Statistiques de base

| Propriétaires institutionnels | 122 total, 122 long only, 0 short only, 0 long/short - change of 2,52% MRQ |

| Allocation moyenne du portefeuille | 0.0685 % - change of -1,24% MRQ |

| Actions institutionnelles (Long) | 17 956 886 (ex 13D/G) - change of 0,26MM shares 1,47% MRQ |

| Valeur institutionnelle (Long) | $ 162 656 USD ($1000) |

Participation institutionnels et actionnaires

Companhia Paranaense de Energia - COPEL - Depositary Receipt (Common Stock) (US:ELP) détient 122 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 17,956,886 actions. Les principaux actionnaires incluent Letko, Brosseau & Associates Inc, Vanguard Group Inc, VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares, BlackRock, Inc., Goldman Sachs Group Inc, Morgan Stanley, SPX Equities Gestao de Recursos Ltda, Bank Of America Corp /de/, Optiver Holding B.V., and Robeco Institutional Asset Management B.V. .

Companhia Paranaense de Energia - COPEL - Depositary Receipt (Common Stock) (NYSE:ELP) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 5, 2025 is 9,12 / share. Previously, on September 9, 2024, the share price was 7,78 / share. This represents an increase of 17,22% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

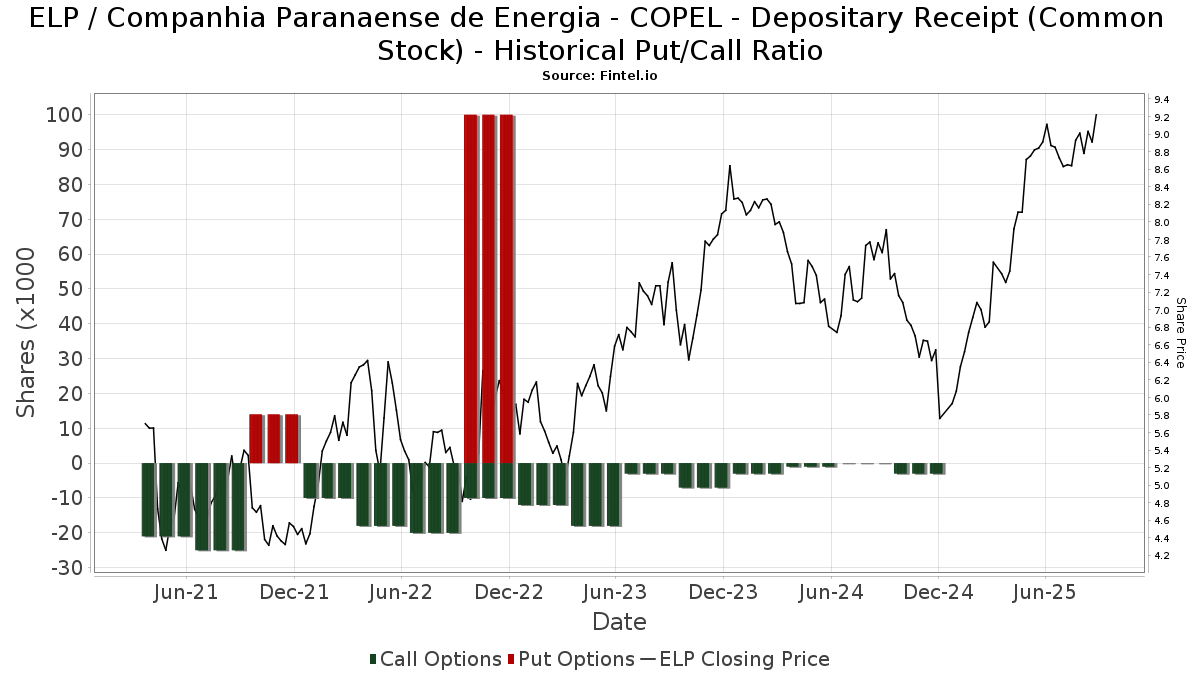

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Ameriprise Financial Inc | 54 281 | 0,82 | 496 | 25,95 | ||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 1 170 772 | 0,07 | 10 689 | 24,99 | ||||

| 2025-08-14 | 13F | Fmr Llc | 13 832 | 22,73 | 126 | 53,66 | ||||

| 2025-06-30 | NP | VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares | 1 528 503 | -7,92 | 12 396 | 12,13 | ||||

| 2025-08-14 | 13F | Barometer Capital Management Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 4 932 | 1,23 | 45 | 28,57 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 29 483 | 1,26 | 269 | 26,89 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 46 230 | 58,50 | 422 | 98,12 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 36 963 | -4,79 | 337 | 19,08 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 1 049 | -4,64 | 10 | 12,50 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 13 227 | 6 683,08 | 121 | 11 900,00 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 54 449 | 0,00 | 497 | 24,87 | ||||

| 2025-08-13 | 13F | Grantham, Mayo, Van Otterloo & Co. LLC | 83 173 | 0,00 | 759 | 25,04 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 118 059 | 53,68 | 1 078 | 91,98 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 541 587 | 0,00 | 4 945 | 24,88 | ||||

| 2025-06-26 | NP | DFEM - Dimensional Emerging Markets Core Equity 2 ETF | 21 675 | 10,73 | 176 | 34,62 | ||||

| 2025-08-28 | NP | CNRG - SPDR S&P Kensho Clean Power ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 60 901 | -50,52 | 556 | -38,15 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 15 509 | 14,94 | 142 | 43,88 | ||||

| 2025-07-18 | 13F | Robeco Institutional Asset Management B.V. | 479 169 | -46,48 | 4 375 | -33,16 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 544 714 | 97,65 | 4 973 | 146,92 | ||||

| 2025-07-24 | 13F | PDS Planning, Inc | 23 064 | 2,61 | 211 | 28,05 | ||||

| 2025-05-15 | 13F | Citadel Advisors Llc | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-19 | 13F | Asset Dedication, LLC | 922 | 0,00 | 8 | 33,33 | ||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Citadel Advisors Llc | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-06 | 13F | True Wealth Design, LLC | 20 | 0,00 | 0 | |||||

| 2025-04-11 | 13F | First Affirmative Financial Network | 16 663 | 53,42 | 122 | 89,06 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 1 235 793 | 4,35 | 11 283 | 30,32 | ||||

| 2025-05-05 | 13F | Eagle Bay Advisors LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | SPX Equities Gestao de Recursos Ltda | 916 030 | -17,54 | 8 363 | 2,99 | ||||

| 2025-06-30 | NP | VGTSX - Vanguard Total International Stock Index Fund Investor Shares | 8 914 | 0,00 | 72 | 22,03 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 15 | 0 | ||||||

| 2025-08-13 | 13F | West Family Investments, Inc. | 13 105 | 0,00 | 120 | 25,26 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 102 641 | -3,12 | 937 | 21,06 | ||||

| 2025-08-14 | 13F | UBS Group AG | 17 957 | -54,90 | 164 | -43,99 | ||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 0 | -100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 402 | 332,26 | 4 | |||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 94 | 49,21 | 1 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 405 | 4 | ||||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 10 183 | -7,63 | 93 | 15,00 | ||||

| 2025-08-08 | 13F | Letko, Brosseau & Associates Inc | 6 704 446 | -0,15 | 61 212 | 24,71 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 109 561 | 24,94 | 973 | 51,79 | ||||

| 2025-07-30 | NP | BRAZ - Global X Brazil Active ETF | 12 002 | 26,34 | 108 | 69,84 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 134 477 | 1 228 | ||||||

| 2025-07-29 | 13F | Wealthstream Advisors, Inc. | 13 590 | 29,79 | 124 | 63,16 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 24 | 0 | ||||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 1 303 | 2,12 | 12 | 22,22 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 12 092 | 110 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 10 151 | 4 094,63 | 93 | 9 100,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 27 972 | 255 | ||||||

| 2025-06-26 | NP | DFSE - Dimensional Emerging Markets Sustainability Core 1 ETF | 11 475 | 13,33 | 93 | 38,81 | ||||

| 2025-08-21 | NP | SMOG - VanEck Vectors Low Carbon Energy ETF | 75 659 | -6,13 | 691 | 17,15 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 391 | 4 | ||||||

| 2025-08-13 | 13F | Invesco Ltd. | 33 755 | 53,38 | 308 | 92,50 | ||||

| 2025-08-11 | 13F | Vanguard Group Inc | 1 767 272 | 0,00 | 16 135 | 24,90 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 4 318 | 279,10 | 39 | 387,50 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 318 | 1,60 | 3 | 0,00 | ||||

| 2025-04-29 | 13F | Lee Danner & Bass Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-28 | NP | EMIF - iShares Emerging Markets Infrastructure ETF | 20 452 | 0,41 | 150 | 24,17 | ||||

| 2025-08-11 | 13F | Banque Cantonale Vaudoise | 4 828 | 0,00 | 0 | |||||

| 2025-06-11 | NP | SLANX - DWS Latin America Equity Fund Class A | 29 109 | 185,97 | 236 | 252,24 | ||||

| 2025-06-26 | NP | DEXC - Dimensional Emerging Markets ex China Core Equity ETF | 12 051 | 21,10 | 98 | 46,97 | ||||

| 2025-06-30 | NP | VEU - Vanguard FTSE All-World ex-US Index Fund ETF Shares | 112 597 | 0,00 | 913 | 21,90 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 80 420 | -54,16 | 734 | -42,75 | ||||

| 2025-06-26 | NP | Dfa Investment Trust Co - The Emerging Markets Series This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 17 400 | 0,00 | 141 | 22,61 | ||||

| 2025-08-08 | 13F | Creative Planning | 121 104 | 18,43 | 1 106 | 47,93 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 18 923 | 16,08 | 173 | 44,54 | ||||

| 2025-08-14 | 13F | State Street Corp | 60 901 | -50,52 | 556 | -38,15 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 108 577 | 91,22 | 991 | 138,80 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 26 909 | 99,25 | 246 | 150,00 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 174 232 | 15,69 | 1 586 | 44,18 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 39 628 | 54,35 | 362 | 93,05 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 11 729 | -1,78 | 107 | 22,99 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 15 852 | 87,60 | 145 | 136,07 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 75 659 | -6,13 | 1 | |||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 13 670 | 125 | ||||||

| 2025-07-18 | 13F | PFG Investments, LLC | 10 202 | 93 | ||||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 381 718 | 131,62 | 3 485 | 189,45 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 35 690 | 33,22 | 326 | 66,67 | ||||

| 2025-08-12 | 13F | Clearbridge Investments, LLC | 20 152 | 61,09 | 184 | 101,10 | ||||

| 2025-05-15 | 13F | Manufacturers Life Insurance Company, The | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 11 730 | 876,69 | 0 | |||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 38 000 | -15,56 | 347 | 5,49 | ||||

| 2025-07-30 | 13F | Ethic Inc. | 39 022 | 7,36 | 348 | 28,52 | ||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 170 | 0,00 | 2 | 0,00 | ||||

| 2025-07-28 | NP | AVEEX - Avantis Emerging Markets Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 14 158 | 0,00 | 127 | 35,11 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 18 985 | 3,66 | 173 | 30,08 | ||||

| 2025-05-15 | 13F | Qube Research & Technologies Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1 922 | -75,17 | 18 | -67,86 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 23 650 | 1,06 | 216 | 25,73 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 104 417 | 953 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 3 116 | 36,25 | 28 | 75,00 | ||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 188 | 261,54 | 2 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 10 968 | 40,71 | 100 | 78,57 | ||||

| 2025-07-31 | 13F | R Squared Ltd | 14 375 | 3,40 | 131 | 29,70 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 31 980 | 0,00 | 292 | 24,89 | ||||

| 2025-06-18 | NP | RTXAX - Tax-Managed Real Assets Fund Class A | 31 980 | 0,00 | 259 | 22,17 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 42 350 | -14,63 | 387 | 6,63 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 166 | 1 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 32 566 | -14,11 | 297 | 7,22 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 11 414 | -10,25 | 104 | 13,04 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 122 422 | -36,32 | 1 118 | -20,50 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 6 063 | 9,03 | 0 | |||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 5 177 | 0,00 | 47 | 27,03 | ||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 29 435 | -7,06 | 269 | 16,02 | ||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 26 191 | 20,27 | 239 | 85,27 | ||||

| 2025-05-07 | 13F | Sheaff Brock Investment Advisors, LLC | 13 000 | 0,00 | 95 | 23,38 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 257 | 0,00 | 2 | 100,00 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 017 792 | 8,83 | 9 292 | 35,93 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 14 171 | 68,92 | 129 | 111,48 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 25 876 | 185,10 | 236 | 257,58 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 151 | -1,31 | 1 | 0,00 | ||||

| 2025-08-08 | NP | QGBLX - Quantified Global Fund Investor Class | 37 017 | 338 | ||||||

| 2025-08-13 | 13F | Cerity Partners LLC | 13 402 | -3,07 | 122 | 20,79 | ||||

| 2025-07-28 | NP | NSI - National Security Emerging Markets Index ETF | 1 552 | 38,32 | 14 | 85,71 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 58 | -84,07 | 1 | -100,00 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 10 187 | 6,05 | 74 | 32,14 | ||||

| 2025-07-25 | 13F | Wealth Architects, LLC | 24 326 | -1,15 | 222 | 24,02 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 200 887 | -3,35 | 1 834 | 20,74 | ||||

| 2025-05-15 | 13F | Point72 Asset Management, L.P. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 15 744 | -23,61 | 144 | -4,67 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 658 | -64,39 | 6 | -53,85 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-28 | NP | AVEM - Avantis Emerging Markets Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 187 574 | 0,00 | 1 684 | 34,83 | ||||

| 2025-06-26 | NP | DFAE - Dimensional Emerging Core Equity Market ETF | 67 550 | 32,32 | 548 | 61,36 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 96 | 0,00 | 1 | |||||

| 2025-08-11 | 13F | Trium Capital LLP | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 1 200 | 11 | ||||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 18 893 | 199,22 | 172 | 273,91 | ||||

| 2025-04-22 | NP | APIE - ActivePassive International Equity ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 492 | 14 | ||||||

| 2025-07-28 | NP | AVSE - Avantis Responsible Emerging Markets Equity ETF | 6 581 | 13,25 | 59 | 55,26 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 304 | 3 | ||||||

| 2025-08-12 | 13F | Rhumbline Advisers | 47 395 | 0,60 | 433 | 25,58 | ||||

| 2025-08-14 | 13F | Brevan Howard Capital Management LP | 85 000 | 768 | ||||||

| 2025-05-15 | 13F | Engineers Gate Manager LP | 0 | -100,00 | 0 |