Statistiques de base

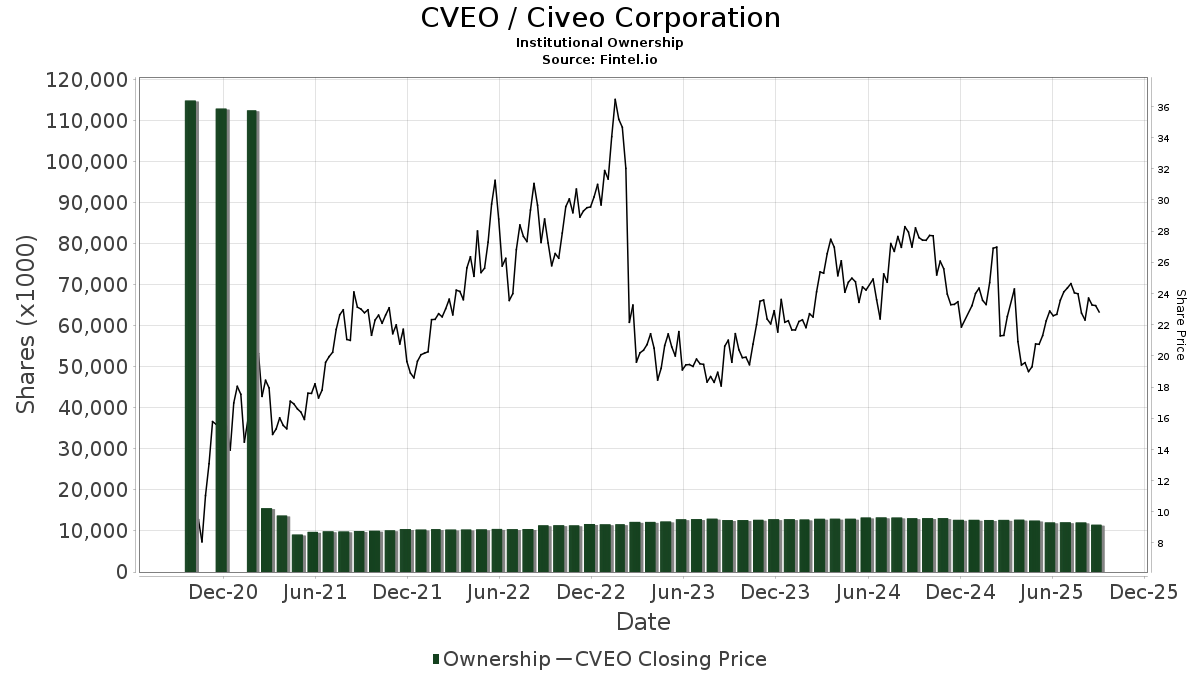

| Actions institutionnelles (Long) | 11 514 928 - 91,74% (ex 13D/G) - change of -0,56MM shares -4,61% MRQ |

| Valeur institutionnelle (Long) | $ 260 597 USD ($1000) |

Participation institutionnels et actionnaires

Civeo Corporation (US:CVEO) détient 138 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 11,514,928 actions. Les principaux actionnaires incluent Horizon Kinetics Asset Management Llc, Engine Capital Management, LP, FLPSX - Fidelity Low-Priced Stock Fund, Tcw Group Inc, Dimensional Fund Advisors Lp, Renaissance Technologies Llc, KINETICS PORTFOLIOS TRUST - Kinetics Small Cap Portfolio, American Century Companies Inc, AVUV - Avantis U.S. Small Cap Value ETF, and Blue Owl Capital Holdings LP .

Civeo Corporation (NYSE:CVEO) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 10, 2025 is 23,22 / share. Previously, on September 11, 2024, the share price was 26,98 / share. This represents a decline of 13,94% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

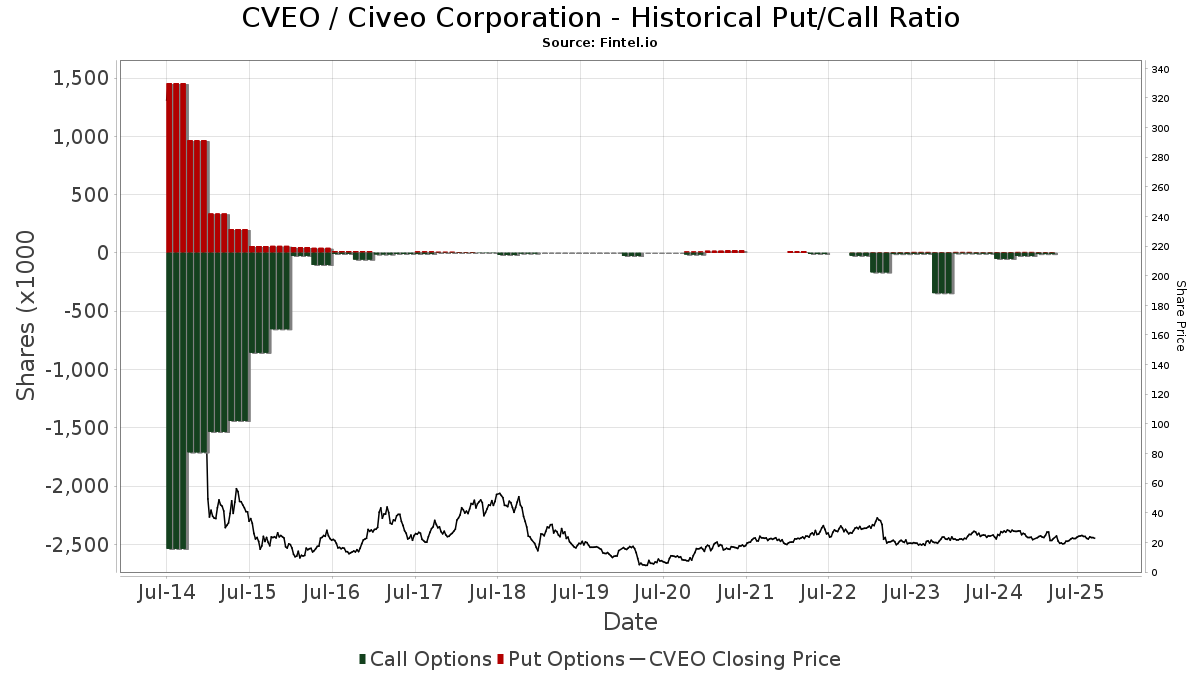

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13D/G

Nous présentons les dépôts 13D/G séparément des dépôts 13F en raison de leur traitement différent par la SEC. Les déclarations 13D/G peuvent être déposées par des groupes d'investisseurs (avec un leader), ce qui n'est pas le cas des déclarations 13F. Il en résulte des situations dans lesquelles un investisseur peut déposer une déclaration 13D/G indiquant une valeur pour le total des actions (représentant toutes les actions détenues par le groupe d'investisseurs), mais déposer ensuite une déclaration 13F indiquant une valeur différente pour le total des actions (représentant strictement ses propres actions). Cela signifie que l'actionnariat des déclarations 13D/G et des déclarations 13F n'est souvent pas directement comparable, c'est pourquoi nous les présentons séparément.

Note : À compter du 16 mai 2021, nous n'affichons plus les propriétaires qui n'ont pas déposé de déclaration 13D/G au cours de l'année écoulée. Auparavant, nous montrions l'historique complet des déclarations 13D/G. En général, les entités qui sont tenues de déposer des déclarations 13D/G doivent le faire au moins une fois par an avant de soumettre une déclaration de clôture. Cependant, il arrive que des fonds sortent de positions sans soumettre de déclaration de clôture (c'est-à-dire qu'ils procèdent à une liquidation), de sorte que l'affichage de l'historique complet pouvait prêter à confusion quant à l'actionnariat actuel. Pour éviter toute confusion, nous n'affichons désormais que les propriétaires "actuels", c'est-à-dire les propriétaires qui ont déposé des documents au cours de l'année écoulée.

Upgrade to unlock premium data.

| Date de dépôt | Formulaire | Investisseur | Actions précédentes |

Actions actuelles |

&Delta ; Actions (Pourcentage) |

Participation (Pourcentage) |

&Delta ; Participation (Pourcentage) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-08-05 | M Partners Fund LP | 679,447 | 666,717 | -1.87 | 5.31 | 7.71 | ||

| 2025-06-18 | ENGINE CAPITAL, L.P. | 1,338,114 | 1,338,114 | 0.00 | 9.90 | 1.02 | ||

| 2025-03-07 | FMR LLC | 704,037 | 2,200 | -99.69 | 0.00 | -100.00 | ||

| 2025-02-13 | HORIZON KINETICS ASSET MANAGEMENT LLC | 3,734,335 | 3,064,019 | -17.95 | 22.30 | -11.86 |

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

Other Listings

| DE:44C1 | 19,00 € |