Statistiques de base

| Propriétaires institutionnels | 133 total, 131 long only, 1 short only, 1 long/short - change of -6,34% MRQ |

| Allocation moyenne du portefeuille | 0.1558 % - change of -18,66% MRQ |

| Actions institutionnelles (Long) | 24 428 876 (ex 13D/G) - change of -3,91MM shares -13,79% MRQ |

| Valeur institutionnelle (Long) | $ 222 997 USD ($1000) |

Participation institutionnels et actionnaires

PennantPark Floating Rate Capital Ltd. (US:PFLT) détient 133 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 24,428,876 actions. Les principaux actionnaires incluent Sound Income Strategies, LLC, Van Eck Associates Corp, BIZD - VanEck Vectors BDC Income ETF, Altshuler Shaham Ltd, Marshall Wace, Llp, UBS Group AG, Invesco Ltd., KBWD - Invesco KBW High Dividend Yield Financial ETF, Two Sigma Investments, Lp, and Qube Research & Technologies Ltd .

PennantPark Floating Rate Capital Ltd. (NYSE:PFLT) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 9, 2025 is 10,18 / share. Previously, on September 10, 2024, the share price was 11,41 / share. This represents a decline of 10,78% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

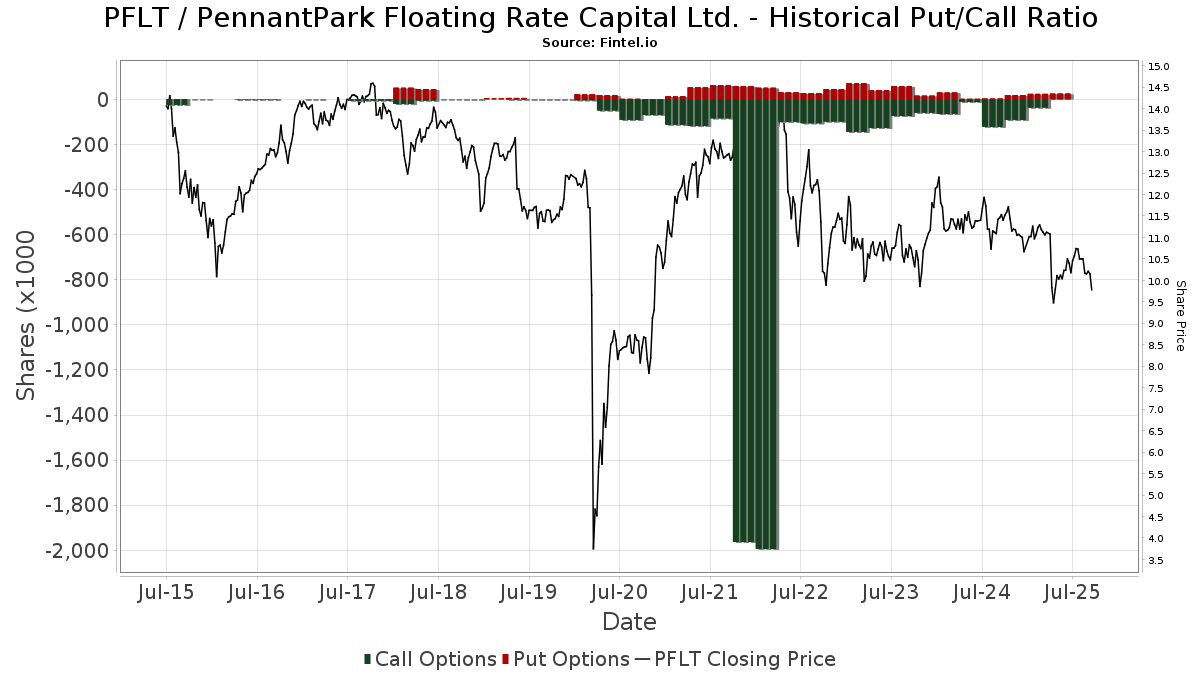

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-12 | 13F | Change Path, LLC | 12 006 | 124 | ||||||

| 2025-08-04 | 13F | Muzinich & Co., Inc. | 104 859 | 103,00 | 1 083 | 87,37 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 2 530 | 0,00 | 26 | -7,14 | ||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 1 200 | 0,00 | 0 | |||||

| 2025-05-15 | 13F | Gwn Securities Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Group One Trading, L.p. | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-14 | 13F | Van Eck Associates Corp | 2 358 575 | 20,52 | 24 | 14,29 | ||||

| 2025-07-23 | 13F | Fulton Breakefield Broenniman Llc | 11 798 | 0,00 | 122 | -8,33 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 64 809 | -12,10 | 669 | -18,91 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 244 157 | -44,38 | 2 522 | -48,66 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 91 475 | 12,50 | 1 | |||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 269 430 | -35,34 | 2 783 | -40,30 | ||||

| 2025-08-07 | 13F | PFG Advisors | 110 108 | 1,81 | 1 137 | -6,03 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 3 363 | 0,00 | 35 | -8,11 | ||||

| 2025-08-05 | 13F | Strategic Financial Concepts, LLC | 63 200 | -1,50 | 648 | -9,76 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Garner Asset Management Corp | 14 267 | -2,41 | 147 | -9,82 | ||||

| 2025-08-11 | 13F | Pin Oak Investment Advisors Inc | 0 | 0 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 511 | 41,94 | 5 | 25,00 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 3 928 | -79,34 | 41 | -80,68 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-04-24 | 13F | Allspring Global Investments Holdings, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 9 | 12,50 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 2 777 | 1 603,68 | 29 | 2 700,00 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 18 126 | 187 | ||||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 10 193 | -8,33 | 105 | -15,32 | ||||

| 2025-07-28 | NP | FXED - Sound Enhanced Fixed Income ETF | 104 495 | 1,12 | 1 076 | -8,11 | ||||

| 2025-04-10 | 13F | Firethorn Wealth Partners, Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-04-23 | 13F | Walkner Condon Financial Advisors LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-17 | 13F | Vermillion Wealth Management, Inc. | 500 | 0,00 | 5 | 0,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 162 389 | 38,36 | 1 678 | 27,72 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 16 381 | 171 | ||||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 12 543 | 0,00 | 130 | -7,86 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 88 549 | -10,61 | 915 | -17,51 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 500 758 | 30,73 | 5 173 | 20,67 | ||||

| 2025-08-21 | NP | BIZD - VanEck Vectors BDC Income ETF | 2 247 824 | 16,02 | 23 220 | 7,11 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 9 756 | 101 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 34 398 | 218,56 | 355 | 195,83 | ||||

| 2025-07-10 | 13F | Sovran Advisors, LLC | 34 184 | 2,01 | 361 | 10,77 | ||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 943 | 0,00 | 10 | -10,00 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 13 296 | 137 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 1 439 742 | -16,75 | 14 873 | -23,15 | ||||

| 2025-08-14 | 13F | Mpwm Advisory Solutions, Llc | 5 000 | 0,00 | 52 | -7,27 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 8 224 | -26,73 | 90 | -28,80 | ||||

| 2025-08-08 | 13F | Investment Partners, Ltd. | 10 000 | 0,00 | 103 | -7,21 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 19 604 | -32,18 | 202 | -37,46 | ||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 21 641 | 18,74 | 224 | 9,85 | ||||

| 2025-08-14 | 13F | Brevan Howard Capital Management LP | 141 985 | 118,14 | 1 467 | 101,37 | ||||

| 2025-05-08 | 13F | We Are One Seven, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 51 986 | 6,32 | 537 | -1,83 | ||||

| 2025-08-14 | 13F | Financial Network Wealth Advisors LLC | 1 426 | 0,00 | 15 | -6,67 | ||||

| 2025-08-14 | 13F | AllSquare Wealth Management LLC | 9 200 | 0,00 | 95 | -6,86 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 41 596 | 181,36 | 430 | 160,00 | ||||

| 2025-08-14 | 13F | Glenview Trust Co | 10 650 | 110 | ||||||

| 2025-05-12 | 13F | Simplex Trading, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-04-29 | 13F | Raleigh Capital Management Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 21 899 | 0,00 | 226 | -7,76 | ||||

| 2025-05-12 | 13F | National Bank Of Canada /fi/ | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | PFG Investments, LLC | 118 908 | 5,61 | 1 228 | -2,46 | ||||

| 2025-05-29 | NP | JAFEX - Total Stock Market Index Trust NAV | 19 | -97,50 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Entropy Technologies, LP | 12 594 | -80,06 | 130 | -81,59 | ||||

| 2025-06-27 | NP | LBO - WHITEWOLF Publicly Listed Private Equity ETF | 11 119 | 14,28 | 112 | 3,70 | ||||

| 2025-08-12 | 13F | Calton & Associates, Inc. | 10 938 | 113 | ||||||

| 2025-08-08 | 13F | Strategies Wealth Advisors, LLC | 12 921 | 2,96 | 133 | -5,00 | ||||

| 2025-05-08 | 13F | Arkadios Wealth Advisors | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 21 234 | 219 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 5 284 | 55 | ||||||

| 2025-08-14 | 13F | Nebula Research & Development LLC | 56 045 | 31,09 | 579 | 20,92 | ||||

| 2025-08-06 | 13F | Yelin Lapidot Holdings Management Ltd. | 19 500 | 0,00 | 201 | -7,80 | ||||

| 2025-05-15 | 13F | Oxford Asset Management Llp | 12 186 | 136 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 358 | -92,84 | 4 | -94,55 | ||||

| 2025-08-14 | 13F | Altshuler Shaham Ltd | 1 730 086 | 9,98 | 17 872 | 1,52 | ||||

| 2025-07-30 | 13F | Mid-American Wealth Advisory Group, Inc. | 485 | 5 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 1 000 | 0,00 | 10 | -9,09 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 1 452 | 1 257,01 | 15 | 1 300,00 | ||||

| 2025-05-12 | 13F | Fmr Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Magnetar Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 329 829 | -0,39 | 3 407 | -8,04 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 3 904 625 | 8,91 | 40 335 | 0,54 | ||||

| 2025-08-14 | 13F | Camden Capital, LLC | 26 658 | 0,00 | 275 | -7,72 | ||||

| 2025-07-29 | 13F | TrueMark Investments, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 25 177 | -18,34 | 260 | -24,42 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 95 188 | -1,24 | 983 | -8,81 | ||||

| 2025-08-14 | 13F | Murphy & Mullick Capital Management Corp | 1 038 | 2,67 | 11 | -9,09 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 69 959 | 7,41 | 707 | -3,28 | ||||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 295 639 | 3,33 | 3 075 | -3,97 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | -100,00 | 0 | |||||

| 2025-08-26 | NP | MCTOX - Modern Capital Tactical Opportunities Fund Class A Shares | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 41 874 | -4,21 | 0 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 243 615 | -58,07 | 2 517 | -61,30 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-04-21 | 13F | Ronald Blue Trust, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 14 429 | -3,74 | 149 | -10,78 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 16 438 | 2,41 | 170 | -5,59 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 594 | 5,15 | 16 | 0,00 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 32 900 | -54,18 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 95 | 0,00 | 1 | -100,00 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 15 795 | 5,12 | 163 | -2,98 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 3 296 | -4,79 | 34 | -10,53 | ||||

| 2025-05-16 | 13F/A | Goldman Sachs Group Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 20 995 | 217 | ||||||

| 2025-07-22 | 13F | Miracle Mile Advisors, LLC | 11 388 | 2,97 | 118 | -4,88 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 207 207 | 734,74 | 2 140 | 672,56 | ||||

| 2025-08-12 | 13F | Hillsdale Investment Management Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 110 971 | 328,51 | 1 146 | 296,54 | ||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 14 271 | 5,32 | 147 | -2,65 | ||||

| 2025-08-13 | 13F | PharVision Advisers, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Scoggin Management Lp | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 566 | 6 | ||||||

| 2025-08-12 | 13F | Virtu Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 94 376 | 245,17 | 975 | 219,34 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 58 603 | -2,99 | 605 | -10,37 | ||||

| 2025-08-11 | 13F | Synergy Investment Management, LLC | 25 011 | 10,42 | 258 | 1,98 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 4 714 | 0,00 | 49 | -7,69 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 7 122 | 0,00 | 74 | 12,31 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 720 074 | -39,83 | 7 438 | -44,46 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 0 | -100,00 | 0 | |||||

| 2025-04-30 | 13F | POM Investment Strategies, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 22 900 | 116,04 | 237 | 100,00 | |||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 653 075 | -48,63 | 6 746 | -52,58 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | First Foundation Advisors | 12 393 | 0,00 | 128 | -7,25 | ||||

| 2025-07-31 | 13F | Optimum Investment Advisors | 17 500 | 0,00 | 181 | -7,69 | ||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 81 236 | 57,27 | 839 | 45,16 | ||||

| 2025-06-25 | NP | VPC - Virtus Private Credit Strategy ETF | 90 483 | 1,15 | 915 | -8,69 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 1 117 647 | 81,73 | 11 545 | 67,76 | ||||

| 2025-07-17 | 13F | GraniteShares Advisors LLC | 255 250 | 6,67 | 2 637 | -1,53 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-26 | NP | FTKI - First Trust Small Cap BuyWrite Income ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-16 | 13F | ORG Partners LLC | 1 500 | 0,00 | 16 | -6,25 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-07-28 | NP | KBWD - Invesco KBW High Dividend Yield Financial ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 032 944 | 5,54 | 10 639 | -4,14 | ||||

| 2025-08-14 | 13F | Beacon Investment Advisors Llc | 19 886 | 1,36 | 204 | -7,31 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | Graypoint LLC | 75 302 | 2,96 | 778 | -5,01 | ||||

| 2025-07-09 | 13F | Westbourne Investments, Inc. | 19 175 | -5,59 | 198 | -12,78 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 4 000 | -0,12 | 41 | -6,82 | ||||

| 2025-08-29 | NP | GraniteShares ETF Trust - GraniteShares HIPS US High Income ETF | 255 250 | 6,67 | 2 637 | -1,53 | ||||

| 2025-08-13 | 13F | Natixis | 44 576 | 0,00 | 460 | -7,63 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 798 816 | -20,27 | 8 252 | -26,40 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 51 706 | -41,10 | 534 | -45,62 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 4 771 | 0 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 78 176 | 32,39 | 1 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 388 070 | -30,43 | 4 009 | -35,78 | ||||

| 2025-04-22 | 13F | Jmac Enterprises Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 177 | 17 600,00 | 2 | |||||

| 2025-08-13 | 13F | Invesco Ltd. | 1 076 310 | 2,52 | 11 118 | -5,35 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 84 170 | 257,74 | 878 | 231,32 | ||||

| 2025-07-30 | 13F | Denali Advisors Llc | 69 103 | -2,61 | 714 | -10,09 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 3 434 | 3,00 | 35 | -5,41 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 30 528 | 2 375,91 | 0 | |||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 63 704 | 2,13 | 658 | -5,60 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 2 400 | 200,00 | 0 | ||||

| 2025-05-30 | NP | ERNZ - TrueShares Active Yield ETF | 310 616 | 735,71 | 3 476 | 755,91 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 36 933 | -1,67 | 382 | -9,29 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 139 202 | 5,04 | 1 | 0,00 | ||||

| 2025-05-01 | 13F | MQS Management LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 526 | 5 | ||||||

| 2025-08-12 | 13F | Legal & General Group Plc | 578 019 | 4,20 | 5 974 | -3,55 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 53 747 | 247,00 | 555 | 220,81 | ||||

| 2025-08-14 | 13F | Quarry LP | 0 | -100,00 | 0 | |||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 16 652 | 172 | ||||||

| 2025-04-24 | 13F | Mirae Asset Global Investments Co., Ltd. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 4 000 | 41 | ||||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 86 588 | 3,37 | 1 | |||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 942 801 | -45,81 | 9 739 | -49,97 | ||||

| 2025-07-31 | 13F | Sage Mountain Advisors LLC | 10 000 | 0,00 | 103 | -7,21 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | DRW Securities, LLC | 33 593 | 347 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 105 656 | 2,25 | 1 091 | -5,62 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 10 439 | 0,53 | 108 | -7,76 | ||||

| 2025-05-12 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 0 | -100,00 | 0 | -100,00 |

Other Listings

| GB:0KH0 | 10,25 $US |