Statistiques de base

| Propriétaires institutionnels | 214 total, 214 long only, 0 short only, 0 long/short - change of 4,37% MRQ |

| Allocation moyenne du portefeuille | 0.2887 % - change of 10,54% MRQ |

| Actions institutionnelles (Long) | 34 265 953 (ex 13D/G) - change of 2,88MM shares 9,17% MRQ |

| Valeur institutionnelle (Long) | $ 1 837 343 USD ($1000) |

Participation institutionnels et actionnaires

Invesco Exchange-Traded Fund Trust II - Invesco RAFI Developed Markets ex-U.S. ETF (US:PXF) détient 214 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 34,265,953 actions. Les principaux actionnaires incluent Charles Schwab Investment Management Inc, Invesco Ltd., Proficio Capital Partners LLC, Morgan Stanley, AIM GROWTH SERIES (INVESCO GROWTH SERIES) - Invesco Oppenheimer Portfolio Series: Active Allocation Fund Class R5, Victory Capital Management Inc, AIM GROWTH SERIES (INVESCO GROWTH SERIES) - Invesco Oppenheimer Portfolio Series: Moderate Investor Fund Class C, Bank Of America Corp /de/, Bank of New York Mellon Corp, and USCRX - Cornerstone Moderately Aggressive Fund .

Invesco Exchange-Traded Fund Trust II - Invesco RAFI Developed Markets ex-U.S. ETF (ARCA:PXF) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 12, 2025 is 61,28 / share. Previously, on September 16, 2024, the share price was 51,51 / share. This represents an increase of 18,98% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

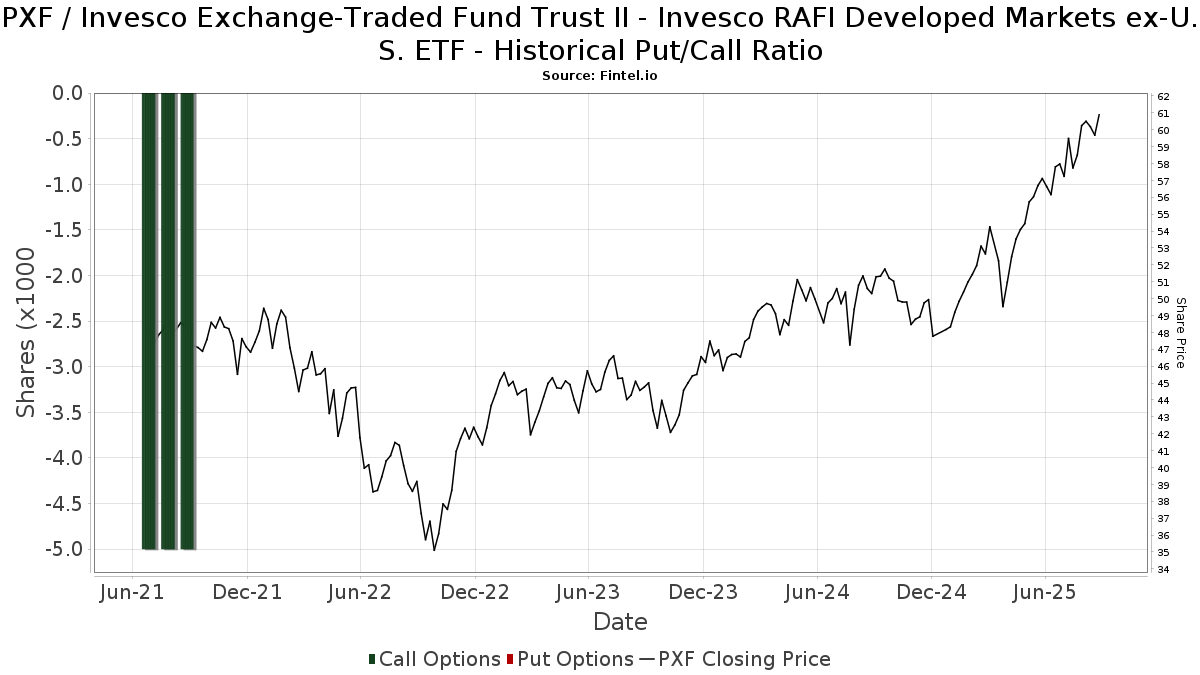

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-23 | 13F | Bellevue Asset Management, Llc | 721 | 0,84 | 41 | 10,81 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 154 | 9 | ||||||

| 2025-07-24 | 13F | Blair William & Co/il | 1 030 | 0,39 | 59 | 11,32 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 322 481 | 23,87 | 75 937 | 36,81 | ||||

| 2025-05-02 | 13F | United Community Bank | 0 | -100,00 | 0 | |||||

| 2025-04-30 | 13F | Ridgeline Wealth Planning, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Bristlecone Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | McNamara Financial Services, Inc. | 3 949 | -2,06 | 227 | 8,13 | ||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 946 | -76,24 | 54 | -73,79 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 3 423 | 0,00 | 197 | 10,73 | ||||

| 2025-07-23 | 13F | Godsey & Gibb Associates | 311 | 18 | ||||||

| 2025-07-28 | 13F | Deroy & Devereaux Private Investment Counsel Inc | 3 570 | 0 | ||||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 21 455 | 7,84 | 1 232 | 19,05 | ||||

| 2025-08-12 | 13F | RiverFront Investment Group, LLC | 4 583 | 263 | ||||||

| 2025-05-06 | 13F | Lifeworks Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Emerald Investment Partners, Llc | 457 | -3,18 | 26 | 8,33 | ||||

| 2025-05-22 | 13F | Mattson Financial Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Aries Wealth Management | 23 596 | 0,00 | 1 355 | 10,44 | ||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 68 445 | -0,20 | 3 930 | 10,24 | ||||

| 2025-07-08 | 13F | Zrc Wealth Management, Llc | 205 | 1,49 | 12 | 10,00 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 12 483 | -2,04 | 717 | 8,16 | ||||

| 2025-07-16 | 13F | Octavia Wealth Advisors, LLC | 11 235 | 0,00 | 645 | 10,45 | ||||

| 2025-07-28 | 13F | Cutler Investment Counsel Llc | 3 695 | 212 | ||||||

| 2025-08-08 | 13F | Creative Planning | 70 917 | 3,78 | 4 072 | 14,64 | ||||

| 2025-07-21 | 13F | Quent Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 883 | 103,93 | 51 | 127,27 | ||||

| 2025-05-05 | 13F | Private Advisor Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 65 345 | -0,84 | 3 397 | 7,67 | ||||

| 2025-08-12 | 13F | Archer Investment Corp | 66 099 | 1,65 | 3 795 | 12,28 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 92 898 | -5,25 | 5 293 | 3,83 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 2 729 | -0,44 | 157 | 9,86 | ||||

| 2025-08-05 | 13F | Plante Moran Financial Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Coston, McIsaac & Partners | 150 | 0,00 | 0 | |||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 480 380 | -10,79 | 27 583 | -1,48 | ||||

| 2025-08-12 | 13F | Shakespeare Wealth Management, Inc. | 26 941 | -20,34 | 1 547 | -12,06 | ||||

| 2025-08-28 | NP | AIM GROWTH SERIES (INVESCO GROWTH SERIES) - Invesco Oppenheimer Portfolio Series: Active Allocation Fund Class R5 | 1 215 737 | 8,54 | 69 808 | 19,88 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 9 483 | 0,00 | 545 | 10,34 | ||||

| 2025-08-12 | 13F | Integrated Advisors Network LLC | 24 237 | -14,03 | 1 392 | -5,05 | ||||

| 2025-07-14 | 13F | Abound Wealth Management | 1 073 | 62 | ||||||

| 2025-07-16 | 13F | Moisand Fitzgerald Tamayo, LLC | 477 | 0,00 | 27 | 12,50 | ||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 195 | 0,00 | 11 | 10,00 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 46 | 0,00 | 3 | 0,00 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 51 885 | 9,06 | 2 979 | 20,46 | ||||

| 2025-08-14 | 13F | Hara Capital LLC | 477 | 0,00 | 27 | 12,50 | ||||

| 2025-04-23 | 13F | Oppenheimer & Co Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-21 | 13F | Empirical Financial Services, LLC d.b.a. Empirical Wealth Management | 4 130 | -5,01 | 237 | 4,87 | ||||

| 2025-08-14 | 13F | Comerica Bank | 7 185 | -4,82 | 413 | 5,10 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 33 | 0,00 | 2 | 0,00 | ||||

| 2025-07-31 | 13F | Wealthfront Advisers Llc | 8 555 | -11,54 | 491 | -2,19 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 4 161 | 239 | ||||||

| 2025-07-08 | 13F | Webster Bank, N. A. | 61 | 0,00 | 4 | 0,00 | ||||

| 2025-08-12 | 13F | Rather & Kittrell, Inc. | 16 351 | -1,32 | 939 | 8,94 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 4 182 | 240 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 3 551 | -23,07 | 0 | |||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 1 138 | 65 | ||||||

| 2025-07-17 | 13F | Charles Schwab Trust Co | 378 017 | 10,81 | 21 706 | 22,38 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 27 281 | -9,76 | 1 566 | -0,32 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 7 764 | 57,26 | 446 | 73,83 | ||||

| 2025-07-17 | 13F | KWB Wealth | 49 696 | -7,62 | 2 584 | 0,27 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 1 099 | 0,64 | 0 | |||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 492 | 113,91 | 28 | 154,55 | ||||

| 2025-08-14 | 13F | Garden State Investment Advisory Services LLC | 57 531 | 60,77 | 3 304 | 77,58 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-04-22 | 13F | Cordant, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 695 | 0,00 | 40 | 8,33 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 116 602 | 64,29 | 6 695 | 81,44 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 2 680 | 3,88 | 154 | 14,18 | ||||

| 2025-08-15 | 13F | WFA of San Diego, LLC | 11 761 | -1,41 | 675 | 8,70 | ||||

| 2025-08-14 | 13F | Financial Advisory Service, Inc. | 493 | 0,00 | 28 | 12,00 | ||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 83 720 | 4 807 | ||||||

| 2025-08-15 | 13F | Binnacle Investments Inc | 114 | 7 | ||||||

| 2025-08-28 | NP | AIM GROWTH SERIES (INVESCO GROWTH SERIES) - Invesco Oppenheimer Portfolio Series: Moderate Investor Fund Class C | 884 052 | 1,55 | 50 762 | 12,15 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 22 396 | 1,00 | 1 286 | 11,55 | ||||

| 2025-08-14 | 13F | Betterment LLC | 3 521 | -29,15 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 49 166 | -37,90 | 2 823 | -31,41 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 14 057 | 134,09 | 807 | 158,65 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 110 557 | -7,05 | 6 348 | 2,65 | ||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 14 600 | 0,00 | 838 | 10,41 | ||||

| 2025-07-10 | 13F | Global Financial Private Client, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 30 707 | 126,32 | 1 760 | 147,05 | ||||

| 2025-07-29 | 13F | Foster & Motley Inc | 15 221 | -9,67 | 1 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 465 | -47,46 | 27 | -43,48 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 7 915 | -2,80 | 454 | 7,33 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 386 923 | -2,71 | 22 217 | 7,45 | ||||

| 2025-08-28 | NP | CMAIX - Invesco Conservative Allocation Fund CLASS R5 | 88 866 | 12,99 | 5 103 | 24,80 | ||||

| 2025-08-11 | 13F | Pin Oak Investment Advisors Inc | 204 | 0 | ||||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 130 455 | -6,25 | 7 491 | 16,47 | ||||

| 2025-08-04 | 13F | Mesirow Financial Investment Management, Inc. | 13 729 | -7,67 | 788 | 1,94 | ||||

| 2025-07-16 | 13F | Paragon Capital Management Ltd | 5 086 | 0,00 | 292 | 10,61 | ||||

| 2025-07-30 | 13F | Fairway Wealth LLC | 511 | -15,40 | 29 | -6,45 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 256 | -31,91 | 15 | -22,22 | ||||

| 2025-07-30 | 13F | Castle Wealth Management Llc | 4 831 | 0,00 | 277 | 10,36 | ||||

| 2025-07-24 | 13F | Stonebridge Financial Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-28 | NP | AIM GROWTH SERIES (INVESCO GROWTH SERIES) - Invesco Oppenheimer Portfolio Series: Growth Investor Fund Class R6 | 607 809 | 4,39 | 34 900 | 15,30 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 112 | -27,74 | 6 | -14,29 | ||||

| 2025-07-21 | 13F | Fortis Capital Advisors, LLC | 20 000 | 0,00 | 1 148 | 10,49 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 20 070 | 8,70 | 1 152 | 20,13 | ||||

| 2025-08-14 | 13F | UBS Group AG | 147 075 | 17,72 | 8 445 | 30,02 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 291 794 | 61,17 | 16 755 | 78,01 | ||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 565 | 0,00 | 32 | 10,34 | ||||

| 2025-08-13 | 13F | Vertex Planning Partners, LLC | 6 280 | 6,51 | 361 | 17,65 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 0 | -100,00 | 0 | |||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 4 890 | -2,65 | 281 | 7,28 | ||||

| 2025-07-14 | 13F | Sentinel Pension Advisors Inc | 3 805 | 218 | ||||||

| 2025-07-15 | 13F | Colonial River Wealth Management, LLC | 9 976 | 51,40 | 579 | 69,01 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-15 | 13F | Verum Partners LLC | 66 905 | 1,29 | 3 842 | 11,85 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 3 897 | 0,00 | 224 | 10,40 | ||||

| 2025-05-13 | 13F | EverSource Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Drive Wealth Management, Llc | 28 278 | 2,94 | 1 624 | 13,66 | ||||

| 2025-07-14 | 13F | Signature Securities Group Corporation | 21 291 | 1,84 | 1 223 | 12,52 | ||||

| 2025-08-06 | 13F | Modera Wealth Management, LLC | 4 753 | 0,00 | 273 | 10,12 | ||||

| 2025-08-28 | NP | AIM GROWTH SERIES (INVESCO GROWTH SERIES) - Invesco Oppenheimer Portfolio Series: Conservative Investor Fund Class R6 | 68 216 | 33,10 | 3 917 | 47,00 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 10 594 | -12,19 | 608 | -3,03 | ||||

| 2025-07-28 | 13F | Arlington Financial Advisors, LLC | 232 516 | 6,97 | 13 351 | 18,15 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 16 400 | 5,01 | 942 | 16,03 | ||||

| 2025-07-24 | 13F | Robertson Stephens Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 113 | 6 | ||||||

| 2025-07-25 | NP | USBSX - Cornerstone Moderate Fund | 322 043 | -4,13 | 18 146 | 4,85 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 700 | 0,00 | 40 | 11,11 | ||||

| 2025-05-14 | 13F | Venture Visionary Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 20 290 | -8,55 | 1 165 | 1,04 | ||||

| 2025-07-29 | 13F | Cidel Asset Management Inc | 31 072 | -0,14 | 1 784 | 10,33 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Mather Group, Llc. | 10 897 | -7,52 | 626 | 2,12 | ||||

| 2025-08-08 | 13F | Security Financial Services, INC. | 10 496 | 63,34 | 603 | 80,24 | ||||

| 2025-07-08 | 13F | Lowe Wealth Advisors, LLC | 19 174 | 8,43 | 1 101 | 19,70 | ||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 3 502 | 201 | ||||||

| 2025-08-27 | NP | ALAAX - INVESCO Income Allocation Fund Class A | 307 673 | -9,72 | 17 667 | -0,29 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 3 015 | 728,30 | 173 | 861,11 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 5 023 | -23,34 | 261 | -16,61 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 20 000 | 0,00 | 1 148 | 10,49 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 165 | 0,00 | 9 | 12,50 | ||||

| 2025-07-07 | 13F | Centurion Wealth Management LLC | 56 530 | 55,61 | 3 246 | 86,60 | ||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | McKinley Carter Wealth Services, Inc. | 4 498 | 258 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 10 535 | -9,53 | 605 | -0,17 | ||||

| 2025-07-31 | 13F | AlTi Global, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 1 229 | 71 | ||||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 5 761 | 0,00 | 331 | 10,37 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 74 861 | 0,16 | 4 331 | 11,48 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 368 | 0,00 | 21 | 10,53 | ||||

| 2025-08-01 | 13F | Chilton Capital Management Llc | 640 | 0,00 | 37 | 9,09 | ||||

| 2025-07-24 | 13F | Financial Connections Group, Inc. | 2 794 | 1,79 | 0 | |||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 770 | 44 | ||||||

| 2025-05-12 | 13F | Sandy Spring Bank | 113 | -34,30 | 6 | -37,50 | ||||

| 2025-08-06 | 13F | Quadrant Private Wealth Management, LLC | 9 150 | 0,00 | 525 | 10,53 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 82 | 0,00 | 5 | 0,00 | ||||

| 2025-08-07 | 13F | Proficio Capital Partners LLC | 1 768 322 | 1 858 | ||||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | RTD Financial Advisors, Inc. | 149 060 | -2,16 | 8 559 | 8,05 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 65 006 | -2,78 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Fmr Llc | 29 322 | 3,45 | 1 684 | 14,26 | ||||

| 2025-07-30 | 13F | Retirement Planning Group | 82 341 | -0,76 | 4 728 | 9,62 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 21 117 | 2,90 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 4 283 | -1,02 | 246 | 9,38 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 96 009 | 9 932,29 | 5 513 | 11 148,98 | ||||

| 2025-07-15 | 13F | MCF Advisors LLC | 675 | 0,00 | 39 | 8,57 | ||||

| 2025-07-17 | 13F | Johnson & White Wealth Management, LLC | 366 105 | 0,86 | 21 | 16,67 | ||||

| 2025-07-23 | 13F | Hardy Reed LLC | 10 346 | 0,00 | 594 | 10,61 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 5 674 | 0,00 | 326 | 10,54 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 238 | 1,28 | 14 | 8,33 | ||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 38 439 | 0,00 | 2 207 | 10,46 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 310 | 2,65 | 18 | 13,33 | ||||

| 2025-05-09 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Maridea Wealth Management LLC | 4 712 | 271 | ||||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 23 628 | -0,56 | 1 357 | 9,80 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 205 | 0,00 | 12 | 10,00 | ||||

| 2025-07-28 | 13F | Revolve Wealth Partners, LLC | 8 573 | 7,78 | 492 | 19,13 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 3 456 | 6,18 | 198 | 17,16 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 502 | -79,02 | 29 | -77,42 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 845 228 | -3,08 | 48 533 | 7,04 | ||||

| 2025-08-06 | 13F | Atlas Legacy Advisors, LLC | 11 184 | 93,63 | 642 | 111,88 | ||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 10 555 | 5,70 | 606 | 16,76 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 10 815 | -0,52 | 621 | 9,91 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 125 291 | 7 194 | ||||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 83 | -80,96 | 5 | -81,82 | ||||

| 2025-07-15 | 13F | Foster Victor Wealth Advisors, LLC | 66 378 | -3,83 | 3 848 | 11,51 | ||||

| 2025-08-28 | NP | AADAX - INVESCO Growth Allocation Fund Class A | 624 071 | 5,04 | 35 834 | 16,02 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 3 490 | -16,29 | 200 | -7,41 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 314 | -25,24 | 18 | -14,29 | ||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 22 | -78,00 | 1 | -80,00 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 14 070 | -0,34 | 808 | 9,95 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 8 041 | 0,00 | 462 | 10,29 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 146 563 | -4,16 | 8 416 | 5,85 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 9 633 | 553 | ||||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 9 160 | -0,52 | 526 | 9,83 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 11 711 | 381,74 | 245 | 94,44 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 883 792 | -3,73 | 50 747 | 6,33 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 27 953 | 4,41 | 1 605 | 15,38 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 44 741 | -3,83 | 2 569 | 6,24 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 7 314 | 0,22 | 420 | 10,55 | ||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 6 365 | 0,02 | 365 | 10,61 | ||||

| 2025-08-12 | 13F | Belmont Capital, LLC | 361 | 0,00 | 21 | 11,11 | ||||

| 2025-08-01 | 13F | Cedar Point Capital Partners, LLC | 36 006 | 4,71 | 2 067 | 15,67 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 36 749 | 8,75 | 2 110 | 20,16 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 648 408 | 26,78 | 37 232 | 40,02 | ||||

| 2025-07-30 | 13F | Atlantic Edge Private Wealth Management, LLC | 105 | 0,00 | 6 | 20,00 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 47 979 | -22,37 | 2 755 | -14,34 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 7 804 | 447 | ||||||

| 2025-08-12 | 13F | Bokf, Na | 0 | -100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 91 099 | 17,27 | 5 231 | 29,54 | ||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 5 694 | 327 | ||||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 130 257 | 1,34 | 7 479 | 11,93 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 7 368 | 39,73 | 423 | 54,38 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 0 | 0 | ||||||

| 2025-07-25 | NP | UCAGX - Cornerstone Aggressive Fund | 43 991 | 0,00 | 2 479 | 9,36 | ||||

| 2025-08-14 | 13F | Greenline Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | PDS Planning, Inc | 11 324 | 0,00 | 650 | 10,54 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 15 022 | 0,54 | 863 | 11,08 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 3 549 | 13,21 | 204 | 25,31 | ||||

| 2025-07-22 | 13F | Three Bridge Wealth Advisors, LLC | 62 360 | 158,32 | 3 581 | 185,26 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 4 516 | -93,81 | 259 | -93,17 | ||||

| 2025-04-29 | 13F | Callan Capital, LLC | 105 664 | -2,93 | 5 493 | 5,37 | ||||

| 2025-03-28 | 13F/A | Berkeley, Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-24 | 13F | Riverchase Wealth Management, Llc | 25 378 | 0,00 | 1 457 | 10,46 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 9 485 | 46,10 | 545 | 61,42 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 5 330 | -3,62 | 306 | 6,62 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 4 | -20,00 | 0 | |||||

| 2025-08-13 | 13F | Invesco Ltd. | 4 588 907 | 2,93 | 263 495 | 13,68 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 9 130 | -13,80 | 524 | -4,73 | ||||

| 2025-05-14 | 13F | Brown Brothers Harriman & Co | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Maltin Wealth Management, Inc. | 85 820 | 4 928 | ||||||

| 2025-08-08 | 13F | Austin Wealth Management, LLC | 3 869 | 0,00 | 222 | 7,80 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 84 261 | -5,90 | 4 838 | 3,93 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 171 590 | 2,65 | 9 853 | 13,37 | ||||

| 2025-07-25 | NP | USCRX - Cornerstone Moderately Aggressive Fund | 653 206 | 0,00 | 36 805 | 9,36 | ||||

| 2025-05-06 | 13F | Kathleen S. Wright Associates Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 11 861 260 | 1,38 | 681 074 | 11,97 | ||||

| 2025-08-13 | 13F | Victory Capital Management Inc | 979 947 | -8,27 | 56 269 | 1,31 | ||||

| 2025-08-08 | 13F | WASHINGTON TRUST Co | 0 | -100,00 | 0 | |||||

| 2025-07-25 | NP | UCMCX - Cornerstone Moderately Conservative Fund | 35 176 | 0,00 | 1 982 | 9,33 | ||||

| 2025-08-07 | 13F | Rollins Financial Advisors, LLC | 3 837 | 220 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 16 062 | 1,81 | 922 | 12,44 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 65 345 | 3 752 | ||||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 1 294 | 161,94 | 74 | 196,00 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 88 | 11,39 | ||||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 1 841 | 10,31 | 106 | 22,09 | ||||

| 2025-07-16 | 13F | Prairiewood Capital, LLC | 12 206 | -9,79 | 701 | -0,43 | ||||

| 2025-07-22 | 13F | Red Tortoise LLC | 39 595 | 0,80 | 2 274 | 11,31 | ||||

| 2025-08-05 | 13F | Tiaa Trust, National Association | 4 215 | 0,00 | 242 | 10,05 | ||||

| 2025-07-09 | 13F | Breakwater Capital Group | 76 931 | 0,87 | 4 417 | 11,40 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 63 489 | -4,64 | 3 646 | 5,32 | ||||

| 2025-07-31 | 13F | Harbour Investment Management Llc | 7 887 | 0,00 | 453 | 10,24 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 6 314 | -15,00 | 363 | -6,22 |