Statistiques de base

| Propriétaires institutionnels | 166 total, 166 long only, 0 short only, 0 long/short - change of 9,93% MRQ |

| Allocation moyenne du portefeuille | 0.1492 % - change of -15,38% MRQ |

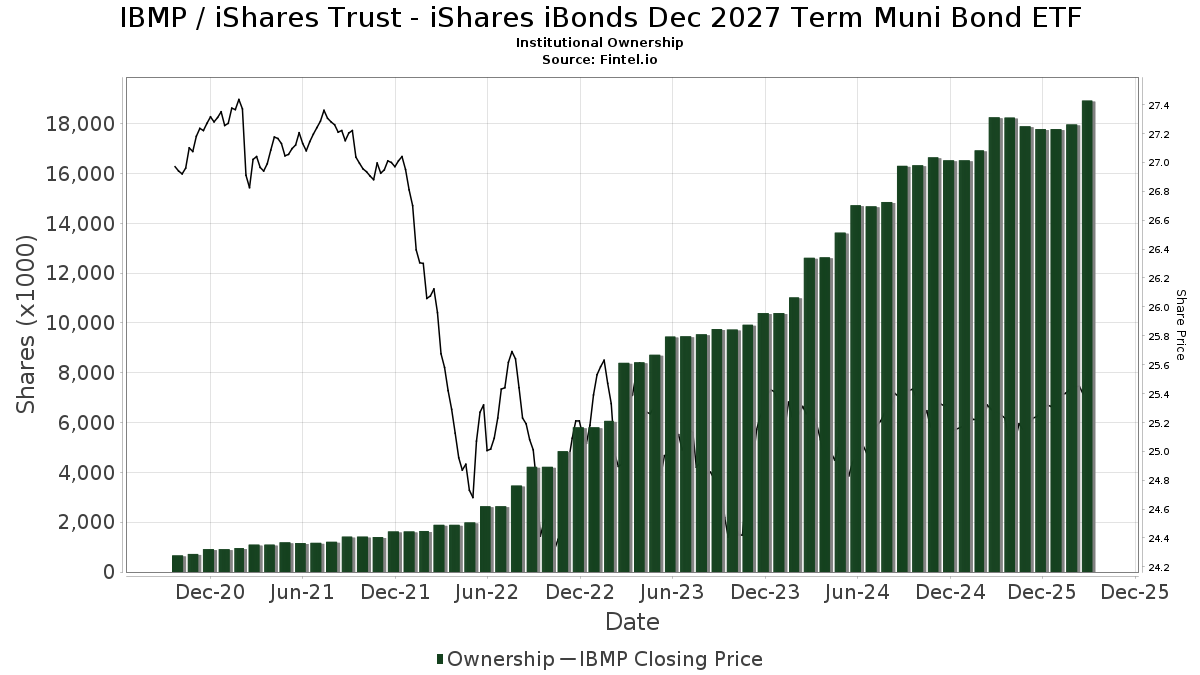

| Actions institutionnelles (Long) | 18 929 539 (ex 13D/G) - change of 1,15MM shares 6,50% MRQ |

| Valeur institutionnelle (Long) | $ 461 832 USD ($1000) |

Participation institutionnels et actionnaires

iShares Trust - iShares iBonds Dec 2027 Term Muni Bond ETF (US:IBMP) détient 166 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 18,929,539 actions. Les principaux actionnaires incluent Bank Of America Corp /de/, Wells Fargo & Company/mn, HighTower Advisors, LLC, Mercer Global Advisors Inc /adv, Hartland & Co., LLC, Envestnet Asset Management Inc, Heartwood Wealth Advisors LLC, Us Bancorp \de\, Morgan Stanley, and LPL Financial LLC .

iShares Trust - iShares iBonds Dec 2027 Term Muni Bond ETF (BATS:IBMP) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 8, 2025 is 25,49 / share. Previously, on September 9, 2024, the share price was 25,41 / share. This represents an increase of 0,31% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Peloton Wealth Strategists | 10 000 | 0,00 | 0 | |||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 117 402 | -8,35 | 2 976 | -8,09 | ||||

| 2025-08-13 | 13F | RIA Advisory Group LLC | 52 178 | 7,85 | 1 323 | 8,09 | ||||

| 2025-08-04 | 13F | Spinnaker Trust | 58 700 | 4,73 | 1 488 | 5,08 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 9 031 | 229 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 30 076 | 4,00 | 762 | 4,24 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 150 | 0,67 | 4 | 0,00 | ||||

| 2025-07-15 | 13F | Cora Capital Advisors Llc | 12 000 | 0,00 | 304 | 0,33 | ||||

| 2025-07-17 | 13F | Archford Capital Strategies, LLC | 12 042 | 5,12 | 305 | 5,54 | ||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 401 761 | -27,60 | 10 185 | -27,40 | ||||

| 2025-08-11 | 13F | Arrow Financial Corp | 9 517 | 0,00 | 241 | 0,42 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 973 274 | 28,92 | 24 672 | 29,27 | ||||

| 2025-07-30 | 13F | Rehmann Capital Advisory Group | 10 277 | 0,00 | 261 | 0,39 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 38 232 | -20,61 | 969 | -20,38 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 898 400 | 3,14 | 22 774 | 3,42 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 14 011 | 71,91 | 355 | 72,33 | ||||

| 2025-08-06 | 13F | Horan Securities, Inc. | 8 544 | 0,00 | 217 | 0,47 | ||||

| 2025-07-18 | 13F | Client 1st Advisory Group, Llc | 9 960 | 0,00 | 252 | 0,40 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 62 074 | 12,67 | 1 574 | 13,00 | ||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 109 726 | -0,24 | 2 782 | 0,04 | ||||

| 2025-07-22 | 13F | Partners Wealth Management, Llc | 11 604 | 0,00 | 293 | 0,00 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 49 050 | 148,10 | 1 243 | 149,10 | ||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 8 633 | 219 | ||||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 911 065 | 9,25 | 23 095 | 9,56 | ||||

| 2025-08-04 | 13F | Jim Saulnier & Associates, Llc | 15 994 | 0,60 | 405 | 1,00 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 425 371 | 4,28 | 10 783 | 4,57 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 316 178 | 13,39 | 8 015 | 13,72 | ||||

| 2025-07-07 | 13F | Trust Co | 13 788 | -0,01 | 350 | 0,29 | ||||

| 2025-07-09 | 13F | Massmutual Trust Co Fsb/adv | 19 539 | 495 | ||||||

| 2025-07-08 | 13F | Heartwood Wealth Advisors LLC | 753 839 | 0,05 | 19 110 | 0,33 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 10 000 | 0,00 | 254 | 0,79 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 5 000 | -28,57 | 127 | -28,41 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 31 161 | 21,27 | 790 | 21,57 | ||||

| 2025-08-01 | 13F | James Investment Research Inc | 14 714 | 0,00 | 373 | 0,54 | ||||

| 2025-07-17 | 13F | Hengehold Capital Management Llc | 396 612 | 3,19 | 10 054 | 3,48 | ||||

| 2025-07-16 | 13F | Evergreen Private Wealth LLC | 44 722 | -1,85 | 1 134 | -1,56 | ||||

| 2025-07-17 | 13F | Coastline Trust Co | 4 716 | 0,00 | 120 | 0,00 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 19 181 | -7,96 | 486 | -7,60 | ||||

| 2025-07-15 | 13F | Postrock Partners Llc | 96 609 | 4,01 | 2 449 | 4,30 | ||||

| 2025-07-11 | 13F | Quantum Financial Advisors, LLC | 142 423 | 3,32 | 3 610 | 3,62 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 14 599 | 0,00 | 370 | 0,27 | ||||

| 2025-07-31 | 13F | Leavell Investment Management, Inc. | 178 143 | 2,01 | 4 516 | 2,29 | ||||

| 2025-07-08 | 13F | Legacy Private Trust Co. | 9 395 | 0,00 | 238 | 0,42 | ||||

| 2025-07-15 | 13F | Droms Strauss Advisors Inc /mo/ /adv | 14 266 | 7,21 | 362 | 7,44 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 40 560 | 25,62 | 1 028 | 25,98 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 92 193 | -37,62 | 2 337 | -37,38 | ||||

| 2025-07-18 | 13F | Precision Wealth Strategies, LLC | 10 417 | 264 | ||||||

| 2025-08-14 | 13F | Comerica Bank | 18 331 | -0,87 | 465 | -0,64 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 42 647 | -5,59 | 1 081 | -5,34 | ||||

| 2025-07-08 | 13F | Prism Advisors, Inc. | 44 715 | 0,00 | 1 134 | 0,27 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 103 126 | -0,27 | 2 614 | 0,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 26 392 | 31,91 | 669 | 32,48 | ||||

| 2025-08-11 | 13F | Avantax Planning Partners, Inc. | 13 043 | -0,78 | 331 | -0,60 | ||||

| 2025-07-31 | 13F | Resonant Capital Advisors, LLC | 13 914 | 0,00 | 353 | 0,28 | ||||

| 2025-08-06 | 13F | Rialto Wealth Management, LLC | 962 | 0,00 | 24 | 0,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 393 517 | -4,28 | 9 976 | -4,01 | ||||

| 2025-04-11 | 13F | First Affirmative Financial Network | 16 862 | 4,22 | 426 | 4,93 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 46 828 | 19,59 | 1 | |||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Covington Investment Advisors Inc. | 329 115 | 1,37 | 8 | 0,00 | ||||

| 2025-08-01 | 13F | First National Trust Co | 8 319 | 211 | ||||||

| 2025-05-12 | 13F | Sandy Spring Bank | 45 616 | 2,54 | 1 153 | 3,13 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 812 | 0,00 | 21 | 0,00 | ||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 10 943 | 0,00 | 277 | 0,36 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 42 051 | -3,35 | 1 066 | -3,09 | ||||

| 2025-07-17 | 13F | Catalytic Wealth RIA, LLC | 31 354 | -2,04 | 795 | -1,85 | ||||

| 2025-07-29 | 13F | Roof Eidam & Maycock/adv | 32 174 | 0,15 | 816 | 0,37 | ||||

| 2025-07-30 | 13F | Granite Harbor Advisors, Inc. | 45 187 | -8,67 | 1 145 | -8,40 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 155 497 | 1,19 | 3 942 | 1,47 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 34 890 | 12,49 | 884 | 12,76 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 1 115 | -55,82 | 28 | -55,56 | ||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 50 995 | 1 293 | ||||||

| 2025-08-14 | 13F | Garden State Investment Advisory Services LLC | 0 | -100,00 | 0 | |||||

| 2025-07-09 | 13F | Praetorian Wealth Management, Inc. | 244 449 | -0,90 | 6 197 | -0,63 | ||||

| 2025-07-11 | 13F | Financial Advisory Corp | 27 254 | 691 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 156 883 | 10,35 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 221 147 | 375,30 | 5 606 | 376,70 | ||||

| 2025-04-24 | 13F | Aspect Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 30 410 | -10,39 | 771 | -10,15 | ||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 6 923 | 0 | ||||||

| 2025-08-04 | 13F | ArborFi Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 2 725 | 0,00 | 69 | 1,47 | ||||

| 2025-07-23 | 13F | Valmark Advisers, Inc. | 64 563 | 8,46 | 1 637 | 8,78 | ||||

| 2025-08-08 | 13F | Wrapmanager Inc | 14 004 | -4,33 | 355 | -4,05 | ||||

| 2025-07-21 | 13F | Crews Bank & Trust | 30 738 | 0,00 | 779 | 0,26 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 2 258 | 0,00 | 57 | 0,00 | ||||

| 2025-07-22 | 13F | Woodmont Investment Counsel Llc | 77 590 | 8,80 | 1 967 | 9,10 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 13 221 | 335 | ||||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 56 799 | 20,90 | 1 440 | 21,23 | ||||

| 2025-08-05 | 13F | American Capital Advisory, LLC | 2 231 | 0,00 | 57 | 0,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 2 102 054 | 7,57 | 53 287 | 7,87 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 414 771 | 9,32 | 10 514 | 9,62 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 13 392 | 19,57 | 339 | 19,79 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 201 049 | 4,58 | 5 097 | 4,88 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 131 364 | 2,34 | 3 330 | 2,62 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 103 | 3 | ||||||

| 2025-08-14 | 13F | 10Elms LLP | 21 344 | 0,95 | 541 | 1,31 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 69 859 | 60,26 | 1 771 | 60,76 | ||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 266 454 | -31,52 | 6 755 | -31,33 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 253 695 | 16,20 | 6 431 | 16,52 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 62 168 | 3,30 | 1 576 | 3,55 | ||||

| 2025-08-07 | 13F | Sound View Wealth Advisors Group, LLC | 154 864 | 27,07 | 3 926 | 27,44 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 28 066 | 200,20 | 1 | |||||

| 2025-07-29 | 13F | Accretive Wealth Partners, LLC | 8 252 | 209 | ||||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 24 647 | -57,33 | 625 | -57,26 | ||||

| 2025-07-28 | 13F | WJ Wealth Management, LLC | 52 833 | 36,05 | 1 339 | 36,49 | ||||

| 2025-08-01 | 13F | Paradigm, Strategies in Wealth Management, LLC | 8 838 | 224 | ||||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 6 549 | 0,05 | 166 | 0,61 | ||||

| 2025-07-18 | 13F | Foundry Financial Group, Inc. | 28 777 | -1,09 | 729 | -0,82 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 866 358 | 0,82 | 21 962 | 1,10 | ||||

| 2025-07-22 | 13F | Penobscot Investment Management Company, Inc. | 8 000 | 203 | ||||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 32 288 | 816 | ||||||

| 2025-07-16 | 13F | Novem Group | 9 997 | 0,60 | 253 | 0,80 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 2 015 | 0,00 | 51 | 2,00 | ||||

| 2025-08-13 | 13F | Green Harvest Asset Management LLC | 14 881 | -1,44 | 377 | -1,05 | ||||

| 2025-07-07 | 13F | Vishria Bird Financial Group, LLC | 15 904 | 403 | ||||||

| 2025-08-11 | 13F | PFG Private Wealth Management, LLC | 11 643 | -3,07 | 295 | -2,64 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 53 314 | 366,48 | 1 352 | 369,10 | ||||

| 2025-07-25 | 13F | Commonwealth Financial Services, LLC | 10 251 | -4,12 | 260 | -4,07 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Envision Financial Planning, LLC | 64 334 | -9,89 | 1 631 | -9,65 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 94 355 | -27,72 | 2 392 | -27,55 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 9 849 | 250 | ||||||

| 2025-08-12 | 13F | Wealthbridge Capital Management, Llc | 14 143 | 5,82 | 359 | 6,23 | ||||

| 2025-07-21 | 13F | Atwater Malick LLC | 80 088 | 4,11 | 2 030 | 4,42 | ||||

| 2025-07-21 | 13F | Cliftonlarsonallen Wealth Advisors, Llc | 202 026 | 27,26 | 5 121 | 27,61 | ||||

| 2025-04-15 | 13F | Members Wealth Llc | 21 804 | 0,00 | 551 | 0,36 | ||||

| 2025-08-05 | 13F | Hills Bank & Trust Co | 399 047 | 17,67 | 10 116 | 18,00 | ||||

| 2025-07-23 | 13F | Prime Capital Investment Advisors, LLC | 13 576 | -8,19 | 344 | -7,77 | ||||

| 2025-04-16 | 13F | Wealth Enhancement Advisory Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 120 610 | 8,92 | 3 057 | 9,22 | ||||

| 2025-07-22 | 13F | Blue Square Asset Management, Llc | 45 097 | -1,96 | 1 143 | -1,64 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 10 631 | 270 | ||||||

| 2025-07-30 | 13F | Klingman & Associates, LLC | 17 490 | -11,82 | 443 | -11,58 | ||||

| 2025-08-07 | 13F | Hughes Financial Services, LLC | 7 550 | 5,73 | 192 | 6,11 | ||||

| 2025-07-14 | 13F | Sentinel Pension Advisors Inc | 58 098 | 0,73 | 1 473 | 0,96 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 18 909 | 106,50 | 479 | 107,36 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 752 155 | 7,56 | 19 067 | 7,86 | ||||

| 2025-08-14 | 13F | Financial Engines Advisors L.L.C. | 31 236 | 31,89 | 792 | 32,22 | ||||

| 2025-07-29 | 13F | Regions Financial Corp | 51 223 | 3,13 | 1 299 | 3,43 | ||||

| 2025-07-01 | 13F | Confluence Investment Management Llc | 39 817 | -1,81 | 1 009 | -1,56 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 950 210 | -6,15 | 24 088 | -5,89 | ||||

| 2025-07-25 | 13F | Stephens Consulting, LLC | 314 | 0,00 | 8 | 0,00 | ||||

| 2025-07-11 | 13F | Lantz Financial LLC | 30 769 | 0,39 | 780 | 0,78 | ||||

| 2025-07-02 | 13F | Crumly & Associates Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Newman Dignan & Sheerar, Inc. | 68 999 | -2,81 | 1 749 | -2,51 | ||||

| 2025-07-30 | 13F | Princeton Global Asset Management LLC | 3 950 | 0,00 | 100 | 1,01 | ||||

| 2025-08-07 | 13F | Addison Advisors LLC | 910 | 23 | ||||||

| 2025-08-15 | 13F | Howland Capital Management Llc | 185 945 | 5,29 | 4 714 | 5,58 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 31 000 | 0,00 | 786 | 0,26 | ||||

| 2025-07-21 | 13F | Cornell Pochily Investment Advisors, Inc. | 8 040 | 204 | ||||||

| 2025-07-23 | 13F | Sax Wealth Advisors, Llc | 15 089 | 383 | ||||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 10 000 | 0,00 | 254 | 0,40 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 86 483 | 0,00 | 2 192 | 0,27 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 648 327 | 33,27 | 16 435 | 33,65 | ||||

| 2025-05-07 | 13F | Mb, Levis & Associates, Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 40 883 | 20,76 | 1 036 | 21,17 | ||||

| 2025-07-15 | 13F | Sightline Wealth Advisors, LLC | 10 086 | 0,61 | 256 | 0,79 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 2 357 | -4,11 | 60 | -3,28 | ||||

| 2025-08-14 | 13F | Fmr Llc | 649 | -92,13 | 16 | -92,31 | ||||

| 2025-07-17 | 13F | E Six Thirteen, Llc | 160 410 | 0,00 | 4 066 | 0,27 | ||||

| 2025-05-09 | 13F | Ogorek Anthony Joseph /ny/ /adv | 0 | -100,00 | 0 | |||||

| 2025-07-09 | 13F | Lbmc Investment Advisors, Llc | 424 215 | 13,99 | 10 754 | 14,31 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 8 134 | 0,00 | 206 | 0,49 | ||||

| 2025-07-21 | 13F | Exchange Capital Management, Inc. | 13 951 | -6,91 | 354 | -6,61 | ||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 8 656 | 219 | ||||||

| 2025-07-30 | 13F | Sonata Capital Group Inc | 92 603 | 0,00 | 2 | 0,00 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 13 926 | -13,80 | 0 | |||||

| 2025-08-14 | 13F | Glenview Trust Co | 83 324 | 0,00 | 2 112 | 0,28 | ||||

| 2025-07-18 | 13F | TPG Advisors LLC | 12 054 | 0,00 | 306 | 0,33 | ||||

| 2025-08-11 | 13F | CFS Investment Advisory Services, LLC | 24 393 | -0,62 | 1 | |||||

| 2025-08-14 | 13F | Godshalk Welsh Capital Management, Inc. | 27 750 | 109,43 | 703 | 110,48 | ||||

| 2025-08-05 | 13F | Gould Asset Management Llc /ca/ | 20 740 | 15,45 | 526 | 15,64 | ||||

| 2025-08-01 | 13F | Signature Wealth Management Group | 51 912 | 0,79 | 1 316 | 1,00 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 20 965 | 120,43 | 531 | 121,25 |