Statistiques de base

| Propriétaires institutionnels | 141 total, 141 long only, 0 short only, 0 long/short - change of 0,71% MRQ |

| Allocation moyenne du portefeuille | 1.1043 % - change of -5,34% MRQ |

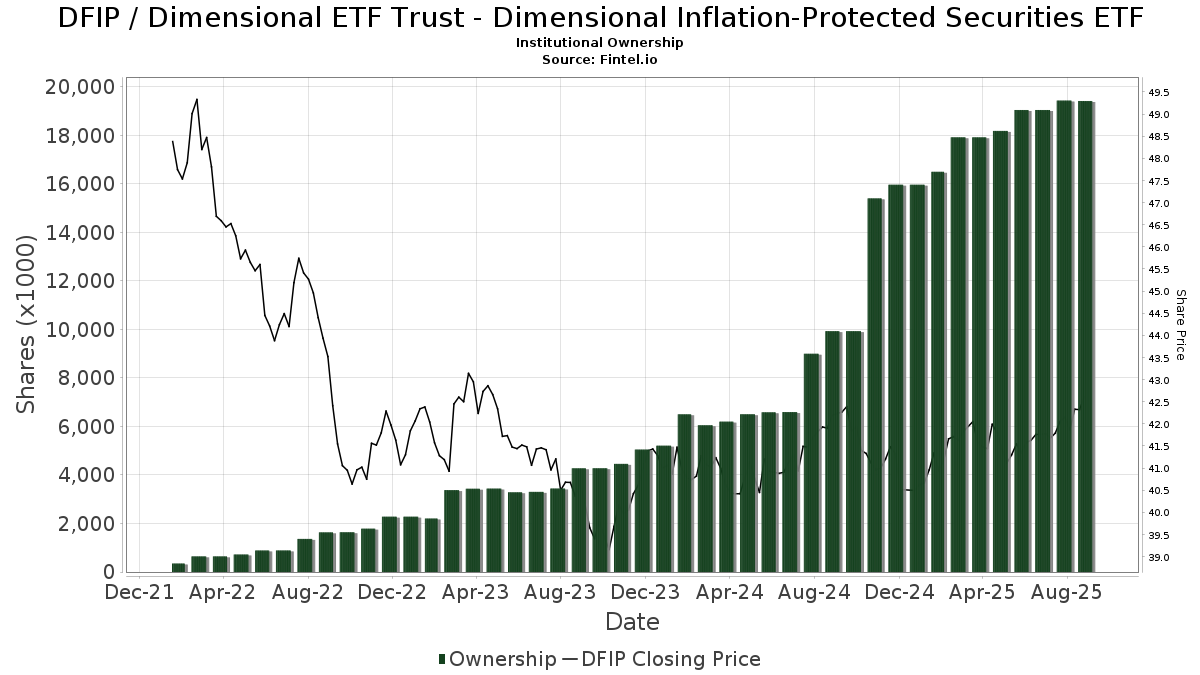

| Actions institutionnelles (Long) | 19 417 021 (ex 13D/G) - change of 0,37MM shares 1,95% MRQ |

| Valeur institutionnelle (Long) | $ 760 854 USD ($1000) |

Participation institutionnels et actionnaires

Dimensional ETF Trust - Dimensional Inflation-Protected Securities ETF (US:DFIP) détient 141 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 19,417,021 actions. Les principaux actionnaires incluent Matson Money. Inc., FMFIX - Free Market Fixed Income Fund Institutional Class, Heirloom Wealth Management, Planning Center, Inc., Hill Investment Group Partners, LLC, Hemington Wealth Management, Geometric Wealth Advisors, CPA Asset Management LLC, Rather & Kittrell, Inc., and Pinney & Scofield, Inc. .

Dimensional ETF Trust - Dimensional Inflation-Protected Securities ETF (ARCA:DFIP) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 5, 2025 is 42,56 / share. Previously, on September 9, 2024, the share price was 42,03 / share. This represents an increase of 1,25% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-16 | 13F | Tru Independence Asset Management 2, Llc | 20 023 | -49,31 | 837 | -49,67 | ||||

| 2025-07-29 | NP | FMVFX - Matson Money Fixed Income VI Portfolio Institutional Class | 29 452 | -3,44 | 1 224 | -4,30 | ||||

| 2025-07-22 | 13F | Awm Capital, Llc | 78 517 | 1,26 | 3 283 | 0,52 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | PBMares Wealth Management LLC | 30 290 | -2,06 | 1 266 | -2,76 | ||||

| 2025-08-05 | 13F | Centennial Bank/AR/ | 22 269 | -2,90 | 931 | -3,52 | ||||

| 2025-07-09 | 13F | Krilogy Financial LLC | 104 458 | 1,64 | 4 367 | 0,92 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 3 107 | 130 | ||||||

| 2025-07-14 | 13F | Shearwater Capital LLC | 39 773 | 1,01 | 1 663 | 0,24 | ||||

| 2025-07-11 | 13F | Physician Wealth Solutions Inc. | 350 435 | -0,28 | 14 652 | -0,99 | ||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 2 601 | 0,00 | 109 | -0,92 | ||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 31 111 | 8,16 | 1 301 | 7,35 | ||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 19 798 | 146,83 | 828 | 145,40 | ||||

| 2025-07-09 | 13F | HFG Wealth Management, LLC | 10 920 | 2,30 | 460 | 6,25 | ||||

| 2025-07-23 | 13F | First Financial Group Corp | 6 220 | -1,19 | 260 | -1,89 | ||||

| 2025-07-17 | 13F | SC&H Financial Advisors, Inc. | 7 775 | 1,12 | 325 | 0,62 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 26 199 | 0,88 | 1 095 | 1,20 | ||||

| 2025-08-13 | 13F | SageView Advisory Group, LLC | 37 743 | 0,40 | 1 575 | -0,57 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Vestment Financial LLC | 130 432 | 5,65 | 5 447 | 4,47 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 895 | -97,16 | 37 | -97,21 | ||||

| 2025-07-15 | 13F | Level Financial Advisors, Inc. | 199 579 | 6,58 | 8 344 | 5,82 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 118 619 | 0,00 | 4 959 | -0,72 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 2 550 | 169,84 | 106 | 171,79 | ||||

| 2025-07-08 | 13F | Henrickson Nauta Wealth Advisors, Inc. | 64 038 | 15,11 | 2 677 | 16,90 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 7 933 | -59,13 | 332 | -59,49 | ||||

| 2025-07-18 | 13F | BCU Wealth Advisors, LLC | 96 949 | 16,67 | 4 053 | 15,83 | ||||

| 2025-07-29 | 13F | Two West Capital Advisors LLC | 6 491 | -7,05 | 271 | -5,57 | ||||

| 2025-07-17 | 13F | Applied Capital LLC | 15 219 | -0,11 | 636 | -0,78 | ||||

| 2025-07-22 | 13F | Firethorn Wealth Partners, Llc | 14 166 | 1,65 | 592 | 1,02 | ||||

| 2025-08-07 | 13F | Samalin Investment Counsel, LLC | 29 250 | -15,04 | 1 223 | -15,67 | ||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 13 | 0,00 | 1 | |||||

| 2025-08-13 | 13F | Legacy Capital Wealth Partners, LLC | 7 102 | 297 | ||||||

| 2025-08-07 | 13F | Nwam Llc | 40 917 | 3,16 | 1 711 | 2,40 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 3 103 | 0,00 | 130 | 3,20 | ||||

| 2025-08-14 | 13F | UBS Group AG | 13 967 | 584 | ||||||

| 2025-08-12 | 13F | Change Path, LLC | 23 043 | 4,65 | 963 | 3,88 | ||||

| 2025-07-28 | 13F | Sterling Financial Planning, Inc. | 132 599 | 6,07 | 5 544 | 5,30 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 2 428 | -40,48 | 102 | -40,94 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 30 059 | -2,39 | 1 253 | -3,32 | ||||

| 2025-04-16 | 13F | Lam Group, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-03 | 13F | CPA Asset Management LLC | 432 044 | 2,35 | 18 064 | 1,61 | ||||

| 2025-08-15 | 13F | Binnacle Investments Inc | 54 982 | 4,77 | 2 299 | 4,03 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 4 428 | -5,63 | 185 | -6,09 | ||||

| 2025-05-08 | 13F | Essential Planning, LLC. | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Savant Capital, LLC | 7 523 | 315 | ||||||

| 2025-08-08 | 13F | Sensible Financial Planning & Management, LLC. | 170 489 | -8,01 | 7 128 | -8,66 | ||||

| 2025-07-14 | 13F | Kfg Wealth Management, Llc | 194 955 | 2,42 | 8 151 | 1,68 | ||||

| 2025-07-17 | 13F | Porter White Investment Advisors, Inc. | 48 010 | 6,28 | 2 007 | 5,52 | ||||

| 2025-05-02 | 13F | MB Generational Wealth, LLC | 5 369 | 226 | ||||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Modera Wealth Management, LLC | 12 833 | 0,00 | 537 | -0,74 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 6 475 | -2,32 | 271 | -3,23 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 97 | 2,11 | 4 | 0,00 | ||||

| 2025-07-22 | 13F | Yardley Wealth Management LLC | 250 286 | 3,68 | 10 | 0,00 | ||||

| 2025-07-17 | 13F | XY Planning Network, Inc. | 19 416 | 8,50 | 812 | 7,70 | ||||

| 2025-07-31 | 13F | Brinker Capital Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 21 008 | 138,84 | 878 | 137,30 | ||||

| 2025-07-18 | 13F | Lynx Investment Advisory | 7 774 | 1,07 | 325 | 0,62 | ||||

| 2025-07-22 | 13F | Visionary Horizons, LLC | 14 691 | 16,09 | 614 | 15,41 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 15 604 | 3,87 | 652 | 3,16 | ||||

| 2025-07-16 | 13F | Vestia Personal Wealth Advisors | 31 286 | 15,05 | 1 308 | 14,15 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 183 032 | -21,94 | 7 653 | -22,50 | ||||

| 2025-07-09 | 13F | Market Street Wealth Management Advisors Llc | 290 171 | 2,17 | 12 132 | 1,45 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 9 692 | 405 | ||||||

| 2025-08-14 | 13F | Monograph Wealth Advisors, Llc | 136 427 | 5,04 | 5 704 | 4,30 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 21 | 0,00 | 1 | |||||

| 2025-07-31 | 13F | Orion Capital Management LLC | 255 | -21,54 | 11 | -23,08 | ||||

| 2025-07-29 | 13F | Fundamentun, Llc | 349 242 | 6,80 | 14 602 | 6,03 | ||||

| 2025-07-31 | 13F | City State Bank | 6 250 | 150,00 | 261 | 148,57 | ||||

| 2025-08-04 | 13F | Saxony Capital Management, LLC | 41 633 | -21,57 | 1 741 | -22,15 | ||||

| 2025-07-16 | 13F | Leading Edge Financial Planning LLC | 382 545 | 7,08 | 15 994 | 6,31 | ||||

| 2025-07-22 | 13F | David Wealth Management LLC | 152 228 | 6,44 | 6 365 | 5,68 | ||||

| 2025-08-08 | 13F | SageOak Financial, LLC | 5 436 | -43,88 | 227 | -44,23 | ||||

| 2025-08-11 | 13F | CFS Investment Advisory Services, LLC | 49 050 | 0,40 | 2 | 0,00 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 84 242 | 354,04 | 3 522 | 350,96 | ||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 945 | 0,00 | 40 | 0,00 | ||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 243 967 | 67,13 | 10 200 | 65,93 | ||||

| 2025-07-22 | 13F | Aspire Private Capital, LLC | 12 155 | 10,81 | 508 | 10,20 | ||||

| 2025-08-12 | 13F | Rather & Kittrell, Inc. | 417 381 | -0,55 | 17 451 | -1,27 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 34 488 | 1,95 | 1 442 | 1,19 | ||||

| 2025-07-16 | 13F | Spinnaker Investment Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 5 820 | 35,29 | 243 | 34,25 | ||||

| 2025-07-17 | 13F | Northwest Wealth Management, Llc | 16 991 | 1,84 | 710 | 1,14 | ||||

| 2025-08-13 | 13F | Plan Group Financial, LLC | 98 375 | -28,06 | 4 113 | -28,57 | ||||

| 2025-07-15 | 13F | Maseco Llp | 1 866 | 78 | ||||||

| 2025-08-12 | 13F | TCP Asset Management, LLC | 37 197 | 8,45 | 1 555 | 7,69 | ||||

| 2025-08-05 | 13F | C2P Capital Advisory Group, LLC d.b.a. Prosperity Capital Advisors | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Burk Holdings LLC | 15 619 | 16,98 | 653 | 16,19 | ||||

| 2025-08-14 | 13F | Betterment LLC | 7 972 | -6,92 | 0 | |||||

| 2025-07-30 | 13F | Drive Wealth Management, Llc | 6 351 | -24,87 | 266 | -25,35 | ||||

| 2025-07-31 | 13F | Core Wealth Management, Inc. | 222 731 | 6,36 | 9 312 | 5,60 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 428 | 0,00 | 18 | 0,00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 626 | 68 | ||||||

| 2025-07-25 | 13F | Hemington Wealth Management | 765 886 | 6,47 | 32 | 6,67 | ||||

| 2025-08-11 | 13F | Root Financial Partners, LLC | 10 989 | -60,29 | 459 | -60,60 | ||||

| 2025-08-06 | 13F | Entrewealth, Llc | 61 488 | 27,90 | 2 571 | 26,98 | ||||

| 2025-07-21 | 13F | Onyx Financial Advisors, LLC | 38 116 | 49,09 | 1 594 | 48,05 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 9 408 | 2,60 | 393 | 5,93 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Fmb Wealth Management | 29 242 | -2,12 | 1 223 | -2,86 | ||||

| 2025-08-12 | 13F | Coston, McIsaac & Partners | 6 268 | 603,48 | 0 | |||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 18 951 | 23,19 | 792 | 22,41 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 6 991 | 1,54 | 292 | 1,04 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 493 | 0,00 | 0 | |||||

| 2025-07-31 | 13F | Heirloom Wealth Management | 983 348 | -4,14 | 41 114 | -4,83 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 46 095 | -14,20 | 2 | -50,00 | ||||

| 2025-07-08 | 13F | Apella Capital, LLC | 167 513 | 0,88 | 6 979 | 1,07 | ||||

| 2025-07-14 | 13F | Foster Group, Inc. | 18 094 | 0,00 | 757 | -0,66 | ||||

| 2025-07-25 | 13F | Concord Wealth Partners | 3 595 | 202,10 | 150 | 200,00 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 3 881 | -0,51 | 162 | -1,22 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 33 891 | 115,29 | 1 417 | 113,73 | ||||

| 2025-07-30 | 13F | Klingman & Associates, LLC | 31 534 | -3,98 | 1 318 | -4,63 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 73 475 | 3 072 | ||||||

| 2025-07-30 | 13F | Forum Financial Management, LP | 83 158 | -3,08 | 3 477 | -3,79 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 5 000 | 0,20 | 209 | -0,48 | ||||

| 2025-07-23 | 13F | Sax Wealth Advisors, Llc | 8 243 | 52,85 | 345 | 51,54 | ||||

| 2025-07-17 | 13F | Willow Creek Wealth Management Inc. | 35 279 | -1,88 | 1 475 | -2,58 | ||||

| 2025-07-31 | 13F | Curio Wealth, Llc | 17 610 | 31 346,43 | 736 | -61,26 | ||||

| 2025-07-30 | 13F | Matson Money. Inc. | 3 573 335 | 0,01 | 149 401 | -0,77 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 68 750 | 3 | ||||||

| 2025-08-14 | 13F | Note Advisors, LLC | 10 250 | -3,38 | 429 | -4,04 | ||||

| 2025-08-12 | 13F | Nemes Rush Group LLC | 3 273 | 33,43 | 137 | 32,04 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 3 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 188 | 0,00 | 8 | 0,00 | ||||

| 2025-07-22 | 13F | Berger Financial Group, Inc | 4 898 | 0,00 | 205 | -0,97 | ||||

| 2025-07-18 | 13F | Meritas Wealth Management, LLC | 4 788 | 200 | ||||||

| 2025-08-08 | 13F | Tortoise Investment Management, LLC | 26 908 | 28,82 | 1 125 | 27,99 | ||||

| 2025-07-16 | 13F | Five Oceans Advisors | 254 918 | 3,55 | 10 658 | 2,82 | ||||

| 2025-07-18 | 13F | Bridge Generations Wealth Management Llc | 3 609 | 0,00 | 151 | -0,66 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Grove Street Fiduciary, LLC | 91 644 | -2,75 | 3 832 | -3,45 | ||||

| 2025-07-17 | 13F | Global Trust Asset Management, LLC | 2 900 | 2 800,00 | 121 | 2 925,00 | ||||

| 2025-07-30 | 13F | Exencial Wealth Advisors, Llc | 43 643 | -6,71 | 1 825 | -7,36 | ||||

| 2025-08-12 | 13F | Hill Investment Group Partners, LLC | 798 105 | 1,07 | 33 369 | 0,34 | ||||

| 2025-07-15 | 13F | Total Wealth Planning, Llc | 21 509 | -27,31 | 899 | -27,85 | ||||

| 2025-07-23 | 13F | Elevate Wealth Advisory, Inc | 1 953 | 0,00 | 82 | -1,22 | ||||

| 2025-07-10 | 13F | Stewardship Advisors, LLC | 9 608 | -2,46 | 402 | -3,14 | ||||

| 2025-08-14 | 13F | Balanced Rock Investment Advisor | 51 707 | 2 162 | ||||||

| 2025-07-17 | 13F | Blossom Wealth Management | 7 753 | 12,59 | 324 | 12,11 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Midwest Heritage Bank, FSB | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Geometric Wealth Advisors | 498 824 | 0,17 | 20 856 | -0,55 | ||||

| 2025-08-08 | 13F | Pinney & Scofield, Inc. | 400 303 | -0,17 | 16 737 | -0,88 | ||||

| 2025-08-08 | 13F | Austin Wealth Management, LLC | 261 287 | 8,21 | 10 902 | 8,31 | ||||

| 2025-07-29 | NP | FMFIX - Free Market Fixed Income Fund Institutional Class | 3 543 397 | 0,00 | 147 228 | -0,86 | ||||

| 2025-08-06 | 13F | New Dimensions Wealth Management, LLC | 202 204 | 2,83 | 8 439 | 1,92 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 4 999 | 10,60 | 209 | 10,00 | ||||

| 2025-07-16 | 13F | Strategic Investment Solutions, Inc. /IL | 5 710 | 602,34 | 239 | 600,00 | ||||

| 2025-07-28 | 13F | Verisail Partners, LLC | 5 118 | 0,71 | 214 | -0,47 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Planning Center, Inc. | 868 594 | 2,19 | 36 316 | 1,46 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Scratch Capital Llc | 234 900 | 25,03 | 9 821 | 24,14 | ||||

| 2025-08-08 | 13F | Altiora Financial Group, LLC | 81 946 | 0,46 | 3 426 | -0,26 |