Statistiques de base

| Propriétaires institutionnels | 173 total, 173 long only, 0 short only, 0 long/short - change of 7,45% MRQ |

| Allocation moyenne du portefeuille | 0.6711 % - change of -1,05% MRQ |

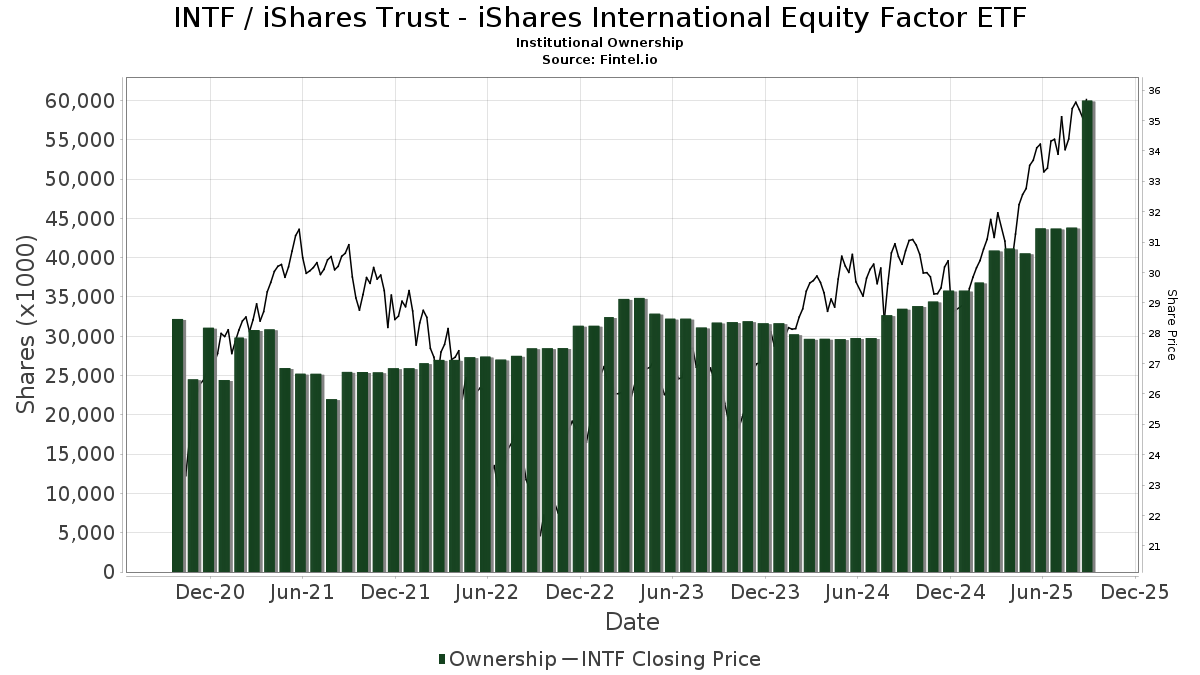

| Actions institutionnelles (Long) | 59 990 784 (ex 13D/G) - change of 16,28MM shares 37,23% MRQ |

| Valeur institutionnelle (Long) | $ 1 996 220 USD ($1000) |

Participation institutionnels et actionnaires

iShares Trust - iShares International Equity Factor ETF (US:INTF) détient 173 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 59,990,784 actions. Les principaux actionnaires incluent Northwestern Mutual Wealth Management Co, Strategic Financial Services, Inc,, Halbert Hargrove Global Advisors, Llc, Tolleson Wealth Management, Inc., Invesco Ltd., Clearwater Capital Advisors, LLC, Atomi Financial Group, Inc., Jpmorgan Chase & Co, Integrated Wealth Concepts LLC, and Kestra Investment Management, LLC .

iShares Trust - iShares International Equity Factor ETF (ARCA:INTF) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 8, 2025 is 35,80 / share. Previously, on September 9, 2024, the share price was 30,27 / share. This represents an increase of 18,25% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

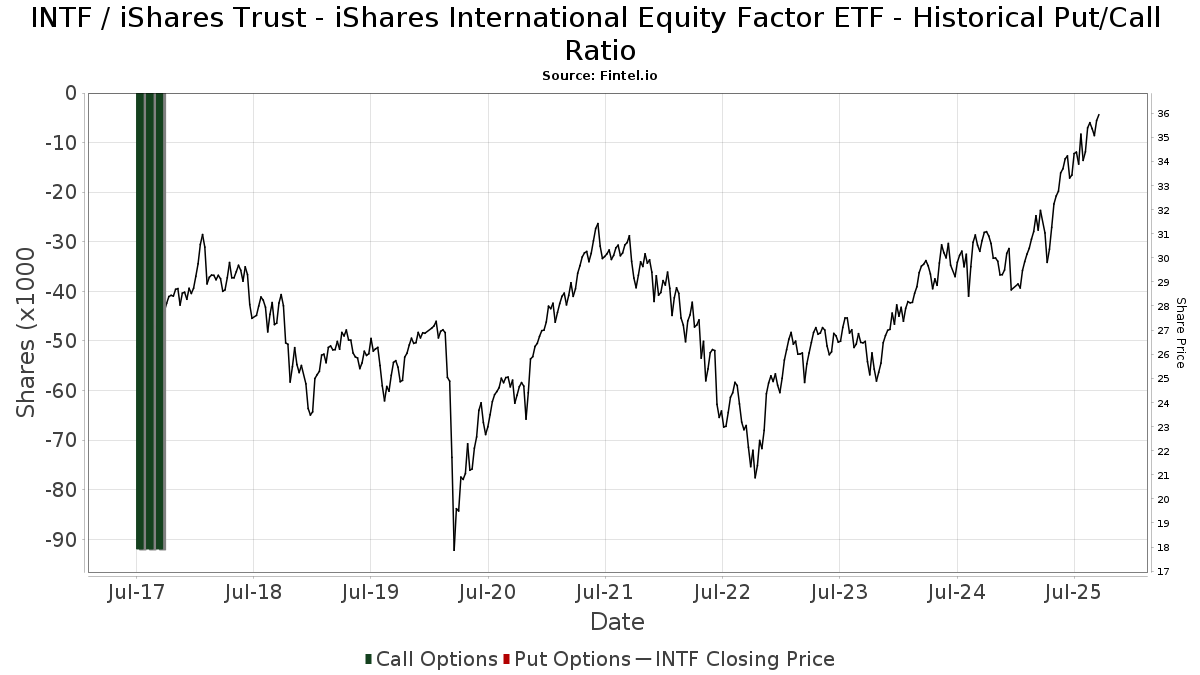

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-16 | 13F/A | CX Institutional | 7 469 | 1,69 | 0 | |||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 12 815 | 0,04 | 439 | 10,89 | ||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 70 527 | -0,62 | 2 414 | 10,33 | ||||

| 2025-07-18 | 13F | SigFig Wealth Management, LLC | 123 649 | 3,95 | 4 225 | 14,22 | ||||

| 2025-05-07 | 13F | Horan Capital Advisors, LLC. | 6 642 | 205 | ||||||

| 2025-07-21 | 13F | HighMark Wealth Management LLC | 151 | 5 | ||||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-07 | 13F | Brio Consultants, LLC | 241 659 | 11,93 | 8 272 | 24,23 | ||||

| 2025-07-24 | 13F | Capital Advisors, Ltd. LLC | 13 268 | 0,23 | 0 | |||||

| 2025-08-14 | 13F | Operose Advisors LLC | 800 | 0,00 | 27 | 12,50 | ||||

| 2025-07-31 | 13F | AlTi Global, Inc. | 84 127 | -36,23 | 2 880 | -29,23 | ||||

| 2025-07-16 | 13F | New Insight Wealth Advisors | 19 982 | 41,93 | 684 | 57,37 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 81 369 | 2,58 | 2 785 | 13,86 | ||||

| 2025-08-06 | 13F | North Capital, Inc. | 108 | 1,89 | 4 | 0,00 | ||||

| 2025-06-26 | NP | FINT - Frontier Asset Total International Equity ETF | 229 075 | -10,71 | 7 383 | -3,75 | ||||

| 2025-07-08 | 13F | RMR Wealth Builders | 9 874 | 338 | ||||||

| 2025-07-17 | 13F | LexAurum Advisors, LLC | 21 763 | -2,50 | 745 | 8,14 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 6 000 | 203 | ||||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 21 320 | 30,40 | 730 | 44,64 | ||||

| 2025-08-11 | 13F | Westover Capital Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Cerity Partners LLC | 71 293 | -1,70 | 2 440 | 9,12 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 976 | 33 | ||||||

| 2025-08-12 | 13F | Blueprint Investment Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Ascent Wealth Partners, LLC | 16 085 | 0,00 | 551 | 10,89 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 36 543 | 19,66 | 1 251 | 32,84 | ||||

| 2025-08-01 | 13F | Strategic Financial Services, Inc, | 8 575 507 | -0,95 | 293 540 | 9,94 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 25 | 0,00 | 1 | |||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 236 515 | -1,27 | 8 096 | 9,58 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 13 033 | 74,85 | 446 | 93,07 | ||||

| 2025-08-28 | 13F/A | Tolleson Wealth Management, Inc. | 2 851 077 | 4,34 | 97 592 | 15,81 | ||||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 831 | 28 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 381 780 | 26,84 | 13 068 | 40,79 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 12 246 | 1,44 | 0 | |||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 26 213 | 897 | ||||||

| 2025-08-07 | 13F | Weil Company, Inc. | 412 946 | 16,61 | 14 135 | 29,43 | ||||

| 2025-07-15 | 13F | EWG Elevate Inc. | 59 564 | 363,93 | 2 039 | 415,95 | ||||

| 2025-05-14 | 13F | CIBC Private Wealth Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-08 | 13F | Baker Ellis Asset Management LLC | 27 800 | -9,74 | 952 | 0,21 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 18 691 | -23,82 | 640 | -15,48 | ||||

| 2025-04-11 | 13F | Princeton Global Asset Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 76 066 | 63,18 | 2 604 | 81,14 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 12 196 | 417 | ||||||

| 2025-08-07 | 13F | Allworth Financial LP | 2 020 | -6,09 | 69 | 1,47 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 1 771 706 | 2,44 | 60 645 | 13,70 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 14 015 | 63,54 | 480 | 81,44 | ||||

| 2025-08-14 | 13F | UBS Group AG | 441 395 | 1,91 | 15 109 | 13,11 | ||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 59 350 | 30,35 | 2 087 | 42,10 | ||||

| 2025-08-05 | 13F | Landmark Wealth Management, Inc. | 31 371 | 0,00 | 1 074 | 10,96 | ||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 6 051 | -7,79 | 207 | 2,48 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 91 289 | -8,20 | 3 | 0,00 | ||||

| 2025-07-10 | 13F | Orgel Wealth Management, LLC | 8 733 | 0,48 | 299 | 11,19 | ||||

| 2025-07-29 | 13F | Fundamentun, Llc | 61 760 | -3,27 | 2 114 | 7,42 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 879 447 | -2,15 | 30 103 | 8,61 | ||||

| 2025-07-28 | 13F | ForthRight Wealth Management, LLC | 9 872 | 0,00 | 338 | 10,86 | ||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 13 158 | 0,91 | 450 | 11,94 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 1 059 484 | 61,24 | 36 264 | 78,96 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 65 252 | -1,58 | 2 234 | 9,25 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 325 | 0,00 | 11 | 10,00 | ||||

| 2025-08-06 | 13F | HORAN Wealth, LLC | 6 642 | 227 | ||||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 15 878 455 | 54 816,15 | 543 519 | 60 901,01 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 42 097 | 136,09 | 1 441 | 162,30 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 948 892 | -1,46 | 32 481 | 9,37 | ||||

| 2025-08-06 | 13F | DDFG, Inc | 226 977 | 1,97 | 7 769 | 13,18 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 88 910 | 31,82 | 3 | 50,00 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Colony Group, LLC | 123 915 | 65,82 | 4 242 | 84,07 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 18 765 | 0,00 | 1 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 3 977 | 0,00 | 136 | 11,48 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 101 440 | -8,11 | 3 472 | 2,00 | ||||

| 2025-07-17 | 13F | Halbert Hargrove Global Advisors, Llc | 3 195 954 | 0,44 | 109 397 | 11,47 | ||||

| 2025-08-05 | 13F | Meridian Management Co | 267 156 | -5,70 | 9 030 | 3,34 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 273 723 | 5,08 | 9 370 | 16,63 | ||||

| 2025-04-16 | 13F | Smithbridge Asset Management Inc/de | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Quadrant Private Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 561 257 | -36,09 | 19 212 | -29,07 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 123 437 | 974,95 | 4 209 | 1 088,70 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 851 829 | -6,62 | 29 | 3,57 | ||||

| 2025-07-25 | 13F | Hemington Wealth Management | 871 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 11 092 | 0,03 | 380 | 11,14 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 194 | 0,00 | 7 | 20,00 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 94 543 | 0,00 | 3 236 | 11,01 | ||||

| 2025-07-11 | 13F | Rockwood Wealth Management, LLC | 10 000 | 0,00 | 342 | 11,04 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 8 320 | 0,00 | 285 | 10,94 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 30 | 1 | ||||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 4 452 | 0,00 | 152 | 10,95 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 125 | 0,00 | 4 | 33,33 | ||||

| 2025-08-18 | 13F/A | Kestra Investment Management, LLC | 1 237 354 | -45,98 | 42 355 | -40,04 | ||||

| 2025-04-23 | 13F | Mascagni Wealth Management, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Horan Securities, Inc. | 6 642 | 0,00 | 227 | 11,27 | ||||

| 2025-07-29 | 13F | Foster & Motley Inc | 410 664 | -11,87 | 14 | 0,00 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 9 495 | -0,01 | 325 | 11,30 | ||||

| 2025-08-06 | 13F | Stokes Family Office, LLC | 807 176 | 41,47 | 27 630 | 57,03 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 15 620 | 10,69 | 535 | 22,76 | ||||

| 2025-04-23 | 13F | Legacy Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 1 055 237 | 8,29 | 36 121 | 20,20 | ||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 7 005 | -14,27 | 240 | -4,78 | ||||

| 2025-08-14 | 13F | Obsido Oy | 259 933 | 1,66 | 8 898 | 12,83 | ||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 563 | 19 | ||||||

| 2025-07-10 | 13F | Sovran Advisors, LLC | 6 072 | 208 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 655 614 | -4,16 | 22 442 | 6,37 | ||||

| 2025-08-01 | 13F | First Command Advisory Services, Inc. | 760 428 | 3,89 | 26 029 | 15,03 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 448 | -94,52 | 15 | -94,09 | ||||

| 2025-07-29 | 13F | Signature Estate & Investment Advisors Llc | 56 319 | -36,37 | 1 928 | -29,39 | ||||

| 2025-05-09 | 13F | Wade Financial Advisory, Inc | 318 745 | 9,44 | 9 830 | 17,53 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 28 975 | -12,81 | 992 | -3,22 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 203 335 | 8,57 | 6 960 | 20,25 | ||||

| 2025-08-13 | 13F | Avestar Capital, LLC | 145 907 | 28,85 | 4 994 | 43,01 | ||||

| 2025-07-10 | 13F | Wedmont Private Capital | 30 272 | 0,02 | 1 041 | 15,04 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 9 570 | -0,57 | 0 | |||||

| 2025-07-14 | 13F | Seascape Capital Management | 13 851 | 2,37 | 0 | |||||

| 2025-07-21 | 13F | Pflug Koory, LLC | 500 | 0,00 | 17 | 13,33 | ||||

| 2025-08-12 | 13F | Clearwater Capital Advisors, LLC | 1 843 707 | -0,53 | 63 110 | 10,41 | ||||

| 2025-08-11 | 13F | Wescott Financial Advisory Group, LLC | 10 665 | -5,45 | 365 | 5,19 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 15 104 | 1,68 | 517 | 12,88 | ||||

| 2025-08-27 | 13F | Stonebridge Wealth Management, LLC | 65 845 | 2 254 | ||||||

| 2025-08-14 | 13F | Financial Engines Advisors L.L.C. | 6 141 | 210 | ||||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 11 238 | -21,93 | 385 | -13,32 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 250 523 | 179,48 | 8 575 | 210,24 | ||||

| 2025-07-10 | 13F | Sterling Financial Group, Inc. | 623 742 | 39,57 | 21 351 | 54,91 | ||||

| 2025-07-28 | 13F | Sagespring Wealth Partners, Llc | 148 756 | 19,17 | 5 092 | 32,27 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 1 466 | 0,00 | 50 | 11,11 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 4 095 | 45,11 | 140 | 60,92 | ||||

| 2025-07-23 | 13F | Heck Capital Advisors, LLC | 59 956 | -42,41 | 2 052 | -36,07 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 19 799 | 0,09 | 678 | 10,98 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 10 817 | 0,00 | 370 | 10,12 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 1 046 | 0,00 | 36 | 9,38 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1 267 | 0,48 | 43 | 13,16 | ||||

| 2025-07-09 | 13F | Thrive Wealth Management, LLC | 341 743 | -6,75 | 11 698 | 3,49 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 1 344 337 | 11,10 | 46 017 | 23,31 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 460 | -87,80 | 16 | -87,07 | ||||

| 2025-08-14 | 13F | Fmr Llc | 5 453 | 6,57 | 187 | 18,47 | ||||

| 2025-08-12 | 13F | Inscription Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 197 | 0,00 | 6 | -16,67 | ||||

| 2025-08-13 | 13F | Summit Wealth Group Llc / Co | 13 052 | 447 | ||||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 5 964 | 0,00 | 204 | 11,48 | ||||

| 2025-08-13 | 13F | Colonial Trust Advisors | 520 | 0,00 | 18 | 6,25 | ||||

| 2025-08-13 | 13F | SageView Advisory Group, LLC | 8 228 | -0,66 | 282 | 10,59 | ||||

| 2025-07-09 | 13F | Archer Investment Management, LLC | 32 517 | -22,12 | 1 113 | -13,52 | ||||

| 2025-08-13 | 13F | Mount Yale Investment Advisors, LLC | 34 102 | 1 167 | ||||||

| 2025-07-31 | 13F | Cabot Wealth Management Inc | 56 430 | 1,28 | 1 932 | 12,40 | ||||

| 2025-08-27 | 13F | Barnes Wealth Management Group, Inc | 7 560 | -2,70 | 259 | 7,95 | ||||

| 2025-04-29 | 13F | Callan Capital, LLC | 749 022 | -2,67 | 23 100 | 4,52 | ||||

| 2025-08-05 | 13F | Dynasty Wealth Management, Llc | 108 416 | -12,15 | 3 711 | -2,47 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 27 544 | 943 | ||||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 10 847 | -13,29 | 371 | -3,64 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 3 450 | 0,00 | 118 | 11,32 | ||||

| 2025-08-08 | 13F | Horizon Family Wealth, Inc. | 129 770 | 0,16 | 4 442 | 11,19 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 1 485 415 | 0,00 | 50 846 | 10,99 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 90 606 | 1 085,32 | 3 101 | 1 219,57 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 7 206 | -39,28 | 247 | -32,51 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 2 520 000 | 0,00 | 86 260 | 10,99 | ||||

| 2025-04-10 | 13F | Retirement Planning Group | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 750 747 | -2,90 | 25 698 | 7,78 | ||||

| 2025-04-22 | 13F/A | NorthRock Partners, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-24 | 13F | GFG Capital, LLC | 0 | 0 | ||||||

| 2025-07-25 | 13F | RHS Financial, LLC | 120 956 | 22,83 | 4 140 | 36,36 | ||||

| 2025-08-05 | 13F | Magnolia Capital Advisors Llc | 45 591 | 26,35 | 1 561 | 40,29 | ||||

| 2025-07-31 | 13F | Sage Mountain Advisors LLC | 42 634 | 1,96 | 1 459 | 13,19 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 21 199 | 726 | ||||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 7 248 | 0,01 | 248 | 11,21 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 18 448 | -18,00 | 631 | -8,95 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 827 | 28 | ||||||

| 2025-08-11 | 13F | CFS Investment Advisory Services, LLC | 30 824 | -10,31 | 1 | 0,00 | ||||

| 2025-08-08 | 13F | Creative Planning | 70 731 | -0,94 | 2 421 | 9,95 | ||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 318 396 | -19,45 | 10 899 | -10,61 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 37 914 | 5 129,52 | 1 298 | 6 385,00 | ||||

| 2025-08-06 | 13F | Mark Sheptoff Financial Planning, Llc | 35 | 0,00 | 1 | 0,00 | ||||

| 2025-08-04 | 13F | Beirne Wealth Consulting Services, LLC | 108 240 | 2,37 | 3 706 | 13,62 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 337 171 | 1,67 | 11 541 | 12,85 | ||||

| 2025-07-25 | 13F | Concord Wealth Partners | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Sigma Planning Corp | 26 603 | 911 | ||||||

| 2025-07-23 | 13F | Armbruster Capital Management, Inc. | 32 775 | 39,02 | 1 122 | 54,20 | ||||

| 2025-07-16 | 13F | Signature Resources Capital Management, LLC | 1 576 | 0,00 | 54 | 10,42 | ||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 1 069 | 37 | ||||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 113 540 | 37,21 | 3 886 | 52,27 | ||||

| 2025-07-23 | 13F | Citizens National Bank Trust Department | 135 288 | -1,23 | 4 631 | 9,61 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 123 974 | 23,30 | 4 236 | 35,51 | ||||

| 2025-07-24 | 13F | Edge Financial Advisors LLC | 33 340 | -17,02 | 1 141 | -7,91 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 9 982 | 0,00 | 342 | 11,07 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 1 006 | 0,00 | 34 | 9,68 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 101 | -95,58 | 3 | -95,71 | ||||

| 2025-07-09 | 13F | Lincoln Capital Corp | 46 920 | -2,50 | 1 606 | 8,22 | ||||

| 2025-07-14 | 13F | Acropolis Investment Management, LLC | 301 413 | 4,14 | 10 317 | 15,60 | ||||

| 2025-08-14 | 13F | 10Elms LLP | 2 069 | 0,00 | 71 | 11,11 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 8 160 | -60,28 | 279 | -55,92 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 220 | 0,00 | 8 | 16,67 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 6 395 | 219 | ||||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 395 | 14 |