Statistiques de base

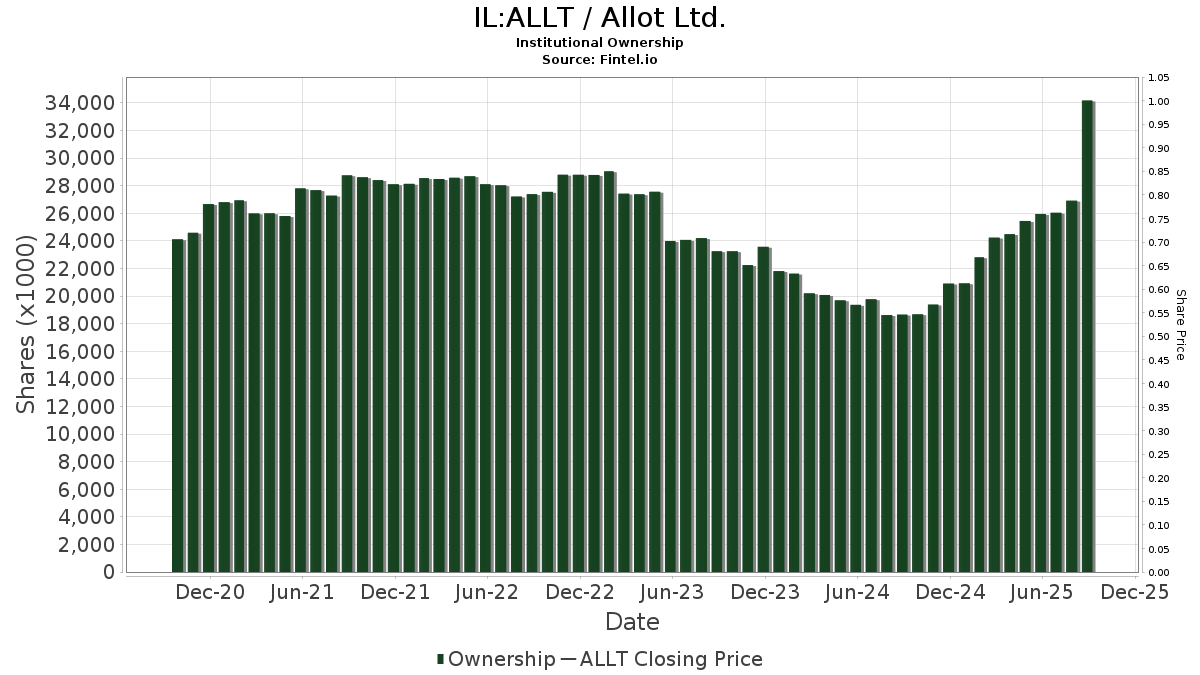

| Actions institutionnelles (Long) | 34 173 300 (ex 13D/G) - change of 9,06MM shares 36,06% MRQ |

| Valeur institutionnelle (Long) | $ 268 812 USD ($1000) |

Participation institutionnels et actionnaires

Allot Ltd. (IL:ALLT) détient 101 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 34,173,300 actions. Les principaux actionnaires incluent Lynrock Lake LP, Kanen Wealth Management LLC, QVT Financial LP, G2 Investment Partners Management LLC, Clal Insurance Enterprises Holdings Ltd, PHLOX - Philotimo Focused Growth and Income Fund, Renaissance Technologies Llc, P.a.w. Capital Corp, Susquehanna International Group, Llp, and Acadian Asset Management Llc .

Allot Ltd. (TASE:ALLT) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-12 | 13F | EAM Global Investors LLC | 14 160 | 121 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 104 799 | 588,02 | 896 | 941,86 | ||||

| 2025-05-13 | 13F | Quadrature Capital Ltd | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 500 | 309,84 | 4 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 40 983 | 350 | ||||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 8 | 100,00 | 0 | |||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 18 278 | 156 | ||||||

| 2025-06-25 | NP | IZRL - ARK Israel Innovative Technology ETF | 281 868 | 13,43 | 1 637 | -23,36 | ||||

| 2025-08-12 | 13F | Clal Insurance Enterprises Holdings Ltd | 1 564 990 | 0,00 | 13 | 62,50 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 528 | 5 | ||||||

| 2025-08-07 | NP | PHLOX - Philotimo Focused Growth and Income Fund | 1 200 000 | 10,33 | 10 260 | 65,22 | ||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 27 089 | -11,82 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 351 | 3 | ||||||

| 2025-07-09 | 13F | Silverberg Bernstein Capital Management LLC | 146 172 | 38,06 | 1 250 | 106,79 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 970 299 | 2,24 | 8 296 | 53,12 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Core Equity Portfolio Institutional Class Shares | 4 114 | 0,00 | 24 | -31,43 | ||||

| 2025-08-14 | 13F | Bluefin Capital Management, Llc | 106 112 | 907 | ||||||

| 2025-08-14 | 13F | RBF Capital, LLC | 10 360 | 0,00 | 89 | 49,15 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Call | 77 500 | -62,52 | 663 | -43,90 | |||

| 2025-08-14 | 13F | Winton Capital Group Ltd | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 67 835 | 17,57 | 580 | 75,99 | ||||

| 2025-08-12 | 13F | DCF Advisers, LLC | 35 238 | 45,38 | 301 | 118,12 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 500 | 0,00 | 4 | 100,00 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | 226 146 | -16,42 | 1 934 | 25,11 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Put | 165 000 | 0,00 | 1 411 | 49,68 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 26 044 | -65,66 | 208 | -53,05 | ||||

| 2025-07-15 | 13F | Kanen Wealth Management LLC | 4 527 823 | 19,60 | 38 713 | 79,09 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 75 600 | -5,85 | 604 | 28,78 | |||

| 2025-08-06 | 13F | Cloud Capital Management, LLC | 75 992 | -4,17 | 1 | |||||

| 2025-08-06 | 13F | Yelin Lapidot Holdings Management Ltd. | 225 943 | 0,00 | 1 932 | 49,69 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 163 412 | 122,46 | 1 397 | 233,41 | ||||

| 2025-08-14 | 13F | Synovus Financial Corp | 15 500 | -29,55 | 133 | 5,60 | ||||

| 2025-06-26 | NP | DFIEX - International Core Equity Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 48 893 | 0,00 | 289 | -30,94 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | ARK Investment Management LLC | 278 560 | 12,10 | 2 357 | 70,85 | ||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 370 004 | 3 164 | ||||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 16 231 | 139 | ||||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 31 374 | 268 | ||||||

| 2025-08-14 | 13F | Ghisallo Capital Management LLC | 323 343 | 2 765 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 900 | 4 400,00 | 8 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 32 541 | 73,92 | 278 | 162,26 | ||||

| 2025-08-05 | 13F | Prosperity Wealth Management, Inc. | 35 300 | 302 | ||||||

| 2025-08-29 | NP | JAJDX - International Small Company Trust NAV | 2 103 | 0,00 | 18 | 54,55 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 17 900 | 70,48 | 0 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Sustainability Core 1 Portfolio Shares | 5 136 | 0,00 | 30 | -30,23 | ||||

| 2025-08-13 | 13F | Hbk Investments L P | 125 000 | 1 069 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 145 300 | -4,09 | 1 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 116 214 | 7,46 | 1 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 282 489 | 0,96 | 2 415 | 51,22 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Trexquant Investment LP | 120 352 | 129,62 | 1 029 | 244,15 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 3 000 | 42 757,14 | 2 536 | |||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 271 311 | 2 320 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 35 074 | -9,54 | 300 | 35,29 | ||||

| 2025-08-14 | 13F | Maven Securities LTD | 50 000 | 428 | ||||||

| 2025-08-13 | 13F | Greenhaven Road Investment Management, L.P. | 626 024 | 271,97 | 5 353 | 457,50 | ||||

| 2025-05-14 | 13F | HAP Trading, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 14 000 | 33,33 | 0 | |||||

| 2025-08-13 | 13F | HAP Trading, LLC | Put | 165 100 | 0,00 | 32 | -78,91 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | 114 748 | 15,82 | 981 | 73,63 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 491 500 | 9,44 | 4 202 | 63,88 | |||

| 2025-05-09 | 13F | R Squared Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 31 800 | -45,73 | 272 | -18,86 | |||

| 2025-08-12 | 13F | BlackRock, Inc. | 27 865 | 122,37 | 238 | 235,21 | ||||

| 2025-08-14 | 13F | QVT Financial LP | 4 505 793 | 22,18 | 36 598 | 73,80 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 11 612 | 0 | ||||||

| 2025-07-23 | 13F | Meitav Dash Investments Ltd | 36 780 | 0,00 | 314 | 49,52 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 609 | 0 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 260 263 | 2 225 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 1 928 | 0,00 | 16 | 45,45 | ||||

| 2025-08-27 | NP | INSAX - Catalyst Insider Buying Fund Class A | 39 400 | 0,00 | 337 | 50,00 | ||||

| 2025-08-14 | 13F | Sig Brokerage, Lp | 14 873 | 127 | ||||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 | |||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 21 262 | 0,00 | 183 | 46,40 | ||||

| 2025-04-25 | 13F | Emerald Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 0 | -100,00 | 0 | |||||

| 2025-05-08 | 13F | Baader Bank INC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-31 | 13F | Acuitas Investments, LLC | 65 298 | 558 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 4 898 | -79,41 | 42 | -69,12 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 35 857 | 139,21 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna Portfolio Strategies, LLC | 18 753 | 160 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 166 013 | 1 358,81 | 1 419 | 2 117,19 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 203 365 | -27,47 | 1 739 | 8,56 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 38 567 | 56,57 | 330 | 135,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 785 800 | 9,11 | 6 719 | 63,38 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 35 200 | -50,97 | 301 | -26,65 | |||

| 2025-07-31 | 13F | Catalyst Capital Advisors LLC | 39 400 | 0,00 | 337 | 50,00 | ||||

| 2025-08-28 | NP | SEEIX - Sit International Equity Fund - Class I | 32 904 | 281 | ||||||

| 2025-08-13 | 13F | Worth Venture Partners, LLC | 41 995 | 359 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 221 981 | 69,35 | 1 898 | 153,61 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-06-26 | NP | Dfa Investment Trust Co - The Continental Small Company Series This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 171 830 | -7,46 | 1 015 | -35,92 | ||||

| 2025-05-14 | 13F | CIBC Private Wealth Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-29 | NP | JISAX - International Small Company Fund Class NAV | 1 502 | -39,65 | 13 | -20,00 | ||||

| 2025-08-12 | 13F | Magnetar Financial LLC | 20 212 | 173 | ||||||

| 2025-08-14 | 13F | G2 Investment Partners Management LLC | 1 657 913 | 14 175 | ||||||

| 2025-05-13 | 13F | Quantbot Technologies LP | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Heights Capital Management, Inc | 100 000 | 855 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 360 013 | -0,42 | 3 078 | 49,13 | ||||

| 2025-06-26 | NP | DFIS - Dimensional International Small Cap ETF | 14 156 | 1 064,14 | 82 | 720,00 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 778 254 | 12,49 | 7 | 100,00 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 303 | 293,51 | 3 | |||||

| 2025-08-13 | 13F | MYDA Advisors LLC | 250 000 | 2 138 | ||||||

| 2025-06-26 | NP | DFAI - Dimensional International Core Equity Market ETF | 3 092 | 0,00 | 18 | -34,62 | ||||

| 2025-08-14 | 13F | Alyeska Investment Group, L.P. | 150 000 | 1 282 | ||||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 62 010 | 61,50 | 530 | 142,01 | ||||

| 2025-06-26 | NP | DFIC - Dimensional International Core Equity 2 ETF | 2 852 | 7 822,22 | 17 | |||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 21 349 | 0,41 | 183 | 50,41 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 147 065 | 1 115,11 | 1 257 | 1 721,74 | ||||

| 2025-05-15 | 13F | Centiva Capital, LP | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 30 000 | 256 | ||||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 117 | 1 | ||||||

| 2025-08-08 | 13F | Gts Securities Llc | 0 | -100,00 | 0 | |||||

| 2025-08-27 | NP | Brighthouse Funds Trust II - Brighthouse/Dimensional International Small Company Portfolio Class A | 10 216 | 0,00 | 86 | 53,57 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 657 | 0 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 525 | 0,00 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | Lynrock Lake LP | 10 018 661 | 14,26 | 85 660 | 71,08 | ||||

| 2025-08-12 | 13F | P.a.w. Capital Corp | 905 000 | -13,40 | 7 738 | 29,68 | ||||

| 2025-05-15 | 13F | Shay Capital LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 59 968 | 513 | ||||||

| 2025-08-11 | 13F | Blue Bell Private Wealth Management, Llc | 122 | 1 | ||||||

| 2025-08-08 | 13F | Calamos Advisors LLC | 29 680 | 254 | ||||||

| 2025-08-19 | 13F | State of Wyoming | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 291 255 | 12,63 | 2 490 | 68,70 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 85 000 | 727 | |||||

| 2025-06-26 | NP | Dfa Investment Dimensions Group Inc - Va International Small Portfolio This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 540 | 40,64 | 27 | -3,70 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 476 136 | 47,57 | 4 071 | 120,96 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 29 900 | 353,03 | 256 | 589,19 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 10 900 | -85,68 | 93 | -78,57 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 356 400 | 50,70 | 3 047 | 125,70 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | 58 815 | -6,22 | 503 | 40,22 |