Statistiques de base

| Propriétaires institutionnels | 123 total, 122 long only, 0 short only, 1 long/short - change of 12,84% MRQ |

| Allocation moyenne du portefeuille | 1.1381 % - change of -5,98% MRQ |

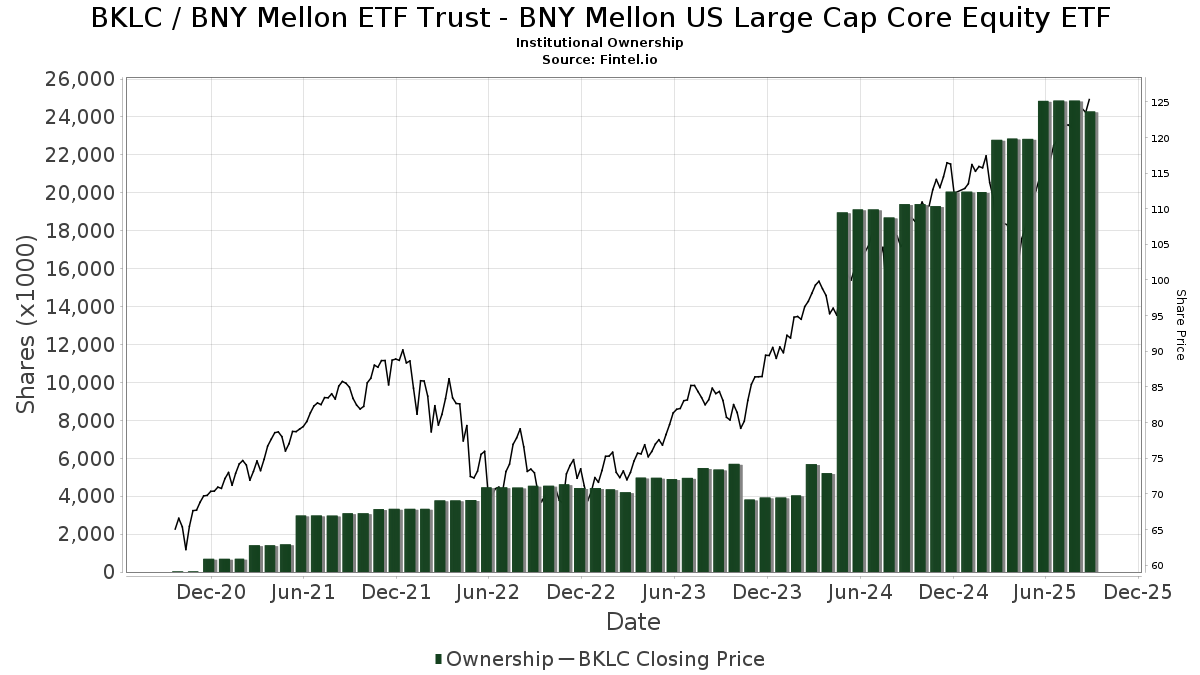

| Actions institutionnelles (Long) | 24 293 265 (ex 13D/G) - change of -0,56MM shares -2,24% MRQ |

| Valeur institutionnelle (Long) | $ 2 867 222 USD ($1000) |

Participation institutionnels et actionnaires

BNY Mellon ETF Trust - BNY Mellon US Large Cap Core Equity ETF (US:BKLC) détient 123 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 24,293,265 actions. Les principaux actionnaires incluent RPOA Advisors, Inc., Integrated Wealth Concepts LLC, Bank of New York Mellon Corp, Sentinel Pension Advisors Inc, RAA - SMI 3Fourteen Real Asset Allocation ETF SMI 3Fourteen REAL Asset Allocation ETF, Stadion Money Management, LLC, Toroso Investments, LLC, GM Advisory Group, Inc., Ameriprise Financial Inc, and Northwestern Mutual Wealth Management Co .

BNY Mellon ETF Trust - BNY Mellon US Large Cap Core Equity ETF (ARCA:BKLC) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 10, 2025 is 125,32 / share. Previously, on September 11, 2024, the share price was 105,32 / share. This represents an increase of 18,99% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

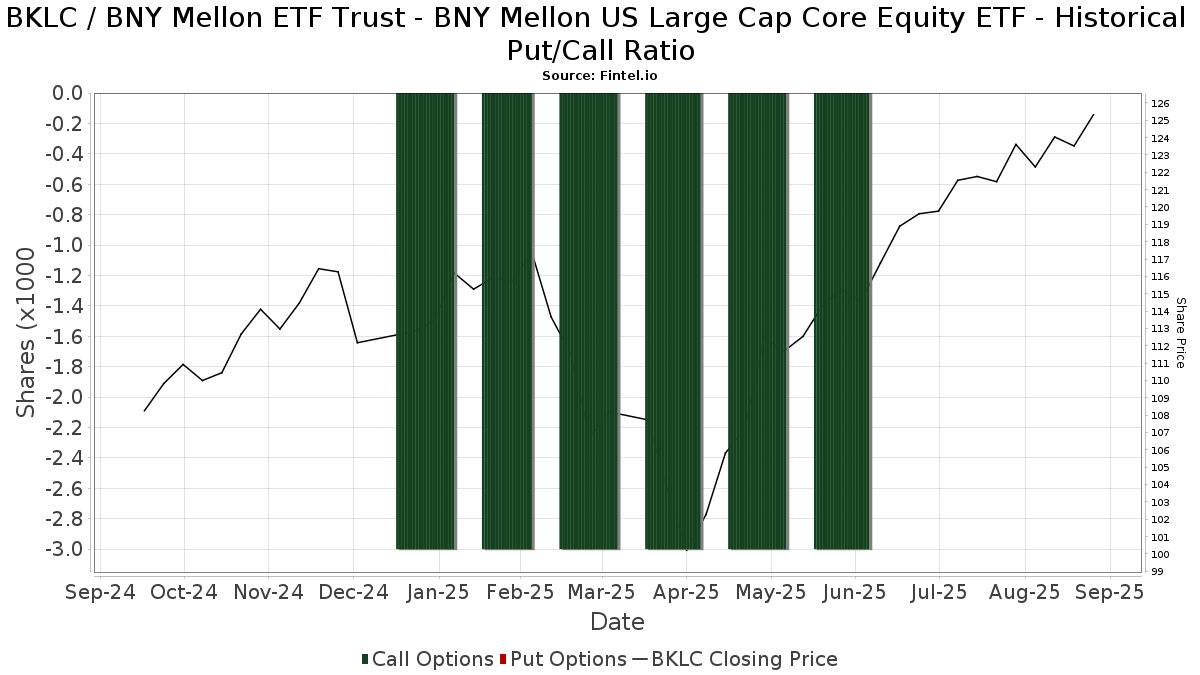

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 112 192 | 539,09 | 13 287 | 612,00 | ||||

| 2025-08-29 | NP | RAA - SMI 3Fourteen Real Asset Allocation ETF SMI 3Fourteen REAL Asset Allocation ETF | 808 422 | 8,01 | 95 741 | 20,32 | ||||

| 2025-07-09 | 13F | WealthCare Investment Partners, LLC | 2 848 | 0,00 | 342 | 22,22 | ||||

| 2025-08-12 | 13F | Quadcap Wealth Management, LLC | 5 604 | 0,11 | 664 | 11,43 | ||||

| 2025-07-25 | 13F | Concord Wealth Partners | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 179 103 | 335,02 | 21 211 | 384,60 | ||||

| 2025-05-05 | 13F | Transce3nd, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Mariner, LLC | 2 645 | -45,69 | 313 | -39,46 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 50 | 0,00 | 6 | 0,00 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | CFS Investment Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 307 822 | 12,69 | 36 455 | 25,53 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 21 406 | 106,03 | 2 535 | 129,62 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 1 857 | 44,51 | 220 | 61,03 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 56 685 | 4,20 | 6 713 | 16,08 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 375 | 13,64 | 0 | |||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 2 482 | -17,46 | 294 | -8,15 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 1 798 063 | -40,91 | 212 945 | -34,18 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 5 270 | 0,00 | 624 | 11,43 | ||||

| 2025-08-12 | 13F | DiMeo Schneider & Associates, L.L.C. | 2 495 | 0,00 | 295 | 11,32 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 8 139 | 45,08 | 1 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 34 196 | -7,28 | 4 050 | 3,26 | ||||

| 2025-07-29 | 13F | Pinnacle Wealth Management, LLC | 4 983 | -4,65 | 590 | 6,31 | ||||

| 2025-07-16 | 13F | Wealth Group Ltd | 13 534 | 1 603 | ||||||

| 2025-07-23 | 13F | REAP Financial Group, LLC | 760 | 0,00 | 90 | 12,50 | ||||

| 2025-07-10 | 13F | Kmg Fiduciary Partners, Llc | 67 389 | 4,40 | 7 981 | 16,28 | ||||

| 2025-07-24 | 13F | Stiles Financial Services Inc | 27 469 | -22,64 | 3 254 | -13,85 | ||||

| 2025-07-29 | 13F | Crux Wealth Advisors | 60 473 | 113,31 | 7 162 | 137,59 | ||||

| 2025-07-15 | 13F | Define Financial, Llc | 1 703 | 202 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 1 814 | 215 | ||||||

| 2025-08-01 | NP | Advisors Preferred Trust - Dynamic Alpha Macro Fund Institutional Class Shares | 89 643 | 0,00 | 10 616 | 11,40 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 1 905 | 0,00 | 226 | 11,39 | ||||

| 2025-08-11 | 13F | Goodman Financial Corp | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Empower Advisory Group, LLC | 2 310 | 274 | ||||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 56 607 | 70,43 | 6 704 | 89,83 | ||||

| 2025-08-01 | 13F | Zhang Financial LLC | 305 121 | 8,15 | 36 136 | 20,47 | ||||

| 2025-08-08 | 13F | Compass Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 4 105 | 3,45 | 486 | 15,44 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 2 377 | -96,94 | 285 | -96,55 | ||||

| 2025-05-13 | 13F | Neuberger Berman Group LLC | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Single Point Partners, LLC | 9 037 | 1 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 41 | 0 | ||||||

| 2025-07-29 | 13F | BKD Wealth Advisors, LLC | 2 079 | 246 | ||||||

| 2025-07-29 | 13F | Woodard & Co Asset Management Group Inc /adv | 230 107 | 2 868,74 | 27 252 | 3 207,16 | ||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 7 874 | 932 | ||||||

| 2025-04-10 | 13F | Retireful, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Lantern Wealth Advisors, LLC | 5 822 | 89,52 | 690 | 100,29 | ||||

| 2025-05-15 | 13F | GWM Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 74 631 | 62,25 | 8 839 | 80,74 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 2 427 445 | 11,76 | 287 482 | 24,48 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 132 111 | -10,04 | 15 646 | 0,20 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 364 511 | 5,38 | 43 169 | 17,38 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 9 | 1 | ||||||

| 2025-04-23 | 13F | Win Advisors, Inc | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 11 060 | -16,11 | 1 327 | -5,35 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 181 577 | -45,71 | 21 504 | -39,53 | ||||

| 2025-08-14 | 13F | UBS Group AG | 78 070 | 6,25 | 9 246 | 18,36 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 97 978 | -2,46 | 11 604 | 8,65 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 16 | 0,00 | 2 | 0,00 | ||||

| 2025-08-11 | 13F | FSA Wealth Management LLC | 316 | 37 | ||||||

| 2025-08-14 | 13F | Fort Point Capital Partners LLC | 11 735 | 0,70 | 1 390 | 12,20 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 24 868 | 58,26 | 3 | 100,00 | ||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 2 330 | 0,00 | 276 | 11,34 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 3 603 | 34,79 | 427 | 50,00 | ||||

| 2025-07-03 | 13F | Collective Family Office Llc | 11 657 | 8,05 | 1 381 | 20,31 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 364 | -11,86 | 43 | 0,00 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 2 443 | -31,01 | 289 | -23,14 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 1 968 | -61,05 | 233 | -56,61 | ||||

| 2025-05-15 | 13F | DZ BANK AG Deutsche Zentral Genossenschafts Bank, Frankfurt am Main | 0 | -100,00 | 0 | |||||

| 2025-06-27 | NP | DUBS - Aptus Large Cap Enhanced Yield ETF | 57 414 | 8,79 | 6 074 | -0,30 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 163 741 | 3,74 | 19 393 | 15,55 | ||||

| 2025-07-29 | NP | EBI - Longview Advantage ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 150 | 0,00 | 18 | 21,43 | ||||

| 2025-08-14 | 13F | Fmr Llc | 14 719 | 250,20 | 1 743 | 290,81 | ||||

| 2025-07-17 | 13F | David Kennon Inc | 18 779 | 2,96 | 2 224 | 14,65 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 1 840 | 218 | ||||||

| 2025-07-15 | 13F | Retirement Income Solutions, Inc | 7 460 | 0,00 | 883 | 11,35 | ||||

| 2025-08-12 | 13F | Wealthbridge Capital Management, Llc | 140 671 | 6,33 | 16 660 | 18,43 | ||||

| 2025-05-13 | 13F | Watchman Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 350 | 0,00 | 41 | 10,81 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 4 229 | -0,94 | 501 | 4,60 | ||||

| 2025-07-14 | 13F | Sentinel Pension Advisors Inc | 852 649 | 2,00 | 100 979 | 13,62 | ||||

| 2025-08-15 | 13F/A | Symphony Financial, Ltd. Co. | 22 164 | 2 635 | ||||||

| 2025-08-14 | 13F | Principia Wealth Advisory, LLC | 13 521 | 1 601 | ||||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 9 230 | 1 093 | ||||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 553 746 | -12,73 | 65 395 | -3,06 | ||||

| 2025-08-14 | 13F | Herold Advisors, Inc. | 14 526 | -17,23 | 1 720 | -7,77 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 2 337 | 16,04 | 0 | |||||

| 2025-08-08 | 13F | Cornerstone Advisors Asset Management, Inc | 14 300 | 0,00 | 1 694 | 11,38 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 6 592 | -1,36 | 781 | 9,86 | ||||

| 2025-07-29 | 13F | RPOA Advisors, Inc. | 12 726 372 | -2,40 | 1 507 184 | 8,72 | ||||

| 2025-08-04 | 13F | JDM Financial Group LLC | 235 158 | 10,22 | 27 850 | 22,78 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 3 009 | 356 | ||||||

| 2025-06-30 | NP | SMIDX - SMI Dynamic Allocation Fund | 8 460 | 895 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 110 223 | 275,36 | 13 054 | 318,10 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 195 | 0,00 | 23 | 15,00 | ||||

| 2025-08-13 | 13F | Wills Financial Group LLC | 1 700 | -15,30 | 201 | -5,63 | ||||

| 2025-08-08 | 13F | Accredited Investors Inc. | 1 946 | 230 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 5 040 | 26,16 | 597 | 40,47 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 8 | 0,00 | 1 | |||||

| 2025-07-29 | 13F | ShoreHaven Wealth Partners, LLC | 4 020 | -3,55 | 476 | 7,45 | ||||

| 2025-08-07 | 13F | Wealth Forward, LLC | 20 232 | -0,08 | 2 396 | 11,34 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 166 | 0,00 | 20 | 11,76 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-13 | 13F | Prime Capital Investment Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Carolina Wealth Advisors, LLC | 894 | 106 | ||||||

| 2025-08-05 | 13F | Advisors Preferred, LLC | 89 643 | 0,00 | 10 607 | 10,57 | ||||

| 2025-07-22 | 13F | Duncan Williams Asset Management, LLC | 3 152 | 373 | ||||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 16 918 | 7,36 | 2 004 | 19,58 | ||||

| 2025-08-01 | 13F | Transcend Wealth Collective, Llc | 2 010 | 0,00 | 238 | 11,74 | ||||

| 2025-05-14 | 13F | Hill Investment Group Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Key FInancial Inc | 139 | 0,00 | 16 | 14,29 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 6 421 | 0,34 | 760 | 11,76 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 12 712 | 81,70 | 2 | |||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 276 | 33 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 63 259 | 139,90 | 7 492 | 167,25 | ||||

| 2025-07-22 | 13F | Kickstand Ventures, Llc. | 3 152 | -5,15 | 373 | 5,67 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 3 556 | 0,28 | 421 | 11,67 | ||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 7 869 | -0,54 | 932 | 10,70 | ||||

| 2025-07-17 | 13F | One Wealth Advisors, LLC | 3 347 | 19,62 | 396 | 33,33 | ||||

| 2025-08-14 | 13F | Betterment LLC | 4 120 | -30,63 | 0 | |||||

| 2025-08-14 | 13F | Stadion Money Management, LLC | 728 410 | -6,40 | 86 027 | 3,97 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 14 746 | -46,78 | 1 746 | -40,73 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 617 | 26,43 | 73 | 35,19 | ||||

| 2025-08-04 | 13F | Mayflower Financial Advisors, LLC | 4 248 | 5,78 | 503 | 18,08 | ||||

| 2025-08-07 | 13F | BOK Financial Private Wealth, Inc. | 1 905 | 0,00 | 226 | 11,39 | ||||

| 2025-06-30 | NP | SMILX - SMI 50/40/10 Fund | 2 470 | 261 | ||||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Call | 3 600 | 9,09 | 426 | 21,71 | |||

| 2025-07-17 | 13F | Clear Point Advisors Inc. | 3 058 | 12,55 | 362 | 25,69 | ||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Put | 100 | 12 | |||||

| 2025-04-29 | 13F | Resources Investment Advisors, LLC. | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Sigma Planning Corp | 14 876 | 1 762 | ||||||

| 2025-08-13 | 13F | GM Advisory Group, Inc. | 452 842 | 8,46 | 53 630 | 20,81 | ||||

| 2025-08-14 | 13F | Dean, Jacobson Financial Services, LLC | 3 646 | 432 | ||||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 5 323 | 4,03 | 630 | 15,81 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 2 492 | -68,12 | 295 | -64,50 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 958 | -53,15 | 232 | -47,97 | ||||

| 2025-08-11 | 13F | Trajan Wealth LLC | 0 | -100,00 | 0 | |||||

| 2025-05-09 | 13F | Belvedere Trading LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-31 | 13F | GenTrust, LLC | 35 370 | 842,95 | 4 189 | 952,26 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 16 022 | 1 951 | ||||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 10 768 | 1 | ||||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 90 600 | 10 730 | ||||||

| 2025-05-02 | 13F | Wealthfront Advisers Llc | 0 | -100,00 | 0 | -100,00 |