Statistiques de base

| Propriétaires institutionnels | 197 total, 186 long only, 1 short only, 10 long/short - change of 6,42% MRQ |

| Allocation moyenne du portefeuille | 0.2490 % - change of 10,96% MRQ |

| Actions institutionnelles (Long) | 17 560 802 (ex 13D/G) - change of -1,40MM shares -7,40% MRQ |

| Valeur institutionnelle (Long) | $ 284 473 USD ($1000) |

Participation institutionnels et actionnaires

ProShares Trust - ProShares Bitcoin ETF (US:BITO) détient 197 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 17,560,802 actions. Les principaux actionnaires incluent Acorns Advisers, LLC, Citadel Advisors Llc, Graham Capital Management, L.P., Jane Street Group, Llc, Goldman Sachs Group Inc, Susquehanna International Group, Llp, Citadel Advisors Llc, Jane Street Group, Llc, Susquehanna International Group, Llp, and Susquehanna International Group, Llp .

ProShares Trust - ProShares Bitcoin ETF (ARCA:BITO) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 10, 2025 is 19,58 / share. Previously, on September 11, 2024, the share price was 17,47 / share. This represents an increase of 12,08% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

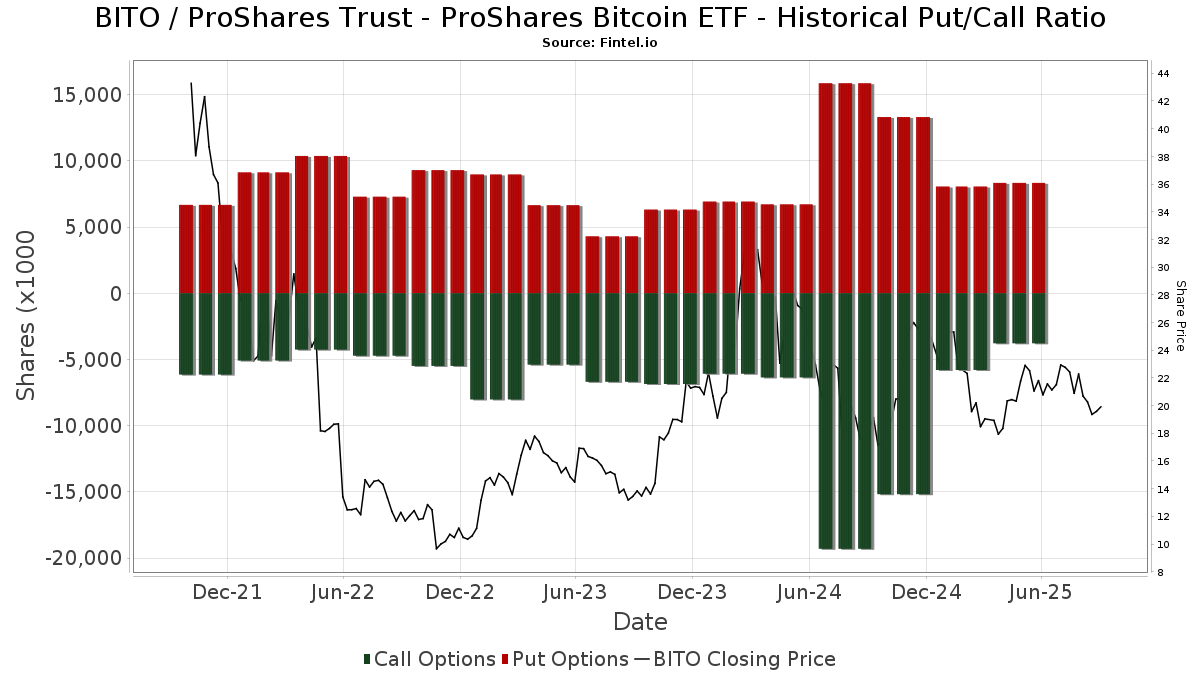

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 15 779 | 11,10 | 339 | 30,38 | ||||

| 2025-08-14 | 13F | Coastal Bridge Advisors, LLC | 9 961 | 214 | ||||||

| 2025-05-14 | 13F | HAP Trading, LLC | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-04 | 13F | Prairie Wealth Advisors, Inc. | 12 694 | 273 | ||||||

| 2025-05-08 | 13F | Altiora Financial Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Cannon Advisors, Inc. | 25 322 | 8,21 | 545 | 27,10 | ||||

| 2025-04-14 | 13F | IMC-Chicago, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Curio Wealth, Llc | 4 | 300,00 | 0 | |||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 510 712 | -0,44 | 10 985 | -3,88 | ||||

| 2025-05-15 | 13F | Luxor Capital Group, LP | Call | 0 | -100,00 | 0 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 4 | 0 | ||||||

| 2025-07-10 | 13F | Perkins Coie Trust Co | 1 000 | 0,00 | 22 | 16,67 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 18 155 | 9,41 | 391 | 28,71 | ||||

| 2025-08-11 | 13F | Pin Oak Investment Advisors Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Dagco, Inc. | 1 715 | 6,59 | 37 | 24,14 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 28 591 | -2,20 | 615 | 14,77 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 1 142 500 | 8,00 | 24 575 | 26,81 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 944 266 | 8 454,68 | 20 311 | 9 954,95 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 38 008 | -1,31 | 818 | 15,89 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 1 522 200 | -45,22 | 32 743 | -35,69 | |||

| 2025-05-07 | 13F | Vista Private Wealth Partners. LLC | 0 | -100,00 | 0 | |||||

| 2025-04-29 | 13F | Envestnet Asset Management Inc | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 365 | 55,32 | 8 | 75,00 | ||||

| 2025-08-08 | 13F | Davies Financial Advisors, Inc. | 14 615 | 9,81 | 314 | 29,22 | ||||

| 2025-07-18 | 13F | Consolidated Portfolio Review Corp | 14 179 | 18,56 | 305 | 38,81 | ||||

| 2025-05-15 | 13F | DRW Securities, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-07 | 13F/A | Symmetry Investments LP | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-13 | 13F | CMT Capital Markets Trading GmbH | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Millstone Evans Group, LLC | 79 | 0,00 | 2 | 0,00 | ||||

| 2025-07-16 | 13F | ORG Partners LLC | 17 886 | 904,83 | 363 | 1 031,25 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 1 255 | 9,80 | 27 | 30,00 | ||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 400 | 0,00 | 9 | 14,29 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | Call | 32 600 | 0 | |||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 35 260 | 23,83 | 1 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 301 300 | -26,33 | 6 439 | -15,63 | |||

| 2025-05-14 | 13F | Venture Visionary Partners LLC | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 306 800 | 1,59 | 6 556 | 16,34 | |||

| 2025-08-05 | 13F | Huntington National Bank | 15 | 16,67 | ||||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 84 255 | -45,90 | 1 801 | -38,04 | ||||

| 2025-05-08 | 13F | Jefferies Financial Group Inc. | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-07-24 | 13F | Blair William & Co/il | 10 112 | 8,97 | 218 | 27,65 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | Put | 2 499 900 | 0,00 | 53 773 | 17,41 | |||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 33 182 | 387,97 | 743 | 499,19 | ||||

| 2025-07-15 | 13F | Compagnie Lombard Odier SCmA | 578 | 0,00 | 12 | 20,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 3 100 | 422,77 | 67 | 560,00 | ||||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 1 291 | 9,78 | 28 | 28,57 | ||||

| 2025-07-14 | 13F | Abound Wealth Management | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Tcfg Wealth Management, Llc | 12 658 | -67,01 | 272 | -61,25 | ||||

| 2025-08-13 | 13F | Millington Financial Advisors, LLC | 8 874 | 202 | ||||||

| 2025-08-14 | 13F | SIH Partners, LLLP | 91 582 | 1 970 | ||||||

| 2025-07-16 | 13F | Independent Wealth Network Inc. | 20 534 | 70,04 | 442 | 99,55 | ||||

| 2025-08-06 | 13F | Founders Financial Securities Llc | 11 619 | 8,54 | 250 | 13,18 | ||||

| 2025-03-25 | NP | HECO - SPDR Galaxy Hedged Digital Asset Ecosystem ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 9 931 | 214 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 476 | -54,58 | 10 | -47,37 | ||||

| 2025-07-25 | 13F | Means Investment Co., Inc. | 19 726 | 14,89 | 424 | 35,03 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 114 | 2 | ||||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 404 | 0,00 | 9 | 14,29 | ||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 19 433 | 418 | ||||||

| 2025-04-28 | 13F | Strategic Financial Concepts, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 171 | 140,85 | 4 | 200,00 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 10 354 | 71,45 | 223 | 101,82 | ||||

| 2025-05-14 | 13F | Peak6 Llc | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-07-22 | 13F | Carolina Wealth Advisors, LLC | 103 | 2 | ||||||

| 2025-08-14 | 13F/A | Barclays Plc | 33 | -52,86 | 0 | |||||

| 2025-07-14 | 13F | McMahon Financial Advisors, LLC | 197 779 | -3,01 | 4 254 | 13,90 | ||||

| 2025-07-16 | 13F | St Germain D J Co Inc | 941 | 20 | ||||||

| 2025-07-16 | 13F | Crowley Wealth Management, Inc. | 5 | 0,00 | 0 | |||||

| 2025-05-15 | 13F | Optiver Holding B.V. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 227 | 26,82 | 5 | 33,33 | ||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 483 | -80,80 | 0 | |||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 48 874 | 323,63 | 1 051 | 398,10 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 101 | 60,32 | 2 | 100,00 | ||||

| 2025-05-14 | 13F | Venture Visionary Partners LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 66 | 10,00 | 1 | 0,00 | ||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 16 | 0,00 | 0 | |||||

| 2025-08-07 | 13F | Marathon Trading Investment Management LLC | 20 702 | -15,16 | 445 | -0,45 | ||||

| 2025-08-12 | 13F | Jaffetilchin Investment Partners, LLC | 9 931 | 214 | ||||||

| 2025-07-30 | 13F | Brookstone Capital Management | 14 624 | -0,87 | 315 | 16,30 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 51 200 | -0,06 | 1 101 | 17,38 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 200 | -5,21 | 4 | 33,33 | ||||

| 2025-07-18 | 13F | Rogco, Lp | 0 | -100,00 | 0 | |||||

| 2025-06-27 | NP | Tidal Trust II - YieldMax(TM) Dorsey Wright Hybrid 5 Income ETF | 38 560 | 788 | ||||||

| 2025-08-01 | 13F | United Capital Management of KS, Inc. | 13 569 | -12,00 | 292 | 3,19 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 25 612 | 16,35 | 551 | 36,48 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F/A | Interchange Capital Partners, LLC | 14 658 | 3,20 | 315 | 21,15 | ||||

| 2025-07-09 | 13F | Triumph Capital Management | 35 827 | 1,71 | 771 | 19,38 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 4 786 | 219,07 | 103 | 277,78 | ||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 15 000 | 0,00 | 323 | 17,45 | ||||

| 2025-04-25 | 13F | Smallwood Wealth Investment Management, LLC | 1 | 0 | ||||||

| 2025-08-14 | 13F | Integrity Wealth Advisors, Inc. | 16 130 | 34,42 | 347 | 57,99 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 4 845 | 24,42 | 104 | 31,65 | ||||

| 2025-08-08 | 13F | Evolution Wealth Advisors, LLC | 19 800 | 4,31 | 426 | 22,48 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 16 298 | 4,05 | 351 | 22,38 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 6 925 | 23,57 | 0 | |||||

| 2025-05-12 | 13F | Citigroup Inc | 0 | -100,00 | 0 | |||||

| 2025-05-07 | 13F | Stevens Capital Management Lp | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 255 | 0,00 | 5 | 25,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 274 | -74,61 | 6 | -70,00 | ||||

| 2025-08-14 | 13F | Riggs Asset Managment Co. Inc. | 200 | 0,00 | 4 | 33,33 | ||||

| 2025-04-23 | 13F | Financial Life Planners | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 7 608 | 122,59 | 164 | 162,90 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 1 295 500 | -15,64 | 27 866 | -0,95 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 709 431 | 15 260 | ||||||

| 2025-07-30 | 13F | Sanders Morris Harris Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 2 531 800 | 10,92 | 54 459 | 30,23 | |||

| 2025-05-16 | 13F | Legacy Wealth Managment, LLC/ID | Call | 5 | 150,00 | |||||

| 2025-08-05 | 13F | Prosperity Wealth Management, Inc. | 24 487 | -25,03 | 527 | -12,04 | ||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 515 | 0,00 | 11 | 22,22 | ||||

| 2025-05-09 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | Call | 7 900 | -70,63 | 170 | -65,65 | |||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | 1 454 | 145 300,00 | 31 | |||||

| 2025-04-30 | 13F | BCJ Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Paragon Private Wealth Management, LLC | 21 623 | 92,26 | 465 | 125,73 | ||||

| 2025-08-04 | 13F | Roble, Belko & Company, Inc | 117 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 34 025 | 21,52 | 732 | 42,77 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | Put | 60 500 | 16 | |||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | Put | 100 | -97,73 | 2 | -97,50 | |||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 15 656 | -28,97 | 234 | -41,94 | ||||

| 2025-08-13 | 13F | Consultiva Wealth Management, Corp. | 175 | 0,00 | 4 | 0,00 | ||||

| 2025-07-07 | 13F | Kings Path Partners LLC | 7 000 | -30,00 | 151 | -18,03 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 1 305 | 28 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 62 197 | 3,55 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 381 148 | 38,24 | 7 827 | 58,09 | ||||

| 2025-07-16 | 13F | Moisand Fitzgerald Tamayo, LLC | 1 038 | -23,05 | 22 | -8,33 | ||||

| 2025-08-12 | 13F | Bokf, Na | 1 534 | 0,00 | 33 | 14,29 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 704 | -14,67 | 15 | 0,00 | ||||

| 2025-08-13 | 13F | Bare Financial Services, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 550 | 0,00 | 12 | 10,00 | ||||

| 2025-05-13 | 13F | Measured Risk Portfolios, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Activest Wealth Management | 81 | 3,85 | 3 | 50,00 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 9 799 | 211 | ||||||

| 2025-07-23 | 13F | West Paces Advisors Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bluefin Capital Management, Llc | 120 500 | -43,95 | 2 592 | -34,21 | ||||

| 2025-07-24 | 13F | Villere St Denis J & Co Llc | 9 468 | 204 | ||||||

| 2025-08-14 | 13F | Bluefin Capital Management, Llc | Call | 14 900 | 1 | |||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bluefin Capital Management, Llc | Put | 11 400 | 12,87 | 2 | -83,33 | |||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 3 070 | -25,25 | 66 | -12,00 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 9 800 | 211 | ||||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 4 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 157 | -69,28 | 3 | -66,67 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 9 786 | 210 | ||||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 12 212 | -24,69 | 263 | -11,78 | ||||

| 2025-08-04 | 13F | Daymark Wealth Partners, Llc | 9 362 | 201 | ||||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 43 700 | -16,60 | 940 | -2,09 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 118 500 | -11,43 | 2 549 | 3,96 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | 23 312 | -68,32 | 501 | -62,83 | ||||

| 2025-08-13 | 13F | Edgestream Partners, L.P. | 10 814 | 233 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 172 958 | 74,02 | 4 | 200,00 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 206 | 5,42 | 26 | 19,05 | ||||

| 2025-07-15 | 13F | Jeppson Wealth Management, Llc | 15 665 | 2,63 | 337 | 20,43 | ||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 1 325 | 10,05 | 29 | 27,27 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 3 579 | 0,00 | 73 | 9,09 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 156 635 | 16,52 | 3 369 | 36,84 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 16 662 | -39,80 | 351 | -30,77 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 43 317 | -0,83 | 794 | -20,30 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 44 794 | 7,63 | 964 | 26,38 | ||||

| 2025-08-26 | NP | BTGD - STKD Bitcoin & Gold ETF | 341 000 | 43,93 | 7 335 | 68,99 | ||||

| 2025-08-06 | 13F | Legacy Wealth Managment, LLC/ID | 510 712 | -0,08 | 10 985 | 17,31 | ||||

| 2025-07-23 | 13F | Wealth Management Nebraska | 19 335 | 16,29 | 413 | 35,86 | ||||

| 2025-06-23 | 13F | RK Capital Management, LLC/FL | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-03-11 | 13F/A | Elequin Capital Lp | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Kaizen Financial Strategies | 9 310 | 200 | ||||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F/A | CX Institutional | 31 934 | 12,36 | 1 | |||||

| 2025-05-14 | 13F | Caitlin John, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Copia Wealth Management | 1 623 | 0,00 | 35 | 17,24 | ||||

| 2025-08-14 | 13F | MGB Wealth Management, LLC | 11 000 | 237 | ||||||

| 2025-07-14 | 13F | Hoey Investments, Inc | 12 624 | -21,71 | 272 | -8,14 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 2 498 420 | 231,64 | 53 741 | 289,40 | ||||

| 2025-08-04 | 13F | Quaker Wealth Management, LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-07-31 | 13F | Richards, Merrill & Peterson, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 3 107 | 67 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 1 201 400 | 29,43 | 25 842 | 51,98 | |||

| 2025-08-11 | 13F | Heritage Wealth Advisors | 12 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 23 | -94,31 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 314 100 | -54,43 | 6 756 | -46,50 | |||

| 2025-08-01 | 13F | Belvedere Trading LLC | 13 594 | 292 | ||||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Call | 3 900 | -96,22 | 84 | -95,61 | |||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 39 584 | -8,62 | 851 | 7,31 | ||||

| 2025-05-07 | 13F/A | Symmetry Investments LP | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Put | 18 500 | -21,28 | 398 | -7,67 | |||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 1 111 | 15,01 | 24 | 35,29 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 7 476 | 1 451,04 | 161 | 1 900,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 60 004 | 9 834,44 | 1 291 | 11 627,27 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 107 300 | 74,76 | 2 308 | 105,34 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 280 | 4,87 | 6 | 0,00 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | Call | 38 000 | 817 | |||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 1 139 | 24 | ||||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 46 060 | 991 | ||||||

| 2025-07-24 | 13F | Stonebridge Financial Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Change Path, LLC | 10 851 | 233 | ||||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 193 218 | 50,59 | 4 156 | 76,85 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 411 800 | 8 858 | ||||||

| 2025-07-25 | 13F | PrairieView Partners, LLC | 50 | 0,00 | 0 | |||||

| 2025-04-22 | 13F | Castleview Partners, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 2 032 | 9,07 | 0 | |||||

| 2025-05-12 | 13F | Fmr Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ausdal Financial Partners, Inc. | 82 748 | 1 780 | ||||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | Put | 447 600 | -45,35 | 9 628 | -35,84 | |||

| 2025-04-17 | 13F | Precision Wealth Strategies, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-16 | 13F | Arete Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 220 | 5 | ||||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-28 | 13F/A | Lavaca Capital Llc | 985 | 21 | ||||||

| 2025-08-14 | 13F | Comerica Bank | 40 | 0,00 | 1 | |||||

| 2025-08-13 | 13F | Cheviot Value Management, LLC | 0 | 0 | ||||||

| 2025-08-11 | 13F | Greenland Capital Management LP | Call | 200 000 | 0,00 | 4 302 | 17,41 | |||

| 2025-05-15 | 13F | J. Goldman & Co LP | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-07-18 | 13F | PFG Investments, LLC | 43 380 | 0,73 | 933 | 18,40 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 1 404 | 30 | ||||||

| 2025-04-22 | 13F | Jfs Wealth Advisors, Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 13 974 | -65,04 | 301 | -59,02 | ||||

| 2025-05-15 | 13F | Gordian Capital Singapore Pte Ltd | 0 | -100,00 | 0 | |||||

| 2025-05-12 | 13F | Sandy Spring Bank | 73 | 0,00 | 1 | 0,00 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 49 085 | 7,36 | 1 056 | 26,05 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 8 234 | 9,79 | 177 | 29,20 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 8 520 | 183 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 259 | -91,78 | 6 | -91,23 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 58 679 | -21,99 | 1 | 0,00 | ||||

| 2025-08-29 | 13F | Total Investment Management Inc | 517 | 11 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | Quinn Opportunity Partners LLC | 165 000 | 0,00 | 3 549 | 17,44 | ||||

| 2025-04-29 | 13F | Capital Investment Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Evermay Wealth Management Llc | 5 | 0 | ||||||

| 2025-08-14 | 13F | SIG North Trading, ULC | 74 687 | -63,44 | 1 607 | -57,08 | ||||

| 2025-05-05 | 13F | IFP Advisors, Inc | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Bay Harbor Wealth Management, LLC | 1 498 | 0,00 | 32 | 18,52 | ||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 10 | 0,00 | 0 | |||||

| 2025-05-05 | 13F | Private Advisor Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Grant Private Wealth Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 1 000 | 22 | ||||||

| 2025-08-14 | 13F | Financial Engines Advisors L.L.C. | 16 355 | 9,17 | 352 | 28,47 | ||||

| 2025-05-14 | 13F | Toroso Investments, LLC | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-07-16 | 13F | Legend Financial Advisors, Inc. | 500 | 11 | ||||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 45 264 | 0,16 | 974 | 17,65 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 50 | 1 | ||||||

| 2025-08-07 | 13F | Proficio Capital Partners LLC | 12 720 | -94,41 | 274 | -94,68 | ||||

| 2025-07-22 | 13F | Cedar Mountain Advisors, LLC | 1 801 | 43,74 | 39 | 72,73 | ||||

| 2025-08-01 | 13F | Vision Financial Markets Llc | 89 139 | 56,06 | 1 917 | 83,27 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 955 | 7,42 | 21 | 25,00 | ||||

| 2025-05-15 | 13F | Sepio Capital, LP | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Acorns Advisers, LLC | 3 928 302 | 7,03 | 84 | 25,37 | ||||

| 2025-05-15 | 13F | Ancora Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-02 | 13F | Capital A Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Dougherty Wealth Advisers LLC | 577 | 49,87 | 12 | 71,43 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 1 909 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 2 730 | 59 | ||||||

| 2025-07-30 | 13F | LGT Financial Advisors LLC | 2 075 | 9,79 | 45 | 29,41 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 467 | 69,20 | 10 | 150,00 | ||||

| 2025-05-15 | 13F | DRW Securities, LLC | Call | 0 | -100,00 | 0 | ||||

| 2025-07-23 | 13F | Prime Capital Investment Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-06 | 13F | AE Wealth Management LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | DRW Securities, LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-08-26 | 13F | Claris Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 18 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ambassador Advisors, LLC | 785 517 | 3,05 | 16 896 | 21,00 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Coastal Investment Advisors, Inc. | 213 521 | 47,59 | 4 593 | 73,28 | ||||

| 2025-04-15 | 13F | Paragon Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Fielder Capital Group LLC | 443 950 | 9 549 | ||||||

| 2025-08-13 | 13F | RK Capital Management, LLC/FL | 833 600 | 374,47 | 17 931 | 457,18 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 400 | -22,03 | 9 | 0,00 | ||||

| 2025-08-13 | 13F | Natixis | 56 185 | -47,09 | 1 209 | -38,77 | ||||

| 2025-08-04 | 13F | Migdal Insurance & Financial Holdings Ltd. | 4 269 | 58,76 | 0 | |||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 24 631 | -32,10 | 530 | -20,33 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Quaker Wealth Management, LLC | 1 | 0 | ||||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 32 430 | -33,85 | 698 | -22,38 | ||||

| 2025-07-21 | 13F | Crews Bank & Trust | 206 | 0,00 | 4 | 33,33 | ||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 13 954 | 27,41 | 300 | 50,00 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 33 170 | 15,05 | 713 | 35,04 | ||||

| 2025-08-13 | 13F | Avestar Capital, LLC | 9 500 | 204 | ||||||

| 2025-08-11 | 13F | Bellwether Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 15 629 | 12,33 | 336 | 32,28 | ||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 70 | 0,00 | 0 | |||||

| 2025-08-05 | 13F | Plante Moran Financial Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-09 | 13F | Capital Performance Advisors Llp | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-04-15 | 13F | Fifth Third Bancorp | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | Nova Wealth Management, Inc. | 1 565 | 0,00 | 36 | 0,00 | ||||

| 2025-07-31 | 13F | Stegent Equity Advisors, Inc. | 15 688 | -57,71 | 337 | -50,37 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 1 597 909 | -80,44 | 34 371 | -77,03 | ||||

| 2025-05-23 | 13F | SWAN Capital LLC | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 86 | 3,61 | 2 | 0,00 |

Other Listings

| PE:BITO | |

| KZ:BITO_KZ | 19,52 $US |