Statistiques de base

| Propriétaires institutionnels | 151 total, 150 long only, 0 short only, 1 long/short - change of 0,66% MRQ |

| Allocation moyenne du portefeuille | 0.2990 % - change of -12,44% MRQ |

| Actions institutionnelles (Long) | 11 103 601 (ex 13D/G) - change of -1,18MM shares -9,57% MRQ |

| Valeur institutionnelle (Long) | $ 278 997 USD ($1000) |

Participation institutionnels et actionnaires

Invesco DB Multi-Sector Commodity Trust - Invesco DB Agriculture Fund (US:DBA) détient 151 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 11,103,601 actions. Les principaux actionnaires incluent Wells Fargo & Company/mn, New York Life Investment Management Llc, Morgan Stanley, Bank Of America Corp /de/, QAI - IQ Hedge Multi-Strategy Tracker ETF, 1832 Asset Management L.P., Kestra Advisory Services, LLC, HighTower Advisors, LLC, Jpmorgan Chase & Co, and Cambria Investment Management, L.P. .

Invesco DB Multi-Sector Commodity Trust - Invesco DB Agriculture Fund (ARCA:DBA) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 11, 2025 is 27,41 / share. Previously, on September 12, 2024, the share price was 24,95 / share. This represents an increase of 9,86% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

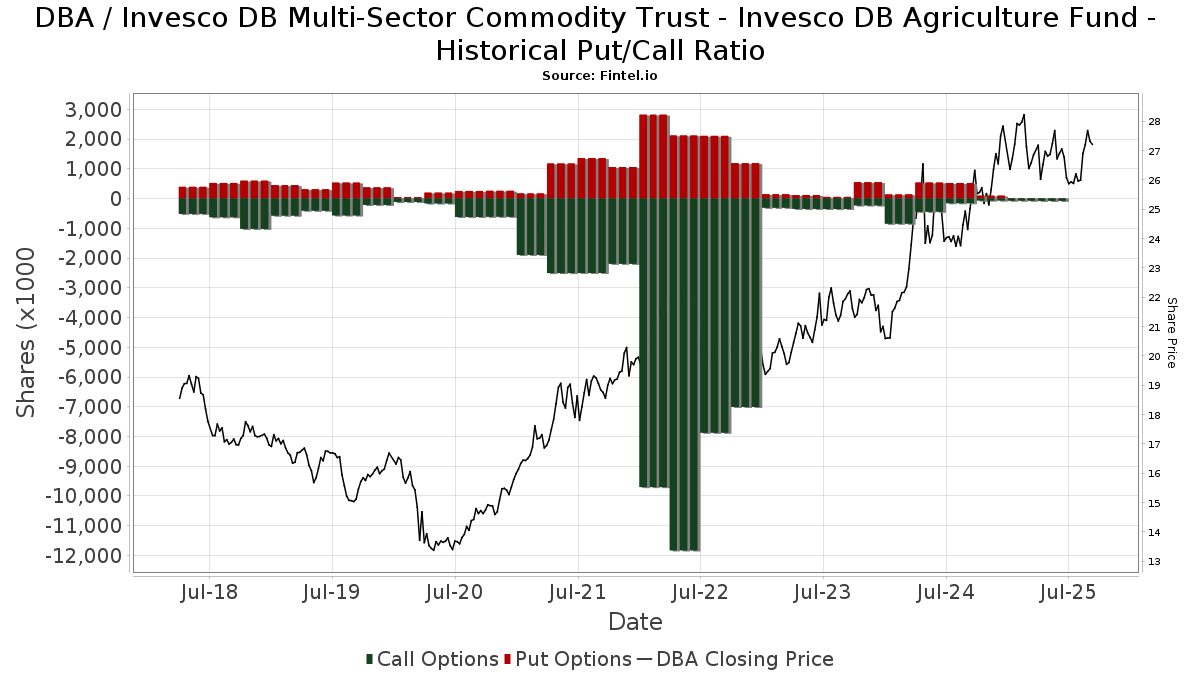

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | VestGen Advisors, LLC | 76 917 | 2 011 | ||||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 25 644 | 27,23 | 671 | 25,70 | ||||

| 2025-06-30 | NP | CAPTX - Canterbury Portfolio Thermostat Fund Institutional Shares | 14 945 | 0,00 | 401 | -2,91 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 427 297 | -25,44 | 11 174 | -25,98 | ||||

| 2025-08-08 | 13F | Creative Planning | 11 804 | 28,25 | 309 | 27,27 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-01 | 13F | First National Bank Sioux Falls | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 24 022 | 0,97 | 628 | 0,32 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 200 | 5 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 4 654 | 45,17 | 122 | 44,05 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 15 443 | 0,00 | 404 | -0,74 | ||||

| 2025-08-08 | 13F | Advyzon Investment Management, LLC | 8 424 | 220 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 26 | 0,00 | 1 | |||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 140 | 0,00 | 4 | 0,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 214 622 | -1,43 | 5 612 | -2,13 | ||||

| 2025-08-14 | 13F | UBS Group AG | 107 952 | -42,79 | 2 823 | -43,22 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 61 559 | 4,51 | 1 610 | 3,74 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 89 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 37 906 | -3,49 | 991 | -4,62 | ||||

| 2025-08-12 | 13F | Blueprint Investment Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Huntington National Bank | 105 | -0,95 | ||||||

| 2025-08-11 | 13F | Midwest Professional Planners, LTD. | 0 | -100,00 | 0 | |||||

| 2025-04-17 | 13F | FNY Investment Advisers, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 19 307 | 3,81 | 505 | 3,07 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 8 838 | 0,00 | 0 | |||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 5 104 | 0,00 | 133 | -0,75 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 91 648 | 3,10 | 2 397 | 2,35 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 3 033 | 0,00 | 79 | 0,00 | ||||

| 2025-08-12 | 13F | Picton Mahoney Asset Management | 2 170 | 30,72 | 0 | |||||

| 2025-07-25 | 13F | Sharp Financial Services, LLC | 19 200 | 6,67 | 502 | 5,91 | ||||

| 2025-06-24 | NP | TNMAX - 1290 Multi-Alternative Strategies Fund Class A | 30 740 | 21,79 | 824 | 18,39 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 216 891 | 5 671 | ||||||

| 2025-07-23 | 13F | WestEnd Advisors, LLC | 3 910 | 102 | ||||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 165 033 | 28,03 | 4 289 | 26,27 | ||||

| 2025-08-06 | 13F | OneAscent Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | PFG Investments, LLC | 15 008 | 3,62 | 392 | 2,89 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 471 | 0,00 | 12 | 0,00 | ||||

| 2025-08-13 | 13F | Cambria Investment Management, L.P. | 308 923 | -4,33 | 8 078 | -5,02 | ||||

| 2025-08-13 | 13F | Vermillion & White Wealth Management Group, LLC | 5 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Main Street Financial Solutions, LLC | 16 335 | 427 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 7 476 | -11,80 | 195 | -13,33 | ||||

| 2025-07-29 | 13F | Sowa Financial Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 4 800 | 0,00 | 126 | -0,79 | ||||

| 2025-08-14 | 13F | Private Wealth Advisors, LLC | 184 499 | -0,43 | 4 825 | -1,15 | ||||

| 2025-08-13 | 13F | Custom Index Systems, Llc | 17 511 | -4,60 | 458 | -5,38 | ||||

| 2025-07-10 | 13F | Signal Advisors Wealth, LLC | 8 424 | 0,00 | 220 | -0,45 | ||||

| 2025-08-12 | 13F | Accredited Wealth Management, LLC | 300 | -72,73 | 8 | -75,00 | ||||

| 2025-05-02 | 13F | Transcendent Capital Group LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 8 900 | 20,27 | 233 | 19,59 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 17 437 | -70,16 | 456 | -70,44 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 10 000 | -43,82 | 262 | -44,23 | |||

| 2025-07-24 | 13F | Trust Co Of Toledo Na /oh/ | 5 527 | 145 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 1 315 | 3 187,50 | 34 | 3 300,00 | ||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-13 | 13F | Bank Of Montreal /can/ | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 7 058 | 212,58 | 185 | 211,86 | ||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 171 255 | 408,90 | 4 478 | 405,42 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 791 | 21 | ||||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 27 003 | 0,00 | 706 | -0,70 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 63 327 | 8,02 | 1 656 | 7,25 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - 1290 VT Multi-Alternative Strategies Portfolio Class IB | 14 570 | 3,70 | 381 | 2,97 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 93 071 | 8,49 | 2 434 | 7,70 | ||||

| 2025-05-28 | NP | GHTA - Goose Hollow Tactical Allocation ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 30 570 | -1,85 | 799 | -2,56 | ||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | 9 103 | 0,00 | 238 | -0,42 | ||||

| 2025-08-04 | 13F | Mesirow Financial Investment Management, Inc. | 54 243 | 3,83 | 1 418 | 3,05 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 4 477 | 0,00 | 117 | 3,54 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 7 671 | 0,00 | 201 | -0,99 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 151 500 | 5,43 | 4 | 0,00 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 5 889 | 154 | ||||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 61 096 | -10,07 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 10 945 | 17,15 | 286 | 16,26 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 99 664 | 14,00 | 3 | 0,00 | ||||

| 2025-08-08 | 13F/A | Ignite Planners, LLC | 27 928 | 16,67 | 727 | 13,97 | ||||

| 2025-07-22 | 13F | Hillcrest Wealth Advisors - NY, LLC | 11 400 | 0,00 | 298 | -0,67 | ||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 19 475 | -4,06 | 509 | -4,68 | ||||

| 2025-07-22 | 13F | Knights of Columbus Asset Advisors LLC | 3 314 | -19,93 | 87 | -21,10 | ||||

| 2025-05-14 | 13F | Walleye Trading LLC | Call | 0 | -100,00 | 0 | ||||

| 2025-04-24 | 13F | Wingate Wealth Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 18 579 | 2,18 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 50 537 | -63,21 | 1 322 | -63,48 | ||||

| 2025-05-15 | 13F | Squarepoint Ops LLC | Call | 0 | -100,00 | 0 | ||||

| 2025-08-11 | 13F | FineMark National Bank & Trust | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 5 317 | 42,59 | 139 | 41,84 | ||||

| 2025-07-31 | 13F | Leavell Investment Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | New York Life Investment Management Llc | 807 885 | -14,77 | 21 126 | -15,38 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 390 | -28,57 | 10 | -28,57 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 913 416 | -3,86 | 23 886 | -4,56 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 90 | 0,00 | 2 | 0,00 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 22 468 | -59,24 | 588 | -59,55 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 90 857 | 11,24 | 2 376 | 10,41 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 9 862 | 9,27 | 0 | |||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 83 930 | 2 195 | ||||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Mid-American Wealth Advisory Group, Inc. | 241 | 6 | ||||||

| 2025-09-10 | 13F | WT Wealth Management | 29 028 | 22,57 | 759 | 21,83 | ||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 15 769 | 0,69 | 412 | 0,00 | ||||

| 2025-04-29 | 13F | Hm Payson & Co | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 45 750 | 1 196 | ||||||

| 2025-08-14 | 13F | Fmr Llc | 2 809 | 152,38 | 73 | 151,72 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 40 000 | -50,00 | 1 046 | -50,36 | ||||

| 2025-08-08 | 13F | Passaic Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Flagship Harbor Advisors, Llc | 30 970 | 6,75 | 810 | 5,89 | ||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Eastern Bank | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Painted Porch Advisors LLC | 275 | 0,00 | 7 | 0,00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 43 381 | 2,85 | 1 134 | 2,07 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 249 201 | 14,10 | 6 517 | 13,28 | ||||

| 2025-07-31 | 13F | Intelligent Financial Strategies | 239 | 6 | ||||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 1 362 | 27,05 | 36 | 25,00 | ||||

| 2025-05-12 | 13F | Providence First Trust Co | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Capital Wealth Alliance, LLC | 196 693 | -13,36 | 5 145 | -13,99 | ||||

| 2025-08-11 | 13F | ARS Investment Partners, LLC | 10 508 | -76,27 | 275 | -76,72 | ||||

| 2025-08-08 | 13F | Itau Unibanco Holding S.A. | 168 400 | 1,32 | 4 404 | 109 975,00 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 19 973 | 522 | ||||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 12 502 | 8,21 | 327 | 7,24 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 2 260 | 0,00 | 59 | -3,28 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 18 319 | 82,42 | 479 | 81,44 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 27 255 | -62,12 | 1 | -100,00 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 1 350 | 0,00 | 35 | 0,00 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 115 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 4 413 | -91,30 | 115 | -91,39 | ||||

| 2025-08-04 | 13F | Amplius Wealth Advisors, LLC | 10 840 | 0,00 | 283 | -0,70 | ||||

| 2025-04-15 | 13F | Simplicity Wealth,LLC | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Hilltop National Bank | 705 | 18 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 57 685 | -28,51 | 1 508 | -29,04 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 1 359 | 36 | ||||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 3 000 | 0,00 | 78 | -1,27 | ||||

| 2025-08-13 | 13F | Barclays Plc | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 10 800 | 0,00 | 282 | -0,70 | ||||

| 2025-08-11 | 13F | Duff & Phelps Investment Management Co | 20 525 | 130,62 | 537 | 129,06 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 219 | 6 | ||||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 30 221 | 40,96 | 790 | 40,07 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 60 800 | 10,75 | 1 590 | 9,89 | |||

| 2025-07-07 | 13F | Park Edge Advisors, LLC | 11 554 | -17,08 | 302 | -17,71 | ||||

| 2025-06-27 | NP | GMOM - Cambria Global Momentum ETF | 228 998 | -6,32 | 6 139 | -9,01 | ||||

| 2025-08-25 | NP | MAINSTAY VP FUNDS TRUST - MainStay VP IQ Hedge Multi-Strategy Portfolio Initial Class | 179 800 | -19,90 | 4 702 | -20,48 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 25 881 | 1 | ||||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 483 845 | 11,17 | 12 653 | 10,37 | ||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 399 | -0,25 | 10 | 0,00 | ||||

| 2025-08-06 | 13F | Adviser Investments LLC | 12 583 | 0,00 | 329 | -0,60 | ||||

| 2025-08-07 | 13F | Guardian Partners Inc. | 26 096 | 24,55 | 677 | 19,65 | ||||

| 2025-04-25 | 13F | Perissos Private Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Savior LLC | 64 845 | 10,12 | 1 696 | 9,28 | ||||

| 2025-05-15 | 13F | IHT Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Spire Wealth Management | 46 728 | 1,08 | 1 222 | 0,33 | ||||

| 2025-05-09 | 13F | Plan Group Financial, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 31 121 | -19,29 | 814 | -19,90 | ||||

| 2025-07-17 | 13F | Vermillion Wealth Management, Inc. | 2 061 | 0,00 | 54 | -1,85 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 1 860 | 0,00 | 49 | 0,00 | ||||

| 2025-08-01 | 13F | Solstein Capital, LLC | 20 523 | 0,00 | 537 | -0,74 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 87 229 | 48,54 | 2 281 | 47,54 | ||||

| 2025-08-14 | 13F | Comerica Bank | 5 547 | 0,00 | 145 | -0,68 | ||||

| 2025-08-12 | 13F | Weaver Consulting Group | 10 640 | 0,00 | 278 | -0,71 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 22 772 | 107,83 | 595 | 106,60 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 1 486 | 0,00 | 39 | -2,56 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | -100,00 | 0 | |||||

| 2025-04-28 | 13F | Heritage Oak Wealth Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 709 984 | -33,66 | 18 566 | -34,13 | ||||

| 2025-07-10 | 13F | Clare Market Investments LLC | 15 915 | 14,99 | 416 | 14,29 | ||||

| 2025-07-16 | 13F | BOS Asset Management, LLC | 8 489 | 0,00 | 222 | -0,90 | ||||

| 2025-08-26 | NP | PDPAX - Virtus Rampart Alternatives Diversifier Fund Class A | 20 525 | 130,62 | 537 | 129,06 | ||||

| 2025-08-08 | 13F | Citizens Financial Group Inc/ri | 121 676 | -0,58 | 3 182 | -1,30 | ||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 555 547 | 8,46 | 14 528 | 7,67 | ||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 100 | 0,00 | 3 | 0,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 698 437 | -0,98 | 18 264 | -1,69 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 125 | 3 | ||||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 471 132 | 0,30 | 12 320 | -0,42 | ||||

| 2025-08-13 | 13F | M Holdings Securities, Inc. | 16 654 | 0 | ||||||

| 2025-05-12 | 13F | Kohmann Bosshard Financial Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 30 905 | -0,80 | 808 | -1,59 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 111 102 | -3,23 | 2 905 | -3,94 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 33 539 | 9,81 | 1 | |||||

| 2025-08-05 | 13F | Intellectus Partners, LLC | 33 345 | 0,00 | 872 | -0,80 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 98 219 | -10,32 | 2 568 | -10,96 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 22 | 22,22 | 1 | |||||

| 2025-07-09 | 13F | Camelot Technology Advisors, Inc. | 25 274 | -11,95 | 661 | -12,70 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 247 | 6 | ||||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 10 649 | -10,95 | 278 | -11,46 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 500 | 0,00 | 13 | 0,00 | ||||

| 2025-06-25 | NP | QAI - IQ Hedge Multi-Strategy Tracker ETF | 606 448 | -14,25 | 16 259 | -16,71 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 44 250 | 32,73 | 1 157 | 30,59 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 27 227 | 10,63 | 712 | 9,72 | ||||

| 2025-06-27 | NP | TRTY - Cambria Trinity ETF | 79 925 | -3,39 | 2 143 | -6,18 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | Put | 0 | -100,00 | 0 | -100,00 |