Statistiques de base

| Propriétaires institutionnels | 140 total, 140 long only, 0 short only, 0 long/short - change of 9,38% MRQ |

| Allocation moyenne du portefeuille | 0.8984 % - change of 5,80% MRQ |

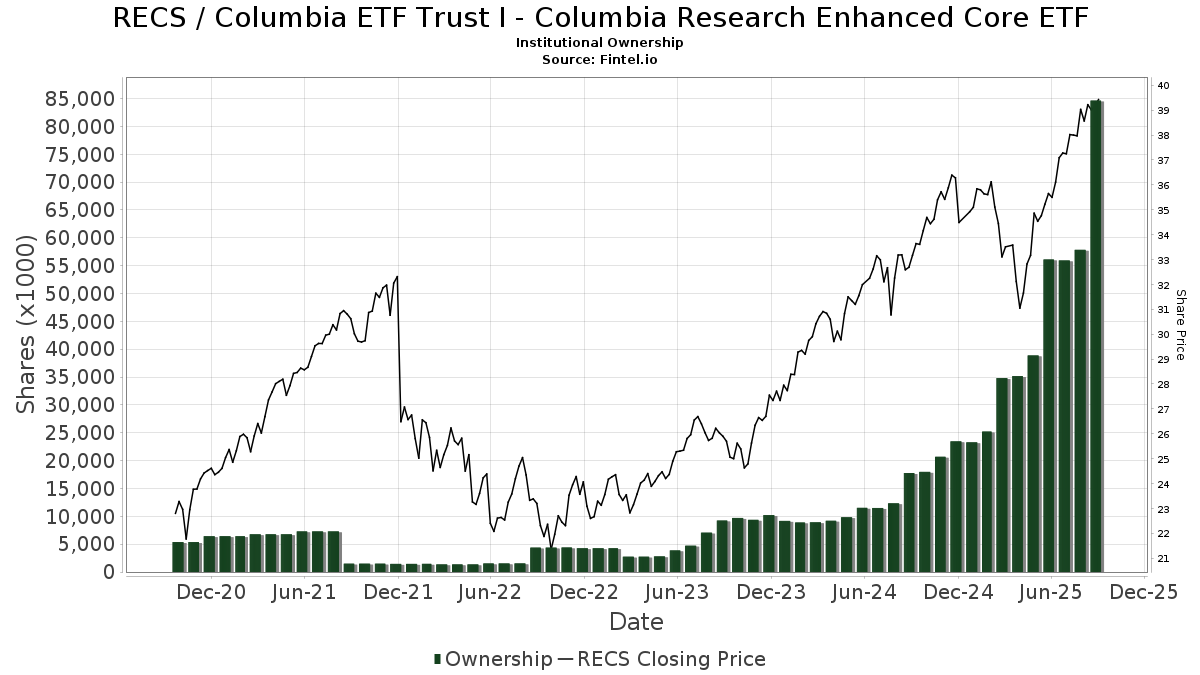

| Actions institutionnelles (Long) | 84 634 179 (ex 13D/G) - change of 28,53MM shares 50,84% MRQ |

| Valeur institutionnelle (Long) | $ 2 973 135 USD ($1000) |

Participation institutionnels et actionnaires

Columbia ETF Trust I - Columbia Research Enhanced Core ETF (US:RECS) détient 140 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 84,634,179 actions. Les principaux actionnaires incluent Jane Street Group, Llc, Ameriprise Financial Inc, LPL Financial LLC, Bank Of America Corp /de/, Morgan Stanley, Raymond James Financial Inc, CTFAX - Columbia Thermostat Fund Class A, Commonwealth Equity Services, Llc, Gradient Investments LLC, and Fundamentun, Llc .

Columbia ETF Trust I - Columbia Research Enhanced Core ETF (ARCA:RECS) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 10, 2025 is 39,17 / share. Previously, on September 11, 2024, the share price was 32,69 / share. This represents an increase of 19,82% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 1 511 634 | -1,17 | 55 613 | 9,48 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 685 926 | 8,83 | 25 235 | 20,56 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 14 303 | -91,10 | 526 | -90,14 | ||||

| 2025-07-23 | 13F | Heck Capital Advisors, LLC | 461 922 | 16 994 | ||||||

| 2025-07-29 | 13F | Fundamentun, Llc | 1 978 098 | 4,39 | 72 774 | 15,64 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 110 244 | -46,99 | 4 056 | -41,28 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 477 034 | -16,81 | 17 551 | -7,83 | ||||

| 2025-08-14 | 13F | LM Advisors LLC | 40 568 | 2,56 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 4 425 196 | -10,10 | 162 803 | -0,40 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 18 761 | 51,27 | 1 | |||||

| 2025-07-25 | 13F | Retirement Planning Group, Llc / Ny | 90 043 | 41,28 | 3 313 | 56,52 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 16 658 312 | 49 303,34 | 612 859 | 54 668,45 | ||||

| 2025-07-23 | 13F | Morey & Quinn Wealth Partners, LLC | 19 785 | 26,95 | 728 | 40,62 | ||||

| 2025-07-02 | 13F | Capital Market Strategies LLC | 10 558 | 388 | ||||||

| 2025-07-09 | 13F | WealthCare Investment Partners, LLC | 23 778 | 15,46 | 889 | 41,85 | ||||

| 2025-08-12 | 13F | Richmond Investment Services, LLC | 68 148 | 102,91 | 2 507 | 124,84 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 374 045 | 6,36 | 14 | 18,18 | ||||

| 2025-08-04 | 13F | Amplius Wealth Advisors, LLC | 1 533 039 | 1,36 | 56 396 | 12,27 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 258 054 | -24,01 | 9 494 | -15,82 | ||||

| 2025-08-14 | 13F | Comerica Bank | 4 737 | -26,38 | 174 | -18,31 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 220 971 | 173,50 | 8 130 | 202,98 | ||||

| 2025-07-29 | 13F | Stratos Wealth Advisors, LLC | 8 856 | 326 | ||||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 5 921 | -6,24 | 218 | 3,83 | ||||

| 2025-08-08 | 13F | Comprehensive Financial Planning, Inc./PA | 1 007 | -6,33 | 37 | 5,71 | ||||

| 2025-08-07 | 13F | Fidelis Capital Partners, LLC | 49 943 | 1 896 | ||||||

| 2025-08-22 | NP | CTFAX - Columbia Thermostat Fund Class A | 2 732 920 | 125,79 | 100 544 | 150,13 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 70 820 | 102,04 | 2 605 | 115,82 | ||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 5 | 0,00 | 0 | |||||

| 2025-07-29 | 13F | Empirical Asset Management, LLC | 69 125 | 1,37 | 2 543 | 12,32 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 20 580 | 13,53 | 757 | 26,59 | ||||

| 2025-08-14 | 13F | Graney & King, LLC | 5 447 | 444,70 | 200 | 506,06 | ||||

| 2025-08-14 | 13F | Byrne Financial Freedom, Llc | 73 933 | 328,75 | 2 720 | 375,35 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 2 517 266 | 77,26 | 93 | 95,74 | ||||

| 2025-08-13 | 13F | Dana Investment Advisors, Inc. | 18 951 | 63,55 | 697 | 81,51 | ||||

| 2025-08-18 | 13F | Tyler-Stone Wealth Management | 10 264 | 0,98 | 378 | 11,87 | ||||

| 2025-07-17 | 13F | Archford Capital Strategies, LLC | 269 439 | 2,56 | 9 913 | 13,60 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 117 | 4 | ||||||

| 2025-07-18 | 13F | Truist Financial Corp | 8 231 | 30,82 | 303 | 45,19 | ||||

| 2025-07-23 | 13F | RiverTree Advisors, LLC | 8 180 | -5,92 | 301 | 4,17 | ||||

| 2025-08-06 | 13F | Mark Sheptoff Financial Planning, Llc | 385 | 0,00 | 14 | 16,67 | ||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 567 951 | 30,34 | 20 895 | 44,39 | ||||

| 2025-08-04 | 13F | Daymark Wealth Partners, Llc | 720 517 | 14,10 | 26 508 | 26,40 | ||||

| 2025-08-11 | 13F | Trajan Wealth LLC | 555 620 | 0,12 | 20 441 | 10,92 | ||||

| 2025-08-05 | 13F | Snider Financial Group | 123 818 | 4 555 | ||||||

| 2025-08-13 | 13F | Balance Wealth, LLC | 54 725 | -81,88 | 2 013 | -79,93 | ||||

| 2025-07-15 | 13F | Palumbo Wealth Management LLC | 11 916 | 438 | ||||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 196 458 | 7,83 | 7 228 | 19,45 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 7 061 | 260 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 65 065 | 1 517,73 | 2 394 | 1 699,25 | ||||

| 2025-07-23 | 13F | Drake & Associates, LLC | 840 273 | 4,37 | 30 914 | 15,61 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 63 469 | 8,08 | 2 394 | 22,77 | ||||

| 2025-07-28 | 13F | Tower Wealth Partners, Inc. | 492 981 | 3,98 | 18 137 | 15,19 | ||||

| 2025-07-17 | 13F | KWB Wealth | 236 281 | 57,88 | 7 847 | 51,44 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 112 533 | 3,26 | 4 140 | 14,40 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 94 953 | 3 493 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 3 401 063 | 41,84 | 125 125 | 57,13 | ||||

| 2025-05-15 | 13F | Ameriflex Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 29 108 | 10,73 | 1 | |||||

| 2025-08-13 | 13F | Copley Financial Group, Inc. | 6 643 | -5,61 | 244 | 4,72 | ||||

| 2025-04-07 | 13F | AdvisorNet Financial, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | BlueStem Wealth Partners, LLC | 1 062 939 | -32,72 | 39 106 | -25,47 | ||||

| 2025-05-09 | 13F | Goldman Sachs Group Inc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Mma Asset Management Llc | 24 955 | -8,73 | 918 | 1,10 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 637 841 | 108,52 | 23 465 | 131,00 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 110 174 | 3,02 | 4 053 | 14,14 | ||||

| 2025-08-11 | 13F | Advisor Resource Council | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Spectrum Wealth Advisory Group, LLC | 837 922 | -16,48 | 30 827 | -7,47 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 3 475 | 128 | ||||||

| 2025-07-29 | 13F | Riverbend Wealth Management, LLC | 14 803 | 38,60 | 545 | 53,67 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 80 568 | 2,77 | 2 964 | 14,57 | ||||

| 2025-08-13 | 13F | Denver Wealth Management, Inc. | 30 795 | 23,55 | 1 133 | 36,88 | ||||

| 2025-08-14 | 13F | Fmr Llc | 2 182 | 114,13 | 80 | 142,42 | ||||

| 2025-07-15 | 13F | Oxinas Partners Wealth Management LLC | 22 200 | 0,00 | 817 | 10,72 | ||||

| 2025-08-29 | 13F | Centaurus Financial, Inc. | 385 922 | 2,64 | 14 | 16,67 | ||||

| 2025-07-07 | 13F | RDA Financial Network | 105 535 | 6,41 | 3 883 | 17,89 | ||||

| 2025-08-14 | 13F | Paragon Private Wealth Management, LLC | 57 620 | 12,59 | 2 120 | 24,72 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 0 | 0 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 240 780 | 12,60 | 9 | 14,29 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 12 963 845 | 22,35 | 476 940 | 35,54 | ||||

| 2025-07-09 | 13F | Fiduciary Alliance LLC | 6 883 | -11,30 | 253 | -1,56 | ||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 6 927 | 10,64 | 255 | 22,71 | ||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 131 024 | 90,96 | 4 820 | 111,59 | ||||

| 2025-05-08 | 13F | Us Bancorp \de\ | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 55 103 | 62,11 | 2 027 | 79,70 | ||||

| 2025-08-06 | 13F/A | Three Cord True Wealth Management, LLC | 523 209 | 7,65 | 19 249 | 19,25 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 27 900 | 1 026 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 3 167 950 | 15,28 | 116 549 | 27,70 | ||||

| 2025-08-14 | 13F | Dagco, Inc. | 80 985 | 25,84 | 2 979 | 39,40 | ||||

| 2025-05-15 | 13F | Old Mission Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 65 696 | 14,49 | 2 417 | 26,82 | ||||

| 2025-08-06 | 13F | Bensler, LLC | 227 616 | 3,67 | 8 374 | 14,84 | ||||

| 2025-07-08 | 13F | Paladin Wealth, LLC | 60 269 | 2,85 | 2 217 | 13,93 | ||||

| 2025-07-31 | 13F | Mason & Associates Inc | 1 029 239 | 37 866 | ||||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 36 | 1 | ||||||

| 2025-07-31 | 13F | Richards, Merrill & Peterson, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | USAdvisors Wealth Management, LLC | 160 450 | 5,13 | 6 | 0,00 | ||||

| 2025-08-14 | 13F | Keystone Financial Services, LLC | 6 698 | 246 | ||||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 190 216 | 6,16 | 6 998 | 17,61 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 603 600 | 544,87 | 22 206 | 614,48 | ||||

| 2025-07-15 | 13F | Axis Wealth Partners, LLC | 33 241 | 13,75 | 1 223 | 25,98 | ||||

| 2025-08-18 | 13F | Arq Wealth Advisors, Llc | 214 206 | 0,00 | 7 114 | 0,00 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 145 845 | 36,98 | 5 366 | 51,77 | ||||

| 2025-05-01 | 13F | Fulcrum Equity Management | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 10 820 984 | 20,41 | 398 104 | 33,38 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 230 633 | 41,60 | 8 455 | 57,27 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 55 754 | -51,17 | 2 051 | -45,91 | ||||

| 2025-07-10 | 13F | Sovran Advisors, LLC | 92 334 | 33,27 | 3 417 | 58,86 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 2 277 | -39,92 | 84 | -33,60 | ||||

| 2025-08-14 | 13F | UBS Group AG | 366 954 | 159,97 | 13 500 | 188,03 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 17 151 | 16,67 | 631 | 29,10 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 5 912 | 218 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 24 351 | 125,26 | 896 | 139,30 | ||||

| 2025-08-05 | 13F | Flynn Zito Capital Management, Llc | 155 216 | -0,15 | 5 710 | 10,62 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 12 430 | 85,52 | 457 | 105,86 | ||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 99 278 | 10,30 | 3 652 | 22,18 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 241 380 | 34,51 | 8 880 | 49,02 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 1 961 | 38,39 | 72 | 60,00 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 2 732 | 2,32 | 101 | 8,70 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 491 805 | 22,81 | 18 094 | 36,05 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 31 536 | 16,06 | 1 160 | 23,40 | ||||

| 2025-08-05 | 13F | Smith Shellnut Wilson Llc /adv | 23 069 | 22,94 | 849 | 36,12 | ||||

| 2025-04-24 | NP | NSGAX - Columbia Select Large Cap Equity Fund Class A | 43 258 | -60,52 | 1 520 | -61,51 | ||||

| 2025-07-08 | 13F | Gradient Investments LLC | 2 031 726 | 1,17 | 74 747 | 12,08 | ||||

| 2025-07-09 | 13F | Fermata Advisors, LLC | 101 501 | -0,73 | 3 734 | 9,99 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 106 | 0,00 | 4 | 0,00 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 320 671 | 394,61 | 11 983 | 456,57 | ||||

| 2025-07-31 | 13F | Leavell Investment Management, Inc. | 125 694 | 39,50 | 4 624 | 54,55 | ||||

| 2025-07-30 | 13F/A | KPP Advisory Services LLC | 45 678 | 196,11 | 1 680 | 228,13 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 14 683 | 12,12 | 540 | 24,42 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 2 376 | -23,67 | 87 | -15,53 | ||||

| 2025-07-09 | 13F | Pines Wealth Management, LLC | 35 328 | 9,89 | 1 320 | 39,68 | ||||

| 2025-07-29 | 13F | Mattson Financial Services, LLC | 64 709 | -5,47 | 2 381 | 4,71 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 522 931 | 67,65 | 56 029 | 85,72 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 357 751 | -0,73 | 13 162 | 9,97 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 8 201 | 13,12 | 302 | 25,42 | ||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 213 424 | 22,60 | 7 852 | 35,81 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 196 | 0,00 | 0 | |||||

| 2025-08-15 | 13F | Brown Financial Advisors | 115 356 | -2,38 | 4 244 | 8,13 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 152 094 | -0,83 | 5 596 | 9,86 | ||||

| 2025-08-01 | 13F | PCA Investment Advisory Services Inc. | 17 464 | 24,71 | 643 | 38,06 | ||||

| 2025-04-17 | 13F | Tcfg Wealth Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | IAG Wealth Partners, LLC | 296 568 | 143,19 | 10 911 | 169,45 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 179 979 | 898,88 | 6 621 | 1 007,19 | ||||

| 2025-07-30 | 13F | Prosperity Financial Group, Inc. | 39 656 | 32,34 | 1 459 | 46,53 | ||||

| 2025-08-12 | 13F | Inscription Capital, LLC | 39 399 | 1 449 | ||||||

| 2025-08-14 | 13F | Mariner, LLC | 126 650 | 31,44 | 4 659 | 45,59 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 22 849 | 841 | ||||||

| 2025-07-16 | 13F | Spirepoint Private Client, Llc | 64 672 | -8,88 | 2 379 | 0,93 | ||||

| 2025-06-25 | NP | LEGAX - Columbia Large Cap Growth Fund Class A | 169 788 | -50,53 | 5 572 | -54,33 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 90 084 | 13,78 | 3 314 | 26,06 |