Statistiques de base

| Propriétaires institutionnels | 132 total, 132 long only, 0 short only, 0 long/short - change of 3,12% MRQ |

| Allocation moyenne du portefeuille | 0.2270 % - change of -3,28% MRQ |

| Actions institutionnelles (Long) | 8 716 184 (ex 13D/G) - change of 0,27MM shares 3,24% MRQ |

| Valeur institutionnelle (Long) | $ 497 114 USD ($1000) |

Participation institutionnels et actionnaires

Fidelity Covington Trust - Fidelity Value Factor ETF (US:FVAL) détient 132 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 8,716,184 actions. Les principaux actionnaires incluent Fmr Llc, Envestnet Asset Management Inc, Commonwealth Equity Services, Llc, High Probability Advisors, LLC, Royal Bank Of Canada, Custos Family Office, LLC, LPL Financial LLC, Advisor Group Holdings, Inc., Jpmorgan Chase & Co, and Kestra Advisory Services, LLC .

Fidelity Covington Trust - Fidelity Value Factor ETF (ARCA:FVAL) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 5, 2025 is 67,54 / share. Previously, on September 9, 2024, the share price was 57,72 / share. This represents an increase of 17,01% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

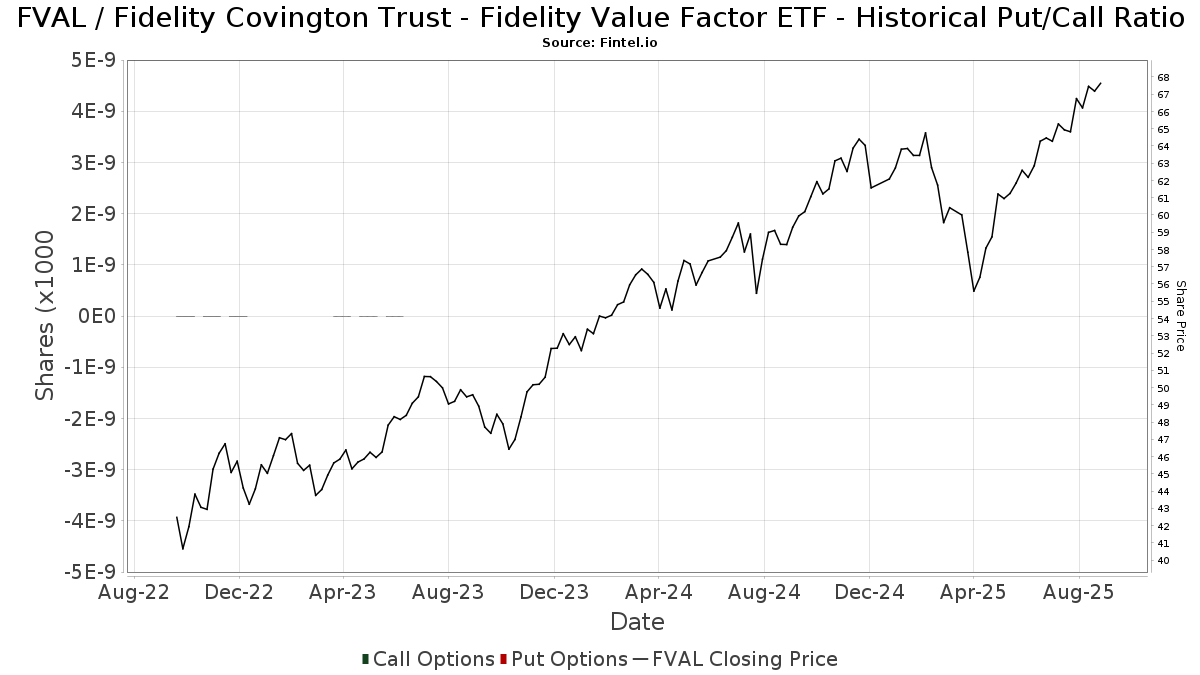

Ratio put/call institutionnel

En plus de signaler les actions et les dettes standard, les institutions ayant plus de 100 millions d'actifs sous gestion doivent également divulguer leurs positions en options de vente et d'achat. Étant donné que les options de vente indiquent généralement une confiance négative, et les options d'achat indiquent une confiance positive, nous pouvons avoir une idée de la confiance institutionnelle globale en traçant le ratio des ventes à découvert par rapport aux achats d'options. Le graphique à droite trace l'historique du ratio des ventes à découvert/achats d'options pour cet instrument.

L'utilisation du ratio put/call comme indicateur de la confiance des investisseurs permet de pallier à l'une des principales lacunes de l'utilisation de la participation institutionnelle totale, à savoir qu'une part importante des actifs sous gestion est investie passivement pour suivre les indices. Les fonds gérés passivement n'achètent généralement pas d'options, de sorte que l'indicateur du ratio put/call suit de plus près la confiance des fonds gérés activement.

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 178 389 | 19,57 | 11 394 | 28,16 | ||||

| 2025-07-29 | NP | EBI - Longview Advantage ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 80 | 0,00 | 5 | 25,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 246 102 | -0,87 | 15 722 | 6,24 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 121 470 | -3,90 | 7 758 | 3,00 | ||||

| 2025-05-12 | 13F | Americana Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 26 970 | -95,28 | 2 | -97,22 | ||||

| 2025-04-21 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Certified Advisory Corp | 5 461 | 0,39 | 349 | 7,41 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 982 | 65 | ||||||

| 2025-07-11 | 13F | Bouvel Investment Partners, LLC | 45 304 | -9,63 | 2 894 | -4,74 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 27 598 | -8,55 | 1 766 | -1,78 | ||||

| 2025-07-08 | 13F | Zrc Wealth Management, Llc | 18 | 0,00 | 1 | 0,00 | ||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 4 933 | -62,14 | 0 | |||||

| 2025-04-11 | 13F | Unique Wealth, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Blair William & Co/il | 200 | 0,00 | 13 | 9,09 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 12 236 | 50,23 | 1 | |||||

| 2025-07-08 | 13F | Prism Advisors, Inc. | 81 530 | 0,00 | 5 207 | 7,18 | ||||

| 2025-08-18 | 13F/A | Kestra Investment Management, LLC | 3 497 | 223 | ||||||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 5 592 | 1,10 | 357 | 8,51 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 3 486 | -1,33 | 223 | 5,71 | ||||

| 2025-08-14 | 13F | Clarity Asset Management, Inc. | 2 129 | -6,95 | 136 | -0,74 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Montis Financial, LLC | 13 560 | -3,74 | 866 | 3,22 | ||||

| 2025-04-21 | 13F | PUREfi Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Hoxton Planning & Management, LLC | 8 830 | 0,00 | 564 | 7,03 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 8 590 | -31,87 | 529 | -29,69 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 104 980 | 3,02 | 6 705 | 10,42 | ||||

| 2025-07-15 | 13F | Avaii Wealth Management, Llc | 4 527 | -0,98 | 289 | 6,25 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 3 496 | -62,93 | 223 | -61,28 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 7 669 | 17,86 | 490 | 26,36 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 31 823 | 22,00 | 2 033 | 30,76 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 1 398 051 | 7,23 | 89 293 | 14,93 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 42 | 0,00 | 3 | 0,00 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 264 | 0,00 | 17 | 6,67 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 49 535 | 115,02 | 3 164 | 130,54 | ||||

| 2025-08-14 | 13F | Fmr Llc | 1 712 580 | 78,90 | 109 382 | 91,75 | ||||

| 2025-08-08 | 13F | CFO4Life Group, LLC | 4 118 | -3,51 | 263 | 3,54 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 5 324 | 340 | ||||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 14 467 | 924 | ||||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 17 973 | 1 148 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 150 335 | 0,13 | 9 602 | 7,31 | ||||

| 2025-08-13 | 13F | Vermillion & White Wealth Management Group, LLC | 78 | 0,00 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 140 932 | 7,93 | 9 001 | 15,68 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 22 959 | -76,01 | 1 466 | -74,29 | ||||

| 2025-04-14 | 13F | Patriot Financial Group Insurance Agency, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 13 969 | 2,96 | 892 | 10,40 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 8 104 | 10,95 | 518 | 18,85 | ||||

| 2025-07-18 | 13F | Childress Capital Advisors, Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-23 | 13F | Sax Wealth Advisors, Llc | 64 778 | 9,42 | 4 137 | 17,30 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 23 822 | -0,51 | 1 522 | 6,66 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 5 645 | 0,18 | 361 | 4,05 | ||||

| 2025-08-07 | 13F | BOK Financial Private Wealth, Inc. | 72 | 5 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 4 152 | 4 672,41 | 265 | 5 200,00 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 223 | 0,00 | 14 | 7,69 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 26 085 | -5,62 | 1 554 | -8,59 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 26 785 | 6,47 | 1 711 | 14,08 | ||||

| 2025-08-14 | 13F | Goodwin Investment Advisory | 78 879 | 21,00 | 5 038 | 29,71 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 1 242 | 0,32 | 79 | 8,22 | ||||

| 2025-04-30 | 13F | Quotient Wealth Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Colonial River Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 3 652 | 2,56 | 233 | 9,91 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 3 242 | -30,37 | 207 | -25,27 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 29 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 2 850 | 0,00 | 182 | 7,69 | ||||

| 2025-07-22 | 13F | Foguth Wealth Management, LLC. | 4 211 | -12,76 | 269 | -6,62 | ||||

| 2025-07-17 | 13F | Prepared Retirement Institute LLC | 5 927 | 0,36 | 379 | 7,69 | ||||

| 2025-07-29 | 13F | Spectrum Investment Advisors, Inc. | 15 089 | 5,96 | 964 | 13,56 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 10 375 | -6,91 | 672 | 1,05 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 208 079 | 7,44 | 13 290 | 15,16 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 15 056 | 13,88 | 962 | 22,11 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 7 775 | 6,89 | 497 | 14,55 | ||||

| 2025-07-30 | 13F | Principle Wealth Partners Llc | 6 167 | 0,00 | 394 | 7,08 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 9 057 | -12,34 | 579 | -6,02 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 5 320 | 0,08 | 340 | 7,28 | ||||

| 2025-05-13 | 13F | Steward Partners Investment Advisory, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Mowery & Schoenfeld Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 9 283 | 593 | ||||||

| 2025-05-20 | 13F/A | Colony Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Forbes Financial Planning, Inc. | 84 443 | -24,77 | 5 393 | -19,36 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 357 889 | 116,85 | 22 859 | 132,43 | ||||

| 2025-07-21 | 13F | Ascent Group, LLC | 5 183 | 2,37 | 331 | 9,97 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 43 647 | 26,14 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 32 636 | 18,43 | 2 084 | 26,92 | ||||

| 2025-08-06 | 13F | Vantage Financial Partners, LLC | 146 131 | 0,04 | 9 333 | 7,23 | ||||

| 2025-07-15 | 13F | LVZ Advisors, Inc. | 28 311 | 1 808 | ||||||

| 2025-08-07 | 13F | New England Private Wealth Advisors LLC | 3 315 | 215 | ||||||

| 2025-08-14 | 13F | Mariner, LLC | 3 647 | -6,34 | 233 | 0,00 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 4 284 | -2,86 | 277 | 5,34 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 177 883 | 7,89 | 11 361 | 15,63 | ||||

| 2025-08-01 | 13F | Cedar Point Capital Partners, LLC | 56 078 | 5,93 | 3 582 | 13,54 | ||||

| 2025-07-29 | 13F | Primoris Wealth Advisors, Llc | 45 482 | 40,09 | 2 905 | 50,16 | ||||

| 2025-08-04 | 13F | Bay Colony Advisory Group, Inc d/b/a Bay Colony Advisors | 4 162 | 2,54 | 266 | 10,42 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 4 062 | -45,02 | 259 | -41,14 | ||||

| 2025-08-01 | 13F | Schmidt P J Investment Management Inc | 13 335 | 185,00 | 852 | 206,12 | ||||

| 2025-07-28 | 13F | Sagespring Wealth Partners, Llc | 4 020 | -62,38 | 257 | -59,75 | ||||

| 2025-08-14 | 13F | Foronjy Financial Llc | 3 428 | 219 | ||||||

| 2025-08-14 | 13F | Comerica Bank | 2 182 | 0,00 | 139 | 6,92 | ||||

| 2025-07-21 | 13F | Custos Family Office, LLC | 321 535 | 0,72 | 20 536 | 7,95 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 57 | -82,78 | 4 | -84,21 | ||||

| 2025-08-08 | 13F | Altfest L J & Co Inc | 39 660 | -4,02 | 2 533 | 2,88 | ||||

| 2025-08-11 | 13F | Traub Capital Management LLC | 18 915 | 1 208 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 26 135 | 53,31 | 1 662 | 64,72 | ||||

| 2025-08-14 | 13F | Harwood Advisory Group, LLC | 16 818 | -4,33 | 1 074 | -0,65 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 253 | 16 | ||||||

| 2025-05-02 | 13F | Capital A Wealth Management, LLC | 12 | 0,00 | 1 | |||||

| 2025-07-07 | 13F | Kings Path Partners LLC | 3 | 0 | ||||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 14 | 366,67 | 1 | |||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 44 | 3 | ||||||

| 2025-08-05 | 13F | Dynasty Wealth Management, Llc | 4 895 | 0,55 | 313 | 7,59 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 30 572 | 10,01 | 1 953 | 17,87 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 9 558 | 0,15 | 610 | 11,11 | ||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 8 098 | -11,21 | 517 | -4,79 | ||||

| 2025-08-08 | 13F | Capital Investment Counsel, Inc | 2 230 | 0,00 | 142 | 7,58 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-22 | 13F | Inlight Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Wood Tarver Financial Group, LLC | 4 084 | 0,00 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | Marshall & Sterling Wealth Advisors Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 3 746 | 3,05 | 239 | 10,65 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 28 | 0,00 | 2 | 0,00 | ||||

| 2025-08-07 | 13F | Samalin Investment Counsel, LLC | 9 090 | -18,34 | 581 | -12,52 | ||||

| 2025-08-08 | 13F | Condor Capital Management | 109 495 | 1,98 | 6 993 | 9,32 | ||||

| 2025-07-23 | 13F | Valmark Advisers, Inc. | 24 748 | 0,73 | 1 581 | 7,92 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 6 062 | 2,33 | 387 | 9,63 | ||||

| 2025-07-31 | 13F | CNB Bank | 686 | 0,00 | 44 | 7,50 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 101 800 | -50,44 | 6 502 | -46,88 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 4 210 | 0 | ||||||

| 2025-08-07 | 13F | PFG Advisors | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 1 179 | 75 | ||||||

| 2025-08-14 | 13F | LaSalle St. Investment Advisors, LLC | 4 791 | -20,24 | 0 | |||||

| 2025-08-12 | 13F | Founders Financial Alliance, LLC | 759 | 15,17 | 48 | 23,08 | ||||

| 2025-07-10 | 13F | Signal Advisors Wealth, LLC | 4 211 | -10,46 | 269 | -4,29 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 178 222 | 2,48 | 11 383 | 9,85 | ||||

| 2025-04-28 | 13F | Clarity Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 110 004 | -2,70 | 7 026 | 4,27 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 37 | 2 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 32 237 | -25,23 | 2 059 | -19,89 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 830 198 | -2,73 | 53 | 6,00 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 294 469 | 15,90 | 18 808 | 24,22 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 5 352 | -1,20 | 342 | 5,90 | ||||

| 2025-05-19 | 13F | Heck Capital Advisors, LLC | 0 | 0 | ||||||

| 2025-07-09 | 13F | High Probability Advisors, LLC | 414 937 | 9,83 | 26 502 | 17,72 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 7 853 | 0,10 | 502 | 7,28 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 245 | 0,00 | 16 | 7,14 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 23 | -93,92 | 1 | -95,45 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 2 054 | 0,00 | 131 | 7,38 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 3 317 | 5,60 | 212 | 12,83 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 3 968 | 0,84 | 253 | 4,55 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 613 | -77,72 | 39 | -76,92 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 29 371 | 12,72 | 1 876 | 20,81 | ||||

| 2025-04-17 | 13F | Fairvoy Private Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 3 500 | 224 | ||||||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 0 | -100,00 | 0 |