Statistiques de base

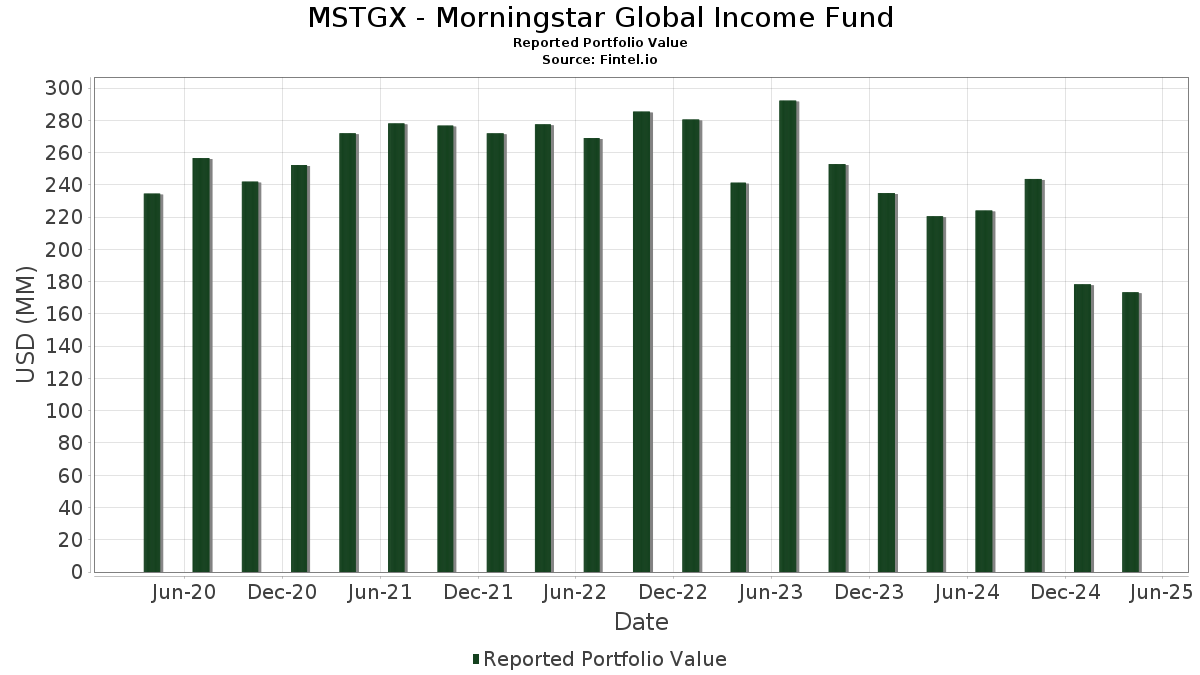

| Valeur du portefeuille | $ 173 462 063 |

| Positions actuelles | 653 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

MSTGX - Morningstar Global Income Fund a déclaré un total de 653 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 173 462 063 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de MSTGX - Morningstar Global Income Fund sont Vanguard Scottsdale Funds - Vanguard Long-Term Treasury ETF (US:VGLT) , Schwab Strategic Trust - Schwab Short-Term U.S. Treasury ETF (US:SCHO) , Vanguard Scottsdale Funds - Vanguard Intermediate-Term Treasury ETF (US:VGIT) , Organization of Football Prognostics S.A. (GR:OPAP) , and Vanguard International Equity Index Funds - Vanguard Total World Stock ETF (US:VT) . Les nouvelles positions de MSTGX - Morningstar Global Income Fund incluent Vanguard International Equity Index Funds - Vanguard Total World Stock ETF (US:VT) , Altice France SA/France (FR:US02156LAH42) , OAKTREE CLO 2022-1 LT FRN (KY:US67402NAA00) , INTESA SANPAOLO SPA REGD 144A P/P 7.80000000 (IT:US46115HCF29) , and Inter-American Development Bank (XX:XS2696224745) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 5,68 | 4,0826 | 4,0826 | ||

| 5,68 | 4,0826 | 4,0826 | ||

| 4,37 | 3,1429 | 3,1429 | ||

| 4,37 | 3,1429 | 3,1429 | ||

| 0,18 | 10,10 | 7,2642 | 2,3998 | |

| 0,03 | 2,92 | 2,1002 | 2,1002 | |

| 2,57 | 1,8448 | 1,8448 | ||

| 2,57 | 1,8448 | 1,8448 | ||

| 2,39 | 1,7174 | 1,7174 | ||

| 2,39 | 1,7174 | 1,7174 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 0,07 | 4,11 | 2,9557 | -4,1693 | |

| -2,92 | -2,0978 | -2,0978 | ||

| -2,92 | -2,0978 | -2,0978 | ||

| 0,35 | 0,35 | 0,2524 | -1,7536 | |

| 0,00 | 0,08 | 0,0573 | -1,5848 | |

| 0,05 | 0,05 | 0,0343 | -1,3499 | |

| 0,00 | 0,00 | 0,0001 | -1,1368 | |

| 0,02 | 0,64 | 0,4636 | -1,0979 | |

| 0,02 | 0,47 | 0,3356 | -0,8828 | |

| 0,01 | 0,56 | 0,4022 | -0,7119 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-06-26 pour la période de déclaration 2025-04-30. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | Prix moyen de l'action | Actions (en millions) |

ΔActions (%) |

ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VGLT / Vanguard Scottsdale Funds - Vanguard Long-Term Treasury ETF | 0,18 | 19,50 | 10,10 | 22,02 | 7,2642 | 2,3998 | |||

| FUT. CBT 5Y T-NOTE JUN25 / DIR (000000000) | 5,68 | 4,0826 | 4,0826 | ||||||

| FUT. CBT 5Y T-NOTE JUN25 / DIR (000000000) | 5,68 | 4,0826 | 4,0826 | ||||||

| JUN 25 US 2YR JUN 25 / DIR (000000000) | 4,37 | 3,1429 | 3,1429 | ||||||

| JUN 25 US 2YR JUN 25 / DIR (000000000) | 4,37 | 3,1429 | 3,1429 | ||||||

| SCHO / Schwab Strategic Trust - Schwab Short-Term U.S. Treasury ETF | 0,17 | 22,78 | 4,18 | 23,90 | 3,0085 | 1,0246 | |||

| VGIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Treasury ETF | 0,07 | -67,03 | 4,11 | -66,11 | 2,9557 | -4,1693 | |||

| OPAP / Organization of Football Prognostics S.A. | 0,13 | -29,15 | 2,96 | -8,21 | 2,1306 | 0,2339 | |||

| VT / Vanguard International Equity Index Funds - Vanguard Total World Stock ETF | 0,03 | 2,92 | 2,1002 | 2,1002 | |||||

| US6652791053 / Northern Inst Fds LIQ ASET PORTF | 2,79 | 12,64 | 2,79 | 12,64 | 2,0060 | 0,5510 | |||

| US6652791053 / Northern Inst Fds LIQ ASET PORTF | 2,79 | 0,00 | 2,79 | 0,00 | 2,0060 | 0,0000 | |||

| FUT. U.S. T-BONDS JUN25 / DIR (000000000) | 2,57 | 1,8448 | 1,8448 | ||||||

| FUT. U.S. T-BONDS JUN25 / DIR (000000000) | 2,57 | 1,8448 | 1,8448 | ||||||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0,06 | -12,87 | 2,56 | -4,26 | 1,8402 | 0,2697 | |||

| CRIN / UniCredit S.p.A. | 0,04 | 44,79 | 2,56 | 83,50 | 1,8395 | 1,0202 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0,02 | 7,40 | 2,54 | 16,38 | 1,8290 | 0,5452 | |||

| BAESF / BAE Systems plc | 0,11 | 10,67 | 2,49 | 69,73 | 1,7910 | 0,9289 | |||

| VICI / VICI Properties Inc. | 0,08 | -7,79 | 2,41 | -0,82 | 1,7349 | 0,3058 | |||

| ZURVY / Zurich Insurance Group AG - Depositary Receipt (Common Stock) | 0,00 | -24,36 | 2,40 | -11,45 | 1,7242 | 0,1330 | |||

| 06 JUN 25 EURX 06 JUN / DIR (DE000F1B2NG7) | 2,39 | 1,7174 | 1,7174 | ||||||

| 06 JUN 25 EURX 06 JUN / DIR (DE000F1B2NG7) | 2,39 | 1,7174 | 1,7174 | ||||||

| SOBKY / SoftBank Corp. - Depositary Receipt (Common Stock) | 1,54 | -25,77 | 2,34 | -12,67 | 1,6798 | 0,1083 | |||

| ET / Energy Transfer LP - Limited Partnership | 0,14 | -9,69 | 2,29 | -27,06 | 1,6461 | -0,1978 | |||

| SIEGY / Siemens Aktiengesellschaft - Depositary Receipt (Common Stock) | 0,01 | -9,97 | 2,25 | -3,30 | 1,6212 | 0,2515 | |||

| NTPXX / Northern Institutional Funds - Northern Institutional Treasury Portfolio Premier Shares | 1,93 | 25,93 | 1,93 | 25,98 | 1,3842 | 0,2850 | |||

| NG/ / National Grid PLC | 0,13 | 3 936,33 | 1,84 | 4 395,12 | 1,3258 | 1,3041 | |||

| CCEP / Coca-Cola Europacific Partners PLC | 0,02 | 27,97 | 1,84 | 47,83 | 1,3204 | 0,5907 | |||

| ENLAY / Enel SpA - Depositary Receipt (Common Stock) | 0,19 | 2 357,96 | 1,69 | 4 725,71 | 1,2149 | 1,1977 | |||

| PETR4 / Petróleo Brasileiro S.A. - Petrobras - Preferred Stock | 0,30 | -17,95 | 1,67 | -34,97 | 1,1999 | -0,3074 | |||

| JPM / JPMorgan Chase & Co. | 0,01 | -40,56 | 1,61 | -45,60 | 1,1605 | -0,5826 | |||

| NN / NN Group N.V. | 0,03 | 1,61 | 1,1580 | 1,1580 | |||||

| NTPXX / Northern Institutional Funds - Northern Institutional Treasury Portfolio Premier Shares | 1,58 | 59 747,92 | 1,58 | 78 950,00 | 1,1369 | 1,1350 | |||

| FIBRAPL14 / PrologisProperty Mexico SA de CV | 0,44 | -15,65 | 1,55 | -3,90 | 1,1177 | 0,1673 | |||

| SCHH / Schwab Strategic Trust - Schwab U.S. REIT ETF | 0,07 | 0,00 | 1,54 | -0,90 | 1,1057 | 0,1942 | |||

| NTPXX / Northern Institutional Funds - Northern Institutional Treasury Portfolio Premier Shares | 1,53 | 181 239,38 | 1,53 | 115,51 | 1,0991 | 1,0986 | |||

| ENB / Enbridge Inc. | 0,03 | 109,84 | 1,38 | 127,06 | 0,9899 | 0,6335 | |||

| JUN 25 LIF LONG JUN 25 / DIR (GB00MDWGKH25) | 1,25 | 0,8961 | 0,8961 | ||||||

| JUN 25 LIF LONG JUN 25 / DIR (GB00MDWGKH25) | 1,25 | 0,8961 | 0,8961 | ||||||

| SGO / Compagnie de Saint-Gobain S.A. | 0,01 | -9,28 | 1,08 | 5,18 | 0,7743 | 0,1729 | |||

| VLVLY / AB Volvo (publ) - Depositary Receipt (Common Stock) | 0,03 | -41,97 | 0,85 | -42,79 | 0,6080 | -0,2597 | |||

| JUN 25 CBT UL JUN 25 / DIR (000000000) | 0,73 | 0,5221 | 0,5221 | ||||||

| JUN 25 CBT UL JUN 25 / DIR (000000000) | 0,73 | 0,5221 | 0,5221 | ||||||

| US02156LAH42 / Altice France SA/France | 0,69 | 2,84 | 0,4944 | 0,1019 | |||||

| JNJ / Johnson & Johnson | 0,00 | -27,75 | 0,66 | -25,73 | 0,4754 | -0,0479 | |||

| 2454 / MediaTek Inc. | 0,02 | -75,28 | 0,64 | -75,77 | 0,4636 | -1,0979 | |||

| KO / The Coca-Cola Company | 0,01 | -28,46 | 0,61 | -18,27 | 0,4413 | 0,0003 | |||

| CMCSA / Comcast Corporation | 0,02 | -18,96 | 0,59 | -17,70 | 0,4219 | 0,0033 | |||

| JCI / Johnson Controls International plc | 0,01 | -72,58 | 0,56 | -70,52 | 0,4022 | -0,7119 | |||

| 088980 / Macquarie Korea Infrastructure Fund | 0,07 | -61,42 | 0,54 | -56,98 | 0,3858 | -0,3463 | |||

| CME / CME Group Inc. | 0,00 | -28,85 | 0,53 | -16,61 | 0,3827 | 0,0076 | |||

| PM / Philip Morris International Inc. | 0,00 | -46,11 | 0,52 | -29,14 | 0,3730 | -0,0567 | |||

| FUT JUN 25 SFE 10Y T-BOND / DIR (000000000) | 0,52 | 0,3707 | 0,3707 | ||||||

| FUT JUN 25 SFE 10Y T-BOND / DIR (000000000) | 0,52 | 0,3707 | 0,3707 | ||||||

| US64072TAC99 / CSC Holdings LLC | 0,51 | 25,62 | 0,3671 | 0,1566 | |||||

| VZ / Verizon Communications Inc. | 0,01 | -27,16 | 0,51 | -18,59 | 0,3658 | -0,0010 | |||

| US67402NAA00 / OAKTREE CLO 2022-1 LT FRN | 0,48 | -1,44 | 0,3458 | 0,0591 | |||||

| MSADF / MS&AD Insurance Group Holdings, Inc. | 0,02 | -79,47 | 0,47 | -77,53 | 0,3356 | -0,8828 | |||

| PG / The Procter & Gamble Company | 0,00 | -28,02 | 0,46 | -29,53 | 0,3334 | -0,0530 | |||

| US46115HCF29 / INTESA SANPAOLO SPA REGD 144A P/P 7.80000000 | 0,45 | -1,31 | 0,3243 | 0,0555 | |||||

| XS2696224745 / Inter-American Development Bank | 0,42 | -31,91 | 0,2998 | -0,0593 | |||||

| APD / Air Products and Chemicals, Inc. | 0,00 | -16,58 | 0,41 | -32,57 | 0,2951 | -0,0624 | |||

| PFE / Pfizer Inc. | 0,02 | -17,48 | 0,40 | -24,14 | 0,2873 | -0,0217 | |||

| MDT / Medtronic plc | 0,00 | -30,17 | 0,40 | -34,82 | 0,2841 | -0,0721 | |||

| XOM / Exxon Mobil Corporation | 0,00 | -27,34 | 0,39 | -28,12 | 0,2813 | -0,0386 | |||

| CCI / Crown Castle Inc. | 0,00 | -36,22 | 0,39 | -24,47 | 0,2802 | -0,0228 | |||

| PEP / PepsiCo, Inc. | 0,00 | -19,50 | 0,39 | -27,50 | 0,2769 | -0,0354 | |||

| RIO / Rio Tinto Group | 0,00 | -37,57 | 0,37 | -35,08 | 0,2676 | -0,0695 | |||

| TXN / Texas Instruments Incorporated | 0,00 | -16,67 | 0,37 | -27,70 | 0,2647 | -0,0346 | |||

| MDLZ / Mondelez International, Inc. | 0,01 | -32,75 | 0,37 | -21,00 | 0,2630 | -0,0090 | |||

| US6652791053 / Northern Inst Fds LIQ ASET PORTF | 0,35 | -87,42 | 0,35 | -87,41 | 0,2524 | -1,7536 | |||

| US30711XQW73 / Fannie Mae Connecticut Avenue Securities | 0,35 | -1,42 | 0,2507 | 0,0428 | |||||

| ABBV / AbbVie Inc. | 0,00 | -33,89 | 0,35 | -29,96 | 0,2493 | -0,0411 | |||

| SATS / EchoStar Corporation | 0,34 | -2,00 | 0,2470 | 0,0413 | |||||

| GILD / Gilead Sciences, Inc. | 0,00 | -33,18 | 0,34 | -26,68 | 0,2431 | -0,0281 | |||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0,33 | -0,30 | 0,2398 | 0,0433 | |||||

| FRT / Federal Realty Investment Trust | 0,00 | -16,32 | 0,33 | -27,53 | 0,2367 | -0,0303 | |||

| AMCR / Amcor plc | 0,03 | -24,10 | 0,32 | -28,19 | 0,2311 | -0,0317 | |||

| AMGN / Amgen Inc. | 0,00 | -27,70 | 0,32 | -26,39 | 0,2293 | -0,0249 | |||

| MCD / McDonald's Corporation | 0,00 | -23,63 | 0,31 | -15,49 | 0,2243 | 0,0076 | |||

| AEP / American Electric Power Company, Inc. | 0,00 | -30,12 | 0,31 | -23,00 | 0,2216 | -0,0136 | |||

| BRSTNCNTF204 / Brazil Notas do Tesouro Nacional Serie F | 0,30 | 7,12 | 0,2165 | 0,0510 | |||||

| US35564KDX46 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,30 | -1,66 | 0,2131 | 0,0360 | |||||

| US05608BAN01 / BX Commercial Mortgage Trust 2019-IMC | 0,29 | -1,68 | 0,2106 | 0,0361 | |||||

| IVYCST 7.625 01/30/33 144A / DBT (US221625AT38) | 0,28 | -3,08 | 0,2036 | 0,0315 | |||||

| USB / U.S. Bancorp | 0,01 | -11,16 | 0,28 | -25,00 | 0,2029 | -0,0181 | |||

| HII / Huntington Ingalls Industries, Inc. | 0,00 | 10,56 | 0,28 | 29,44 | 0,1994 | 0,0732 | |||

| US382371AC66 / GoodLeap Sustainable Home Solutions Trust 2021-3 | 0,28 | -12,93 | 0,1986 | 0,0122 | |||||

| KMI / Kinder Morgan, Inc. | 0,01 | -24,14 | 0,28 | -27,25 | 0,1978 | -0,0248 | |||

| US35566CBD65 / Freddie Mac STACR REMIC Trust 2020-DNA6 | 0,27 | -2,49 | 0,1971 | 0,0320 | |||||

| US05608RAA32 / BX Trust | 0,27 | -1,11 | 0,1927 | 0,0341 | |||||

| US23330JAB70 / DP World PLC | 0,27 | -0,37 | 0,1925 | 0,0348 | |||||

| KENINT 9.75 02/16/31 144A / DBT (US491798AM68) | 0,27 | -3,97 | 0,1918 | 0,0289 | |||||

| US05609VAL99 / BX Commercial Mortgage Trust 2021-VOLT | 0,27 | -1,49 | 0,1912 | 0,0330 | |||||

| US335934AU96 / First Quantum Minerals Ltd. | 0,26 | -44,16 | 0,1895 | -0,0877 | |||||

| ZFFNGR 6.875 04/23/32 144A / DBT (US98877DAG07) | 0,26 | 82,64 | 0,1893 | 0,1044 | |||||

| ZFFNGR 6.875 04/23/32 144A / DBT (US98877DAG07) | 0,26 | 82,64 | 0,1893 | 0,1044 | |||||

| US35564KBE82 / FHLMC STACR REMIC Trust, Series 2021-DNA1, Class B2 | 0,26 | -3,01 | 0,1856 | 0,0293 | |||||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0,01 | -26,56 | 0,26 | -32,72 | 0,1849 | -0,0397 | |||

| IBM / International Business Machines Corporation | 0,00 | -22,61 | 0,26 | -26,86 | 0,1845 | -0,0215 | |||

| KVUE / Kenvue Inc. | 0,01 | -22,94 | 0,25 | -14,77 | 0,1831 | 0,0080 | |||

| BLK / BlackRock, Inc. | 0,00 | -11,33 | 0,25 | -24,70 | 0,1801 | -0,0151 | |||

| CVX / Chevron Corporation | 0,00 | -31,43 | 0,25 | -37,50 | 0,1799 | -0,0551 | |||

| BFLD 2024-UNIV D / ABS-O (US08861RAG65) | 0,25 | -1,20 | 0,1785 | 0,0310 | |||||

| US09630QAQ47 / BlueMountain CLO XXX Ltd | 0,25 | -0,80 | 0,1783 | 0,0312 | |||||

| US21623PAJ66 / Cook Park CLO Ltd | 0,25 | -1,59 | 0,1782 | 0,0305 | |||||

| KMB / Kimberly-Clark Corporation | 0,00 | -22,75 | 0,25 | -21,59 | 0,1779 | -0,0077 | |||

| US05682GAL23 / Bain Capital Credit CLO 2022-2 Ltd | 0,25 | -1,99 | 0,1775 | 0,0299 | |||||

| US05971PAB40 / Banco Mercantil del Norte SA/Grand Cayman | 0,24 | 1,24 | 0,1757 | 0,0337 | |||||

| US17326DAC65 / Citigroup Commercial Mortgage Trust 2017-P8 | 0,24 | 0,83 | 0,1752 | 0,0335 | |||||

| US05609JAL61 / BXHPP TRUST 2021-FILM BXHPP 2021-FILM C | 0,24 | -4,71 | 0,1752 | 0,0250 | |||||

| US09630LAE20 / BlueMountain CLO XXIX Ltd | 0,24 | -3,60 | 0,1736 | 0,0263 | |||||

| US69356MAA45 / PM General Purchaser LLC | 0,24 | -16,32 | 0,1735 | 0,0039 | |||||

| US87167WAJ45 / Symphony CLO XXV Ltd 0.000 19 Apr 2034 Class E 144A | 0,24 | -5,18 | 0,1718 | 0,0244 | |||||

| BAX / Baxter International Inc. | 0,01 | 2,02 | 0,24 | -2,46 | 0,1718 | 0,0281 | |||

| US35564KRN18 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,23 | -0,85 | 0,1678 | 0,0293 | |||||

| US74365PAF53 / Prosus NV | 0,23 | 3,56 | 0,1676 | 0,0349 | |||||

| US41809JAA34 / Jordan Government International Bond | 0,23 | -0,43 | 0,1674 | 0,0305 | |||||

| US71677KAB44 / PETM 7 3/4 02/15/29 | 0,23 | 0,1674 | 0,1674 | ||||||

| US126307AQ03 / CSC HOLDINGS LLC 5.50% 04/15/2027 144A | 0,23 | -44,23 | 0,1670 | -0,0778 | |||||

| US55285AAA51 / MF1 2022-FL9 LLC SER 2022-FL9 CL A V/R REGD 144A P/P 2.96000000 | 0,23 | -2,95 | 0,1654 | 0,0260 | |||||

| FM / First Quantum Minerals Ltd. | 0,23 | 0,1636 | 0,1636 | ||||||

| US30227FAG54 / Extended Stay America Trust | 0,22 | -2,63 | 0,1601 | 0,0260 | |||||

| US30227FAL40 / Extended Stay America Trust | 0,22 | -2,63 | 0,1599 | 0,0255 | |||||

| EMR / Emerson Electric Co. | 0,00 | -23,72 | 0,22 | -38,38 | 0,1587 | -0,0514 | |||

| 46090K109 / Intrawest Resorts Holdings, Inc. | 0,22 | -0,91 | 0,1569 | 0,0275 | |||||

| US58518N2A93 / MEGlobal Canada ULC | 0,22 | 1,40 | 0,1566 | 0,0307 | |||||

| AKUCN 9 08/01/27 144A / DBT (US01021XAB64) | 0,22 | 0,46 | 0,1566 | 0,0295 | |||||

| HON / Honeywell International Inc. | 0,00 | 8,99 | 0,22 | 2,84 | 0,1560 | 0,0317 | |||

| BMY / Bristol-Myers Squibb Company | 0,00 | -20,37 | 0,22 | -32,29 | 0,1558 | -0,0319 | |||

| D / Dominion Energy, Inc. | 0,00 | -18,37 | 0,22 | -20,07 | 0,1550 | -0,0036 | |||

| CSCO / Cisco Systems, Inc. | 0,00 | -15,98 | 0,22 | -19,78 | 0,1548 | -0,0032 | |||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0,21 | -15,42 | 0,1545 | 0,0053 | |||||

| NTRS / Northern Trust Corporation | 0,00 | -11,53 | 0,21 | -25,96 | 0,1520 | -0,0157 | |||

| US63543LAD73 / National Collegiate Student Loan Trust 2007-2 | 0,21 | -9,48 | 0,1515 | 0,0149 | |||||

| TROW / T. Rowe Price Group, Inc. | 0,00 | 5,42 | 0,21 | -20,15 | 0,1512 | -0,0035 | |||

| TPMT 2015-5 B3 / ABS-O (US89171VAG23) | 0,21 | 1,46 | 0,1498 | 0,0293 | |||||

| AssuredPartners Term Loan B-5 (Incremental) 350 2031-02-04 / LON (US04621HAW34) | 0,21 | -0,48 | 0,1494 | 0,0269 | |||||

| US20755DAB29 / Fannie Mae Connecticut Avenue Securities | 0,21 | -1,43 | 0,1493 | 0,0254 | |||||

| LIGPLL 7.25 08/15/32 144A / DBT (US53229KAA79) | 0,21 | 43,75 | 0,1490 | 0,0640 | |||||

| PremiStars (fka Reedy Industries) Term Loan B 425 2028-08-01 / LON (US88366MAE49) | 0,21 | -0,96 | 0,1484 | 0,0257 | |||||

| PremiStars (fka Reedy Industries) Term Loan B 425 2028-08-01 / LON (US88366MAE49) | 0,21 | -0,96 | 0,1484 | 0,0257 | |||||

| JANEST 7.125 04/30/31 144A / DBT (US47077WAC29) | 0,21 | 0,00 | 0,1483 | 0,0269 | |||||

| JANEST 7.125 04/30/31 144A / DBT (US47077WAC29) | 0,21 | 0,00 | 0,1483 | 0,0269 | |||||

| US36250PAM77 / GS Mortgage Securities Trust 2015-GC32 | 0,21 | -1,44 | 0,1480 | 0,0258 | |||||

| CIFC 2017-3A D1R / ABS-CBDO (US12548JAU60) | 0,21 | -4,21 | 0,1477 | 0,0218 | |||||

| CIFC 2017-3A D1R / ABS-CBDO (US12548JAU60) | 0,21 | -4,21 | 0,1477 | 0,0218 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,20 | -1,94 | 0,1456 | 0,0244 | |||||

| RIDE 2025-SHRE D / ABS-O (US765692AG37) | 0,20 | 0,1453 | 0,1453 | ||||||

| OBX 2024-NQM3 M1 / ABS-O (US67118KAD54) | 0,20 | 0,00 | 0,1452 | 0,0267 | |||||

| US67091TAA34 / OCP SA | 0,20 | -0,99 | 0,1452 | 0,0255 | |||||

| US67091TAA34 / OCP SA | 0,20 | -0,99 | 0,1452 | 0,0255 | |||||

| UPS / United Parcel Service, Inc. | 0,00 | -27,40 | 0,20 | -39,58 | 0,1445 | -0,0504 | |||

| TTKOM / Türk Telekomünikasyon Anonim Sirketi | 0,20 | -1,48 | 0,1439 | 0,0245 | |||||

| TTKOM / Türk Telekomünikasyon Anonim Sirketi | 0,20 | -1,48 | 0,1439 | 0,0245 | |||||

| PNC / The PNC Financial Services Group, Inc. | 0,00 | -12,84 | 0,20 | -30,42 | 0,1435 | -0,0247 | |||

| US67116VAA98 / OBX 2022-NQM6 TRUST SER 2022-NQM6 CL A1 V/R REGD 144A P/P 4.70000000 | 0,20 | -2,94 | 0,1425 | 0,0227 | |||||

| SHC / Sotera Health Company | 0,20 | -0,50 | 0,1425 | 0,0251 | |||||

| SHC / Sotera Health Company | 0,20 | -0,50 | 0,1425 | 0,0251 | |||||

| US78457JAQ58 / SMRT 2022-MINI SOFR30A+330 01/15/2024 144A | 0,20 | -1,01 | 0,1423 | 0,0251 | |||||

| HIH 2024-61P F / ABS-O (US40444VAL53) | 0,20 | -1,01 | 0,1419 | 0,0244 | |||||

| US92537RAA77 / THYELE 5 1/4 07/15/27 | 0,20 | 0,1416 | 0,1416 | ||||||

| US62475WAL90 / MTN COML MTG TR 2022-LPFL F TSFR1M+393.47 03/15/2039 144A | 0,20 | 0,51 | 0,1411 | 0,0264 | |||||

| BHCCN 10 04/15/32 144A / DBT (US68288AAA51) | 0,20 | 0,1408 | 0,1408 | ||||||

| US17330VAA44 / CMLTI_22-A | 0,20 | -2,50 | 0,1404 | 0,0226 | |||||

| US21871NAA90 / CoreCivic, Inc. | 0,19 | 32,88 | 0,1401 | 0,0542 | |||||

| Spencer Spirit Term Loan B 550 2031-06-13 / LON (US84823UAE29) | 0,19 | -3,00 | 0,1399 | 0,0220 | |||||

| Spencer Spirit Term Loan B 550 2031-06-13 / LON (US84823UAE29) | 0,19 | -3,00 | 0,1399 | 0,0220 | |||||

| US12434CAQ78 / BX 2021-SDMF 1ML+193.7 09/15/2023 144A | 0,19 | 0,00 | 0,1394 | 0,0257 | |||||

| US89177HAE27 / TOWD POINT MORTGAGE TRUST 2019-HY2 SER 2019-HY2 CL B1 V/R REGD 144A P/P 2.39800000 | 0,19 | -0,52 | 0,1386 | 0,0251 | |||||

| US78433QAA31 / SG Residential Mortgage Trust 2022-1 | 0,19 | -1,04 | 0,1374 | 0,0239 | |||||

| US59980MAJ09 / MCMLT 18-2 M3 144A FRN 05-25-58 | 0,19 | 0,53 | 0,1369 | 0,0254 | |||||

| US05549GAA94 / BHMS 2018-ATLS | 0,19 | 0,00 | 0,1365 | 0,0250 | |||||

| US46593EAG08 / JP Morgan Chase Commercial Mortgage Securities Corp | 0,19 | -0,53 | 0,1363 | 0,0245 | |||||

| BANK 2024-BNK48 A5 / ABS-O (US06541GAH02) | 0,19 | 1,07 | 0,1360 | 0,0256 | |||||

| VTR / Ventas, Inc. | 0,00 | -28,10 | 0,19 | -16,37 | 0,1359 | 0,0028 | |||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0,19 | -3,11 | 0,1346 | 0,0207 | |||||

| HAS / Hasbro, Inc. | 0,00 | -18,77 | 0,19 | -13,49 | 0,1345 | 0,0081 | |||

| NI / NiSource Inc. | 0,00 | -17,95 | 0,18 | -14,42 | 0,1330 | 0,0067 | |||

| GLOBAU 8.75 01/15/32 144A / DBT (US00033GAB14) | 0,18 | -9,36 | 0,1325 | 0,0129 | |||||

| O / Realty Income Corporation | 0,00 | -30,16 | 0,18 | -26,23 | 0,1300 | -0,0136 | |||

| US64831MAA09 / New Residential Mortgage Loan Trust 2022-NQM2 | 0,18 | -0,56 | 0,1293 | 0,0231 | |||||

| US36253PAB85 / GS Mortgage Securities Trust 2017-GS6 | 0,18 | 1,13 | 0,1292 | 0,0250 | |||||

| US12659YAA29 / COLT 2022-3 Mortgage Loan Trust | 0,18 | -2,72 | 0,1291 | 0,0204 | |||||

| US359678AC31 / FULL HOUSE RESORTS INC REGD 144A P/P 8.25000000 | 0,18 | 17,22 | 0,1279 | 0,0391 | |||||

| US04649VAY65 / ASURION LLC | 0,18 | -2,21 | 0,1275 | 0,0207 | |||||

| 1IFF / International Flavors & Fragrances Inc. | 0,00 | 0,18 | 0,1271 | 0,1271 | |||||

| Acrisure Term Loan B 300 2030-11-01 / LON (US00488PAV76) | 0,18 | -1,68 | 0,1267 | 0,0215 | |||||

| Acrisure Term Loan B 300 2030-11-01 / LON (US00488PAV76) | 0,18 | -1,68 | 0,1267 | 0,0215 | |||||

| SAVE 11 03/06/30 144A / DBT (US84859BAC54) | 0,17 | 0,1253 | 0,1253 | ||||||

| CVS / CVS Health Corporation | 0,00 | -57,12 | 0,17 | -49,40 | 0,1225 | -0,0751 | |||

| OPAL US LLC TL / LON (F7000QAB7) | 0,17 | 0,1211 | 0,1211 | ||||||

| US05609QAA40 / BX Commercial Mortgage Trust 2021-ACNT | 0,17 | 0,00 | 0,1210 | 0,0219 | |||||

| US25470MAG42 / DISH Network Corp | 0,17 | 0,00 | 0,1209 | 0,0217 | |||||

| SBUX / Starbucks Corporation | 0,00 | -32,29 | 0,17 | -49,85 | 0,1207 | -0,0752 | |||

| US665531AG42 / Northern Oil and Gas Inc | 0,17 | -2,91 | 0,1207 | 0,0191 | |||||

| Primo Brands (BlueTriton Brands/Nestle Waters NA) Term Loan B 225 2028-03-01 / LON (US89678QAD88) | 0,17 | 0,1195 | 0,1195 | ||||||

| US035198AF76 / Angolan Government International Bond | 0,16 | -11,83 | 0,1184 | 0,0089 | |||||

| US14445LAA52 / Carriage Purchaser Inc | 0,16 | -11,35 | 0,1181 | 0,0091 | |||||

| US24022KAB52 / DCert Buyer, Inc. 2019 Term Loan B | 0,16 | -0,61 | 0,1178 | 0,0214 | |||||

| US36264EAG98 / GS Mortgage-Backed Securities Trust 2022-NQM1 | 0,16 | -1,22 | 0,1170 | 0,0202 | |||||

| OKE / ONEOK, Inc. | 0,00 | -24,10 | 0,16 | -35,97 | 0,1170 | -0,0320 | |||

| SPG / Simon Property Group, Inc. | 0,00 | -13,15 | 0,16 | -21,36 | 0,1166 | -0,0046 | |||

| US36250GAW50 / GS Mortgage Securities Corp. II, Series 2015-GC30, Class C | 0,16 | 0,63 | 0,1164 | 0,0224 | |||||

| TPC / Tutor Perini Corporation | 0,16 | 11,03 | 0,1163 | 0,0311 | |||||

| TPC / Tutor Perini Corporation | 0,16 | 11,03 | 0,1163 | 0,0311 | |||||

| NYMT 2024-BPL1 A1 / ABS-O (US62956MAA36) | 0,16 | 0,00 | 0,1162 | 0,0212 | |||||

| LHOME 2024-RTL1 A1 / ABS-O (US50205DAA72) | 0,16 | 0,00 | 0,1162 | 0,0212 | |||||

| CAFL 2023-RTL1 A1 / ABS-O (US124762AA38) | 0,16 | -0,62 | 0,1159 | 0,0205 | |||||

| CAFL 2023-RTL1 A1 / ABS-O (US124762AA38) | 0,16 | -0,62 | 0,1159 | 0,0205 | |||||

| TRNTS 2024-27A D1 / ABS-CBDO (US89642VAJ70) | 0,16 | -1,83 | 0,1158 | 0,0192 | |||||

| TRNTS 2024-27A D1 / ABS-CBDO (US89642VAJ70) | 0,16 | -1,83 | 0,1158 | 0,0192 | |||||

| COLT 2024-1 M1 / ABS-O (US19688TAD72) | 0,16 | 0,00 | 0,1155 | 0,0210 | |||||

| PSTAT 2022-3A CR / ABS-CBDO (US69690CAU71) | 0,16 | -0,62 | 0,1153 | 0,0207 | |||||

| PSTAT 2022-3A CR / ABS-CBDO (US69690CAU71) | 0,16 | -0,62 | 0,1153 | 0,0207 | |||||

| GRADE 2024-RTL4 A1 / ABS-O (US79584CAA99) | 0,16 | -0,62 | 0,1152 | 0,0205 | |||||

| US01771JAH68 / ALLEN MEDIA LLC | 0,16 | -22,33 | 0,1151 | -0,0061 | |||||

| US55342UAH77 / Mpt Operating Partnership Lp / Mpt Finance Corp 5.00% 10/15/2027 Bond | 0,16 | -19,29 | 0,1143 | -0,0014 | |||||

| US55316VAL80 / MHC Commercial Mortgage Trust 2021-MHC | 0,16 | -1,25 | 0,1142 | 0,0202 | |||||

| SYY / Sysco Corporation | 0,00 | 0,16 | 0,1137 | 0,1137 | |||||

| VERUS 2024-4 A3 / ABS-O (US92540GAC24) | 0,16 | -7,69 | 0,1128 | 0,0132 | |||||

| VERUS 2024-4 A3 / ABS-O (US92540GAC24) | 0,16 | -7,69 | 0,1128 | 0,0132 | |||||

| Davis-Standard Term Loan B 550 2030-11-26 / LON (US23344YAG70) | 0,16 | -7,14 | 0,1125 | 0,0137 | |||||

| Davis-Standard Term Loan B 550 2030-11-26 / LON (US23344YAG70) | 0,16 | -7,14 | 0,1125 | 0,0137 | |||||

| US482606AQ32 / KNDR 2021 KIND | 0,15 | -1,28 | 0,1111 | 0,0189 | |||||

| RAD 2023-21A D1R / ABS-CBDO (US750099AS26) | 0,15 | -4,37 | 0,1107 | 0,0167 | |||||

| US716564AB55 / Petroleos del Peru SA | 0,15 | -3,16 | 0,1102 | 0,0171 | |||||

| 000333 / Midea Group Co., Ltd. | 0,02 | -84,56 | 0,15 | -85,00 | 0,1100 | -0,4896 | |||

| US78433XAB64 / SALTT 21-1A A 144A 2.675% 02-28-33/02-15-28 | 0,15 | -16,11 | 0,1088 | 0,0029 | |||||

| US71424VAA89 / Permian Resources Operating LLC | 0,15 | 34,82 | 0,1086 | 0,0422 | |||||

| AER V6.95 03/10/55 / DBT (US00774MBK09) | 0,15 | -1,96 | 0,1083 | 0,0180 | |||||

| AER V6.95 03/10/55 / DBT (US00774MBK09) | 0,15 | -1,96 | 0,1083 | 0,0180 | |||||

| US126405AA77 / CSMC 2020-RPL4 Trust | 0,15 | -1,32 | 0,1079 | 0,0183 | |||||

| US10569FAA66 / BRAVO 22-NQM1 A1 144A FRN 09-25-61/02-25-26 | 0,15 | -1,97 | 0,1075 | 0,0182 | |||||

| PLMRS 2022-3A D1R / ABS-CBDO (US69690ABC09) | 0,15 | -2,61 | 0,1074 | 0,0174 | |||||

| United Airlines Term Loan B 200 2031-02-01 / LON (US90932RAP91) | 0,15 | -1,33 | 0,1071 | 0,0188 | |||||

| United Airlines Term Loan B 200 2031-02-01 / LON (US90932RAP91) | 0,15 | -1,33 | 0,1071 | 0,0188 | |||||

| US74841CAA99 / Quicken Loans LLC / Quicken Loans Co-Issuer Inc | 0,15 | 1,37 | 0,1070 | 0,0211 | |||||

| AMMC 2020-23A D1R2 / ABS-CBDO (US00177JBS33) | 0,15 | -1,99 | 0,1065 | 0,0174 | |||||

| AMMC 2020-23A D1R2 / ABS-CBDO (US00177JBS33) | 0,15 | -1,99 | 0,1065 | 0,0174 | |||||

| TFC / Truist Financial Corporation | 0,00 | -24,44 | 0,15 | -39,09 | 0,1065 | -0,0365 | |||

| Ryan LLC Term Loan B 450 2030-10-22 / LON (US78350LAZ85) | 0,15 | -35,81 | 0,1061 | -0,0284 | |||||

| NCC 2021-IA DR / ABS-CBDO (US631704AP85) | 0,15 | -2,67 | 0,1053 | 0,0172 | |||||

| NCC 2021-IA DR / ABS-CBDO (US631704AP85) | 0,15 | -2,67 | 0,1053 | 0,0172 | |||||

| BRAVO 2024-NQM2 A3 / ABS-O (US10569KAC18) | 0,15 | -8,75 | 0,1053 | 0,0112 | |||||

| BRAVO 2024-NQM2 A3 / ABS-O (US10569KAC18) | 0,15 | -8,75 | 0,1053 | 0,0112 | |||||

| US48275EAJ55 / KREF 2022-FL3, Ltd. | 0,15 | 0,00 | 0,1052 | 0,0192 | |||||

| Caesars Entertainment Inc Term Loan B (Incremental) 275 2031-01-16 / LON (US12768EAH99) | 0,15 | -2,68 | 0,1049 | 0,0173 | |||||

| AMMC 2021-24A DR / ABS-O (US00177LAQ32) | 0,15 | -3,97 | 0,1045 | 0,0155 | |||||

| AMMC 2021-24A DR / ABS-O (US00177LAQ32) | 0,15 | -3,97 | 0,1045 | 0,0155 | |||||

| 90184LAA0 / Twitter, Inc. Bond | 0,14 | 0,1041 | 0,1041 | ||||||

| 90184LAA0 / Twitter, Inc. Bond | 0,14 | 0,1041 | 0,1041 | ||||||

| GFLCN 6.625 04/01/32 144A / DBT (US37441QAA94) | 0,14 | 0,1033 | 0,1033 | ||||||

| GFLCN 6.625 04/01/32 144A / DBT (US37441QAA94) | 0,14 | 0,1033 | 0,1033 | ||||||

| US92332YAD31 / Venture Global LNG Inc | 0,14 | 17,36 | 0,1022 | 0,0311 | |||||

| US10568KAC27 / BRAVO Residential Funding Trust | 0,14 | -2,10 | 0,1010 | 0,0166 | |||||

| US50219UAB17 / LTR Intermediate Holdings Inc | 0,14 | -3,45 | 0,1008 | 0,0151 | |||||

| MVEW 2022-1A DR / ABS-CBDO (US62432UAU51) | 0,14 | -1,41 | 0,1008 | 0,0171 | |||||

| GLM 2017-1A ER3 / ABS-CBDO (US38136HAS85) | 0,14 | -7,33 | 0,1003 | 0,0122 | |||||

| GLM 2017-1A ER3 / ABS-CBDO (US38136HAS85) | 0,14 | -7,33 | 0,1003 | 0,0122 | |||||

| QUALITYTECH LP TL / LON (US74758JAB35) | 0,14 | -1,43 | 0,0999 | 0,0175 | |||||

| VERUS 2024-1 A3 / ABS-O (US92540EAC75) | 0,14 | -10,39 | 0,0997 | 0,0088 | |||||

| Innomotics Term Loan B 400 2031-09-15 / LON (US26806DAB82) | 0,14 | 0,0997 | 0,0997 | ||||||

| US06540KBQ13 / BANK 2022-BNK44 | 0,14 | -8,00 | 0,0996 | 0,0115 | |||||

| SATS / EchoStar Corporation | 0,14 | -11,04 | 0,0990 | 0,0081 | |||||

| US12543DBJ81 / CHS/CMNTY HEALTH SYSTEMS INC 6.875% 04/15/2029 144A | 0,13 | 285,29 | 0,0943 | 0,0741 | |||||

| US72353PAA49 / Pioneer Aircraft Finance Ltd | 0,13 | -3,70 | 0,0940 | 0,0146 | |||||

| US92676XAF42 / Viking Cruises Ltd | 0,13 | -0,76 | 0,0938 | 0,0167 | |||||

| WU / The Western Union Company | 0,01 | -14,70 | 0,13 | -18,35 | 0,0933 | 0,0002 | |||

| US03753YAG35 / APEX CREDIT CLO 2022- FRN | 0,13 | -0,77 | 0,0931 | 0,0163 | |||||

| SONRAVA HEALTH HOLDING TL / LON (LX2368368) | 0,13 | -5,88 | 0,0922 | 0,0118 | |||||

| US726503AE55 / Plains All American Pipeline, LP | 0,13 | -0,78 | 0,0922 | 0,0161 | |||||

| US53219LAV18 / LifePoint Health Inc | 0,13 | -7,97 | 0,0918 | 0,0103 | |||||

| BOCA 2024-BOCA E / ABS-O (US096817AJ00) | 0,13 | -3,05 | 0,0914 | 0,0140 | |||||

| US31935HAG20 / First Brands Group, LLC, Senior Secured First Lien Term Loan | 0,13 | -6,67 | 0,0913 | 0,0119 | |||||

| US92328MAC73 / Venture Global Calcasieu Pass LLC | 0,13 | -2,33 | 0,0910 | 0,0152 | |||||

| US1248EPCK74 / CCO Holdings LLC / CCO Holdings Capital Corp | 0,13 | -10,64 | 0,0909 | 0,0076 | |||||

| XS2385150417 / Provincia de Buenos Aires/Government Bonds | 0,13 | -37,93 | 0,0907 | -0,0290 | |||||

| VST 6.875 04/15/32 144A / DBT (US92840VAR33) | 0,12 | 21,57 | 0,0894 | 0,0289 | |||||

| US257867BA88 / Rr Donnelley & Sons Bond | 0,12 | -14,58 | 0,0890 | 0,0043 | |||||

| US023771T402 / American Airlines, Inc. | 0,12 | -3,17 | 0,0879 | 0,0137 | |||||

| VENLNG V9 PERP 144a / DBT (US92332YAF88) | 0,12 | -42,31 | 0,0865 | -0,0359 | |||||

| US03464TAC36 / Angel Oak Mortgage Trust 2022-3 | 0,12 | -1,64 | 0,0864 | 0,0142 | |||||

| US78448YAF88 / SMB Private Education Loan Trust 2021-A | 0,12 | -7,75 | 0,0859 | 0,0100 | |||||

| Virtu Financial Term Loan B 250 2031-06-01 / LON (US91820UAV26) | 0,12 | 0,0858 | 0,0858 | ||||||

| XS2066744231 / Carnival PLC | 0,12 | -21,33 | 0,0856 | -0,0028 | |||||

| XS2066744231 / Carnival PLC | 0,12 | -21,33 | 0,0856 | -0,0028 | |||||

| MF1 2025-FL17 A / ABS-CBDO (US55287HAA86) | 0,12 | -0,84 | 0,0853 | 0,0150 | |||||

| MF1 2025-FL17 A / ABS-CBDO (US55287HAA86) | 0,12 | -0,84 | 0,0853 | 0,0150 | |||||

| VYSPK 2022-1A DRR / ABS-CBDO (US92013AAZ21) | 0,12 | -3,31 | 0,0846 | 0,0134 | |||||

| US88830MAM47 / Titan International Inc | 0,12 | -15,22 | 0,0845 | 0,0029 | |||||

| NEW GENERATION 0.00% / DBT (64199ANB6) | 0,12 | 0,00 | 0,0842 | 0,0154 | |||||

| NEW GENERATION 0.00% / DBT (64199ANB6) | 0,12 | 0,00 | 0,0842 | 0,0154 | |||||

| ACCTHR 11 12/01/31 144A / DBT (US00456LAC63) | 0,11 | 6,54 | 0,0821 | 0,0192 | |||||

| SolarWinds First-lien Term Loan 400 2032-03-01 / LON (US85554UAB08) | 0,11 | 0,0816 | 0,0816 | ||||||

| US344849AA21 / FOOT LOCKER INC | 0,11 | -22,07 | 0,0816 | -0,0041 | |||||

| US91086QBB32 / Mexico Government International Bond | 0,11 | 0,00 | 0,0815 | 0,0146 | |||||

| US10568KAA60 / BRAVO Residential Funding Trust | 0,11 | -1,75 | 0,0811 | 0,0141 | |||||

| US75281ABJ79 / Range Resources Corp | 0,11 | -22,22 | 0,0810 | -0,0036 | |||||

| VERUS 2024-3 A3 / ABS-O (US92540MAC91) | 0,11 | -11,90 | 0,0805 | 0,0064 | |||||

| VERUS 2024-3 A3 / ABS-O (US92540MAC91) | 0,11 | -11,90 | 0,0805 | 0,0064 | |||||

| GALXY 2018-26A DR / ABS-CBDO (US36321LAQ23) | 0,11 | 0,00 | 0,0792 | 0,0142 | |||||

| GALXY 2018-26A DR / ABS-CBDO (US36321LAQ23) | 0,11 | 0,00 | 0,0792 | 0,0142 | |||||

| US35563PC802 / SEASONED CREDIT RISK VAR | 0,11 | 34,57 | 0,0791 | 0,0312 | |||||

| BERRY 2024-1A D1 / ABS-CBDO (US09609QAG38) | 0,11 | -2,68 | 0,0787 | 0,0127 | |||||

| BERRY 2024-1A D1 / ABS-CBDO (US09609QAG38) | 0,11 | -2,68 | 0,0787 | 0,0127 | |||||

| RSCIBI L 11/01/26 1 / LON (LX2189566) | 0,11 | 8,00 | 0,0778 | 0,0190 | |||||

| ALLWYN ENT FIN US LLC TL / LON (LX2579204) | 0,11 | 0,0772 | 0,0772 | ||||||

| Cotiviti Inc Term Loan B 325 2031-02-12 / LON (US22164MAB37) | 0,11 | -2,75 | 0,0765 | 0,0120 | |||||

| Cotiviti Inc Term Loan B 325 2031-02-12 / LON (US22164MAB37) | 0,11 | -2,75 | 0,0765 | 0,0120 | |||||

| BX / Blackstone Inc. | 0,00 | -8,41 | 0,11 | -31,61 | 0,0763 | -0,0152 | |||

| US57069PAA03 / Marks & Spencer PLC | 0,11 | 0,95 | 0,0763 | 0,0144 | |||||

| US281020AS67 / Edison International | 0,10 | 1,98 | 0,0741 | 0,0146 | |||||

| US61772WAG24 / MORGAN STANLEY CAPITAL I TRUST MSC 2021 230P B 144A | 0,10 | -1,92 | 0,0737 | 0,0123 | |||||

| US86964WAK80 / Suzano Austria GmbH | 0,10 | 2,00 | 0,0736 | 0,0146 | |||||

| Global Medical Response (fka Air Medical Group) Term Loan B 550 2028-10-01 / LON (US00169QAG47) | 0,10 | -41,28 | 0,0733 | -0,0282 | |||||

| Global Medical Response (fka Air Medical Group) Term Loan B 550 2028-10-01 / LON (US00169QAG47) | 0,10 | -41,28 | 0,0733 | -0,0282 | |||||

| SMB 2024-D D / ABS-O (US83207QAE98) | 0,10 | 1,00 | 0,0732 | 0,0143 | |||||

| SMB 2024-D D / ABS-O (US83207QAE98) | 0,10 | 1,00 | 0,0732 | 0,0143 | |||||

| US06427DAC74 / Banc of America Commercial Mortgage Trust, Series 2017-BNK3, Class D | 0,10 | 1,01 | 0,0721 | 0,0139 | |||||

| WorldPay Term Loan B 200 2031-01-01 / LON (US92943EAG17) | 0,10 | 0,0715 | 0,0715 | ||||||

| 09238EAB0 / Blackhawk Network Holdings, Inc. Bond 1.500% 1/1 | 0,10 | 0,0712 | 0,0712 | ||||||

| 09238EAB0 / Blackhawk Network Holdings, Inc. Bond 1.500% 1/1 | 0,10 | 0,0712 | 0,0712 | ||||||

| KREF HOLDINGS X LLC TL / DBT (LX2593908) | 0,10 | 0,0711 | 0,0711 | ||||||

| Endeavor Term Loan B 300 2032-01-15 / LON (US26875YAB83) | 0,10 | 0,0709 | 0,0709 | ||||||

| Endeavor Term Loan B 300 2032-01-15 / LON (US26875YAB83) | 0,10 | 0,0709 | 0,0709 | ||||||

| Imperial Dade Term Loan B 325 2030-12-01 / LON (US05550HAQ83) | 0,10 | 0,0709 | 0,0709 | ||||||

| MF1 2025-FL17 D / ABS-CBDO (US55287HAJ95) | 0,10 | -2,02 | 0,0704 | 0,0118 | |||||

| LTM / LATAM Airlines Group S.A. | 0,10 | -3,00 | 0,0704 | 0,0113 | |||||

| BX 2024-BIO2 D / ABS-O (US05613GAG73) | 0,10 | -1,02 | 0,0699 | 0,0121 | |||||

| BX 2024-BIO2 D / ABS-O (US05613GAG73) | 0,10 | -1,02 | 0,0699 | 0,0121 | |||||

| CTEV / Claritev Corporation | 0,10 | 0,0699 | 0,0699 | ||||||

| Virgin Media Term Loan Y (Add-on) 325 2031-03-01 / LON (XAG9368PBK93) | 0,10 | 0,00 | 0,0698 | 0,0122 | |||||

| US92676XAG25 / Viking Cruises Ltd | 0,10 | -40,74 | 0,0692 | -0,0263 | |||||

| US45567YAN58 / MH Sub I, LLC 2023 Term Loan | 0,09 | -43,37 | 0,0681 | -0,0296 | |||||

| Novolex Term Loan B (Incremental) 325 2032-03-15 / LON (US18972FAE25) | 0,09 | 0,0678 | 0,0678 | ||||||

| TKO Group Holdings (UFC) Term Loan B 225 2031-11-05 / LON (US90266UAK97) | 0,09 | -37,33 | 0,0676 | -0,0209 | |||||

| TKO Group Holdings (UFC) Term Loan B 225 2031-11-05 / LON (US90266UAK97) | 0,09 | -37,33 | 0,0676 | -0,0209 | |||||

| US12543DBM11 / CHS/Community Health Systems Inc | 0,09 | 82,35 | 0,0675 | 0,0374 | |||||

| US89346DAH08 / TransAlta Corp | 0,09 | -18,42 | 0,0674 | 0,0003 | |||||

| AmWINS Group Term Loan B 225 2032-01-01 / LON (US03234TBA51) | 0,09 | -38,00 | 0,0673 | -0,0209 | |||||

| AmWINS Group Term Loan B 225 2032-01-01 / LON (US03234TBA51) | 0,09 | -38,00 | 0,0673 | -0,0209 | |||||

| Action Nederland B.V. Term Loan B-4B 250 2030-10-01 / LON (XAN6872NAM82) | 0,09 | 0,0673 | 0,0673 | ||||||

| Medline Industries Term Loan B (Incremental) 225 2028-10-01 / LON (US58503UAF03) | 0,09 | -33,09 | 0,0672 | -0,0149 | |||||

| Medline Industries Term Loan B (Incremental) 225 2028-10-01 / LON (US58503UAF03) | 0,09 | -33,09 | 0,0672 | -0,0149 | |||||

| Alliance Laundry Systems Term Loan B 350 2031-07-30 / LON (US01862LBA52) | 0,09 | -41,87 | 0,0671 | -0,0272 | |||||

| LX2110380 / SEDGWICK CLAIMS MNGT TL | 0,09 | -41,77 | 0,0668 | -0,0265 | |||||

| Jane Street Group Term Loan B 200 2031-12-01 / LON (US47077DAM20) | 0,09 | -61,34 | 0,0668 | -0,0732 | |||||

| Jane Street Group Term Loan B 200 2031-12-01 / LON (US47077DAM20) | 0,09 | -61,34 | 0,0668 | -0,0732 | |||||

| Flutter Entertainment Term Loan B 175 2030-11-01 / LON (XAN3313EAG51) | 0,09 | -55,56 | 0,0666 | -0,0554 | |||||

| Flutter Entertainment Term Loan B 175 2030-11-01 / LON (XAN3313EAG51) | 0,09 | -55,56 | 0,0666 | -0,0554 | |||||

| LifePoint Health Term Loan B 375 2031-05-01 / LON (US75915TAK88) | 0,09 | -69,13 | 0,0663 | -0,1090 | |||||

| US55361AAZ75 / MSWF Commercial Mortgage Trust 2023-2 | 0,09 | -4,17 | 0,0662 | 0,0094 | |||||

| US03969AAP57 / Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc | 0,09 | -16,36 | 0,0661 | 0,0012 | |||||

| US03969AAR14 / Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc | 0,09 | -16,36 | 0,0661 | 0,0012 | |||||

| Authentic Brands Term Loan B (Incremental) 225 2032-02-04 / LON (US00076VBM19) | 0,09 | 0,0661 | 0,0661 | ||||||

| EQMSRM 8.625 05/15/32 144A / DBT (US29450YAB56) | 0,09 | 7,06 | 0,0661 | 0,0160 | |||||

| EQMSRM 8.625 05/15/32 144A / DBT (US29450YAB56) | 0,09 | 7,06 | 0,0661 | 0,0160 | |||||

| QUIKHO 6.375 03/01/32 144A / DBT (US74843PAA84) | 0,09 | 0,0651 | 0,0651 | ||||||

| US75079MAA71 / Railworks Holdings LP / Railworks Rally Inc | 0,09 | 200,00 | 0,0648 | 0,0470 | |||||

| US92328MAE30 / Venture Global Calcasieu Pass LLC | 0,09 | -40,79 | 0,0647 | -0,0250 | |||||

| US87256YAC75 / TKC Holdings Inc | 0,09 | 13,92 | 0,0647 | 0,0179 | |||||

| CELSIUS HLDGS INC TL / DBT (LX2602931) | 0,09 | 0,0643 | 0,0643 | ||||||

| NielsenIQ/Global Connect Term Loan B 350 2028-03-01 / LON (US45674PAR55) | 0,09 | 0,0643 | 0,0643 | ||||||

| Action Nederland B.V. Term Loan B-5B 250 2031-07-01 / LON (XAN6872NAN65) | 0,09 | 0,0642 | 0,0642 | ||||||

| ADT Corp Term Loan B 200 2030-10-01 / LON (US03765VAP58) | 0,09 | -1,12 | 0,0639 | 0,0112 | |||||

| Cotiviti Inc Fixed-rate Loan 2031-02-12 / LON (US22164MAD92) | 0,09 | -2,22 | 0,0639 | 0,0106 | |||||

| Cotiviti Inc Fixed-rate Loan 2031-02-12 / LON (US22164MAD92) | 0,09 | -2,22 | 0,0639 | 0,0106 | |||||

| EUC (End User Computing) Term Loan B 450 2031-04-01 / LON (US60753DAC83) | 0,09 | -57,28 | 0,0637 | -0,0577 | |||||

| EUC (End User Computing) Term Loan B 450 2031-04-01 / LON (US60753DAC83) | 0,09 | -57,28 | 0,0637 | -0,0577 | |||||

| PR 6.25 02/01/33 144A / DBT (US71424VAB62) | 0,09 | 203,45 | 0,0633 | 0,0477 | |||||

| PR 6.25 02/01/33 144A / DBT (US71424VAB62) | 0,09 | 203,45 | 0,0633 | 0,0477 | |||||

| 90184LAA0 / Twitter, Inc. Bond | 0,09 | 0,0631 | 0,0631 | ||||||

| 90184LAA0 / Twitter, Inc. Bond | 0,09 | 0,0631 | 0,0631 | ||||||

| US74339VAB45 / T/L CLOUDERA INC REGD 0.00000000 | 0,09 | -2,25 | 0,0630 | 0,0106 | |||||

| Harbor Freight Term Loan B 250 2031-05-27 / LON (US41151PAR64) | 0,09 | -36,96 | 0,0626 | -0,0187 | |||||

| Harbor Freight Term Loan B 250 2031-05-27 / LON (US41151PAR64) | 0,09 | -36,96 | 0,0626 | -0,0187 | |||||

| WTS. SPIRIT AIRLINES LLC / DE (000000000) | 0,09 | 0,0619 | 0,0619 | ||||||

| WTS. SPIRIT AIRLINES LLC / DE (000000000) | 0,09 | 0,0619 | 0,0619 | ||||||

| NTAP / NetApp, Inc. | 0,00 | 26,53 | 0,09 | -6,59 | 0,0612 | 0,0074 | |||

| VET / Vermilion Energy Inc. | 0,08 | -30,25 | 0,0603 | -0,0098 | |||||

| VET / Vermilion Energy Inc. | 0,08 | -30,25 | 0,0603 | -0,0098 | |||||

| GLOB TEL LINK CORP TL / LON (US37959JAG67) | 0,08 | -6,74 | 0,0601 | 0,0078 | |||||

| GLOB TEL LINK CORP TL / LON (US37959JAG67) | 0,08 | -6,74 | 0,0601 | 0,0078 | |||||

| US12543DBN93 / CHS/Community Health Systems Inc | 0,08 | -57,95 | 0,0594 | -0,0556 | |||||

| BBD.A / Bombardier Inc. | 0,08 | 0,0582 | 0,0582 | ||||||

| BBD.A / Bombardier Inc. | 0,08 | 0,0582 | 0,0582 | ||||||

| MEDIND 6.25 04/01/29 144A / DBT (US58506DAA63) | 0,08 | -1,23 | 0,0580 | 0,0102 | |||||

| MEDIND 6.25 04/01/29 144A / DBT (US58506DAA63) | 0,08 | -1,23 | 0,0580 | 0,0102 | |||||

| LX1855092 / MRI SOFTWARE LLC TL | 0,08 | -36,51 | 0,0579 | -0,0163 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 0,08 | -1,23 | 0,0577 | 0,0098 | |||||

| US87256YAA10 / TKC HOLDINGS INC 10.5% 05/15/2029 144A | 0,08 | -1,23 | 0,0575 | 0,0096 | |||||

| S1YM34 / Gen Digital Inc. - Depositary Receipt (Common Stock) | 0,08 | 0,0574 | 0,0574 | ||||||

| MS / Morgan Stanley | 0,00 | -96,58 | 0,08 | -97,17 | 0,0573 | -1,5848 | |||

| Alpha Generation LLC Term Loan B 275 2031-09-08 / LON (US02072UAC62) | 0,08 | -1,25 | 0,0572 | 0,0101 | |||||

| Cotiviti Inc Term Loan B (Incremental) 275 2032-02-06 / LON (US22164MAF41) | 0,08 | 0,0562 | 0,0562 | ||||||

| US389284AA85 / Gray Television Inc | 0,08 | -1,28 | 0,0560 | 0,0099 | |||||

| XAN9833RAJ85 / Ziggo Financing Partnership USD Term Loan I | 0,08 | -71,38 | 0,0555 | -0,1027 | |||||

| US90355HAB06 / UST Holdings Ltd., Term Loan B | 0,08 | -72,66 | 0,0551 | -0,1084 | |||||

| GEO 10.25 04/15/31 / DBT (US36162JAH95) | 0,08 | -63,46 | 0,0550 | -0,0672 | |||||

| GEO 10.25 04/15/31 / DBT (US36162JAH95) | 0,08 | -63,46 | 0,0550 | -0,0672 | |||||

| US00165CBA18 / AMC Entertainment Holdings Inc | 0,08 | -18,48 | 0,0546 | 0,0000 | |||||

| US25470XBE40 / DISH DBS Corp | 0,07 | -1,37 | 0,0523 | 0,0089 | |||||

| FLYY / Spirit Aviation Holdings, Inc. | 0,01 | 0,07 | 0,0520 | 0,0520 | |||||

| EVERTEC Term Loan B 350 2030-09-24 / LON (U3000JAQ2) | 0,07 | 0,00 | 0,0518 | 0,0089 | |||||

| EIX / Edison International | 0,00 | -22,57 | 0,07 | -23,66 | 0,0517 | -0,0034 | |||

| SHC / Sotera Health Company | 0,07 | -21,98 | 0,0516 | -0,0022 | |||||

| SHC / Sotera Health Company | 0,07 | -21,98 | 0,0516 | -0,0022 | |||||

| COMM 9.5 12/15/31 144A / DBT (US20338MAA09) | 0,07 | 0,0515 | 0,0515 | ||||||

| COMM 9.5 12/15/31 144A / DBT (US20338MAA09) | 0,07 | 0,0515 | 0,0515 | ||||||

| XS2085724156 / MPT Operating Partnership LP / MPT Finance Corp | 0,07 | 0,00 | 0,0511 | 0,0094 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0,07 | -49,64 | 0,0503 | -0,0308 | |||||

| Two Kings Casino Term Loan B 475 2031-12-01 / LON (US14907EAD67) | 0,07 | 0,0499 | 0,0499 | ||||||

| Two Kings Casino Term Loan B 475 2031-12-01 / LON (US14907EAD67) | 0,07 | 0,0499 | 0,0499 | ||||||

| US92540DAC92 / Verus Securitization Trust 2023-8 | 0,07 | -8,00 | 0,0496 | 0,0053 | |||||

| CTEV 6.75 03/31/31 144A / DBT (US62548MAA80) | 0,07 | 0,0484 | 0,0484 | ||||||

| SAGLEN 11 12/15/29 144A / DBT (US79380MAA36) | 0,07 | -30,53 | 0,0480 | -0,0083 | |||||

| US65505PAA57 / Noble Finance II LLC | 0,07 | -27,47 | 0,0480 | -0,0058 | |||||

| FPH 10.5 01/15/28 144A / DBT (US33834YAB48) | 0,07 | 0,00 | 0,0479 | 0,0086 | |||||

| BBD.A / Bombardier Inc. | 0,07 | -24,42 | 0,0471 | -0,0038 | |||||

| BBD.A / Bombardier Inc. | 0,07 | -24,42 | 0,0471 | -0,0038 | |||||

| US470160CF77 / Jamaica Government International Bond | 0,07 | -1,52 | 0,0471 | 0,0083 | |||||

| US12768EAG17 / Caesars Entertainment Inc | 0,06 | -1,54 | 0,0464 | 0,0077 | |||||

| US92332YAC57 / Venture Global LNG Inc | 0,06 | 12,73 | 0,0447 | 0,0120 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 0,06 | 0,0429 | 0,0429 | ||||||

| XS2264968665 / Ivory Coast Government International Bond | 0,06 | 0,0429 | 0,0429 | ||||||

| Austin Powder Holdings Company Term Loan B 325 2031-07-21 / LON (US00036FAB04) | 0,06 | -1,67 | 0,0429 | 0,0074 | |||||

| Madison Air Term Loan B (Incremental) 325 2032-03-22 / LON (US55759VAD01) | 0,06 | 0,0427 | 0,0427 | ||||||

| MH SUB I LLC TL / LON (LX2555832) | 0,06 | 0,0426 | 0,0426 | ||||||

| MH SUB I LLC TL / LON (LX2555832) | 0,06 | 0,0426 | 0,0426 | ||||||

| CHRD / Chord Energy Corporation | 0,06 | 0,0420 | 0,0420 | ||||||

| US57165KAB26 / Red Planet Borrower LLC, First Lien Initial Term Loan | 0,06 | 0,00 | 0,0419 | 0,0073 | |||||

| GEO Group Term Loan B 525 2029-03-31 / LON (US36170EAC12) | 0,06 | 0,00 | 0,0415 | 0,0075 | |||||

| GEO Group Term Loan B 525 2029-03-31 / LON (US36170EAC12) | 0,06 | 0,00 | 0,0415 | 0,0075 | |||||

| US20338HAB96 / Commscope Technologies Llc 5.00% 03/15/2027 144a Bond | 0,05 | -55,17 | 0,0375 | -0,0312 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0,05 | -16,39 | 0,0373 | 0,0009 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0,05 | -16,39 | 0,0373 | 0,0009 | |||||

| US983133AC37 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp | 0,05 | -1,92 | 0,0371 | 0,0064 | |||||

| BLURAC 7.25 07/15/32 144A / DBT (US095796AK46) | 0,05 | -1,92 | 0,0369 | 0,0061 | |||||

| BLURAC 7.25 07/15/32 144A / DBT (US095796AK46) | 0,05 | -1,92 | 0,0369 | 0,0061 | |||||

| TDG 6.625 03/01/32 144A / DBT (US893647BV82) | 0,05 | 2,00 | 0,0368 | 0,0070 | |||||

| HOWMID 7.375 07/15/32 144A / DBT (US442722AC80) | 0,05 | -17,74 | 0,0368 | 0,0002 | |||||

| HOWMID 7.375 07/15/32 144A / DBT (US442722AC80) | 0,05 | -17,74 | 0,0368 | 0,0002 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0,05 | 0,0366 | 0,0366 | ||||||

| US00790RAB06 / Advanced Drainage Systems Inc | 0,05 | -16,67 | 0,0365 | 0,0009 | |||||

| US465965AC53 / JB Poindexter & Co Inc | 0,05 | -5,66 | 0,0361 | 0,0049 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 0,05 | 0,0359 | 0,0359 | ||||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 0,05 | 0,0359 | 0,0359 | ||||||

| OIS_CCP MXN RCV 8.902% PAY MXIBTIEF1D 16-NOV-2029 / DIR (000000000) | 0,05 | 0,0358 | 0,0358 | ||||||

| OIS_CCP MXN RCV 8.902% PAY MXIBTIEF1D 16-NOV-2029 / DIR (000000000) | 0,05 | 0,0358 | 0,0358 | ||||||

| US443628AH54 / Hudbay Minerals Inc | 0,05 | -18,33 | 0,0358 | 0,0005 | |||||

| US31944TAA88 / FirstCash Inc | 0,05 | -15,52 | 0,0353 | 0,0008 | |||||

| NGP Midstream Term Loan B 400 2031-07-07 / LON (US62927UAB98) | 0,05 | -2,00 | 0,0353 | 0,0057 | |||||

| NGP Midstream Term Loan B 400 2031-07-07 / LON (US62927UAB98) | 0,05 | -2,00 | 0,0353 | 0,0057 | |||||

| CB BUYER TL / LON (LX2375942) | 0,05 | 6,52 | 0,0353 | 0,0081 | |||||

| CB BUYER TL / LON (LX2375942) | 0,05 | 6,52 | 0,0353 | 0,0081 | |||||

| US92552VAL45 / ViaSat Inc | 0,05 | -28,36 | 0,0352 | -0,0047 | |||||

| EMPRCC 9.75 05/01/29 144A / DBT (US29163VAG86) | 0,05 | -7,69 | 0,0351 | 0,0045 | |||||

| EMPRCC 9.75 05/01/29 144A / DBT (US29163VAG86) | 0,05 | -7,69 | 0,0351 | 0,0045 | |||||

| US38723BAJ08 / WIN WASTE TERM B 1LN 03/25/2028 | 0,05 | 0,00 | 0,0351 | 0,0068 | |||||

| US58003UAA60 / MF1 Multifamily Housing Mortgage Loan Trust | 0,05 | -26,15 | 0,0350 | -0,0034 | |||||

| GRAY TELEVISION INC TL / LON (LX2334782) | 0,05 | 2,17 | 0,0344 | 0,0068 | |||||

| GRAY TELEVISION INC TL / LON (LX2334782) | 0,05 | 2,17 | 0,0344 | 0,0068 | |||||

| NTPXX / Northern Institutional Funds - Northern Institutional Treasury Portfolio Premier Shares | 0,05 | -97,53 | 0,05 | -97,56 | 0,0343 | -1,3499 | |||

| ADNT 7.5 02/15/33 144A / DBT (US00687YAD76) | 0,05 | -41,98 | 0,0341 | -0,0136 | |||||

| DTV 10 02/15/31 144A / DBT (US25461LAD47) | 0,05 | 0,0340 | 0,0340 | ||||||

| DTV 10 02/15/31 144A / DBT (US25461LAD47) | 0,05 | 0,0340 | 0,0340 | ||||||

| Starwood Property Mortgage Term Loan B 225 2027-11-01 / LON (US85570DAK81) | 0,05 | 0,0338 | 0,0338 | ||||||

| US87470LAJ08 / Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp | 0,05 | -19,30 | 0,0335 | -0,0005 | |||||

| CRGYFN 7.625 04/01/32 144A / DBT (US45344LAD55) | 0,05 | -10,00 | 0,0327 | 0,0031 | |||||

| CRGYFN 7.625 04/01/32 144A / DBT (US45344LAD55) | 0,05 | -10,00 | 0,0327 | 0,0031 | |||||

| US48123VAF94 / J2 Global Inc | 0,04 | -18,52 | 0,0318 | -0,0005 | |||||

| US90355YAA55 / US Renal Care Inc | 0,04 | -2,22 | 0,0317 | 0,0053 | |||||

| CXW / CoreCivic, Inc. | 0,04 | -31,15 | 0,0303 | -0,0022 | |||||

| CXW / CoreCivic, Inc. | 0,04 | -31,15 | 0,0303 | -0,0022 | |||||

| DIAMOND SPORTS NET TL / LON (US25277EAB83) | 0,04 | -77,22 | 0,0300 | -0,0757 | |||||

| DIAMOND SPORTS NET TL / LON (US25277EAB83) | 0,04 | -77,22 | 0,0300 | -0,0757 | |||||

| US05765WAA18 / TIBCO Software Inc | 0,04 | -55,91 | 0,0300 | -0,0250 | |||||

| US05765WAA18 / TIBCO Software Inc | 0,04 | -55,91 | 0,0300 | -0,0250 | |||||

| AMCX / AMC Networks Inc. | 0,04 | -2,38 | 0,0295 | 0,0045 | |||||

| US64069JAF93 / Neptune Bidco US Inc 2022 USD Term Loan A | 0,04 | -80,49 | 0,0294 | -0,0915 | |||||

| ALPGEN 6.75 10/15/32 144A / DBT (US02073LAA98) | 0,04 | 0,00 | 0,0293 | 0,0056 | |||||

| ROCKIE 6.75 03/15/33 144A / DBT (US77340RAU14) | 0,04 | 0,0292 | 0,0292 | ||||||

| US674599CY98 / Occidental Petroleum Corp | 0,04 | -4,88 | 0,0287 | 0,0041 | |||||

| PRMWCN 6.25 04/01/29 144A / DBT (US74168RAC79) | 0,04 | 0,0286 | 0,0286 | ||||||

| PRMWCN 6.25 04/01/29 144A / DBT (US74168RAC79) | 0,04 | 0,0286 | 0,0286 | ||||||

| US77340RAD98 / ROCKIES EXPRESS PIPELINE SR UNSECURED 144A 07/38 7.5 | 0,04 | -2,50 | 0,0282 | 0,0047 | |||||

| Natgasoline Term Loan B 550 2030-03-09 / LON (US63232EAD94) | 0,04 | 0,0280 | 0,0280 | ||||||

| US92840JAD19 / VistaJet Malta Finance plc | 0,04 | -72,86 | 0,0279 | -0,0543 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0,04 | -2,56 | 0,0279 | 0,0046 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0,04 | -2,56 | 0,0279 | 0,0046 | |||||

| US87821EAB92 / TEAM SERVICES GROUP TERM LOAN | 0,04 | -2,56 | 0,0274 | 0,0041 | |||||

| US81761LAB80 / SERVICE PPTYS TR 5.5% 12/15/2027 | 0,04 | -55,81 | 0,0274 | -0,0235 | |||||

| Bausch Health (fka Valeant) Term Loan B 625 2030-09-17 / LON (XAC6903HAB06) | 0,04 | 0,0271 | 0,0271 | ||||||

| CURRENCY CONTRACT - AUD / DFE (000000000) | 0,04 | 0,0268 | 0,0268 | ||||||

| CURRENCY CONTRACT - AUD / DFE (000000000) | 0,04 | 0,0268 | 0,0268 | ||||||

| US55916AAA25 / Magic Mergeco Inc | 0,03 | -32,61 | 0,0225 | -0,0049 | |||||

| VEGLPL 7.5 05/01/33 144A / DBT (US922966AA47) | 0,03 | 0,0221 | 0,0221 | ||||||

| RSCIBI L 11/01/26 1 / LON (LX1836159) | 0,03 | 0,00 | 0,0216 | 0,0039 | |||||

| RSCIBI L 11/01/26 1 / LON (LX1836159) | 0,03 | 0,00 | 0,0216 | 0,0039 | |||||

| US3742751130 / Getty Images Holdings, Inc. | 0,03 | 0,0212 | 0,0212 | ||||||

| US3742751130 / Getty Images Holdings, Inc. | 0,03 | 0,0212 | 0,0212 | ||||||

| CAPCOP 6.75 03/31/33 144A / DBT (US14071LAA61) | 0,03 | 0,0212 | 0,0212 | ||||||

| US00164VAF04 / AMC Networks Inc | 0,03 | -6,45 | 0,0212 | 0,0026 | |||||

| XAC8000CAB90 / Panther BF Aggregator 2 LP USD Term Loan B | 0,03 | -3,33 | 0,0211 | 0,0034 | |||||

| XAC8000CAB90 / Panther BF Aggregator 2 LP USD Term Loan B | 0,03 | -3,33 | 0,0211 | 0,0034 | |||||

| US11565HAD89 / BROWN GROUP HOLDING, LLC | 0,03 | 0,00 | 0,0210 | 0,0036 | |||||

| TEAM Services Term Loan B (Incremental) 525 2027-12-01 / LON (US87821AAB70) | 0,03 | -6,67 | 0,0208 | 0,0032 | |||||

| TEAM Services Term Loan B (Incremental) 525 2027-12-01 / LON (US87821AAB70) | 0,03 | -6,67 | 0,0208 | 0,0032 | |||||

| US62482BAB80 / MOZART DEBT MERGER SUB INC | 0,03 | -3,45 | 0,0205 | 0,0034 | |||||

| CDAY / Hamilton Enhanced Canadian Equity Daymax Etf | 0,03 | 0,0205 | 0,0205 | ||||||

| US98262PAA93 / WW International, Inc. | 0,03 | 16,67 | 0,0202 | 0,0060 | |||||

| US89346DAE76 / Transalta Corp Senior Notes 6.5% 03/15/40 | 0,03 | -6,90 | 0,0199 | 0,0026 | |||||

| US177376AE06 / Citrix Systems Inc | 0,03 | 50,00 | 0,0196 | 0,0089 | |||||

| US92328MAB90 / Venture Global Calcasieu Pass LLC | 0,03 | -3,70 | 0,0194 | 0,0034 | |||||

| US458140CJ73 / Intel Corp | 0,03 | 0,0192 | 0,0192 | ||||||

| LX1903959 / MRI SOFTWARE LLC TL | 0,02 | -38,46 | 0,0179 | -0,0050 | |||||

| EYECARE PARTNERS LLC TL / LON (US30233PAT75) | 0,02 | -79,83 | 0,0174 | -0,0530 | |||||

| EYECARE PARTNERS LLC TL / LON (US30233PAT75) | 0,02 | -79,83 | 0,0174 | -0,0530 | |||||

| IHRT / iHeartMedia, Inc. | 0,02 | -8,33 | 0,0158 | 0,0012 | |||||

| IHRT / iHeartMedia, Inc. | 0,02 | -8,33 | 0,0158 | 0,0012 | |||||

| RSCIBI L 11/01/26 1 / LON (LX2004682) | 0,02 | 0,00 | 0,0156 | 0,0028 | |||||

| US91327TAA97 / Uniti Group LP / Uniti Group Finance Inc / CSL Capital LLC | 0,02 | 0,00 | 0,0153 | 0,0027 | |||||

| RSCIBI L 11/01/26 1 / LON (LX2082068) | 0,02 | 0,00 | 0,0150 | 0,0027 | |||||

| RSCIBI L 11/01/26 1 / LON (LX2082068) | 0,02 | 0,00 | 0,0150 | 0,0027 | |||||

| RSCIBI L 11/01/26 1 / LON (7299967S1) | 0,02 | 0,00 | 0,0148 | 0,0027 | |||||

| RSCIBI L 11/01/26 1 / LON (7299967S1) | 0,02 | 0,00 | 0,0148 | 0,0027 | |||||

| VEGLPL 7.75 05/01/35 144A / DBT (US922966AB20) | 0,02 | 0,0148 | 0,0148 | ||||||

| VIRT 7.5 06/15/31 144A / DBT (US91824YAA64) | 0,02 | 0,00 | 0,0148 | 0,0026 | |||||

| VIRT 7.5 06/15/31 144A / DBT (US91824YAA64) | 0,02 | 0,00 | 0,0148 | 0,0026 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0,02 | 0,0147 | 0,0147 | ||||||

| CZR 6.5 02/15/32 144A / DBT (US12769GAC42) | 0,02 | 100,00 | 0,0145 | 0,0092 | |||||

| US90932VAA35 / United Airlines Pass Through Trust | 0,02 | -13,64 | 0,0143 | 0,0008 | |||||

| AQUARI 7.875 11/01/29 144A / DBT (US00188QAA40) | 0,02 | -5,00 | 0,0140 | 0,0022 | |||||

| US18453HAA41 / Clear Channel Worldwide Holdings Inc 5.125% 08/15/2027 144A | 0,02 | -92,49 | 0,0140 | -0,1348 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0,02 | 0,00 | 0,0137 | 0,0020 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0,02 | 0,00 | 0,0137 | 0,0020 | |||||

| US90346WAA18 / US Airways 2013-1 Class A Pass Through Trust | 0,02 | 0,00 | 0,0136 | 0,0025 | |||||

| BRSTNCLTN7U7 / BRAZIL LETRAS DO TESOURO NACIONAL 0% 01/01/2026 | 0,02 | 5,88 | 0,0132 | 0,0031 | |||||

| UNSTSV 8 04/30/30 144A / DBT (US92905YAA64) | 0,02 | -55,56 | 0,0121 | -0,0093 | |||||

| CTEV / Claritev Corporation | 0,02 | 0,0118 | 0,0118 | ||||||

| CTEV / Claritev Corporation | 0,02 | 0,0118 | 0,0118 | ||||||

| US86745GAF00 / Sunnova Energy Corp | 0,01 | -91,23 | 0,0108 | -0,0899 | |||||

| ATGE / Adtalem Global Education Inc. | 0,01 | 0,00 | 0,0107 | 0,0019 | |||||

| US03072SA214 / AMERIQUEST MORTGAGE SECURITIES AMSI 2005 R3 M4 | 0,01 | -46,15 | 0,0103 | -0,0052 | |||||

| US55328HAK77 / MPH Acquisition Holdings LLC 2021 Term Loan B | 0,01 | -90,00 | 0,0085 | -0,0561 | |||||

| CB BUYER INC DEL DRAW TL / LON (LX2375967) | 0,01 | 0,0074 | 0,0074 | ||||||

| US36472TAA79 / GANNETT CO INC NEW 12/27 6 | 0,01 | -9,09 | 0,0072 | 0,0005 | |||||

| EQMSRM 8 03/15/33 144A / DBT (US29450YAC30) | 0,01 | 0,0071 | 0,0071 | ||||||

| EQMSRM 8 03/15/33 144A / DBT (US29450YAC30) | 0,01 | 0,0071 | 0,0071 | ||||||

| Focus Financial Term Loan B-8 (add-on) 275 2031-09-01 / LON (US34416DBD93) | 0,01 | 0,0071 | 0,0071 | ||||||

| First Brands (Trico Group) Term Loan B (add-on) 500 2027-03-01 / LON (US31935HAH03) | 0,01 | 0,00 | 0,0066 | 0,0009 | |||||

| OIS_CCP MXN RCV 8.885% PAY MXIBTIEF1D 10-NOV-2034 / DIR (000000000) | 0,01 | 0,0066 | 0,0066 | ||||||

| OIS_CCP MXN RCV 8.885% PAY MXIBTIEF1D 10-NOV-2034 / DIR (000000000) | 0,01 | 0,0066 | 0,0066 | ||||||

| CTEV / Claritev Corporation | 0,01 | 0,0065 | 0,0065 | ||||||

| CTEV / Claritev Corporation | 0,01 | 0,0065 | 0,0065 | ||||||

| US432833AN19 / HILTON DOMESTIC OPERATING CO INC 3.625% 02/15/2032 144A | 0,01 | 0,0064 | 0,0064 | ||||||

| NTPXX / Northern Institutional Funds - Northern Institutional Treasury Portfolio Premier Shares | 0,01 | 879,81 | 0,01 | -98,87 | 0,0060 | 0,0054 | |||

| RAX 3.5 05/15/28 144A / DBT (US75008WAA18) | 0,01 | -33,33 | 0,0060 | -0,0013 | |||||

| RAX 3.5 05/15/28 144A / DBT (US75008WAA18) | 0,01 | -33,33 | 0,0060 | -0,0013 | |||||

| Learfield Communications Term Loan B 500 2028-06-01 / LON (US00165HAL78) | 0,01 | -96,19 | 0,0058 | -0,1177 | |||||

| US94989AAZ84 / Wells Fargo Commercial Mortgage Trust 2014-LC18 | 0,01 | -93,81 | 0,0049 | -0,0521 | |||||

| BHC / Bausch Health Companies Inc. | 0,01 | 0,0047 | 0,0047 | ||||||

| US92941PAC77 / WW International, Inc. 2021 Term Loan B | 0,00 | 0,00 | 0,0033 | 0,0008 | |||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0032 | 0,0032 | ||||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0032 | 0,0032 | ||||||

| CURRENCY CONTRACT - CAD / DFE (000000000) | 0,00 | 0,0030 | 0,0030 | ||||||

| CURRENCY CONTRACT - CAD / DFE (000000000) | 0,00 | 0,0030 | 0,0030 | ||||||

| SWO_CDX CDX.NA.HY.44 (5Y) / DCR (000000000) | 0,00 | 0,0021 | 0,0021 | ||||||

| SWO_CDX CDX.NA.HY.44 (5Y) / DCR (000000000) | 0,00 | 0,0021 | 0,0021 | ||||||

| NTPXX / Northern Institutional Funds - Northern Institutional Treasury Portfolio Premier Shares | 0,00 | -94,45 | 0,00 | -95,74 | 0,0019 | -0,0324 | |||

| CURRENCY CONTRACT - EUR / DFE (000000000) | 0,00 | 0,0014 | 0,0014 | ||||||

| CURRENCY CONTRACT - EUR / DFE (000000000) | 0,00 | 0,0014 | 0,0014 | ||||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0014 | 0,0014 | ||||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0014 | 0,0014 | ||||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0013 | 0,0013 | ||||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0013 | 0,0013 | ||||||

| NOVHOL L 03/29/32 6 / LON (US18972FAF99) | 0,00 | 0,0012 | 0,0012 | ||||||

| CURRENCY CONTRACT - EUR / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | ||||||

| CURRENCY CONTRACT - EUR / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | ||||||

| US917288BL51 / Uruguay Government International Bond | 0,00 | 0,00 | 0,0011 | 0,0002 | |||||

| CURRENCY CONTRACT - USD / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | ||||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | ||||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | ||||||

| SWO_CDX CDX.NA.HY.44 (5Y) / DCR (000000000) | 0,00 | 0,0007 | 0,0007 | ||||||

| SWO_CDX CDX.NA.HY.44 (5Y) / DCR (000000000) | 0,00 | 0,0007 | 0,0007 | ||||||

| CURRENCY CONTRACT - CNH / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| CURRENCY CONTRACT - CNH / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| NTPXX / Northern Institutional Funds - Northern Institutional Treasury Portfolio Premier Shares | 0,00 | 711,43 | 0,00 | -100,00 | 0,0006 | 0,0005 | |||

| CURRENCY CONTRACT - CNH / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| CURRENCY CONTRACT - CNH / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| CURRENCY CONTRACT - CNH / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| CURRENCY CONTRACT - CNH / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| CURRENCY CONTRACT - INR / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | ||||||

| CURRENCY CONTRACT - INR / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | ||||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| CURRENCY CONTRACT - JPY / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| CURRENCY CONTRACT - CNH / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| CURRENCY CONTRACT - CNH / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| HYMLF / Hyundai Motor | 0,00 | -99,87 | 0,00 | -100,00 | 0,0001 | -0,0633 | |||

| CURRENCY CONTRACT - CHF / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| CURRENCY CONTRACT - CHF / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| NTPXX / Northern Institutional Funds - Northern Institutional Treasury Portfolio Premier Shares | 0,00 | -99,99 | 0,00 | -100,00 | 0,0001 | -1,1368 | |||

| CURRENCY CONTRACT - CHF / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| CURRENCY CONTRACT - CHF / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| CURRENCY CONTRACT - CHF / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| CURRENCY CONTRACT - CHF / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| ROSN / Public Joint Stock Company Rosneft Oil Company | 0,02 | 0,00 | 0,00 | 0,0000 | 0,0000 | ||||

| OGZD / Public Joint Stock Company Gazprom - Depositary Receipt (Common Stock) | 0,03 | 0,00 | 0,00 | 0,0000 | 0,0000 | ||||

| US78433CAA45 / McClatchy Co LLC/The | 0,00 | 0,00 | -100,00 | 0,0000 | -0,0305 | ||||

| LKOH / PJSC LUKOIL | 0,00 | 0,00 | 0,00 | 0,0000 | 0,0000 | ||||

| AVGO / Broadcom Inc. | 0,00 | -100,00 | 0,00 | -100,00 | -0,3977 | ||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | ||||||

| SWO_CDX CDX.NA.HY.44 (5Y) / DCR (000000000) | -0,00 | -0,0005 | -0,0005 | ||||||

| SWO_CDX CDX.NA.HY.44 (5Y) / DCR (000000000) | -0,00 | -0,0005 | -0,0005 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | ||||||

| SWO_CDX CDX.NA.HY.44 (5Y) / DCR (000000000) | -0,00 | -0,0006 | -0,0006 | ||||||

| SWO_CDX CDX.NA.HY.44 (5Y) / DCR (000000000) | -0,00 | -0,0006 | -0,0006 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0008 | -0,0008 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0008 | -0,0008 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0012 | -0,0012 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0012 | -0,0012 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0018 | -0,0018 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0018 | -0,0018 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0019 | -0,0019 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,00 | -0,0019 | -0,0019 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,01 | -0,0055 | -0,0055 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,01 | -0,0055 | -0,0055 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,01 | -0,0076 | -0,0076 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,01 | -0,0076 | -0,0076 | ||||||

| CURRENCY CONTRACT - USD / DFE (000000000) | -0,02 | -0,0134 | -0,0134 | ||||||

| OIS BRL RCV 11.03% PAY BZDIO1D 02-JAN-2026 / DIR (000000000) | -0,03 | -0,0186 | -0,0186 | ||||||

| OIS BRL RCV 11.03% PAY BZDIO1D 02-JAN-2026 / DIR (000000000) | -0,03 | -0,0186 | -0,0186 | ||||||

| EQIX RCV WAM EM FRO PAY SOFR 1D 03-07-25 / DE (000000000) | -0,04 | -0,0277 | -0,0277 | ||||||

| EQIX RCV WAM EM FRO PAY SOFR 1D 03-07-25 / DE (000000000) | -0,04 | -0,0277 | -0,0277 | ||||||

| OIS BRL RCV 10.23% PAY BZDIO1D 02-JAN-2029 / DIR (000000000) | -0,08 | -0,0586 | -0,0586 | ||||||

| OIS BRL RCV 10.23% PAY BZDIO1D 02-JAN-2029 / DIR (000000000) | -0,08 | -0,0586 | -0,0586 | ||||||

| FUT. YR T-NOTES JUN25 / DIR (000000000) | -2,92 | -2,0978 | -2,0978 | ||||||

| FUT. YR T-NOTES JUN25 / DIR (000000000) | -2,92 | -2,0978 | -2,0978 |