Statistiques de base

| Propriétaires institutionnels | 79 total, 73 long only, 4 short only, 2 long/short - change of 6,76% MRQ |

| Prix de l'action | 19,30 |

| Allocation moyenne du portefeuille | 0.2594 % - change of -6,55% MRQ |

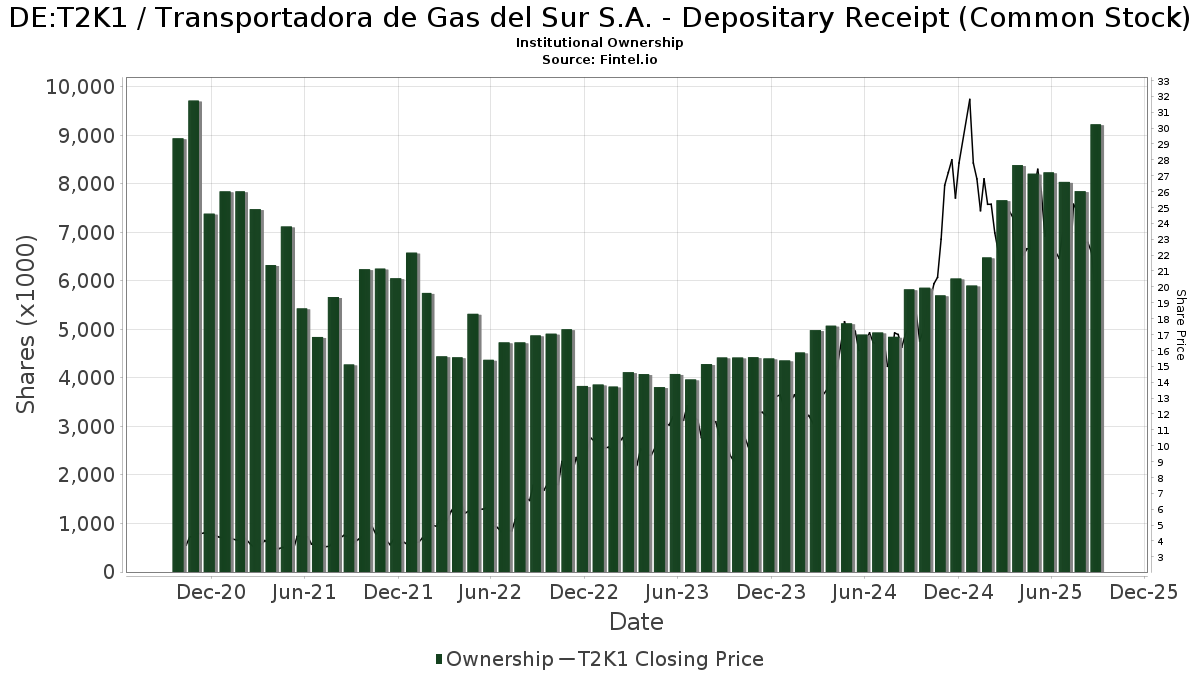

| Actions institutionnelles (Long) | 9 231 312 (ex 13D/G) - change of 0,96MM shares 11,55% MRQ |

| Valeur institutionnelle (Long) | $ 234 903 USD ($1000) |

Participation institutionnels et actionnaires

Transportadora de Gas del Sur S.A. - Depositary Receipt (Common Stock) (DE:T2K1) détient 79 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 9,232,057 actions. Les principaux actionnaires incluent MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd., ARGT - Global X MSCI Argentina ETF, Encompass Capital Advisors LLC, TT International Asset Management LTD, SPX Equities Gestao de Recursos Ltda, Balyasny Asset Management Llc, Morgan Stanley, Fourth Sail Capital LP, VR Advisory Services Ltd, and Arrowstreet Capital, Limited Partnership .

Transportadora de Gas del Sur S.A. - Depositary Receipt (Common Stock) (BST:T2K1) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 12, 2025 is 19,30 / share. Previously, on September 16, 2024, the share price was 18,70 / share. This represents an increase of 3,21% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 409 812 | -21,15 | 10 614 | -22,82 | ||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 10 700 | 105,26 | 277 | 102,19 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 10 000 | 0 | ||||||

| 2025-08-12 | 13F | SPX Equities Gestao de Recursos Ltda | 837 142 | 21 682 | ||||||

| 2025-08-26 | NP | NOEMX - Northern Emerging Markets Equity Index Fund | 0 | 0 | ||||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 3 967 | -0,28 | 103 | -2,86 | ||||

| 2025-06-23 | NP | Global Macro Capital Opportunities Portfolio - Global Macro Capital Opportunities Portfolio | 90 216 | 0,33 | 2 294 | -9,65 | ||||

| 2025-05-09 | 13F | William Blair Investment Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 25 343 | 656 | ||||||

| 2025-08-26 | NP | MCTOX - Modern Capital Tactical Opportunities Fund Class A Shares | 11 989 | 0,00 | 311 | -2,21 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-04-25 | 13F | Shilanski & Associates, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 483 | 0 | ||||||

| 2025-07-16 | 13F | ORG Partners LLC | 70 | 2 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 1 900 | 72,73 | 0 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 318 248 | 30,01 | 8 243 | 27,27 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 3 225 | -9,97 | 84 | -11,70 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 26 000 | 642,86 | 1 | ||||

| 2025-08-08 | 13F | Itau Unibanco Holding S.A. | 65 251 | -26,26 | 1 690 | 84 400,00 | ||||

| 2025-05-13 | 13F | Schroder Investment Management Group | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Oaktree Capital Management Lp | 137 630 | -71,60 | 3 565 | -72,20 | ||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-07-23 | 13F | Ameliora Wealth Management Ltd. | 714 | 0,00 | 22 | 5,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Old National Bancorp /in/ | 8 900 | 0,00 | 231 | -2,13 | ||||

| 2025-07-21 | 13F | Ping Capital Management, Inc. | 58 500 | 7,93 | 1 515 | 5,65 | ||||

| 2025-08-14 | 13F | Glenorchy Capital Ltd | 46 244 | -2,11 | 1 198 | -4,16 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 29 721 | 77,38 | 1 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 43 459 | -25,24 | 1 126 | -26,85 | ||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 22 500 | -19,42 | 583 | -21,14 | ||||

| 2025-08-14 | 13F | Banco BTG Pactual S.A. | 82 657 | 2 141 | ||||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 18 837 | 488 | ||||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 26 857 | 706 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 4 379 | -12,30 | 113 | -14,39 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 0 | -100,00 | 0 | |||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 6 739 | 189 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 38 538 | -73,22 | 998 | -73,79 | ||||

| 2025-06-27 | NP | ARGT - Global X MSCI Argentina ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 476 900 | -12,39 | 37 558 | -21,11 | ||||

| 2025-05-08 | NP | QGBLX - Quantified Global Fund Investor Class | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Turim 21 Investimentos Ltda. | 17 903 | 464 | ||||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 19 054 | -21,93 | 493 | -23,57 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 27 953 | -0,09 | 1 | |||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 1 627 579 | 9,19 | 42 154 | 6,88 | ||||

| 2025-07-31 | 13F | Anthracite Investment Company, Inc. | 36 500 | 0,00 | 945 | -2,07 | ||||

| 2025-08-04 | 13F | Yorktown Management & Research Co Inc | 10 300 | 0,00 | 267 | -2,21 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 114 073 | 3,96 | 2 954 | 1,76 | ||||

| 2025-05-27 | NP | HRITX - Hood River International Opportunity Fund Retirement Shares | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-06-30 | NP | APITX - Yorktown Growth Fund Class L Shares | 10 300 | 0,00 | 262 | -10,00 | ||||

| 2025-07-16 | 13F | ABS Direct Equity Fund LLC | 69 658 | 10,22 | 1 804 | 7,89 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 534 | 0,99 | 40 | -2,50 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 127 089 | 182,39 | 3 292 | 176,55 | ||||

| 2025-08-07 | 13F | Fourth Sail Capital LP | 253 168 | 37,07 | 6 557 | 34,17 | ||||

| 2025-07-24 | 13F | Lester Murray Antman dba SimplyRich | 64 518 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 10 200 | 264 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 16 721 | 433 | ||||||

| 2025-05-06 | 13F | Advisors Preferred, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-13 | 13F | Liontrust Investment Partners LLP | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 50 | 0,00 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 92 | 2 | ||||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 20 300 | 526 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 744 | 19 | ||||||

| 2025-05-15 | 13F | Brevan Howard Capital Management LP | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-04-22 | 13F | Channing Global Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 24 300 | -38,94 | 629 | -40,27 | |||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 49 346 | 44,06 | 1 278 | 41,06 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 87 900 | 99,32 | 2 277 | 95,20 | |||

| 2025-05-16 | 13F | Jones Financial Companies Lllp | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-05-15 | 13F | Point72 (DIFC) Ltd | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 0 | -100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 397 | -49,10 | 10 | -50,00 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 47 700 | 1 235 | ||||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 101 094 | 75,48 | 2 618 | 71,78 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 2 | -60,00 | 0 | |||||

| 2025-05-28 | NP | BESIX - William Blair Emerging Markets Small Cap Growth Fund Class I | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 30 886 | -14,52 | 800 | -16,42 | ||||

| 2025-08-08 | 13F | North of South Capital LLP | 37 000 | 48,00 | 958 | 44,93 | ||||

| 2025-06-27 | NP | EAEMX - Parametric Emerging Markets Fund Investor Class | 2 413 | 0,00 | 61 | -10,29 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 117 680 | 22,38 | 3 048 | 19,77 | ||||

| 2025-08-25 | NP | EITEX - Parametric Tax-Managed Emerging Markets Fund Institutional Class | 16 270 | 0,00 | 421 | -2,09 | ||||

| 2025-08-14 | 13F | Encompass Capital Advisors LLC | 1 000 000 | 25 900 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 176 | 5 | ||||||

| 2025-04-29 | 13F | Hm Payson & Co | 3 220 | 0,00 | 85 | -9,57 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 8 896 | -5,69 | 230 | -7,63 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 15 400 | -79,82 | 399 | -80,28 | |||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 72 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 10 063 | -37,22 | 261 | -38,68 | ||||

| 2025-05-12 | 13F | Citigroup Inc | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 0 | -100,00 | 0 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 19 | 0,00 | 0 | |||||

| 2025-07-10 | 13F | TT International Asset Management LTD | 993 934 | -19,04 | 25 743 | -20,75 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 14 100 | -54,66 | 365 | -55,60 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 17 973 | -15,17 | 466 | -16,96 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 35 | -5,41 | 1 | |||||

| 2025-05-15 | 13F | Hood River Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Seldon Capital Lp | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 21 129 | 84,66 | 547 | 81,13 | ||||

| 2025-05-14 | 13F | Credit Agricole S A | 335 | 9 | ||||||

| 2025-08-27 | NP | IEMSX - ABS Insights Emerging Markets Fund Super Institutional Class Shares | 7 600 | 0,00 | 197 | -2,49 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 11 093 | 287 | ||||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 0 | -100,00 | 0 | |||||

| 2025-08-27 | NP | TIFF INVESTMENT PROGRAM - TIFF Multi-Asset Fund | Short | -745 | 163,25 | -19 | 137,50 | |||

| 2025-08-07 | 13F | Kempen Capital Management N.v. | 132 293 | 14,62 | 3 426 | 12,18 | ||||

| 2025-08-14 | 13F | VR Advisory Services Ltd | 215 761 | -50,11 | 5 588 | -51,16 | ||||

| 2025-06-24 | NP | FFTY - Innovator IBD(R) 50 ETF | 11 068 | 281 | ||||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 12 146 | -0,25 | 315 | -2,48 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 182 354 | 10,96 | 4 723 | 8,60 |