Statistiques de base

| Propriétaires institutionnels | 241 total, 238 long only, 0 short only, 3 long/short - change of 0,83% MRQ |

| Allocation moyenne du portefeuille | 0.3389 % - change of 27,08% MRQ |

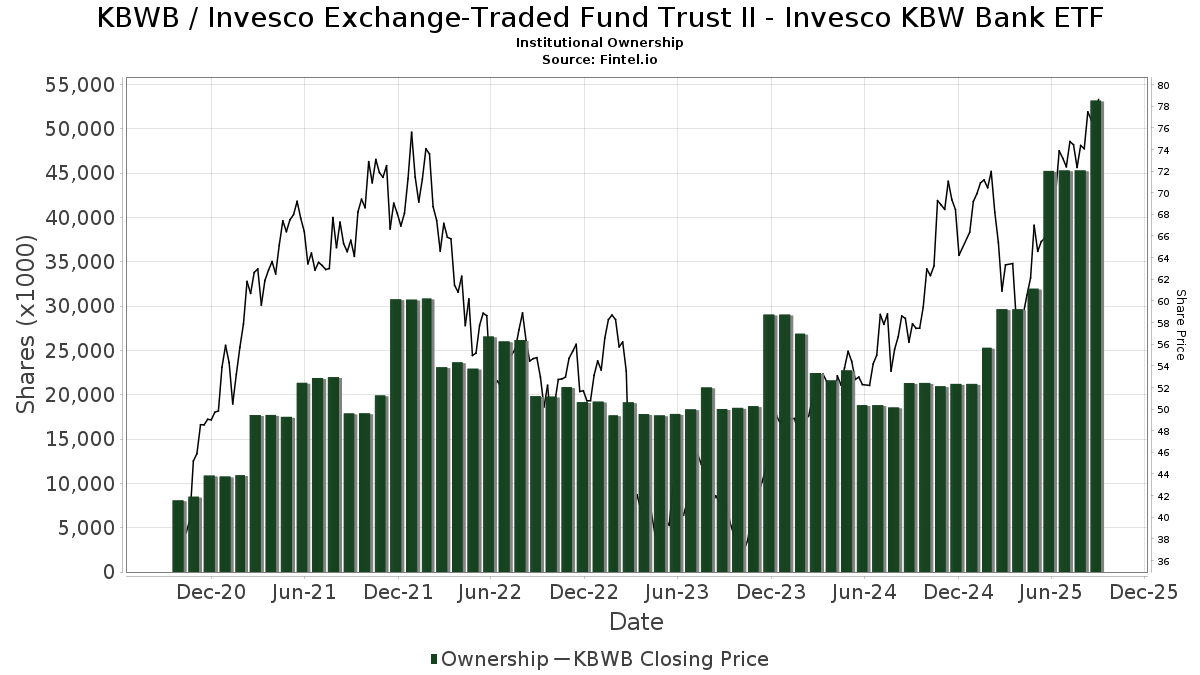

| Actions institutionnelles (Long) | 53 187 480 (ex 13D/G) - change of 7,94MM shares 17,54% MRQ |

| Valeur institutionnelle (Long) | $ 2 759 730 USD ($1000) |

Participation institutionnels et actionnaires

Invesco Exchange-Traded Fund Trust II - Invesco KBW Bank ETF (US:KBWB) détient 241 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 53,187,480 actions. Les principaux actionnaires incluent Bank Of America Corp /de/, Migdal Insurance & Financial Holdings Ltd., Clal Insurance Enterprises Holdings Ltd, Jpmorgan Chase & Co, Menora Mivtachim Holdings Ltd., Fisher Asset Management, LLC, Goldman Sachs Group Inc, Harel Insurance Investments & Financial Services Ltd., Wharton Business Group, LLC, and Morgan Stanley .

Invesco Exchange-Traded Fund Trust II - Invesco KBW Bank ETF (NasdaqGM:KBWB) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 12, 2025 is 78,06 / share. Previously, on September 12, 2024, the share price was 56,05 / share. This represents an increase of 39,26% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

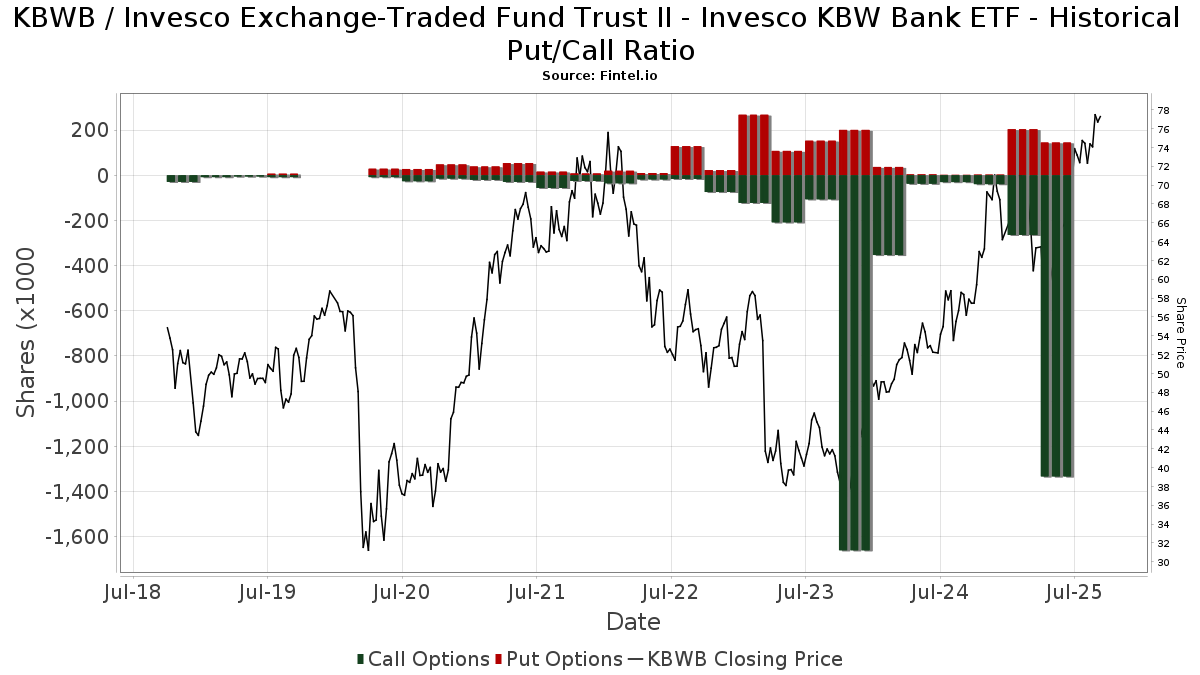

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 14 086 | 2,09 | 1 | |||||

| 2025-07-24 | 13F | Blair William & Co/il | 433 | -98,65 | 31 | -98,46 | ||||

| 2025-08-06 | 13F | Hallmark Capital Management Inc | 253 642 | 15,30 | 18 166 | 31,55 | ||||

| 2025-07-16 | 13F | Magnus Financial Group LLC | 20 428 | 14,91 | 1 463 | 31,21 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 16 087 | -2,92 | 1 152 | 10,77 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 30 170 | 817,58 | 2 161 | 948,54 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 13 339 | -1,28 | 955 | 12,62 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 1 193 | 85 | ||||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 46 | 0,00 | 3 | 50,00 | ||||

| 2025-07-24 | NP | HASAX - Horizon Active Asset Allocation Fund Advisor Class | 349 309 | 5,47 | 22 918 | -0,58 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 10 043 | 12,17 | 719 | 28,16 | ||||

| 2025-08-14 | 13F | Gotham Asset Management, LLC | 10 000 | 0,00 | 716 | 14,19 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 7 506 | 538 | ||||||

| 2025-08-26 | NP | LCR - Leuthold Core ETF | 8 561 | 2,64 | 613 | 17,21 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 250 | -6,02 | 18 | 6,25 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | WP Advisors, LLC | 93 352 | 0,95 | 6 686 | 15,18 | ||||

| 2025-08-12 | 13F | Quadcap Wealth Management, LLC | 54 782 | -0,66 | 3 923 | 13,35 | ||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 4 890 | 0,00 | 307 | -4,08 | ||||

| 2025-08-14 | 13F | Broadleaf Partners, LLC | 4 841 | 0,00 | 347 | 14,19 | ||||

| 2025-07-23 | 13F | Meitav Dash Investments Ltd | 40 455 | 60,66 | 2 897 | 83,35 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 109 116 | 7,65 | 79 435 | 22,83 | ||||

| 2025-05-05 | 13F | Montag A & Associates Inc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Sanibel Captiva Trust Company, Inc. | 5 120 | 0,00 | 367 | 14,02 | ||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 3 831 | 5,07 | 240 | 0,84 | ||||

| 2025-08-14 | 13F | UBS Group AG | 343 850 | 17,58 | 24 627 | 34,16 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 4 954 | 55,10 | 355 | 77,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | Call | 268 100 | 19 201 | |||||

| 2025-08-13 | 13F | Advocacy Wealth Management Services, LLC | 38 543 | -17,17 | 2 760 | -5,48 | ||||

| 2025-08-14 | 13F | Fosun International Ltd | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Rockland Trust Co | 15 335 | -7,54 | 1 098 | 5,48 | ||||

| 2025-08-14 | 13F | Comerica Bank | 1 755 | 47,60 | 126 | 68,92 | ||||

| 2025-08-13 | 13F | Collar Capital Management, LLC | 2 969 | 213 | ||||||

| 2025-08-14 | 13F | Aragon Global Management, LP | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | WESPAC Advisors SoCal, LLC | 18 716 | -2,16 | 1 340 | 11,67 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Mainstay Capital Management Llc /adv | 15 126 | -8,20 | 1 083 | 4,74 | ||||

| 2025-07-30 | 13F | Axecap Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Aviso Financial Inc. | 98 | 7 | ||||||

| 2025-08-14 | 13F | Pentwater Capital Management LP | Put | 0 | -100,00 | 0 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 12 388 | 887 | ||||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 66 | 0 | ||||||

| 2025-08-14 | 13F | Ulysses Management LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-19 | 13F | Delos Wealth Advisors, LLC | 31 291 | -8,03 | 2 241 | 4,96 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 100 | 7 | ||||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 41 976 | 2,79 | 3 006 | 17,28 | ||||

| 2025-07-08 | 13F | Webster Bank, N. A. | 861 | 0,00 | 62 | 12,96 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 5 213 | 2,64 | 373 | 17,30 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 5 612 | -73,64 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 54 | -25,00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 243 | -83,80 | 89 | -81,38 | ||||

| 2025-05-16 | 13F | Laidlaw Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | M&t Bank Corp | 5 000 | 0,00 | 358 | 14,38 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 3 860 | 0,00 | 276 | 14,05 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 3 531 | -49,82 | 253 | -42,86 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 372 | 0,27 | 27 | 13,04 | ||||

| 2025-08-11 | 13F | Tidemark, LLC | 194 | 0,00 | 14 | 8,33 | ||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 692 760 | -27,52 | 49 616 | -17,31 | ||||

| 2025-07-24 | 13F | Stonebridge Financial Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Wharton Business Group, LLC | 1 914 019 | 6,56 | 137 | 21,43 | ||||

| 2025-08-07 | 13F | Investment Management Corp /va/ /adv | 12 927 | 2,25 | 926 | 16,65 | ||||

| 2025-05-14 | 13F | Joseph P. Lucia & Associates, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 132 | 9 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 3 503 711 | 117,74 | 250 936 | 148,44 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 11 391 | -3,65 | 816 | 5,57 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-03 | 13F | City Center Advisors, LLC | 7 777 | 1,79 | 557 | 16,28 | ||||

| 2025-05-05 | 13F | J.w. Cole Advisors, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-04 | 13F | One Day In July LLC | 7 112 | -15,33 | 509 | -3,42 | ||||

| 2025-08-13 | 13F | Custom Index Systems, Llc | 4 127 | 0,27 | 296 | 14,34 | ||||

| 2025-08-14 | 13F | BTG Pactual Asset Management US LLC | 1 150 | 82 | ||||||

| 2025-08-08 | 13F | Altfest L J & Co Inc | 169 626 | 3 328,17 | 12 149 | 3 818,71 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 9 806 | 702 | ||||||

| 2025-07-28 | 13F | WealthPlan Investment Management, LLC | 3 176 | 227 | ||||||

| 2025-08-14 | 13F | Nan Shan Life Insurance Co., Ltd. | 99 650 | 0,00 | 7 137 | 14,08 | ||||

| 2025-08-14 | 13F | Guardian Wealth Advisors, Llc / Nc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Jain Global LLC | 14 842 | 1 063 | ||||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 2 213 | -7,29 | 158 | 6,04 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 5 256 | 29,62 | 374 | 48,61 | ||||

| 2025-05-14 | 13F | CI Private Wealth, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-22 | 13F | SOL Capital Management CO | 283 134 | -0,33 | 20 | 17,65 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 753 504 | 59,98 | 53 967 | 82,54 | ||||

| 2025-08-13 | 13F | Leuthold Group, Llc | 9 210 | 2,76 | 660 | 17,26 | ||||

| 2025-07-29 | 13F | Stephens Inc /ar/ | 82 050 | -0,04 | 5 876 | 14,05 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 744 956 | 600,70 | 53 354 | 699,54 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 161 | 0,62 | 12 | 10,00 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 4 997 | -2,84 | 358 | 10,87 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 417 804 | 2,23 | 29 923 | 16,64 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 3 419 | 3 156,19 | 249 | 4 033,33 | ||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ulysses Management LLC | Call | 25 000 | 1 790 | |||||

| 2025-05-06 | 13F | Bank Julius Baer & Co. Ltd, Zurich | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Hobbs Group Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | FRG Family Wealth Advisors LLC | 2 800 | 201 | ||||||

| 2025-07-02 | 13F | Central Pacific Bank - Trust Division | 52 890 | 87,06 | 3 788 | 113,47 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 204 | 0,00 | 15 | 16,67 | ||||

| 2025-07-24 | 13F | Robertson Stephens Wealth Management, LLC | 11 689 | 16,61 | 837 | 33,07 | ||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 302 | 0,00 | 22 | 16,67 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 10 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 36 400 | 2 607 | |||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 122 | 5,17 | 9 | 14,29 | ||||

| 2025-07-30 | NP | ENDW - Cambria Endowment Style ETF | 57 | 4 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 121 100 | 8 673 | |||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | D. E. Shaw & Co., Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F/A | Curat Global, LLC | 200 | 0,00 | 14 | 16,67 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 204 669 | 4,84 | 14 658 | 19,62 | ||||

| 2025-08-14 | 13F | Menora Mivtachim Holdings Ltd. | 3 085 450 | 107,36 | 220 980 | 136,59 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 8 780 | 9,82 | 629 | 25,35 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 3 255 | -2,66 | 0 | |||||

| 2025-04-29 | 13F | Hm Payson & Co | 1 156 | 0,00 | 73 | -4,00 | ||||

| 2025-08-11 | 13F | Advisor Resource Council | 9 433 | -80,83 | 676 | -72,97 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 613 | -78,05 | 44 | -75,43 | ||||

| 2025-08-05 | 13F | Fourth Dimension Wealth, LLC | 100 | 0,00 | 7 | 16,67 | ||||

| 2025-08-14 | 13F | Summit Trail Advisors, Llc | 473 162 | -29,69 | 33 888 | -19,78 | ||||

| 2025-07-15 | 13F | DSG Capital Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-04-15 | 13F | Thompson Investment Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 300 | 21 | ||||||

| 2025-08-13 | 13F | Tranquilli Financial Advisor LLC | 6 117 | 29,46 | 438 | 47,97 | ||||

| 2025-08-13 | 13F | Helix Partners Management LP | 35 000 | 2 507 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 413 | -39,71 | 30 | -30,95 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 26 585 | -2,13 | 1 904 | 11,74 | ||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 8 444 | 0,00 | 605 | 13,96 | ||||

| 2025-04-11 | 13F | Permanent Capital Management, LP | 9 756 | 612 | ||||||

| 2025-08-12 | 13F | Laurel Wealth Advisors LLC | 5 372 | 5 272,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Fairscale Capital, LLC | 4 042 | 1,51 | 297 | 19,28 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Addison Advisors LLC | 1 655 | -2,99 | 119 | 10,28 | ||||

| 2025-06-30 | NP | Two Roads Shared Trust - Anfield U.S. Equity Sector Rotation ETF | 59 105 | 3 578 | ||||||

| 2025-08-18 | NP | JAMEX - Jamestown Equity Fund | 12 165 | 0,00 | 871 | 14,15 | ||||

| 2025-08-05 | 13F | Harel Insurance Investments & Financial Services Ltd. | 2 272 620 | 0,00 | 163 | 14,08 | ||||

| 2025-08-14 | 13F | Quantitative Investment Management, LLC | 15 418 | -50,95 | 1 | 0,00 | ||||

| 2025-08-12 | 13F | Edmond De Rothschild Holding S.a. | 153 800 | 1,96 | 11 015 | 16,34 | ||||

| 2025-07-16 | 13F | PFS Partners, LLC | 95 | -11,21 | 7 | 0,00 | ||||

| 2025-08-13 | 13F | Barclays Plc | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 2 233 | -96,60 | 160 | -96,14 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 134 838 | -4,91 | 9 657 | 8,49 | ||||

| 2025-08-07 | 13F | David R. Rahn & Associates Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Truist Financial Corp | 16 681 | -2,24 | 1 195 | 11,48 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 4 815 | -18,83 | 345 | -7,53 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 319 770 | -31,60 | 22 902 | -21,96 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 1 775 | 4,35 | 116 | 8,49 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 326 | 23 | ||||||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 13 094 | -45,07 | 1 | -100,00 | ||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 26 959 | 16,92 | 2 | 0,00 | ||||

| 2025-08-11 | 13F | One Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-08 | 13F | Juncture Wealth Strategies, Llc | 28 572 | 106,88 | 2 046 | 136,26 | ||||

| 2025-05-06 | 13F | Y-Intercept (Hong Kong) Ltd | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Blume Capital Management, Inc. | 400 | 0,00 | 29 | 12,00 | ||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 493 | 35 | ||||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 3 658 | 262 | ||||||

| 2025-07-31 | 13F | GLOBALT Investments LLC / GA | 8 709 | -10,42 | 624 | 2,13 | ||||

| 2025-05-20 | 13F/A | Colony Group, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Founders Financial Securities Llc | 30 586 | 34,84 | 2 191 | 60,20 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 340 | 38,78 | 24 | 60,00 | ||||

| 2025-05-12 | 13F | Nomura Asset Management Co Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Logan Capital Management Inc | 17 | 0,00 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Family Management Corp | 10 817 | 0,00 | 775 | 14,16 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 100 | -25,93 | 7 | -12,50 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 40 215 | -0,73 | 3 | 0,00 | ||||

| 2025-08-12 | 13F | Nemes Rush Group LLC | 119 | 8 | ||||||

| 2025-07-31 | 13F | Pinnacle Wealth Management Group, Inc. | 34 978 | 5,93 | 2 505 | 20,90 | ||||

| 2025-08-14 | 13F | FIL Ltd | 196 021 | 214,72 | 14 127 | 261,40 | ||||

| 2025-08-13 | 13F | Philadelphia Trust Co | 10 000 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | 7 850 | -71,49 | 562 | -67,48 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 4 847 | -5,24 | 347 | 8,10 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 54 600 | 3 910 | ||||||

| 2025-08-14 | 13F | Temasek Holdings (Private) Ltd | 0 | -100,00 | 0 | |||||

| 2025-05-27 | NP | XNAV - FundX Aggressive ETF | 34 681 | 0,00 | 2 177 | -3,97 | ||||

| 2025-07-10 | 13F | Piscataqua Savings Bank | 180 | 0,00 | 13 | 9,09 | ||||

| 2025-07-18 | 13F | Parsons Capital Management Inc/ri | 14 291 | 0,00 | 1 024 | 14,05 | ||||

| 2025-07-15 | 13F | MCF Advisors LLC | 375 | 0,54 | 27 | 13,04 | ||||

| 2025-08-14 | 13F | Murphy & Mullick Capital Management Corp | 85 | 0,00 | 6 | 20,00 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 6 546 | 63,94 | 469 | 87,20 | ||||

| 2025-08-15 | 13F | Provenance Wealth Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 400 | -8,26 | 29 | 3,70 | ||||

| 2025-08-08 | 13F | Itau Unibanco Holding S.A. | 9 000 | -88,07 | 645 | 16 000,00 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 8 932 | 640 | ||||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 110 795 | 21,41 | 7 935 | 38,53 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 4 649 | 583,68 | 333 | 690,48 | ||||

| 2025-04-21 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 253 076 | 35,45 | 18 125 | 54,56 | ||||

| 2025-08-04 | 13F | Ledyard National Bank | 269 215 | -4,03 | 19 281 | 9,50 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 35 200 | 58,56 | 2 521 | 80,98 | |||

| 2025-07-17 | 13F | Fifth Third Securities, Inc. | 3 332 | -7,42 | 239 | 5,78 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 400 | 59,36 | 29 | 86,67 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 81 800 | 245,15 | 5 859 | 293,95 | |||

| 2025-08-11 | 13F | Lowe Brockenbrough & Co Inc | 108 413 | -1,72 | 7 765 | 12,13 | ||||

| 2025-08-13 | 13F | Fisher Asset Management, LLC | 2 991 470 | 14,54 | 214 249 | 30,69 | ||||

| 2025-08-14 | 13F | First International Bank of Israel Ltd. | 62 000 | 4 440 | ||||||

| 2025-07-21 | 13F | Barrett & Company, Inc. | 8 | 0,00 | 1 | |||||

| 2025-07-28 | 13F | Duncker Streett & Co Inc | 14 | 0,00 | 1 | |||||

| 2025-07-29 | 13F | Dumont & Blake Investment Advisors Llc | 11 793 | -0,74 | 845 | 13,29 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 3 039 | 218 | ||||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 2 940 662 | 31,28 | 210 610 | 49,79 | ||||

| 2025-08-14 | 13F | Transamerica Financial Advisors, Inc. | 36 323 | -22,49 | 2 601 | 129 950,00 | ||||

| 2025-08-04 | 13F | Migdal Insurance & Financial Holdings Ltd. | 5 595 000 | 64,80 | 401 | 87,79 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 10 085 | -0,36 | 722 | 13,70 | ||||

| 2025-05-15 | 13F | Alliancebernstein L.p. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Argent Trust Co | 3 700 | 0,00 | 265 | 13,79 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 77 465 | -1,22 | 5 548 | 12,72 | ||||

| 2025-05-19 | 13F | Heck Capital Advisors, LLC | 0 | 0 | ||||||

| 2025-08-14 | 13F | Hrt Financial Lp | 22 162 | 2 | ||||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 6 927 | -0,66 | 496 | 13,50 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 5 559 | 13,87 | 398 | 30,07 | ||||

| 2025-07-14 | 13F | Masso Torrence Wealth Management Inc. | 27 103 | -3,46 | 1 941 | 10,16 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 23 | 0,00 | 2 | 0,00 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 22 | -75,28 | 2 | -80,00 | ||||

| 2025-08-14 | 13F | LM Advisors LLC | 4 000 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Fiduciary Trust Co | 926 093 | 7,37 | 66 327 | 22,51 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 25 | -73,40 | 2 | -80,00 | ||||

| 2025-08-07 | 13F | Guardian Partners Inc. | 608 586 | 839,16 | 44 542 | 1 068,47 | ||||

| 2025-08-12 | 13F | Clal Insurance Enterprises Holdings Ltd | 4 370 000 | 23,27 | 313 | 40,54 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 66 | 5 | ||||||

| 2025-04-15 | 13F | Integrated Advisors Network LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Schroder Investment Management Group | 322 906 | 22 965 | ||||||

| 2025-07-15 | 13F | Mather Group, Llc. | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Gemmer Asset Management LLC | 0 | -100,00 | 0 | |||||

| 2025-05-19 | 13F/A | Jane Street Group, Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 431 | 31 | ||||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 55 166 | 133,22 | 3 951 | 166,17 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 8 295 | 0,00 | 594 | 14,23 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 23 713 | -7,87 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 5 055 | -88,06 | 362 | -86,37 | ||||

| 2025-08-13 | 13F | Shepherd Financial Partners LLC | 4 765 | 341 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 222 400 | 107,27 | 15 928 | 136,50 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 73 500 | -11,02 | 5 264 | 1,54 | |||

| 2025-07-29 | 13F | Mattson Financial Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 411 120 | 6,84 | 29 444 | 21,91 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 68 227 | -42,49 | 4 881 | -34,48 | ||||

| 2025-07-11 | 13F | Grove Bank & Trust | 140 | 10 | ||||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 940 | -1,88 | 67 | 11,67 | ||||

| 2025-07-18 | 13F | Consolidated Portfolio Review Corp | 2 834 | 203 | ||||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 819 | 0,00 | 59 | 13,73 | ||||

| 2025-07-22 | 13F | Miracle Mile Advisors, LLC | 7 879 | 20,68 | 564 | 37,90 | ||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 3 446 | 258 | ||||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 6 600 | 0,00 | 473 | 14,01 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 89 | 32,84 | 6 | 50,00 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 141 | 642,11 | 10 | 900,00 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 32 876 | -72,58 | 2 355 | -68,72 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 4 185 | -25,65 | 300 | -15,30 | ||||

| 2025-07-18 | 13F | TruNorth Capital Management, LLC | 114 | 0,00 | 8 | 14,29 | ||||

| 2025-08-14 | 13F | Synovus Financial Corp | 53 686 | -0,20 | 3 847 | 13,92 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 34 781 | -0,35 | 2 491 | 13,74 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 0 | 0 | ||||||

| 2025-08-08 | 13F | ProVise Management Group, LLC | 43 033 | -4,46 | 3 082 | 9,02 | ||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | Call | 177 700 | 33,01 | 12 727 | 51,75 | |||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 42 435 | -32,06 | 3 039 | -22,47 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 39 709 | -8,69 | 2 844 | 4,21 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 12 | -62,50 | 1 | -100,00 | ||||

| 2025-07-10 | 13F | Rfg Holdings, Inc. | 197 378 | -1,63 | 14 136 | 12,23 | ||||

| 2025-07-09 | 13F | Finley Financial, LLC | 2 250 | 0,00 | 161 | 18,38 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 2 783 | 18,32 | 199 | 35,37 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 44 600 | 3 194 | ||||||

| 2025-08-08 | 13F | Principal Financial Group Inc | 54 986 | -23,43 | 3 938 | -12,62 | ||||

| 2025-08-11 | 13F | Y.D. More Investments Ltd | 810 | 0,00 | 58 | 16,00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 39 | 0,00 | 3 | 0,00 | ||||

| 2025-08-06 | 13F | Csenge Advisory Group | 107 014 | -0,51 | 7 021 | 15,00 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 952 | 0,11 | 68 | 15,25 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 154 | 0,00 | 11 | 22,22 | ||||

| 2025-08-14 | 13F | Ssi Investment Management Llc | 124 746 | 95,08 | 8 934 | 122,63 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Huntington National Bank | 14 | -7,14 | ||||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 143 009 | 5,32 | 10 242 | 20,18 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 28 001 | -1,98 | 2 005 | 11,82 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 3 334 | 22,44 | 240 | 41,18 | ||||

| 2025-07-03 | 13F | First Hawaiian Bank | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | Attessa Capital LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Anfield Capital Management, LLC | 59 495 | -1,29 | 4 261 | 12,64 | ||||

| 2025-08-14 | 13F | Horizon Investments, LLC | 457 451 | 19,85 | 32 763 | 36,75 | ||||

| 2025-08-01 | 13F | Clark Asset Management, LLC | 6 501 | 0,57 | 466 | 14,81 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 4 890 | 350 | ||||||

| 2025-07-09 | 13F | Sapient Capital Llc | 3 422 | 0,00 | 245 | 14,49 | ||||

| 2025-07-21 | 13F | Quattro Financial Advisors Llc | 42 307 | -6,32 | 3 030 | 6,92 | ||||

| 2025-07-22 | 13F | Bank Hapoalim Bm | 7 270 | 12,73 | 1 | |||||

| 2025-08-05 | 13F | Access Investment Management LLC | 60 | 0,00 | 4 | 33,33 | ||||

| 2025-08-13 | 13F | Green Harvest Asset Management LLC | 49 132 | 16,61 | 3 519 | 33,06 | ||||

| 2025-08-13 | 13F | StoneX Group Inc. | 9 982 | -8,08 | 715 | 4,85 | ||||

| 2025-07-22 | 13F | Beacon Financial Advisory LLC | 13 869 | -2,08 | 993 | 11,70 | ||||

| 2025-07-18 | 13F | Tanager Wealth Management LLP | 6 057 | 0,00 | 434 | 13,95 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 97 156 | 281,57 | 6 958 | 335,42 | ||||

| 2025-08-14 | 13F | Avanda Investment Management Pte. Ltd. | Call | 437 500 | 31 334 | |||||

| 2025-07-16 | 13F | American National Bank | 62 | 4 | ||||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 459 | 214,38 | 33 | 255,56 | ||||

| 2025-08-08 | 13F | Accredited Investors Inc. | 3 545 | 0,03 | 254 | 13,96 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 12 830 652 | -1,52 | 918 931 | 12,36 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 20 831 | 27,03 | 1 492 | 44,90 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 240 411 | 64,08 | 17 218 | 87,21 | ||||

| 2025-07-25 | 13F | Astoria Portfolio Advisors LLC. | 5 351 | 399 | ||||||

| 2025-08-14 | 13F | Banco BTG Pactual S.A. | 120 000 | -9,50 | 8 594 | 3,26 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 16 540 | 0,01 | 1 185 | 14,07 | ||||

| 2025-05-15 | 13F | Marshall Wace, Llp | 0 | -100,00 | 0 | -100,00 |