Statistiques de base

| Propriétaires institutionnels | 137 total, 137 long only, 0 short only, 0 long/short - change of 7,81% MRQ |

| Allocation moyenne du portefeuille | 0.3005 % - change of -23,27% MRQ |

| Actions institutionnelles (Long) | 9 882 667 (ex 13D/G) - change of -0,43MM shares -4,17% MRQ |

| Valeur institutionnelle (Long) | $ 389 759 USD ($1000) |

Participation institutionnels et actionnaires

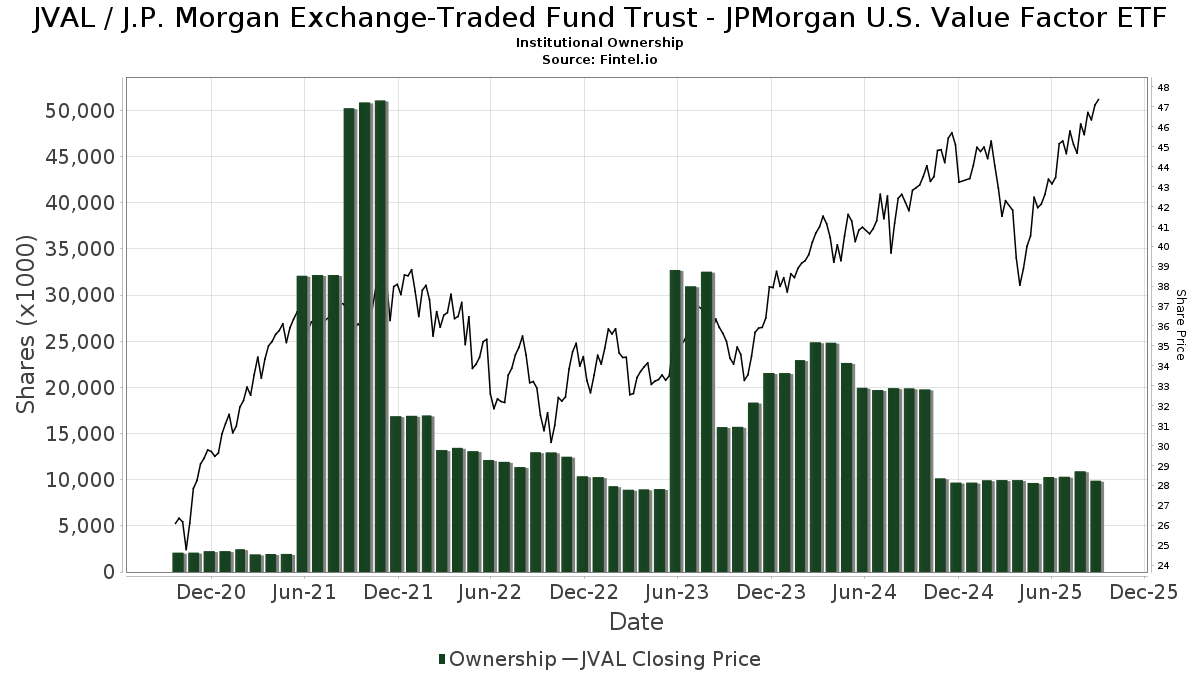

J.P. Morgan Exchange-Traded Fund Trust - JPMorgan U.S. Value Factor ETF (US:JVAL) détient 137 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 9,882,667 actions. Les principaux actionnaires incluent Cobblestone Capital Advisors Llc /ny/, LPL Financial LLC, Avidian Wealth Solutions, LLC, Cwm, Llc, Cerity Partners LLC, Bank Of America Corp /de/, Jpmorgan Chase & Co, Mainsail Financial Group, LLC, PFSEX - RiskPro® 30+ Fund Class R, and Apeiron RIA LLC .

J.P. Morgan Exchange-Traded Fund Trust - JPMorgan U.S. Value Factor ETF (ARCA:JVAL) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 8, 2025 is 46,99 / share. Previously, on September 9, 2024, the share price was 41,65 / share. This represents an increase of 12,81% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

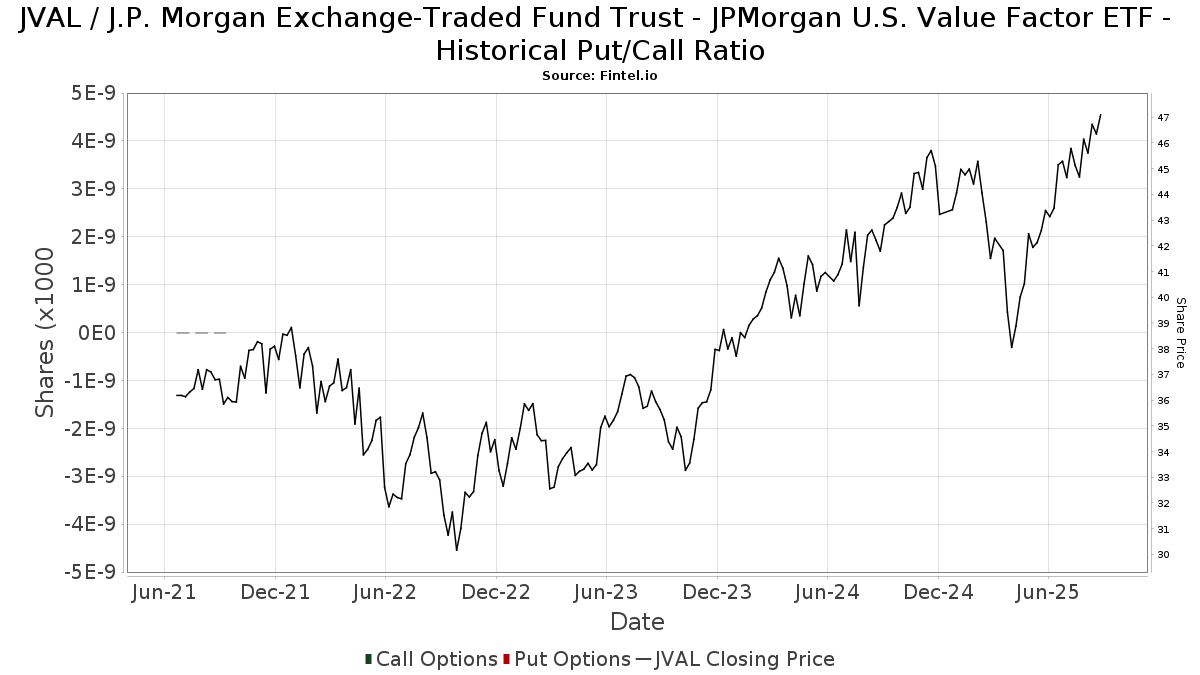

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 7 092 | -42,22 | 0 | |||||

| 2025-07-17 | 13F | Mainsail Financial Group, LLC | 366 260 | 0,72 | 16 324 | 8,38 | ||||

| 2025-07-24 | 13F | 3Chopt Investment Partners, LLC | 4 961 | 219 | ||||||

| 2025-08-14 | 13F | Mariner, LLC | 15 747 | -2,74 | 696 | 3,88 | ||||

| 2025-08-07 | 13F | Addison Advisors LLC | 18 590 | 70,71 | 822 | 82,26 | ||||

| 2025-08-12 | 13F | Jaffetilchin Investment Partners, LLC | 28 179 | -2,68 | 1 246 | 3,92 | ||||

| 2025-07-08 | 13F | Gallacher Capital Management LLC | 39 258 | -0,46 | 1 736 | 6,31 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 48 659 | 4,73 | 2 152 | 11,85 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 7 562 | -0,68 | 334 | 6,03 | ||||

| 2025-08-13 | 13F | Gateway Wealth Partners, LLC | 22 627 | 1 001 | ||||||

| 2025-03-31 | NP | PFSEX - RiskPro® 30+ Fund Class R | 247 560 | -1,96 | 11 128 | 2,49 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 8 779 | -34,22 | 388 | -29,71 | ||||

| 2025-07-09 | 13F | Alesco Advisors Llc | 8 975 | 3,52 | 397 | 10,31 | ||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 143 006 | 36,24 | 6 325 | 45,50 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Cobblestone Asset Management LLC | 24 621 | 15,58 | 1 089 | 23,36 | ||||

| 2025-08-06 | 13F | Adviser Investments LLC | 8 522 | -0,65 | 377 | 5,92 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 19 147 | 847 | ||||||

| 2025-07-31 | 13F | MN Wealth Advisors, LLC | 19 892 | 70,79 | 880 | 82,37 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 401 083 | 42,89 | 17 740 | 52,59 | ||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 23 278 | -27,43 | 1 030 | -22,52 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 20 350 | 0,49 | 900 | 7,40 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 1 164 | 0,00 | 51 | 6,25 | ||||

| 2025-05-01 | 13F | Steel Peak Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 447 | 14,91 | 20 | 18,75 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 18 | 0,00 | 1 | |||||

| 2025-08-08 | 13F | Mv Capital Management, Inc. | 153 | 0,00 | 7 | 0,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 6 631 | -32,18 | 293 | -27,65 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 0 | 0 | ||||||

| 2025-07-22 | 13F | Miracle Mile Advisors, LLC | 7 996 | 0,00 | 354 | 6,65 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 5 630 | -0,35 | 249 | 6,41 | ||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | NWF Advisory Services Inc. | 5 177 | 0,00 | 214 | -4,04 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 76 234 | -19,35 | 3 372 | -13,90 | ||||

| 2025-08-05 | 13F | 5T Wealth, LLC | 25 616 | 12,53 | 1 133 | 20,17 | ||||

| 2025-08-08 | 13F | L & S Advisors Inc | 18 349 | 16,32 | 812 | 24,20 | ||||

| 2025-08-01 | 13F | Ashton Thomas Private Wealth, LLC | 14 375 | 97,11 | 636 | 110,26 | ||||

| 2025-08-29 | 13F | Total Investment Management Inc | 126 | 6 | ||||||

| 2025-07-21 | 13F | Ascent Group, LLC | 4 530 | 200 | ||||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Planned Solutions, Inc. | 152 636 | -38,27 | 6 751 | -34,08 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 24 406 | 0,00 | 1 079 | 6,83 | ||||

| 2025-07-16 | 13F | Blue Oak Capital, LLC | 16 148 | -7,63 | 714 | -1,38 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 106 553 | -10,31 | 4 713 | -4,23 | ||||

| 2025-08-14 | 13F | Comerica Bank | 7 383 | 1,10 | 327 | 7,95 | ||||

| 2025-08-11 | 13F | Invenio Wealth Partners Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 900 | -91,58 | 40 | -91,18 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 10 | 0,00 | 0 | |||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 48 365 | -11,99 | 2 139 | -6,02 | ||||

| 2025-07-23 | 13F | Defined Financial Planning LLC | 161 785 | 14,68 | 7 211 | 23,46 | ||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 7 262 | 1,54 | 321 | 8,45 | ||||

| 2025-08-14 | 13F | UBS Group AG | 540 | 19,47 | 24 | 27,78 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 4 974 | -2,79 | 220 | 4,27 | ||||

| 2025-07-30 | 13F | First Citizens Bank & Trust Co | 50 693 | -12,16 | 2 242 | -6,19 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 551 676 | 1,45 | 24 401 | 8,33 | ||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 58 094 | -4,52 | 2 564 | 1,95 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 25 020 | 0,47 | 1 107 | 7,27 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 46 | 0,00 | 2 | 100,00 | ||||

| 2025-08-06 | 13F | Modera Wealth Management, LLC | 4 867 | 0,00 | 215 | 6,97 | ||||

| 2025-08-14 | 13F | Chilton Investment Co Llc | 7 983 | 0,00 | 353 | 6,97 | ||||

| 2025-08-14 | 13F | Goodwin Investment Advisory | 4 985 | 0,00 | 220 | 6,80 | ||||

| 2025-07-17 | 13F | Fifth Third Securities, Inc. | 50 002 | 1,27 | 2 212 | 8,12 | ||||

| 2025-08-13 | 13F | Cary Street Partner Investment Advisory Llc | 18 | -25,00 | 1 | |||||

| 2025-08-04 | 13F | Northwest Financial Advisors | 7 990 | -27,48 | 353 | -22,59 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 15 280 | -97,07 | 676 | -96,88 | ||||

| 2025-08-14 | 13F | Guardian Wealth Advisors, Llc / Nc | 478 | 0,00 | 21 | 10,53 | ||||

| 2025-07-28 | 13F | Sagespring Wealth Partners, Llc | 31 433 | -2,38 | 1 390 | 4,28 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 34 | -40,35 | 2 | -50,00 | ||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 137 | 6 | ||||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 27 842 | -20,44 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Campbell Deegan Wealth Management, LLC | 4 638 | 205 | ||||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 12 659 | 1,19 | 560 | 7,92 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 10 899 | 10,85 | 482 | 18,43 | ||||

| 2025-04-28 | 13F | Strategic Financial Concepts, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 478 | 0,00 | 21 | 10,53 | ||||

| 2025-07-22 | 13F | Berger Financial Group, Inc | 4 542 | -9,32 | 201 | -3,38 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 496 878 | 9,09 | 21 977 | 16,49 | ||||

| 2025-07-22 | 13F | Confluence Wealth Services, Inc. | 52 310 | 0,01 | 2 314 | 13,77 | ||||

| 2025-07-30 | 13F | Retirement Planning Group | 19 932 | -21,76 | 882 | -16,49 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 1 500 | -1,38 | 66 | 1,54 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 1 342 | -14,69 | 59 | -9,23 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 8 064 | -58,61 | 357 | -55,89 | ||||

| 2025-08-06 | 13F | Summit Wealth & Retirement Planning, Inc. | 4 580 | 203 | ||||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 143 | 0,00 | 6 | 20,00 | ||||

| 2025-07-22 | 13F | Coastal Investment Advisors, Inc. | 600 | 0,00 | 27 | 8,33 | ||||

| 2025-07-30 | 13F | Patten Group, Inc. | 12 118 | -6,19 | 536 | 0,00 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 4 966 | -1,23 | 220 | 5,29 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 71 816 | 3 176 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 188 691 | 22,21 | 8 346 | 30,51 | ||||

| 2025-08-27 | 13F | Barnes Wealth Management Group, Inc | 8 156 | -2,44 | 361 | 4,05 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 217 | 0,00 | 10 | 12,50 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-07 | 13F | Park Edge Advisors, LLC | 4 750 | 210 | ||||||

| 2025-04-14 | 13F | Umb Bank N A/mo | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Acropolis Investment Management, LLC | 9 650 | -4,36 | 427 | 2,16 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 51 872 | -0,88 | 2 294 | 5,86 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 19 651 | -15,25 | 869 | 3,70 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 5 198 | 0,33 | 0 | |||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 5 349 | 239 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 4 501 | -24,49 | 199 | -19,11 | ||||

| 2025-07-09 | 13F | Heritage Wealth Architects, Inc. | 42 024 | -0,70 | 1 859 | 6,05 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 1 134 | 19,49 | 0 | |||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 18 306 | 91,91 | 810 | 104,81 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 20 531 | 14,67 | 908 | 22,54 | ||||

| 2025-08-11 | 13F | Intrust Bank Na | 72 829 | -0,20 | 3 221 | 6,59 | ||||

| 2025-09-03 | 13F | American Trust | 6 488 | 287 | ||||||

| 2025-07-17 | 13F | Park Place Capital Corp | 1 180 | 0,00 | 53 | 8,33 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 173 874 | -11,88 | 7 202 | -15,51 | ||||

| 2025-04-08 | 13F | Parallel Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 853 589 | 0,53 | 38 | 5,71 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 76 784 | 3,70 | 3 396 | 10,73 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 149 798 | 0,19 | 7 | 0,00 | ||||

| 2025-08-12 | 13F | Auxano Advisors, LLC | 5 121 | 0,69 | 226 | 7,62 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 106 | 0,00 | 5 | 0,00 | ||||

| 2025-08-01 | 13F | Howard Capital Management Inc. | 10 763 | 0,00 | 476 | 6,97 | ||||

| 2025-08-08 | 13F | Accredited Investors Inc. | 4 800 | 212 | ||||||

| 2025-08-07 | 13F | Apeiron RIA LLC | 228 112 | 5,68 | 10 089 | 12,85 | ||||

| 2025-04-30 | 13F | Stratos Wealth Partners, LTD. | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 33 143 | 8,72 | 1 505 | 19,18 | ||||

| 2025-07-24 | 13F | Columbia Advisory Partners Llc | 165 954 | 18,12 | 7 340 | 26,14 | ||||

| 2025-08-28 | 13F/A | Lavaca Capital Llc | 2 619 | -2,96 | 116 | 3,60 | ||||

| 2025-08-14 | 13F | Mpwm Advisory Solutions, Llc | 158 | 0,00 | 7 | 0,00 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 612 | 27 | ||||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 6 929 | 5,82 | 306 | 12,92 | ||||

| 2025-07-22 | 13F | MBL Wealth, LLC | 12 000 | 0,00 | 531 | 6,64 | ||||

| 2025-08-13 | 13F | SCS Capital Management LLC | 17 721 | 0,00 | 784 | 6,68 | ||||

| 2025-08-18 | 13F | Goodman Advisory Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 18 466 | 15,13 | 817 | 22,89 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 22 996 | -3,62 | 1 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 87 | 0,00 | 4 | 0,00 | ||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 961 736 | 81,46 | 42 538 | 93,77 | ||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 8 884 | -9,04 | 393 | -2,97 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 778 | 35 | ||||||

| 2025-08-04 | 13F | Atria Investments Llc | 159 559 | 15,35 | 7 057 | 23,18 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 7 234 | -39,82 | 320 | -35,81 | ||||

| 2025-07-21 | 13F | Triad Wealth Partners, LLC | 6 447 | 285 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 994 237 | 1,42 | 43 975 | 8,30 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 16 193 | 716 | ||||||

| 2025-08-12 | 13F | Burk Holdings LLC | 5 956 | 0,00 | 263 | 6,91 | ||||

| 2025-08-04 | 13F | Daymark Wealth Partners, Llc | 47 667 | 57,19 | 2 108 | 67,83 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 130 935 | -1,03 | 5 791 | 5,69 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 18 920 | -63,81 | 837 | -61,39 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 158 665 | -8,75 | 7 018 | -2,56 | ||||

| 2025-05-16 | 13F | Legacy Wealth Managment, LLC/ID | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Private Trust Co Na | 1 009 | 0,00 | 45 | 7,32 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 1 942 | 0,00 | 86 | 6,25 | ||||

| 2025-08-01 | 13F | Cobblestone Capital Advisors Llc /ny/ | 1 189 925 | -0,57 | 52 630 | 6,17 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 33 570 | -30,81 | 1 485 | -26,13 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 167 694 | 0,81 | 7 417 | 7,65 | ||||

| 2025-04-23 | 13F | Creative Financial Designs Inc /adv | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 558 | 98,22 | 69 | 112,50 |

Other Listings

| MX:JVAL |