Statistiques de base

| Propriétaires institutionnels | 269 total, 266 long only, 0 short only, 3 long/short - change of 5,08% MRQ |

| Allocation moyenne du portefeuille | 0.3224 % - change of -6,13% MRQ |

| Actions institutionnelles (Long) | 52 164 224 (ex 13D/G) - change of 1,13MM shares 2,22% MRQ |

| Valeur institutionnelle (Long) | $ 1 205 084 USD ($1000) |

Participation institutionnels et actionnaires

Sixth Street Specialty Lending, Inc. (US:TSLX) détient 269 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 52,164,224 actions. Les principaux actionnaires incluent Strs Ohio, Sixth Street Partners Management Company, L.P., Progeny 3, Inc., Sound Income Strategies, LLC, Burgundy Asset Management Ltd., Van Eck Associates Corp, BIZD - VanEck Vectors BDC Income ETF, Morgan Stanley, Allen Investment Management LLC, and Ares Management Llc .

Sixth Street Specialty Lending, Inc. (NYSE:TSLX) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 10, 2025 is 24,38 / share. Previously, on September 11, 2024, the share price was 21,15 / share. This represents an increase of 15,27% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

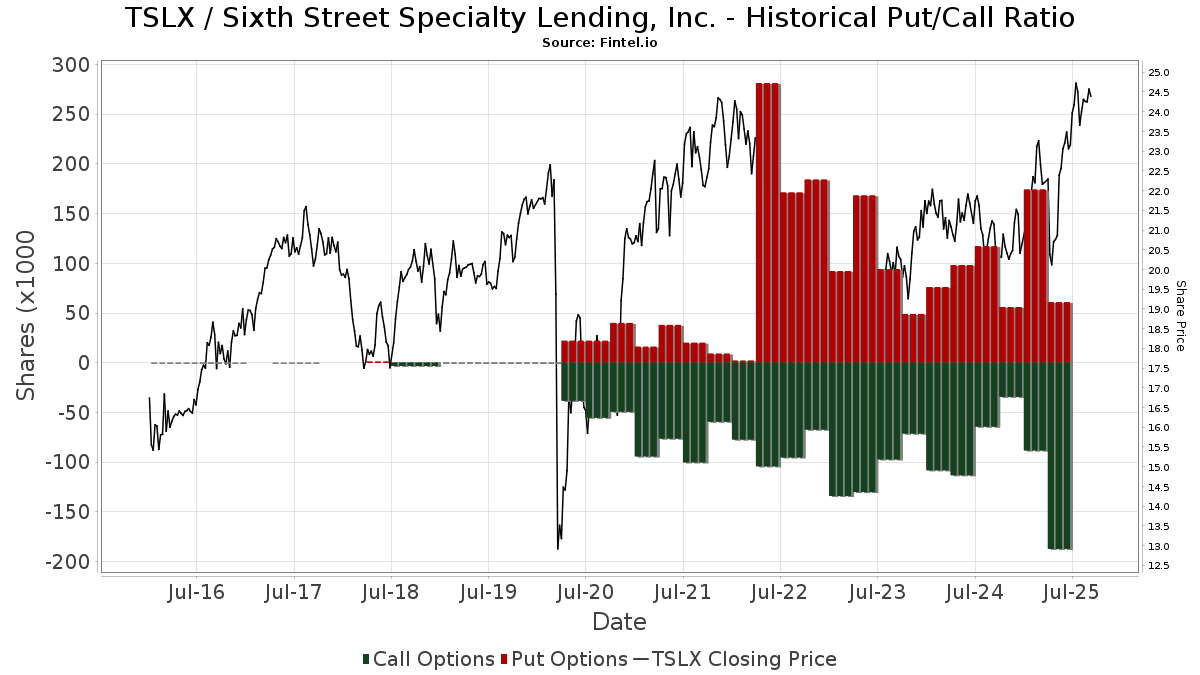

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-11 | 13F | EMC Capital Management | 6 120 | -9,29 | 0 | |||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 2 983 | 0,10 | 71 | 14,52 | ||||

| 2025-08-28 | NP | SVOAX - Simt Us Managed Volatility Fund Class F | 38 650 | -38,99 | 920 | -35,07 | ||||

| 2025-05-05 | 13F | Transce3nd, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Muzinich & Co., Inc. | 608 616 | 35,21 | 14 491 | 43,85 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 512 747 | 17,61 | 12 209 | 25,13 | ||||

| 2025-08-15 | 13F | Northeast Financial Consultants Inc | 26 000 | 0,00 | 619 | 6,54 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 19 159 | -3,69 | 456 | 2,47 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 98 843 | 0,00 | 2 353 | 6,37 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 1 001 | 0,00 | 24 | 4,55 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 84 292 | 52,37 | 2 007 | 62,04 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 76 206 | -4,27 | 1 814 | 1,85 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 16 052 | 24,86 | 382 | 33,10 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 42 122 | 1 003 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 1 186 011 | 35,43 | 28 239 | 44,09 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 4 659 | -8,70 | 111 | -3,51 | ||||

| 2025-05-01 | 13F | Country Club Bank /gfn | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Hager Investment Management Services, Llc | 55 | 1,85 | 1 | 0,00 | ||||

| 2025-08-06 | 13F | Round Rock Advisors, LLC | 281 184 | 2,44 | 6 695 | 8,99 | ||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Ellsworth Advisors, LLC | 29 815 | 710 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1 770 | -31,37 | 42 | -26,32 | ||||

| 2025-07-01 | 13F | Confluence Investment Management Llc | 288 066 | 14,58 | 6 859 | 21,90 | ||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 1 584 | -13,63 | 38 | -9,76 | ||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 395 347 | 12,96 | 9 413 | 20,17 | ||||

| 2025-08-14 | 13F | Alyeska Investment Group, L.P. | 189 491 | 4 512 | ||||||

| 2025-08-14 | 13F | Mariner, LLC | 38 629 | 13,16 | 920 | 20,45 | ||||

| 2025-08-14 | 13F | FJ Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | NP | SVYAX - SIIT U.S. Managed Volatility Fund - Class A | 104 200 | 0,00 | 2 427 | -0,94 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 334 | 1 570,00 | 8 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 1 672 | 0,00 | 40 | 5,41 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 5 235 | 0,00 | 125 | 5,98 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 872 708 | 0,15 | 44 589 | 6,55 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 17 300 | -24,78 | 412 | -20,04 | |||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 11 514 | 274 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 667 | 0,00 | 16 | 7,14 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 50 774 | -76,82 | 1 209 | -75,36 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 46 900 | 838,00 | 1 117 | 905,41 | |||

| 2025-09-10 | NP | Putnam ETF Trust - Putnam BDC ETF - | 491 597 | 2,60 | 11 936 | 20,00 | ||||

| 2025-07-10 | 13F | Security National Bank | 3 361 | 5,96 | 80 | 14,29 | ||||

| 2025-07-22 | 13F | Romano Brothers And Company | 25 200 | 46,51 | 601 | 56,51 | ||||

| 2025-08-11 | 13F | Greykasell Wealth Strategies, Inc. | 497 | -39,76 | 12 | -38,89 | ||||

| 2025-07-28 | NP | FXED - Sound Enhanced Fixed Income ETF | 52 635 | 1,12 | 1 226 | 0,16 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 600 | 0,00 | 14 | 7,69 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 74 279 | 176,23 | 1 769 | 194,18 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Register Financial Advisors LLC | 7 665 | 0,24 | 183 | 6,43 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 7 341 | 0,00 | 175 | 6,10 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 595 029 | -1,60 | 14 168 | 4,68 | ||||

| 2025-07-28 | 13F | Melia Wealth LLC | 614 916 | 3,56 | 14 641 | 10,18 | ||||

| 2025-08-13 | 13F | Lansforsakringar Fondforvaltning AB (publ) | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Pasadena Private Wealth, LLC | 10 090 | -9,66 | 240 | -3,61 | ||||

| 2025-05-14 | 13F | Campbell & CO Investment Adviser LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 123 237 | -5,70 | 2 936 | 0,75 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 8 570 | 204 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 75 811 | 186,63 | 1 805 | 205,41 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 17 540 | 418 | ||||||

| 2025-08-11 | 13F | Lsv Asset Management | 1 055 562 | -10,33 | 25 | -3,85 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 485 418 | 9,97 | 11 558 | 17,00 | ||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 211 976 | 3,40 | 5 047 | 10,00 | ||||

| 2025-08-20 | NP | LSPAX - LoCorr Spectrum Income Fund Class A | 29 829 | -48,40 | 710 | -45,09 | ||||

| 2025-08-14 | 13F | London & Capital Asset Management Ltd | 19 400 | 0,00 | 462 | 6,22 | ||||

| 2025-07-15 | 13F | Family Wealth Partners, Llc | 16 297 | 81,54 | 388 | 94,00 | ||||

| 2025-07-21 | 13F | Future Financial Wealth Managment LLC | 4 200 | 0,00 | 100 | 7,53 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 30 628 | 7,98 | 729 | 14,98 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 37 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | DRW Securities, LLC | 25 122 | 598 | ||||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 53 219 | 2,24 | 1 267 | 8,85 | ||||

| 2025-08-13 | 13F | Legacy Capital Wealth Partners, LLC | 61 987 | -3,10 | 1 476 | 3,07 | ||||

| 2025-08-13 | 13F | Texas Capital Bank Wealth Management Services Inc | 148 017 | 5,87 | 3 524 | 12,66 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 8 733 | 208 | ||||||

| 2025-07-29 | 13F | Stableford Capital Ii Llc | 8 500 | 208 | ||||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 20 608 | 14,31 | 491 | 21,59 | ||||

| 2025-08-13 | 13F | Advisory Research Inc | 10 564 | -1,55 | 252 | 4,58 | ||||

| 2025-08-13 | 13F | Wambolt & Associates, LLC | 146 586 | -8,68 | 3 487 | -3,14 | ||||

| 2025-07-18 | 13F | Generali Investments CEE, investicni spolecnost, a.s. | 24 084 | 4,50 | 573 | 11,26 | ||||

| 2025-07-25 | NP | First Trust Specialty Finance & Financial Opportunities Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 222 000 | 12,69 | 5 170 | 11,64 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 1 297 | -9,55 | 0 | |||||

| 2025-06-30 | NP | PSP - Invesco Global Listed Private Equity ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 26 905 | -22,31 | 559 | -28,00 | ||||

| 2025-07-25 | 13F | Community Bank, N.A. | 1 000 | 0,00 | 24 | 4,55 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 241 039 | 3,07 | 29 549 | 9,66 | ||||

| 2025-08-26 | NP | NORTHERN FUNDS - NORTHERN SMALL CAP CORE FUND Class K | 10 068 | -5,54 | 240 | 0,42 | ||||

| 2025-08-11 | 13F | Universal- Beteiligungs- und Servicegesellschaft mbH | 150 543 | 0,00 | 3 584 | 6,41 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 43 | 1 | ||||||

| 2025-08-13 | 13F | Brown Advisory Inc | 38 999 | -14,98 | 929 | -9,55 | ||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 41 047 | 4,57 | 977 | 11,28 | ||||

| 2025-07-29 | NP | PPADX - GMO U.S. Opportunistic Value Fund Class III | 21 838 | 509 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 18 012 | -13,02 | 429 | -7,56 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 538 400 | 8,83 | 12 819 | 15,79 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 11 138 | 265 | ||||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 15 050 | 66,87 | 358 | 78,11 | ||||

| 2025-08-08 | 13F | Tortoise Investment Management, LLC | Call | 500 | 0 | |||||

| 2025-07-28 | 13F | Frazier Financial Advisors, LLC | 4 814 | 0,00 | 115 | 6,54 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 663 112 | -4,02 | 15 789 | 2,11 | ||||

| 2025-05-30 | NP | ERNZ - TrueShares Active Yield ETF | 13 535 | -93,77 | 303 | -93,47 | ||||

| 2025-08-13 | 13F | Delphi Financial Group, Inc. | 20 041 | -55,57 | 477 | -52,73 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 14 825 | 353 | ||||||

| 2025-06-26 | NP | LSVQX - LSV Small Cap Value Fund Institutional Class Shares | 90 000 | 0,00 | 1 868 | -7,25 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 4 000 | 0,00 | 95 | 6,74 | ||||

| 2025-08-14 | 13F | BI Asset Management Fondsmaeglerselskab A/S | 1 919 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 206 077 | 16,24 | 4 907 | 23,67 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 678 886 | -7,62 | 16 164 | -1,71 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 324 196 | 7 719 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 94 | -57,27 | 2 | -50,00 | ||||

| 2025-08-14 | 13F | Clayton Partners LLC | 137 140 | -9,62 | 3 265 | -3,83 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 219 | 2,34 | 5 | 25,00 | ||||

| 2025-05-15 | 13F | Centiva Capital, LP | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-06-25 | NP | VPC - Virtus Private Credit Strategy ETF | 36 498 | -16,64 | 758 | -22,68 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 828 529 | -0,33 | 19 727 | 6,04 | ||||

| 2025-08-14 | 13F | Barnett & Company, Inc. | 36 750 | 22,30 | 875 | 30,21 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 21 868 | 1,38 | 521 | 7,88 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-07-17 | 13F | LexAurum Advisors, LLC | 8 454 | 201 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 14 150 | 0,00 | 337 | 6,33 | ||||

| 2025-07-11 | 13F | Mallini Complete Financial Planning LLC | 15 226 | 16,87 | 362 | 24,40 | ||||

| 2025-08-04 | 13F | Savvy Advisors, Inc. | 35 138 | 15,92 | 837 | 23,30 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 178 | 0,00 | 4 | 33,33 | ||||

| 2025-07-16 | 13F | Magnus Financial Group LLC | 12 526 | -13,05 | 298 | -7,45 | ||||

| 2025-07-18 | 13F | Union Bancaire Privee, UBP SA | 19 319 | 5,09 | 65 559 | 15 851,09 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 14 726 | -60,82 | 351 | -58,38 | ||||

| 2025-08-12 | 13F | Argent Trust Co | 144 734 | 36,10 | 3 446 | 44,85 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 2 144 | 0,00 | 51 | 24,39 | ||||

| 2025-08-14 | 13F | AllSquare Wealth Management LLC | 500 | 0,00 | 12 | 0,00 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 100 | 0,00 | 0 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 107 300 | 29,75 | 2 555 | 38,05 | |||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 9 300 | 3 000,00 | 0 | ||||

| 2025-08-14 | 13F | FIL Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 44 000 | -64,80 | 1 048 | -62,57 | |||

| 2025-08-14 | 13F | Hrt Financial Lp | 190 316 | 185,61 | 5 | 300,00 | ||||

| 2025-07-30 | 13F | Principle Wealth Partners Llc | 11 701 | -11,02 | 279 | -5,44 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 6 588 | 157 | ||||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 250 | 0,00 | 6 | 0,00 | ||||

| 2025-07-29 | 13F | TrueMark Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-04-28 | 13F | Redmont Wealth Advisors Llc | 4 341 | 97 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 32 652 | -47,47 | 777 | -44,14 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 19 502 | 1,22 | 464 | 7,66 | ||||

| 2025-05-15 | 13F | Nebula Research & Development LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Trexquant Investment LP | 168 058 | 11,57 | 4 001 | 18,69 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 696 005 | 16,84 | 16 572 | 24,30 | ||||

| 2025-08-07 | 13F | Allen Investment Management LLC | 1 557 126 | 8,52 | 37 075 | 15,45 | ||||

| 2025-08-14 | 13F | Parkwood LLC | 184 819 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 11 100 | 264 | |||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 9 361 | -13,84 | 223 | -8,64 | ||||

| 2025-06-26 | NP | LSVMX - LSV U.S. MANAGED VOLATILITY FUND Institutional Class Shares | 4 700 | 0,00 | 98 | -7,62 | ||||

| 2025-07-30 | NP | BIGTX - The Texas Fund Class I | 5 220 | 89,82 | 122 | 105,08 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 2 825 | -80,22 | 67 | -77,96 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 142 414 | 12,01 | 3 | 50,00 | ||||

| 2025-04-29 | 13F | Riggs Asset Managment Co. Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 2 143 789 | -3,78 | 51 | 4,08 | ||||

| 2025-08-01 | 13F | First National Trust Co | 214 770 | 0,00 | 5 114 | 6,39 | ||||

| 2025-08-13 | 13F | Grantham, Mayo, Van Otterloo & Co. LLC | 67 700 | -7,02 | 1 612 | -1,10 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 700 | 0,00 | 17 | 6,67 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 575 432 | -8,50 | 13 701 | -2,66 | ||||

| 2025-08-14 | 13F | Glenview Trust Co | 9 700 | 231 | ||||||

| 2025-07-24 | 13F | Wealthstar Advisors, Llc | 129 482 | -0,40 | 3 083 | 5,95 | ||||

| 2025-08-13 | 13F | Callodine Capital Management, LP | 1 064 824 | -0,02 | 25 353 | 6,36 | ||||

| 2025-07-29 | NP | GBFFX - GMO Benchmark-Free Fund Class III | 2 970 | 69 | ||||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 52 996 | -23,25 | 1 262 | -18,38 | ||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 32 519 | 787 | ||||||

| 2025-08-15 | 13F | Provenance Wealth Advisors, LLC | 100 | 0,00 | 2 | 0,00 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 427 840 | 3,05 | 10 187 | 9,63 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 100 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Sargent Investment Group, LLC | 28 400 | 0,00 | 682 | 7,24 | ||||

| 2025-08-14 | 13F | Comerica Bank | 9 280 | 12,42 | 221 | 19,57 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 63 911 | -38,55 | 1 522 | -34,64 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 113 162 | 181,73 | 2 694 | 200,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 40 339 | -4,92 | 961 | 1,16 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 2 406 296 | 1,91 | 57 294 | 8,42 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 2 000 | 11,11 | 48 | 17,50 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 64 376 | 7 857,48 | 2 | |||||

| 2025-07-07 | 13F | First Community Trust Na | 1 040 | 0,00 | 25 | 4,35 | ||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 500 | 0 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 70 817 | -42,45 | 1 686 | -38,76 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 47 667 | 9,70 | 1 135 | 16,67 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Quarry LP | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 527 107 | 21,01 | 12 550 | 28,74 | ||||

| 2025-07-10 | 13F | Worth Asset Management, LLC | 14 322 | 0,10 | 341 | 6,56 | ||||

| 2025-08-14 | 13F | Principal Street Partners, LLC | 14 570 | -4,65 | 347 | 1,47 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 93 065 | 16,48 | 2 216 | 23,88 | ||||

| 2025-07-28 | NP | PEX - ProShares Global Listed Private Equity ETF | 20 431 | 1,50 | 476 | 0,42 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 12 595 | 5,85 | 300 | 12,41 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 39 024 | -17,62 | 929 | -12,36 | ||||

| 2025-08-12 | 13F | Heritage Trust Co | 15 580 | 371 | ||||||

| 2025-08-12 | 13F | Waterloo Capital, L.P. | 103 773 | 7,64 | 2 471 | 14,51 | ||||

| 2025-07-29 | NP | SLPAX - Siit Small Cap Fund - Class A | 12 300 | 0,00 | 286 | -1,04 | ||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 29 811 | -26,19 | 710 | -21,48 | ||||

| 2025-07-28 | 13F | Naviter Wealth, LLC | 137 708 | 19,01 | 3 279 | 24,31 | ||||

| 2025-08-11 | 13F | Platform Technology Partners | 27 945 | -4,90 | 665 | 1,22 | ||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 16 513 | -4,37 | 393 | 1,81 | ||||

| 2025-08-08 | 13F | MTM Investment Management, LLC | 2 040 | 49 | ||||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 1 204 | 2,29 | 29 | 7,69 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 1 746 | 0,00 | 42 | 5,13 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 100 | 2 | ||||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 286 | 7 | ||||||

| 2025-08-12 | 13F | Legal & General Group Plc | 622 774 | 0,14 | 14 822 | 6,57 | ||||

| 2025-07-09 | 13F | Inspirion Wealth Advisors, Llc | 15 426 | 0,00 | 367 | 6,38 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 19 955 | 145,57 | 475 | 162,43 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 225 | -43,47 | 5 | -37,50 | ||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 35 508 | -2,42 | 845 | 3,81 | ||||

| 2025-08-14 | 13F | Fmr Llc | 34 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 46 666 | -0,14 | 1 111 | 6,32 | ||||

| 2025-08-13 | 13F | Burgundy Asset Management Ltd. | 2 378 968 | 1,36 | 56 643 | 7,84 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 161 | 1,90 | 4 | 0,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 83 | -82,23 | 2 | -90,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 52 974 | 1 261 | ||||||

| 2025-08-08 | 13F | Creative Planning | 38 717 | -3,54 | 922 | 2,56 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 12 200 | 290 | |||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 260 | 61,49 | 6 | 66,67 | ||||

| 2025-08-14 | 13F | Dearborn Partners Llc | 63 576 | 0,27 | 1 514 | 6,62 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Whalerock Point Partners, Llc | 13 200 | 24,24 | 314 | 32,49 | ||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 48 778 | -9,64 | 1 161 | -3,89 | ||||

| 2025-07-30 | 13F | Denali Advisors Llc | 198 685 | -2,34 | 4 731 | 3,91 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 494 410 | 10,14 | 11 772 | 17,17 | ||||

| 2025-08-13 | 13F | SCS Capital Management LLC | 622 522 | 2,86 | 14 822 | 9,43 | ||||

| 2025-08-21 | NP | BIZD - VanEck Vectors BDC Income ETF | 1 873 346 | -9,19 | 44 604 | -3,39 | ||||

| 2025-06-27 | NP | LBO - WHITEWOLF Publicly Listed Private Equity ETF | 6 624 | 14,29 | 138 | 6,20 | ||||

| 2025-08-04 | 13F | Strs Ohio | 3 176 606 | -10,80 | 75 635 | -5,10 | ||||

| 2025-08-08 | 13F | Marble Harbor Investment Counsel, LLC | 10 210 | -10,00 | 243 | -3,95 | ||||

| 2025-07-21 | 13F | Vaughan Nelson Investment Management, L.p. | 5 350 | 0,00 | 127 | |||||

| 2025-08-08 | 13F | Advisors Capital Management, LLC | 718 338 | 1,95 | 17 104 | 8,46 | ||||

| 2025-08-29 | NP | John Hancock Financial Opportunities Fund | 228 214 | 0,00 | 5 434 | 6,38 | ||||

| 2025-07-09 | 13F | Westmount Partners, LLC | 13 030 | 0,00 | 310 | 6,53 | ||||

| 2025-08-06 | 13F | Baillie Gifford & Co | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-23 | 13F | PARK CIRCLE Co | 62 000 | 0,00 | 1 476 | 6,42 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 4 264 | 83,48 | 102 | 94,23 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 29 302 | -26,67 | 698 | -22,04 | ||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 22 864 | 1,33 | 560 | 19,15 | ||||

| 2025-08-08 | 13F | Alberta Investment Management Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 141 477 | 13,87 | 3 369 | 21,19 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 609 227 | 0,94 | 14 506 | 7,39 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 604 | 0,00 | 14 | 7,69 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Dakota Wealth Management | 39 220 | 8,27 | 934 | 15,19 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 1 061 | 0,00 | 25 | 8,70 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 179 702 | 3,56 | 4 279 | 10,17 | ||||

| 2025-05-15 | 13F | Brevan Howard Capital Management LP | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 49 612 | 58,49 | 1 181 | 68,71 | ||||

| 2025-07-24 | 13F | Robertson Stephens Wealth Management, LLC | 9 700 | 0,00 | 231 | 5,99 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 422 634 | -4,82 | 10 063 | 1,26 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 26 971 | 5,81 | 642 | 12,63 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 230 586 | -0,88 | 5 490 | 5,46 | ||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 178 214 | 4 243 | ||||||

| 2025-07-09 | 13F | Mirador Capital Partners LP | 21 920 | 4,38 | 522 | 10,85 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 16 296 | 81,55 | 388 | 94,00 | ||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 9 575 | 0,00 | 228 | 6,07 | ||||

| 2025-08-11 | 13F | Core Wealth Partners LLC | 11 668 | 0,00 | 278 | 6,13 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 18 000 | 0,00 | 429 | 6,47 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 32 266 | -38,05 | 1 | -100,00 | ||||

| 2025-08-07 | 13F | Evoke Wealth, Llc | 39 859 | 0,00 | 949 | 6,39 | ||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 193 963 | -0,71 | 4 618 | 5,65 | ||||

| 2025-07-30 | 13F | Mid-American Wealth Advisory Group, Inc. | 189 | 4 | ||||||

| 2025-08-08 | 13F | Bouchey Financial Group Ltd | 30 252 | 0,00 | 720 | 6,35 | ||||

| 2025-04-30 | 13F | Stratos Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | RMR Capital Management, LLC | 190 495 | -21,68 | 4 536 | -16,68 | ||||

| 2025-07-23 | 13F | Columbus Macro, LLC | 437 561 | 12,40 | 10 418 | 19,60 | ||||

| 2025-08-13 | 13F | Natixis | 25 249 | 0,00 | 601 | 6,75 | ||||

| 2025-07-30 | 13F | Blume Capital Management, Inc. | 450 | 0,00 | 11 | 0,00 | ||||

| 2025-08-08 | 13F/A | Ignite Planners, LLC | 71 358 | 53,96 | 1 770 | 85,82 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 18 339 | 10,88 | 437 | 17,84 | ||||

| 2025-08-14 | 13F | Progeny 3, Inc. | 2 476 398 | 0,96 | 58 963 | 7,41 | ||||

| 2025-05-14 | 13F | Group One Trading, L.p. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 5 115 | 0,00 | 122 | 6,14 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 200 | 0,00 | 5 | 0,00 | ||||

| 2025-08-28 | NP | SMVIX - Simt Small Cap Value Fund Class I | 4 848 | -71,11 | 115 | -69,33 | ||||

| 2025-08-07 | 13F | Merrion Investment Management Co, LLC | 25 000 | 0,00 | 595 | 6,44 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 215 650 | 6,58 | 5 176 | 14,24 | ||||

| 2025-06-10 | 13F | Birchbrook, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 942 789 | 0,49 | 22 448 | 6,92 | ||||

| 2025-08-14 | 13F | State Street Corp | 89 663 | 257,76 | 2 135 | 281,07 | ||||

| 2025-07-22 | 13F | Grimes & Company, Inc. | 12 161 | 290 | ||||||

| 2025-08-13 | 13F | Barclays Plc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Peoples Bank/KS | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 58 035 | 1 382 | ||||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 44 425 | -31,00 | 1 058 | -26,60 | ||||

| 2025-08-13 | 13F | Plan Group Financial, LLC | 51 428 | 32,13 | 1 224 | 40,53 | ||||

| 2025-05-14 | 13F | Caitlin John, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | NP | GIMFX - GMO Implementation Fund | 6 729 | 157 | ||||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 4 123 | 73,97 | 98 | 84,91 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 51 926 | 1 236 | ||||||

| 2025-07-15 | 13F | Riverbridge Partners Llc | 48 835 | 3,37 | 1 163 | 9,93 | ||||

| 2025-05-14 | 13F | Group One Trading, L.p. | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 31 070 | 0,00 | 740 | 6,33 | ||||

| 2025-08-14 | 13F | Ares Management Llc | 1 402 689 | 2,19 | 33 398 | 8,72 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 347 494 | 336,55 | 8 274 | 364,51 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 264 827 | -4,34 | 6 | 0,00 | ||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 105 149 | 6,64 | 2 504 | 13,46 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 9 484 | 0,32 | 226 | 6,64 | ||||

| 2025-07-09 | 13F | Gilman Hill Asset Management, LLC | 465 241 | 4,09 | 11 077 | 10,74 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 207 112 | 7,31 | 4 931 | 14,17 | ||||

| 2025-08-04 | 13F | Canton Hathaway, LLC | 47 430 | -1,66 | 1 | 0,00 | ||||

| 2025-07-22 | 13F | Sage Investment Counsel LLC | 26 277 | 0,00 | 626 | 6,29 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 303 843 | -0,12 | 7 235 | 6,26 | ||||

| 2025-08-12 | 13F | Sixth Street Partners Management Company, L.P. | 2 714 226 | 0,00 | 64 626 | 6,39 | ||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 136 054 | 2,59 | 3 | 50,00 | ||||

| 2025-08-21 | NP | MOFTX - Mercer Opportunistic Fixed Income Fund Class I | 30 000 | 714 | ||||||

| 2025-08-26 | NP | GMOV - GMO U.S. Value ETF | 2 345 | -1,64 | 56 | 3,77 | ||||

| 2025-08-06 | 13F | Texas Yale Capital Corp. | 35 500 | 1,43 | 845 | 7,92 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 25 113 | 0,00 | 598 | 6,23 | ||||

| 2025-08-08 | 13F | Lgt Capital Partners Ltd. | 336 500 | -14,81 | 8 012 | -9,37 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 24 606 | 586 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100,00 | 0 |