Statistiques de base

| Propriétaires institutionnels | 161 total, 161 long only, 0 short only, 0 long/short - change of 14,18% MRQ |

| Allocation moyenne du portefeuille | 0.5856 % - change of 14,53% MRQ |

| Actions institutionnelles (Long) | 20 603 562 (ex 13D/G) - change of 4,32MM shares 26,55% MRQ |

| Valeur institutionnelle (Long) | $ 793 466 USD ($1000) |

Participation institutionnels et actionnaires

EA Series Trust - Freedom 100 Emerging Markets ETF (US:FRDM) détient 161 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 20,603,562 actions. Les principaux actionnaires incluent Retirement Planning Group, Northwestern Mutual Wealth Management Co, Wells Fargo & Company/mn, Ellevest, Inc., Tanglewood Wealth Management, Inc., Willis Johnson & Associates, Inc., Aptus Capital Advisors, LLC, Guardian Wealth Advisors, Llc / Nc, Coyle Financial Counsel LLC, and Kathmere Capital Management, LLC .

EA Series Trust - Freedom 100 Emerging Markets ETF (BATS:FRDM) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 9, 2025 is 42,74 / share. Previously, on September 10, 2024, the share price was 33,82 / share. This represents an increase of 26,37% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

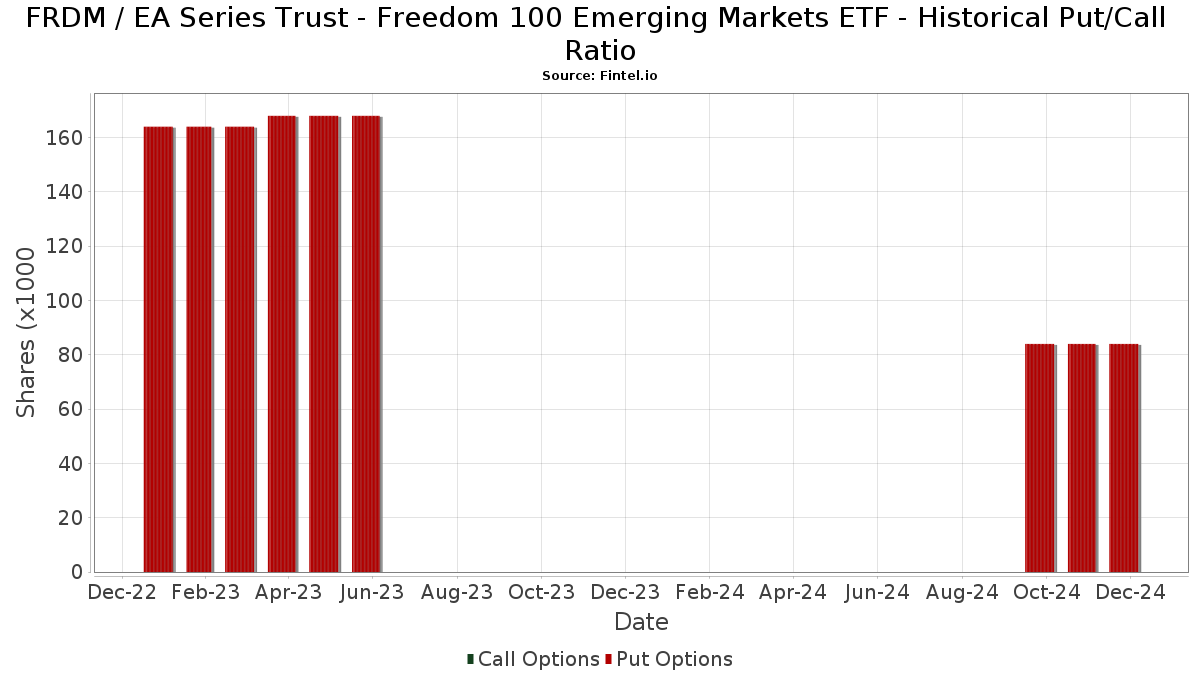

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-23 | 13F | Lansing Street Advisors | 37 230 | 25,76 | 1 504 | 45,03 | ||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 51 537 | 74,11 | 2 082 | 115,31 | ||||

| 2025-08-13 | 13F | Millstone Evans Group, LLC | 634 | 0,32 | 26 | 13,64 | ||||

| 2025-08-13 | 13F | WCG Wealth Advisors LLC | 174 390 | -21,80 | 7 045 | -9,88 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 30 620 | 1 237 | ||||||

| 2025-08-07 | 13F | Mayport, Llc | 265 391 | 6,57 | 10 722 | 22,83 | ||||

| 2025-08-08 | 13F | Smithfield Trust Co | 1 328 | 0,00 | 0 | |||||

| 2025-07-25 | 13F | Commonwealth Financial Services, LLC | 259 753 | 0,84 | 10 494 | 16,24 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 5 164 | -46,29 | 209 | -38,28 | ||||

| 2025-08-14 | 13F | Financial Network Wealth Advisors LLC | 2 119 | -32,06 | 86 | -22,02 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 3 858 | 21,59 | 156 | 39,64 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 454 117 | 16,51 | 18 346 | 34,29 | ||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 1 600 | 65 | ||||||

| 2025-07-17 | 13F | XY Planning Network, Inc. | 8 801 | 356 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 25 396 | 157,30 | 1 019 | 194,51 | ||||

| 2025-04-25 | 13F | Smallwood Wealth Investment Management, LLC | 113 884 | 3,65 | 3 992 | 11,17 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 236 | 293,33 | 10 | 350,00 | ||||

| 2025-08-14 | 13F | Guardian Wealth Advisors, Llc / Nc | 622 371 | 83,09 | 25 144 | 110,63 | ||||

| 2025-07-16 | 13F | Beaumont Financial Advisors, LLC | 220 075 | 14,20 | 8 891 | 31,64 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 12 109 | -41,94 | 489 | -33,11 | ||||

| 2025-07-10 | 13F | Signal Advisors Wealth, LLC | 85 799 | 57,61 | 3 466 | 81,66 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 5 317 | 0,00 | 215 | 15,05 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 935 | 3,89 | 38 | 19,35 | ||||

| 2025-03-12 | 13F/A | Private Capital Management Llc | 12 295 | 434 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 7 971 | 322 | ||||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 8 046 | 4,47 | 325 | 20,82 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 87 706 | 11,90 | 3 543 | 28,98 | ||||

| 2025-05-15 | 13F | Gts Securities Llc | 0 | -100,00 | 0 | |||||

| 2025-09-09 | 13F | Cambridge Financial Group, LLC | 6 883 | 0,61 | 278 | 15,83 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 1 920 | 1,64 | 78 | 16,67 | ||||

| 2025-08-14 | 13F | Fmr Llc | 1 304 | -22,79 | 53 | -11,86 | ||||

| 2025-07-29 | 13F | Angeles Wealth Management, Llc | 30 072 | 1 215 | ||||||

| 2025-08-07 | 13F | 1620 Investment Advisors, Inc. | 62 574 | 4,01 | 2 528 | 19,88 | ||||

| 2025-08-14 | 13F | UBS Group AG | 813 | 33 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 86 | -86,11 | 3 | -85,71 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 1 | 0 | ||||||

| 2025-07-21 | 13F | Tanglewood Wealth Management, Inc. | 1 107 772 | 48,58 | 44 754 | 71,24 | ||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Quarry Hill Advisors, Llc | 134 479 | -1,85 | 5 433 | 13,12 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 24 986 | 1 009 | ||||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 160 176 | -0,73 | 6 471 | 14,43 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 12 431 | -6,56 | 502 | 7,73 | ||||

| 2025-08-13 | 13F | Willis Johnson & Associates, Inc. | 982 672 | 4,38 | 39 700 | 20,31 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 178 208 | -1,74 | 7 200 | 13,25 | ||||

| 2025-08-12 | 13F | Frontier Asset Management, LLC | 7 294 | -90,97 | 295 | -89,61 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 7 940 | 321 | ||||||

| 2025-08-15 | 13F | Koesten, Hirschmann & Crabtree, INC. | 19 | 0,00 | 1 | |||||

| 2025-07-23 | 13F | Heck Capital Advisors, LLC | 249 563 | 0,22 | 10 082 | 15,51 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 184 | 0,00 | 7 | 16,67 | ||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 25 440 | -15,02 | 1 028 | -2,10 | ||||

| 2025-07-11 | 13F | William Howard & Co Financial Advisors Inc | 16 137 | 0,70 | 652 | 16,04 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 46 326 | 1 872 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 24 877 | 827,55 | 1 005 | 969,15 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 250 227 | 461,77 | 10 109 | 547,60 | ||||

| 2025-07-22 | 13F | Yardley Wealth Management LLC | 360 025 | -1,64 | 15 | 16,67 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 30 | 0,00 | 1 | 0,00 | ||||

| 2025-07-08 | 13F | Prism Advisors, Inc. | 28 337 | -39,00 | 1 145 | -29,73 | ||||

| 2025-04-23 | 13F | Mascagni Wealth Management, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-18 | 13F/A | MJT & Associates Financial Advisory Group, Inc. | 685 | 28 | ||||||

| 2025-08-12 | 13F | Tableaux Llc | 15 000 | -86,72 | 15 | -99,62 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 1 438 388 | 12,01 | 58 111 | 29,10 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 47 054 | 21,55 | 1 896 | 39,75 | ||||

| 2025-08-05 | 13F | Lord & Richards Wealth Management, LLC | 21 950 | 146,68 | 887 | 184,89 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 362 962 | -0,75 | 14 664 | 14,39 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 139 220 | -29,31 | 5 624 | -18,53 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 31 665 | -27,02 | 1 | 0,00 | ||||

| 2025-07-23 | 13F | High Note Wealth, LLC | 178 666 | 186,57 | 7 218 | 230,34 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 200 | 0,00 | 8 | 14,29 | ||||

| 2025-05-15 | 13F | Bank Of America Corp /de/ | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 1 632 | 0,00 | 66 | 14,04 | ||||

| 2025-07-21 | 13F | Investment Planning Advisors, Inc. | 416 007 | 107,51 | 16 807 | 139,16 | ||||

| 2025-05-13 | 13F/A | Magnolia Capital Advisors Llc | 26 757 | 3,61 | 874 | -4,17 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 193 | 0,00 | 8 | 40,00 | ||||

| 2025-07-16 | 13F | Magnus Financial Group LLC | 32 105 | -0,12 | 1 297 | 15,19 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 25 267 | 4,53 | 1 031 | 18,53 | ||||

| 2025-07-03 | 13F | TrueWealth Advisors, LLC | 128 729 | -4,52 | 5 201 | 10,03 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 163 305 | -10,48 | 6 598 | 3,17 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 264 419 | 228,60 | 51 083 | 278,75 | ||||

| 2025-07-31 | 13F | Trademark Financial Management, LLC | 72 304 | 270,13 | 2 921 | 327,05 | ||||

| 2025-08-08 | 13F | Islay Capital Management, Llc | 71 613 | 4,53 | 2 893 | 20,49 | ||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 3 000 | 0,00 | 121 | 15,24 | ||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 23 568 | 0,58 | 952 | 15,96 | ||||

| 2025-08-14 | 13F | Comerica Bank | 2 401 | 0,00 | 97 | 15,48 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 2 133 | 86 | ||||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 396 795 | 8,89 | 16 030 | 25,50 | ||||

| 2025-07-15 | 13F | Mather Group, Llc. | 21 469 | 0,00 | 867 | 15,29 | ||||

| 2025-07-28 | 13F | Lunt Capital Management, Inc. | 62 234 | 0,81 | 2 514 | 16,23 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 10 248 | 414 | ||||||

| 2025-08-14 | 13F | L2 Asset Management, LLC | 8 816 | 356 | ||||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 270 737 | 1,50 | 11 | 11,11 | ||||

| 2025-07-23 | 13F | Clear Creek Financial Management, LLC | 59 183 | -2,31 | 2 391 | 11,73 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 5 300 | 214 | ||||||

| 2025-08-08 | 13F | Bailard, Inc. | 5 200 | 210 | ||||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 72 481 | -87,76 | 3 | -90,00 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 55 000 | 0,00 | 2 222 | 15,31 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 55 000 | 0,00 | 1 928 | 7,23 | ||||

| 2025-07-23 | 13F | L.K. Benson & Company, P.C. | 14 206 | 17,03 | 574 | 34,82 | ||||

| 2025-05-02 | 13F | Transcendent Capital Group LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Global View Capital Management LLC | 20 857 | -10,17 | 843 | 3,57 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 24 654 | 0,94 | 996 | 16,08 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 450 | 18 | ||||||

| 2025-08-14 | 13F | Coyle Financial Counsel LLC | 523 087 | 5,48 | 21 133 | 21,57 | ||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Financial Guidance Group, Inc. | 31 969 | 1 292 | ||||||

| 2025-07-31 | 13F | Longview Financial Advisors, Inc. | 40 180 | 13,59 | 1 623 | 30,99 | ||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 519 600 | 0,78 | 20 992 | 16,15 | ||||

| 2025-07-25 | 13F | Pandora Wealth, Inc. | 45 188 | 0,65 | 1 826 | 16,02 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Marshall Investment Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 20 746 | 37,98 | 838 | 59,01 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 7 427 | 15,52 | 300 | 33,33 | ||||

| 2025-08-12 | 13F | Maripau Wealth Management Llc | 44 870 | 47,80 | 1 826 | 71,52 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 55 313 | 275,44 | 2 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 4 992 | 5,45 | 202 | 21,82 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 10 432 | 18,05 | 421 | 36,25 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 11 689 | 1 111,30 | 472 | 1 422,58 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 60 967 | -14,77 | 2 463 | -1,79 | ||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 48 | 2,13 | 2 | 0,00 | ||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 5 432 | 219 | ||||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Skyline Advisors, Inc. | 8 717 | 0,68 | 352 | 16,17 | ||||

| 2025-07-17 | 13F | Smith Anglin Financial, LLC | 11 844 | -5,87 | 478 | 8,39 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Tfo-tdc, Llc | 10 000 | 404 | ||||||

| 2025-08-07 | 13F | New England Private Wealth Advisors LLC | 113 580 | 1,62 | 4 597 | 17,33 | ||||

| 2025-08-08 | 13F | Creative Planning | 13 532 | 28,10 | 547 | 47,57 | ||||

| 2025-07-31 | 13F | Stegent Equity Advisors, Inc. | 11 763 | 0,00 | 475 | 15,29 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 1 441 | -66,57 | 58 | -61,59 | ||||

| 2025-08-06 | 13F | Stokes Family Office, LLC | 226 851 | -0,38 | 9 165 | 14,81 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 5 161 | 209 | ||||||

| 2025-05-14 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | New Harbor Financial Group, LLC | 5 589 | -4,61 | 226 | 9,76 | ||||

| 2025-08-12 | 13F | Watchman Group, Inc. | 190 367 | -0,70 | 7 691 | 14,45 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 10 109 | -3,03 | 408 | 11,78 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 5 010 | -8,98 | 202 | 5,21 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 22 443 | -37,71 | 907 | -28,32 | ||||

| 2025-04-16 | 13F | Fortitude Family Office, LLC | 0 | -100,00 | 0 | |||||

| 2025-04-10 | 13F | Clarus Wealth Advisors | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 23 269 | 29,61 | 1 | |||||

| 2025-07-24 | 13F | Capital Advisors, Ltd. LLC | 8 583 | 21,31 | 0 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 72 132 | 5,36 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 7 729 | -3,04 | 312 | 11,83 | ||||

| 2025-04-28 | 13F | Strategic Financial Concepts, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 28 306 | 3,23 | 1 144 | 18,94 | ||||

| 2025-08-12 | 13F | Allen Capital Group, LLC | 33 656 | 9,53 | 1 360 | 26,18 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 89 981 | 402,43 | 3 635 | 479,74 | ||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 196 276 | 1,86 | 7 930 | 14,43 | ||||

| 2025-08-13 | 13F | Lumbard & Kellner, LLC | 154 307 | 97,17 | 6 234 | 127,27 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 356 976 | 527,54 | 14 422 | 623,58 | ||||

| 2025-08-05 | 13F | Ellevest, Inc. | 1 140 983 | 458,64 | 46 096 | 543,96 | ||||

| 2025-07-30 | 13F | Mills Wealth Advisors LLC | 5 280 | 213 | ||||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 10 611 | -3,01 | 429 | 11,75 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 11 387 | -11,69 | 460 | 2,00 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 1 121 | 0,00 | 45 | 15,38 | ||||

| 2025-06-27 | NP | GIAX - Nicholas Global Equity and Income ETF | 57 776 | 22,11 | 2 089 | 29,69 | ||||

| 2025-08-04 | 13F | Center for Financial Planning, Inc. | 650 | 48,40 | 26 | 73,33 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 60 830 | 5,29 | 2 458 | 21,33 | ||||

| 2025-08-15 | 13F | First Heartland Consultants, Inc. | 362 182 | 14 632 | ||||||

| 2025-04-30 | 13F | Bull Oak Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Old Mission Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 729 | -98,73 | 29 | -98,56 | ||||

| 2025-07-09 | 13F | Intelligence Driven Advisers, LLC | 422 619 | 25,95 | 17 074 | 45,17 | ||||

| 2025-08-01 | 13F | SwitchPoint Financial Planning, LLC | 5 644 | 228 | ||||||

| 2025-07-25 | 13F | Stephens Consulting, LLC | 187 682 | 14,25 | 7 582 | 31,70 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 658 174 | 91,48 | 26 590 | 120,70 | ||||

| 2025-07-15 | 13F | EWG Elevate Inc. | 93 518 | 3 778 | ||||||

| 2025-08-07 | 13F | Gs Investments, Inc. | 8 055 | 0,00 | 325 | 15,25 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 341 | -77,67 | 14 | -75,47 | ||||

| 2025-07-16 | 13F | ORG Partners LLC | 1 000 | 0,00 | 40 | 14,29 | ||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 3 371 | 28,47 | 136 | 49,45 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 227 106 | 25,38 | 9 175 | 44,51 | ||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 37 747 | 1 333 | ||||||

| 2025-07-30 | 13F | Retirement Planning Group | 2 386 771 | 1,20 | 96 426 | 16,64 | ||||

| 2025-08-14 | 13F | Arete Wealth Advisors, LLC | 12 874 | -5,93 | 1 | |||||

| 2025-07-18 | 13F | Warren Street Wealth Advisors, LLC | 5 828 | 0,00 | 235 | 15,20 | ||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 94 884 | 5,72 | 3 833 | 21,88 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 45 526 | 88,34 | 1 839 | 117,12 |