Statistiques de base

| Propriétaires institutionnels | 223 total, 223 long only, 0 short only, 0 long/short - change of 7,69% MRQ |

| Allocation moyenne du portefeuille | 0.1353 % - change of 1,65% MRQ |

| Actions institutionnelles (Long) | 12 836 415 (ex 13D/G) - change of 1,42MM shares 12,44% MRQ |

| Valeur institutionnelle (Long) | $ 426 409 USD ($1000) |

Participation institutionnels et actionnaires

Reaves Utility Income Fund (US:UTG) détient 223 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 12,836,415 actions. Les principaux actionnaires incluent Bank Of America Corp /de/, Morgan Stanley, Cornerstone Advisors, LLC, Wells Fargo & Company/mn, LPL Financial LLC, Commonwealth Equity Services, Llc, Royal Bank Of Canada, Cornerstone Strategic Value Fund Inc, Ameriprise Financial Inc, and J.w. Cole Advisors, Inc. .

Reaves Utility Income Fund (NYSEAM:UTG) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 5, 2025 is 37,39 / share. Previously, on September 9, 2024, the share price was 30,48 / share. This represents an increase of 22,67% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

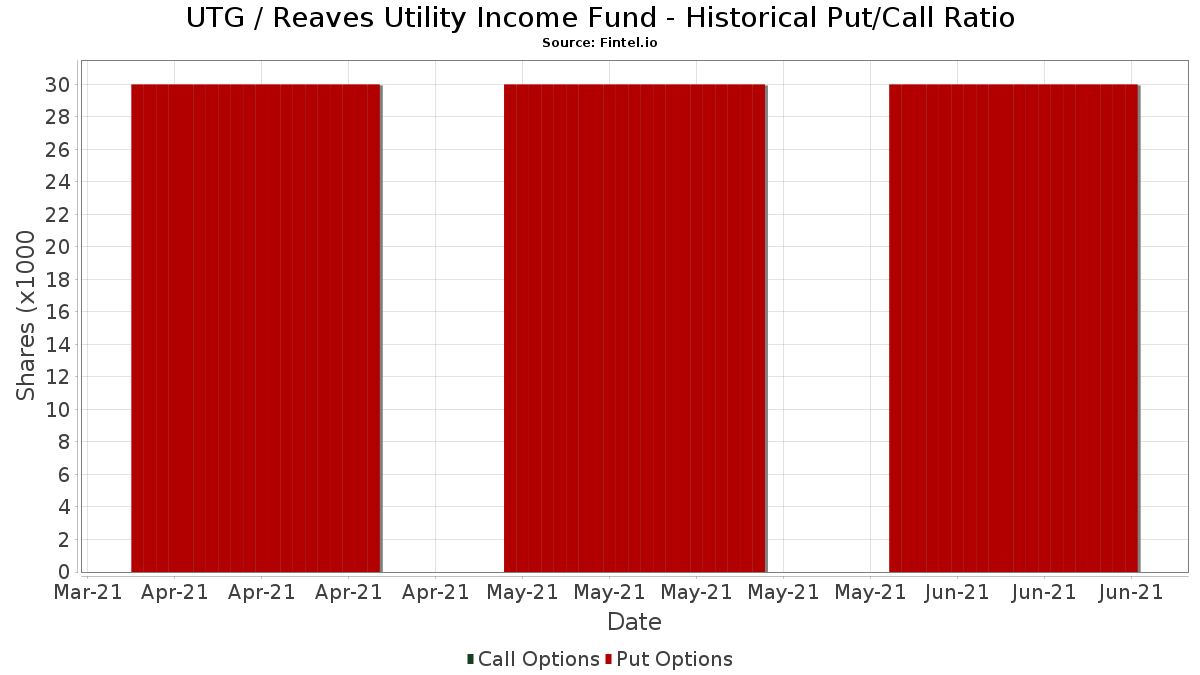

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 362 956 | 366,21 | 13 132 | 418,40 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 616 607 | 2,90 | 22 309 | 14,41 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 300 | -0,33 | 11 | 25,00 | ||||

| 2025-08-11 | 13F | Elequin Capital Lp | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Edge Financial Advisors LLC | 8 215 | 298 | ||||||

| 2025-07-29 | 13F | Stephens Inc /ar/ | 26 913 | 5,38 | 974 | 17,09 | ||||

| 2025-04-24 | 13F | Wingate Wealth Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-06 | 13F | Proficio Capital Partners LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 58 209 | 7,56 | 2 106 | 19,53 | ||||

| 2025-05-06 | 13F | Kovack Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 382 317 | -22,02 | 13 827 | -12,98 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 5 604 | -8,19 | 203 | 2,02 | ||||

| 2025-07-17 | 13F | Sterling Investment Advisors, Ltd. | 192 359 | 3,88 | 6 960 | 15,50 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 50 949 | -19,13 | 1 843 | -10,10 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 36 009 | 8,18 | 1 | 0,00 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 14 011 | -7,00 | 507 | 3,27 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 7 095 | 257 | ||||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 358 | 0,00 | 13 | 9,09 | ||||

| 2025-08-14 | 13F | Beaird Harris Wealth Management, LLC | 175 | 0,00 | 6 | 20,00 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 509 049 | 3,98 | 18 | 20,00 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 140 633 | 6,95 | 5 088 | 18,93 | ||||

| 2025-07-15 | 13F | Wealth Effects Llc | 69 699 | 0,14 | 2 522 | 11,35 | ||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 3 795 | 0,00 | 123 | 2,50 | ||||

| 2025-07-18 | 13F | Consolidated Portfolio Review Corp | 132 011 | -13,26 | 4 776 | -3,55 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 40 221 | -31,59 | 1 455 | -23,94 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 574 | 0,00 | 21 | 11,11 | ||||

| 2025-07-24 | 13F | Costello Asset Management, INC | 10 700 | -1,42 | 387 | 9,63 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 8 638 | 313 | ||||||

| 2025-08-13 | 13F | Allie Family Office LLC | 6 490 | 0,00 | 235 | 10,90 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 19 185 | 0,15 | 734 | 17,82 | ||||

| 2025-07-11 | 13F | Seacrest Wealth Management, Llc | 7 195 | 10,78 | 260 | 23,22 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 14 849 | 26,29 | 537 | 40,58 | ||||

| 2025-07-17 | 13F | Oak Family Advisors, Llc | 249 394 | -6,90 | 9 023 | 3,51 | ||||

| 2025-08-11 | 13F | Semus Wealth Partners LLC | 12 809 | -6,45 | 463 | 4,04 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 5 232 | 0,69 | 189 | 11,83 | ||||

| 2025-07-21 | 13F | Hilltop National Bank | 590 | 0,00 | 21 | 16,67 | ||||

| 2025-08-07 | 13F | McClarren Financial Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Financial Security Advisor, Inc. | 10 000 | 0,00 | 362 | 11,08 | ||||

| 2025-08-01 | 13F | Centerpoint Advisors, LLC | 1 700 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Tradition Wealth Management, LLC | 98 261 | 1,40 | 3 555 | 12,75 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 950 | 0,00 | 34 | 13,33 | ||||

| 2025-07-22 | 13F | Kercheville Advisors, LLC | 34 770 | -2,16 | 1 258 | 8,74 | ||||

| 2025-08-13 | 13F | StoneX Group Inc. | 12 464 | -8,39 | 451 | 1,81 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 17 207 | -5,04 | 623 | 5,60 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 228 | -70,47 | 8 | -68,00 | ||||

| 2025-05-19 | 13F | Smith Asset Management Co., LLC | 80 660 | -0,28 | 2 625 | 2,38 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 234 | 0,00 | 8 | 14,29 | ||||

| 2025-08-14 | 13F | UBS Group AG | 188 829 | 7,57 | 6 832 | 19,59 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 12 104 | 438 | ||||||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | 9 014 | 326 | ||||||

| 2025-05-02 | 13F | Cullen/frost Bankers, Inc. | 0 | -100,00 | 0 | |||||

| 2025-06-27 | NP | Calamos ETF Trust - Calamos CEF Income & Arbitrage ETF | 9 808 | -11,53 | 322 | -12,05 | ||||

| 2025-07-24 | 13F | Morton Brown Family Wealth, LLC | 153 | 6 | ||||||

| 2025-07-21 | 13F | Future Financial Wealth Managment LLC | 26 170 | 1,83 | 947 | 13,16 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 255 169 | 14,06 | 9 232 | 26,82 | ||||

| 2025-08-04 | 13F | Roble, Belko & Company, Inc | 72 | 1,41 | 0 | |||||

| 2025-08-28 | NP | Cohen & Steers Closed-end Opportunity Fund, Inc. | 20 000 | 30,85 | 724 | 73,80 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 13 284 | -9,90 | 481 | 0,21 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 22 606 | 7,27 | 818 | 19,27 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 5 677 | 3,77 | 205 | 15,17 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 30 825 | 9,25 | 1 115 | 21,46 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 11 711 | 7,18 | 424 | 19,15 | ||||

| 2025-05-12 | 13F | Wolverine Asset Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 4 225 | 0,00 | 153 | 10,95 | ||||

| 2025-07-28 | 13F/A | Penbrook Management LLC | 6 075 | -37,53 | 220 | -30,70 | ||||

| 2025-07-10 | 13F | Focus Financial Network, Inc. | 10 882 | 6,01 | 394 | 17,66 | ||||

| 2025-08-22 | NP | Cornerstone Strategic Value Fund Inc | 482 478 | 74,39 | 17 456 | 93,91 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 254 | 9 | ||||||

| 2025-08-13 | 13F | Keystone Financial Group | 5 640 | 204 | ||||||

| 2025-08-12 | 13F | Walled Lake Planning & Wealth Management, Llc | 14 045 | 29,21 | 508 | 43,91 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 17 658 | -16,50 | 1 | |||||

| 2025-07-31 | 13F/A | Avion Wealth | 0 | 0 | ||||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 7 586 | 7,91 | 274 | 20,18 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 150 194 | 0,55 | 5 434 | 11,81 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 150 407 | 0,73 | 5 442 | 12,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 493 887 | -1,45 | 17 868 | 9,57 | ||||

| 2025-08-07 | 13F | Samalin Investment Counsel, LLC | 19 814 | 1,30 | 717 | 12,58 | ||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 67 552 | 1,45 | 2 444 | 12,83 | ||||

| 2025-07-25 | 13F | Commonwealth Financial Services, LLC | 5 819 | 211 | ||||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Family Office Research LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | NP | FCEF - First Trust CEF Income Opportunity ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 24 510 | 7,99 | 848 | 13,83 | ||||

| 2025-07-16 | 13F | ORG Partners LLC | 7 564 | 5,22 | 275 | 16,10 | ||||

| 2025-07-09 | 13F | Triumph Capital Management | 7 982 | -7,85 | 289 | 2,49 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 645 | 23 | ||||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 36 177 | 2,84 | 1 309 | 14,34 | ||||

| 2025-08-08 | 13F | Cornerstone Advisors, LLC | 732 485 | 80,17 | 26 501 | 100,33 | ||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 359 116 | -2,20 | 12 993 | 8,74 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 485 | 0,00 | 18 | 13,33 | ||||

| 2025-04-21 | 13F | Beacon Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Welch Group, LLC | 22 500 | 18,32 | 814 | 31,93 | ||||

| 2025-08-08 | 13F | IMA Wealth, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Certified Advisory Corp | 15 246 | -11,98 | 552 | -2,13 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 237 084 | 1,35 | 8 579 | 12,71 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 6 751 | 1,86 | 244 | 16,19 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 975 172 | 1,53 | 35 282 | 12,89 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 28 890 | 0,71 | 1 045 | 12,00 | ||||

| 2025-05-06 | 13F | Readystate Asset Management Lp | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 16 802 | -2,26 | 608 | 8,59 | ||||

| 2025-08-08 | 13F | Westbourne Investment Advisors, Inc. | 22 900 | 829 | ||||||

| 2025-08-13 | 13F | Custom Index Systems, Llc | 6 679 | 2,39 | 242 | 13,68 | ||||

| 2025-07-08 | 13F | Ballew Advisors, Inc | 5 664 | 204 | ||||||

| 2025-08-12 | 13F | Landscape Capital Management, L.l.c. | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Maridea Wealth Management LLC | 15 310 | 1,88 | 554 | 13,09 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 14 039 | 508 | ||||||

| 2025-08-13 | 13F | Alerus Financial Na | 267 | 10 | ||||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 201 | 7 | ||||||

| 2025-08-12 | 13F | Armor Investment Advisors, LLC | 21 050 | 4,54 | 762 | 16,18 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 4 289 | 38,89 | 155 | 58,16 | ||||

| 2025-08-13 | 13F | Per Stirling Capital Management, LLC. | 13 254 | 8,37 | 480 | 20,65 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 20 496 | 742 | ||||||

| 2025-07-31 | 13F | Leavell Investment Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 178 906 | -18,82 | 6 473 | -9,74 | ||||

| 2025-07-28 | 13F | Mission Hills Financial Advisory, LLC | 12 374 | 448 | ||||||

| 2025-08-05 | 13F | Huntington National Bank | 0 | -100,00 | ||||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 11 241 | 407 | ||||||

| 2025-08-11 | 13F | Novak & Powell Financial Services, Inc. | 7 941 | 1,33 | 287 | 12,55 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-02 | 13F | HBW Advisory Services LLC | 32 143 | 1,05 | 1 163 | 12,27 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 1 461 | 73,93 | 53 | 92,59 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 8 335 | -5,01 | 302 | 5,61 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 13 726 | 4,21 | 497 | 15,89 | ||||

| 2025-05-05 | 13F | Transce3nd, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Carnegie Lake Advisors LLC | 28 609 | -7,59 | 1 | 0,00 | ||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 320 | 0,00 | 12 | 10,00 | ||||

| 2025-07-16 | 13F | West Branch Capital LLC | 830 | 1,22 | 30 | 15,38 | ||||

| 2025-08-04 | 13F | ELCO Management Co., LLC | 7 550 | -0,66 | 273 | 10,53 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 57 609 | -0,59 | 2 084 | 10,56 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 22 769 | 2,36 | 1 | |||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 5 808 | 210 | ||||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 51 173 | -7,98 | 2 | 0,00 | ||||

| 2025-08-12 | 13F | Retirement Planning Co of New England, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 395 | 0,00 | 14 | 16,67 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 7 744 | 13,67 | 280 | 26,70 | ||||

| 2025-07-07 | 13F | Investors Research Corp | 7 077 | 0,00 | 256 | 11,30 | ||||

| 2025-07-08 | 13F | Webster Bank, N. A. | 995 | 0,00 | 36 | 9,38 | ||||

| 2025-08-13 | 13F | Leslie Global Wealth, LLC | 9 667 | 0,00 | 350 | 11,15 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | XTX Topco Ltd | 14 844 | 537 | ||||||

| 2025-08-14 | 13F | Vivaldi Capital Management, LLC | 24 350 | 0,00 | 881 | 11,11 | ||||

| 2025-07-02 | 13F | Neville Rodie & Shaw Inc | 12 701 | 0,00 | 0 | |||||

| 2025-08-07 | 13F | Nwam Llc | 7 480 | 20,45 | 285 | 41,09 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 93 563 | 36,82 | 3 | 50,00 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 34 599 | 86,71 | 1 252 | 107,81 | ||||

| 2025-08-11 | 13F/A | Purus Wealth Management, LLC | 6 406 | 232 | ||||||

| 2025-08-14 | 13F | Cohen & Steers, Inc. | 20 000 | 1 | ||||||

| 2025-05-12 | 13F | Fmr Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 632 944 | 1,33 | 22 900 | 12,66 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 8 694 | 6,00 | 315 | 18,05 | ||||

| 2025-07-29 | 13F | Balboa Wealth Partners | 8 761 | -9,74 | 317 | 0,32 | ||||

| 2025-04-25 | 13F | Albion Financial Group /ut | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 1 043 401 | 11,74 | 37 750 | 24,24 | ||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 17 087 | 30,03 | 618 | 44,73 | ||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 1 450 | 0,00 | 52 | 10,64 | ||||

| 2025-05-15 | 13F | Parvin Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Savant Capital, LLC | 6 142 | 222 | ||||||

| 2025-08-14 | 13F | Matrix Private Capital Group Llc | 11 550 | -4,94 | 418 | 5,57 | ||||

| 2025-08-07 | 13F | Sound View Wealth Advisors Group, LLC | 14 725 | -5,66 | 533 | 4,93 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 2 500 | 0,00 | 90 | 11,11 | ||||

| 2025-08-06 | 13F | Aspect Partners, LLC | 100 | 0,00 | 4 | 0,00 | ||||

| 2025-07-08 | 13F | Dover Advisors, Llc | 9 600 | 9,71 | 347 | 22,18 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 550 | 0,00 | 20 | 11,76 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 4 000 | -0,77 | 145 | 9,92 | ||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 100 | 0,00 | 4 | 0,00 | ||||

| 2025-07-23 | 13F | Abel Hall, LLC | 10 000 | 362 | ||||||

| 2025-08-14 | 13F | Visionary Wealth Advisors | 11 620 | 47,72 | 420 | 64,71 | ||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 613 | 0,00 | 22 | 15,79 | ||||

| 2025-08-04 | 13F | Bay Colony Advisory Group, Inc d/b/a Bay Colony Advisors | 8 803 | 13,78 | 318 | 26,69 | ||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 580 | 0,00 | 21 | 11,11 | ||||

| 2025-05-12 | 13F | Sandy Spring Bank | 201 | 0,00 | 7 | 0,00 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 4 430 | -6,12 | 160 | 4,58 | ||||

| 2025-05-15 | 13F | Talon Private Wealth, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 57 193 | -9,29 | 2 069 | 0,88 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 91 696 | 3,85 | 3 | 50,00 | ||||

| 2025-07-16 | 13F | Signature Resources Capital Management, LLC | 250 | 0,00 | 9 | 12,50 | ||||

| 2025-08-13 | 13F | Everstar Asset Management, LLC | 5 650 | 204 | ||||||

| 2025-08-15 | 13F | Resources Management Corp /ct/ /adv | 356 | 0,00 | 0 | |||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 22 283 | 806 | ||||||

| 2025-08-29 | 13F | Centaurus Financial, Inc. | 54 102 | -2,54 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Colonial Trust Advisors | 1 500 | 0,00 | 54 | 12,50 | ||||

| 2025-08-08 | 13F | Calamos Advisors LLC | 9 808 | -7,99 | 355 | 2,31 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 2 664 | 96 | ||||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 3 216 | 0,25 | 116 | 11,54 | ||||

| 2025-07-25 | 13F | Orca Investment Management, LLC | 9 775 | 0,00 | 354 | 11,01 | ||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 340 | 12 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 1 442 | 0,00 | 52 | 13,04 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 58 928 | 17,60 | 2 132 | 30,80 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 554 | 0,00 | 20 | 11,11 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 15 575 | 0,00 | 564 | 11,26 | ||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 1 246 | 0,00 | 45 | 12,50 | ||||

| 2025-08-12 | 13F | NWF Advisory Services Inc. | 25 240 | 821 | ||||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 32 998 | 6,06 | 1 194 | 17,89 | ||||

| 2025-08-01 | 13F | Logan Capital Management Inc | 1 000 | 0,00 | 36 | 12,50 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 12 841 | 465 | ||||||

| 2025-09-04 | 13F | Beacon Capital Management, Inc. | 34 500 | 43,75 | 1 248 | 50,72 | ||||

| 2025-08-12 | 13F | Laurel Wealth Advisors LLC | 90 450 | 3 518,00 | 2 | -97,53 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 1 622 | 1,69 | 59 | 13,73 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 16 096 | 2,73 | 582 | 14,34 | ||||

| 2025-08-14 | 13F | Comerica Bank | 19 164 | 1,70 | 693 | 13,05 | ||||

| 2025-05-07 | 13F | Ramirez Asset Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-12 | 13F | Virtu Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | JBR Co Financial Management Inc | 131 812 | -3,16 | 4 769 | 7,65 | ||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 200 | 0,00 | 7 | 16,67 | ||||

| 2025-07-08 | 13F | Atlas Brown,Inc. | 19 579 | -5,87 | 708 | 4,73 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 1 692 | 61 | ||||||

| 2025-07-09 | 13F | Sunpointe, LLC | 17 774 | -25,10 | 643 | -16,71 | ||||

| 2025-08-08 | 13F | Islay Capital Management, Llc | 0 | 0 | ||||||

| 2025-07-17 | 13F | XML Financial, LLC | 49 655 | 3,62 | 1 797 | 15,20 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 40 375 | 21,78 | 1 461 | 35,44 | ||||

| 2025-04-29 | 13F | Raleigh Capital Management Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 1 253 | 0,00 | 45 | 12,50 | ||||

| 2025-08-14 | 13F | Peapack Gladstone Financial Corp | 8 150 | -6,25 | 0 | |||||

| 2025-07-08 | 13F | Lowe Wealth Advisors, LLC | 6 250 | 1,63 | 226 | 13,00 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 384 | 0,00 | 14 | 8,33 | ||||

| 2025-07-23 | 13F | Stonegate Investment Group, LLC | 7 171 | 0,11 | 259 | 11,16 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 2 307 | -51,88 | 83 | -46,45 | ||||

| 2025-07-17 | 13F | Oakworth Capital, Inc. | 9 000 | 0,00 | 326 | 11,30 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 591 | 1,72 | 21 | 10,53 | ||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 97 683 | 64,07 | 3 534 | 82,45 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 1 000 | 0,00 | 36 | 12,50 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 54 707 | 16,46 | 1 967 | 28,73 | ||||

| 2025-08-04 | 13F | HBK Sorce Advisory LLC | 13 067 | 11,07 | 473 | 23,56 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 14 280 | 4,18 | 517 | 15,70 | ||||

| 2025-08-08 | 13F | Atlanta Consulting Group Advisors, LLC | 24 534 | 0,22 | 888 | 11,43 | ||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 98 | 0,00 | 4 | 0,00 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 1 067 | -25,85 | 39 | -17,39 | ||||

| 2025-08-08 | 13F | Creative Planning | 23 109 | 3,42 | 836 | 14,99 | ||||

| 2025-08-04 | 13F | Flagship Harbor Advisors, Llc | 10 875 | 0,00 | 393 | 11,33 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 5 152 | 0,00 | 186 | 11,38 | ||||

| 2025-08-22 | NP | Cornerstone Total Return Fund Inc | 250 007 | 92,49 | 9 045 | 114,03 | ||||

| 2025-07-11 | 13F | LongView Wealth Management | 69 680 | 0,10 | 2 521 | 11,30 | ||||

| 2025-08-07 | 13F | Montag A & Associates Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 287 238 | 17,78 | 10 392 | 30,96 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 4 874 | -74,07 | 173 | -71,69 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 111 791 | 42,31 | 4 045 | 58,22 | ||||

| 2025-07-23 | 13F | Castle Rock Wealth Management, LLC | 14 736 | 549 | ||||||

| 2025-08-07 | 13F | Merrion Investment Management Co, LLC | 25 000 | 0,00 | 904 | 11,19 | ||||

| 2025-07-31 | 13F | Graybill Bartz & Assoc Ltd | 12 081 | 12,47 | 437 | 25,21 | ||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 33 623 | 9,32 | 1 216 | 21,60 | ||||

| 2025-08-14 | 13F | Monetary Management Group Inc | 16 400 | 134,29 | 593 | 161,23 | ||||

| 2025-08-13 | 13F | Hollow Brook Wealth Management LLC | 7 606 | -11,90 | 275 | -1,79 | ||||

| 2025-07-09 | 13F | Bank of New Hampshire | 1 560 | 0,00 | 56 | 12,00 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 19 496 | 10,14 | 705 | 22,40 | ||||

| 2025-07-16 | 13F | Magnus Financial Group LLC | 203 951 | 9,02 | 7 379 | 21,21 | ||||

| 2025-08-04 | 13F | Keybank National Association/oh | 12 700 | 0,00 | 459 | 11,14 | ||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 8 644 | 2,64 | 313 | 13,87 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 128 952 | 2,46 | 4 665 | 13,92 | ||||

| 2025-08-11 | 13F | Reaves W H & Co Inc | 88 623 | 1,64 | 3 206 | 13,01 | ||||

| 2025-08-13 | 13F | Strategic Family Wealth Counselors, L.L.C. | 28 073 | -0,67 | 1 016 | 10,45 | ||||

| 2025-04-14 | 13F | Bruce G. Allen Investments, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 41 144 | -0,45 | 1 489 | 10,71 | ||||

| 2025-05-16 | 13F | Jones Financial Companies Lllp | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | LRI Investments, LLC | 1 440 | 0,00 | 52 | 13,04 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 15 474 | 0,51 | 560 | 11,80 |