Statistiques de base

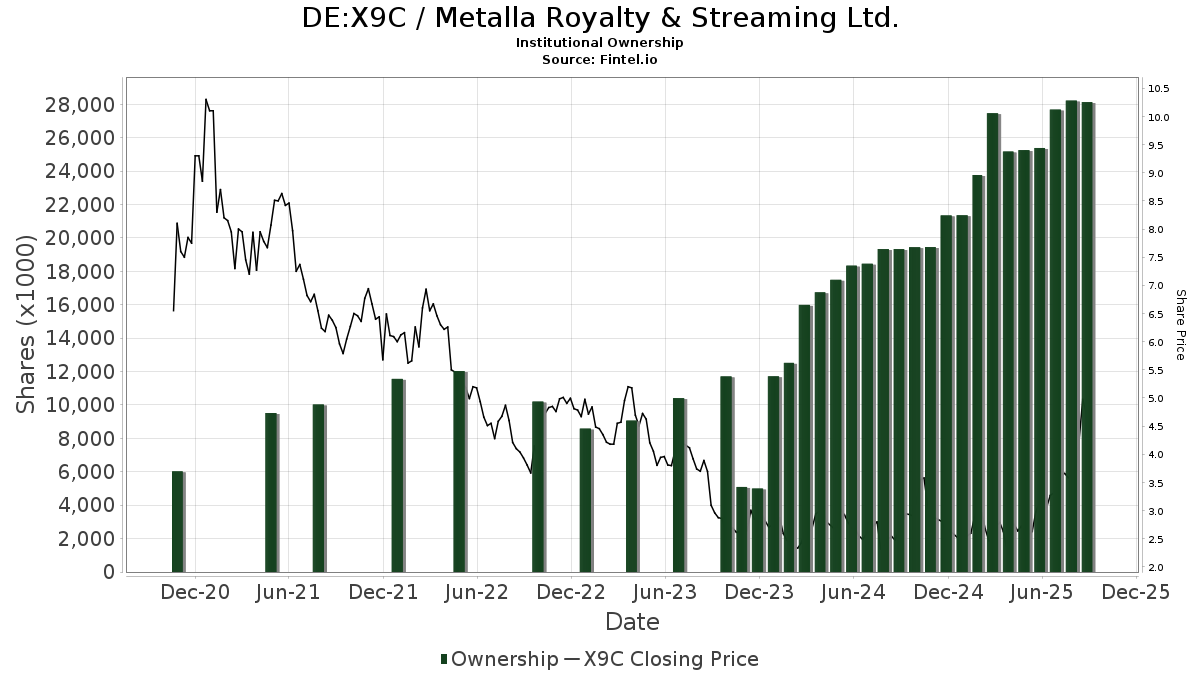

| Actions institutionnelles (Long) | 28 130 805 - 30,40% (ex 13D/G) - change of 2,75MM shares 10,83% MRQ |

| Valeur institutionnelle (Long) | $ 70 377 USD ($1000) |

Participation institutionnels et actionnaires

Metalla Royalty & Streaming Ltd. (DE:X9C) détient 77 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 28,130,805 actions. Les principaux actionnaires incluent Euro Pacific Asset Management, LLC, EPGFX - EuroPac Gold Fund Class A, ASA Gold & Precious Metals Ltd, Merk Investments LLC, Van Eck Associates Corp, GDXJ - VanEck Vectors Junior Gold Miners ETF, Fmr Llc, Citadel Advisors Llc, Sprott Inc., and FSDPX - Materials Portfolio .

Metalla Royalty & Streaming Ltd. (DB:X9C) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 9, 2025 is 4,80 / share. Previously, on September 10, 2024, the share price was 2,61 / share. This represents an increase of 83,91% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | 683 Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 36 483 | 66,08 | 140 | 125,81 | ||||

| 2025-08-12 | 13F | Tradition Wealth Management, LLC | 10 329 | 0,00 | 40 | 34,48 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 54 343 | 209 | ||||||

| 2025-08-21 | NP | GDXJ - VanEck Vectors Junior Gold Miners ETF | 2 410 869 | -28,97 | 9 258 | -4,64 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 281 800 | 37,13 | 1 082 | 84,33 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 16 700 | 0,00 | 42 | -12,77 | ||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 10 091 | -25,70 | 38 | -5,00 | ||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 357 029 | 1 371 | ||||||

| 2025-08-13 | 13F | Northern Trust Corp | 47 082 | 181 | ||||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 2 756 190 | -25,79 | 11 | 0,00 | ||||

| 2025-07-29 | 13F | LB Partners LLC | 36 000 | 0,00 | 138 | 33,98 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 278 201 | 497,72 | 1 068 | 703,01 | ||||

| 2025-07-24 | NP | FSDPX - Materials Portfolio This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 648 100 | 10,96 | 2 092 | 30,26 | ||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | 3 096 | 12 | ||||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 1 | 0 | ||||||

| 2025-07-09 | 13F | Massmutual Trust Co Fsb/adv | 4 680 | 0,00 | 18 | 30,77 | ||||

| 2025-09-09 | 13F | NWF Advisory Services Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Df Dent & Co Inc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Virtu Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Papamarkou Wellner Asset Management inc. | 30 272 | 9,50 | 116 | 46,84 | ||||

| 2025-08-14 | 13F | Fmr Llc | 1 224 000 | 10,86 | 4 692 | 47,01 | ||||

| 2025-07-29 | 13F | Sentry Investment Management Llc | 14 977 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Walleye Capital LLC | 146 364 | 562 | ||||||

| 2025-08-12 | 13F | Hillsdale Investment Management Inc. | 66 600 | 255 | ||||||

| 2025-08-26 | NP | AFMCX - Acuitas US Microcap Fund Institutional Shares | 36 531 | 140 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 14 071 | 42,13 | 54 | 92,86 | ||||

| 2025-07-28 | NP | ASA Gold & Precious Metals Ltd | 3 000 000 | 0,00 | 9 660 | 17,09 | ||||

| 2025-08-14 | 13F | Merk Investments LLC | 3 000 000 | 0,00 | 11 520 | 34,27 | ||||

| 2025-08-14 | 13F | Man Group plc | 63 404 | 99,35 | 243 | 170,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 16 400 | 63 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 91 575 | 254,31 | 352 | 380,82 | ||||

| 2025-08-14 | 13F | SWAN Capital LLC | 200 | 1 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 21 859 | 2 077,19 | 84 | 4 050,00 | ||||

| 2025-05-21 | 13F/A | Geneos Wealth Management Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-07 | 13F | LPL Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 277 833 | 300,91 | 1 067 | 438,38 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 408 227 | 66,99 | 1 568 | 124,18 | ||||

| 2025-05-15 | 13F | Tower Research Capital LLC (TRC) | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | MAI Capital Management | 2 419 | 0,00 | 9 | 50,00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 12 681 | 0,00 | 49 | 33,33 | ||||

| 2025-08-12 | 13F | Boreal Capital Management LLC | 41 630 | 160 | ||||||

| 2025-08-12 | 13F | XTX Topco Ltd | 88 710 | 203,42 | 341 | 309,64 | ||||

| 2025-08-11 | 13F | Sprott Inc. | 721 059 | -0,45 | 2 771 | 33,80 | ||||

| 2025-08-12 | 13F | Horizon Kinetics Asset Management Llc | 405 430 | 0,97 | 1 557 | 35,54 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 60 622 | 40,03 | 0 | |||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 1 500 | 0,00 | 6 | 25,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-04-24 | 13F | U S Global Investors Inc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 32 824 | 144,54 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 153 800 | 200,98 | 591 | 304,11 | ||||

| 2025-07-15 | 13F | Northside Capital Management, LLC | 111 578 | 0,00 | 428 | 34,17 | ||||

| 2025-07-25 | 13F | Stonehage Fleming Financial Services Holdings Ltd | 20 490 | 95,20 | 79 | 160,00 | ||||

| 2025-07-23 | 13F/A | Euro Pacific Asset Management, LLC | 5 657 905 | 11,78 | 22 | 50,00 | ||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 79 800 | 0,00 | 306 | 34,21 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 419 373 | 32,02 | 1 610 | 77,31 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 47 000 | 0 | ||||||

| 2025-08-22 | NP | FFNKX - Materials Portfolio Initial Class | 55 000 | 11,11 | 211 | 46,85 | ||||

| 2025-05-15 | 13F | Two Sigma Securities, Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 132 199 | -0,77 | 508 | 33,07 | ||||

| 2025-08-14 | 13F | Oxford Asset Management Llp | 32 934 | 126 | ||||||

| 2025-07-24 | NP | FNARX - Natural Resources Portfolio This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 520 900 | 10,71 | 1 681 | 29,91 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 790 501 | 57,75 | 3 036 | 111,79 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 88 121 | -20,45 | 338 | 6,96 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 2 200 | 0,00 | 8 | 33,33 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 50 800 | 116,17 | 195 | 191,04 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 43 400 | 197,26 | 167 | 304,88 | |||

| 2025-07-21 | 13F | Hilltop National Bank | 869 | 525,18 | 3 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 6 566 | 10,20 | 24 | 41,18 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 21 023 | -8,04 | 81 | 21,21 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 10 409 | 40 | ||||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 5 236 | -54,69 | 19 | -42,42 | ||||

| 2025-08-28 | NP | INFL - Horizon Kinetics Inflation Beneficiaries ETF | 390 000 | 0,00 | 1 498 | 34,26 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 280 508 | 2 230,38 | 1 077 | 3 067,65 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 30 578 | 57,85 | 117 | 112,73 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 278 750 | 6 697,12 | 1 070 | 9 627,27 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 1 000 | 0,00 | 4 | 50,00 | ||||

| 2025-06-25 | NP | EPGFX - EuroPac Gold Fund Class A | 3 155 115 | 268,25 | 9 635 | 294,72 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 6 003 | 595,60 | 23 | 1 050,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 72 162 | 3 836,82 | 277 | 5 440,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 5 126 | -68,60 | 20 | -57,45 | ||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 13 202 | 51 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 94 813 | -43,57 | 0 | |||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 1 | 0,00 | 0 | |||||

| 2025-08-06 | 13F | Legacy Wealth Managment, LLC/ID | 400 | 0,00 | 2 | 0,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 14 084 | 7,64 | 54 | 45,95 | ||||

| 2025-08-14 | 13F/A | Perritt Capital Management Inc | 2 850 | 0,00 | 11 | 25,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 72 131 | 277 | ||||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 400 | 2 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 12 996 | 50 |