Statistiques de base

| Propriétaires institutionnels | 127 total, 123 long only, 1 short only, 3 long/short - change of 2,40% MRQ |

| Allocation moyenne du portefeuille | 0.2810 % - change of 7,24% MRQ |

| Actions institutionnelles (Long) | 16 862 291 (ex 13D/G) - change of 0,51MM shares 3,09% MRQ |

| Valeur institutionnelle (Long) | $ 299 577 USD ($1000) |

Participation institutionnels et actionnaires

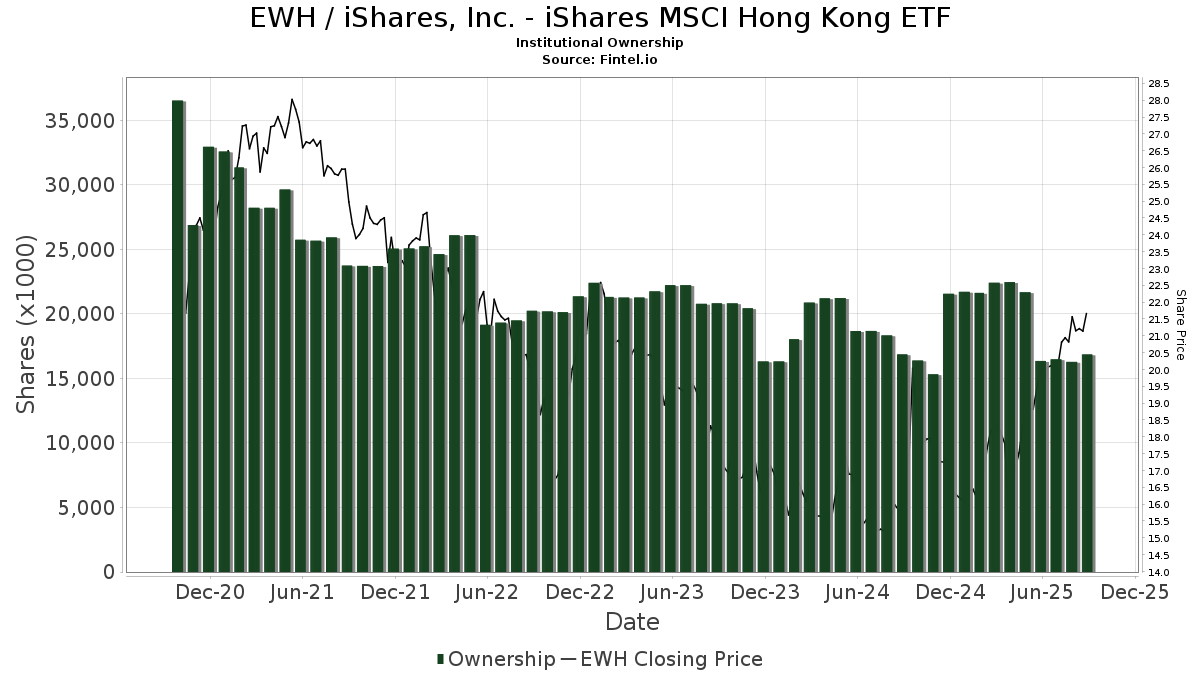

iShares, Inc. - iShares MSCI Hong Kong ETF (US:EWH) détient 127 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 16,862,291 actions. Les principaux actionnaires incluent Wright Fund Managment, LLC, Morgan Stanley, Bank Julius Baer & Co. Ltd, Zurich, SG Americas Securities, LLC, D. E. Shaw & Co., Inc., Catalyst Capital Advisors LLC, MBXAX - Catalyst/Millburn Hedge Strategy Fund Class A, Millburn Ridgefield Corp, Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 50 Fund Investor Class, and Quadrature Capital Ltd .

iShares, Inc. - iShares MSCI Hong Kong ETF (ARCA:EWH) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 10, 2025 is 21,66 / share. Previously, on September 11, 2024, the share price was 15,76 / share. This represents an increase of 37,44% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-12 | 13F | MAI Capital Management | 208 | 1,96 | 4 | 33,33 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 500 | 0,00 | 10 | 12,50 | ||||

| 2025-08-14 | 13F | SummitTX Capital, L.P. | 11 200 | 222 | ||||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 54 028 | 243,62 | 1 073 | 289,82 | ||||

| 2025-08-13 | 13F | Barclays Plc | Put | 0 | -100,00 | 0 | ||||

| 2025-07-23 | 13F | Viewpoint Capital Management LLC | 6 241 | 0,00 | 124 | 12,84 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 76 862 | -60,42 | 4 229 | 24,38 | ||||

| 2025-04-16 | 13F | Wealth Enhancement Advisory Services, Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-12 | 13F | Zacks Investment Management | 21 664 | 430 | ||||||

| 2025-08-11 | 13F | Rahlfs Capital, Llc | 11 050 | 219 | ||||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 15 937 | 0,31 | 321 | 15,47 | ||||

| 2025-08-14 | 13F | Fmr Llc | 5 916 | 8,91 | 117 | 23,16 | ||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 16 352 | 325 | ||||||

| 2025-08-14 | 13F | Quantitative Investment Management, LLC | 59 004 | 1 | ||||||

| 2025-08-04 | 13F | JDM Financial Group LLC | 550 | 0,00 | 11 | 11,11 | ||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 0 | -100,00 | 0 | |||||

| 2025-03-26 | NP | MNERX - MainStay Conservative ETF Allocation Fund Class R3 | 61 191 | 9,50 | 1 010 | 1,10 | ||||

| 2025-05-29 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 70 Fund Investor Class | 152 100 | 2 663 | ||||||

| 2025-08-13 | 13F | Korea Investment CORP | 132 000 | 0,00 | 2 622 | 13,41 | ||||

| 2025-07-21 | 13F | J. Safra Sarasin Holding AG | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Wright Fund Managment, LLC | 1 407 375 | 0,00 | 24 643 | 0,00 | ||||

| 2025-08-12 | 13F | Elo Mutual Pension Insurance Co | 504 498 | 0,00 | 10 019 | 13,43 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 0 | |||||||

| 2025-05-29 | NP | SIRAX - Sierra Tactical All Asset Fund Class A | 517 500 | 9 061 | ||||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 102 | 0,00 | 2 | 100,00 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 1 925 | 0,00 | 38 | 18,75 | ||||

| 2025-08-14 | 13F/A | Bank Julius Baer & Co. Ltd, Zurich | 1 210 055 | 24 032 | ||||||

| 2025-07-22 | 13F | Chung Wu Investment Group, LLC | 8 500 | 169 | ||||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 400 | 0,00 | 8 | 0,00 | ||||

| 2025-07-31 | 13F | Sharper & Granite LLC | 82 575 | -1,19 | 1 661 | 13,47 | ||||

| 2025-08-05 | 13F | Advisors Preferred, LLC | 1 411 | 28 | ||||||

| 2025-05-14 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 144 176 | 3 780,92 | 2 863 | 4 373,44 | ||||

| 2025-08-13 | 13F | Mount Yale Investment Advisors, LLC | 138 | 3 | ||||||

| 2025-03-26 | NP | MWFQX - MainStay Equity ETF Allocation Fund Class R3 | 129 177 | 14,38 | 2 131 | 5,60 | ||||

| 2025-05-13 | 13F | HighTower Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-02 | 13F | Whittier Trust Co | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 428 667 | -45,34 | 8 513 | -38,01 | ||||

| 2025-07-07 | 13F | Upper Left Wealth Management, LLC | 14 066 | 2,55 | 279 | 16,25 | ||||

| 2025-04-22 | 13F | Cambridge Investment Research Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Exencial Wealth Advisors, Llc | 46 936 | 6,80 | 932 | 21,20 | ||||

| 2025-08-13 | 13F | Provida Pension Fund Administrator | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-31 | 13F | Catalyst Capital Advisors LLC | 646 987 | -12,03 | 12 849 | -0,23 | ||||

| 2025-08-29 | NP | MBXAX - Catalyst/Millburn Hedge Strategy Fund Class A | 646 987 | -12,03 | 12 849 | -0,23 | ||||

| 2025-08-29 | NP | CGHIX - Timber Point Global Allocations Fund Institutional Class Shares | 10 000 | -50,00 | 199 | -43,43 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 212 315 | -14,04 | 24 077 | -2,51 | ||||

| 2025-08-12 | 13F | Picton Mahoney Asset Management | 5 970 | -21,24 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 117 644 | 85,41 | 2 335 | 110,17 | ||||

| 2025-07-31 | 13F | United Community Bank | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 42 251 | -95,07 | 839 | -94,41 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 12 720 | -4,68 | 253 | 8,15 | ||||

| 2025-08-13 | 13F | National Bank Of Canada /fi/ | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 30 307 | -55,28 | 602 | -49,33 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 94 548 | 62,56 | 1 878 | 84,38 | ||||

| 2025-06-26 | NP | SSXU - Day Hagan/Ned Davis Research Smart Sector International ETF | 128 246 | 2 247 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 3 600 | 0,00 | 71 | 12,70 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 16 234 | 20,02 | 323 | 36,44 | ||||

| 2025-04-22 | 13F | Moisand Fitzgerald Tamayo, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Prudential Plc | 199 443 | 3 961 | ||||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 742 520 | 284,26 | 14 746 | 335,89 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 268 | 5 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 214 | -38,86 | 4 | -33,33 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 564 759 | -13,02 | 11 219 | -1,39 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 20 400 | 29,94 | 405 | 47,81 | |||

| 2025-05-08 | 13F | New York Life Investment Management Llc | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Blair William & Co/il | 2 896 | -22,21 | 58 | -12,31 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 27 834 | 316,74 | 553 | 371,79 | ||||

| 2025-07-10 | 13F | Contravisory Investment Management, Inc. | 25 720 | 511 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 16 800 | -93,32 | 334 | -92,44 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 0 | -100,00 | 0 | ||||

| 2025-08-28 | NP | TFAFX - Tactical Growth Allocation Fund Class I | 1 600 | 32 | ||||||

| 2025-08-05 | 13F | Harel Insurance Investments & Financial Services Ltd. | 5 000 | 108,33 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 322 199 | -16,08 | 6 399 | -4,82 | ||||

| 2025-07-16 | 13F | Banque Pictet & Cie Sa | 215 913 | 0,00 | 4 288 | 13,44 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 556 | 0,00 | 11 | 22,22 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 115 | 0,00 | 2 | 0,00 | ||||

| 2025-05-14 | 13F | Walleye Trading LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 220 | -37,85 | 4 | -33,33 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 26 525 | 12,75 | 1 | |||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-06-26 | NP | BlackRock ETF Trust - iShares International Country Rotation Active ETF | 2 415 | -27,24 | 42 | -22,22 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 476 469 | -1,35 | 9 463 | 11,88 | ||||

| 2025-08-28 | NP | ICCIX - Dynamic International Opportunity Fund Class I | 29 101 | -19,19 | 578 | -8,41 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 10 233 | -7,18 | 203 | 5,18 | ||||

| 2025-04-25 | 13F | Mmbg Investment Advisors Co. | 0 | -100,00 | 0 | |||||

| 2025-03-26 | NP | MDAKX - MainStay Moderate ETF Allocation Fund Class C | 194 616 | 11,09 | 3 211 | 2,59 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-07-23 | 13F | Vontobel Holding Ltd. | 333 736 | -1,18 | 6 628 | 12,08 | ||||

| 2025-07-28 | 13F | Twin Tree Management, LP | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Texas Yale Capital Corp. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 1 431 | 0,00 | 28 | 12,00 | ||||

| 2025-08-13 | 13F | Taikang Asset Management (Hong Kong) Co Ltd | 55 029 | 0,00 | 1 093 | 13,40 | ||||

| 2025-08-13 | 13F | Capital Fund Management S.a. | 33 788 | 49,29 | 671 | 69,44 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 24 004 | 33,87 | 477 | 52,08 | ||||

| 2025-05-15 | 13F | Optiver Holding B.V. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 58 | 1 | ||||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 1 455 | 0,00 | 29 | 12,00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 616 | 0,00 | 12 | 20,00 | ||||

| 2025-07-22 | 13F | 4Thought Financial Group Inc. | 184 | 3,37 | 4 | 0,00 | ||||

| 2025-08-08 | 13F | Creative Planning | 10 553 | -0,01 | 210 | 13,59 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 10 100 | -79,72 | 201 | -77,04 | |||

| 2025-08-05 | 13F | Castlekeep Investment Advisors Llc | 20 757 | -3,42 | 412 | 9,57 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 12 229 | -92,56 | 243 | -91,59 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Capital Fund Management S.a. | Call | 14 400 | -54,29 | 286 | -48,28 | |||

| 2025-05-15 | 13F | Dai-ichi Life Holdings, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 179 958 | 4 | ||||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 1 195 271 | 738,32 | 24 | 1 050,00 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 43 000 | 854 | ||||||

| 2025-07-14 | 13F | Legacy Capital Group California, Inc. | 25 470 | 506 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 63 032 | -49,05 | 1 252 | -42,24 | ||||

| 2025-08-11 | 13F | Covestor Ltd | 7 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 124 720 | 6,09 | 2 477 | 20,31 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Barings Llc | 208 539 | -8,67 | 4 142 | 3,58 | ||||

| 2025-07-29 | 13F | Millburn Ridgefield Corp | 646 987 | -12,03 | 12 849 | -0,23 | ||||

| 2025-08-13 | 13F | Baker Avenue Asset Management, LP | Put | 150 000 | -55,88 | 8 | -97,92 | |||

| 2025-05-07 | 13F | Drive Wealth Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 81 957 | 0,28 | 1 628 | 13,70 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 29 020 | 8,78 | 576 | 23,34 | ||||

| 2025-08-06 | 13F | Innealta Capital, Llc | 29 101 | -19,19 | 578 | -8,41 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 544 097 | -22,59 | 10 806 | -12,21 | ||||

| 2025-08-14 | 13F | Gotham Asset Management, LLC | 10 426 | 0,00 | 207 | 13,74 | ||||

| 2025-08-13 | 13F | Idaho Trust Bank | 29 514 | 25,87 | 586 | 42,93 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 9 036 | 179 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 48 311 | 29,52 | 959 | 46,86 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1 837 | -37,81 | 36 | -41,94 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 192 022 | -3,68 | 3 814 | 9,26 | ||||

| 2025-07-31 | 13F | GenTrust, LLC | 20 561 | 6,03 | 408 | 20,35 | ||||

| 2025-08-14 | 13F | Comerica Bank | 1 112 | 11,87 | 22 | 29,41 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 500 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 0 | -100,00 | 0 | ||||

| 2025-08-08 | 13F | Abc Arbitrage Sa | 17 827 | -80,52 | 354 | -77,90 | ||||

| 2025-07-29 | NP | HFND - Unlimited HFND Multi-Strategy Return Tracker ETF | 2 959 | 866,99 | 56 | 1 020,00 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 927 | -98,35 | 18 | -98,17 | ||||

| 2025-07-17 | 13F | Albion Financial Group /ut | 63 000 | 0,00 | 1 251 | 13,42 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 434 900 | 76,22 | 8 637 | 99,88 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 26 239 | -72,07 | 521 | -68,33 | ||||

| 2025-07-18 | 13F | USA Financial Portformulas Corp | 7 706 | -38,75 | 153 | -30,45 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 29 | 1 | ||||||

| 2025-03-26 | NP | MOEAX - MainStay Growth ETF Allocation Fund Class A | 163 359 | 11,17 | 2 695 | 2,67 | ||||

| 2025-08-05 | 13F | Gould Asset Management Llc /ca/ | 39 511 | -3,26 | 785 | 9,65 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 20 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 17 106 | -68,19 | 340 | -63,97 | ||||

| 2025-05-29 | NP | Northern Lights Fund Trust - Sierra Tactical Core Growth Fund Investor Class Shares | 26 075 | 457 | ||||||

| 2025-05-29 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 50 Fund Investor Class | 568 800 | 9 960 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 33 500 | 665 | |||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 15 626 | -2,78 | 310 | 10,32 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 165 021 | 382,84 | 3 277 | 447,99 | ||||

| 2025-05-15 | 13F | Barclays Plc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 54 406 | -41,23 | 1 080 | -33,33 | ||||

| 2025-05-01 | 13F | Cwm, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-14 | 13F | Horizon Investments, LLC | 27 | 107,69 | 1 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 87 564 | -46,51 | 1 739 | -39,32 | ||||

| 2025-05-29 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 30 Fund Instl Class | 142 900 | 2 502 | ||||||

| 2025-08-08 | NP | QALTX - Quantified Alternative Investment Fund Investor Class Shares | 1 411 | 28 | ||||||

| 2025-08-13 | 13F | Amundi | 23 414 | 7,90 | 471 | 24,01 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 70 005 | -21,62 | 1 390 | -11,07 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 15 828 | 314 | ||||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-04-28 | 13F | Pictet North America Advisors SA | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F/A | CX Institutional | 584 | -32,56 | 0 | |||||

| 2025-05-15 | 13F | Crestline Management, LP | 0 | -100,00 | 0 |