Statistiques de base

| Propriétaires institutionnels | 142 total, 139 long only, 1 short only, 2 long/short - change of -10,13% MRQ |

| Allocation moyenne du portefeuille | 0.1326 % - change of -16,48% MRQ |

| Actions institutionnelles (Long) | 20 961 440 (ex 13D/G) - change of -1,65MM shares -7,29% MRQ |

| Valeur institutionnelle (Long) | $ 137 074 USD ($1000) |

Participation institutionnels et actionnaires

BlackRock TCP Capital Corp. (US:TCPC) détient 142 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 21,272,201 actions. Les principaux actionnaires incluent Van Eck Associates Corp, BIZD - VanEck Vectors BDC Income ETF, KBWD - Invesco KBW High Dividend Yield Financial ETF, UBS Group AG, Invesco Ltd., Transcend Wealth Collective, Llc, Next Capital Management LLC, Two Sigma Advisers, Lp, Two Sigma Investments, Lp, and Morgan Stanley .

BlackRock TCP Capital Corp. (NasdaqGS:TCPC) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 5, 2025 is 7,24 / share. Previously, on September 9, 2024, the share price was 9,14 / share. This represents a decline of 20,79% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

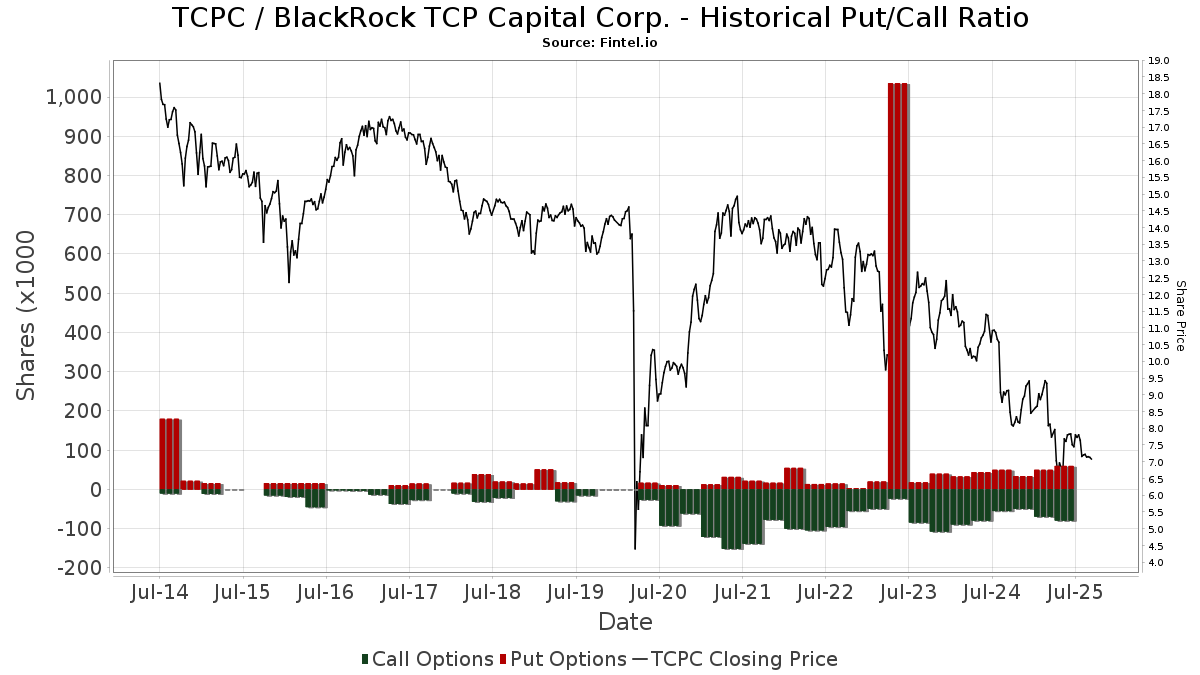

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | Alberta Investment Management Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 1 150 | 0,00 | 9 | -11,11 | ||||

| 2025-07-22 | 13F | Romano Brothers And Company | 87 645 | 0,00 | 675 | -3,99 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 32 988 | 11,40 | 254 | 7,17 | ||||

| 2025-04-09 | 13F | American National Bank | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 212 989 | -4,68 | 1 640 | -8,33 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 707 036 | -24,10 | 5 444 | -27,04 | ||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 106 720 | 822 | ||||||

| 2025-07-23 | 13F | Joel Isaacson & Co., LLC | 16 710 | 0,00 | 129 | -3,76 | ||||

| 2025-08-12 | 13F | Barings Llc | 497 580 | 0,00 | 3 831 | -3,86 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 65 670 | -31,96 | 506 | -34,67 | ||||

| 2025-08-13 | 13F | Loomis Sayles & Co L P | 245 000 | 0,00 | 1 886 | 188 500,00 | ||||

| 2025-08-13 | 13F | Colonial Trust Advisors | 573 | 4 | ||||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 2 178 715 | 7,30 | 17 | 0,00 | ||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | CF Capital LLC | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Transcend Wealth Collective, Llc | 1 333 693 | -9,43 | 10 269 | -12,94 | ||||

| 2025-08-04 | 13F | Muzinich & Co., Inc. | 256 389 | -2,84 | 1 974 | -6,58 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 58 379 | -89,64 | 450 | -90,05 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 29 776 | 229 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 6 868 | 0,53 | 53 | -3,70 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 29 592 | 2,98 | 228 | -1,30 | ||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 11 812 | 0,00 | 91 | -4,26 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 799 | 0,00 | 6 | 0,00 | ||||

| 2025-07-30 | NP | ORR - Militia Long/Short Equity ETF | Short | -310 761 | 311,67 | -2 436 | 282,42 | |||

| 2025-04-11 | 13F | Seacrest Wealth Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-05-12 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 0 | -100,00 | 0 | |||||

| 2025-05-12 | 13F | Fmr Llc | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 1 364 | 11 | ||||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 253 357 | -2,88 | 1 951 | -6,65 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 142 047 | 24,94 | 1 094 | 20,11 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 131 304 | -11,45 | 1 011 | -14,83 | ||||

| 2025-05-13 | 13F | Evoke Wealth, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 14 936 | 115 | ||||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 165 000 | 6,35 | 1 270 | 2,25 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 11 656 | 13,12 | 91 | 10,98 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 1 000 | 8 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 26 389 | -4,93 | 0 | |||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 58 397 | -57,51 | 450 | -59,18 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Legal & General Group Plc | 559 479 | -0,01 | 4 300 | -4,25 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 3 904 | 30 | ||||||

| 2025-08-07 | 13F | Samalin Investment Counsel, LLC | 65 611 | -4,32 | 505 | -8,01 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 120 032 | -51,56 | 924 | -53,43 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 510 941 | 29,32 | 3 934 | 24,34 | ||||

| 2025-05-12 | 13F | National Bank Of Canada /fi/ | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | United Advisor Group, LLC | 141 741 | -5,80 | 1 091 | -9,46 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 1 991 | 0,00 | 15 | 0,00 | ||||

| 2025-05-15 | 13F | Alpine Global Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-07 | 13F | Midwest Trust Co | 12 500 | 96 | ||||||

| 2025-08-13 | 13F | Cerity Partners LLC | 24 643 | -74,79 | 190 | -75,83 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-13 | 13F | Cercano Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 27 775 | -30,85 | 214 | -33,64 | ||||

| 2025-05-13 | 13F | Sterling Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 223 722 | 101,64 | 1 723 | 93,92 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 21 200 | 0,00 | 163 | -3,55 | ||||

| 2025-08-05 | 13F | Mission Wealth Management, Lp | 14 859 | 114 | ||||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 1 468 | 0,00 | 11 | 0,00 | ||||

| 2025-05-30 | NP | ERNZ - TrueShares Active Yield ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 1 423 209 | -7,63 | 10 959 | -11,21 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 950 517 | 2,34 | 7 319 | -1,63 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 96 565 | 11,69 | 744 | 7,37 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 3 160 | 0,00 | 24 | 20,00 | ||||

| 2025-07-11 | 13F | Mallini Complete Financial Planning LLC | 22 898 | 1,75 | 176 | -2,22 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 750 | 0,00 | 6 | -16,67 | ||||

| 2025-08-12 | 13F | Journey Strategic Wealth Llc | 10 826 | 0,00 | 83 | -3,49 | ||||

| 2025-08-12 | 13F | Wood Tarver Financial Group, LLC | 470 | 0,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 0 | -100,00 | 0 | |||||

| 2025-07-28 | NP | KBWD - Invesco KBW High Dividend Yield Financial ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 516 037 | -4,05 | 11 886 | -10,87 | ||||

| 2025-05-15 | 13F | Hrt Financial Lp | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 1 000 | 0,00 | 8 | -12,50 | ||||

| 2025-08-07 | 13F/A | Tortoise Investment Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Legacy Wealth Managment, LLC/ID | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 86 364 | 4,41 | 1 | |||||

| 2025-08-08 | 13F/A | Ignite Planners, LLC | 30 754 | -67,55 | 236 | -63,07 | ||||

| 2025-08-04 | 13F | MeadowBrook Investment Advisors LLC | 6 733 | 0,00 | 52 | -3,77 | ||||

| 2025-08-01 | 13F | Financial Counselors Inc | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Accel Wealth Management | 12 000 | 0,00 | 92 | -4,17 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 10 135 | -3,49 | 78 | -7,14 | ||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 59 557 | 459 | ||||||

| 2025-07-31 | 13F | Nisa Investment Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Columbus Macro, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 1 | 0,00 | 0 | |||||

| 2025-06-25 | NP | VPC - Virtus Private Credit Strategy ETF | 141 720 | -3,57 | 969 | -28,38 | ||||

| 2025-08-13 | 13F | Wealthedge Investment Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 712 321 | 8,83 | 5 485 | 4,62 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 13 151 | 0,00 | 101 | -3,81 | ||||

| 2025-07-25 | 13F | Verdence Capital Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | M&t Bank Corp | 24 122 | 0,00 | 186 | -4,15 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 63 921 | 1,89 | 492 | -1,99 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 221 | 2,79 | 2 | 0,00 | ||||

| 2025-07-30 | 13F | Privium Fund Management (UK) Ltd | 125 977 | -15,04 | 983 | -16,78 | ||||

| 2025-08-15 | 13F | Caxton Associates Llp | 60 779 | 16,21 | 468 | 11,72 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 38 312 | -62,14 | 295 | -63,58 | ||||

| 2025-08-14 | 13F | Eight 31 Financial Llc | 17 246 | 133 | ||||||

| 2025-08-14 | 13F | Stifel Financial Corp | 75 444 | -0,78 | 581 | -4,76 | ||||

| 2025-07-28 | 13F | Curated Wealth Partners LLC | 38 587 | 0,00 | 297 | -3,88 | ||||

| 2025-08-14 | 13F | BI Asset Management Fondsmaeglerselskab A/S | 417 991 | 6,06 | 3 | 0,00 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Comerica Bank | 1 840 | -1,18 | 14 | 0,00 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 120 624 | -44,46 | 929 | -46,64 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 11 447 | 88 | ||||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 960 | 153,97 | 7 | 133,33 | ||||

| 2025-08-07 | 13F | Lakeridge Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Centiva Capital, LP | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Talon Private Wealth, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-09 | 13F | Pathway Financial Advisers, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Credit Agricole S A | 235 | 0,00 | 2 | -50,00 | ||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 48 440 | 359,15 | 373 | 338,82 | ||||

| 2025-08-14 | 13F | AllSquare Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 304 | 0,00 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | WealthTrust Axiom LLC | 14 975 | 0,00 | 115 | -3,36 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 68 149 | 0,21 | 1 | |||||

| 2025-06-27 | NP | LBO - WHITEWOLF Publicly Listed Private Equity ETF | 8 743 | 14,27 | 60 | -15,71 | ||||

| 2025-08-08 | 13F | MTM Investment Management, LLC | 5 976 | 46 | ||||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 21 380 | -1,03 | 165 | -5,20 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 148 | 0,00 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Quarry LP | 2 064 | 16 | ||||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 215 | 0,00 | 2 | 0,00 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 56 782 | -24,68 | 437 | -27,53 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 2 000 | 0,00 | 15 | -6,25 | ||||

| 2025-08-14 | 13F | UBS Group AG | 1 475 030 | 12,37 | 11 358 | 8,02 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 13 900 | -17,75 | 107 | -20,74 | ||||

| 2025-08-11 | 13F | Universal- Beteiligungs- und Servicegesellschaft mbH | 51 900 | 0,00 | 400 | -3,86 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 20 428 | 157 | ||||||

| 2025-05-15 | 13F | Ares Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 290 474 | -24,42 | 2 237 | -27,36 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Bokf, Na | 208 | 0,00 | 2 | 0,00 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | GraniteShares Advisors LLC | 319 833 | 6,67 | 2 463 | 2,54 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 1 715 | 0,00 | 13 | 0,00 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 525 266 | 4 045 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 28 600 | -45,73 | 220 | -47,87 | |||

| 2025-08-21 | NP | BIZD - VanEck Vectors BDC Income ETF | 1 926 567 | 2,81 | 14 835 | -1,17 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 64 809 | -89,08 | 499 | -89,50 | ||||

| 2025-08-05 | 13F | Next Capital Management LLC | 1 134 826 | 2 131,36 | 8 738 | 2 046,93 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Lsv Asset Management | 361 470 | 1,78 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 65 302 | 47,26 | 503 | 41,41 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 57 000 | 25,00 | 439 | 20,00 | |||

| 2025-08-12 | 13F | XTX Topco Ltd | 21 536 | 166 | ||||||

| 2025-03-28 | NP | DVDN - Kingsbarn Dividend Opportunity ETF | 6 318 | 58 | ||||||

| 2025-05-13 | 13F | M Holdings Securities, Inc. | 0 | -100,00 | 0 | |||||

| 2025-04-22 | 13F | TrueMark Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 3 100 | 10,71 | 0 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 5 700 | 62,86 | 0 | ||||

| 2025-07-29 | 13F | Disciplined Investments, LLC | 20 000 | 0,00 | 154 | -3,75 | ||||

| 2025-08-07 | 13F | Verus Capital Partners, Llc | 12 750 | -79,47 | 98 | -80,28 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 13 563 | 0,00 | 104 | -3,70 | ||||

| 2025-08-05 | 13F | Access Investment Management LLC | 54 300 | 0,00 | 418 | -11,44 | ||||

| 2025-08-11 | 13F | VSM Wealth Advisory, LLC | 7 563 | -32,65 | 58 | -34,83 | ||||

| 2025-07-23 | 13F | Steel Peak Wealth Management LLC | 10 000 | 0,00 | 77 | -3,75 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 13 580 | -6,86 | 118 | 1,72 | ||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 2 295 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 50 811 | -2,55 | 391 | -6,24 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 90 675 | 7,73 | 698 | 3,56 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 12 922 | 0,20 | 100 | -3,88 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 20 000 | 25,00 | 154 | 20,31 | ||||

| 2025-05-15 | 13F | Balyasny Asset Management Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | Two Sigma Securities, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 2 761 | 0,00 | 21 | -4,55 | ||||

| 2025-05-14 | 13F | Group One Trading, L.p. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 10 200 | 0,00 | 79 | -3,70 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 200 | -13,04 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 1 956 | 15 | ||||||

| 2025-05-12 | 13F | Entropy Technologies, LP | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 1 334 | -27,26 | 10 | -28,57 | ||||

| 2025-05-09 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 5 489 | 0,00 | 42 | -2,33 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 25 000 | 1 150,00 | 192 | 1 100,00 | |||

| 2025-05-12 | 13F | Virtu Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 11 062 | 85 | ||||||

| 2025-06-12 | 13F/A | Deutsche Bank Ag\ | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Key FInancial Inc | 26 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 66 327 | 0,08 | 511 | -3,77 | ||||

| 2025-07-21 | 13F | Future Financial Wealth Managment LLC | 4 000 | 0,00 | 31 | -6,25 | ||||

| 2025-07-07 | 13F | Investors Research Corp | 3 471 | 0,00 | 27 | -3,70 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 459 881 | -3,28 | 3 541 | -7,01 | ||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 12 055 | -0,86 | 93 | -5,15 | ||||

| 2025-07-09 | 13F | Triumph Capital Management | 30 834 | -2,63 | 237 | -6,32 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 1 | 0 | ||||||

| 2025-08-29 | NP | GraniteShares ETF Trust - GraniteShares HIPS US High Income ETF | 319 833 | 6,67 | 2 463 | 2,54 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 13 942 | 0,90 | 107 | -2,73 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 20 100 | 76,32 | 155 | 69,23 | |||

| 2025-08-14 | 13F | New England Asset Management Inc | 170 034 | 0,00 | 1 309 | -3,82 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 35 580 | 0,00 | 274 | -3,87 | ||||

| 2025-05-14 | 13F | CI Private Wealth, LLC | 0 | -100,00 | 0 | -100,00 |