Statistiques de base

| Propriétaires institutionnels | 207 total, 207 long only, 0 short only, 0 long/short - change of 16,29% MRQ |

| Allocation moyenne du portefeuille | 0.4410 % - change of -6,78% MRQ |

| Actions institutionnelles (Long) | 34 273 811 (ex 13D/G) - change of -2,69MM shares -7,28% MRQ |

| Valeur institutionnelle (Long) | $ 1 415 265 USD ($1000) |

Participation institutionnels et actionnaires

First Trust Exchange-Traded AlphaDEX Fund - First Trust Utilities AlphaDEX Fund (US:FXU) détient 207 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 34,273,811 actions. Les principaux actionnaires incluent First Trust Advisors Lp, FV - First Trust Dorsey Wright Focus 5 ETF, Morgan Stanley, Wells Fargo & Company/mn, LPL Financial LLC, Raymond James Financial Inc, Bank Of America Corp /de/, GWM Advisors LLC, UBS Group AG, and NewSquare Capital LLC .

First Trust Exchange-Traded AlphaDEX Fund - First Trust Utilities AlphaDEX Fund (ARCA:FXU) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 5, 2025 is 43,89 / share. Previously, on September 9, 2024, the share price was 36,26 / share. This represents an increase of 21,04% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

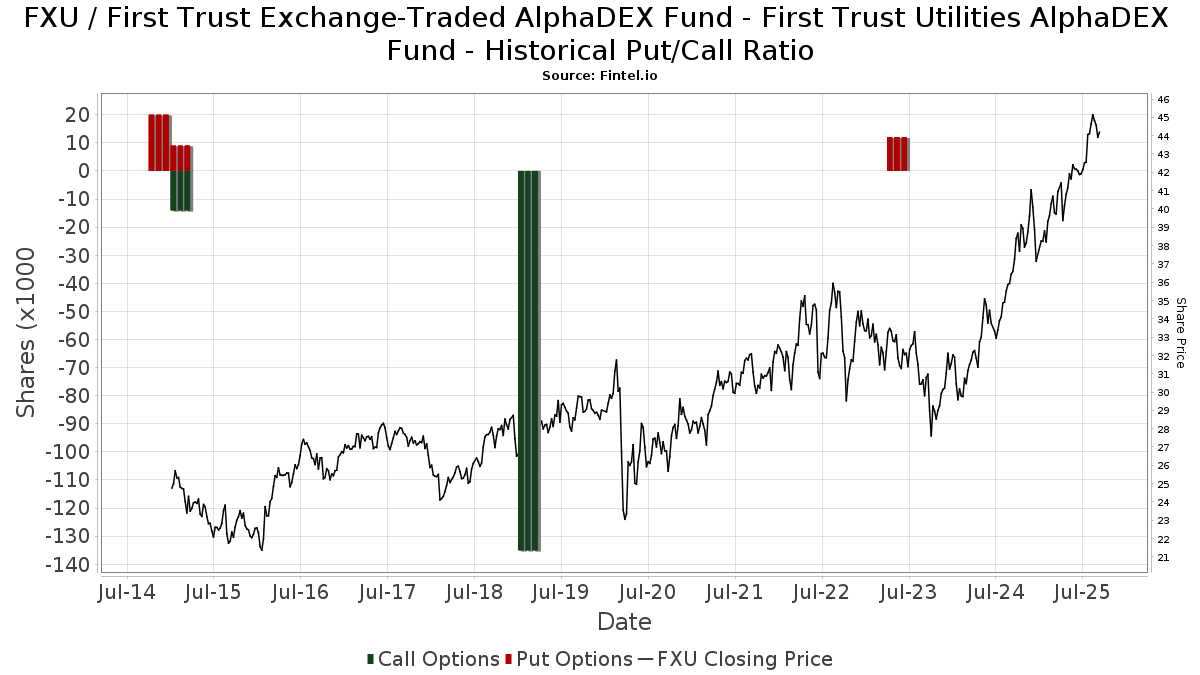

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13D/G

Nous présentons les dépôts 13D/G séparément des dépôts 13F en raison de leur traitement différent par la SEC. Les déclarations 13D/G peuvent être déposées par des groupes d'investisseurs (avec un leader), ce qui n'est pas le cas des déclarations 13F. Il en résulte des situations dans lesquelles un investisseur peut déposer une déclaration 13D/G indiquant une valeur pour le total des actions (représentant toutes les actions détenues par le groupe d'investisseurs), mais déposer ensuite une déclaration 13F indiquant une valeur différente pour le total des actions (représentant strictement ses propres actions). Cela signifie que l'actionnariat des déclarations 13D/G et des déclarations 13F n'est souvent pas directement comparable, c'est pourquoi nous les présentons séparément.

Note : À compter du 16 mai 2021, nous n'affichons plus les propriétaires qui n'ont pas déposé de déclaration 13D/G au cours de l'année écoulée. Auparavant, nous montrions l'historique complet des déclarations 13D/G. En général, les entités qui sont tenues de déposer des déclarations 13D/G doivent le faire au moins une fois par an avant de soumettre une déclaration de clôture. Cependant, il arrive que des fonds sortent de positions sans soumettre de déclaration de clôture (c'est-à-dire qu'ils procèdent à une liquidation), de sorte que l'affichage de l'historique complet pouvait prêter à confusion quant à l'actionnariat actuel. Pour éviter toute confusion, nous n'affichons désormais que les propriétaires "actuels", c'est-à-dire les propriétaires qui ont déposé des documents au cours de l'année écoulée.

Upgrade to unlock premium data.

| Date de dépôt | Formulaire | Investisseur | Actions précédentes |

Actions actuelles |

&Delta ; Actions (Pourcentage) |

Participation (Pourcentage) |

&Delta ; Participation (Pourcentage) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-07-23 | FIRST TRUST PORTFOLIOS LP | 16,743,402 | 16,528,148 | -1.29 | 42.22 | -7.21 |

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-11 | 13F | Perennial Investment Advisors, LLC | 5 111 | 217 | ||||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 2 975 | -1,39 | 126 | 2,44 | ||||

| 2025-08-05 | 13F | C2P Capital Advisory Group, LLC d.b.a. Prosperity Capital Advisors | 12 964 | -5,07 | 549 | -2,31 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 6 395 | 7,90 | 271 | 11,52 | ||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 19 708 | 120,42 | 835 | 128,14 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 154 | 0,00 | 7 | 0,00 | ||||

| 2025-07-08 | 13F | Zrc Wealth Management, Llc | 1 376 | -33,91 | 58 | -31,76 | ||||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 6 666 | -29,92 | 283 | -27,69 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 223 276 | 118,81 | 9 | 125,00 | ||||

| 2025-07-16 | 13F/A | CX Institutional | 209 | -83,04 | 0 | |||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 200 | 8 | ||||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 3 985 | -7,90 | 169 | -5,08 | ||||

| 2025-08-13 | 13F | Virtue Capital Management, LLC | 161 458 | 615,78 | 6 843 | 639,68 | ||||

| 2025-06-17 | 13F | Howe & Rusling Inc | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Topsail Wealth Management, LLC | 1 000 | 0,00 | 42 | 2,44 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-08-25 | NP | FVC - First Trust Dorsey Wright Dynamic Focus 5 ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 212 850 | -38,97 | 9 021 | -36,94 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 7 650 | -0,71 | 324 | 2,86 | ||||

| 2025-08-29 | 13F | Centaurus Financial, Inc. | 13 038 | 7,71 | 1 | |||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 840 | -0,83 | 36 | 9,38 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 541 082 | 16,20 | 22 931 | 20,09 | ||||

| 2025-08-12 | 13F | OneAscent Financial Services LLC | 7 121 | 16,99 | 0 | |||||

| 2025-08-04 | 13F | Spire Wealth Management | 61 | -99,23 | 3 | -99,39 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 5 184 | -0,58 | 220 | 2,82 | ||||

| 2025-08-13 | 13F | Rockport Wealth LLC | 367 638 | 15 580 | ||||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 471 | 20 | ||||||

| 2025-07-29 | 13F | Signature Estate & Investment Advisors Llc | 10 509 | -4,87 | 445 | -1,77 | ||||

| 2025-07-16 | 13F | Minichmacgregor Wealth Management, Llc | 15 587 | -5,46 | 661 | -2,37 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 97 451 | 124,52 | 4 130 | 131,97 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 101 390 | 215,43 | 4 297 | 225,95 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 135 018 | 37,58 | 6 | 25,00 | ||||

| 2025-08-08 | 13F | Beacon Harbor Wealth Advisors, Inc. | 263 189 | 11 154 | ||||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 124 172 | 7,59 | 5 262 | 11,18 | ||||

| 2025-08-14 | 13F | Comerica Bank | 16 119 | 3,40 | 683 | 6,89 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 2 691 | -8,75 | 114 | -5,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 127 120 | 46,96 | 5 388 | 51,90 | ||||

| 2025-08-04 | 13F | Daymark Wealth Partners, Llc | 33 154 | 1 405 | ||||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 41 939 | 4,59 | 1 777 | 8,09 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 12 586 | 533 | ||||||

| 2025-08-06 | 13F | O'Dell Group, LLC | 444 560 | -5,16 | 18 840 | -1,99 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 135 | 0,00 | 6 | 0,00 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 1 589 604 | 49,30 | 67 367 | 54,29 | ||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 470 272 | 1,42 | 19 930 | 4,81 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 2 446 | 104 | ||||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 95 | 0,00 | 4 | 33,33 | ||||

| 2025-08-07 | 13F | Efficient Advisors, LLC | 29 686 | 192,53 | 1 258 | 202,40 | ||||

| 2025-07-30 | 13F | Rehmann Capital Advisory Group | 13 262 | 4,92 | 562 | 8,49 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 71 218 | 724,66 | 3 | |||||

| 2025-08-01 | 13F | Motco | 5 000 | 222 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 3 667 | 8,27 | 155 | 12,32 | ||||

| 2025-08-14 | 13F | Fmr Llc | 1 206 | 20,00 | 51 | 24,39 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 81 005 | 3 433 | ||||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 3 979 | 0,00 | 169 | 3,07 | ||||

| 2025-08-26 | NP | FIRST TRUST VARIABLE INSURANCE TRUST - First Trust Dorsey Wright Tactical Core Portfolio Class I This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 108 238 | 2,11 | 4 587 | 5,52 | ||||

| 2025-08-05 | 13F | EPG Wealth Management LLC | 2 542 | 0,47 | 108 | 3,88 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 1 248 | 108,00 | 53 | 136,36 | ||||

| 2025-07-23 | 13F | Element Wealth, LLC | 19 720 | 836 | ||||||

| 2025-07-28 | 13F | Rosenberg Matthew Hamilton | 0 | -100,00 | 0 | |||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 455 369 | -0,20 | 20 250 | 8,22 | ||||

| 2025-05-07 | 13F | WMS Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | First Command Advisory Services, Inc. | 346 | 15 | ||||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 850 | 0,00 | 36 | 5,88 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 43 440 | 16,54 | 1 841 | 20,42 | ||||

| 2025-08-14 | 13F | Transamerica Financial Advisors, Inc. | 52 422 | 6,10 | 2 222 | 110 950,00 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 1 075 | 0,00 | 46 | 2,27 | ||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 34 356 | 1 456 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 164 098 | 24,18 | 6 954 | 28,33 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 9 418 | -79,69 | 399 | -79,01 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 4 989 | -8,61 | 211 | -5,38 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 25 557 | 1 125 | ||||||

| 2025-08-11 | 13F | Regal Investment Advisors LLC | 8 737 | 0,00 | 370 | 3,35 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1 537 | 4,99 | 65 | 8,33 | ||||

| 2025-07-30 | 13F | Greenup Street Wealth Management Llc | 79 575 | 8,21 | 3 372 | 11,84 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 364 | 15 | ||||||

| 2025-08-14 | 13F | Blue Capital, Inc. | 15 471 | 656 | ||||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 70 Fund Investor Class | 21 800 | 924 | ||||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 637 | 0,00 | 27 | 0,00 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 319 | 0,00 | 12 | -7,69 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 340 578 | 413,10 | 14 | 600,00 | ||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 60 | 3 | ||||||

| 2025-04-10 | 13F | Iams Wealth Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | TriaGen Wealth Management LLC | 52 322 | 92,17 | 2 217 | 98,66 | ||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 8 897 | 0,02 | 377 | 3,57 | ||||

| 2025-08-25 | 13F | Fulcrum Equity Management | 21 953 | 930 | ||||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 100 169 | 5,12 | 4 245 | 8,65 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 78 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 21 058 | 6,77 | 892 | 10,40 | ||||

| 2025-07-21 | 13F | Fortis Capital Advisors, LLC | 4 989 | -8,61 | 211 | -5,38 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 5 763 | 244 | ||||||

| 2025-07-23 | 13F | REAP Financial Group, LLC | 737 | -6,59 | 31 | -3,12 | ||||

| 2025-07-29 | 13F | Cottonwood Capital Advisors, Llc | 9 942 | -0,23 | 421 | 3,19 | ||||

| 2025-08-04 | 13F | Center for Financial Planning, Inc. | 825 | 0,00 | 35 | 3,03 | ||||

| 2025-08-13 | 13F | WCG Wealth Advisors LLC | 147 893 | 6 268 | ||||||

| 2025-07-24 | 13F | WMG Financial Advisors, LLC | 17 728 | 0,00 | 751 | 3,30 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 328 906 | 40,72 | 13 939 | 45,43 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 2 753 121 | 38,61 | 116 677 | 43,24 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 15 284 | 36,75 | 648 | 41,27 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 9 743 | 6,56 | 413 | 10,16 | ||||

| 2025-08-01 | 13F | Winebrenner Capital Management Llc | 18 126 | 1,25 | 768 | 4,63 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 12 877 | 0,60 | 546 | 4,01 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 9 493 | 0,20 | 402 | 3,61 | ||||

| 2025-08-14 | 13F | Vivaldi Capital Management, LLC | 5 130 | 0,00 | 217 | 3,33 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 2 028 | 0,00 | 86 | 2,41 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 40 | 0,00 | 2 | 0,00 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 5 210 | 221 | ||||||

| 2025-07-24 | 13F | Blair William & Co/il | 261 | 0,00 | 11 | 10,00 | ||||

| 2025-04-11 | 13F | Davis Capital Management | 131 | 0,00 | 5 | 25,00 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 140 | -32,37 | 6 | -37,50 | ||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 30 Fund Instl Class | 25 800 | 1 093 | ||||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 111 | 5 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 14 374 | 609 | ||||||

| 2025-07-07 | 13F | Nova Wealth Management, Inc. | 4 149 | 11,17 | 176 | 14,38 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 266 865 | 81,56 | 11 309 | 87,61 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 13 122 | -3,95 | 556 | -0,71 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 3 539 | -1,67 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Harmony Asset Management Llc | 18 563 | 0,00 | 787 | 3,29 | ||||

| 2025-05-08 | NP | QALTX - Quantified Alternative Investment Fund Investor Class Shares | 15 126 | 46,36 | 620 | 56,17 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 776 920 | 17,62 | 32 926 | 21,54 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 9 697 | 40,39 | 411 | 45,23 | ||||

| 2025-07-30 | 13F | Pacific Sun Financial Corp | 5 600 | 0,00 | 237 | 3,49 | ||||

| 2025-08-06 | 13F | Csenge Advisory Group | 236 174 | -0,53 | 10 094 | 4,67 | ||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 250 | 0,00 | 11 | 0,00 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 7 739 | -19,61 | 328 | -17,01 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 978 | -19,44 | 41 | -16,33 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 9 058 | -69,37 | 384 | -68,40 | ||||

| 2025-08-05 | 13F | Advisors Preferred, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 27 376 | 36,62 | 1 160 | 41,29 | ||||

| 2025-07-22 | 13F | Coastal Investment Advisors, Inc. | 15 200 | 5,64 | 644 | 9,15 | ||||

| 2025-08-08 | 13F | Meridian Wealth Management, LLC | 10 312 | -0,96 | 437 | 2,58 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 141 357 | 69,24 | 5 991 | 74,89 | ||||

| 2025-08-13 | 13F | Green Harvest Asset Management LLC | 197 755 | -2,28 | 8 381 | 0,98 | ||||

| 2025-07-17 | 13F | Wagner Wealth Management, Llc | 37 | 0,00 | 2 | 0,00 | ||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 8 188 | -0,61 | 347 | 2,97 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 833 | 276,92 | 35 | 288,89 | ||||

| 2025-07-08 | 13F | Davis Investment Partners, LLC | 31 427 | 1,68 | 1 331 | 6,66 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 53 564 | 2 380,96 | 2 270 | 2 479,55 | ||||

| 2025-04-21 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 294 682 | 25,60 | 12 489 | 29,80 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 54 876 | -98,66 | 2 326 | -98,61 | ||||

| 2025-07-31 | 13F | Nilsine Partners, LLC | 319 643 | -16,95 | 13 546 | -14,18 | ||||

| 2025-08-06 | 13F | ROI Financial Advisors, LLC | 6 559 | -3,03 | 278 | 0,00 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 154 934 | 10,25 | 6 566 | 13,93 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 6 000 | 0,00 | 254 | 3,25 | ||||

| 2025-08-13 | 13F | RPg Family Wealth Advisory, LLC | 16 793 | -2,33 | 712 | 0,85 | ||||

| 2025-08-13 | 13F | StoneX Group Inc. | 30 525 | 5,12 | 1 294 | 8,66 | ||||

| 2025-08-14 | 13F | MGB Wealth Management, LLC | 7 120 | 39,88 | 302 | 44,71 | ||||

| 2025-08-14 | 13F | UBS Group AG | 510 992 | 86,45 | 21 656 | 92,68 | ||||

| 2025-07-07 | 13F | Trust Co Of Oklahoma | 18 003 | -28,91 | 763 | -26,59 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 13 487 | 21,28 | 572 | 25,22 | ||||

| 2025-08-12 | 13F | One Charles Private Wealth Services, LLC | 10 705 | -0,73 | 454 | 2,49 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 303 608 | 301,04 | 12 867 | 314,50 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 19 443 | 58,74 | 824 | 63,94 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 12 095 | 63,12 | 510 | 69,44 | ||||

| 2025-08-11 | 13F | Brass Tax Wealth Management, Inc | 6 951 | -0,69 | 295 | 2,44 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 2 778 | 97,02 | 118 | 105,26 | ||||

| 2025-07-02 | 13F | HBW Advisory Services LLC | 8 696 | -38,45 | 369 | -36,44 | ||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 270 054 | 413,38 | 11 445 | 430,55 | ||||

| 2025-04-01 | 13F | Hobart Private Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Global View Capital Management LLC | 7 421 | 315 | ||||||

| 2025-08-12 | 13F | PKS Advisory Services, LLC | 24 201 | 6,53 | 1 026 | 10,10 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 620 797 | 20,00 | 68 689 | 24,01 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 824 969 | 86,01 | 34 962 | 92,23 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 22 268 | 2,39 | 944 | 5,84 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 12 048 | -40,61 | 511 | -38,63 | ||||

| 2025-08-11 | 13F | Core Wealth Partners LLC | 6 560 | 0,00 | 278 | 3,35 | ||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 5 306 | 0,47 | 225 | 3,70 | ||||

| 2025-08-06 | 13F | Rps Advisory Solutions Llc | 12 108 | 513 | ||||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 16 528 148 | -11,90 | 700 463 | -8,95 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 270 | 0,00 | 11 | 0,00 | ||||

| 2025-08-14 | 13F | LaSalle St. Investment Advisors, LLC | 5 129 | 0,10 | 0 | |||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 28 | 0,00 | 1 | 0,00 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 5 448 | 231 | ||||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 2 233 | 95 | ||||||

| 2025-08-15 | 13F | Asset Allocation Strategies LLC | 31 196 | 8,81 | 1 322 | 12,51 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 38 223 | 44,15 | 1 620 | 48,94 | ||||

| 2025-08-28 | NP | SIRAX - Sierra Tactical All Asset Fund Class A | 112 100 | 4 751 | ||||||

| 2025-08-13 | 13F | Gateway Wealth Partners, LLC | 5 417 | 230 | ||||||

| 2025-07-23 | 13F | Trueblood Wealth Management, LLC | 14 696 | 0,29 | 623 | 3,67 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 57 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 9 380 | -3,10 | 398 | 0,25 | ||||

| 2025-08-07 | 13F | Apeiron RIA LLC | 17 156 | 727 | ||||||

| 2025-08-05 | 13F | HFG Advisors, Inc. | 20 957 | 1,46 | 888 | 4,84 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 111 963 | -0,04 | 4 745 | 3,29 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 24 674 | 47,24 | 1 046 | 52,11 | ||||

| 2025-07-31 | 13F | Leelyn Smith, LLC | 8 766 | 372 | ||||||

| 2025-08-05 | 13F | Claro Advisors LLC | 9 359 | 4,68 | 397 | 8,20 | ||||

| 2025-08-14 | 13F | Ausdal Financial Partners, Inc. | 25 350 | 155,03 | 1 074 | 163,88 | ||||

| 2025-08-25 | NP | FV - First Trust Dorsey Wright Focus 5 ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 15 898 782 | -11,48 | 673 790 | -8,53 | ||||

| 2025-08-19 | 13F | Delos Wealth Advisors, LLC | 139 692 | -4,87 | 5 920 | -1,69 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 57 121 | -1,82 | 2 421 | 1,47 | ||||

| 2025-08-14 | 13F | Financial Network Wealth Advisors LLC | 120 | 0,00 | 5 | 25,00 | ||||

| 2025-07-17 | 13F | Lee Johnson Capital Management, Llc | 8 296 | 352 | ||||||

| 2025-08-13 | 13F | Proactive Wealth Strategies LLC | 56 250 | -2,09 | 2 | 0,00 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 59 175 | 39,74 | 2 508 | 44,41 | ||||

| 2025-04-23 | 13F | Mascagni Wealth Management, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 10 574 | 14,31 | 448 | 18,21 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 31 333 | -1,65 | 1 330 | 1,84 | ||||

| 2025-04-30 | 13F | Brown Advisory Inc | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 9 756 | 3,96 | 413 | 6,99 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 27 486 | -23,32 | 1 165 | -20,82 | ||||

| 2025-08-14 | 13F | Garden State Investment Advisory Services LLC | 11 875 | 503 | ||||||

| 2025-08-26 | NP | DALI - First Trust Dorsey Wright DALI 1 ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 307 891 | -10,30 | 13 048 | -7,30 | ||||

| 2025-08-01 | 13F | Brinker Capital Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Core Growth Fund Investor Class Shares | 4 435 | 188 | ||||||

| 2025-08-06 | 13F | Legacy Wealth Managment, LLC/ID | 60 | 3 | ||||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 19 400 | 822 | ||||||

| 2025-07-23 | 13F | Schrum Private Wealth Management LLC | 8 411 | 0,00 | 356 | 3,49 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 47 520 | 45,27 | 2 | 100,00 | ||||

| 2025-07-16 | 13F | Bright Financial Advisors, Inc. | 5 555 | 0,00 | 235 | 3,52 | ||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 52 843 | 2 239 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 19 829 | 840 | ||||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 15 739 | 35,06 | 667 | 39,83 | ||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 50 Fund Investor Class | 76 700 | 3 251 | ||||||

| 2025-07-15 | 13F | Wealth Effects Llc | 6 898 | 0,00 | 292 | 3,55 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 192 800 | 25,03 | 8 171 | 29,21 | ||||

| 2025-08-20 | 13F/A | Coppell Advisory Solutions LLC | 7 347 | 0,00 | 310 | 1,64 | ||||

| 2025-07-22 | 13F | Ergawealth Advisors, Inc. | 13 336 | 565 |

Other Listings

| MX:FXU |