Statistiques de base

| Propriétaires institutionnels | 144 total, 144 long only, 0 short only, 0 long/short - change of 6,62% MRQ |

| Allocation moyenne du portefeuille | 0.4807 % - change of 8,62% MRQ |

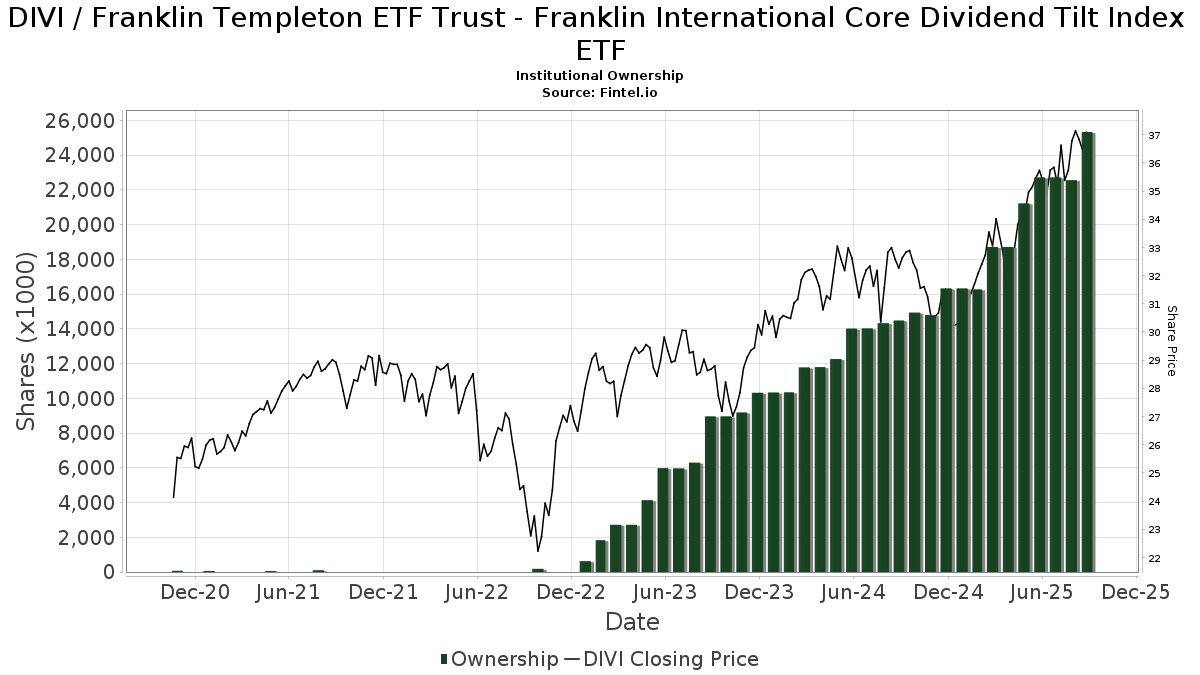

| Actions institutionnelles (Long) | 25 335 825 (ex 13D/G) - change of 2,58MM shares 11,34% MRQ |

| Valeur institutionnelle (Long) | $ 782 787 USD ($1000) |

Participation institutionnels et actionnaires

Franklin Templeton ETF Trust - Franklin International Core Dividend Tilt Index ETF (US:DIVI) détient 144 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 25,335,825 actions. Les principaux actionnaires incluent Retirement Planning Group, LPL Financial LLC, Bank Of America Corp /de/, Capital Analysts, Inc., Legacy Financial Advisors, Inc., Cwm, Llc, Raymond James Financial Inc, Northwestern Mutual Wealth Management Co, GWM Advisors LLC, and Baron Wealth Management LLC .

Franklin Templeton ETF Trust - Franklin International Core Dividend Tilt Index ETF (ARCA:DIVI) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 8, 2025 is 37,18 / share. Previously, on September 9, 2024, the share price was 32,30 / share. This represents an increase of 15,11% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 140 173 | 0,00 | 4 996 | 9,35 | ||||

| 2025-07-16 | 13F/A | CX Institutional | 23 254 | -6,14 | 1 | |||||

| 2025-07-18 | 13F | Powers Advisory Group, LLC | 30 329 | 55,58 | 1 081 | 70,08 | ||||

| 2025-07-15 | 13F | Burns Matteson Capital Management, LLC | 8 100 | -3,77 | 289 | 5,11 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 3 905 450 | 3,69 | 139 190 | 13,40 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 70 | 0,00 | 2 | 0,00 | ||||

| 2025-07-31 | 13F | Sage Mountain Advisors LLC | 379 | 0,00 | 14 | 8,33 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 1 519 906 | 138,40 | 54 169 | 160,72 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 53 544 | 12,05 | 2 | 0,00 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 830 491 | 17,00 | 30 | 26,09 | ||||

| 2025-07-24 | 13F | Ridgeline Wealth Planning, LLC | 111 469 | 7,62 | 3 973 | 17,69 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 6 773 | 6,91 | 241 | 16,99 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 23 157 | 350,09 | 825 | 391,07 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 54 281 | -49,33 | 1 935 | -44,60 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 121 | 1,68 | 4 | 33,33 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 5 813 | -19,92 | 207 | -12,29 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 6 765 | -6,46 | 241 | 1,69 | ||||

| 2025-08-14 | 13F | Fmr Llc | 5 529 | 120,89 | 197 | 143,21 | ||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 26 473 | 0,00 | 943 | 9,40 | ||||

| 2025-07-17 | 13F | Kelly Financial Services LLC | 47 719 | 1 701 | ||||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 622 | -88,19 | 22 | -87,13 | ||||

| 2025-07-09 | 13F | Baron Wealth Management LLC | 678 704 | 93,77 | 24 189 | 111,91 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 1 224 | 44 | ||||||

| 2025-08-11 | 13F | Tidemark, LLC | 4 559 | 59,85 | 162 | 76,09 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 120 073 | 57,67 | 4 277 | 71,04 | ||||

| 2025-08-25 | 13F | Silverlake Wealth Management Llc | 21 787 | 12,55 | 776 | 23,17 | ||||

| 2025-08-07 | 13F | LOM Asset Management Ltd | 7 155 | 0 | ||||||

| 2025-04-28 | 13F | Rosenberg Matthew Hamilton | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 174 616 | -11,66 | 6 | 0,00 | ||||

| 2025-08-13 | 13F | StoneX Group Inc. | 6 665 | 238 | ||||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 6 934 | 247 | ||||||

| 2025-08-11 | 13F | Cascade Wealth Advisors, Inc | 7 720 | 280 | ||||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 715 | 0,00 | 25 | 8,70 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 7 488 | 5,30 | 267 | 15,15 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 200 | 0,00 | 7 | 16,67 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 734 473 | 30,07 | 26 177 | 42,25 | ||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Titleist Asset Management, Llc | 20 548 | -20,92 | 732 | -13,48 | ||||

| 2025-05-06 | 13F | PFG Advisors | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 14 395 | 23,36 | 513 | 35,00 | ||||

| 2025-08-14 | 13F | Visionary Wealth Advisors | 81 671 | 2 911 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 288 | 28 700,00 | 10 | |||||

| 2025-08-14 | 13F | Stifel Financial Corp | 242 446 | 18,89 | 8 641 | 30,02 | ||||

| 2025-08-04 | 13F | Savvy Advisors, Inc. | 13 146 | -2,81 | 469 | 6,36 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 6 164 | 220 | ||||||

| 2025-08-07 | 13F | Winch Advisory Services, LLC | 246 | 0,00 | 9 | 0,00 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 5 842 | 205 | ||||||

| 2025-07-17 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 6 157 | 0,00 | 219 | 9,50 | ||||

| 2025-08-11 | 13F | Ritter Daniher Financial Advisory LLC / DE | 2 | 0 | ||||||

| 2025-07-22 | 13F | Integrated Capital Management, LLC | 303 380 | 5,50 | 11 | 11,11 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 24 781 | 22,14 | 883 | 33,59 | ||||

| 2025-07-29 | 13F | Fundamentun, Llc | 15 964 | 569 | ||||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 8 244 | 1,80 | 294 | 11,41 | ||||

| 2025-08-08 | 13F | Empower Advisory Group, LLC | 11 489 | 0,00 | 409 | 9,36 | ||||

| 2025-08-11 | 13F | Slagle Financial, LLC | 37 316 | 17,05 | 1 330 | 28,03 | ||||

| 2025-07-29 | 13F | Goldstein Advisors, LLC | 16 796 | -0,55 | 599 | 8,73 | ||||

| 2025-07-16 | 13F | Owen LaRue, LLC | 107 419 | -0,51 | 3 828 | 8,81 | ||||

| 2025-07-31 | 13F | Hartford Financial Management Inc. | 1 946 | -19,52 | 69 | -11,54 | ||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 34 611 | 15,64 | 1 234 | 26,46 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 381 022 | 1,14 | 13 580 | 10,61 | ||||

| 2025-07-16 | 13F | Novem Group | 58 601 | -2,50 | 2 089 | 6,64 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 210 825 | 41,08 | 7 514 | 54,27 | ||||

| 2025-08-14 | 13F | Betterment LLC | 9 397 | -3,89 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 350 | 0,86 | 12 | 9,09 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 752 548 | 35,11 | 26 821 | 47,75 | ||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | CAP Partners, LLC | 19 468 | 6,45 | 694 | 16,28 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 26 107 | 3,44 | 930 | 13,14 | ||||

| 2025-07-25 | 13F | Evolution Advisers, Inc. | 2 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 91 711 | 79,71 | 3 269 | 96,63 | ||||

| 2025-07-28 | 13F | RFG Advisory, LLC | 30 441 | 19,17 | 1 085 | 30,29 | ||||

| 2025-07-17 | 13F | Prepared Retirement Institute LLC | 114 223 | 1,24 | 4 071 | 10,72 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 56 240 | 99,33 | 2 004 | 118,06 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 683 764 | 3,83 | 24 369 | 13,55 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 874 | 31 | ||||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 959 | 0,00 | 34 | 9,68 | ||||

| 2025-08-13 | 13F | Royal Fund Management, LLC | 16 083 | -1,06 | 573 | 8,32 | ||||

| 2025-05-13 | 13F | UBS Group AG | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Whitaker-Myers Wealth Managers, LTD. | 22 018 | 9,44 | 785 | 19,69 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 3 608 | -3,24 | 129 | 15,32 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 24 882 | 14,91 | 887 | 25,67 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 7 926 | -0,60 | 282 | 8,88 | ||||

| 2025-07-29 | 13F | LMG Wealth Partners, LLC | 249 684 | 2,31 | 8 899 | 11,88 | ||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 12 167 | 1,82 | 432 | 11,95 | ||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 131 978 | -38,81 | 5 | -42,86 | ||||

| 2025-07-11 | 13F | OxenFree Capital LLC | 47 594 | 0,03 | 1 696 | 10,78 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 69 655 | 6,12 | 2 482 | 16,04 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 250 | 0,00 | 9 | 0,00 | ||||

| 2025-07-02 | 13F | HBW Advisory Services LLC | 45 253 | 230,80 | 1 613 | 262,25 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 250 | 0,00 | 9 | 0,00 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 70 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 20 616 | 96,03 | 734 | 113,99 | ||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 353 793 | 14,01 | 12 609 | 24,68 | ||||

| 2025-08-27 | 13F | Barnes Wealth Management Group, Inc | 7 759 | -2,22 | 277 | 6,98 | ||||

| 2025-07-30 | 13F | Castle Wealth Management Llc | 127 160 | 2,09 | 4 532 | 11,63 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 107 454 | 6,16 | 3 830 | 16,10 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 261 023 | 46,17 | 9 303 | 59,86 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 65 452 | -32,04 | 2 | -33,33 | ||||

| 2025-07-09 | 13F | Defined Wealth Management, Llc | 119 474 | -1,28 | 4 258 | 7,96 | ||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 1 592 | 57 | ||||||

| 2025-08-07 | 13F | AllGen Financial Advisors, Inc. | 303 123 | 10 803 | ||||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 3 010 | 0,00 | 107 | 9,18 | ||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Midwest Financial Group LLC | 34 511 | 94,26 | 1 230 | 112,63 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 1 208 | 1 489,47 | 43 | 2 050,00 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 45 903 | 0,04 | 1 636 | 9,36 | ||||

| 2025-08-12 | 13F | Absolute Capital Management, LLC | 45 000 | 0,00 | 1 604 | 9,35 | ||||

| 2025-06-11 | 13F | Fortitude Financial, LLC | 29 225 | 0,00 | 952 | 8,55 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 136 352 | 8,50 | 4 860 | 18,66 | ||||

| 2025-07-16 | 13F | Meridian Financial, LLC | 11 714 | 9,04 | 417 | 19,14 | ||||

| 2025-07-14 | 13F | Southland Equity Partners LLC | 40 423 | 6,45 | 1 441 | 16,41 | ||||

| 2025-04-28 | 13F | Financial Advocates Investment Management | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 117 339 | -29,23 | 4 | -20,00 | ||||

| 2025-07-23 | 13F | TriaGen Wealth Management LLC | 468 136 | 13,33 | 16 684 | 23,93 | ||||

| 2025-04-21 | 13F | Envestnet Portfolio Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-04-28 | 13F | Smart Money Group LLC | 0 | -100,00 | 0 | |||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 1 316 | 0,00 | 47 | 9,52 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 106 332 | 0,83 | 3 859 | 9,20 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 97 106 | -34,76 | 3 461 | -28,66 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 1 335 749 | 116,33 | 48 | 135,00 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 636 711 | 9,51 | 22 692 | 19,76 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 391 | 14 | ||||||

| 2025-08-05 | 13F | Sigma Planning Corp | 5 943 | 212 | ||||||

| 2025-08-28 | NP | AAMAX - Absolute Capital Asset Allocator Fund Class A Shares | 45 000 | 0,00 | 1 604 | 9,35 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 8 228 | 293 | ||||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 45 886 | 1,38 | 1 495 | 10,09 | ||||

| 2025-08-05 | 13F | BCGM Wealth Management, LLC | 12 610 | -88,09 | 449 | -86,99 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 73 294 | 661,10 | 2 612 | 734,50 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 449 890 | 10,18 | 16 034 | 20,49 | ||||

| 2025-07-30 | 13F | Retirement Planning Group | 4 475 833 | 5,09 | 159 519 | 14,93 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 59 880 | 0,44 | 2 134 | 9,89 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 226 501 | 14,61 | 8 072 | 25,34 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 432 808 | -15,70 | 15 425 | -7,81 | ||||

| 2025-08-15 | 13F | Koesten, Hirschmann & Crabtree, INC. | 20 | 0,00 | 1 | |||||

| 2025-08-07 | 13F | Legacy Financial Advisors, Inc. | 877 208 | 2,02 | 31 264 | 11,56 | ||||

| 2025-07-03 | 13F | First Hawaiian Bank | 139 987 | 41,79 | 4 989 | 55,08 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 1 963 | 70 | ||||||

| 2025-08-04 | 13F | Flagship Harbor Advisors, Llc | 404 307 | -0,39 | 14 409 | 8,93 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 228 842 | -74,01 | 8 | -71,43 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 141 930 | 99,58 | 5 058 | 116,62 | ||||

| 2025-08-15 | 13F | Cornerstone Financial Group, LLC /NE/ | 7 441 | 0,45 | 265 | 4,33 | ||||

| 2025-08-14 | 13F | Comerica Bank | 2 960 | -9,40 | 105 | -0,94 | ||||

| 2025-08-08 | 13F | Emerald Investment Partners, Llc | 5 276 | 1,00 | 188 | 10,59 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 187 | 1,80 | 42 | 10,53 | ||||

| 2025-08-12 | 13F | Vickerman Investment Advisors, Inc. | 354 086 | 6,80 | 12 620 | 16,79 | ||||

| 2025-08-26 | NP | FTRAX - Franklin LifeSmart Retirement Income Fund CLASS A | 40 500 | -1,70 | 1 443 | 7,53 | ||||

| 2025-08-14 | 13F | Clark Capital Management Group, Inc. | 26 113 | 0,00 | 931 | 9,28 | ||||

| 2025-08-15 | 13F/A | MONECO Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-23 | 13F | Godsey & Gibb Associates | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 19 296 | 0,07 | 688 | 9,39 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 40 966 | -1,75 | 1 460 | 7,51 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 38 217 | -0,26 | 1 362 | 9,05 | ||||

| 2025-08-07 | 13F | Blackston Financial Advisory Group, LLC | 10 550 | -9,32 | 376 | -0,79 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 85 | 0,00 | 3 | 0,00 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 87 614 | 3 |