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 19 431 | 1,08 | 108 | 8,00 | ||||

| 2025-07-08 | 13F | Quintet Private Bank (Europe) S.A. | 2 400 | 0,00 | 13 | 8,33 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 196 735 | 211,35 | 1 094 | 232,22 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 1 353 300 | 14,39 | 7 524 | 21,85 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 16 906 | -0,29 | 94 | 5,68 | ||||

| 2025-08-04 | 13F | Dumac, Inc. | 112 000 | 0,00 | 623 | 6,51 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 3 | 0,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 3 552 | 20 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 1 754 | 10 | ||||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 65 151 | -26,85 | 362 | -21,98 | ||||

| 2025-08-14 | 13F | Winton Capital Group Ltd | 25 603 | 142 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1 843 | -77,66 | 10 | -76,74 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 45 000 | 250 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 80 000 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Jump Financial, LLC | 322 061 | 227,30 | 1 791 | 248,93 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 19 400 | 977,78 | 108 | 1 088,89 | |||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 734 079 | 135,39 | 4 | 300,00 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 1 137 | 0,00 | 6 | 50,00 | ||||

| 2025-08-14 | 13F | Anson Funds Management LP | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 127 100 | 707 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 1 872 837 | 148,34 | 10 413 | 164,53 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 39 400 | 2 930,77 | 219 | 3 550,00 | |||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 912 990 | 119,59 | 5 076 | 133,92 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 27 446 | -18,44 | 153 | -13,14 | ||||

| 2025-06-26 | NP | OWSMX - Old Westbury Small & Mid Cap Strategies Fund | 57 493 | 88,96 | 282 | 183,84 | ||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 49 707 | 276 | ||||||

| 2025-08-26 | NP | WAR - U.S. Global Technology and Aerospace & Defense ETF | 9 231 | 51 | ||||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 510 | 3 | ||||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 13 869 | 0,00 | 77 | 6,94 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 66 | -95,49 | 0 | |||||

| 2025-08-06 | 13F | Savant Capital, LLC | 15 494 | 86 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 462 | 3 | ||||||

| 2025-08-19 | 13F | State of Wyoming | 53 910 | 300 | ||||||

| 2025-08-14 | 13F | Quarry LP | 729 | 4 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 26 075 | -0,72 | 145 | 5,11 | ||||

| 2025-08-13 | 13F | Diametric Capital, LP | 76 723 | -19,39 | 427 | -14,11 | ||||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 70 615 | 393 | ||||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 27 790 | 155 | ||||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 18 273 | 0 | ||||||

| 2025-08-12 | 13F | Trexquant Investment LP | 174 824 | 972 | ||||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 100 991 | 562 | ||||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 36 708 | -22,72 | 204 | -17,41 | ||||

| 2025-08-13 | 13F | Korea Investment CORP | 21 666 802 | 0,00 | 120 467 | 6,51 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 606 500 | 189,22 | 3 372 | 208,23 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 341 730 | -4,15 | 1 900 | 2,10 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 42 048 | 234 | ||||||

| 2025-06-13 | NP | AIAFX - Aberdeen Global Infrastructure Fund Class A | 107 226 | -28,04 | 525 | 7,58 | ||||

| 2025-08-14 | 13F | PDT Partners, LLC | 155 443 | 185,47 | 864 | 204,23 | ||||

| 2025-07-23 | 13F | Armbruster Capital Management, Inc. | 165 347 | 0,00 | 919 | 6,49 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 15 408 | -46,57 | 86 | -43,33 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 4 414 254 | 13,46 | 24 543 | 20,85 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 199 240 | 33,75 | 1 108 | 42,47 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 765 831 | 54,01 | 4 258 | 64,08 | ||||

| 2025-08-14 | 13F | Petrus Trust Company, LTA | 59 019 | 328 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 2 405 394 | 16,95 | 13 374 | 24,56 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 985 646 | 124,11 | 11 040 | 138,70 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-06-26 | NP | SMLF - iShares Edge MSCI Multifactor USA Small-Cap ETF | 135 237 | 9,47 | 663 | 63,46 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 244 149 | -0,13 | 1 357 | 6,35 | ||||

| 2025-08-14 | 13F | Numerai GP LLC | 84 134 | 419,09 | 468 | 455,95 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 342 376 | 74,79 | 1 904 | 86,20 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 37 030 | -0,56 | 206 | 5,67 | ||||

| 2025-08-08 | 13F | Helikon Investments Ltd | 2 357 338 | 64,43 | 13 107 | 75,14 | ||||

| 2025-07-21 | 13F | Ascent Group, LLC | 22 719 | 126 | ||||||

| 2025-08-12 | 13F | Magnetar Financial LLC | 37 403 | 208 | ||||||

| 2025-08-14 | 13F | State Street Corp | 14 963 | 83 | ||||||

| 2025-08-11 | 13F | Blue Bell Private Wealth Management, Llc | 161 | 1 | ||||||

| 2025-08-28 | NP | CPAEX - Counterpoint Tactical Equity Fund Class A Shares | 70 615 | 393 | ||||||

| 2025-04-29 | 13F | Calamos Advisors LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-08-04 | 13F | Pinnacle Associates Ltd | 73 350 | -11,31 | 408 | -5,57 | ||||

| 2025-08-07 | 13F | Compass Rose Asset Management, LP | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Principal Street Partners, LLC | 25 902 | 158,07 | 144 | 176,92 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 48 700 | 0 | ||||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 22 438 | 125 | ||||||

| 2025-08-11 | 13F | Greenland Capital Management LP | 120 000 | -37,66 | 667 | -33,57 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 12 861 | 72 | ||||||

| 2025-07-28 | 13F | Wendel SE | 62 975 396 | 0,00 | 350 143 | 6,51 | ||||

| 2025-05-13 | 13F | State of New Jersey Common Pension Fund D | 0 | -100,00 | 0 | |||||

| 2025-06-30 | NP | PRFZ - Invesco FTSE RAFI US 1500 Small-Mid ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 82 545 | -12,59 | 404 | 30,74 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 261 920 | -11,24 | 1 456 | -5,45 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 10 182 | 57 | ||||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 195 535 | -32,34 | 1 087 | -27,92 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 1 113 427 | 457,05 | 6 191 | 493,48 | ||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 2 565 900 | -7,59 | 14 266 | -1,57 | ||||

| 2025-08-14 | 13F | Jain Global LLC | 79 391 | 508,31 | 441 | 548,53 | ||||

| 2025-07-29 | 13F | Stratos Wealth Advisors, LLC | 10 403 | 58 | ||||||

| 2025-08-04 | 13F | Assetmark, Inc | 34 | 0 | ||||||

| 2025-05-15 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Spire Wealth Management | 566 | -33,65 | 3 | -25,00 | ||||

| 2025-05-09 | 13F | Deutsche Bank Ag\ | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 80 640 | -7,25 | 448 | -1,10 | ||||

| 2025-08-12 | 13F | Moon Capital Management Lp | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Dark Forest Capital Management Lp | 120 198 | -37,56 | 668 | -33,47 | ||||

| 2025-06-25 | NP | TRAMX - T. Rowe Price Africa & Middle East Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 177 400 | -9,99 | 869 | 34,52 | ||||

| 2025-08-12 | 13F | Rare Infrastructure Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-28 | NP | GWX - SPDR(R) S&P(R) International Small Cap ETF | 14 963 | 83 | ||||||

| 2025-08-14 | 13F | Occudo Quantitative Strategies Lp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Sona Asset Management (us) Llc | 1 802 674 | -14,27 | 10 023 | -8,68 | ||||

| 2025-08-14 | 13F | Man Group plc | 106 733 | -0,04 | 593 | 6,46 | ||||

| 2025-08-14 | 13F | Susquehanna Portfolio Strategies, LLC | 87 728 | 488 | ||||||

| 2025-08-14 | 13F | Quaker Capital Investments, LLC | 4 215 205 | 0,00 | 23 437 | 6,51 | ||||

| 2025-07-25 | NP | FNDB - Schwab Fundamental U.S. Broad Market Index ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 3 186 | 18 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 2 394 160 | 177,44 | 13 312 | 195,54 |

Other Listings

| DE:4JB | 6,00 € |