Statistiques de base

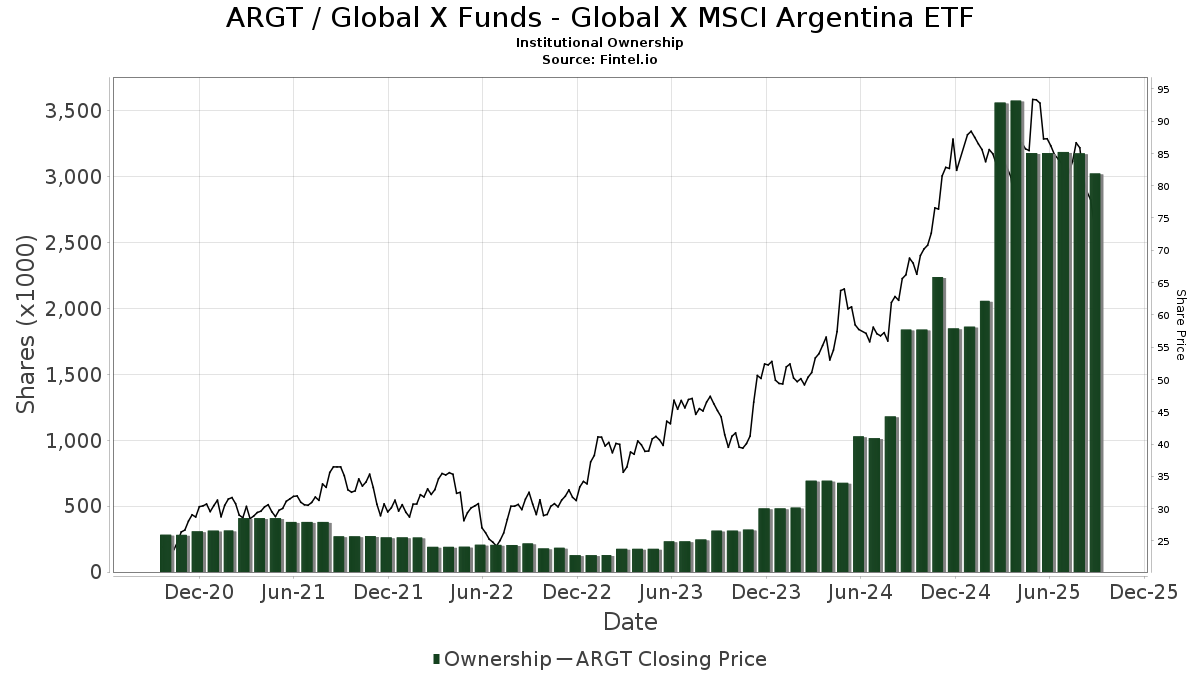

| Propriétaires institutionnels | 125 total, 122 long only, 0 short only, 3 long/short - change of -2,34% MRQ |

| Allocation moyenne du portefeuille | 0.2899 % - change of 73,91% MRQ |

| Actions institutionnelles (Long) | 3 025 016 (ex 13D/G) - change of -0,16MM shares -4,99% MRQ |

| Valeur institutionnelle (Long) | $ 223 809 USD ($1000) |

Participation institutionnels et actionnaires

Global X Funds - Global X MSCI Argentina ETF (US:ARGT) détient 125 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 3,025,016 actions. Les principaux actionnaires incluent Bank Julius Baer & Co. Ltd, Zurich, Duquesne Family Office LLC, Marshall Wace, Llp, Breakout Capital Partners, LP, LPL Financial LLC, Morgan Stanley, Bank Of America Corp /de/, Susquehanna International Group, Llp, Activest Wealth Management, and Moran Wealth Management, LLC .

Global X Funds - Global X MSCI Argentina ETF (ARCA:ARGT) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 12, 2025 is 71,37 / share. Previously, on September 13, 2024, the share price was 68,53 / share. This represents an increase of 4,14% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

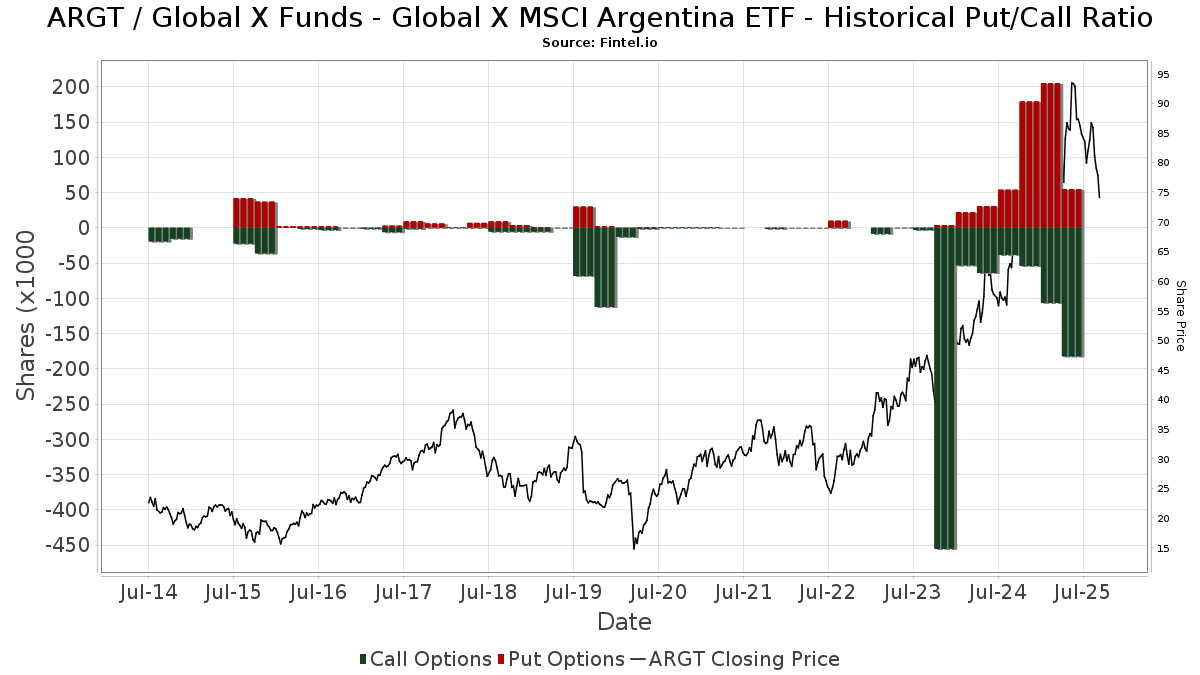

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-31 | 13F | Leavell Investment Management, Inc. | 4 361 | 370 | ||||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 200 | -74,03 | 17 | -5,88 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 63 461 | 95,14 | 5 377 | 104,76 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 3 732 | -78,50 | 316 | -77,46 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 3 450 | 33,46 | 285 | 37,02 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 96 240 | 1,13 | 8 154 | 6,09 | ||||

| 2025-08-15 | 13F | Duquesne Family Office LLC | 267 700 | -39,68 | 23 | -37,14 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 2 491 | 0,00 | 211 | 4,98 | ||||

| 2025-05-12 | 13F | Citigroup Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | LMR Partners LLP | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Moran Wealth Management, LLC | 82 007 | 2,06 | 6 948 | 7,07 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 29 330 | 18,92 | 2 485 | 24,75 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 55 419 | 39,99 | 4 696 | 46,86 | ||||

| 2025-05-12 | 13F | Founders Financial Securities Llc | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-07-30 | 13F | Loring Wolcott & Coolidge Fiduciary Advisors Llp/ma | 4 645 | 394 | ||||||

| 2025-08-14 | 13F | Kite Lake Capital Management (uk) Llp | 40 000 | 0,00 | 3 389 | 4,92 | ||||

| 2025-08-14 | 13F | Barometer Capital Management Inc. | 5 300 | 253,33 | 449 | 271,07 | ||||

| 2025-08-04 | 13F | Bay Colony Advisory Group, Inc d/b/a Bay Colony Advisors | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-04-30 | 13F | BCJ Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Cavalier Investments, LLC | 22 781 | -1,98 | 1 930 | 2,82 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 18 799 | 34,17 | 2 | 0,00 | ||||

| 2025-07-10 | 13F | Contravisory Investment Management, Inc. | 5 697 | 483 | ||||||

| 2025-08-14 | 13F | Intrepid Family Office Llc | 15 000 | 50,00 | 1 271 | 57,37 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 40 723 | 1,72 | 3 450 | 6,71 | ||||

| 2025-05-14 | 13F | Absolute Gestao de Investimentos Ltda. | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Harvest Fund Management Co., Ltd | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 21 | -12,50 | 2 | 0,00 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 621 | 918,03 | 53 | 2 500,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 19 753 | 29,78 | 1 673 | 36,13 | ||||

| 2025-05-13 | 13F | Waratah Capital Advisors Ltd. | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | CI Private Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 3 085 | 261 | ||||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-11 | 13F | Grove Bank & Trust | 25 | 2 | ||||||

| 2025-07-29 | 13F | Primoris Wealth Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 13 078 | 18,28 | 1 | |||||

| 2025-08-13 | 13F | Berbice Capital Management LLC | 300 | 0,00 | 25 | 4,17 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 383 | -64,00 | 33 | -62,35 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 3 652 | -20,87 | 310 | -16,67 | ||||

| 2025-08-06 | 13F | Csenge Advisory Group | 20 802 | 0,35 | 1 877 | 5,57 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 7 560 | -29,12 | 641 | -25,67 | ||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 3 667 | 6,63 | 311 | 11,91 | ||||

| 2025-07-22 | 13F | Kercheville Advisors, LLC | 4 000 | -42,86 | 339 | -40,18 | ||||

| 2025-08-01 | 13F | Belvedere Trading LLC | 21 033 | 2,46 | 1 782 | 7,48 | ||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Call | 15 800 | 295,00 | 1 339 | 314,24 | |||

| 2025-05-07 | 13F | Chandler Asset Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Put | 13 000 | 2 066,67 | 1 101 | 2 193,75 | |||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 7 131 | 604 | ||||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 303 | -96,12 | 25 | -96,07 | ||||

| 2025-08-05 | 13F | Verity Asset Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 151 933 | 0,60 | 12 873 | 5,53 | ||||

| 2025-08-14 | 13F/A | Bank Julius Baer & Co. Ltd, Zurich | 284 421 | 13,57 | 24 099 | 5,41 | ||||

| 2025-07-29 | 13F | Fundamentun, Llc | 39 434 | 38,59 | 3 341 | 45,39 | ||||

| 2025-08-14 | 13F | DZ BANK AG Deutsche Zentral Genossenschafts Bank, Frankfurt am Main | 5 900 | 0,00 | 500 | 4,83 | ||||

| 2025-05-15 | 13F | Integrated Wealth Concepts LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Basso Capital Management, L.p. | 25 | -99,43 | 2 | -99,43 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 50 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Coco Enterprises, LLC | 20 102 | 11,57 | 1 703 | 34,52 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 7 501 | 35,06 | 1 | |||||

| 2025-07-28 | NP | AGOX - Adaptive Growth Opportunities ETF | 22 741 | -3,07 | 2 052 | 5,61 | ||||

| 2025-08-08 | 13F | Smithfield Trust Co | 237 | 0,00 | 0 | |||||

| 2025-03-25 | NP | FEDERATED CORE TRUST - Emerging Markets Core Fund This fund is a listed as child fund of Federated Hermes, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 12 524 | 1 083 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 7 366 | -29,44 | 624 | -25,98 | ||||

| 2025-07-24 | 13F | Capital Advisors, Ltd. LLC | 581 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Banco BTG Pactual S.A. | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Roxbury Financial LLC | 35 | 0,00 | 3 | 0,00 | ||||

| 2025-07-28 | 13F | Copia Wealth Management | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | FIL Ltd | 612 | 4,79 | 53 | 10,64 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 171 | 14 | ||||||

| 2025-08-14 | 13F | Stifel Financial Corp | 15 059 | -0,49 | 1 276 | 4,34 | ||||

| 2025-08-14 | 13F | Militia Capital Partners, LP | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Gordian Capital Singapore Pte Ltd | 1 900 | -57,78 | 161 | -57,22 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 2 838 | -7,32 | 240 | -2,83 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 25 | 0,00 | 2 | 0,00 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 71 | 0,00 | 6 | 20,00 | ||||

| 2025-08-13 | 13F | Global Endowment Management, LP | 12 000 | 0,00 | 1 017 | 4,85 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 485 | -95,65 | 41 | -95,45 | ||||

| 2025-05-15 | 13F | Hilltop Holdings Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Southpoint Capital Advisors LP | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Park Edge Advisors, LLC | 6 844 | 21,09 | 580 | 26,97 | ||||

| 2025-07-16 | 13F | ORG Partners LLC | 20 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 55 854 | 42,49 | 4 733 | 49,46 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 17 239 | 1 461 | ||||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 210 | 2 000,00 | 18 | |||||

| 2025-04-17 | 13F | Good Life Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Itau Unibanco Holding S.A. | 16 282 | 1 380 | ||||||

| 2025-08-14 | 13F | Private Wealth Advisors, LLC | 26 581 | 2 252 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 7 094 | -64,71 | 601 | -62,97 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 5 590 | 0,00 | 474 | 4,88 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 2 955 | 250 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 171 520 | 1,11 | 14 533 | 6,07 | ||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 12 373 | -0,98 | 1 048 | 3,87 | ||||

| 2025-07-29 | 13F | Stratos Wealth Advisors, LLC | 2 745 | -82,05 | 233 | -81,20 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 531 | 45 | ||||||

| 2025-08-14 | 13F | Nwi Management Lp | 8 900 | 0,00 | 1 | |||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 230 361 | 1 074,11 | 19 518 | 1 132,20 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 59 212 | -23,18 | 5 017 | -19,41 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 300 | 25 | ||||||

| 2025-07-14 | 13F | Legacy Capital Group California, Inc. | 5 642 | 478 | ||||||

| 2025-08-13 | 13F | VestGen Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Breakout Capital Partners, LP | 192 800 | 16 336 | ||||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 30 | 3 | ||||||

| 2025-05-13 | 13F | M Holdings Securities, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Fundsmith Investment Services Ltd. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 0 | -100,00 | 0 | |||||

| 2025-05-06 | 13F | Financial & Tax Architects, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 3 149 | -1,04 | 267 | 3,91 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 2 | -60,00 | 0 | |||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 35 908 | 10,10 | 3 042 | 15,49 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 25 808 | 5,26 | 2 187 | 10,40 | ||||

| 2025-08-19 | 13F | Slocum, Gordon & Co LLP | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | City Of London Investment Management Co Ltd | 34 400 | 14,67 | 2 915 | 20,26 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 5 236 | -30,90 | 444 | -27,50 | ||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 63 | 0,00 | 5 | 0,00 | ||||

| 2025-07-23 | 13F | MADDEN SECURITIES Corp | 3 000 | 0,00 | 254 | 4,96 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 44 500 | 28,61 | 3 770 | 34,93 | |||

| 2025-08-14 | 13F | Fmr Llc | 1 591 | 0,00 | 137 | 6,25 | ||||

| 2025-05-16 | 13F | Cape Investment Advisory, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-09 | 13F | Client First Investment Management LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 10 283 | -97,43 | 871 | -97,30 | ||||

| 2025-07-10 | 13F | Family Legacy Financial Solutions, LLC | 60 | 5 | ||||||

| 2025-08-14 | 13F | Comerica Bank | 268 | 0,00 | 23 | 4,76 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 163 931 | 27,92 | 13 890 | 34,18 | ||||

| 2025-05-15 | 13F | Polymer Capital Management (HK) LTD | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Miracle Mile Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-30 | NP | ENDW - Cambria Endowment Style ETF | 318 | 29 | ||||||

| 2025-04-22 | 13F | Channing Global Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Laffer Investments | 2 571 | 218 | ||||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 33 | 0,00 | 3 | 0,00 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 200 | 0,00 | 17 | 0,00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1 091 | 60,68 | 92 | 70,37 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 45 224 | -57,36 | 3 832 | -55,27 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 76 170 | 48,94 | 6 454 | 56,25 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 3 568 | 16,60 | 302 | 22,27 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 31 000 | -29,22 | 2 627 | -25,76 | |||

| 2025-08-08 | 13F | Glaxis Capital Management, LLC | 30 000 | 2 542 | ||||||

| 2025-07-15 | 13F | Optima Capital Llc | 7 327 | 11,27 | 621 | 16,95 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 249 | -21,94 | 21 | -19,23 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 11 400 | -89,71 | 966 | -89,22 | |||

| 2025-07-14 | 13F | Ridgewood Investments LLC | 600 | 0,00 | 51 | 4,17 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 66 625 | -22,31 | 5 645 | -18,50 | ||||

| 2025-04-14 | 13F | Wedmont Private Capital | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Riggs Asset Managment Co. Inc. | 1 309 | 1 977,78 | 111 | 2 100,00 | ||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Parametrica Management Ltd | 5 400 | 0,00 | 458 | 4,82 | ||||

| 2025-04-29 | 13F | Pensionmark Financial Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co | 2 477 | 0,00 | 210 | 4,50 | ||||

| 2025-04-24 | 13F | Wright Fund Managment, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 121 900 | 104,19 | 10 329 | 114,23 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | 1 681 | 740,50 | 142 | 787,50 | ||||

| 2025-08-14 | 13F | Aprio Wealth Management, LLC | 6 000 | 3,00 | 508 | 8,09 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 3 206 | -19,99 | 272 | -16,10 | ||||

| 2025-04-22 | 13F | Jfs Wealth Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Encompass More Asset Management | 19 892 | 1 685 | ||||||

| 2025-07-10 | 13F | Rfg Holdings, Inc. | 27 755 | 2,16 | 2 352 | 7,16 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 69 866 | 6 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 296 | -99,64 | 25 | -99,62 | ||||

| 2025-07-23 | 13F | Clear Creek Financial Management, LLC | 19 453 | 15,46 | 1 648 | 21,18 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Blue Capital, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | StoneX Group Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 6 223 | 1,63 | 527 | 6,68 | ||||

| 2025-07-24 | 13F | Verde Servicos Internacionais S.A. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 280 | 24 | ||||||

| 2025-07-09 | 13F | Fiduciary Alliance LLC | 23 420 | 28,53 | 1 984 | 34,87 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 2 | 0 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 399 | 0,00 | 34 | 3,13 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 4 593 | 83,57 | 418 | 106,93 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 250 | -83,33 | 21 | -82,64 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | -100,00 | 0 | |||||

| 2025-06-27 | NP | GIAX - Nicholas Global Equity and Income ETF | 24 519 | -4,80 | 2 101 | -5,66 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Sona Asset Management (us) Llc | 27 000 | -28,00 | 2 288 | -24,47 | ||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 |