Statistiques de base

| Propriétaires institutionnels | 172 total, 172 long only, 0 short only, 0 long/short - change of 16,11% MRQ |

| Allocation moyenne du portefeuille | 0.3793 % - change of 26,77% MRQ |

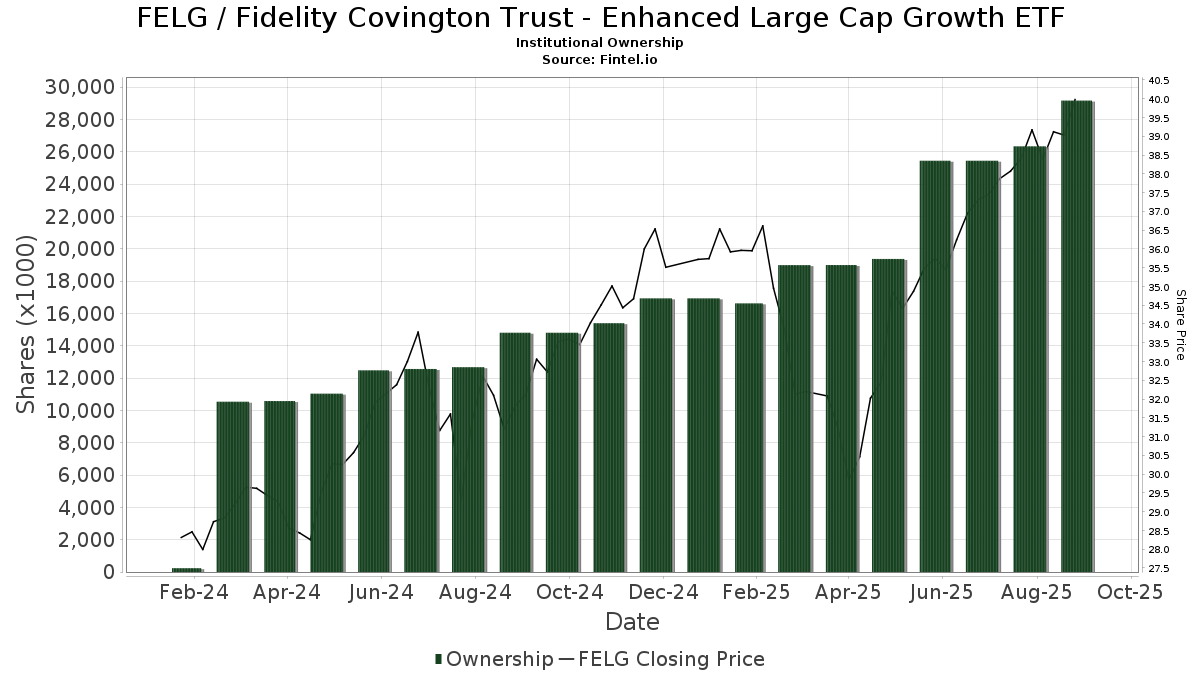

| Actions institutionnelles (Long) | 29 171 785 (ex 13D/G) - change of 3,72MM shares 14,63% MRQ |

| Valeur institutionnelle (Long) | $ 703 097 USD ($1000) |

Participation institutionnels et actionnaires

Fidelity Covington Trust - Enhanced Large Cap Growth ETF (US:FELG) détient 172 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 29,171,785 actions. Les principaux actionnaires incluent Mml Investors Services, Llc, Envestnet Asset Management Inc, Commonwealth Equity Services, Llc, LPL Financial LLC, Equitable Holdings, Inc., Independence Financial Advisors, LLC, Raymond James Financial Inc, Advisor Group Holdings, Inc., Spectrum Investment Advisors, Inc., and Cambridge Investment Research Advisors, Inc. .

Fidelity Covington Trust - Enhanced Large Cap Growth ETF (ARCA:FELG) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 12, 2025 is 40,32 / share. Previously, on September 13, 2024, the share price was 32,29 / share. This represents an increase of 24,87% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 1 082 | 0,00 | 41 | 28,13 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 22 225 | 31,19 | 823 | 54,41 | ||||

| 2025-08-14 | 13F | Geneva Partners, LLC | 19 154 | -43,18 | 709 | -32,86 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 14 666 | -1,60 | 1 | |||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 13 099 | 4,93 | 0 | |||||

| 2025-04-28 | 13F | CarsonAllaria Wealth Management, Ltd. | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 22 006 | 37,93 | 815 | 62,15 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 2 801 | 104 | ||||||

| 2025-05-14 | 13F | PKS Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F/A | Kestra Investment Management, LLC | 462 790 | -41,23 | 17 137 | -30,91 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 231 | 0,00 | 9 | 14,29 | ||||

| 2025-08-07 | 13F | Proficio Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 26 372 | 977 | ||||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 0 | -100,00 | 0 | |||||

| 2025-05-06 | 13F | Assetmark, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Stifel Financial Corp | 24 697 | 90,75 | 915 | 124,57 | ||||

| 2025-08-08 | 13F | Advisors Capital Management, LLC | 190 632 | 89,46 | 7 059 | 122,75 | ||||

| 2025-08-14 | 13F | Menora Mivtachim Holdings Ltd. | 211 326 | 55,32 | 7 825 | 82,61 | ||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 7 647 | 283 | ||||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 10 634 | 11,58 | 394 | 31,00 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 10 979 | 407 | ||||||

| 2025-07-09 | 13F | Baron Wealth Management LLC | 11 426 | 423 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 1 651 | 0,00 | 61 | 17,31 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 5 941 796 | 7,70 | 220 025 | 26,60 | ||||

| 2025-07-21 | 13F | Pacific Financial Group Inc | 6 044 | 224 | ||||||

| 2025-07-18 | 13F | Rogco, Lp | 1 521 | 56 | ||||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 550 317 | 15,08 | 20 378 | 35,29 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 3 462 | 0,03 | 128 | 18,52 | ||||

| 2025-08-11 | 13F | Regal Investment Advisors LLC | 11 193 | 2,87 | 414 | 21,05 | ||||

| 2025-07-18 | 13F | Madrona Financial Services, LLC | 11 706 | 46,03 | 433 | 71,83 | ||||

| 2025-07-29 | 13F | Fundamentun, Llc | 7 857 | 291 | ||||||

| 2025-08-08 | 13F | Creative Planning | 42 648 | 0,96 | 1 579 | 18,72 | ||||

| 2025-07-15 | 13F | Charter Capital Management, LLC\DE | 8 938 | 331 | ||||||

| 2025-07-09 | 13F | Act Wealth Management, Llc | 10 667 | 0,12 | 395 | 17,61 | ||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 6 289 | -38,63 | 0 | |||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 6 086 | 69,01 | 225 | 99,12 | ||||

| 2025-08-27 | NP | ACGRX - Advisors Capital Growth Fund | 153 700 | 128,38 | 5 692 | 168,57 | ||||

| 2025-07-15 | 13F | Bay Capital Advisors, LLC | 19 219 | 13,23 | 712 | 33,15 | ||||

| 2025-07-25 | 13F | Ball & Co Wealth Management Inc. | 20 497 | -45,42 | 1 | -100,00 | ||||

| 2025-07-15 | 13F | Beacon Investment Advisory Services, Inc. | 10 021 | 0,00 | 371 | 17,78 | ||||

| 2025-07-18 | 13F | Rolek Wealth Management LLC | 31 558 | -20,72 | 1 169 | -4,50 | ||||

| 2025-07-25 | 13F | Verdence Capital Advisors LLC | 11 182 | 0,13 | 414 | 17,95 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1 687 | 313,48 | 62 | 416,67 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 499 432 | 0,87 | 18 494 | 18,58 | ||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 1 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 3 343 | 124 | ||||||

| 2025-07-17 | 13F | Halbert Hargrove Global Advisors, Llc | 253 | 0,00 | 9 | 28,57 | ||||

| 2025-05-28 | 13F | Intrua Financial, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-29 | 13F | Spectrum Investment Advisors, Inc. | 690 417 | 4,06 | 25 566 | 22,34 | ||||

| 2025-08-13 | 13F | Fisher Asset Management, LLC | 6 336 | 235 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Colonial Trust Advisors | 1 121 | 42 | ||||||

| 2025-05-01 | 13F | Iron Horse Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 11 458 | 424 | ||||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 593 | 0,17 | 0 | |||||

| 2025-08-07 | 13F | Cahill Financial Advisors Inc | 5 887 | 218 | ||||||

| 2025-08-13 | 13F | IAG Wealth Partners, LLC | 28 | 1 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 550 661 | 45,33 | 20 | 81,82 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 3 678 | -8,12 | 136 | 7,94 | ||||

| 2025-08-01 | 13F | Transcend Wealth Collective, Llc | 7 644 | 283 | ||||||

| 2025-08-14 | 13F | Foronjy Financial Llc | 7 758 | 287 | ||||||

| 2025-08-11 | 13F | Heritage Wealth Advisors | 552 | 0,00 | 20 | 17,65 | ||||

| 2025-07-23 | 13F | Element Wealth, LLC | 8 993 | 333 | ||||||

| 2025-07-14 | 13F | Sentinel Pension Advisors Inc | 381 516 | 40,05 | 14 128 | 64,63 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 196 778 | 24,39 | 7 287 | 46,22 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 11 822 | -1,34 | 438 | 15,92 | ||||

| 2025-08-13 | 13F | Summit Wealth Group Llc / Co | 31 127 | 1 153 | ||||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Clear Creek Financial Management, LLC | 24 841 | -29,85 | 920 | -17,58 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 1 671 | 97,99 | 62 | 134,62 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 4 479 | 52,92 | 166 | 79,35 | ||||

| 2025-08-12 | 13F | Wood Tarver Financial Group, LLC | 5 707 | 0,00 | 0 | -100,00 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 7 497 | -2,20 | 278 | 14,94 | ||||

| 2025-07-28 | 13F | Duncker Streett & Co Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 34 945 | -13,34 | 1 294 | 1,89 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 40 943 | -1,77 | 1 516 | 15,55 | ||||

| 2025-08-14 | 13F | Fmr Llc | 441 654 | 14,85 | 16 354 | 35,01 | ||||

| 2025-07-07 | 13F | Investors Research Corp | 1 208 | -19,89 | 45 | -6,38 | ||||

| 2025-07-23 | 13F | Richardson Capital Management LLC | 5 777 | 0,00 | 214 | 17,68 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 8 843 | 0 | ||||||

| 2025-07-23 | 13F | Elm3 Financial Group, LLC | 11 548 | 65,23 | 428 | 94,09 | ||||

| 2025-08-07 | 13F | Flagship Wealth Advisors, Llc | 133 223 | 15,49 | 4 933 | 35,78 | ||||

| 2025-08-05 | 13F | Sage Capital Management, LLC | 12 344 | 0,10 | 457 | 17,78 | ||||

| 2025-05-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | BKD Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 14 217 | 2,05 | 527 | 20,09 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 2 325 | 0 | ||||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 9 533 | -10,14 | 364 | 8,98 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 824 707 | -0,30 | 30 539 | 17,20 | ||||

| 2025-07-10 | 13F | Family Legacy Financial Solutions, LLC | 17 | 1 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 148 583 | 3 074,17 | 5 502 | 3 642,86 | ||||

| 2025-09-12 | 13F/A | Valeo Financial Advisors, LLC | 17 504 | -5,24 | 648 | 11,53 | ||||

| 2025-07-30 | 13F | Drive Wealth Management, Llc | 6 620 | 0,65 | 245 | 18,36 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 3 720 | 0,11 | 138 | 17,09 | ||||

| 2025-05-09 | 13F | Keeler THomas Management LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Bensler, LLC | 11 185 | -5,03 | 414 | 11,59 | ||||

| 2025-07-07 | 13F | Nova Wealth Management, Inc. | 59 048 | 3,05 | 2 187 | 21,11 | ||||

| 2025-07-08 | 13F | Lowe Wealth Advisors, LLC | 101 | 0,00 | 4 | 0,00 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 26 144 | 0,00 | 968 | 17,62 | ||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 21 618 | 9,26 | 801 | 28,41 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 1 435 | -49,83 | 53 | -41,11 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 200 469 | -1,99 | 7 423 | 15,23 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 14 954 | -26,48 | 554 | -13,59 | ||||

| 2025-07-21 | 13F | Greenwood Capital Associates Llc | 51 998 | 21,36 | 1 925 | 42,70 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 34 390 | -93,88 | 1 | -94,74 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 8 100 | 17,39 | 300 | 37,79 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 721 700 | -30,49 | 26 723 | -18,31 | ||||

| 2025-07-29 | 13F | Salus Financial Advisors, LLC | 6 772 | -17,68 | 251 | -3,47 | ||||

| 2025-04-21 | 13F | ORG Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 21 071 | 0,04 | 780 | 17,65 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 5 981 257 | 20,36 | 221 | 41,67 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 111 039 | 2,60 | 4 112 | 20,59 | ||||

| 2025-08-12 | 13F | Vestor Capital, Llc | 12 665 | 45,74 | 1 | |||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 24 561 | 84,70 | 909 | 117,46 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 35 388 | -2,01 | 1 310 | 15,22 | ||||

| 2025-04-21 | 13F | Envestnet Portfolio Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Redwood Financial Network Corp | 24 448 | 4,33 | 905 | 22,63 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 275 017 | 123,96 | 10 184 | 163,26 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 6 593 | 244 | ||||||

| 2025-08-08 | 13F | Advyzon Investment Management, LLC | 12 282 | 455 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 072 | 40 | ||||||

| 2025-08-11 | 13F | CBIZ Investment Advisory Services, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | Perennial Advisors, LLC | 12 675 | 0,00 | 469 | 17,54 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 472 | -98,76 | 0 | -100,00 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 19 745 | 0,13 | 731 | 17,71 | ||||

| 2025-05-09 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 169 996 | -38,78 | 6 295 | -28,04 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 11 935 | -51,75 | 442 | -43,39 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 8 651 | 251,10 | 320 | 315,58 | ||||

| 2025-08-08 | 13F | Independence Financial Advisors, LLC | 830 356 | 1 399,41 | 30 748 | 1 663,07 | ||||

| 2025-08-14 | 13F | RMB Capital Management, LLC | 5 822 | 216 | ||||||

| 2025-07-17 | 13F | Prepared Retirement Institute LLC | 239 293 | 64,32 | 8 861 | 93,18 | ||||

| 2025-07-18 | 13F | Pure Financial Advisors, Inc. | 21 944 | 3,04 | 813 | 21,19 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 6 967 | 0,00 | 258 | 17,35 | ||||

| 2025-08-25 | 13F | Silverlake Wealth Management Llc | 81 009 | -17,10 | 3 000 | -2,57 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 4 087 | -9,92 | 151 | 6,34 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 34 819 | 1 289 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 3 520 372 | 47,86 | 130 | 75,68 | ||||

| 2025-07-30 | 13F | Roman Butler Fullerton & Co | 7 078 | 0,13 | 270 | 23,96 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 101 | 0,00 | 4 | 0,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 497 331 | 8,68 | 18 416 | 27,76 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 5 567 | -84,52 | 206 | -83,28 | ||||

| 2025-07-14 | 13F | Abound Wealth Management | 1 093 | 40 | ||||||

| 2025-07-31 | 13F | First Business Financial Services, Inc. | 5 700 | 211 | ||||||

| 2025-07-14 | 13F | Infinity Wealth Counsel, LLC | 23 225 | 10,07 | 860 | 29,52 | ||||

| 2025-07-15 | 13F | Financial Partners Group, Inc | 58 112 | -7,34 | 2 152 | 8,91 | ||||

| 2025-05-14 | 13F | Ameriprise Financial Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Comerica Bank | 856 | 152,51 | 32 | 210,00 | ||||

| 2025-07-15 | 13F | Regatta Capital Group, Llc | 7 157 | 0,13 | 265 | 17,78 | ||||

| 2025-08-13 | 13F | Maia Wealth LLC | 10 183 | -4,33 | 377 | 15,29 | ||||

| 2025-08-14 | 13F | Investmark Advisory Group LLC | 53 740 | 448,14 | 1 990 | 546,10 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 153 232 | 4,52 | 5 674 | 22,89 | ||||

| 2025-07-23 | 13F | Traphagen Investment Advisors Llc | 18 187 | 0,12 | 673 | 17,66 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 22 698 | 6,06 | 840 | 24,63 | ||||

| 2025-05-12 | 13F | Sandy Spring Bank | 3 051 | 96 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 41 284 | -9,77 | 1 529 | 6,03 | ||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 3 051 | 113 | ||||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 10 344 | 0,12 | 383 | 17,85 | ||||

| 2025-08-12 | 13F | SlateStone Wealth, LLC | 5 564 | 0 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 20 017 | 47 559,52 | 741 | 74 000,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 7 335 | 272 | ||||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 300 | 0,00 | 11 | 22,22 | ||||

| 2025-08-07 | 13F | Rollins Financial Advisors, LLC | 53 948 | -15,16 | 1 998 | -0,25 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 12 493 | 466 | ||||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 72 557 | 3,42 | 2 687 | 21,59 | ||||

| 2025-07-15 | 13F | FMA Wealth Management, LLC | 10 965 | 32,68 | 406 | 42,46 | ||||

| 2025-05-15 | 13F | National Wealth Management Group, LLC | 9 642 | 0,00 | 304 | -10,88 | ||||

| 2025-07-23 | 13F | Venturi Wealth Management, LLC | 8 000 | 0,00 | 296 | 17,46 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 1 006 | 0,00 | 37 | 19,35 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 1 891 | -39,85 | 70 | -29,29 | ||||

| 2025-08-13 | 13F | Kuhn & Co Investment Counsel | 15 372 | 2,88 | 569 | 21,06 | ||||

| 2025-07-23 | 13F | Valmark Advisers, Inc. | 102 329 | 64,90 | 3 789 | 93,91 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 948 919 | -30,16 | 35 138 | -17,90 | ||||

| 2025-07-10 | 13F | Security National Bank | 11 175 | 0,00 | 414 | 17,33 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 1 082 | 40 | ||||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 1 621 | 0,00 | 60 | 17,65 | ||||

| 2025-08-14 | 13F | Coastal Bridge Advisors, LLC | 10 793 | 0,12 | 400 | 17,70 | ||||

| 2025-07-23 | 13F | InTrack Investment Management Inc | 39 816 | 1 474 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 185 403 | 10 263,50 | 6 865 | 10 796,83 | ||||

| 2025-07-25 | 13F | Gibson Capital, LLC | 16 230 | 0,00 | 601 | 17,61 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 5 308 | 90,52 | 197 | 125,29 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 641 | 75,62 | 24 | 109,09 | ||||

| 2025-08-14 | 13F | LaSalle St. Investment Advisors, LLC | 13 775 | -2,73 | 1 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 250 | 0,00 | 9 | 28,57 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 5 969 | -17,56 | 211 | -7,46 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 440 | 0,00 | 16 | 23,08 | ||||

| 2025-07-10 | 13F | Sovran Advisors, LLC | 26 496 | 162,47 | 980 | 226,33 | ||||

| 2025-07-16 | 13F | Castleview Partners, Llc | 92 003 | 3 407 | ||||||

| 2025-08-06 | 13F | New Millennium Group LLC | 0 | 0 | ||||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 1 836 582 | 47,64 | 68 009 | 73,56 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 9 313 | -1,64 | 345 | 15,44 |