Statistiques de base

| Propriétaires institutionnels | 37 total, 37 long only, 0 short only, 0 long/short - change of -2,63% MRQ |

| Allocation moyenne du portefeuille | 0.1559 % - change of -2,26% MRQ |

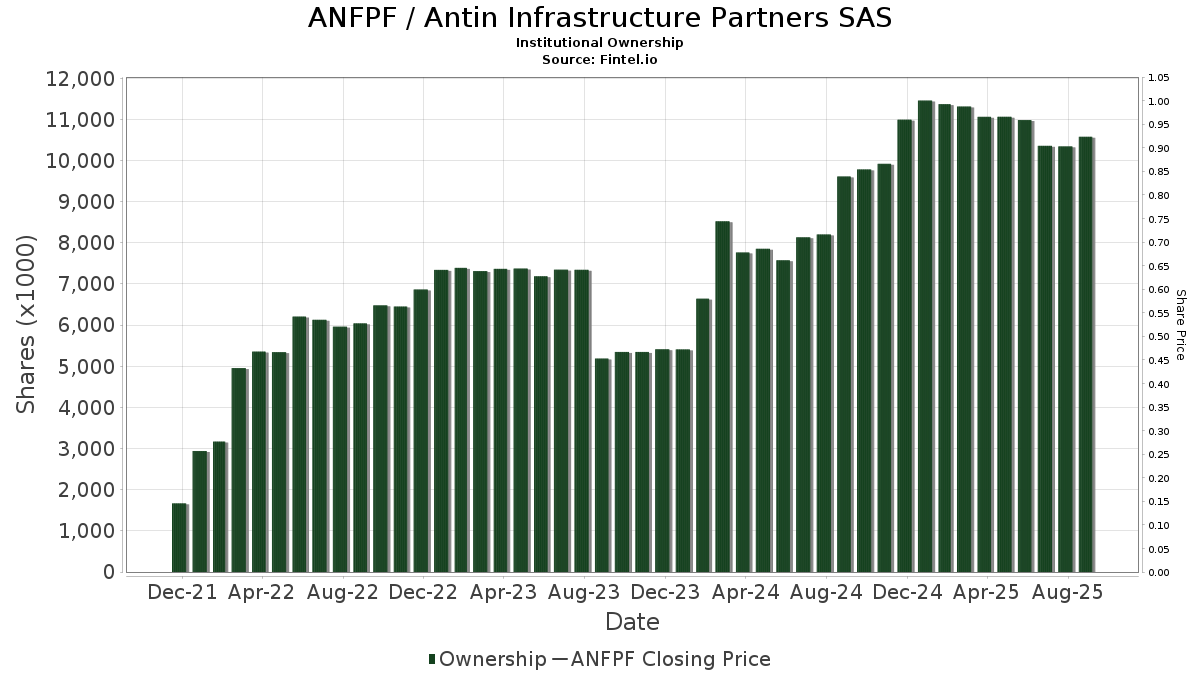

| Actions institutionnelles (Long) | 10 577 691 (ex 13D/G) - change of -0,41MM shares -3,70% MRQ |

| Valeur institutionnelle (Long) | $ 135 910 USD ($1000) |

Participation institutionnels et actionnaires

Antin Infrastructure Partners SAS (US:ANFPF) détient 37 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 10,577,691 actions. Les principaux actionnaires incluent SMCWX - SMALLCAP WORLD FUND INC Class A, FLPSX - Fidelity Low-Priced Stock Fund, VTMGX - Vanguard Developed Markets Index Fund Admiral Shares, VGTSX - Vanguard Total International Stock Index Fund Investor Shares, FLKSX - Fidelity Low-Priced Stock K6 Fund, FISMX - Fidelity International Small Cap Fund, FCTDX - Strategic Advisers Fidelity U.S. Total Stock Fund, IEFA - iShares Core MSCI EAFE ETF, RYIPX - Royce International Premier Fund Service Class, and GPGIX - Grandeur Peak Global Opportunities Fund Institutional Class .

Antin Infrastructure Partners SAS (OTCPK:ANFPF) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.