Statistiques de base

| Propriétaires institutionnels | 154 total, 154 long only, 0 short only, 0 long/short - change of -0,65% MRQ |

| Allocation moyenne du portefeuille | 0.1487 % - change of -0,48% MRQ |

| Actions institutionnelles (Long) | 27 782 993 (ex 13D/G) - change of 0,93MM shares 3,47% MRQ |

| Valeur institutionnelle (Long) | $ 943 601 USD ($1000) |

Participation institutionnels et actionnaires

Goldman Sachs ETF Trust - Goldman Sachs ActiveBeta Emerging Markets Equity ETF (US:GEM) détient 154 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 27,782,993 actions. Les principaux actionnaires incluent Wells Fargo & Company/mn, SigFig Wealth Management, LLC, Goldman Sachs Group Inc, Betterment LLC, LPL Financial LLC, GGMBX - Goldman Sachs Global Managed Beta Fund Institutional Shares, Arvest Bank Trust Division, HB Wealth Management, LLC, State Of Wisconsin Investment Board, and Envestnet Asset Management Inc .

Goldman Sachs ETF Trust - Goldman Sachs ActiveBeta Emerging Markets Equity ETF (ARCA:GEM) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

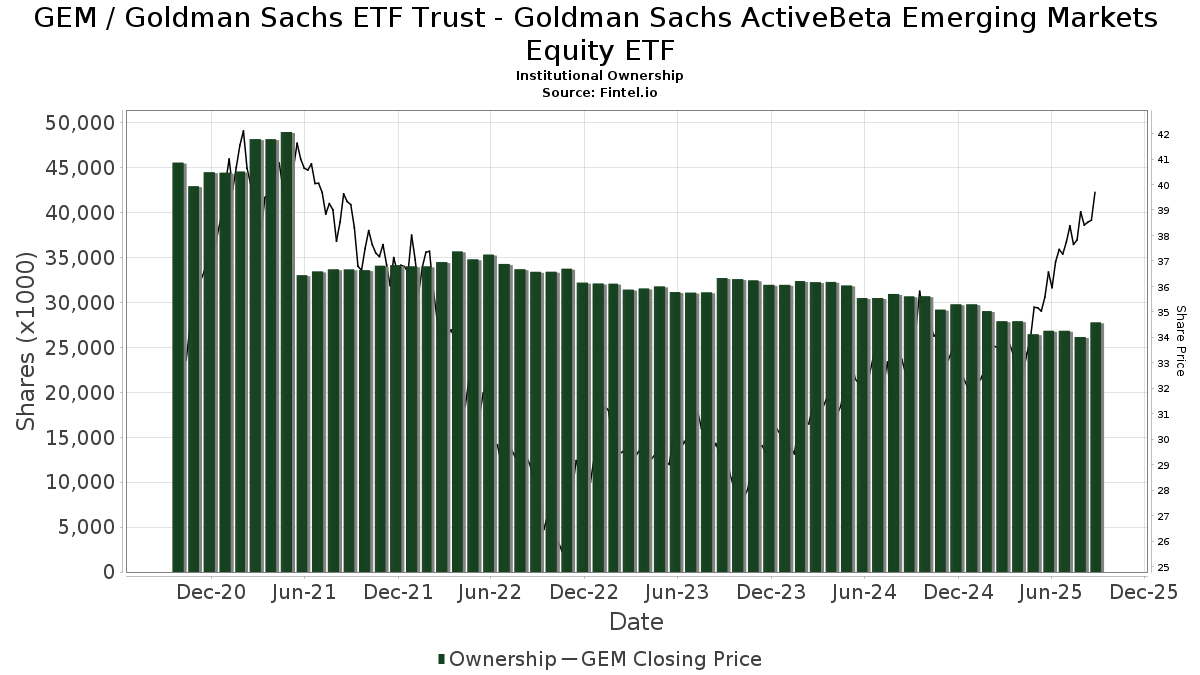

The share price as of September 12, 2025 is 40,21 / share. Previously, on September 13, 2024, the share price was 32,82 / share. This represents an increase of 22,52% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

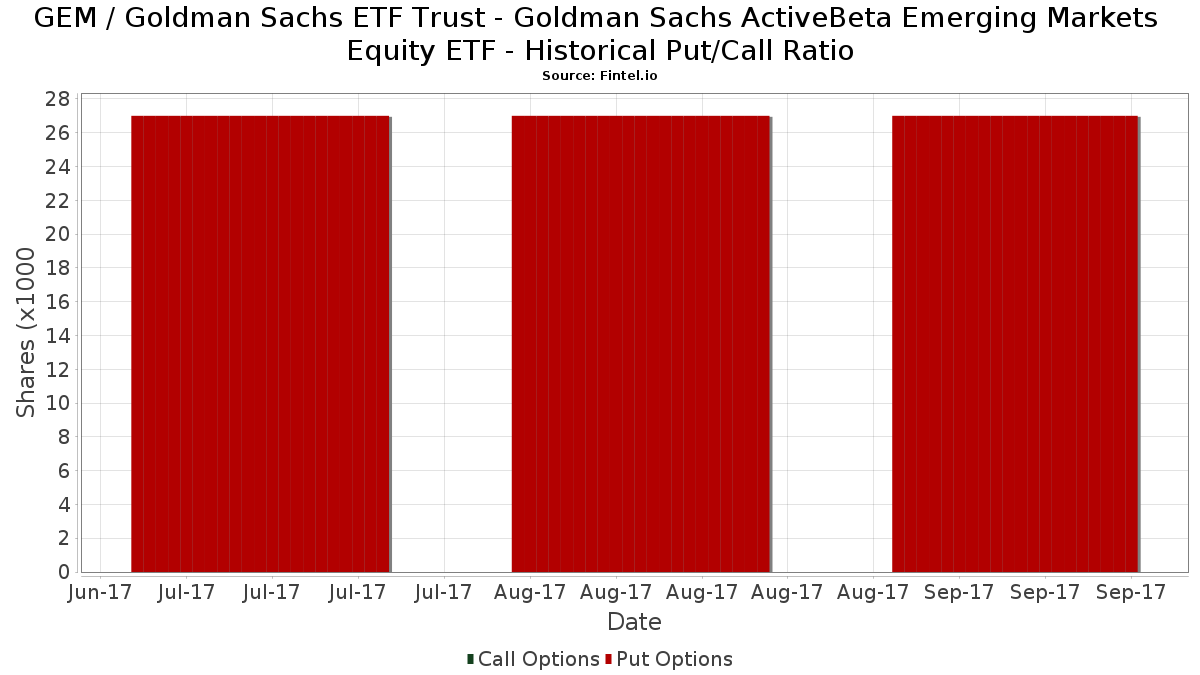

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 337 | -27,06 | 13 | -20,00 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 14 250 | 6,18 | 530 | 19,10 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | HFM Investment Advisors, LLC | 189 | 5,59 | 7 | 40,00 | ||||

| 2025-07-07 | 13F | Nova Wealth Management, Inc. | 19 | -92,31 | 1 | -100,00 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 40 263 | -1,00 | 1 498 | 11,05 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 1 124 949 | -36,81 | 41 859 | -29,13 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 116 302 | 6,42 | 4 328 | 19,33 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 289 967 | 3 903,41 | 10 790 | 4 395,42 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 41 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | State Of Wisconsin Investment Board | 1 091 863 | 0,00 | 40 628 | 12,15 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-04-21 | 13F | ORG Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Maia Wealth LLC | 11 913 | -2,55 | 443 | 13,01 | ||||

| 2025-07-28 | 13F | Elmwood Wealth Management, Inc. | 25 220 | -0,05 | 938 | 12,07 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 34 402 | -8,61 | 1 280 | 2,48 | ||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 8 796 | -23,21 | 327 | -13,95 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 25 442 | 3,83 | 947 | 16,36 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 9 714 | -2,05 | 0 | |||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 318 162 | 33,42 | 11 839 | 55,54 | ||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 16 910 | -4,69 | 629 | 6,97 | ||||

| 2025-08-04 | 13F | Spinnaker Trust | 204 634 | -4,97 | 7 614 | 6,58 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 109 617 | 638,01 | 4 079 | 728,86 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 359 226 | 28,25 | 13 366 | 43,83 | ||||

| 2025-08-14 | 13F | Betterment LLC | 2 098 854 | 19,20 | 78 | 34,48 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 483 005 | 0,20 | 17 973 | 12,37 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | First Foundation Advisors | 330 790 | 2,55 | 12 309 | 15,00 | ||||

| 2025-07-30 | 13F | Whittier Trust Co | 13 527 | -29,87 | 503 | -21,28 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 141 | 69,88 | 5 | 150,00 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 557 | 0,00 | 21 | 11,11 | ||||

| 2025-08-14 | 13F | Glenview Trust Co | 8 897 | -1,36 | 331 | 10,70 | ||||

| 2025-08-13 | 13F | Cheviot Value Management, LLC | 65 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 1 377 | -62,39 | 51 | -57,85 | ||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Prostatis Group LLC | 32 539 | 104,63 | 1 211 | 129,60 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 0 | -100,00 | 0 | |||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 6 208 | 1,31 | 232 | 14,29 | ||||

| 2025-05-15 | 13F | Stonehaven Wealth & Tax Solutions, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 2 941 097 | 7,81 | 109 438 | 20,91 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 23 996 | 8,69 | 893 | 21,86 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Clearwater Capital Advisors, LLC | 9 380 | -92,68 | 349 | -91,80 | ||||

| 2025-07-21 | 13F | Quent Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 18 096 | 2,68 | 673 | 15,24 | ||||

| 2025-04-09 | 13F | Signature Securities Group Corporation | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 27 | -90,53 | 1 | -88,89 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 129 989 | -0,96 | 4 837 | 11,04 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 41 614 | -28,87 | 1 548 | -20,25 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 7 530 | 0,00 | 280 | 12,45 | ||||

| 2025-08-14 | 13F | LifePlan Investment Advisors, Inc. | 21 652 | 39,04 | 806 | 56,01 | ||||

| 2025-08-14 | 13F | Comerica Bank | 10 386 | -13,02 | 386 | -2,53 | ||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 327 | 12 | ||||||

| 2025-08-14 | 13F | 10Elms LLP | 1 | 0,00 | 0 | |||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 104 317 | 4,10 | 3 882 | 16,76 | ||||

| 2025-07-17 | 13F | CogentBlue Wealth Advisors, LLC | 7 457 | -2,85 | 277 | 9,06 | ||||

| 2025-07-24 | 13F | Mengis Capital Management, Inc. | 5 935 | 221 | ||||||

| 2025-08-14 | 13F | Fmr Llc | 1 795 | -14,40 | 67 | -4,35 | ||||

| 2025-08-01 | 13F | Strategic Financial Services, Inc, | 245 844 | 13,79 | 9 148 | 27,61 | ||||

| 2025-08-19 | NP | GAPIX - Goldman Sachs Dynamic Global Equity Fund Institutional | 85 902 | 14,84 | 3 196 | 28,82 | ||||

| 2025-08-06 | 13F | Mark Sheptoff Financial Planning, Llc | 29 | 0,00 | 1 | |||||

| 2025-08-19 | NP | GOIIX - Goldman Sachs Growth and Income Strategy Portfolio Institutional | 130 954 | 0,00 | 4 873 | 12,13 | ||||

| 2025-04-29 | 13F | Callan Capital, LLC | 99 619 | -1,11 | 3 305 | 2,80 | ||||

| 2025-08-01 | 13F | Bank of Jackson Hole Trust | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Investors Research Corp | 523 | 0,00 | 19 | 11,76 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 11 495 | 989,57 | 428 | 1 120,00 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 74 | -25,25 | 3 | -33,33 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 392 021 | 1,29 | 14 587 | 13,60 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 11 | 0 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 28 852 | 13,35 | 1 073 | 27,13 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 11 109 | 4,68 | 413 | 17,33 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 359 | 0,00 | 13 | 18,18 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 349 | 12,94 | 13 | 20,00 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 62 562 | -4,39 | 2 328 | 7,23 | ||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 331 | 0,00 | 12 | 20,00 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 405 | -29,07 | 15 | -16,67 | ||||

| 2025-07-03 | 13F | Arvest Investments, Inc. | 446 226 | -2,49 | 16 604 | 9,35 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 47 | 2 | ||||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 111 | 4 | ||||||

| 2025-07-28 | 13F | Morris Financial Concepts, Inc. | 11 485 | -0,57 | 427 | 11,49 | ||||

| 2025-08-11 | 13F | Shufro Rose & Co Llc | 42 591 | -0,71 | 1 413 | -0,70 | ||||

| 2025-04-14 | 13F | Greenspring Advisors, LLC | 6 641 | 0,00 | 220 | 4,27 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 2 293 | -39,48 | 85 | -32,54 | ||||

| 2025-07-21 | 13F | Monticello Wealth Management, Llc | 78 368 | -4,43 | 2 916 | 7,21 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 22 118 | -0,01 | 823 | 12,28 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 131 318 | 932,62 | 4 886 | 1 060,57 | ||||

| 2025-07-28 | 13F | Naviter Wealth, LLC | 5 813 | 216 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 22 129 | 11,89 | 823 | 25,46 | ||||

| 2025-08-13 | 13F | StoneX Group Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 26 289 | 1 | ||||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 683 | 0,00 | 25 | 13,64 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1 560 | 171,30 | 58 | 205,26 | ||||

| 2025-07-17 | 13F | Archford Capital Strategies, LLC | 8 849 | -1,52 | 329 | 10,40 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 416 | 0,00 | 15 | 15,38 | ||||

| 2025-08-11 | 13F | Heritage Wealth Advisors | 200 | 0,00 | 7 | 16,67 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 32 018 | -0,44 | 1 188 | 11,04 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 53 758 | 0,08 | 2 000 | 12,23 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 40 | 1 | ||||||

| 2025-07-18 | 13F | Consolidated Portfolio Review Corp | 8 101 | 301 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 706 273 | -2,10 | 26 280 | 9,80 | ||||

| 2025-07-24 | 13F | Capital Advisors, Ltd. LLC | 2 302 | -8,61 | 0 | |||||

| 2025-08-06 | 13F | Rialto Wealth Management, LLC | 439 | 0,00 | 16 | 14,29 | ||||

| 2025-07-30 | 13F | Syntegra Private Wealth Group, LLC | 16 350 | 90,14 | 608 | 113,33 | ||||

| 2025-07-14 | 13F | Golden State Equity Partners | 29 712 | -13,21 | 1 106 | -2,73 | ||||

| 2025-08-08 | 13F | Strategies Wealth Advisors, LLC | 11 997 | 0,00 | 446 | 12,06 | ||||

| 2025-08-08 | 13F | Altfest L J & Co Inc | 12 693 | -38,69 | 472 | -31,20 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 147 817 | 722,39 | 5 500 | 822,82 | ||||

| 2025-05-13 | 13F | Bokf, Na | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 454 | 123,65 | 17 | 166,67 | ||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 10 197 | 15,91 | 379 | 30,24 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 5 973 | -1,86 | 222 | 10,45 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 700 | 0,00 | 26 | 13,04 | ||||

| 2025-08-14 | 13F | Strategic Wealth Designers | 0 | 0 | ||||||

| 2025-07-21 | NP | GGMBX - Goldman Sachs Global Managed Beta Fund Institutional Shares | 1 537 577 | 16,39 | 53 508 | 24,17 | ||||

| 2025-07-29 | 13F | Kelman-Lazarov, Inc. | 15 178 | -65,11 | 565 | -60,91 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 9 205 | 0,00 | 343 | 12,13 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 992 | 37 | ||||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 104 923 | 0,87 | 3 904 | 13,13 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 388 | 11,49 | 14 | 27,27 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 157 937 | -0,34 | 6 | 0,00 | ||||

| 2025-07-24 | 13F | GFG Capital, LLC | 151 428 | -4,95 | 5 635 | 6,58 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 143 | 0,00 | 5 | 25,00 | ||||

| 2025-07-16 | 13F | RWM Asset Management, LLC | 163 880 | 3,31 | 6 098 | 15,85 | ||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 6 433 | -0,60 | 239 | 11,68 | ||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Haverford Trust Co | 11 576 | 0,00 | 431 | 11,98 | ||||

| 2025-07-09 | 13F | Breakwater Investment Management | 75 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 2 | -98,17 | 0 | -100,00 | ||||

| 2025-07-08 | 13F | Atwood & Palmer Inc | 47 310 | -1,57 | 1 760 | 10,41 | ||||

| 2025-08-13 | 13F | IAG Wealth Partners, LLC | 17 127 | 72,86 | 637 | 94,21 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 3 522 921 | 7,48 | 131 088 | 20,53 | ||||

| 2025-05-15 | 13F | Tower Research Capital LLC (TRC) | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 822 | -9,77 | 31 | 0,00 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 350 522 | 1,35 | 13 043 | 13,66 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 65 136 | -36,46 | 2 448 | -28,05 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 132 106 | 2,52 | 4 916 | 14,97 | ||||

| 2025-05-07 | 13F | WMS Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | American National Bank | 126 967 | -5,30 | 4 724 | 6,21 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 49 008 | 1 824 | ||||||

| 2025-07-08 | 13F | Apella Capital, LLC | 338 287 | -15,74 | 12 530 | -0,79 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 1 918 529 | 5,94 | 71 388 | 18,81 | ||||

| 2025-08-19 | NP | GGSIX - Goldman Sachs Growth Strategy Portfolio Institutional | 197 259 | 0,00 | 7 340 | 12,15 | ||||

| 2025-05-15 | 13F | Chilton Investment Co Llc | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Edge Financial Advisors LLC | 20 015 | -10,51 | 745 | 0,27 | ||||

| 2025-08-13 | 13F | Brown Advisory Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 258 100 | 4,17 | 9 604 | 16,81 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 186 | -49,87 | 0 | |||||

| 2025-05-09 | 13F | NewEdge Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 290 | 11 | ||||||

| 2025-08-07 | 13F | Allworth Financial LP | 974 | 0,00 | 36 | 12,50 | ||||

| 2025-08-13 | 13F | SageView Advisory Group, LLC | 15 596 | -1,52 | 589 | 12,19 | ||||

| 2025-07-17 | 13F | Independence Bank of Kentucky | 850 | 32 | ||||||

| 2025-08-12 | 13F | Inscription Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-19 | NP | GIPIX - Goldman Sachs Balanced Strategy Portfolio Institutional | 49 119 | 0,00 | 1 828 | 12,15 | ||||

| 2025-07-17 | 13F | Clay Northam Wealth Management, LLC | 53 457 | 0,00 | 1 989 | 12,18 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 2 149 | 29,61 | 80 | 43,64 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 815 464 | 4,70 | 30 343 | 17,42 | ||||

| 2025-07-30 | 13F | Princeton Global Asset Management LLC | 497 | 0,00 | 18 | 12,50 | ||||

| 2025-07-17 | 13F | Worth Financial Advisory Group, LLC | 13 703 | -4,17 | 510 | 7,38 | ||||

| 2025-08-08 | 13F | Arvest Bank Trust Division | 1 212 184 | -0,59 | 45 105 | 11,48 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | PrairieView Partners, LLC | 104 | 0,00 | 0 | |||||

| 2025-07-30 | 13F | Gables Capital Management Inc. | 4 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 1 075 | -20,37 | 40 | -11,11 | ||||

| 2025-07-28 | 13F | Frazier Financial Advisors, LLC | 10 | 0,00 | 0 | |||||

| 2025-07-10 | 13F | Wedmont Private Capital | 8 000 | 0,00 | 298 | 17,32 | ||||

| 2025-05-15 | 13F | Alexis Investment Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 8 068 | 19,03 | 300 | 38,89 | ||||

| 2025-08-29 | 13F | Centaurus Financial, Inc. | 4 200 | 11,26 | 0 | |||||

| 2025-07-18 | 13F | SigFig Wealth Management, LLC | 3 303 512 | -1,07 | 122 659 | 10,43 | ||||

| 2025-04-21 | 13F | Ronald Blue Trust, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-22 | 13F | Coastal Investment Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Change Path, LLC | 11 209 | -2,96 | 417 | 8,88 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 13 771 | -55,86 | 512 | -50,53 | ||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 208 | 0,00 | 8 | 16,67 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 10 612 | 40,11 | 352 | 46,06 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 455 | 0,00 | 0 | |||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 4 410 | -9,59 | 164 | 1,86 | ||||

| 2025-08-14 | 13F | Keebeck Wealth Management, LLC | 30 865 | 1 148 | ||||||

| 2025-07-23 | 13F | West Paces Advisors Inc. | 0 | -100,00 | 0 |

Other Listings

| MX:GEM |