Citigroup Initiates Coverage of TIM S.A. - Depositary Receipt () (TIMB) with Buy Recommendation

Fintel reports that on September 10, 2025, Citigroup initiated coverage of TIM S.A. - Depositary Receipt () (NYSE:TIMB) with a Buy recommendation.

Analyst Price Forecast Suggests 0.81% Upside

As of August 22, 2025, the average one-year price target for TIM S.A. - Depositary Receipt () is $20.93/share. The forecasts range from a low of $20.01 to a high of $22.32. The average price target represents an increase of 0.81% from its latest reported closing price of $20.76 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for TIM S.A. - Depositary Receipt () is 26,241MM, an increase of 0.76%. The projected annual non-GAAP EPS is 1.70.

What is the Fund Sentiment?

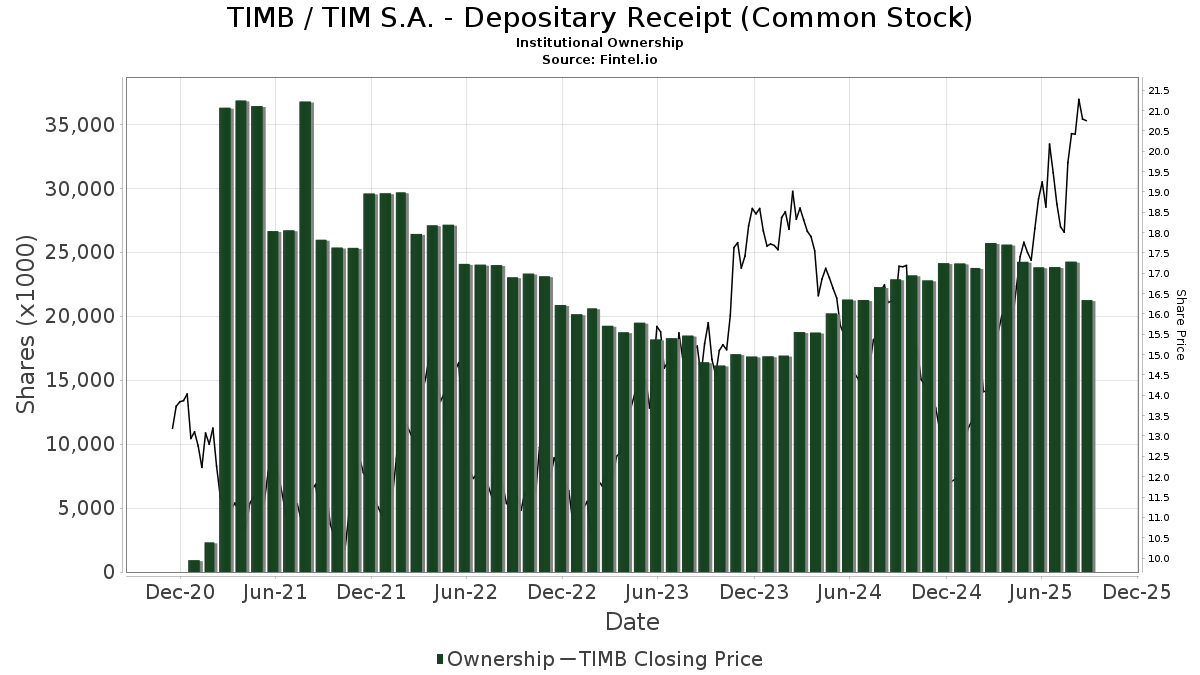

There are 158 funds or institutions reporting positions in TIM S.A. - Depositary Receipt ().

This is an decrease of 1 owner(s) or 0.63% in the last quarter.

Average portfolio weight of all funds dedicated to TIMB is 0.09%, an increase of 23.68%.

Total shares owned by institutions decreased in the last three months by 10.76% to 21,252K shares.

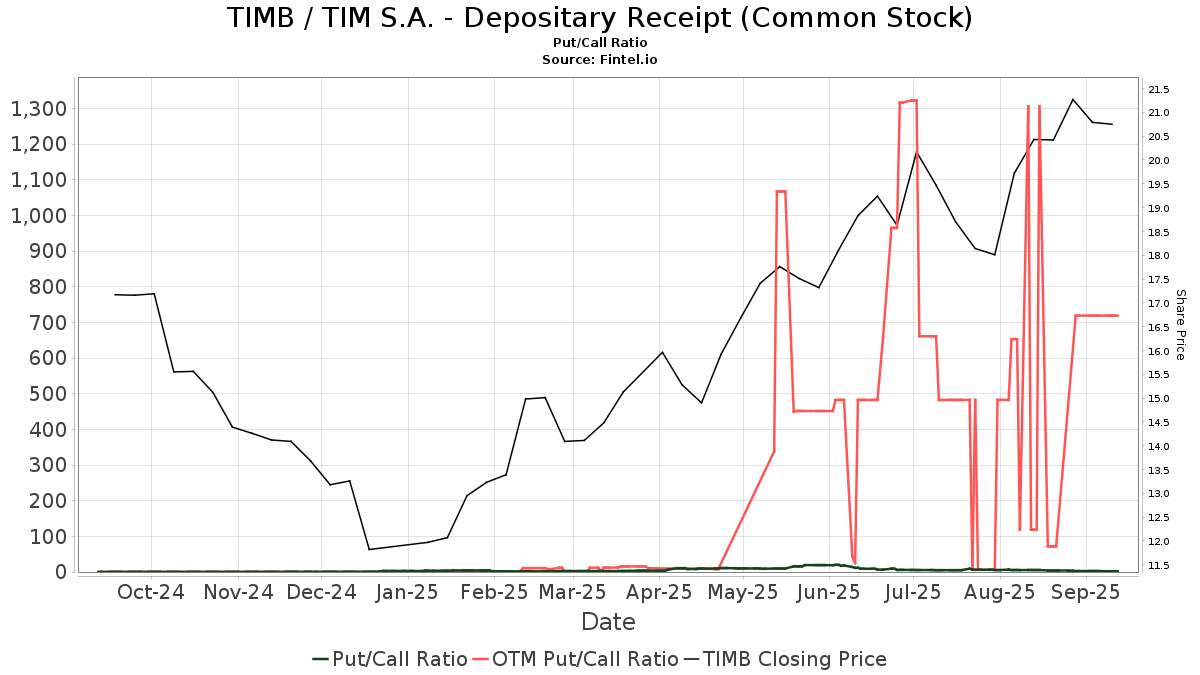

The put/call ratio of TIMB is 2.21, indicating a

bearish outlook.

The put/call ratio of TIMB is 2.21, indicating a

bearish outlook.

What are Other Shareholders Doing?

Robeco Institutional Asset Management B.V. holds 3,482K shares. In its prior filing, the firm reported owning 3,143K shares , representing an increase of 9.75%. The firm increased its portfolio allocation in TIMB by 18.51% over the last quarter.

Arrowstreet Capital, Limited Partnership holds 1,989K shares. In its prior filing, the firm reported owning 2,110K shares , representing a decrease of 6.04%. The firm increased its portfolio allocation in TIMB by 5.53% over the last quarter.

Renaissance Technologies holds 1,682K shares. In its prior filing, the firm reported owning 1,625K shares , representing an increase of 3.35%. The firm increased its portfolio allocation in TIMB by 16.86% over the last quarter.

Macquarie Group holds 1,680K shares. In its prior filing, the firm reported owning 1,713K shares , representing a decrease of 1.98%. The firm increased its portfolio allocation in TIMB by 38.93% over the last quarter.

DEMAX - Delaware Emerging Markets Fund holds 1,245K shares. No change in the last quarter.