Statistiques de base

| Propriétaires institutionnels | 164 total, 164 long only, 0 short only, 0 long/short - change of -4,07% MRQ |

| Allocation moyenne du portefeuille | 0.1232 % - change of -8,22% MRQ |

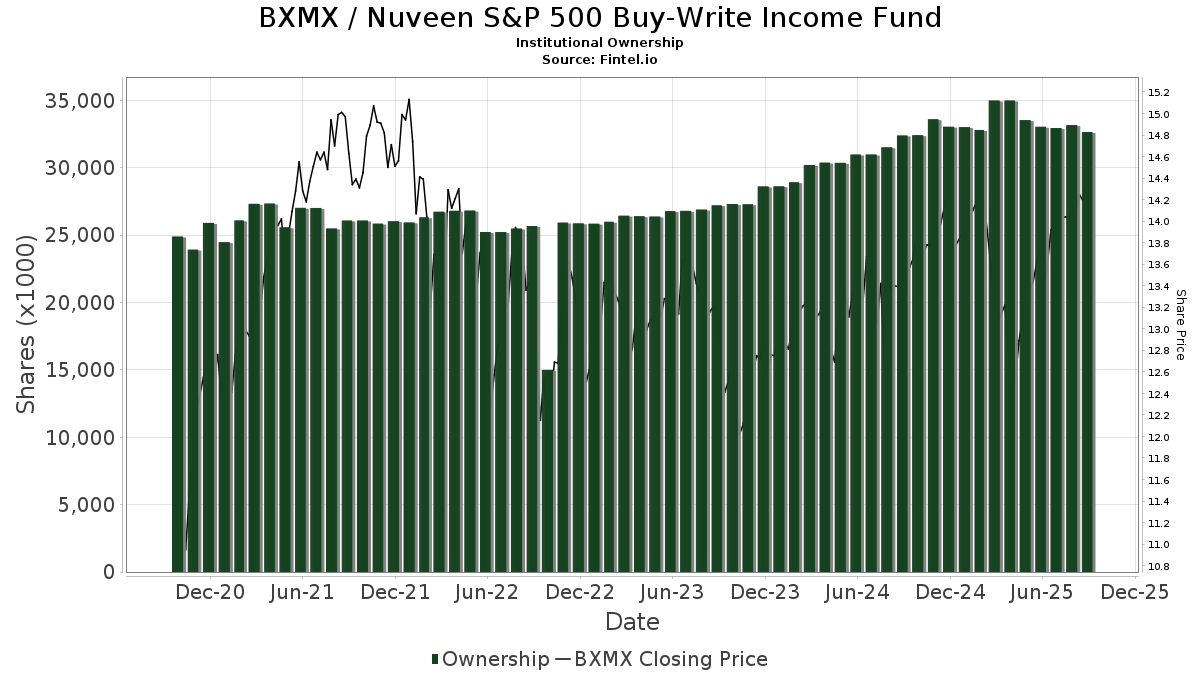

| Actions institutionnelles (Long) | 32 658 930 (ex 13D/G) - change of -0,30MM shares -0,91% MRQ |

| Valeur institutionnelle (Long) | $ 433 203 USD ($1000) |

Participation institutionnels et actionnaires

Nuveen S&P 500 Buy-Write Income Fund (US:BXMX) détient 164 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 32,658,930 actions. Les principaux actionnaires incluent Morgan Stanley, Wells Fargo & Company/mn, LPL Financial LLC, Invesco Ltd., UBS Group AG, PCEF - Invesco CEF Income Composite ETF, Raymond James Financial Inc, Advisors Asset Management, Inc., Allspring Global Investments Holdings, LLC, and Bank Of America Corp /de/ .

Nuveen S&P 500 Buy-Write Income Fund (NYSE:BXMX) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 10, 2025 is 14,37 / share. Previously, on September 11, 2024, the share price was 13,44 / share. This represents an increase of 6,92% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-15 | 13F | World Equity Group, Inc. | 26 750 | 102,65 | 371 | 114,45 | ||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 9 597 | 0,00 | 126 | -6,72 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 39 598 | -11,90 | 550 | -6,79 | ||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 8 609 | 0,00 | 119 | 6,25 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 2 511 | 35 | ||||||

| 2025-08-14 | 13F | Polar Asset Management Partners Inc. | 156 696 | 2 175 | ||||||

| 2025-07-16 | 13F | Twelve Points Wealth Management LLC | 432 690 | 4,27 | 6 006 | 10,30 | ||||

| 2025-08-12 | 13F | Wealth Dimensions Group, Ltd. | 10 943 | -10,69 | 152 | -5,62 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 5 200 | -7,14 | 72 | -1,37 | ||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 47 367 | 10,33 | 657 | 16,70 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 87 831 | 102,31 | 1 219 | 114,24 | ||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 1 800 | 0,00 | 25 | 4,35 | ||||

| 2025-03-12 | 13F/A | Private Capital Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 927 730 | 18,19 | 12 877 | 25,03 | ||||

| 2025-08-07 | 13F | BOK Financial Private Wealth, Inc. | 1 957 | 0,00 | 28 | 3,85 | ||||

| 2025-08-14 | 13F | Apriem Advisors | 17 968 | 0,00 | 249 | 5,96 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 269 380 | 27,32 | 4 | 50,00 | ||||

| 2025-08-06 | 13F | Maltin Wealth Management, Inc. | 18 291 | 1,72 | 254 | 7,66 | ||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 7 594 | -21,89 | 0 | |||||

| 2025-07-23 | 13F | Joel Isaacson & Co., LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Costello Asset Management, INC | 100 | 0,00 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 17 905 | 5,32 | 0 | |||||

| 2025-08-07 | 13F | Readystate Asset Management Lp | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Cornerstone Advisors, LLC | 380 684 | -45,66 | 5 284 | -42,52 | ||||

| 2025-08-13 | 13F | StoneX Group Inc. | 26 437 | -20,26 | 373 | -16,03 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 1 748 | 0,00 | 0 | |||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 28 864 | -0,71 | 0 | |||||

| 2025-07-17 | 13F | Venture Visionary Partners LLC | 52 681 | -3,03 | 731 | 2,67 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 87 808 | 67,66 | 1 219 | 78,59 | ||||

| 2025-07-29 | 13F | Hoese & Co LLP | 875 | -50,00 | 12 | -45,45 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 167 022 | -4,50 | 2 318 | 1,05 | ||||

| 2025-08-13 | 13F | Kayne Anderson Rudnick Investment Management Llc | 465 | 0,00 | 6 | 0,00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 50 446 | 1,03 | 700 | 6,87 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 169 380 | 2 351 | ||||||

| 2025-08-13 | 13F | Global Endowment Management, LP | 0 | -100,00 | 0 | |||||

| 2025-05-08 | 13F | Plante Moran Financial Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-04-29 | 13F | Pensionmark Financial Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 1 629 051 | 0,85 | 22 611 | 6,69 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 104 200 | 99,24 | 1 446 | 110,79 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 479 512 | -3,25 | 6 656 | 2,37 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 17 537 | 0,00 | 243 | 5,65 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 74 671 | 11,09 | 1 036 | 17,59 | ||||

| 2025-08-04 | 13F | Carret Asset Management, Llc | 10 000 | 0,00 | 139 | 5,34 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 15 769 | 219 | ||||||

| 2025-08-13 | 13F | Invesco Ltd. | 1 507 507 | -0,41 | 20 924 | 5,36 | ||||

| 2025-07-15 | 13F | Bay Capital Advisors, LLC | 15 950 | 0,00 | 221 | 5,74 | ||||

| 2025-08-15 | 13F | Puff Wealth Management, Llc | 81 552 | 3,15 | 1 132 | 9,06 | ||||

| 2025-08-12 | 13F | Wood Tarver Financial Group, LLC | 21 | 0,00 | 0 | |||||

| 2025-07-25 | 13F | Northwest Capital Management Inc | 978 | 0,00 | 14 | 8,33 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 567 331 | 1,63 | 8 | 0,00 | ||||

| 2025-07-25 | 13F | Stephens Consulting, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 18 292 | 5,02 | 254 | 10,96 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 689 550 | 1,44 | 23 451 | 7,32 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 504 | 0,00 | 7 | 0,00 | ||||

| 2025-03-11 | 13F/A | Elequin Capital Lp | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Matrix Trust Co | 57 855 | 0,67 | 1 | |||||

| 2025-07-09 | 13F | Triumph Capital Management | 17 432 | 0,00 | 242 | 5,70 | ||||

| 2025-05-15 | 13F | Talon Private Wealth, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 690 062 | 0,00 | 9 054 | -6,22 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 122 039 | -4,13 | 2 | 0,00 | ||||

| 2025-08-11 | 13F | Blue Bell Private Wealth Management, Llc | 5 680 | 2,64 | 79 | 8,33 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 327 849 | -6,20 | 5 | 0,00 | ||||

| 2025-08-07 | 13F | Commerce Bank | 15 819 | 0,00 | 220 | 5,80 | ||||

| 2025-05-06 | 13F | MCF Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 12 762 | 8,09 | 177 | 14,94 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 3 090 | 43 | ||||||

| 2025-08-12 | 13F | Landscape Capital Management, L.l.c. | 0 | -100,00 | 0 | |||||

| 2025-05-08 | 13F | Private Advisory Group LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 693 | 0,00 | 10 | 0,00 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 77 062 | -5,89 | 1 070 | -0,47 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 2 650 | 0,00 | 37 | 5,88 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Multi-Hedge Strategies Fund Variable Annuity | 230 | -19,30 | 3 | 0,00 | ||||

| 2025-07-15 | 13F | Focused Wealth Management, Inc | 333 887 | 1,57 | 4 634 | 7,47 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 37 | 0,00 | 1 | |||||

| 2025-07-24 | 13F | Leo Wealth, LLC | 34 991 | 0,00 | 486 | 5,66 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 16 381 | 12,93 | 227 | 19,47 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 1 061 | 15 | ||||||

| 2025-04-15 | 13F | Fiduciary Financial Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-28 | NP | PCEF - Invesco CEF Income Composite ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 465 087 | -0,51 | 19 735 | -3,24 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 17 671 | -0,82 | 250 | 5,04 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 13 927 | 0,00 | 193 | 6,04 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 48 594 | 0,70 | 674 | 6,48 | ||||

| 2025-08-14 | 13F | UBS Group AG | 1 488 300 | -4,04 | 20 658 | 1,52 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 37 364 | 10,23 | 519 | 16,67 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 22 147 | 18,73 | 307 | 25,82 | ||||

| 2025-08-05 | 13F | Prosperity Wealth Management, Inc. | 123 745 | 1,21 | 1 718 | 7,04 | ||||

| 2025-08-06 | 13F | Marco Investment Management Llc | 27 300 | 0,00 | 379 | 5,59 | ||||

| 2025-08-12 | 13F | Founders Financial Alliance, LLC | 12 908 | -0,20 | 179 | 5,92 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 105 731 | 39,30 | 1 468 | 47,54 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 823 947 | 2,94 | 11 436 | 8,90 | ||||

| 2025-08-12 | 13F | Armor Investment Advisors, LLC | 19 673 | -0,07 | 273 | 5,81 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 1 825 | 25 | ||||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 31 119 | -70,37 | 432 | -70,66 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 2 000 | -12,78 | 28 | -10,00 | ||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 905 057 | 42,10 | 12 562 | 50,34 | ||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 1 850 | 0,00 | 26 | 4,17 | ||||

| 2025-08-14 | 13F | NCP Inc. | 127 332 | 0,82 | 1 767 | 6,64 | ||||

| 2025-07-29 | 13F | Sims Investment Management, Llc | 60 100 | 0,00 | 834 | 5,84 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 15 970 | -21,96 | 222 | -17,54 | ||||

| 2025-08-14 | 13F | Cnh Partners Llc | 361 193 | -23,44 | 4 992 | -18,61 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 29 808 | -4,34 | 414 | 1,23 | ||||

| 2025-08-05 | 13F | Shaker Financial Services, LLC | 77 595 | -62,94 | 1 106 | -60,77 | ||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 254 | 0,00 | 3 | 0,00 | ||||

| 2025-08-04 | 13F | Horizon Wealth Management, LLC | 11 660 | 0,00 | 162 | 5,92 | ||||

| 2025-07-16 | 13F | St Germain D J Co Inc | 187 | 0,00 | 3 | 0,00 | ||||

| 2025-08-13 | 13F | Colonial Trust Advisors | 2 200 | 31 | ||||||

| 2025-08-27 | NP | RYMSX - Guggenheim Multi-Hedge Strategies Fund Class P | 137 | -37,44 | 2 | -50,00 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 3 000 | 0,00 | 42 | 5,13 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 33 | 0,00 | 0 | |||||

| 2025-08-18 | 13F | Arq Wealth Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Sage Capital Management, LLC | 255 095 | 2,35 | 3 541 | 8,26 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 978 | 0,00 | 14 | 8,33 | ||||

| 2025-07-25 | 13F | Integrated Capital Management, Inc. | 23 069 | 2,70 | 320 | 8,84 | ||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 20 877 | -6,92 | 290 | -1,70 | ||||

| 2025-08-14 | 13F | Wealth Preservation Advisors, LLC | 7 655 | 0,00 | 106 | 6,00 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 35 | 0,00 | ||||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 314 | 0,00 | 4 | 0,00 | ||||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 12 778 | -3,77 | 177 | 1,72 | ||||

| 2025-04-22 | 13F | Castleview Partners, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 5 000 | 0,00 | 69 | 6,15 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 41 249 | -0,07 | 573 | 5,73 | ||||

| 2025-07-07 | 13F | Bangor Savings Bank | 1 057 | -45,99 | 15 | -44,00 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 26 414 | 116,45 | 373 | 133,13 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 100 783 | 1,49 | 1 399 | 7,37 | ||||

| 2025-07-08 | 13F | Apella Capital, LLC | 15 035 | 0,00 | 209 | 8,33 | ||||

| 2025-07-21 | 13F | Pflug Koory, LLC | 33 682 | 0,00 | 468 | 5,90 | ||||

| 2025-07-17 | 13F | Jackson, Grant Investment Advisers, Inc. | 31 103 | 1,49 | 432 | 7,21 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 313 236 | -21,45 | 4 334 | -17,17 | ||||

| 2025-08-20 | NP | ADANX - AQR Diversified Arbitrage Fund Class N | 119 046 | -13,55 | 1 652 | -8,53 | ||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 73 052 | -44,65 | 1 014 | -41,48 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 153 547 | 8,89 | 2 131 | 15,19 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 9 252 | -1,76 | 128 | 4,07 | ||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 6 000 | 0,00 | 83 | 6,41 | ||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 25 640 | 0,07 | 356 | 5,65 | ||||

| 2025-08-14 | 13F | CoreFirst Bank & Trust | 930 | 13 | ||||||

| 2025-08-22 | NP | Cornerstone Total Return Fund Inc | 87 486 | -63,05 | 1 214 | -60,91 | ||||

| 2025-07-16 | 13F | Encompass Wealth Advisors, Llc | 14 207 | -37,20 | 197 | -33,45 | ||||

| 2025-04-23 | 13F | Continuum Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 47 387 | 3,15 | 658 | 9,14 | ||||

| 2025-05-15 | 13F | Gwn Securities Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 951 409 | -0,65 | 13 206 | 5,11 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 36 858 | 244,79 | 512 | 278,52 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 37 334 | -13,43 | 518 | -8,32 | ||||

| 2025-07-07 | 13F | Centurion Wealth Management LLC | 12 318 | 0,00 | 171 | -1,16 | ||||

| 2025-07-10 | 13F | Global Financial Private Client, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Commons Capital, Llc | 15 127 | 1,34 | 210 | 7,18 | ||||

| 2025-07-24 | 13F | Eastern Bank | 2 199 | 0,00 | 31 | 7,14 | ||||

| 2025-08-11 | 13F | Alteri Wealth LLC | 47 955 | 10,48 | 666 | 16,87 | ||||

| 2025-06-04 | 13F | Pvg Asset Management Corp | 0 | -100,00 | 0 | |||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 2 468 | 0,00 | 34 | 6,25 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 14 914 | -69,25 | 211 | -67,34 | ||||

| 2025-07-21 | 13F | Patriot Financial Group Insurance Agency, LLC | 27 630 | 0,93 | 384 | 6,69 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 32 256 | 29,21 | 448 | 36,70 | ||||

| 2025-05-14 | 13F | ICONIQ Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Investment Partners Asset Management, Inc. | 37 219 | -0,24 | 517 | 5,52 | ||||

| 2025-08-08 | 13F | Fortis Group Advisors, LLC | 250 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 34 524 | 1,75 | 479 | 7,64 | ||||

| 2025-04-25 | 13F | Smallwood Wealth Investment Management, LLC | 4 027 | 53 | ||||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 257 967 | -2,18 | 3 581 | 3,50 | ||||

| 2025-08-12 | 13F | Bokf, Na | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Richmond Investment Services, LLC | 114 171 | 95,73 | 1 585 | 107,06 | ||||

| 2025-05-08 | 13F | Essential Planning, LLC. | 0 | -100,00 | 0 | |||||

| 2025-05-07 | 13F | Sheaff Brock Investment Advisors, LLC | 13 188 | -0,08 | 173 | -5,98 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 380 959 | 3,05 | 5 288 | 9,03 | ||||

| 2025-08-14 | 13F | Quantedge Capital Pte Ltd | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | TPG Advisors LLC | 138 713 | -0,49 | 1 925 | 5,31 | ||||

| 2025-08-05 | 13F | Palogic Value Management, L.P. | 21 371 | -2,29 | 297 | 3,50 | ||||

| 2025-05-06 | 13F | Atria Investments Llc | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Shulman DeMeo Asset Management LLC | 96 095 | -0,12 | 1 334 | 5,63 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 2 895 | 40 | ||||||

| 2025-08-08 | 13F | Creative Planning | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 683 | -35,63 | 9 | -30,77 | ||||

| 2025-08-13 | 13F | Green Harvest Asset Management LLC | 15 760 | 0,00 | 219 | 5,83 | ||||

| 2025-08-08 | 13F | Islay Capital Management, Llc | 76 317 | -4,91 | 1 059 | 0,67 | ||||

| 2025-08-14 | 13F | Comerica Bank | 92 866 | 3,05 | 1 289 | 8,97 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 20 656 | 55,19 | 287 | 64,37 | ||||

| 2025-06-12 | 13F/A | Deutsche Bank Ag\ | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 26 302 | 109,85 | 365 | 108,57 | ||||

| 2025-04-16 | 13F | Fortitude Family Office, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 2 528 | 4,08 | 35 | 12,90 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 723 627 | 8,17 | 10 044 | 14,44 | ||||

| 2025-05-02 | 13F | Legacy Capital Wealth Partners, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 302 608 | 7,54 | 4 200 | 13,79 | ||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 5 000 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 11 835 003 | 2,03 | 164 270 | 7,94 | ||||

| 2025-08-04 | 13F | Wolverine Asset Management Llc | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Instrumental Wealth, Llc | 25 251 | 5,92 | 353 | 15,41 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 30 143 | 21,39 | 418 | 28,62 | ||||

| 2025-07-30 | 13F | Patten Group, Inc. | 58 215 | -0,73 | 808 | 5,07 | ||||

| 2025-07-31 | 13F | Blake Schutter Theil Wealth Advisors, LLC | 68 604 | 0,24 | 952 | 6,13 | ||||

| 2025-08-07 | 13F | Clarity Wealth Advisors, LLC | 10 091 | -17,10 | 140 | -11,95 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 3 600 | 380,00 | 50 | 444,44 | ||||

| 2025-07-23 | 13F | Ameliora Wealth Management Ltd. | 200 | 0,00 | 3 | 0,00 | ||||

| 2025-08-22 | NP | Cornerstone Strategic Value Fund Inc | 293 198 | -36,79 | 4 070 | -33,13 |