AddLife AB (OM:ALIF B) Price Target Increased by 11.05% to 194.82

The average one-year price target for AddLife AB (OM:ALIF B) has been revised to 194,82 kr / share. This is an increase of 11.05% from the prior estimate of 175,44 kr dated March 17, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 181,80 kr to a high of 215,25 kr / share. The average price target represents an increase of 34.45% from the latest reported closing price of 144,90 kr / share.

AddLife AB Maintains 0.35% Dividend Yield

At the most recent price, the company’s dividend yield is 0.35%.

Additionally, the company’s dividend payout ratio is 0.23. The payout ratio tells us how much of a company’s income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company’s income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company’s 3-Year dividend growth rate is -0.75% .

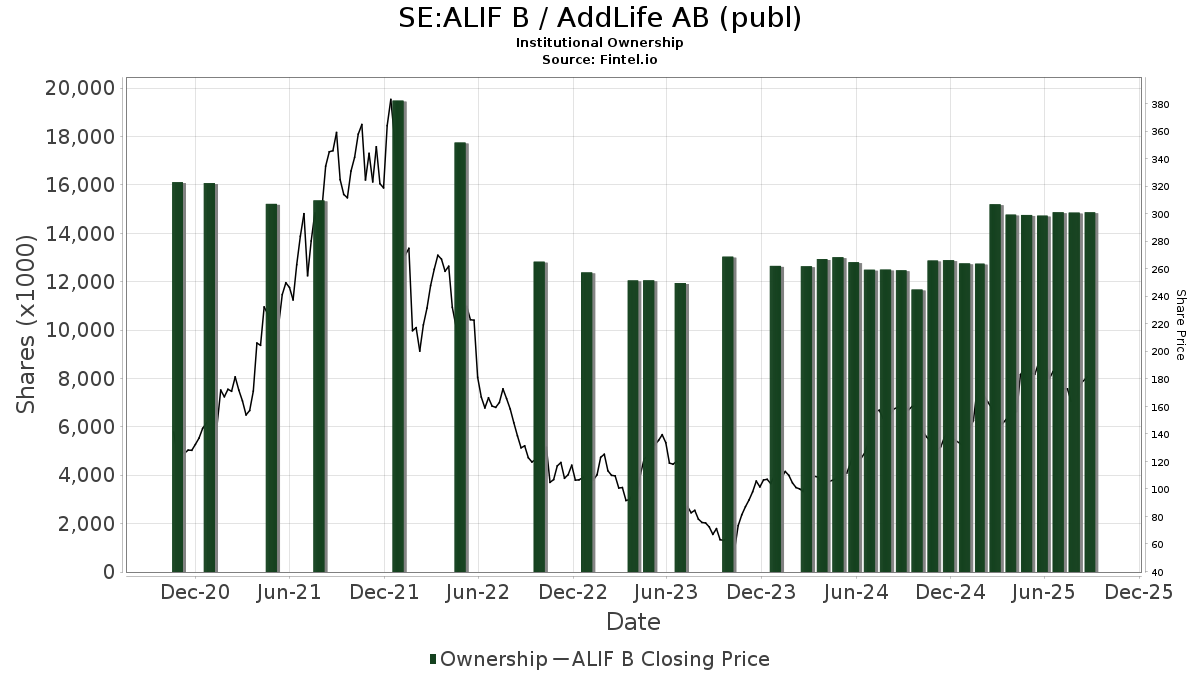

What is the Fund Sentiment?

There are 69 funds or institutions reporting positions in AddLife AB. This is an increase of 7 owner(s) or 11.29% in the last quarter. Average portfolio weight of all funds dedicated to ALIF B is 0.10%, an increase of 3.78%. Total shares owned by institutions increased in the last three months by 15.80% to 14,771K shares.

What are Other Shareholders Doing?

SMCWX - SMALLCAP WORLD FUND INC holds 2,092K shares representing 1.78% ownership of the company. In its prior filing, the firm reported owning 68K shares , representing an increase of 96.77%. The firm increased its portfolio allocation in ALIF B by 1,913.63% over the last quarter.

FOSFX - Fidelity Overseas Fund holds 1,578K shares representing 1.35% ownership of the company. No change in the last quarter.

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 1,534K shares representing 1.31% ownership of the company. In its prior filing, the firm reported owning 1,521K shares , representing an increase of 0.84%. The firm increased its portfolio allocation in ALIF B by 7.25% over the last quarter.

FWWFX - Fidelity Worldwide Fund holds 1,134K shares representing 0.97% ownership of the company. No change in the last quarter.

FSTSX - Fidelity Series International Small Cap Fund holds 1,030K shares representing 0.88% ownership of the company. In its prior filing, the firm reported owning 1,384K shares , representing a decrease of 34.38%. The firm decreased its portfolio allocation in ALIF B by 18.02% over the last quarter.