| Actions en circulation | 88,257,253 shares |

| Actions d'initiés | 24 606 829 shares |

| Participation des initiés | 27,88 % |

| Nombre total d'initiés | 62 |

Indice de confiance des initiés

L'indice de confiance des initiés identifie les entreprises achetées par les initiés.

Il est le résultat d'un modèle quantitatif sophistiqué et multifactoriel qui identifie les entreprises présentant les niveaux les plus élevés de capitalisation d'initiés. Le modèle de notation utilise une combinaison du nombre net d'initiés ayant acheté des actions au cours des 90 derniers jours, du nombre total d'actions achetées en pourcentage du flottant et du nombre total d'actions détenues par les initiés. Le nombre varie de 0 à 100, les chiffres les plus élevés indiquant un niveau d'accumulation supérieur à celui de ses pairs, et 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Indice de confiance des dirigeants

L'indice de confiance des dirigeants identifie les entreprises dont les actions sont achetées par des dirigeants d'entreprise.

Par définition, les dirigeants d'entreprise sont des initiés, mais contrairement à d'autres initiés (actionnaires à 10 % et membres du conseil d'administration), les dirigeants travaillent quotidiennement pour l'entreprise et utilisent leur propre argent lorsqu'ils effectuent des opérations (les actionnaires à 10 % et les membres du conseil d'administration sont souvent des gestionnaires de fonds qui gèrent l'argent d'autrui). À ce titre, les opérations d'initiés réalisées par les dirigeants sont beaucoup plus significatives et doivent être traitées de manière appropriée.

Comme l'indice de confiance des initiés, l'indice de confiance des dirigeants est le résultat d'un modèle quantitatif sophistiqué et multifactoriel qui identifie les entreprises présentant les niveaux les plus élevés d'accumulation de dirigeants.

Fréquence de mise à jour : Quotidienne

Principaux indicateurs des initiés

Cette carte montre comment l'entreprise se positionne par rapport à divers indicateurs d'initiés. La position en centile montre comment cette entreprise se situe par rapport aux autres entreprises sur les marchés américains. Une position plus élevée indique une meilleure situation.

Par exemple, il est généralement admis que les achats d'initiés sont un indicateur positif, de sorte que les entreprises dont les achats d'initiés sont plus nombreux se positionnent mieux que celles dont les achats d'initiés sont moins nombreux (ou même les ventes d'initiés).

Pourcentage du flottant acheté par les initiés (position)

0.000 %( )

5177 out of 11220Le pourcentage du flottant acheté par les initiés est le nombre total d'actions achetées par les initiés moins le nombre total d'actions vendues par les initiés au cours des 90 derniers jours, divisé par le flottant total et multiplié par 100.

Graphique des opérations d'initiés

Les opérations d'initiés de Altimmune, Inc. sont présentées dans le graphique suivant. Les initiés sont des dirigeants, des administrateurs ou des investisseurs importants dans une entreprise. En général, il est illégal pour les initiés d'effectuer des opérations d'initiés dans leur entreprise sur la base d'informations matérielles non publiques. Cela ne signifie pas qu'il est illégal pour eux d'effectuer toute transaction dans leurs propres entreprises. Toutefois, ils doivent déclarer toutes les transactions à la SEC au moyen d'un formulaire 4.

Liste d'initiés et indicateurs de rentabilité

Ce tableau présente la liste des initiés connus et est généré automatiquement à partir des dépôts communiqués à la SEC. Outre les noms, le titre le plus récent et la désignation du directeur, du dirigeant ou du propriétaire à 10 %, nous indiquons les dernières participations divulguées. En outre, lorsque cela est possible, nous indiquons les performances historiques des opérations d'initiés. La performance historique des transactions est une moyenne pondérée de la performance des opérations d'achat réelles sur le marché public effectuées par l'initié. Pour plus d'informations sur le mode de calcul, regardez ce webinaire sur YouTube.

See our leaderboard of most profitable insider traders.

| Initié | Profit moyen (%) | Actions détenues |

Fractionnement Ajusté |

|---|---|---|---|

| Eric Aguiar - | 250 000 | 125 000 | |

| William Michael Brown Chief Financial Officer - [O] | 17 721 | 17 721 | |

| James H Cavanaugh - | 3 297 174 | 3 297 174 | |

| Linda L Chang SVP, CFO & Secretary - [O] | 30 000 | 30 000 | |

| Elizabeth Czerepak Director - [D] | 1 320 065 | 1 320 065 | |

| Christopher C Camut VP, Chief Financial Officer - [O] | 49 308 | 49 308 | |

|

David J Collier

10% Owner -

|

3 774 500 | 3 774 500 | |

| Francesca M Cook SVP, Policy & Gov't Affairs - [O] | 37 631 | 37 631 | |

| David Drutz Director - [D] | 55 524 | 55 524 | |

|

Israel A Englander

10% Owner -

|

984 500 | 1 200 000 | |

| Richard I Eisenstadt Chief Financial Officer - [O] | 45 012 | 45 012 | |

| William Enright President and CEO, Director - [D] [O] | 365 839 | 12 195 | |

|

Phil Frohlich

10% Owner -

|

6 626 403 | 6 626 403 | |

| Thomas Richard Fuerst | 20 000 | ||

| Joan Fusco SVP, Operations - [O] | 40 812 | 40 812 | |

| John Gill Director - [D] | 2 771 | 2 771 | |

| Vipin K Garg President and CEO, Director - [D] [O] | 355 082 | 355 082 | |

| Healthcare Ventures Vii Lp - | 125 000 | 125 000 | |

| Matthew Scott Harris Chief Medical Officer - [O] | 83 874 | 83 874 | |

| Philip Hodges Director - [D] | 8 731 | 8 731 |

| Initié | Profit moyen (%) | Actions détenues |

Fractionnement Ajusté |

|---|---|---|---|

| Jeffrey Michael Jones COO - [O] | 5 088 | 5 088 | |

| Raymond M Jordt Chief Business Officer - [O] | 36 270 | 36 270 | |

| Diane Jorkasky Director - [D] | 0 | 0 | |

| Jordan P Karp SVP, General Counsel - [O] | 21 929 | 21 929 | |

|

Bong Y Koh

10% Owner -

|

3 500 000 | 3 500 000 | |

| Philip Macneill VP, CFO, Treasurer, Secretary - [O] | 126 346 | 126 346 | |

| Brian A Markison Director - [D] | 0 | 0 | |

|

Millenco Llc

10% Owner -

|

1 200 000 | 1 200 000 | |

| Wayne Morges VP, Regulatory Affairs & Qual - [O] | 38 091 | 38 091 | |

| Joel McCleary | 5 061 | ||

|

Bioventures Ltd Novartis

10% Owner -

|

8 345 145 | 278 172 | |

| John Pappajohn | 10 000 | ||

|

Prescott Group Capital Management, L.l.c.

10% Owner -

|

6 626 403 | 6 626 403 | |

|

Paradigm Venture Partners, L.P.

10% Owner -

|

4 455 | 4 455 | |

| Wayne Pisano Director - [D] | 8 498 | 8 498 | |

| Kevin Price President-Pharmathene UK, Ltd. - [O] | 2 500 | 2 500 | |

| Eric I Richman Director - [D] | 898 055 | 898 055 | |

|

Redmont VAXN Capital Holdings, LLC

10% Owner -

|

0 | 0 | |

|

Redmont Venture Partners, Inc.

10% Owner -

|

4 455 | 4 455 | |

| Valerie D Riddle VP, Medical Director - [O] | 58 824 | 58 824 | |

| M Scot Roberts Chief Scientific Officer - [O] | 74 066 | 74 066 |

| Initié | Profit moyen (%) | Actions détenues |

Fractionnement Ajusté |

|---|---|---|---|

| Runge Jeffrey W. Director - [D] | 197 700 | 197 700 | |

| Mitchel Sayare Director - [D] | 26 363 | 26 363 | |

| Derace L Schaffer Director - [D] | 589 453 | 19 648 | |

| Klaus Schafer Director - [D] | 9 179 | 9 179 | |

|

Nimish P Shah

10% Owner -

|

3 500 000 | 3 500 000 | |

| Andrew Shutterly Acting Chief Financial Officer - [O] | 11 372 | 11 372 | |

| Sohn Catherine A. Director - [D] | 1 000 | 1 000 | |

| Peter Steven St Director - [D] | 205 004 | 205 004 | |

| Sybil Tasker | 20 000 | ||

|

Truffle Capital S.A.S.

10% Owner -

|

76 700 | 2 557 | |

|

Velocity Pharmaceutical Holdings Llc

10% Owner -

|

1 687 250 | 1 687 250 | |

|

VHCP Co-Investment Holdings II, LLC

10% Owner -

|

3 500 000 | 3 500 000 | |

|

VHCP Co-Investment Holdings III, LLC

10% Owner -

|

3 500 000 | 3 500 000 | |

|

VHCP Management II, LLC

10% Owner -

|

3 500 000 | 3 500 000 | |

|

VHCP Management III, LLC

10% Owner -

|

3 500 000 | 3 500 000 | |

|

Velocity Pharma Management, LLC

10% Owner -

|

3 774 500 | 3 774 500 | |

|

Venrock Healthcare Capital Partners II, L.P.

10% Owner -

|

3 500 000 | 3 500 000 | |

|

Venrock Healthcare Capital Partners III, L.P.

10% Owner -

|

3 500 000 | 3 500 000 | |

| Gregory L Weaver Chief Financial Officer - [O] | 10 000 | 10 000 | |

| David P Wright President and CEO, Director - [D] [O] | 307 115 | 307 115 | |

|

James F Watson

10% Owner -

|

3 774 500 | 3 774 500 |

Report errors via our new Insider Auditing Tool

Historique des achats d'initiés - Analyse des bénéfices à court terme

Dans cette section, nous analysons la rentabilité de chaque achat d'initié non planifié et effectué sur le marché public dans ALT / Altimmune, Inc.. Cette analyse permet de comprendre si l'initié génère régulièrement des rendements anormaux et s'il vaut la peine d'être suivi. Cette analyse porte sur l'année qui suit chaque transaction et les résultats sont théoriques .

Le tableau suivant présente les achats sur le marché public les plus récents qui ne faisaient pas partie d'un plan de trading automatique.

Prix ajusté est le prix ajusté suite au fractionnement. Actions ajustées est le nombre d'actions ajustées suite au fractionnement.

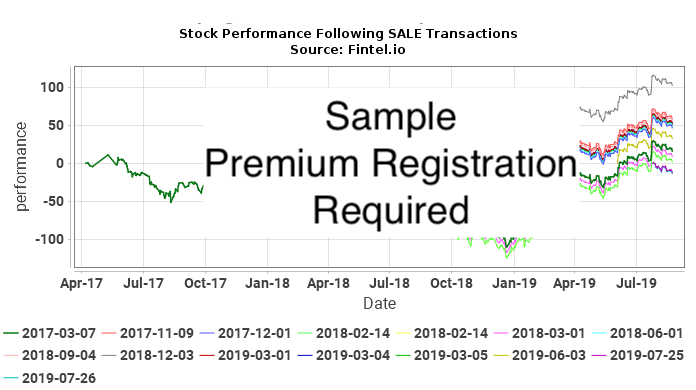

Historique des ventes d'initiés - Analyse des pertes à court terme

Dans cette section, nous analysons l'évitement des pertes à court terme de chaque vente d'initié non planifiée et réalisée sur le marché public dans ALT / Altimmune, Inc.. Un schéma cohérent d'évitement des pertes peut suggérer que les transactions de vente futures peuvent prédire des baisses de prix. Cette analyse porte sur l'année qui suit chaque transaction, et les résultats sont théoriques .

Le tableau suivant présente les ventes les plus récentes sur le marché public qui ne faisaient pas partie d'un plan de trading automatique.

Prix ajusté est le prix ajusté suite au fractionnement. Actions ajustées est le nombre d'actions ajustées suite au fractionnement.

Historique des transactions

Click the link icon to see the full transaction history. Transactions reported as part of a 10b5-1 automatic trading plan will have an X in the column marked 10b-5.

| Date de dépôt |

Date de transaction |

Formulaire | Initié | Libellé | Nom du titre | Code | Direct | Prix d'exercice |

Prix unitaire |

Unités Modifié |

Valeur Modifiée (1K) |

Options restantes |

Actions restantes |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-04 | 2025-07-31 | 4 | Jordt Raymond M | ALT | Common Stock, par value $0.0001 | D | 3,1400 | 1 368 | 4 | 36 270 | ||||

| 2025-08-04 | 2025-07-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 3,1400 | 846 | 3 | 74 066 | ||||

| 2025-08-04 | 2025-07-31 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 3,1400 | 2 018 | 6 | 16 087 | ||||

| 2025-03-18 | 2025-03-17 | 4 | Sohn Catherine A. | ALT | Common Stock, par value $0.0001 | D | 5,7845 | 1 000 | 6 | 1 000 | ||||

| 2025-03-14 | 2025-03-13 | 4 | WEAVER GREGORY L | ALT | Common Stock, par value $0.0001 | D | 5,1996 | 10 000 | 52 | 10 000 | ||||

| 2025-03-11 | 2025-03-07 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | -67 787 | 14 069 | ||||||

| 2025-02-03 | 2025-02-02 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 6,6400 | -8 282 | -55 | 355 082 | ||||

| 2025-02-03 | 2025-02-02 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 18 950 | 363 364 | ||||||

| 2025-02-03 | 2025-02-01 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 6,6400 | -7 231 | -48 | 344 414 | ||||

| 2025-02-03 | 2025-02-01 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 16 545 | 351 645 | ||||||

| 2025-02-03 | 2025-01-31 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 5,1800 | 4 105 | 21 | 335 100 | ||||

| 2025-02-03 | 2025-01-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 7,0000 | -11 701 | -82 | 330 995 | ||||

| 2025-02-03 | 2025-01-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 26 775 | 342 696 | ||||||

| 2025-02-03 | 2025-02-02 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 6,6400 | -2 708 | -18 | 81 856 | ||||

| 2025-02-03 | 2025-02-02 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 7 775 | 84 564 | ||||||

| 2025-02-03 | 2025-02-01 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 6,6400 | -2 109 | -14 | 76 789 | ||||

| 2025-02-03 | 2025-02-01 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 6 166 | 78 898 | ||||||

| 2025-02-03 | 2025-01-31 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 5,1800 | 1 905 | 10 | 72 732 | ||||

| 2025-02-03 | 2025-01-30 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 7,0000 | -3 173 | -22 | 70 827 | ||||

| 2025-02-03 | 2025-01-30 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 9 275 | 74 000 | ||||||

| 2025-02-03 | 2025-01-31 | 4 | Jordt Raymond M | ALT | Common Stock, par value $0.0001 | D | 5,1800 | 2 614 | 14 | 34 902 | ||||

| 2025-02-03 | 2025-02-02 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 6,6400 | -2 316 | -15 | 73 220 | ||||

| 2025-02-03 | 2025-02-02 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 7 775 | 75 536 | ||||||

| 2025-02-03 | 2025-02-01 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 6,6400 | -1 801 | -12 | 67 761 | ||||

| 2025-02-03 | 2025-02-01 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 6 166 | 69 562 | ||||||

| 2025-02-03 | 2025-01-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 5,1800 | 3 184 | 16 | 63 396 | ||||

| 2025-02-03 | 2025-01-30 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 7,0000 | -2 709 | -19 | 60 212 | ||||

| 2025-02-03 | 2025-01-30 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 9 275 | 62 921 | ||||||

| 2025-01-28 | 2025-01-25 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 6,9800 | -4 264 | -30 | 53 646 | ||||

| 2025-01-28 | 2025-01-25 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 14 600 | 57 910 | ||||||

| 2025-01-28 | 2025-01-25 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 6,9800 | -4 994 | -35 | 64 725 | ||||

| 2025-01-28 | 2025-01-25 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 14 600 | 69 719 | ||||||

| 2025-01-28 | 2025-01-25 | 4 | Jordt Raymond M | ALT | Common Stock, par value $0.0001 | D | 6,9800 | -3 862 | -27 | 32 288 | ||||

| 2025-01-28 | 2025-01-25 | 4 | Jordt Raymond M | ALT | Common Stock, par value $0.0001 | D | 14 600 | 36 150 | ||||||

| 2025-01-28 | 2025-01-25 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 6,9800 | -18 157 | -127 | 315 921 | ||||

| 2025-01-28 | 2025-01-25 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 42 050 | 334 078 | ||||||

| 2025-01-03 | 2025-01-01 | 4 | Jordt Raymond M | ALT | Common Stock, par value $0.0001 | D | 7,2100 | -2 485 | -18 | 21 550 | ||||

| 2025-01-03 | 2025-01-01 | 4 | Jordt Raymond M | ALT | Common Stock, par value $0.0001 | D | 9 375 | 24 035 | ||||||

| 2024-08-20 | 2024-08-19 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | I | 6,8800 | -8 184 | -56 | 55 524 | ||||

| 2024-08-20 | 2024-08-19 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | I | 2,5000 | 21 750 | 54 | 63 708 | ||||

| 2024-08-20 | 2024-08-19 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | I | 6,9300 | -7 827 | -54 | 41 958 | ||||

| 2024-08-20 | 2024-08-19 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | I | 2,6000 | 20 000 | 52 | 49 785 | ||||

| 2024-08-01 | 2024-07-31 | 4 | Shutterly Andrew | ALT | Common Stock, par value $0.0001 | D | 5,4100 | 1 259 | 7 | 11 372 | ||||

| 2024-08-01 | 2024-07-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 5,4100 | 650 | 4 | 43 310 | ||||

| 2024-08-01 | 2024-07-31 | 4 | Jordt Raymond M | ALT | Common Stock, par value $0.0001 | D | 5,4100 | 917 | 5 | 14 660 | ||||

| 2024-08-01 | 2024-07-31 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 5,4100 | 1 486 | 8 | 55 119 | ||||

| 2024-07-01 | 3 | Shutterly Andrew | ALT | Common Stock, par value $0.0001 | D | 10 113 | ||||||||

| 2024-02-05 | 2024-02-02 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 9,3200 | -2 330 | -22 | 42 660 | ||||

| 2024-02-05 | 2024-02-02 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 7 775 | 44 990 | ||||||

| 2024-02-05 | 2024-02-01 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 9,8800 | -1 801 | -18 | 37 215 | ||||

| 2024-02-05 | 2024-02-01 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 6 166 | 39 016 | ||||||

| 2024-02-05 | 2024-02-02 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 9,3200 | -2 332 | -22 | 53 633 | ||||

| 2024-02-05 | 2024-02-02 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 7 775 | 55 965 | ||||||

| 2024-02-05 | 2024-02-01 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 9,8800 | -1 801 | -18 | 48 190 | ||||

| 2024-02-05 | 2024-02-01 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 6 166 | 49 991 | ||||||

| 2024-02-05 | 2024-02-02 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 9,3200 | -8 376 | -78 | 292 028 | ||||

| 2024-02-05 | 2024-02-02 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 18 950 | 300 404 | ||||||

| 2024-02-05 | 2024-02-01 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 9,8800 | -7 313 | -72 | 281 454 | ||||

| 2024-02-05 | 2024-02-01 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 16 545 | 288 767 | ||||||

| 2024-02-01 | 2024-01-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 2,6900 | 5 860 | 16 | 32 850 | ||||

| 2024-02-01 | 2024-01-30 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 9,8000 | -2 709 | -27 | 26 990 | ||||

| 2024-02-01 | 2024-01-30 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 9 275 | 29 699 | ||||||

| 2024-02-01 | 2024-01-31 | 4 | Jordt Raymond M | ALT | Common Stock, par value $0.0001 | D | 2,6900 | 5 030 | 14 | 13 743 | ||||

| 2024-02-01 | 2024-01-31 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 2,6900 | 3 257 | 9 | 43 825 | ||||

| 2024-02-01 | 2024-01-30 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 9,8000 | -2 709 | -27 | 40 568 | ||||

| 2024-02-01 | 2024-01-30 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 9 275 | 43 277 | ||||||

| 2024-02-01 | 2024-01-31 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 2,6900 | 7 889 | 21 | 272 222 | ||||

| 2024-02-01 | 2024-01-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 9,8000 | -11 697 | -115 | 264 333 | ||||

| 2024-02-01 | 2024-01-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 26 775 | 276 030 | ||||||

| 2024-02-01 | 2024-01-31 | 4 | Eisenstadt Richard I | ALT | Common Stock, par value $0.0001 | D | 2,6900 | 4 621 | 12 | 45 012 | ||||

| 2024-02-01 | 2024-01-30 | 4 | Eisenstadt Richard I | ALT | Common Stock, par value $0.0001 | D | 9,8000 | -2 175 | -21 | 40 391 | ||||

| 2024-02-01 | 2024-01-30 | 4 | Eisenstadt Richard I | ALT | Common Stock, par value $0.0001 | D | 9 275 | 42 566 | ||||||

| 2024-01-04 | 2024-01-01 | 4 | Jordt Raymond M | ALT | Common Stock, par value $0.0001 | D | 11,2500 | -2 503 | -28 | 8 704 | ||||

| 2024-01-04 | 2024-01-01 | 4 | Jordt Raymond M | ALT | Common Stock, par value $0.0001 | D | 9 375 | 11 207 | ||||||

| 2024-01-02 | 2023-12-29 | 4 | Eisenstadt Richard I | ALT | Common Stock, par value $0.0001 | D | 11,2500 | -3 044 | -34 | 33 291 | ||||

| 2024-01-02 | 2023-12-29 | 4 | Eisenstadt Richard I | ALT | Common Stock, par value $0.0001 | D | 12 500 | 36 335 | ||||||

| 2023-08-15 | 2023-08-15 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | I | 2,8750 | 300 | 1 | 29 785 | ||||

| 2023-08-02 | 2023-07-31 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 2,8100 | 126 | 0 | 249 255 | ||||

| 2023-08-02 | 2023-07-31 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 2,8100 | 691 | 2 | 34 002 | ||||

| 2023-08-02 | 2023-07-31 | 4 | Eisenstadt Richard I | ALT | Common Stock, par value $0.0001 | D | 2,8100 | 1 825 | 5 | 23 835 | ||||

| 2023-08-02 | 2023-07-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 2,8100 | 568 | 2 | 20 424 | ||||

| 2023-08-02 | 2023-07-31 | 4 | Jordt Raymond M | ALT | Common Stock, par value $0.0001 | D | 2,8100 | 1 832 | 5 | 1 832 | ||||

| 2023-07-06 | 2022-08-12 | 4 | GILL JOHN | ALT | Common Stock, par value $0.0001 | D | 15,0000 | -2 714 | -41 | 2 771 | ||||

| 2023-03-27 | 2023-03-23 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | I | 4,2700 | 9 000 | 38 | 29 484 | ||||

| 2023-03-24 | 2023-03-24 | 4 | Eisenstadt Richard I | ALT | Common Stock, par value $0.0001 | D | 4,3140 | 10 000 | 43 | 22 010 | ||||

| 2023-03-23 | 2023-03-23 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 4,2200 | 10 000 | 42 | 33 311 | ||||

| 2023-02-06 | 2023-02-02 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 15,0400 | -2 364 | -36 | 23 311 | ||||

| 2023-02-06 | 2023-02-02 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 7 775 | 25 675 | ||||||

| 2023-02-06 | 2023-02-02 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 15,0400 | -2 375 | -36 | 19 856 | ||||

| 2023-02-06 | 2023-02-02 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 7 775 | 22 231 | ||||||

| 2023-02-06 | 2023-02-02 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 15,0400 | -8 422 | -127 | 249 129 | ||||

| 2023-02-06 | 2023-02-02 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 18 950 | 257 551 | ||||||

| 2023-02-02 | 2023-02-01 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 13,7800 | -2 183 | -30 | 17 900 | ||||

| 2023-02-02 | 2023-02-01 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 6 166 | 20 083 | ||||||

| 2023-02-02 | 2023-01-31 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 10,2085 | 1 296 | 13 | 13 917 | ||||

| 2023-02-02 | 2023-02-01 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 13,7800 | -2 183 | -30 | 14 456 | ||||

| 2023-02-02 | 2023-02-01 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 6 166 | 16 639 | ||||||

| 2023-02-02 | 2023-01-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 10,2085 | 1 436 | 15 | 10 473 | ||||

| 2023-02-02 | 2023-01-31 | 4 | Eisenstadt Richard I | ALT | Common Stock, par value $0.0001 | D | 10,2085 | 1 172 | 12 | 12 010 | ||||

| 2023-02-02 | 2023-02-01 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 13,7800 | -7 658 | -106 | 238 601 | ||||

| 2023-02-02 | 2023-02-01 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 16 546 | 246 259 | ||||||

| 2023-02-02 | 2023-01-31 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 10,2085 | 1 938 | 20 | 229 713 | ||||

| 2023-01-03 | 2022-12-31 | 4 | Eisenstadt Richard I | ALT | Common Stock, par value $0.0001 | D | 16,4500 | -3 028 | -50 | 10 838 | ||||

| 2023-01-03 | 2022-12-31 | 4 | Eisenstadt Richard I | ALT | Common Stock, par value $0.0001 | D | 12 500 | 13 866 | ||||||

| 2022-12-22 | 2022-12-22 | 4 | Pisano Wayne | ALT | Common Stock, par value $0.0001 | D | 15,0134 | -20 000 | -300 | 8 498 | ||||

| 2022-12-22 | 2022-12-22 | 4 | Pisano Wayne | ALT | Common Stock, par value $0.0001 | D | 2,6000 | 20 000 | 52 | 28 498 | ||||

| 2022-12-01 | 2022-11-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 9,9500 | -3 007 | -30 | 227 775 | ||||

| 2022-11-21 | 2022-11-18 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | D | 2,4000 | 139 | 0 | 20 151 | ||||

| 2022-10-31 | 2022-10-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 12,7700 | -3 007 | -38 | 230 782 | ||||

| 2022-10-03 | 2022-09-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 12,7700 | -3 008 | -38 | 233 789 | ||||

| 2022-09-01 | 2022-08-31 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 20,0161 | -20 000 | -400 | 236 797 | ||||

| 2022-09-01 | 2022-08-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 18,9400 | -3 007 | -57 | 256 797 | ||||

| 2022-08-12 | 2022-08-12 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 15,0593 | -15 000 | -226 | 259 804 | ||||

| 2022-08-03 | 2022-07-31 | 4 | Eisenstadt Richard I | ALT | Common Stock, par value $0.0001 | D | 6,8600 | 1 366 | 9 | 1 366 | ||||

| 2022-08-03 | 2022-07-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 6,8600 | 732 | 5 | 9 037 | ||||

| 2022-08-03 | 2022-07-31 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 6,8600 | 1 076 | 7 | 12 621 | ||||

| 2022-08-01 | 2022-07-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 12,0100 | -3 007 | -36 | 274 804 | ||||

| 2022-07-05 | 2022-07-05 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 12,0000 | -10 182 | -122 | 8 305 | ||||

| 2022-07-05 | 2022-07-05 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 2,9500 | 787 | 2 | 18 487 | ||||

| 2022-07-05 | 2022-07-01 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 12,0000 | -26 982 | -324 | 17 700 | ||||

| 2022-07-05 | 2022-07-01 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 2,9500 | 22 963 | 68 | 44 682 | ||||

| 2022-07-05 | 2022-07-01 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 2,6000 | 4 019 | 10 | 21 719 | ||||

| 2022-07-01 | 2022-06-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 11,7000 | -3 007 | -35 | 277 811 | ||||

| 2022-06-30 | 2022-06-29 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 12,0004 | -5 462 | -66 | 17 700 | ||||

| 2022-06-30 | 2022-06-29 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 2,6000 | 5 462 | 14 | 23 162 | ||||

| 2022-06-28 | 2022-06-27 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 12,0008 | -37 352 | -448 | 17 700 | ||||

| 2022-06-28 | 2022-06-27 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 2,6000 | 11 769 | 31 | 55 052 | ||||

| 2022-06-28 | 2022-06-27 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 1,9213 | 25 583 | 49 | 43 283 | ||||

| 2022-06-28 | 2022-06-27 | 4 | Jorkasky Diane | ALT | Common Stock, par value $0.0001 | D | 11,7515 | -17 610 | -207 | 0 | ||||

| 2022-06-28 | 2022-06-27 | 4 | Jorkasky Diane | ALT | Common Stock, par value $0.0001 | D | 3,1500 | 17 610 | 55 | 17 610 | ||||

| 2022-06-22 | 2022-06-20 | 4 | Schafer Klaus | ALT | Common Stock, par value $0.0001 | D | 2,4000 | 60 | 0 | 9 179 | ||||

| 2022-06-22 | 2022-06-20 | 4 | Schafer Klaus | ALT | Common Stock, par value $0.0001 | D | 2,4000 | 60 | 0 | 9 179 | ||||

| 2022-06-22 | 2022-06-20 | 4 | Schafer Klaus | ALT | Common Stock, par value $0.0001 | D | 2,4000 | 159 | 0 | 9 119 | ||||

| 2022-06-16 | 2022-06-15 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | D | 8,0000 | 1 000 | 8 | 20 012 | ||||

| 2022-05-31 | 2022-05-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 5,0300 | -3 008 | -15 | 280 818 | ||||

| 2022-05-25 | 2022-05-24 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | D | 4,5000 | 1 200 | 5 | 19 012 | ||||

| 2022-05-02 | 2022-04-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 4,5200 | -3 008 | -14 | 283 826 | ||||

| 2022-03-31 | 2022-03-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 6,0500 | -3 007 | -18 | 286 834 | ||||

| 2022-03-02 | 2022-02-28 | 4 | Harris Matthew Scott | ALT | Stock Options (option to buy) | D | 1,92 | -30 000 | 31 400 | |||||

| 2022-03-02 | 2022-02-28 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 7,5200 | -30 000 | -226 | 11 545 | ||||

| 2022-03-02 | 2022-02-28 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 1,9213 | 30 000 | 58 | 41 545 | ||||

| 2022-03-01 | 2022-02-28 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 7,4100 | -3 007 | -22 | 289 841 | ||||

| 2022-02-16 | 2017-05-04 | 4/A | Drutz David | ALT | Stock Options (option to buy) | D | 2,40 | 139 | 139 | |||||

| 2022-02-16 | 2017-05-04 | 4/A | Drutz David | ALT | Stock Options (option to buy) | D | 17,70 | 139 | 139 | |||||

| 2022-02-14 | 2021-12-27 | 5 | GILL JOHN | ALT | Common Stock, par value $0.0001 | D | -2 714 | 2 771 | ||||||

| 2022-02-14 | 2021-12-27 | 5 | GILL JOHN | ALT | Common Stock, par value $0.0001 | D | -2 714 | 2 771 | ||||||

| 2022-02-14 | 2021-05-03 | 5 | GILL JOHN | ALT | Common Stock, par value $0.0001 | D | -3 000 | 8 199 | ||||||

| 2022-02-03 | 2022-02-02 | 4 | Garg Vipin K | ALT | Restricted Stock Units | D | 75 800 | 75 800 | ||||||

| 2022-02-03 | 2022-02-02 | 4 | Garg Vipin K | ALT | Stock Options (option to buy) | D | 7,53 | 223 000 | 223 000 | |||||

| 2022-02-03 | 2022-02-01 | 4 | Garg Vipin K | ALT | Restricted Stock Units | D | -16 545 | 49 636 | ||||||

| 2022-02-03 | 2022-02-01 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 7,9800 | -7 655 | -61 | 292 848 | ||||

| 2022-02-03 | 2022-02-01 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 16 545 | 300 503 | ||||||

| 2022-02-03 | 2022-01-31 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 6,8600 | 2 757 | 19 | 283 958 | ||||

| 2022-02-03 | 2022-02-02 | 4 | Harris Matthew Scott | ALT | Restricted Stock Units | D | 31 100 | 31 100 | ||||||

| 2022-02-03 | 2022-02-02 | 4 | Harris Matthew Scott | ALT | Stock Options (option to buy) | D | 7,53 | 91 600 | 91 600 | |||||

| 2022-02-03 | 2022-02-01 | 4 | Harris Matthew Scott | ALT | Restricted Stock Units | D | -6 166 | 18 498 | ||||||

| 2022-02-03 | 2022-02-01 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 7,9800 | -2 183 | -17 | 11 545 | ||||

| 2022-02-03 | 2022-02-01 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 6 166 | 13 728 | ||||||

| 2022-02-03 | 2022-01-31 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 6,8600 | 1 800 | 12 | 7 562 | ||||

| 2022-02-03 | 2022-02-02 | 4 | Roberts M Scot | ALT | Restricted Stock Units | D | 31 100 | 31 100 | ||||||

| 2022-02-03 | 2022-02-02 | 4 | Roberts M Scot | ALT | Stock Options (option to buy) | D | 7,53 | 91 600 | 91 600 | |||||

| 2022-02-03 | 2022-02-01 | 4 | Roberts M Scot | ALT | Restricted Stock Units | D | -6 166 | 18 498 | ||||||

| 2022-02-03 | 2022-02-01 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 7,9800 | -2 183 | -17 | 17 700 | ||||

| 2022-02-03 | 2022-02-01 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 6 166 | 19 883 | ||||||

| 2022-02-03 | 2022-01-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 6,8600 | 2 106 | 14 | 13 717 | ||||

| 2022-01-31 | 2022-01-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 7,2000 | -2 355 | -17 | 281 201 | ||||

| 2022-01-26 | 2022-01-25 | 4 | Drutz David | ALT | Stock Options (option to buy) | D | 2,40 | -70 | 69 | |||||

| 2022-01-26 | 2022-01-25 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | D | 2,4000 | 70 | 0 | 17 882 | ||||

| 2022-01-04 | 2021-12-31 | 4 | Eisenstadt Richard I | ALT | Restricted Stock Units | D | 50 000 | 50 000 | ||||||

| 2022-01-04 | 2021-12-31 | 4 | Eisenstadt Richard I | ALT | Stock Options (option to buy) | D | 9,16 | 150 000 | 150 000 | |||||

| 2022-01-03 | 2021-12-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 8,9300 | -3 007 | -27 | 283 556 | ||||

| 2021-12-15 | 2021-12-14 | 4 | Drutz David | ALT | Stock Options (option to buy) | D | 2,40 | -139 | 0 | |||||

| 2021-12-15 | 2021-12-14 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | D | 2,4000 | 139 | 0 | 17 812 | ||||

| 2021-12-01 | 2021-11-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 10,4900 | -3 007 | -32 | 286 563 | ||||

| 2021-11-19 | 2021-11-19 | 4 | Drutz David | ALT | Stock Options (option to buy) | D | 2,40 | -70 | 0 | |||||

| 2021-11-19 | 2021-11-19 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | D | 2,4000 | 70 | 0 | 17 673 | ||||

| 2021-11-01 | 2021-10-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 10,8000 | -3 007 | -32 | 289 570 | ||||

| 2021-10-01 | 2021-09-23 | 4 | Jorkasky Diane | ALT | Stock Options (option to buy) | D | 15,44 | 24 100 | 24 100 | |||||

| 2021-10-01 | 2021-09-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 11,3100 | -3 007 | -34 | 292 577 | ||||

| 2021-09-24 | 2021-09-23 | 4 | GILL JOHN | ALT | Stock Options (option to buy) | D | 15,44 | 24 100 | 24 100 | |||||

| 2021-09-24 | 2021-09-23 | 4 | SAYARE MITCHEL | ALT | Stock Options (option to buy) | D | 15,44 | 24 100 | 24 100 | |||||

| 2021-09-24 | 2021-09-23 | 4 | Schafer Klaus | ALT | Stock Options (option to buy) | D | 15,44 | 24 100 | 24 100 | |||||

| 2021-09-24 | 2021-09-23 | 4 | Hodges Philip | ALT | Stock Options (option to buy) | D | 15,44 | 24 100 | 24 100 | |||||

| 2021-09-24 | 2021-09-23 | 4 | Pisano Wayne | ALT | Stock Options (option to buy) | D | 15,44 | 24 100 | 24 100 | |||||

| 2021-09-24 | 2021-09-23 | 4 | Drutz David | ALT | Stock Options (option to buy) | D | 15,44 | 24 100 | 24 100 | |||||

| 2021-08-31 | 2021-08-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 14,0900 | -3 008 | -42 | 295 584 | ||||

| 2021-08-06 | 2021-07-31 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 7,7095 | 725 | 6 | 5 762 | ||||

| 2021-08-06 | 2021-07-31 | 4 | Brown William Michael | ALT | Common Stock, par value $0.0001 | D | 7,7095 | 803 | 6 | 17 721 | ||||

| 2021-08-06 | 2021-07-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 7,7095 | 1 750 | 13 | 11 611 | ||||

| 2021-08-02 | 2021-07-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 9,0700 | -3 007 | -27 | 298 592 | ||||

| 2021-07-01 | 2021-06-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 9,8500 | -3 007 | -30 | 301 599 | ||||

| 2021-06-02 | 2021-05-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 12,6500 | -2 577 | -33 | 304 606 | ||||

| 2021-05-04 | 2021-04-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 14,4700 | -1 999 | -29 | 307 183 | ||||

| 2021-03-31 | 2021-03-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 13,5500 | -1 998 | -27 | 309 182 | ||||

| 2021-03-01 | 2021-02-28 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 15,9400 | -1 998 | -32 | 311 180 | ||||

| 2021-03-01 | 2021-03-01 | 4 | Hodges Philip | ALT | Common Stock, par value $0.0001 | D | 16,0800 | -6 000 | -96 | 8 731 | ||||

| 2021-03-01 | 2021-02-25 | 4 | Venrock Healthcare Capital Partners III, L.P. By Funds | ALT | Warrant | I | 0,00 | 1 000 000 | 1 000 000 | |||||

| 2021-03-01 | 2021-02-25 | 4 | Venrock Healthcare Capital Partners III, L.P. By Funds | ALT | Common Stock | I | -1 000 000 | 3 500 000 | ||||||

| 2021-02-03 | 2021-02-01 | 4 | Harris Matthew Scott | ALT | Restricted Stock Units | D | 24 664 | 24 664 | ||||||

| 2021-02-03 | 2021-02-01 | 4 | Harris Matthew Scott | ALT | Stock Options (option to buy) | D | 16,71 | 90 000 | 90 000 | |||||

| 2021-02-03 | 2021-01-31 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 12,1400 | 968 | 12 | 5 037 | ||||

| 2021-02-03 | 2021-02-01 | 4 | Garg Vipin K | ALT | Restricted Stock Units | D | 66 181 | 66 181 | ||||||

| 2021-02-03 | 2021-02-01 | 4 | Garg Vipin K | ALT | Stock Options (option to buy) | D | 16,71 | 241 500 | 241 500 | |||||

| 2021-02-03 | 2021-01-31 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 12,1400 | 1 055 | 13 | 313 178 | ||||

| 2021-02-03 | 2021-02-01 | 4 | Roberts M Scot | ALT | Restricted Stock Units | D | 24 664 | 24 664 | ||||||

| 2021-02-03 | 2021-02-01 | 4 | Roberts M Scot | ALT | Stock Options (option to buy) | D | 16,71 | 90 000 | 90 000 | |||||

| 2021-02-03 | 2021-01-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 12,1400 | 467 | 6 | 9 861 | ||||

| 2021-02-03 | 2021-02-01 | 4 | Brown William Michael | ALT | Restricted Stock Units | D | 24 664 | 24 664 | ||||||

| 2021-02-03 | 2021-02-01 | 4 | Brown William Michael | ALT | Stock Options (option to buy) | D | 16,71 | 90 000 | 90 000 | |||||

| 2021-02-03 | 2021-01-31 | 4 | Brown William Michael | ALT | Common Stock, par value $0.0001 | D | 12,1400 | 937 | 11 | 16 918 | ||||

| 2021-02-01 | 2021-01-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 14,2800 | -2 353 | -34 | 312 123 | ||||

| 2021-01-04 | 2020-12-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 11,3000 | -3 025 | -34 | 314 476 | ||||

| 2020-12-11 | 2020-12-10 | 4 | Schafer Klaus | ALT | Common Stock, par value $0.0001 | D | 11,9900 | 2 000 | 24 | 8 900 | ||||

| 2020-12-02 | 2020-11-30 | 4 | GILL JOHN | ALT | Common Stock, par value $0.0001 | D | 11,9200 | -8 425 | -100 | 11 199 | ||||

| 2020-12-02 | 2020-11-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 12,2300 | -2 243 | -27 | 317 501 | ||||

| 2020-12-02 | 2020-12-01 | 4 | Hodges Philip | ALT | Common Stock, par value $0.0001 | I | 13,5400 | -1 227 | -17 | 0 | ||||

| 2020-12-02 | 2020-11-30 | 4 | Hodges Philip | ALT | Common Stock, par value $0.0001 | D | 12,0000 | -2 500 | -30 | 14 731 | ||||

| 2020-11-17 | 2020-11-13 | 4 | Drutz David | ALT | Stock Options (option to buy) | D | 2,40 | -60 | 0 | |||||

| 2020-11-17 | 2020-11-13 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | D | 2,4000 | 60 | 0 | 17 603 | ||||

| 2020-11-13 | 2020-11-12 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 10,0200 | -4 015 | -40 | 4 069 | ||||

| 2020-11-13 | 2020-11-12 | 4 | Pisano Wayne | ALT | Common Stock, par value $0.0001 | D | 9,9000 | -10 352 | -102 | 8 498 | ||||

| 2020-11-13 | 2020-11-12 | 4 | Schafer Klaus | ALT | Common Stock, par value $0.0001 | D | 9,9100 | -10 150 | -101 | 6 900 | ||||

| 2020-11-02 | 2020-10-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 11,4500 | -2 015 | -23 | 319 744 | ||||

| 2020-10-16 | 2020-09-24 | 4 | Schafer Klaus | ALT | Restricted Stock Units ("RSUs") | D | -16 850 | 0 | ||||||

| 2020-10-16 | 2020-09-24 | 4 | Schafer Klaus | ALT | Common Stock, par value $0.0001 | D | 16 850 | 17 050 | ||||||

| 2020-10-16 | 2020-09-24 | 4 | Hodges Philip | ALT | Restricted Stock Units ("RSUs") | D | -16 850 | 0 | ||||||

| 2020-10-16 | 2020-09-24 | 4 | Hodges Philip | ALT | Common Stock, par value $0.0001 | D | 16 850 | 36 306 | ||||||

| 2020-10-16 | 2020-09-24 | 4 | Drutz David | ALT | Restricted Stock Units ("RSUs") | D | -16 850 | 0 | ||||||

| 2020-10-16 | 2020-09-24 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | D | 16 850 | 17 543 | ||||||

| 2020-10-16 | 2020-09-24 | 4 | SAYARE MITCHEL | ALT | Restricted Stock Units ("RSUs") | D | -25 275 | 0 | ||||||

| 2020-10-16 | 2020-09-24 | 4 | SAYARE MITCHEL | ALT | Common Stock, par value $0.0001 | D | 25 275 | 26 363 | ||||||

| 2020-10-16 | 2020-09-24 | 4 | GILL JOHN | ALT | Restricted Stock Units ("RSUs") | D | -16 850 | 0 | ||||||

| 2020-10-16 | 2020-09-24 | 4 | GILL JOHN | ALT | Common Stock, par value $0.0001 | D | 16 850 | 19 624 | ||||||

| 2020-10-16 | 2020-09-24 | 4 | Pisano Wayne | ALT | Restricted Stock Units ("RSUs") | D | -16 850 | 0 | ||||||

| 2020-10-16 | 2020-09-24 | 4 | Pisano Wayne | ALT | Common Stock, par value $0.0001 | D | 16 850 | 18 850 | ||||||

| 2020-10-02 | 2020-09-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 13,2000 | -2 015 | -27 | 321 759 | ||||

| 2020-09-28 | 2020-09-24 | 4 | GILL JOHN | ALT | Stock Options (option to buy) | D | 12,03 | 25 500 | 25 500 | |||||

| 2020-09-28 | 2020-09-24 | 4 | Jorkasky Diane | ALT | Stock Options (option to buy) | D | 12,03 | 9 500 | 9 500 | |||||

| 2020-09-28 | 2020-09-24 | 4 | Schafer Klaus | ALT | Stock Options (option to buy) | D | 12,03 | 25 500 | 25 500 | |||||

| 2020-09-28 | 2020-09-24 | 4 | SAYARE MITCHEL | ALT | Stock Options (option to buy) | D | 12,03 | 25 500 | 25 500 | |||||

| 2020-09-28 | 2020-09-24 | 4 | Drutz David | ALT | Stock Options (option to buy) | D | 12,03 | 25 500 | 25 500 | |||||

| 2020-09-28 | 2020-09-24 | 4 | Pisano Wayne | ALT | Stock Options (option to buy) | D | 12,03 | 25 500 | 25 500 | |||||

| 2020-09-28 | 2020-09-24 | 4 | Hodges Philip | ALT | Stock Options (option to buy) | D | 12,03 | 25 500 | 25 500 | |||||

| 2020-08-31 | 2020-08-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 17,6200 | -2 015 | -36 | 323 774 | ||||

| 2020-08-04 | 2020-07-31 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 1,4600 | 11 674 | 17 | 325 789 | ||||

| 2020-08-04 | 2020-07-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 1,4600 | 3 859 | 6 | 9 394 | ||||

| 2020-08-04 | 2020-07-31 | 4 | Brown William Michael | ALT | Common Stock, par value $0.0001 | D | 1,4600 | 7 920 | 12 | 15 981 | ||||

| 2020-08-04 | 2020-07-31 | 4 | Harris Matthew Scott | ALT | Common Stock, par value $0.0001 | D | 1,4600 | 8 084 | 12 | 8 084 | ||||

| 2020-08-03 | 2020-07-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 26,0600 | -2 015 | -53 | 314 115 | ||||

| 2020-07-01 | 2020-06-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 10,7100 | -2 015 | -22 | 316 130 | ||||

| 2020-06-29 | 2020-06-25 | 4 | Schafer Klaus | ALT | Restricted Stock Units ("RSUs") | D | 16 850 | 16 850 | ||||||

| 2020-06-29 | 2020-06-25 | 4 | Hodges Philip | ALT | Restricted Stock Units ("RSUs") | D | 16 850 | 16 850 | ||||||

| 2020-06-29 | 2020-06-25 | 4 | Drutz David | ALT | Restricted Stock Units ("RSUs") | D | 16 850 | 16 850 | ||||||

| 2020-06-15 | 2020-06-15 | 4 | Venrock Healthcare Capital Partners III, L.P. By Funds | ALT | Common Stock | I | 7,5400 | 1 500 000 | 11 310 | 4 500 000 | ||||

| 2020-06-02 | 2020-05-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 9,2800 | -2 015 | -19 | 318 145 | ||||

| 2020-05-28 | 2020-05-28 | 4 | Venrock Healthcare Capital Partners III, L.P. By Funds | ALT | Common Stock | I | 8,8700 | 173 711 | 1 541 | 3 000 000 | ||||

| 2020-05-28 | 2020-05-28 | 4 | Venrock Healthcare Capital Partners III, L.P. By Funds | ALT | Common Stock | I | 7,7900 | 27 763 | 216 | 2 826 289 | ||||

| 2020-05-28 | 2020-05-27 | 4 | Venrock Healthcare Capital Partners III, L.P. By Funds | ALT | Common Stock | I | 7,9200 | 277 000 | 2 194 | 2 798 526 | ||||

| 2020-05-28 | 2020-05-27 | 4 | Venrock Healthcare Capital Partners III, L.P. By Funds | ALT | Common Stock | I | 7,2300 | 125 162 | 905 | 2 521 526 | ||||

| 2020-05-28 | 2020-05-26 | 4 | Venrock Healthcare Capital Partners III, L.P. By Funds | ALT | Common Stock | I | 9,7800 | 390 547 | 3 820 | 2 396 364 | ||||

| 2020-05-28 | 2020-05-26 | 4 | Venrock Healthcare Capital Partners III, L.P. By Funds | ALT | Common Stock | I | 8,7900 | 309 453 | 2 720 | 2 005 817 | ||||

| 2020-05-28 | 3 | Shah Nimish P By Funds | ALT | Common Stock | I | 3 392 728 | ||||||||

| 2020-05-28 | 3 | Shah Nimish P By Funds | ALT | Common Stock | I | 3 392 728 | ||||||||

| 2020-05-28 | 3 | Shah Nimish P By Funds | ALT | Common Stock | I | 3 392 728 | ||||||||

| 2020-05-28 | 3 | Shah Nimish P By Funds | ALT | Common Stock | I | 3 392 728 | ||||||||

| 2020-05-28 | 3 | Shah Nimish P By Funds | ALT | Common Stock | I | 3 392 728 | ||||||||

| 2020-05-28 | 3 | Shah Nimish P By Funds | ALT | Common Stock | I | 3 392 728 | ||||||||

| 2020-05-28 | 3 | Shah Nimish P By Funds | ALT | Common Stock | I | 3 392 728 | ||||||||

| 2020-05-28 | 3 | Shah Nimish P By Funds | ALT | Common Stock | I | 3 392 728 | ||||||||

| 2020-05-28 | 3 | Shah Nimish P By Funds | ALT | Common Stock | I | 3 392 728 | ||||||||

| 2020-05-28 | 3 | Shah Nimish P By Funds | ALT | Common Stock | I | 3 392 728 | ||||||||

| 2020-05-18 | 2020-05-15 | 4 | VELOCITY PHARMACEUTICAL HOLDINGS LLC | ALT | Common Stock | D | 4,6500 | -30 622 | -142 | 1 687 250 | ||||

| 2020-05-18 | 2020-05-14 | 4 | VELOCITY PHARMACEUTICAL HOLDINGS LLC | ALT | Common Stock | D | 4,8100 | -169 378 | -815 | 1 717 872 | ||||

| 2020-05-12 | 2020-05-11 | 4 | Jorkasky Diane | ALT | Stock Options (option to buy) | D | 3,15 | 40 000 | 40 000 | |||||

| 2020-05-04 | 2020-04-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 3,0500 | -2 015 | -6 | 320 160 | ||||

| 2020-04-01 | 2020-03-31 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 3,0200 | -2 016 | -6 | 322 175 | ||||

| 2020-03-03 | 2020-02-29 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 3,7000 | -2 015 | -7 | 324 191 | ||||

| 2020-02-14 | 3 | Velocity Pharma Management, LLC | ALT | Common Stock | D | 3 774 500 | ||||||||

| 2020-02-14 | 3 | Velocity Pharma Management, LLC | ALT | Common Stock | D | 3 774 500 | ||||||||

| 2020-02-14 | 3 | Velocity Pharma Management, LLC | ALT | Common Stock | D | 3 774 500 | ||||||||

| 2020-02-14 | 3 | Velocity Pharma Management, LLC | ALT | Common Stock | D | 3 774 500 | ||||||||

| 2020-02-14 | 3 | Velocity Pharma Management, LLC | ALT | Common Stock | D | 3 774 500 | ||||||||

| 2020-02-14 | 3 | Velocity Pharma Management, LLC | ALT | Common Stock | D | 3 774 500 | ||||||||

| 2020-02-04 | 2020-01-31 | 4 | Brown William Michael | ALT | Common Stock, par value $0.0001 | D | 1,4600 | 8 061 | 12 | 8 061 | ||||

| 2020-02-04 | 2020-01-31 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 1,4600 | 11 289 | 16 | 326 206 | ||||

| 2020-02-04 | 2020-01-31 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 1,4600 | 3 698 | 5 | 5 535 | ||||

| 2020-02-03 | 2020-01-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 1,7700 | -2 015 | -4 | 314 917 | ||||

| 2020-01-03 | 2020-01-02 | 4 | Brown William Michael | ALT | Stock Options (option to buy) | D | 1,92 | 61 400 | 61 400 | |||||

| 2020-01-03 | 2020-01-02 | 4 | Harris Matthew Scott | ALT | Stock Options (option to buy) | D | 1,92 | 61 400 | 61 400 | |||||

| 2020-01-03 | 2020-01-02 | 4 | Garg Vipin K | ALT | Stock Options (option to buy) | D | 1,92 | 149 500 | 149 500 | |||||

| 2020-01-03 | 2020-01-02 | 4 | Roberts M Scot | ALT | Stock Options (option to buy) | D | 1,92 | 61 400 | 61 400 | |||||

| 2020-01-02 | 2019-12-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 1,8000 | -1 999 | -4 | 316 932 | ||||

| 2019-12-03 | 2019-11-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 1,8200 | -23 976 | -44 | 318 931 | ||||

| 2019-09-11 | 2019-09-09 | 4 | Harris Matthew Scott | ALT | Stock Options (option to buy) | D | 2,13 | 107 000 | 107 000 | |||||

| 2019-09-05 | 2019-09-05 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 2,1000 | 20 000 | 42 | 342 907 | ||||

| 2019-06-19 | 2019-06-17 | 4 | Tasker Sybil | ALT | Stock Options (option to buy) | D | 2,46 | 20 000 | 20 000 | |||||

| 2019-06-12 | 2019-06-10 | 4 | Brown William Michael | ALT | Stock Options (option to buy) | D | 2,34 | 50 000 | 50 000 | |||||

| 2019-03-27 | 2019-03-26 | 4 | Roberts M Scot | ALT | Stock Options (option to buy) | D | 2,95 | 38 000 | 38 000 | |||||

| 2019-03-27 | 2019-03-26 | 4 | Tasker Sybil | ALT | Stock Options (option to buy) | D | 2,95 | 38 000 | 38 000 | |||||

| 2019-01-04 | 2019-01-02 | 4 | Brown William Michael | ALT | Stock Options (option to buy) | D | 2,60 | 30 000 | 30 000 | |||||

| 2019-01-04 | 2019-01-02 | 4 | Hodges Philip | ALT | Stock Options (option to buy) | D | 2,60 | 20 000 | 20 000 | |||||

| 2019-01-04 | 2019-01-02 | 4 | Schafer Klaus | ALT | Stock Options (option to buy) | D | 2,60 | 20 000 | 20 000 | |||||

| 2019-01-04 | 2019-01-02 | 4 | SAYARE MITCHEL | ALT | Stock Options (option to buy) | D | 2,60 | 30 000 | 30 000 | |||||

| 2019-01-04 | 2019-01-02 | 4 | Pisano Wayne | ALT | Stock Options (option to buy) | D | 2,60 | 20 000 | 20 000 | |||||

| 2019-01-04 | 2019-01-02 | 4 | Drutz David | ALT | Stock Options (option to buy) | D | 2,60 | 20 000 | 20 000 | |||||

| 2019-01-04 | 2019-01-02 | 4 | GILL JOHN | ALT | Stock Options (option to buy) | D | 2,60 | 20 000 | 20 000 | |||||

| 2019-01-04 | 2019-01-02 | 4 | Roberts M Scot | ALT | Stock Options (option to buy) | D | 2,60 | 30 000 | 30 000 | |||||

| 2019-01-04 | 2019-01-02 | 4 | Tasker Sybil | ALT | Stock Options (option to buy) | D | 2,60 | 30 000 | 30 000 | |||||

| 2018-12-04 | 2018-11-30 | 4 | Garg Vipin K | ALT | Stock Options (option to buy) | D | 3,59 | 111 421 | 111 421 | |||||

| 2018-12-04 | 2018-11-30 | 4 | Garg Vipin K | ALT | Stock Options (option to buy) | D | 3,59 | 211 486 | 211 486 | |||||

| 2018-12-04 | 2018-11-30 | 4 | Garg Vipin K | ALT | Common Stock, par value $0.0001 | D | 322 907 | 322 907 | ||||||

| 2018-10-11 | 2018-10-09 | 4 | Pisano Wayne | ALT | Common Stock, par value $0.0001 | D | 4,5900 | 2 000 | 9 | 2 000 | ||||

| 2018-09-14 | 2018-09-12 | 4 | Novartis Bioventures Ltd | ALT | Warrants | I | 2,67 | -465 086 | 0 | |||||

| 2018-09-14 | 2018-09-12 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 2 069 993 | 8 345 145 | ||||||

| 2018-07-13 | 2018-07-11 | 4 | Novartis Bioventures Ltd | ALT | Series B Convertible Preferred Stock | I | 2,67 | 940,0000 | -345 | -324 | 0 | |||

| 2018-07-13 | 2018-07-11 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 663 346 | 6 275 152 | ||||||

| 2018-06-19 | 2018-06-15 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 14 449 | 5 611 806 | ||||||

| 2018-06-15 | 2018-06-13 | 4 | Novartis Bioventures Ltd | ALT | Series B Convertible Preferred Stock | I | 2,67 | -345 | 345 | |||||

| 2018-06-15 | 2018-06-13 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 720 878 | 5 597 357 | ||||||

| 2018-05-29 | 2018-05-25 | 4 | Enright William | ALT | Common Stock, par value $0.0001 | D | 0,5076 | 1 300 | 1 | 365 839 | ||||

| 2018-05-23 | 2018-05-21 | 4 | Tasker Sybil | ALT | Stock Options (option to buy) | D | 0,44 | 50 016 | 50 016 | |||||

| 2018-05-23 | 2018-05-21 | 4 | Roberts M Scot | ALT | Stock Options (option to buy) | D | 0,08 | -55 120 | 0 | |||||

| 2018-05-23 | 2018-05-21 | 4 | Roberts M Scot | ALT | Stock Options (option to buy) | D | 0,44 | 50 016 | 50 016 | |||||

| 2018-05-23 | 2018-05-21 | 4 | Roberts M Scot | ALT | Common Stock, par value $0.0001 | D | 0,0800 | 55 120 | 4 | 55 120 | ||||

| 2018-05-23 | 2018-05-21 | 4 | Enright William | ALT | Stock Options (option to buy) | D | 0,44 | 103 158 | 103 158 | |||||

| 2018-05-17 | 2018-05-16 | 4 | Novartis Bioventures Ltd | ALT | Series B Convertible Preferred Stock | I | 2,67 | -345 | 690 | |||||

| 2018-05-17 | 2018-05-16 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 767 728 | 4 876 479 | ||||||

| 2018-05-17 | 2018-05-15 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 274 703 | 4 108 751 | ||||||

| 2018-04-18 | 2018-04-16 | 4 | Novartis Bioventures Ltd | ALT | Series B Convertible Preferred Stock | I | 2,67 | -345 | 1 035 | |||||

| 2018-04-18 | 2018-04-16 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 217 159 | 3 834 048 | ||||||

| 2018-04-18 | 2018-04-16 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 482 907 | 3 616 889 | ||||||

| 2018-04-06 | 2018-04-05 | 4 | SAYARE MITCHEL | ALT | Stock Options (option to buy) | D | 0,95 | 35 000 | 35 000 | |||||

| 2018-03-19 | 2018-03-15 | 4 | Novartis Bioventures Ltd | ALT | Series B Convertible Preferred Stock | I | 2,67 | -345 | 1 380 | |||||

| 2018-03-19 | 2018-03-15 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 261 969 | 3 133 982 | ||||||

| 2018-02-23 | 2017-06-06 | 4 | Roberts M Scot Shares held by spouse of Reporting Person | ALT | Common Stock, par value $0.0001 | I | 4,4200 | 449 | 2 | 449 | ||||

| 2018-02-15 | 2018-02-15 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 4 483 | 76 700 | ||||||

| 2018-02-15 | 2018-02-15 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 4 483 | 76 700 | ||||||

| 2018-02-15 | 2018-02-15 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 5 977 | 139 184 | ||||||

| 2018-02-15 | 2018-02-13 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -23 | 114 | |||||

| 2018-02-15 | 2018-02-13 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -23 | 114 | |||||

| 2018-02-15 | 2018-02-13 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -30 | 152 | |||||

| 2018-02-15 | 2018-02-13 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 17 789 | 72 217 | ||||||

| 2018-02-15 | 2018-02-13 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 17 789 | 72 217 | ||||||

| 2018-02-15 | 2018-02-13 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 23 719 | 133 207 | ||||||

| 2018-02-15 | 2018-02-15 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 67 925 | 2 872 013 | ||||||

| 2018-02-15 | 2018-02-13 | 4 | Novartis Bioventures Ltd | ALT | Series B Convertible Preferred Stock | I | 2,67 | -345 | 1 725 | |||||

| 2018-02-15 | 2018-02-13 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 269 527 | 2 804 088 | ||||||

| 2018-01-19 | 2018-01-17 | 4 | Novartis Bioventures Ltd | ALT | Series B Convertible Preferred Stock | I | 2,67 | -345 | 2 070 | |||||

| 2018-01-19 | 2018-01-17 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 176 586 | 2 534 561 | ||||||

| 2018-01-19 | 2018-01-17 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -23 | 137 | |||||

| 2018-01-19 | 2018-01-17 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -23 | 137 | |||||

| 2018-01-19 | 2018-01-17 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -30 | 182 | |||||

| 2018-01-19 | 2018-01-17 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 11 655 | 54 428 | ||||||

| 2018-01-19 | 2018-01-17 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 11 655 | 54 428 | ||||||

| 2018-01-19 | 2018-01-17 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 15 541 | 109 488 | ||||||

| 2018-01-04 | 2018-01-02 | 4 | Enright William | ALT | Stock Options (option to buy) | D | 0,08 | -183 347 | 0 | |||||

| 2018-01-04 | 2018-01-02 | 4 | Enright William | ALT | Common Stock, par value $0.0001 | D | 0,0800 | 183 347 | 15 | 364 511 | ||||

| 2018-01-03 | 2017-12-29 | 4 | SAYARE MITCHEL | ALT | Common Stock, par value $0.0001 | I | 1,9535 | 5 100 | 10 | 32 650 | ||||

| 2018-01-02 | 2017-12-29 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,9323 | 38 699 | 75 | 589 453 | ||||

| 2018-01-02 | 2017-12-28 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,9191 | 58 711 | 113 | 550 754 | ||||

| 2017-12-27 | 2017-12-27 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,7700 | 27 706 | 49 | 492 043 | ||||

| 2017-12-27 | 2017-12-27 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,7634 | 50 000 | 88 | 464 337 | ||||

| 2017-12-27 | 2017-12-26 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,8131 | 51 442 | 93 | 414 337 | ||||

| 2017-12-27 | 2017-12-22 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,6059 | 17 982 | 29 | 362 895 | ||||

| 2017-12-15 | 2017-12-15 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 65 718 | 2 357 975 | ||||||

| 2017-12-15 | 2017-12-13 | 4 | Novartis Bioventures Ltd | ALT | Series B Convertible Preferred Stock | I | 2,67 | -345 | 2 415 | |||||

| 2017-12-15 | 2017-12-13 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 242 694 | 2 292 257 | ||||||

| 2017-12-15 | 2017-12-15 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 4 337 | 42 773 | ||||||

| 2017-12-15 | 2017-12-15 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 4 337 | 42 773 | ||||||

| 2017-12-15 | 2017-12-15 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 5 784 | 93 947 | ||||||

| 2017-12-15 | 2017-12-13 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -23 | 159 | |||||

| 2017-12-15 | 2017-12-13 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -23 | 159 | |||||

| 2017-12-15 | 2017-12-13 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -30 | 212 | |||||

| 2017-12-15 | 2017-12-13 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 16 018 | 38 436 | ||||||

| 2017-12-15 | 2017-12-13 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 16 018 | 38 436 | ||||||

| 2017-12-15 | 2017-12-13 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 21 357 | 88 163 | ||||||

| 2017-12-08 | 2017-12-07 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,7421 | 7 639 | 13 | 344 913 | ||||

| 2017-12-08 | 2017-12-06 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,8003 | 16 106 | 29 | 337 274 | ||||

| 2017-12-05 | 2017-12-05 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,7775 | 13 495 | 24 | 321 168 | ||||

| 2017-12-05 | 2017-12-04 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,8076 | 7 300 | 13 | 307 673 | ||||

| 2017-12-05 | 2017-12-01 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,8034 | 5 215 | 9 | 300 373 | ||||

| 2017-11-30 | 2017-11-30 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,8351 | 12 978 | 24 | 295 158 | ||||

| 2017-11-30 | 2017-11-29 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,9362 | 7 942 | 15 | 282 180 | ||||

| 2017-11-30 | 2017-11-28 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,9722 | 12 395 | 24 | 274 238 | ||||

| 2017-11-27 | 2017-11-27 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 1,9976 | 10 042 | 20 | 261 843 | ||||

| 2017-11-27 | 2017-11-24 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 2,0233 | 6 505 | 13 | 251 801 | ||||

| 2017-11-27 | 2017-11-22 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 2,1024 | 5 261 | 11 | 245 296 | ||||

| 2017-11-21 | 2017-11-21 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 2,0599 | 7 236 | 15 | 240 035 | ||||

| 2017-11-21 | 2017-11-20 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 2,0745 | 4 800 | 10 | 232 799 | ||||

| 2017-11-21 | 2017-11-17 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 2,1210 | 6 295 | 13 | 227 999 | ||||

| 2017-11-16 | 2017-11-14 | 4 | Novartis Bioventures Ltd | ALT | Series B Convertible Preferred Stock | I | 2,67 | -345 | 2 760 | |||||

| 2017-11-16 | 2017-11-14 | 4 | Novartis Bioventures Ltd | ALT | Common Stock, par value $0.0001 | I | 182 262 | 2 049 563 | ||||||

| 2017-11-16 | 2017-11-14 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -23 | 182 | |||||

| 2017-11-16 | 2017-11-14 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -23 | 182 | |||||

| 2017-11-16 | 2017-11-14 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | -30 | 243 | |||||

| 2017-11-16 | 2017-11-14 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 12 030 | 22 418 | ||||||

| 2017-11-16 | 2017-11-14 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 12 030 | 22 418 | ||||||

| 2017-11-16 | 2017-11-14 | 4 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 16 039 | 66 806 | ||||||

| 2017-10-17 | 2017-10-17 | 4 | Hodges Philip | ALT | Common Stock, par value $0.0001 | I | -1 278 471 | 0 | ||||||

| 2017-10-17 | 2017-10-13 | 4 | Hodges Philip | ALT | Stock Options (option to buy) | D | 2,50 | 20 000 | 20 000 | |||||

| 2017-10-17 | 2017-10-13 | 4 | Drutz David | ALT | Stock Options (option to buy) | D | 2,50 | 20 000 | 20 000 | |||||

| 2017-10-17 | 2017-10-13 | 4 | GILL JOHN | ALT | Stock Options (option to buy) | D | 2,50 | 20 000 | 20 000 | |||||

| 2017-10-17 | 2017-10-13 | 4 | Schafer Klaus | ALT | Stock Options (option to buy) | D | 2,50 | 20 000 | 20 000 | |||||

| 2017-10-17 | 2017-10-13 | 4 | SCHAFFER DERACE L | ALT | Stock Options (option to buy) | D | 2,50 | 20 000 | 20 000 | |||||

| 2017-10-17 | 2017-10-13 | 4 | SAYARE MITCHEL | ALT | Stock Options (option to buy) | D | 2,50 | 20 000 | 20 000 | |||||

| 2017-09-26 | 2017-09-22 | 4 | CZEREPAK ELIZABETH | ALT | Stock Options (option to buy) | D | 2,48 | 62 500 | 62 500 | |||||

| 2017-09-26 | 2017-09-22 | 4 | CZEREPAK ELIZABETH | ALT | Stock Options (option to buy) | D | 2,48 | 62 500 | 62 500 | |||||

| 2017-09-26 | 2017-09-22 | 4 | Enright William | ALT | Stock Options (option to buy) | D | 2,48 | 125 000 | 125 000 | |||||

| 2017-09-26 | 2017-09-22 | 4 | Roberts M Scot | ALT | Stock Options (option to buy) | D | 2,48 | 50 000 | 50 000 | |||||

| 2017-09-26 | 2017-09-22 | 4 | Tasker Sybil | ALT | Stock Options (option to buy) | D | 2,48 | 50 000 | 50 000 | |||||

| 2017-08-28 | 2017-08-25 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 2,2478 | 50 000 | 112 | 221 704 | ||||

| 2017-08-28 | 2017-08-24 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 2,2447 | 17 326 | 39 | 171 704 | ||||

| 2017-08-24 | 2017-08-23 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | D | 2,2679 | 5 000 | 11 | 30 777 | ||||

| 2017-08-24 | 2017-08-22 | 4 | Drutz David | ALT | Common Stock, par value $0.0001 | D | 2,1515 | 5 000 | 11 | 25 777 | ||||

| 2017-08-23 | 2017-08-23 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 2,2225 | 43 352 | 96 | 154 378 | ||||

| 2017-08-23 | 2017-08-22 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 2,1012 | 5 958 | 13 | 111 026 | ||||

| 2017-08-23 | 2017-08-21 | 4 | SCHAFFER DERACE L | ALT | Common Stock, par value $0.0001 | D | 2,0213 | 690 | 1 | 105 068 | ||||

| 2017-08-23 | 2017-08-21 | 4 | Truffle Capital S.A.S. | ALT | Warrant | I | 2,67 | 30 696 | 30 696 | |||||

| 2017-08-23 | 2017-08-21 | 4 | Truffle Capital S.A.S. | ALT | Warrant | I | 2,67 | 30 696 | 30 696 | |||||

| 2017-08-23 | 2017-08-21 | 4 | Truffle Capital S.A.S. | ALT | Warrant | I | 2,67 | 40 927 | 40 927 | |||||

| 2017-08-23 | 2017-08-21 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | 940,0000 | 205 | 193 | 205 | |||

| 2017-08-23 | 2017-08-21 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | 940,0000 | 205 | 193 | 205 | |||

| 2017-08-23 | 2017-08-21 | 4 | Truffle Capital S.A.S. | ALT | Series B Convertible Preferred Stock | I | 2,67 | 940,0000 | 273 | 257 | 273 | |||

| 2017-08-23 | 2017-08-21 | 4 | Novartis Bioventures Ltd | ALT | Warrant | I | 2,67 | 465 086 | 465 086 | |||||

| 2017-08-23 | 2017-08-21 | 4 | Novartis Bioventures Ltd | ALT | Series B Convertible Preferred Stock | I | 2,67 | 940,0000 | 3 104 | 2 918 | 3 104 | |||

| 2017-08-18 | 2017-08-16 | 4 | Enright William | ALT | Stock Options (option to buy) | D | 0,08 | -91 733 | 0 | |||||

| 2017-08-18 | 2017-08-16 | 4 | Enright William | ALT | Stock Options (option to buy) | D | 0,08 | -71 644 | 0 | |||||

| 2017-08-18 | 2017-08-16 | 4 | Enright William | ALT | Common Stock | D | 0,0800 | 91 733 | 7 | 181 164 | ||||

| 2017-08-18 | 2017-08-16 | 4 | Enright William | ALT | Common Stock | D | 0,0800 | 71 644 | 6 | 89 431 | ||||

| 2017-06-08 | 2017-06-06 | 4 | Tasker Sybil | ALT | Stock Options (option to buy) | D | 4,12 | 40 000 | 40 000 | |||||

| 2017-06-06 | 2017-06-02 | 4 | GILL JOHN | ALT | Common Stock, par value $0.0001 | D | 4,3435 | 1 000 | 4 | 83 224 | ||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 562 167 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 561 648 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 570 781 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 611 160 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 673 508 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 744 083 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 790 496 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 976 436 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 570 781 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 561 648 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 562 167 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 611 160 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 673 508 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 666 197 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 677 047 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 711 834 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 739 752 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 744 083 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 790 496 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 976 436 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 666 197 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 677 047 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 711 834 | ||||||||

| 2017-05-15 | 3 | Truffle Capital S.A.S. | ALT | Common Stock, par value $0.0001 | I | 1 739 752 | ||||||||

| 2017-05-08 | 3 | Novartis Bioventures Ltd | NASDAQ:ALT | Common Stock, par value $0.0001 | I | 3 734 602 | ||||||||

| 2017-05-08 | 3 | Novartis Bioventures Ltd | NASDAQ:ALT | Common Stock, par value $0.0001 | I | 3 734 602 | ||||||||

| 2017-05-08 | 3 | Novartis Bioventures Ltd | NASDAQ:ALT | Common Stock, par value $0.0001 | I | 3 734 602 | ||||||||

| 2017-05-08 | 2017-05-04 | 4 | Roberts M Scot | NASDAQ:ALT | Stock Option (option to buy) | D | 13,38 | 11 235 | 11 235 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Roberts M Scot | NASDAQ:ALT | Stock Option (option to buy) | D | 2,59 | 8 956 | 8 956 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Roberts M Scot | NASDAQ:ALT | Stock Option (option to buy) | D | 0,59 | 8 956 | 8 956 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Roberts M Scot | NASDAQ:ALT | Stock Option (option to buy) | D | 0,08 | 55 120 | 55 120 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Hodges Philip | NASDAQ:ALT | Common Stock, par value $0.0001 | I | 4 455 | 4 455 | ||||||

| 2017-05-08 | 2017-05-04 | 4 | Hodges Philip | NASDAQ:ALT | Common Stock, par value $0.0001 | I | 36 785 | 36 785 | ||||||

| 2017-05-08 | 2017-05-04 | 4 | Hodges Philip | NASDAQ:ALT | Common Stock, par value $0.0001 | I | 1 278 471 | 1 278 471 | ||||||

| 2017-05-08 | 2017-05-04 | 4 | Schafer Klaus | NASDAQ:ALT | Stock Option (option to buy) | D | 0,59 | 1 791 | 1 791 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Schafer Klaus | NASDAQ:ALT | Stock Option (option to buy) | D | 0,08 | 1 791 | 1 791 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Schafer Klaus | NASDAQ:ALT | Stock Option (option to buy) | D | 0,08 | 1 791 | 1 791 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Schafer Klaus | NASDAQ:ALT | Stock Option (option to buy) | D | 0,08 | 4 775 | 4 775 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Schafer Klaus | NASDAQ:ALT | Common Stock, par value $0.0001 | D | 5 998 | 5 998 | ||||||

| 2017-05-08 | 2017-05-04 | 4 | Tasker Sybil | NASDAQ:ALT | Stock Options (option to buy) | D | 13,38 | 48 691 | 48 691 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Drutz David | NASDAQ:ALT | Stock Option (option to buy) | D | 0,59 | 4 177 | 4 177 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Drutz David | NASDAQ:ALT | Stock Option (option to buy) | D | 0,08 | 4 178 | 4 178 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Drutz David | NASDAQ:ALT | Stock Option (option to buy) | D | 0,08 | 4 178 | 4 178 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Drutz David | NASDAQ:ALT | Stock Option (option to buy) | D | 0,08 | 2 090 | 2 090 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Drutz David | NASDAQ:ALT | Stock Option (option to buy) | D | 0,08 | 1 791 | 1 791 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Drutz David | NASDAQ:ALT | Stock Option (option to buy) | D | 0,08 | 1 791 | 1 791 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Drutz David | NASDAQ:ALT | Stock Option (option to buy) | D | 0,08 | 4 755 | 4 755 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Drutz David | NASDAQ:ALT | Common Stock, par value $0.0001 | D | 20 777 | 20 777 | ||||||

| 2017-05-08 | 2017-05-04 | 4 | CZEREPAK ELIZABETH | NASDAQ:ALT | Stock Option (option to buy) | D | 13,38 | 18 727 | 18 727 | |||||

| 2017-05-08 | 2017-05-04 | 4 | CZEREPAK ELIZABETH | NASDAQ:ALT | Stock Option (option to buy) | D | 13,35 | 178 595 | 178 595 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Enright William | NASDAQ:ALT | Stock Options (option to buy) | D | 6,50 | 99 927 | 99 927 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Enright William | NASDAQ:ALT | Stock Options (option to buy) | D | 0,08 | 183 347 | 183 347 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Enright William | NASDAQ:ALT | Stock Options (option to buy) | D | 0,08 | 91 733 | 91 733 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Enright William | NASDAQ:ALT | Stock Options (option to buy) | D | 0,08 | 71 644 | 71 644 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Enright William | NASDAQ:ALT | Stock Options (option to buy) | D | 2,59 | 125 887 | 125 887 | |||||

| 2017-05-08 | 2017-05-04 | 4 | Enright William | NASDAQ:ALT | Common Stock, par value $0.0001 | D | 17 787 | 17 787 | ||||||

| 2017-01-24 | 2017-01-20 | 4 | Runge Jeffrey W. | PIP | Stock Option (right to buy) | D | 3,11 | -20 000 | 0 | |||||

| 2017-01-24 | 2017-01-20 | 4 | Runge Jeffrey W. | PIP | Common Stock, par value $0.0001 per share | D | 3,1100 | 20 000 | 62 | 197 700 | ||||

| 2017-01-17 | 2017-01-13 | 4 | SCHAFFER DERACE L | PIP | Stock option (right to buy) | D | 2,20 | -20 000 | 0 | |||||

| 2017-01-17 | 2017-01-13 | 4 | SCHAFFER DERACE L | PIP | Common Stock, $0.0001 par value per share | D | 2,2000 | 20 000 | 44 | 1 043 782 | ||||

| 2017-01-05 | 2017-01-04 | 4 | St Peter Steven | PIP | Stock Option (right to buy) | D | 2,47 | -20 000 | 0 | |||||

| 2017-01-05 | 2017-01-04 | 4 | St Peter Steven | PIP | Stock Option (right to buy) | D | 2,20 | -20 000 | 0 | |||||

| 2017-01-05 | 2017-01-04 | 4 | St Peter Steven | PIP | Stock Option (right to buy) | D | 3,11 | -20 000 | 0 | |||||

| 2017-01-05 | 2017-01-04 | 4 | St Peter Steven | PIP | Stock Option (right to buy) | D | 2,59 | -10 000 | 0 | |||||

| 2017-01-05 | 2017-01-04 | 4 | St Peter Steven | PIP | Common Stock, par value $0.0001 per share | D | 2,2000 | 20 000 | 44 | 205 004 | ||||

| 2017-01-05 | 2017-01-04 | 4 | St Peter Steven | PIP | Common Stock, par value $0.0001 per share | D | 3,1100 | 20 000 | 62 | 185 004 | ||||

| 2017-01-05 | 2017-01-04 | 4 | St Peter Steven | PIP | Common Stock, par value $0.0001 per share | D | 2,4700 | 20 000 | 49 | 165 004 | ||||

| 2017-01-05 | 2017-01-04 | 4 | St Peter Steven | PIP | Common Stock, par value $0.0001 per share | D | 2,5900 | 10 000 | 26 | 145 004 | ||||

| 2016-12-22 | 2016-12-21 | 4 | MACNEILL PHILIP | PIP | Employee Stock Option (right to buy) | D | 1,66 | -17 657 | 35 312 | |||||

| 2016-12-22 | 2016-12-21 | 4 | MACNEILL PHILIP | PIP | Employee Stock Option (right to buy) | D | 1,71 | -5 000 | 5 000 | |||||

| 2016-12-22 | 2016-12-21 | 4 | MACNEILL PHILIP | PIP | Common Stock, par value $0.0001 per share | D | 1,6600 | 17 657 | 29 | 126 346 | ||||

| 2016-12-22 | 2016-12-21 | 4 | MACNEILL PHILIP | PIP | Common Stock, par value $0.0001 per share | D | 1,7100 | 5 000 | 9 | 108 689 | ||||

| 2016-12-09 | 2016-12-09 | 4 | PRESCOTT GROUP CAPITAL MANAGEMENT, L.L.C. | PIP | Common Stock, par value $0.0001 per share | I | 3,2600 | -436 324 | -1 422 | 6 626 403 | ||||

| 2016-12-09 | 2016-12-08 | 4 | PRESCOTT GROUP CAPITAL MANAGEMENT, L.L.C. | PIP | Common Stock, par value $0.0001 per share | I | 3,2500 | -440 479 | -1 432 | 7 062 727 | ||||

| 2016-12-09 | 2016-12-07 | 4 | PRESCOTT GROUP CAPITAL MANAGEMENT, L.L.C. | PIP | Common Stock, par value $0.0001 per share | I | 3,2600 | -477 829 | -1 558 | 7 503 206 | ||||

| 2016-11-30 | 2016-11-28 | 4 | Runge Jeffrey W. | PIP | Stock Option (right to buy) | D | 2,20 | -20 000 | 0 | |||||

| 2016-11-30 | 2016-11-28 | 4 | Runge Jeffrey W. | PIP | Common Stock, par value $0.0001 per share | D | 2,2000 | 20 000 | 44 | 177 700 | ||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Stock option (right to buy) | D | 2,20 | -20 000 | 0 | |||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Stock option (right to buy) | D | 1,69 | -20 000 | 0 | |||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Stock option (right to buy) | D | 1,71 | -135 660 | 0 | |||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Stock Option (right to buy) | D | 1,94 | -240 000 | 0 | |||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Stock Option (right to buy) | D | 1,19 | -37 500 | 0 | |||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Stock Option (right to buy) | D | 2,46 | -30 573 | 0 | |||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Common Stock, $0.0001 par value per share | D | 2,2000 | 20 000 | 44 | 898 055 | ||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Common Stock, $0.0001 par value per share | D | 1,6900 | 20 000 | 34 | 878 055 | ||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Common Stock, $0.0001 par value per share | D | 1,7100 | 135 660 | 232 | 858 055 | ||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Common Stock, $0.0001 par value per share | D | 1,9400 | 240 000 | 466 | 722 395 | ||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Common Stock, $0.0001 par value per share | D | 1,1900 | 37 500 | 45 | 482 395 | ||||

| 2016-11-23 | 2016-11-22 | 4 | RICHMAN ERIC I | PIP | Common Stock, $0.0001 par value per share | D | 2,4600 | 30 573 | 75 | 444 895 | ||||