Statistiques de base

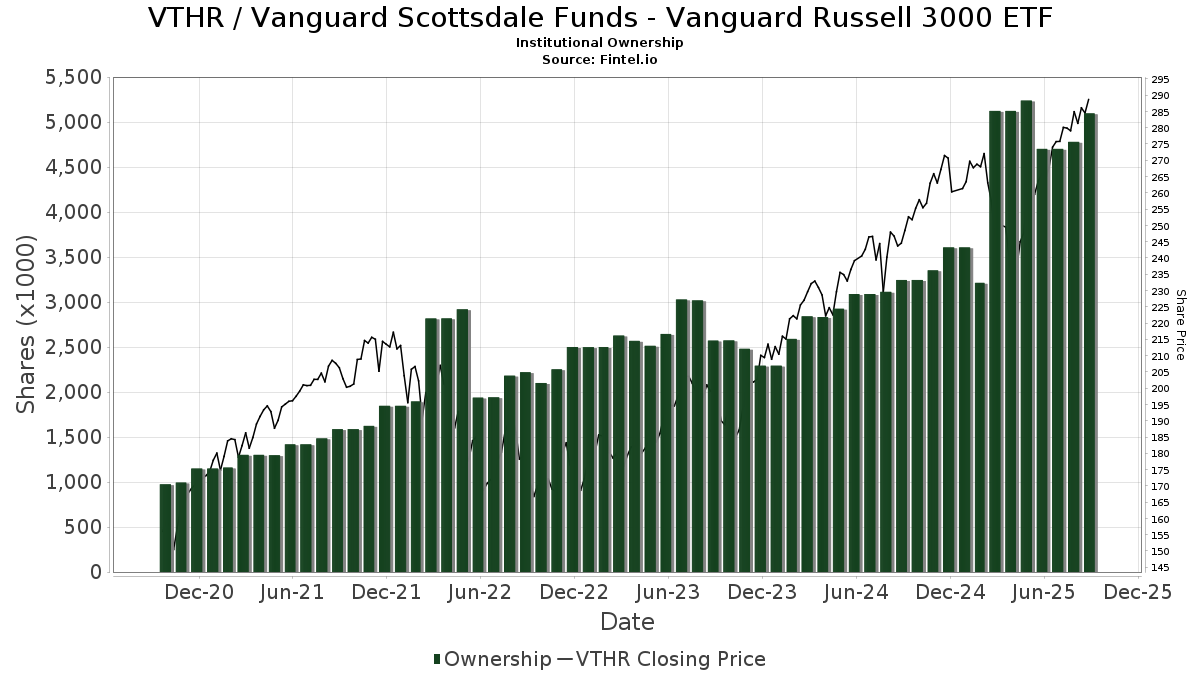

| Propriétaires institutionnels | 211 total, 211 long only, 0 short only, 0 long/short - change of 3,92% MRQ |

| Allocation moyenne du portefeuille | 0.3484 % - change of -0,29% MRQ |

| Actions institutionnelles (Long) | 5 098 998 (ex 13D/G) - change of 0,40MM shares 8,41% MRQ |

| Valeur institutionnelle (Long) | $ 1 273 948 USD ($1000) |

Participation institutionnels et actionnaires

Vanguard Scottsdale Funds - Vanguard Russell 3000 ETF (US:VTHR) détient 211 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 5,098,998 actions. Les principaux actionnaires incluent Ameriprise Financial Inc, Lincoln National Corp, LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Vanguard Domestic Equity ETF Fund Standard Class, Cliffwater LLC, Morgan Stanley, Colony Group, LLC, Natixis Advisors, L.p., Tompkins Financial Corp, Cerity Partners LLC, and Fund Evaluation Group, LLC .

Vanguard Scottsdale Funds - Vanguard Russell 3000 ETF (NasdaqGM:VTHR) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 11, 2025 is 291,25 / share. Previously, on September 12, 2024, the share price was 246,84 / share. This represents an increase of 17,99% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-31 | 13F | City State Bank | 50 | 0,00 | 14 | 8,33 | ||||

| 2025-08-08 | 13F | Firestone Capital Management | 1 000 | 0,00 | 273 | 10,57 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Chilton Capital Management Llc | 203 | 0,00 | 55 | 10,00 | ||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 41 | -73,55 | 11 | -71,05 | ||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 3 417 | 0,00 | 932 | 10,56 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 74 648 | 214,84 | 20 360 | 248,03 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 10 327 | 30,89 | 2 817 | 44,71 | ||||

| 2025-07-21 | 13F | Verus Financial Partners, Inc. | 8 358 | 1,31 | 2 305 | 18,09 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 10 046 | -16,66 | 2 740 | -7,87 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 78 929 | -0,10 | 21 528 | 10,42 | ||||

| 2025-07-16 | 13F | Dakota Wealth Management | 903 | 0,00 | 246 | 10,81 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 21 100 | 5 755 | ||||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 1 966 | 0,31 | 536 | 10,97 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 883 | 241 | ||||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 222 295 | 0,36 | 61 | 11,11 | ||||

| 2025-07-15 | 13F | Main Street Group, LTD | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Lowe Brockenbrough & Co Inc | 36 664 | 10 000 | ||||||

| 2025-08-07 | 13F | Evoke Wealth, Llc | 10 182 | 2 777 | ||||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 50 | 14 | ||||||

| 2025-08-28 | 13F/A | Tolleson Wealth Management, Inc. | 16 701 | 0,00 | 4 555 | 10,53 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 2 580 | -11,76 | 703 | -2,63 | ||||

| 2025-07-09 | 13F | Bowman & Co S.C. | 1 045 | 14,33 | 285 | 26,67 | ||||

| 2025-08-13 | 13F | Virtue Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Corundum Trust Company, INC | 1 892 | 0,00 | 516 | 10,73 | ||||

| 2025-08-07 | 13F | Tacita Capital Inc | 625 | 0,00 | 170 | 10,39 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 551 | 1 024,49 | 150 | 1 141,67 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 3 377 | -14,01 | 921 | -4,95 | ||||

| 2025-07-24 | 13F | Lokken Investment Group LLC | 1 905 | 520 | ||||||

| 2025-07-22 | 13F | Evensky & Katz LLC | 44 464 | 429,40 | 12 | 500,00 | ||||

| 2025-07-07 | 13F | Global Wealth Strategies & Associates | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Mycio Wealth Partners, Llc | 314 | 86 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 17 779 | 46,32 | 4 849 | 61,74 | ||||

| 2025-08-04 | 13F | Linscomb & Williams, Inc. | 26 427 | -1,73 | 7 208 | 8,62 | ||||

| 2025-07-18 | 13F | Centricity Wealth Management, LLC | 287 | 0,00 | 78 | 11,43 | ||||

| 2025-08-15 | 13F | Koesten, Hirschmann & Crabtree, INC. | 452 | 0,22 | 123 | 10,81 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 14 447 | 0,38 | 3 940 | 10,95 | ||||

| 2025-07-29 | 13F | Stratos Wealth Advisors, LLC | 16 417 | 1,40 | 4 478 | 12,07 | ||||

| 2025-07-21 | 13F | Precedent Wealth Partners, Llc | 1 820 | 9,84 | 496 | 21,57 | ||||

| 2025-07-31 | 13F | Sage Mountain Advisors LLC | 420 | 0,00 | 115 | 10,68 | ||||

| 2025-07-09 | 13F | Radnor Capital Management, LLC | 1 100 | 0,00 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 586 | 0,34 | 160 | 12,77 | ||||

| 2025-08-07 | 13F | Fund Evaluation Group, LLC | 139 081 | 37 934 | ||||||

| 2025-07-30 | 13F | Arbor Investment Advisors, LLC | 1 787 | -11,80 | 487 | -2,40 | ||||

| 2025-08-05 | 13F | Lincoln National Corp | 466 325 | 1,42 | 127 190 | 12,10 | ||||

| 2025-08-14 | 13F | Gould Capital, LLC | 13 | 8,33 | 4 | 50,00 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 12 533 | 0,01 | 3 418 | 10,54 | ||||

| 2025-07-31 | 13F | Fiduciary Wealth Partners, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 21 194 | -22,13 | 5 781 | -13,92 | ||||

| 2025-08-19 | 13F/A | Pitcairn Co | 23 421 | -18,27 | 6 388 | -9,66 | ||||

| 2025-07-25 | 13F | Johnson Investment Counsel Inc | 4 802 | 0,00 | 1 310 | 10,56 | ||||

| 2025-07-25 | 13F | Investment Advisory Group, LLC | 5 978 | -0,91 | 1 631 | 9,54 | ||||

| 2025-07-31 | 13F | Nilsine Partners, LLC | 1 498 | -5,96 | 409 | 3,82 | ||||

| 2025-08-11 | 13F | Diversified Portfolios, Inc. | 53 527 | 1,70 | 14 599 | 12,41 | ||||

| 2025-07-09 | 13F | Inspirion Wealth Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-02 | 13F | Central Pacific Bank - Trust Division | 24 | 0,00 | 7 | 20,00 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 136 | 0,00 | 37 | 12,12 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 1 478 | 0,00 | 403 | 10,71 | ||||

| 2025-07-30 | 13F | Forum Financial Management, LP | 2 448 | 0,29 | 668 | 10,80 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 2 847 | -66,80 | 777 | -63,31 | ||||

| 2025-07-30 | 13F | Whittier Trust Co | 5 659 | 0,00 | 1 543 | 10,53 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 3 081 | -0,03 | 840 | 10,53 | ||||

| 2025-08-04 | 13F | Flagship Harbor Advisors, Llc | 5 648 | 7,07 | 1 541 | 18,37 | ||||

| 2025-08-12 | 13F | Howe & Rusling Inc | 281 | 0,00 | 77 | 10,14 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 2 966 | 56,60 | 809 | 73,02 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 2 406 | 74,22 | 656 | 91,81 | ||||

| 2025-07-10 | 13F | Wedmont Private Capital | 5 599 | -0,94 | 1 544 | 16,37 | ||||

| 2025-04-24 | 13F | Wingate Wealth Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 1 691 | 461 | ||||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Vanguard Domestic Equity ETF Fund Standard Class | 466 325 | 1,42 | 127 190 | 12,10 | ||||

| 2025-07-31 | 13F | FSA Investment Group, LLC | 9 255 | 36,10 | 2 524 | 50,42 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 15 001 | 43,50 | 4 092 | 58,63 | ||||

| 2025-07-22 | 13F | Bay Harbor Wealth Management, LLC | 16 | 0,00 | 4 | 33,33 | ||||

| 2025-08-07 | 13F | BOK Financial Private Wealth, Inc. | 1 807 | 0,00 | 493 | 10,56 | ||||

| 2025-08-05 | 13F | Centennial Bank/AR/ | 4 946 | 210,29 | 1 349 | 243,26 | ||||

| 2025-07-09 | 13F | Christopher J. Hasenberg, Inc | 12 886 | -55,06 | 3 515 | -50,53 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 40 | 0,00 | 11 | 11,11 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 1 384 | 5,09 | 378 | 16,00 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 15 292 | 0,94 | 4 171 | 11,56 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 1 372 | -15,52 | 374 | -6,50 | ||||

| 2025-04-23 | 13F | Moran Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Moneta Group Investment Advisors Llc | 1 616 | 0,00 | 441 | 10,55 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 208 | 0,00 | 57 | 9,80 | ||||

| 2025-07-15 | 13F | DB Fitzpatrick & Co, Inc | 14 210 | -2,70 | 3 876 | 7,55 | ||||

| 2025-08-12 | 13F/A | Cozad Asset Management Inc | 2 493 | 0,00 | 680 | 10,41 | ||||

| 2025-08-11 | 13F | Banque Cantonale Vaudoise | 1 794 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Cliffwater LLC | 235 936 | -9,98 | 64 352 | -0,50 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 4 027 | -8,58 | 1 099 | 1,10 | ||||

| 2025-07-17 | 13F | Coastline Trust Co | 12 240 | -2,67 | 3 338 | 7,57 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 9 546 | -1,99 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Tennessee Valley Asset Management Partners | 12 549 | 3,47 | 3 423 | 14,37 | ||||

| 2025-07-18 | 13F | BSW Wealth Partners | 771 | 210 | ||||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 14 617 | 17,07 | 4 038 | 31,10 | ||||

| 2025-07-11 | 13F | Diversified Trust Co | 84 088 | 0,02 | 22 935 | 10,56 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 64 547 | 19,84 | 17 605 | 32,47 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 11 000 | -5,71 | 3 | 50,00 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 719 | -49,61 | 196 | -44,32 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 901 | -30,59 | 0 | |||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Wesbanco Bank Inc | 5 005 | 0,00 | 1 365 | 10,53 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 1 368 | 2,86 | 373 | 13,72 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 14 849 | 0,53 | 4 050 | 11,14 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 1 132 | 0,00 | 309 | 10,39 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 16 033 | -0,71 | 4 | 33,33 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 2 887 | -0,62 | 787 | 9,92 | ||||

| 2025-07-11 | 13F | Orrstown Financial Services Inc | 8 373 | -2,71 | 2 284 | 7,54 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 31 081 | -28,87 | 8 477 | -21,38 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 24 501 | 26,74 | 6 683 | 40,08 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | JDM Financial Group LLC | 59 | 0,00 | 16 | 14,29 | ||||

| 2025-05-08 | 13F | Armis Advisers, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Brighton Jones Llc | 1 190 | 0,25 | 325 | 10,96 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 3 309 | 33,54 | 903 | 47,63 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 24 | 0,00 | 7 | 0,00 | ||||

| 2025-07-31 | 13F | Topsail Wealth Management, LLC | 101 | 0,00 | 28 | 12,50 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 1 500 | -57,14 | 409 | -52,61 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 12 129 | 7,00 | 3 308 | 18,23 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 64 523 | -60,37 | 18 | -57,50 | ||||

| 2025-05-14 | 13F | Retirement Capital Strategies | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | NorthCrest Asset Manangement, LLC | 5 590 | 0,00 | 1 544 | 11,97 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 32 | 0,00 | 9 | 14,29 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 165 | 1,23 | 45 | 12,50 | ||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 8 925 | 0,00 | 2 434 | 10,54 | ||||

| 2025-07-21 | 13F | Monticello Wealth Management, Llc | 9 411 | 0,00 | 2 567 | 10,51 | ||||

| 2025-04-17 | 13F | Qrg Capital Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Huntington National Bank | 116 | -4,96 | ||||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 63 374 | 81,39 | 17 285 | 100,50 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 29 293 | 7 990 | ||||||

| 2025-08-14 | 13F | Silvercrest Asset Management Group Llc | 4 034 | 0,30 | 1 100 | 10,89 | ||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 21 100 | 0,00 | 5 207 | -5,00 | ||||

| 2025-08-14 | 13F | Graney & King, LLC | 102 | 0,00 | 28 | 8,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 97 699 | -1,64 | 26 648 | 8,71 | ||||

| 2025-07-07 | 13F | Bangor Savings Bank | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Embree Financial Group | 9 870 | -0,17 | 2 692 | 10,37 | ||||

| 2025-07-31 | 13F | CNB Bank | 3 189 | -11,54 | 870 | -2,25 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 1 636 | -4,05 | 449 | 6,90 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 988 | 269 | ||||||

| 2025-08-14 | 13F | Gotham Asset Management, LLC | 41 208 | 30,62 | 11 239 | 44,37 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 4 803 | 0,00 | 1 310 | 10,55 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 1 763 | 0,00 | 481 | 10,60 | ||||

| 2025-08-13 | 13F | American Investment Services, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | BCJ Capital Management, LLC | 930 | 0,00 | 254 | 10,48 | ||||

| 2025-07-22 | 13F | Compass Financial Group, INC/SD | 4 665 | 0,00 | 1 272 | 10,51 | ||||

| 2025-07-18 | 13F | Cooper Financial Group | 1 470 | 401 | ||||||

| 2025-08-14 | 13F | Principal Street Partners, LLC | 5 248 | 100,00 | 1 431 | 121,17 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 93 624 | -1,99 | 25 536 | 8,33 | ||||

| 2025-08-12 | 13F | New Republic Capital, LLC | 1 063 | 290 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 3 800 | 44,10 | 1 036 | 59,38 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 40 506 | -2,51 | 11 048 | 7,76 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 75 540 | 105,11 | 20 604 | 126,73 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 1 405 | 0,00 | 383 | 10,69 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 525 460 | 1,47 | 143 561 | 12,46 | ||||

| 2025-08-08 | 13F | Emerald Investment Partners, Llc | 10 | 0,00 | 3 | 0,00 | ||||

| 2025-08-08 | 13F | Jacksonville Wealth Management, LLC | 2 990 | -1,52 | 816 | 8,81 | ||||

| 2025-03-12 | 13F/A | Private Capital Management Llc | 272 | 65 | ||||||

| 2025-07-02 | 13F | First Financial Bank - Trust Division | 3 788 | 1,23 | 1 033 | 11,92 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 2 453 | 79,18 | 669 | 98,52 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 618 | 0,00 | 168 | 10,53 | ||||

| 2025-08-14 | 13F | Operose Advisors LLC | 5 166 | 0,19 | 1 409 | 10,69 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 4 250 | -0,86 | 1 159 | 9,65 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 30 | 0,00 | 8 | 14,29 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 3 505 | -0,79 | 956 | 9,64 | ||||

| 2025-08-29 | 13F | Evolution Wealth Management Inc. | 5 802 | 1 582 | ||||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 18 502 | 2,83 | 5 046 | 13,65 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 2 110 | 0,00 | 576 | 10,58 | ||||

| 2025-08-07 | 13F | Everhart Financial Group, Inc. | 3 148 | 37,11 | 859 | 51,59 | ||||

| 2025-08-14 | 13F | Capital Planning Advisors, LLC | 1 891 | 0,00 | 516 | 10,52 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 140 611 | 4,93 | 38 352 | 15,98 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 6 049 | 2,44 | 1 650 | 13,18 | ||||

| 2025-08-08 | 13F | Family Firm, Inc. | 41 713 | 3,59 | 11 377 | 14,50 | ||||

| 2025-08-14 | 13F | NCP Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 41 | 0,00 | 11 | 10,00 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 26 | 13,04 | 7 | 40,00 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 224 686 | 0,94 | 61 283 | 11,58 | ||||

| 2025-07-18 | 13F | PBMares Wealth Management LLC | 7 710 | -21,99 | 2 103 | -13,78 | ||||

| 2025-07-28 | 13F | Davidson Investment Advisors | 2 424 | 661 | ||||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 1 | 0,00 | 0 | |||||

| 2025-05-07 | 13F | Evermay Wealth Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Fairscale Capital, LLC | 2 655 | 0,00 | 740 | 12,82 | ||||

| 2025-08-13 | 13F | Grove Street Fiduciary, LLC | 1 992 | 0,00 | 543 | 10,59 | ||||

| 2025-07-11 | 13F | Adirondack Trust Co | 24 674 | 20,33 | 6 730 | 33,01 | ||||

| 2025-08-11 | 13F | Sykon Capital Llc | 920 | 0,00 | 251 | 10,13 | ||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Red Cedar Investment Management, Llc | 14 523 | -9,13 | 3 961 | 0,46 | ||||

| 2025-08-14 | 13F | Fmr Llc | 3 873 | -22,74 | 1 056 | -14,63 | ||||

| 2025-08-13 | 13F | Momentous Wealth Management, Inc. | 943 | 0,00 | 257 | 10,78 | ||||

| 2025-07-10 | 13F | Tompkins Financial Corp | 220 065 | 22,58 | 60 023 | 35,49 | ||||

| 2025-07-22 | 13F | Olistico Wealth, LLC | 6 | 2 | ||||||

| 2025-08-08 | 13F | Creative Planning | 3 967 | 4,86 | 1 082 | 15,86 | ||||

| 2025-08-12 | 13F | Jacobi Capital Management LLC | 1 324 | 0,00 | 361 | 10,74 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 188 | -47,63 | 51 | -42,05 | ||||

| 2025-08-14 | 13F | Pennington Partners & Co., Llc | 46 295 | 7,41 | 12 627 | 18,72 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 29 711 | 6,76 | 8 104 | 18,00 | ||||

| 2025-08-14 | 13F | Comerica Bank | 14 | -99,34 | 4 | -99,43 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 344 | 421,21 | 94 | 447,06 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 224 848 | 2,70 | 61 328 | 13,52 | ||||

| 2025-08-12 | 13F | Coston, McIsaac & Partners | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | AA Financial Advisors, LLC | 1 026 | -0,10 | 280 | 10,28 | ||||

| 2025-08-08 | 13F | Smithfield Trust Co | 340 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Synovus Financial Corp | 897 | 245 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 2 681 | 0,00 | 731 | 10,59 | ||||

| 2025-08-13 | 13F | Baker Avenue Asset Management, LP | 1 517 | -45,92 | 414 | -40,32 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Keystone Financial Group | 2 615 | 0,00 | 713 | 10,54 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 85 680 | -8,04 | 23 369 | 1,65 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 16 341 | 3,35 | 4 | 33,33 | ||||

| 2025-07-10 | 13F | ARS Wealth Advisors Group, LLC | 1 834 | 0,00 | 500 | 10,62 | ||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 4 400 | 1 200 | ||||||

| 2025-08-14 | 13F | Hrt Financial Lp | 8 737 | 2 | ||||||

| 2025-08-18 | 13F | N.E.W. Advisory Services LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Activest Wealth Management | 155 | 0,00 | 42 | 10,53 | ||||

| 2025-07-23 | 13F | Hardy Reed LLC | 8 048 | 0,00 | 2 195 | 10,58 | ||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 15 055 | 4 106 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 5 248 | 439,92 | 1 431 | 498,74 | ||||

| 2025-08-14 | 13F | Hirtle Callaghan & Co LLC | 2 500 | -16,67 | 682 | -7,97 | ||||

| 2025-08-07 | 13F | Commerce Bank | 37 517 | -6,38 | 10 233 | 3,48 | ||||

| 2025-06-03 | 13F/A | First National Bank Of Omaha | 1 274 | -39,01 | 314 | -29,28 | ||||

| 2025-04-30 | 13F | Brown Advisory Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-08 | 13F | Apella Capital, LLC | 4 269 | 1 170 | ||||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 32 686 | -14,42 | 8 915 | -5,40 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 581 | 0,35 | 158 | 11,27 | ||||

| 2025-07-22 | 13F | Silvia Mccoll Wealth Management, Llc | 2 463 | 0,00 | 672 | 10,54 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 19 198 | 31,33 | 5 236 | 45,16 | ||||

| 2025-08-04 | 13F | Silver Coast Investments LLC | 6 052 | 3,36 | 1 651 | 14,27 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 2 700 | 1 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 60 887 | 32,10 | 16 607 | 46,01 | ||||

| 2025-07-09 | 13F | Sunpointe, LLC | 1 495 | 408 | ||||||

| 2025-07-24 | 13F | Blair William & Co/il | 386 | 26,56 | 105 | 40,00 | ||||

| 2025-05-02 | 13F | Wealthfront Advisers Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-04-28 | 13F | Strategic Financial Concepts, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Paulson Wealth Management Inc. | 1 900 | -0,11 | 518 | 10,45 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 26 918 | 0,96 | 7 | 16,67 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 866 | 0,00 | 236 | 10,80 | ||||

| 2025-07-29 | 13F | Wealthstream Advisors, Inc. | 32 874 | -2,84 | 8 966 | 7,39 | ||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 11 653 | -0,07 | 3 178 | 10,46 | ||||

| 2025-07-30 | 13F | Sonata Capital Group Inc | 850 | 0,00 | 0 |