Statistiques de base

| Propriétaires institutionnels | 158 total, 157 long only, 0 short only, 1 long/short - change of 0,63% MRQ |

| Allocation moyenne du portefeuille | 0.2214 % - change of 17,39% MRQ |

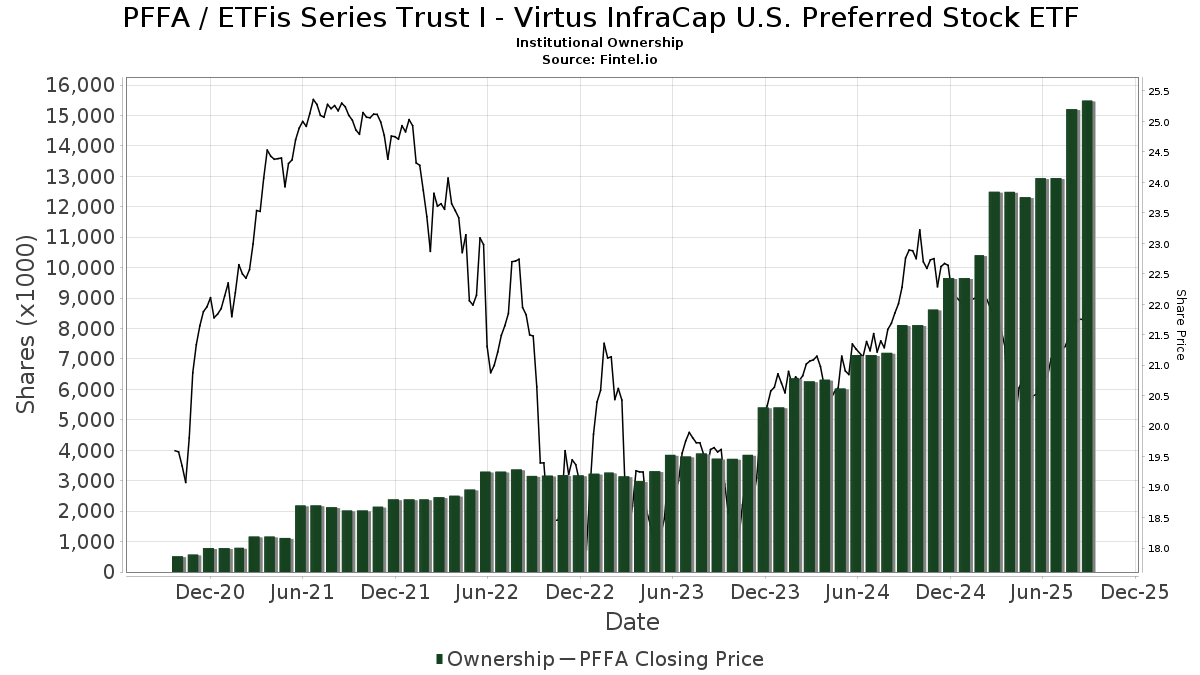

| Actions institutionnelles (Long) | 15 489 990 (ex 13D/G) - change of 2,55MM shares 19,69% MRQ |

| Valeur institutionnelle (Long) | $ 243 094 USD ($1000) |

Participation institutionnels et actionnaires

ETFis Series Trust I - Virtus InfraCap U.S. Preferred Stock ETF (US:PFFA) détient 158 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 15,489,990 actions. Les principaux actionnaires incluent LPL Financial LLC, Kingstone Capital Partners Texas, LLC, Royal Bank Of Canada, Cambridge Investment Research Advisors, Inc., Advisor Group Holdings, Inc., Mml Investors Services, Llc, Melia Wealth LLC, Steward Partners Investment Advisory, Llc, Anderson Financial Strategies, LLC, and Equitable Holdings, Inc. .

ETFis Series Trust I - Virtus InfraCap U.S. Preferred Stock ETF (ARCA:PFFA) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 12, 2025 is 22,27 / share. Previously, on September 13, 2024, the share price was 22,45 / share. This represents a decline of 0,80% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-06 | 13F | Wsfs Capital Management, Llc | 17 074 | 12,81 | 356 | 10,59 | ||||

| 2025-08-07 | 13F | Samalin Investment Counsel, LLC | 94 062 | 5,61 | 1 959 | 3,71 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 800 | 0,00 | 17 | 0,00 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 15 730 | 14,36 | 328 | 12,37 | ||||

| 2025-08-14 | 13F | SWAN Capital LLC | 352 | 0,00 | 7 | 0,00 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 5 000 | 0,00 | 104 | -0,95 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Fiduciary Group LLC | 17 659 | 84,18 | 368 | 80,79 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 244 678 | -9,05 | 5 097 | -10,69 | ||||

| 2025-08-12 | 13F | Mcdonald Partners Llc | 20 000 | 0,00 | 417 | -1,89 | ||||

| 2025-05-15 | 13F | Bank Of America Corp /de/ | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 768 888 | 53,11 | 16 | 60,00 | ||||

| 2025-07-21 | 13F | Hudson Valley Investment Advisors Inc /adv | 12 000 | 0,00 | 250 | -1,97 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 0 | -100,00 | 0 | |||||

| 2025-05-30 | NP | ERNZ - TrueShares Active Yield ETF | 62 152 | 1 318 | ||||||

| 2025-04-09 | 13F | American National Bank | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 8 664 | 61 785,71 | 180 | |||||

| 2025-08-08 | 13F | Wiser Advisor Group LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 0 | -100,00 | 0 | |||||

| 2025-07-09 | 13F | Triumph Capital Management | 21 418 | 0,07 | 446 | -1,55 | ||||

| 2025-08-01 | 13F | Pasadena Private Wealth, LLC | 41 610 | -13,83 | 867 | -15,43 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 160 155 | 38,70 | 3 336 | 36,22 | ||||

| 2025-04-24 | 13F | Wingate Wealth Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 43 745 | 2,02 | 911 | 0,22 | ||||

| 2025-08-13 | 13F | WCG Wealth Advisors LLC | 10 608 | 1,25 | 221 | -0,90 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1 777 | -23,70 | 37 | -24,49 | ||||

| 2025-07-18 | 13F | Founders Capital Management | 1 600 | 0,00 | 33 | 0,00 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-07 | 13F | Inspire Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Red Door Wealth Management, LLC | 11 508 | 2,48 | 240 | 0,42 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 262 105 | 20,46 | 5 460 | 18,31 | ||||

| 2025-07-28 | 13F | Melia Wealth LLC | 447 265 | 9 317 | ||||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 15 788 | 10,71 | 329 | 8,61 | ||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 36 600 | 29,79 | 762 | 27,42 | ||||

| 2025-05-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co | 42 491 | 0,00 | 885 | -1,78 | ||||

| 2025-09-09 | 13F | NWF Advisory Services Inc. | 30 738 | 14,81 | 640 | 12,87 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 11 000 | -31,25 | 229 | -32,45 | ||||

| 2025-07-31 | 13F | Darden Wealth Group Inc | 22 907 | 4,11 | 477 | 2,36 | ||||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | 131 240 | -43,33 | 2 734 | -44,35 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 225 | 49,01 | 5 | 33,33 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 111 723 | 21,31 | 2 327 | 19,15 | ||||

| 2025-08-05 | 13F | Atlas Wealth Partners, LLC | 23 550 | 3,92 | 0 | |||||

| 2025-08-11 | 13F | AXS Investments LLC | 111 610 | -22,25 | 2 325 | -23,65 | ||||

| 2025-05-02 | 13F | James Investment Research Inc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 3 000 | 50,00 | 62 | 47,62 | ||||

| 2025-07-31 | 13F | City State Bank | 225 | 0,00 | 5 | 0,00 | ||||

| 2025-05-15 | 13F | Hrt Financial Lp | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Fisher Asset Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 217 302 | 18,37 | 4 526 | 16,26 | ||||

| 2025-08-14 | 13F | Infrastructure Capital Advisors, Llc | 288 471 | -16,37 | 6 009 | -17,88 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 109 003 | 4,49 | 2 271 | 2,62 | ||||

| 2025-05-15 | 13F | Centaurus Financial, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-06 | 13F | Bank Julius Baer & Co. Ltd, Zurich | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 1 250 | 0,00 | 26 | 0,00 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 33 611 | -7,76 | 700 | -9,33 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 919 558 | 0,63 | 19 155 | -1,17 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 21 613 | 77,07 | 450 | 74,42 | ||||

| 2025-08-25 | NP | OIOIX - AXS Income Opportunities Fund Class I | 111 610 | -22,25 | 2 325 | -23,65 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 55 759 | -11,41 | 1 161 | -13,03 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 93 658 | 9,35 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Empire Financial Management Company, LLC | 51 933 | 2,38 | 1 082 | 0,56 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 5 321 | -11,80 | 111 | -13,39 | ||||

| 2025-08-04 | 13F | Bay Colony Advisory Group, Inc d/b/a Bay Colony Advisors | 13 313 | 0,20 | 277 | -2,12 | ||||

| 2025-04-30 | 13F | Sofos Investments, Inc. | 72 555 | 1 539 | ||||||

| 2025-07-18 | 13F | Truist Financial Corp | 15 493 | 4,59 | 323 | 2,55 | ||||

| 2025-07-22 | 13F | Fortitude Advisory Group L.L.C. | 10 302 | 0,00 | 215 | 4,39 | ||||

| 2025-07-22 | 13F | Chung Wu Investment Group, LLC | 44 240 | -34,69 | 922 | -35,86 | ||||

| 2025-04-28 | 13F | Clear Creek Financial Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Secure Asset Management, LLC | 85 729 | -53,20 | 1 786 | -54,05 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 128 | 0,00 | 3 | 0,00 | ||||

| 2025-05-16 | 13F | Empowered Funds, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 22 377 | -3,37 | 475 | -6,51 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 9 819 | 2,21 | 205 | 0,49 | ||||

| 2025-07-21 | 13F | West Financial Advisors, LLC | 26 | 4,00 | 1 | |||||

| 2025-07-25 | 13F | Almanack Investment Partners, LLC. | 10 641 | 12,71 | 222 | 10,50 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-05-08 | 13F | Main Street Financial Solutions, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 8 717 | -26,65 | 182 | -28,17 | ||||

| 2025-08-11 | 13F | Anderson Financial Strategies, LLC | 319 880 | 3,33 | 6 663 | 1,49 | ||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 31 200 | -16,42 | 650 | -17,95 | ||||

| 2025-07-24 | 13F | Wealthstar Advisors, Llc | 58 023 | 4,65 | 1 209 | 2,81 | ||||

| 2025-08-15 | 13F | Prevail Innovative Wealth Advisors, Llc | 225 178 | 1,83 | 4 690 | 0,00 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 300 | -2,28 | 6 | 0,00 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 26 029 | 542 | ||||||

| 2025-07-21 | 13F | Seros Financial, LLC | 30 067 | 0,00 | 626 | -1,73 | ||||

| 2025-07-24 | 13F | Robertson Stephens Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Black Swift Group, LLC | 174 240 | -3,94 | 3 629 | -5,67 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 15 157 | 0,00 | 316 | -1,87 | ||||

| 2025-08-07 | 13F | Montag A & Associates Inc | 4 054 | 0,00 | 84 | -1,18 | ||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 72 610 | 18,98 | 1 512 | 16,85 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 0 | |||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 8 297 | 0,10 | 173 | -1,71 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 89 624 | -2,67 | 1 867 | -4,41 | ||||

| 2025-05-15 | 13F | Talon Private Wealth, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | Sheets Smith Wealth Management | 95 081 | 0,13 | 1 981 | -1,64 | ||||

| 2025-07-23 | 13F | Abel Hall, LLC | 37 553 | 275,53 | 782 | 268,87 | ||||

| 2025-07-07 | 13F | Roxbury Financial LLC | 1 046 | 0,00 | 22 | -8,70 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 2 | -99,81 | 0 | -100,00 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 706 | -79,80 | 15 | -81,58 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 65 732 | 10,54 | 1 369 | 8,56 | ||||

| 2025-07-18 | 13F | Consolidated Portfolio Review Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 25 947 | -45,89 | 540 | -46,85 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 1 803 | 38,37 | 38 | 37,04 | ||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 33 625 | -16,94 | 700 | -18,41 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 305 004 | 6,85 | 6 353 | 4,94 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 213 | -90,35 | 4 | -91,30 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 32 153 | 155,45 | 670 | 151,50 | ||||

| 2025-08-12 | 13F | Archer Investment Corp | 56 | 1,82 | 1 | 0,00 | ||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 17 054 | -20,65 | 355 | -21,98 | ||||

| 2025-05-16 | 13F | Jones Financial Companies Lllp | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 524 | 25,06 | 11 | 25,00 | ||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 109 | 1,87 | 2 | 0,00 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 277 | 6 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 118 912 | -33,53 | 2 477 | -36,79 | ||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 1 100 | 0,00 | 23 | -4,35 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 35 086 | 732 | ||||||

| 2025-08-13 | 13F | Virtus ETF Advisers LLC | 170 | 4 | ||||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 200 | 0,00 | 4 | 0,00 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 32 865 | 46,87 | 685 | 44,30 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 25 764 | 1,22 | 542 | 0,56 | ||||

| 2025-05-14 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 2 068 539 | 45 | ||||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 30 Fund Instl Class | 155 200 | 802,33 | 3 233 | 724,49 | ||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 22 961 | 33,94 | 478 | 31,68 | ||||

| 2025-08-06 | 13F | Rps Advisory Solutions Llc | 10 178 | 5,17 | 212 | 3,41 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 42 306 | 2,33 | 881 | -2,65 | ||||

| 2025-08-12 | 13F | Cumberland Partners Ltd | 12 700 | 265 | ||||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 2 452 132 | -3,80 | 51 078 | -5,53 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 14 467 | 301 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 198 108 | 71,61 | 4 | 100,00 | ||||

| 2025-07-24 | 13F | Cascade Investment Group, Inc. | 17 100 | 356 | ||||||

| 2025-07-29 | 13F | TrueMark Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Activest Wealth Management | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 658 797 | 3,36 | 14 | 0,00 | ||||

| 2025-08-04 | 13F | HBK Sorce Advisory LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 6 100 | 0,03 | 127 | -1,55 | ||||

| 2025-08-14 | 13F | Matrix Private Capital Group Llc | 11 800 | 0,00 | 246 | -2,00 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 1 100 | 0,00 | 23 | -4,35 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 72 593 | 5,92 | 1 512 | 4,06 | ||||

| 2025-08-08 | 13F | Financial Gravity Companies, Inc. | 83 333 | 9,01 | 1 736 | 3,64 | ||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 70 Fund Investor Class | 31 500 | 9,04 | 656 | -0,46 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 55 178 | 71,11 | 1 149 | 68,23 | ||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 32 | 0,00 | 1 | |||||

| 2025-08-11 | 13F | Anfield Capital Management, LLC | 5 352 | 2,76 | 111 | 0,91 | ||||

| 2025-07-30 | 13F | Jackson Thornton Asset Management, Llc | 25 947 | -45,89 | 550 | -43,11 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 481 | 10 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 1 | -99,70 | 0 | -100,00 | ||||

| 2025-04-29 | 13F | Raleigh Capital Management Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 177 | 2 850,00 | 4 | |||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 133 975 | 1,54 | 2 791 | -0,29 | ||||

| 2025-07-23 | 13F | Venturi Wealth Management, LLC | 11 217 | 234 | ||||||

| 2025-07-21 | 13F | Future Financial Wealth Managment LLC | 152 691 | 22,72 | 3 181 | 20,50 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 130 781 | 6,52 | 2 724 | 4,61 | ||||

| 2025-08-14 | 13F | Arete Wealth Advisors, LLC | 11 094 | -81,62 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | World Equity Group, Inc. | 51 808 | 7,70 | 1 079 | 5,78 | ||||

| 2025-08-14 | 13F | Ausdal Financial Partners, Inc. | 17 208 | 5,25 | 358 | 3,47 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 17 410 | -87,01 | 363 | -86,94 | ||||

| 2025-05-14 | 13F | Truvestments Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-04-25 | 13F | New Wave Wealth Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 386 094 | 5,83 | 8 042 | 3,93 | ||||

| 2025-08-14 | 13F | TT Capital Management LLC | 32 700 | 672 | ||||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 900 | 0,00 | 19 | -5,26 | ||||

| 2025-08-14 | 13F | Fmr Llc | 71 | 1 | ||||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 2 801 | 0,00 | 58 | -1,69 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 734 144 | 7,16 | 15 294 | 5,24 | ||||

| 2025-07-22 | 13F | Beacon Financial Advisory LLC | 25 295 | 7,46 | 527 | 5,41 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 244 932 | 0,20 | 5 102 | -1,60 | ||||

| 2025-04-30 | 13F | TradeWell Securities, LLC. | 41 661 | 14,97 | 884 | 11,35 | ||||

| 2025-04-28 | 13F | Strategic Financial Concepts, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-06 | 13F | Avantax Advisory Services, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 2 993 | 0,00 | 62 | -1,59 | ||||

| 2025-04-17 | 13F | Janney Montgomery Scott LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F/A | Avion Wealth | 100 | 0,00 | 0 | |||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 52 804 | -61,66 | 1 133 | -61,23 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 893 | 0,00 | 19 | 0,00 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 30 891 | 10,62 | 643 | 8,61 | ||||

| 2025-08-04 | 13F | Roble, Belko & Company, Inc | 142 | 2,90 | 0 | |||||

| 2025-07-11 | 13F | Great Waters Wealth Management | 10 000 | 0,00 | 208 | -1,89 | ||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Aspect Partners, LLC | 1 050 | 2,44 | 22 | 0,00 | ||||

| 2025-08-14 | 13F | Comerica Bank | 15 029 | 15,09 | 313 | 13,41 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | -100,00 | 0 | |||||

| 2025-04-25 | 13F | Albion Financial Group /ut | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Magnus Financial Group LLC | 20 813 | 6,19 | 434 | 4,34 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 38 572 | 803 | ||||||

| 2025-07-08 | 13F | Webster Bank, N. A. | 3 472 | 0,00 | 72 | -1,37 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 47 727 | 25,05 | 994 | 22,87 | ||||

| 2025-07-28 | 13F | RFG Advisory, LLC | 44 323 | -63,21 | 923 | -63,87 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 2 723 | -3,10 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 226 794 | 39,03 | 4 724 | 36,57 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 152 | -19,58 | 3 | -25,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 16 300 | -34,01 | 340 | -35,18 | |||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 50 Fund Investor Class | 139 200 | -18,45 | 2 900 | -25,61 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 53 300 | -13,75 | 1 110 | -15,27 | |||

| 2025-08-18 | 13F | Tactive Advisors, LLC | 13 431 | 280 |