Qt Group Oyj (HLSE:QTCOM) Price Target Decreased by 11.58% to 63.58

The average one-year price target for Qt Group Oyj (HLSE:QTCOM) has been revised to 63,58 € / share. This is a decrease of 11.58% from the prior estimate of 71,91 € dated August 19, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 52,52 € to a high of 73,50 € / share. The average price target represents an increase of 31.85% from the latest reported closing price of 48,22 € / share.

What is the Fund Sentiment?

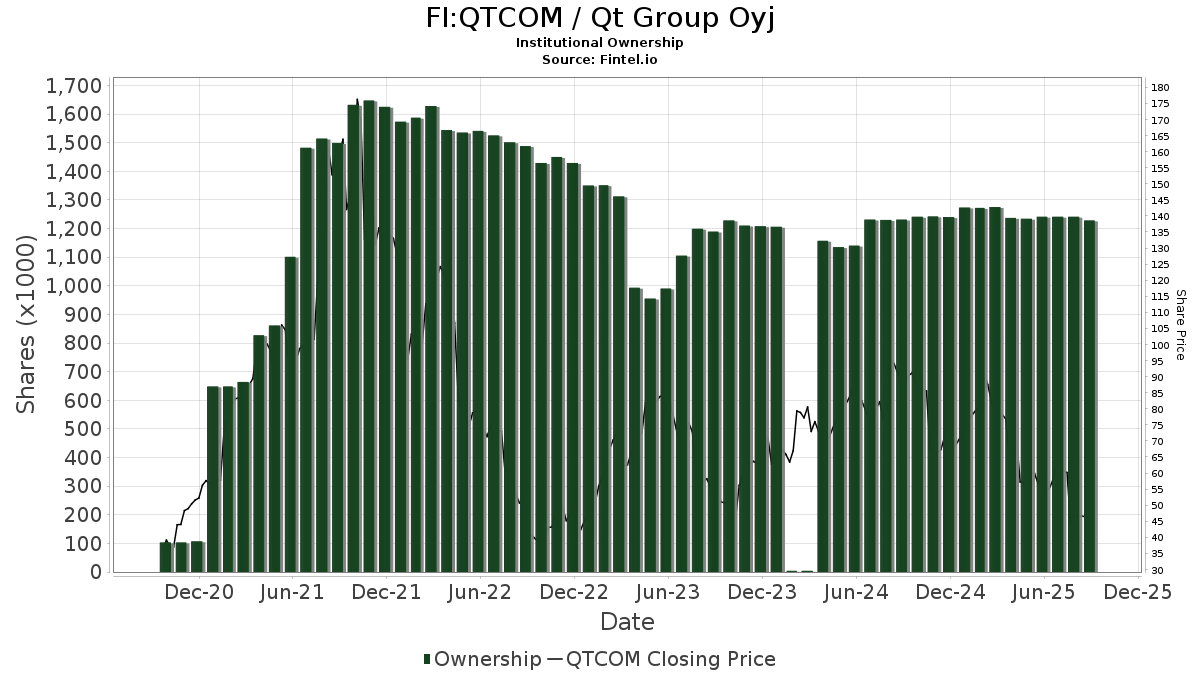

There are 52 funds or institutions reporting positions in Qt Group Oyj. This is unchanged over the last quarter. Average portfolio weight of all funds dedicated to QTCOM is 0.06%, an increase of 18.69%. Total shares owned by institutions decreased in the last three months by 1.04% to 1,229K shares.

What are Other Shareholders Doing?

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 276K shares representing 1.09% ownership of the company. In its prior filing, the firm reported owning 275K shares , representing an increase of 0.45%. The firm decreased its portfolio allocation in QTCOM by 24.17% over the last quarter.

VTMGX - Vanguard Developed Markets Index Fund Admiral Shares holds 160K shares representing 0.63% ownership of the company. In its prior filing, the firm reported owning 173K shares , representing a decrease of 7.65%. The firm decreased its portfolio allocation in QTCOM by 31.65% over the last quarter.

IEFA - iShares Core MSCI EAFE ETF holds 124K shares representing 0.49% ownership of the company. In its prior filing, the firm reported owning 122K shares , representing an increase of 0.94%. The firm decreased its portfolio allocation in QTCOM by 25.54% over the last quarter.

Dfa Investment Trust Co - The Continental Small Company Series holds 79K shares representing 0.31% ownership of the company. No change in the last quarter.

DFIEX - International Core Equity Portfolio - Institutional Class holds 75K shares representing 0.29% ownership of the company. No change in the last quarter.