Statistiques de base

| Propriétaires institutionnels | 140 total, 140 long only, 0 short only, 0 long/short - change of 5,22% MRQ |

| Allocation moyenne du portefeuille | 0.7676 % - change of 16,33% MRQ |

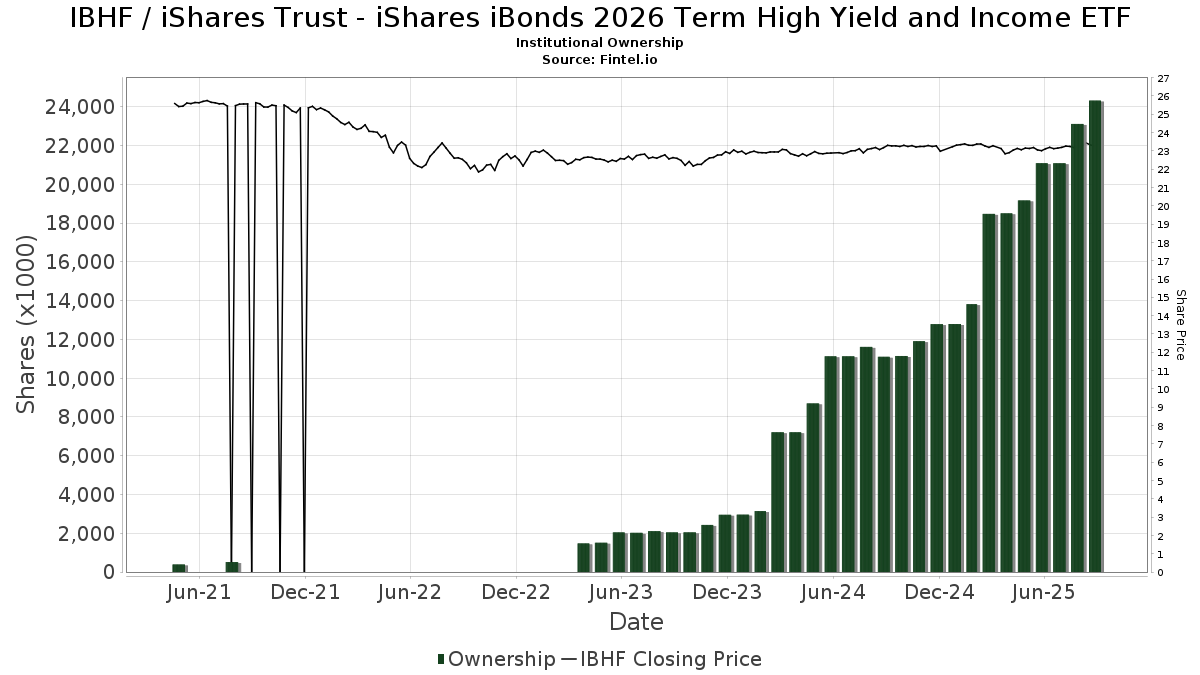

| Actions institutionnelles (Long) | 24 329 899 (ex 13D/G) - change of 3,23MM shares 15,31% MRQ |

| Valeur institutionnelle (Long) | $ 530 334 USD ($1000) |

Participation institutionnels et actionnaires

iShares Trust - iShares iBonds 2026 Term High Yield and Income ETF (US:IBHF) détient 140 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 24,329,899 actions. Les principaux actionnaires incluent Bank Of America Corp /de/, Morgan Stanley, Sterling Financial Group, Inc., Cambridge Investment Research Advisors, Inc., Private Advisor Group, LLC, Wells Fargo & Company/mn, Lbmc Investment Advisors, Llc, Northwestern Mutual Wealth Management Co, Straightline Group Llc, and LPL Financial LLC .

iShares Trust - iShares iBonds 2026 Term High Yield and Income ETF (BATS:IBHF) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 11, 2025 is 23,39 / share. Previously, on September 12, 2024, the share price was 23,18 / share. This represents an increase of 0,88% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 138 721 | 66,83 | 3 223 | 66,94 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 10 156 | 0,00 | 236 | 0,00 | ||||

| 2025-07-08 | 13F | FF Advisors,LLC | 177 871 | 3,56 | 4 132 | 4,32 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-02 | 13F | Whittier Trust Co | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Wrapmanager Inc | 49 204 | 1,68 | 1 143 | 1,78 | ||||

| 2025-07-14 | 13F | Occidental Asset Management, LLC | 11 540 | 0,00 | 268 | 0,37 | ||||

| 2025-04-01 | 13F | Massmutual Trust Co Fsb/adv | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Arrow Financial Corp | 724 261 | 116,28 | 16 825 | 116,39 | ||||

| 2025-08-08 | 13F | Marble Harbor Investment Counsel, LLC | 18 600 | -9,72 | 432 | -9,62 | ||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 2 000 | 46 | ||||||

| 2025-08-15 | 13F | High Falls Advisors, Inc | 12 551 | 16,49 | 292 | 16,40 | ||||

| 2025-08-08 | 13F | Creative Planning | 12 580 | 292 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 869 | 62,13 | 20 | 66,67 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 143 670 | 5,82 | 3 | 0,00 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 177 875 | -7,24 | 4 132 | -7,19 | ||||

| 2025-08-15 | 13F | Howland Capital Management Llc | 13 740 | 0,00 | 319 | 0,00 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 15 | 0 | ||||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 1 309 | 0,46 | 30 | 0,00 | ||||

| 2025-08-01 | 13F | Ashton Thomas Private Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Eight 31 Financial Llc | 79 140 | 0,62 | 1 838 | 0,66 | ||||

| 2025-08-14 | 13F | Ruggaard & Associates LLC | 574 522 | -2,16 | 13 346 | -2,12 | ||||

| 2025-08-04 | 13F | Cottage Street Advisors LLC | 69 930 | 9,74 | 1 624 | 9,80 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 202 776 | 0,66 | 4 710 | 0,71 | ||||

| 2025-08-14 | 13F | Headinvest, Llc | 33 425 | -2,90 | 776 | -2,88 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 10 930 | 1,64 | 254 | 2,02 | ||||

| 2025-07-10 | 13F | Sterling Financial Group, Inc. | 1 210 761 | 28 126 | ||||||

| 2025-08-04 | 13F | Spire Wealth Management | 3 955 | -37,40 | 92 | -37,67 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 10 913 | 254 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 5 822 | 39,82 | 135 | 40,63 | ||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | VSM Wealth Advisory, LLC | 384 | 0,00 | 9 | 0,00 | ||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 41 798 | -24,74 | 1 | -100,00 | ||||

| 2025-08-14 | 13F | Comerica Bank | 4 767 | -1,61 | 111 | -1,79 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 80 035 | 2,27 | 1 859 | 2,31 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 49 319 | 460,44 | 1 146 | 461,27 | ||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 14 099 | 0,00 | 328 | 0,00 | ||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 231 997 | 12,39 | 5 389 | 12,43 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 525 335 | -25,01 | 35 434 | -24,98 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 33 020 | 1,60 | 767 | 1,72 | ||||

| 2025-08-14 | 13F | Sentinus, LLC | 26 056 | 0,03 | 605 | 0,17 | ||||

| 2025-07-23 | 13F | Madden Advisory Services, Inc. | 25 850 | 12,67 | 600 | 12,78 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 138 410 | -5,75 | 3 215 | -5,69 | ||||

| 2025-08-12 | 13F | Cowa, Llc | 685 592 | 25,98 | 15 912 | 25,92 | ||||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 262 625 | 1,79 | 6 101 | 1,82 | ||||

| 2025-04-10 | 13F | Sugar Maple Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Commonwealth Financial Services, LLC | 100 262 | -17,58 | 2 329 | -17,53 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 202 734 | 44,27 | 4 710 | 44,32 | ||||

| 2025-07-16 | 13F | Littlejohn Financial Services, Inc. | 517 294 | 66,17 | 12 017 | 66,24 | ||||

| 2025-08-14 | 13F | Strategic Wealth Designers | 18 | 0 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 49 389 | -80,19 | 1 147 | -80,18 | ||||

| 2025-08-13 | 13F | Baltimore-Washington Financial Advisors, Inc. | 445 589 | -9,04 | 10 351 | -8,99 | ||||

| 2025-08-06 | 13F | Rialto Wealth Management, LLC | 67 198 | 12,33 | 1 561 | 12,38 | ||||

| 2025-08-11 | 13F | PFG Private Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 3 533 | -6,21 | 0 | |||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 144 299 | 10,97 | 3 352 | 11,03 | ||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 34 274 | -17,63 | 796 | -17,60 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | -100,00 | 0 | |||||

| 2025-05-07 | 13F | Vista Private Wealth Partners. LLC | 0 | -100,00 | 0 | |||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Summit Wealth Partners, LLC | 29 265 | -20,21 | 680 | -20,21 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Moisand Fitzgerald Tamayo, LLC | 1 | 0,00 | 0 | |||||

| 2025-07-17 | 13F | Johnson Bixby & Associates, LLC | 14 719 | 2,06 | 342 | 2,10 | ||||

| 2025-07-30 | 13F | Mid-American Wealth Advisory Group, Inc. | 598 347 | 36,55 | 13 900 | 36,61 | ||||

| 2025-07-17 | 13F | Baron Silver Stevens Financial Advisors, Llc | 10 944 | -46,70 | 254 | -46,64 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 34 441 | 0,33 | 800 | 0,38 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 064 628 | 23,99 | 24 731 | 24,04 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Cherry Tree Wealth Management, LLC | 7 621 | 0,00 | 177 | 0,57 | ||||

| 2025-07-29 | 13F | Werba Rubin Papier Wealth Management | 46 638 | 0,00 | 1 083 | 0,09 | ||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 55 710 | 14,50 | 1 294 | 14,61 | ||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 12 435 | 289 | ||||||

| 2025-08-12 | 13F | Bedel Financial Consulting, Inc. | 31 575 | 37,55 | 733 | 38,56 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 29 377 | 0,00 | 682 | 0,00 | ||||

| 2025-07-09 | 13F | Krilogy Financial LLC | 72 641 | -2,66 | 1 687 | -2,60 | ||||

| 2025-07-29 | 13F | Straight Path Wealth Management | 99 793 | 12,11 | 2 318 | 12,20 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 316 269 | 8,25 | 7 347 | 8,28 | ||||

| 2025-08-07 | 13F | PFG Advisors | 69 235 | 1 608 | ||||||

| 2025-07-22 | 13F | Steele Capital Management, Inc. | 37 803 | 0,00 | 878 | 0,11 | ||||

| 2025-08-12 | 13F | Absolute Capital Management, LLC | 61 035 | -4,83 | 1 418 | -4,84 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 54 911 | -20,54 | 1 276 | -20,51 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 12 832 | 0,00 | 298 | 0,34 | ||||

| 2025-07-23 | 13F | Ironwood Financial, llc | 66 160 | 0,00 | 1 536 | 0,00 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 60 020 | 7,53 | 1 394 | 7,56 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 126 076 | 25,35 | 2 929 | 25,40 | ||||

| 2025-07-25 | 13F | M3 Advisory Group, LLC | 9 313 | 0,22 | 216 | 0,47 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 15 309 | 30,89 | 356 | 31,00 | ||||

| 2025-08-07 | 13F | Nwam Llc | 31 990 | -12,40 | 743 | -12,28 | ||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 25 436 | 0,00 | 591 | 0,00 | ||||

| 2025-07-31 | 13F | Keeler THomas Management LLC | 415 775 | 15,57 | 9 658 | 15,62 | ||||

| 2025-07-15 | 13F | MCF Advisors LLC | 29 845 | 41,77 | 693 | 42,01 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 2 345 | 9,07 | 54 | 10,20 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 12 006 | 279 | ||||||

| 2025-08-12 | 13F | Tableaux Llc | 1 363 | 248 | ||||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 1 117 099 | 9,50 | 25 950 | 9,55 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 10 850 | 0,00 | 251 | 0,00 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 373 758 | 2 046,31 | 8 682 | 2 049,01 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 209 350 | 1,44 | 4 864 | 1,48 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 9 067 | 211 | ||||||

| 2025-05-13 | 13F | Claudia M.p. Batlle, Crp (r) Llc | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Summit Investment Advisors, Inc. | 304 244 | 4,38 | 7 043 | 4,84 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 2 146 582 | 2,46 | 49 865 | 2,50 | ||||

| 2025-07-11 | 13F | Quad-Cities Investment Group, LLC | 37 902 | 57,09 | 880 | 57,14 | ||||

| 2025-08-12 | 13F | Boreal Capital Management LLC | 0 | 228 | ||||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 78 255 | 1 817 | ||||||

| 2025-07-01 | 13F | Private Client Services, Llc | 129 040 | -4,96 | 2 998 | -4,92 | ||||

| 2025-07-17 | 13F | Tempus Wealth Planning, LLC | 209 534 | 11,40 | 4 867 | 11,45 | ||||

| 2025-08-15 | 13F | Scissortail Wealth Management, LLC | 140 803 | -3,43 | 3 271 | -3,40 | ||||

| 2025-08-14 | 13F | Hurley Capital, LLC | 249 860 | 15,78 | 5 804 | 15,85 | ||||

| 2025-06-23 | NP | LDRH - iShares iBonds 1-5 Year High Yield and Income Ladder ETF | 34 327 | 14,29 | 794 | 13,12 | ||||

| 2025-07-16 | 13F | Rebalance, Llc | 43 540 | 1,38 | 1 011 | 1,40 | ||||

| 2025-08-01 | 13F | Austin Private Wealth, LLC | 20 379 | 23,66 | 473 | 23,82 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 14 285 | 6,60 | 332 | 6,43 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 271 980 | 3,15 | 6 325 | 3,49 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 93 990 | 2,56 | 2 183 | 2,63 | ||||

| 2025-08-12 | 13F | Landing Point Financial Group, LLC | 53 070 | 15,60 | 1 233 | 15,68 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 328 597 | 33,01 | 7 633 | 33,07 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 148 248 | -7,67 | 3 444 | -7,64 | ||||

| 2025-07-25 | 13F | Heartland Bank & Trust Co | 20 321 | 50,06 | 472 | 50,32 | ||||

| 2025-08-15 | 13F | SkyView Investment Advisors, LLC | 149 642 | -29,67 | 3 | -25,00 | ||||

| 2025-08-12 | 13F | BWM Planning, LLC | 20 566 | 1,70 | 478 | 1,71 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 733 946 | 35,34 | 17 050 | 35,40 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 15 294 | -3,64 | 355 | -3,53 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 136 632 | 1,61 | 3 174 | 1,63 | ||||

| 2025-07-10 | 13F | Klaas Financial Asset Advisors, LLC | 26 578 | -5,80 | 617 | -5,80 | ||||

| 2025-07-11 | 13F | Windsor Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 13 223 | 12,05 | 307 | 12,04 | ||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 22 128 | 514 | ||||||

| 2025-05-05 | 13F | Diversify Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 142 | -52,67 | 3 | -50,00 | ||||

| 2025-05-02 | 13F | Sigma Planning Corp | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Sightline Wealth Advisors, LLC | 69 536 | 0,08 | 1 615 | 0,12 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 6 734 | 19,46 | 156 | 20,00 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 5 574 | 129 | ||||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 3 151 | 0,45 | 73 | 1,39 | ||||

| 2025-07-14 | 13F | Golden State Equity Partners | 37 325 | 0,47 | 867 | 0,58 | ||||

| 2025-08-14 | 13F | Straightline Group Llc | 766 062 | 4,25 | 17 796 | 4,30 | ||||

| 2025-07-23 | 13F | High Note Wealth, LLC | 150 167 | 3 488 | ||||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 349 866 | 2,54 | 8 127 | 2,59 | ||||

| 2025-07-09 | 13F | Lbmc Investment Advisors, Llc | 854 318 | 13,11 | 19 846 | 13,15 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 1 167 957 | 6,99 | 27 | 8,00 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 12 750 | 0,00 | 295 | -0,34 | ||||

| 2025-08-05 | 13F | Summit Investment Advisory Services, LLC | 297 431 | 6 909 | ||||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 1 959 | 46 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 400 | 9 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 32 650 | 27,29 | 758 | 27,39 | ||||

| 2025-07-31 | 13F | Orion Capital Management LLC | 11 000 | 52,35 | 256 | 52,69 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 568 962 | 25,49 | 13 217 | 25,54 | ||||

| 2025-07-18 | 13F | Consolidated Portfolio Review Corp | 21 649 | 8,39 | 503 | 8,42 | ||||

| 2025-08-14 | 13F | 10Elms LLP | 10 615 | 0,00 | 247 | 0,00 | ||||

| 2025-07-24 | 13F | Robertson Stephens Wealth Management, LLC | 21 610 | 40,35 | 502 | 40,62 | ||||

| 2025-08-12 | 13F | Timber Creek Capital Management LLC | 38 802 | 12,52 | 899 | 12,25 | ||||

| 2025-07-29 | 13F | Alaska Permanent Capital Management | 10 089 | 0,56 | 234 | 0,43 | ||||

| 2025-08-07 | 13F | New England Private Wealth Advisors LLC | 9 494 | 2,27 | 221 | 2,33 | ||||

| 2025-07-15 | 13F | Carr Financial Group Corp | 83 323 | 17,66 | 1 936 | 17,70 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 798 372 | 0,87 | 18 546 | 0,92 |