Statistiques de base

| Propriétaires institutionnels | 156 total, 156 long only, 0 short only, 0 long/short - change of -1,88% MRQ |

| Allocation moyenne du portefeuille | 0.5596 % - change of 1,74% MRQ |

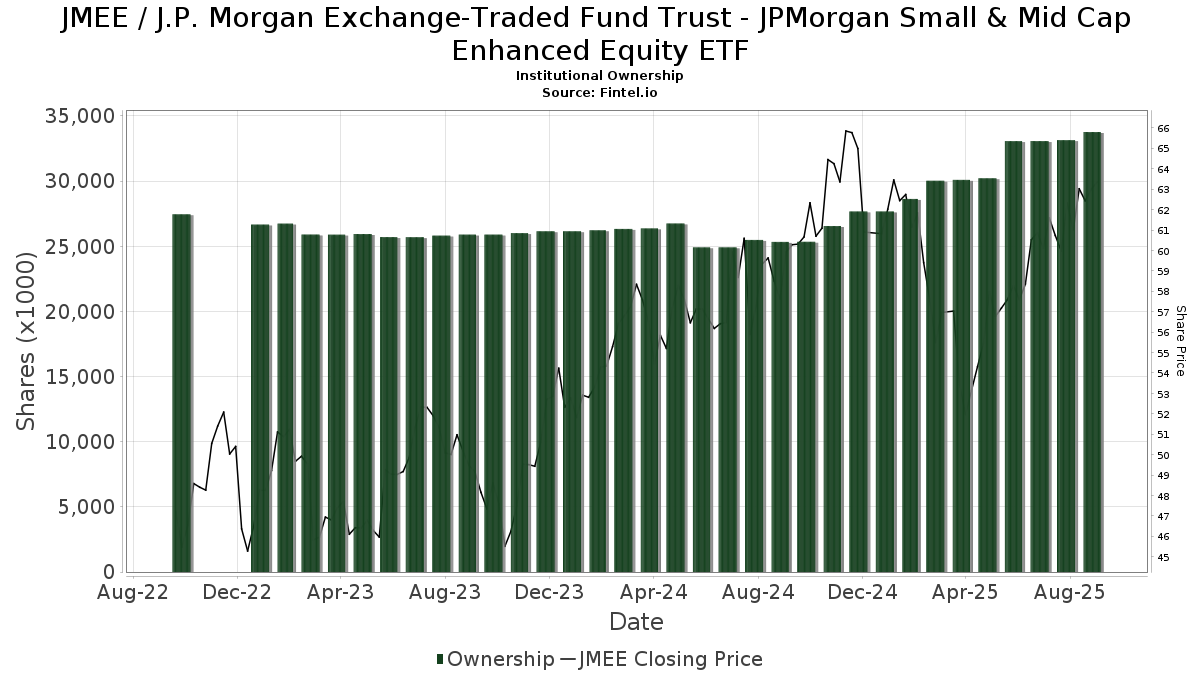

| Actions institutionnelles (Long) | 33 765 008 (ex 13D/G) - change of 0,70MM shares 2,11% MRQ |

| Valeur institutionnelle (Long) | $ 1 936 185 USD ($1000) |

Participation institutionnels et actionnaires

J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Small & Mid Cap Enhanced Equity ETF (US:JMEE) détient 156 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 33,765,008 actions. Les principaux actionnaires incluent Jpmorgan Chase & Co, ONIFX - JPMorgan Investor Growth Fund Class I, ONGFX - JPMorgan Investor Growth & Income Fund Class I, OIBFX - JPMorgan Investor Balanced Fund Class I, LPL Financial LLC, Crestwood Advisors Group LLC, Great Valley Advisor Group, Inc., Syntegra Private Wealth Group, LLC, ONCFX - JPMorgan Investor Conservative Growth Fund Class I, and Advisor Group Holdings, Inc. .

J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Small & Mid Cap Enhanced Equity ETF (ARCA:JMEE) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 10, 2025 is 62,99 / share. Previously, on September 11, 2024, the share price was 57,62 / share. This represents an increase of 9,32% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-08 | 13F | Choice Wealth Advisors, LLC | 156 587 | 1,72 | 9 272 | 7,59 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 324 | -50,08 | 19 | -51,28 | ||||

| 2025-08-12 | 13F/A | Cozad Asset Management Inc | 8 228 | -28,81 | 487 | -24,73 | ||||

| 2025-07-28 | 13F | Nestegg Advisors, Inc. | 3 870 | 0,00 | 229 | 6,02 | ||||

| 2025-07-07 | 13F | Global Wealth Strategies & Associates | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 238 | 14 | ||||||

| 2025-08-26 | NP | EVCLX - The E-Valuator Conservative (15%-30%) RMS Fund Service Class Shares | 2 534 | -50,16 | 150 | -47,18 | ||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 1 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 13 699 | 0,76 | 811 | 6,57 | ||||

| 2025-08-26 | NP | EVTTX - The E-Valuator Conservative/Moderate (30%-50%) RMS Fund Service Class Shares | 2 747 | -47,47 | 163 | -44,52 | ||||

| 2025-08-12 | 13F | Tradition Wealth Management, LLC | 98 232 | 10,61 | 5 816 | 17,00 | ||||

| 2025-07-10 | 13F | Stewardship Advisors, LLC | 74 076 | 0,95 | 4 386 | 6,79 | ||||

| 2025-07-22 | 13F | Siligmueller & Norvid Wealth Advisors LLC | 19 165 | -15,94 | 1 152 | -9,72 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 41 | 0,00 | 2 | 0,00 | ||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 11 741 | 8,93 | 695 | 15,26 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 10 512 654 | 0,10 | 622 454 | 5,88 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 3 489 | -61,68 | 207 | -59,53 | ||||

| 2025-07-09 | 13F | Fermata Advisors, LLC | 21 297 | -16,94 | 1 261 | -12,20 | ||||

| 2025-07-15 | 13F | Avaii Wealth Management, Llc | 7 283 | 431 | ||||||

| 2025-08-14 | 13F | Comerica Bank | 1 043 | -52,66 | 62 | -50,41 | ||||

| 2025-08-07 | 13F | Verus Capital Partners, Llc | 132 146 | -6,75 | 7 824 | -1,36 | ||||

| 2025-08-26 | NP | ONIFX - JPMorgan Investor Growth Fund Class I | 4 247 206 | 0,00 | 251 477 | 5,77 | ||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Bond & Devick Financial Network, Inc. | 154 248 | 6,32 | 9 133 | 12,46 | ||||

| 2025-08-15 | 13F | Asset Allocation Strategies LLC | 24 162 | -19,59 | 1 431 | -14,98 | ||||

| 2025-08-26 | NP | ONGFX - JPMorgan Investor Growth & Income Fund Class I | 2 895 844 | 0,00 | 171 463 | 5,77 | ||||

| 2025-05-13 | 13F | Thrivent Financial For Lutherans | 0 | -100,00 | 0 | |||||

| 2025-04-23 | 13F | Spire Wealth Management | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Visionary Wealth Advisors | 0 | -100,00 | 0 | |||||

| 2025-08-26 | NP | EVMLX - The E-Valuator Moderate (50%-70%) RMS Fund Service Class Shares | 11 868 | -61,56 | 703 | -59,37 | ||||

| 2025-07-10 | 13F | Rockland Trust Co | 9 731 | -4,71 | 576 | 0,88 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-31 | 13F | West Michigan Advisors, Llc | 69 047 | 1,03 | 4 088 | 6,85 | ||||

| 2025-08-08 | 13F | Advisory Resource Group | 286 683 | 21,46 | 16 974 | 28,46 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 4 140 | 245 | ||||||

| 2025-07-25 | 13F | Total Clarity Wealth Management, Inc. | 22 670 | 53,36 | 1 342 | 50,28 | ||||

| 2025-08-04 | 13F | Spinnaker Trust | 3 554 | 210 | ||||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 515 | 0,00 | 30 | 7,14 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 353 | 21 | ||||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 68 860 | 221,09 | 4 077 | 239,75 | ||||

| 2025-08-26 | NP | EVAGX - The E-Valuator Aggressive Growth (85%-99%) RMS Fund Service Class Shares | 27 770 | -58,40 | 1 644 | -56,01 | ||||

| 2025-08-06 | 13F | Mascagni Wealth Management, Inc. | 4 390 | -9,69 | 260 | -4,78 | ||||

| 2025-04-21 | 13F | O'Dell Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Awm Capital, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Schwallier Wealth Management LLC | 120 470 | 26,16 | 7 133 | 33,45 | ||||

| 2025-08-26 | NP | EVGLX - The E-Valuator Growth (70%-85%) RMS Fund Service Class Shares | 34 845 | -59,50 | 2 063 | -57,16 | ||||

| 2025-07-24 | 13F | Leo Wealth, LLC | 18 776 | 1 112 | ||||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 96 831 | 19,95 | 5 733 | -0,74 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 3 989 | 236 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 7 844 | -21,24 | 464 | -16,70 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 81 215 | -4,35 | 4 809 | 1,16 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 670 | -32,39 | 40 | -29,09 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 18 921 | 298,76 | 1 120 | 291,61 | ||||

| 2025-07-07 | 13F | Nova Wealth Management, Inc. | 33 | 10,00 | 2 | 0,00 | ||||

| 2025-07-16 | 13F | Kendall Capital Management | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1 421 | 80,10 | 84 | 90,91 | ||||

| 2025-08-14 | 13F | Freedom Financial Partners LLC | 93 241 | 4,25 | 5 520 | 10,25 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 584 916 | 9,44 | 34 638 | 15,75 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 402 | 0,00 | 0 | |||||

| 2025-07-22 | 13F | Wells Trecaso Financial Group, LLC | 26 064 | 5,42 | 1 543 | 11,57 | ||||

| 2025-08-11 | 13F | PAX Financial Group, LLC | 8 735 | -0,01 | 517 | 5,73 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 4 920 | 35,91 | 295 | 46,04 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 2 100 | 0,00 | 124 | -1,59 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 79 897 | -4,63 | 4 731 | 0,87 | ||||

| 2025-08-26 | NP | OIBFX - JPMorgan Investor Balanced Fund Class I | 2 576 137 | 0,00 | 152 533 | 5,77 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 3 842 | 53,50 | 228 | 62,14 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 3 406 | 202 | ||||||

| 2025-09-03 | 13F | American Trust | 75 645 | 4 479 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 8 463 | 13,05 | 1 | |||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 50 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 30 691 | -47,95 | 1 817 | -44,96 | ||||

| 2025-07-08 | 13F | Adamsbrown Wealth Consultants Llc | 0 | -100,00 | 0 | |||||

| 2025-06-11 | 13F | Fortitude Financial, LLC | 67 249 | 1,88 | 3 765 | -5,69 | ||||

| 2025-04-23 | 13F | SFG Wealth Management, LLC. | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Summit Wealth Partners, LLC | 11 801 | 5,27 | 699 | 11,32 | ||||

| 2025-04-23 | 13F | Bluesphere Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Heritage Wealth Management, Inc. | 5 558 | 39,05 | 329 | 47,53 | ||||

| 2025-07-30 | 13F | Syntegra Private Wealth Group, LLC | 799 983 | 5,84 | 47 367 | 11,94 | ||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 83 493 | 29,38 | 4 944 | 36,85 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 27 137 | -11,18 | 2 | 0,00 | ||||

| 2025-05-06 | 13F | Assetmark, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Lakeridge Wealth Management LLC | 77 720 | 3,10 | 4 602 | 9,05 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 210 980 | 21,07 | 12 | 33,33 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 4 853 | -11,33 | 287 | -6,21 | ||||

| 2025-07-14 | 13F | Rooted Wealth Advisors, Inc. | 16 940 | 8,65 | 1 028 | 29,80 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 46 424 | -4,08 | 2 749 | 1,44 | ||||

| 2025-08-04 | 13F | Daymark Wealth Partners, Llc | 14 711 | 1,88 | 871 | 7,80 | ||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 8 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 5 961 | 0,00 | 353 | 5,71 | ||||

| 2025-08-07 | 13F | Nwam Llc | 10 691 | -73,74 | 649 | -71,52 | ||||

| 2025-07-16 | 13F | RWM Asset Management, LLC | 63 706 | 2,36 | 3 772 | 8,27 | ||||

| 2025-07-28 | 13F | WealthPlan Investment Management, LLC | 11 876 | 703 | ||||||

| 2025-07-29 | 13F | Systelligence, LLC | 80 142 | -58,77 | 4 745 | -56,39 | ||||

| 2025-05-15 | 13F | Talon Private Wealth, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Arete Wealth Advisors, LLC | 8 886 | 1,73 | 1 | |||||

| 2025-08-05 | 13F | Prosperity Wealth Management, Inc. | 5 544 | -5,30 | 328 | 0,31 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 34 273 | -7,17 | 2 029 | -1,79 | ||||

| 2025-08-26 | NP | EVVLX - The E-Valuator Very Conservative (0%-15%) RMS Fund Service Class Shares | 378 | -6,20 | 22 | 0,00 | ||||

| 2025-05-09 | 13F | CoreCap Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Total Wealth Planning, Llc | 442 415 | 11,47 | 26 195 | 17,91 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 28 120 | -0,01 | 1 665 | 5,72 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 56 849 | -33,59 | 3 | -25,00 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 290 | -19,44 | 17 | -15,00 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 135 | 0,00 | 8 | 14,29 | ||||

| 2025-08-14 | 13F | Sequent Planning LLC | 4 734 | 19,12 | 280 | 26,13 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 4 041 | 423,45 | 239 | 455,81 | ||||

| 2025-08-13 | 13F | Avestar Capital, LLC | 27 155 | 18,94 | 1 608 | 25,74 | ||||

| 2025-05-13 | 13F | Heck Capital Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 416 | 1 334,48 | 25 | 2 300,00 | ||||

| 2025-05-13 | 13F | Quadrature Capital Ltd | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Banco de Sabadell, S.A | 517 | 0 | ||||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 32 626 | 59,29 | 1 932 | 68,50 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 27 836 | -21,26 | 1 648 | -16,73 | ||||

| 2025-08-07 | 13F | Meridian Financial Partners LLC | 285 065 | 8,81 | 17 | 14,29 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 37 388 | -15,92 | 2 214 | -10,87 | ||||

| 2025-08-14 | 13F | Ruggaard & Associates LLC | 28 071 | -11,86 | 1 662 | -6,73 | ||||

| 2025-05-12 | 13F | Citigroup Inc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 258 682 | 17,29 | 15 317 | 24,06 | ||||

| 2025-08-14 | 13F | Fmr Llc | 303 | 604,65 | 18 | 750,00 | ||||

| 2025-07-21 | 13F | Greenwood Capital Associates Llc | 18 489 | 20,45 | 1 095 | 27,36 | ||||

| 2025-08-04 | 13F | Center for Financial Planning, Inc. | 1 223 | 0,00 | 72 | 5,88 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 18 097 | 15,81 | 1 072 | 22,54 | ||||

| 2025-07-30 | 13F | Wbh Advisory Inc | 19 148 | 1 134 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 155 929 | 4,05 | 9 232 | 10,04 | ||||

| 2025-07-24 | 13F | Eastern Bank | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 15 | 0,00 | 1 | |||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 916 | 54 | ||||||

| 2025-08-06 | 13F | Atlas Legacy Advisors, LLC | 45 021 | 6,79 | 2 666 | 10,03 | ||||

| 2025-07-28 | 13F | CGC Financial Services, LLC | 368 650 | 5,55 | 21 828 | 11,64 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 50 255 | -18,13 | 2 976 | -13,42 | ||||

| 2025-07-17 | 13F | Fifth Third Securities, Inc. | 41 172 | 17,12 | 2 438 | 23,89 | ||||

| 2025-04-23 | 13F | Valicenti Advisory Services Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 56 348 | -6,12 | 3 336 | -0,71 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 12 182 | 6,96 | 731 | 15,30 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 0 | 0 | ||||||

| 2025-07-08 | 13F | Legacy Private Trust Co. | 89 163 | 418,87 | 5 279 | 449,32 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 195 | 10,17 | 12 | 22,22 | ||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 8 746 | 518 | ||||||

| 2025-04-21 | 13F | MN Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Balance Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-09 | 13F | Triumph Capital Management | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Wagner Wealth Management, Llc | 387 521 | 6,02 | 22 945 | 12,15 | ||||

| 2025-08-05 | 13F | Strategic Financial Concepts, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Concord Wealth Partners | 341 | 2,71 | 20 | 11,11 | ||||

| 2025-08-05 | 13F | Flynn Zito Capital Management, Llc | 108 351 | 2,39 | 6 415 | 8,29 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 579 860 | 13,85 | 34 333 | 20,42 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 10 524 | 8,45 | 623 | 14,73 | ||||

| 2025-07-25 | 13F | Northwest Capital Management Inc | 4 826 | 22,96 | 286 | 30,14 | ||||

| 2025-08-05 | 13F | Crestwood Advisors Group LLC | 859 938 | -24,33 | 50 917 | -19,97 | ||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 1 885 | 0,00 | 0 | |||||

| 2025-08-07 | 13F | PCG Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 845 752 | 22,45 | 50 077 | 29,51 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 52 710 | 17,10 | 3 121 | 23,86 | ||||

| 2025-08-04 | 13F | MeadowBrook Investment Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 5 514 | -1,27 | 326 | 4,49 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 288 256 | 41,50 | 17 073 | 50,40 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 25 725 | 1 523 | ||||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 6 119 | -14,94 | 362 | -9,95 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 1 535 | 0,00 | 91 | 20,00 | ||||

| 2025-08-13 | 13F | Capital Advisors Wealth Management, LLC | 5 133 | 16,66 | 304 | 23,17 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 913 | 18,11 | 54 | 25,58 | ||||

| 2025-08-12 | 13F | Barnes Pettey Financial Advisors, Llc | 12 811 | 759 | ||||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Vienna Asset Management LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | B & T Capital Management DBA Alpha Capital Management | 197 209 | -3,41 | 11 677 | 2,16 | ||||

| 2025-07-09 | 13F | Breakwater Capital Group | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-21 | 13F | Ashton Thomas Securities, Llc | 28 823 | -18,22 | 1 707 | -13,49 | ||||

| 2025-07-31 | 13F | Oak Harbor Wealth Partners, Llc | 17 227 | 16,23 | 1 020 | 23,04 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Elios Financial Group Inc. | 7 543 | 15,74 | 447 | 22,53 | ||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 3 246 | 369,75 | 192 | 405,26 | ||||

| 2025-03-18 | 13F/A | Bank Of America Corp /de/ | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Modus Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 38 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 69 098 | 13,24 | 4 091 | 19,80 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 61 922 | -5,38 | 3 777 | 3,08 | ||||

| 2025-04-16 | 13F | Twin Peaks Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 49 854 | 46,52 | 2 952 | 54,99 | ||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 463 991 | 4,65 | 27 | 12,50 | ||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 53 | 60,61 | 3 | 200,00 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 5 268 | -4,48 | 312 | 0,97 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 1 976 433 | 12,98 | 117 025 | 19,50 | ||||

| 2025-07-16 | 13F | Strategic Investment Solutions, Inc. /IL | 216 | 0,00 | 13 | 0,00 | ||||

| 2025-08-08 | 13F | Creative Planning | 6 936 | 0,78 | 411 | 6,49 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 409 | 24 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 140 176 | 12,78 | 8 300 | 19,27 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-26 | NP | ONCFX - JPMorgan Investor Conservative Growth Fund Class I | 623 255 | 3,61 | 36 903 | 9,59 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 8 083 | 1,67 | 479 | 7,42 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 408 759 | 18,20 | 24 203 | 25,02 | ||||

| 2025-07-21 | 13F | Triad Wealth Partners, LLC | 6 289 | -35,48 | 372 | -31,74 |