Statistiques de base

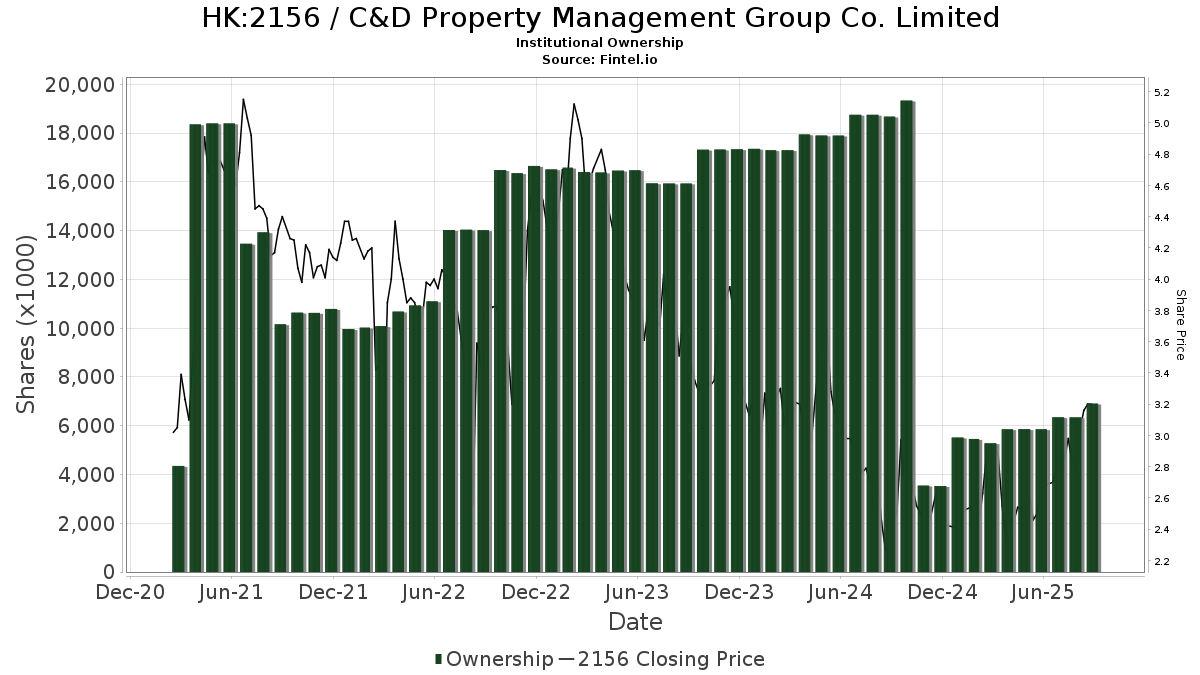

| Actions institutionnelles (Long) | 6 908 959 - 0,49% (ex 13D/G) - change of 1,05MM shares 17,96% MRQ |

| Valeur institutionnelle (Long) | $ 2 266 USD ($1000) |

Participation institutionnels et actionnaires

C&D Property Management Group Co. Limited (HK:2156) détient 15 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 6,908,959 actions. Les principaux actionnaires incluent VGRLX - Vanguard Global ex-U.S. Real Estate Index Fund Admiral, DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class, QCSTRX - Stock Account Class R1, DFEM - Dimensional Emerging Markets Core Equity 2 ETF, Dfa Investment Trust Co - The Emerging Markets Small Cap Series, DFAX - Dimensional World ex U.S. Core Equity 2 ETF, DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Social Core Equity Portfolio Shares, DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Sustainability Core 1 Portfolio Institutional Class, ECNS - iShares MSCI China Small-Cap ETF, and AVEM - Avantis Emerging Markets Equity ETF .

C&D Property Management Group Co. Limited (SEHK:2156) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

The share price as of September 12, 2025 is 3,14 / share. Previously, on September 13, 2024, the share price was 2,43 / share. This represents an increase of 29,22% over that period.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.