Statistiques de base

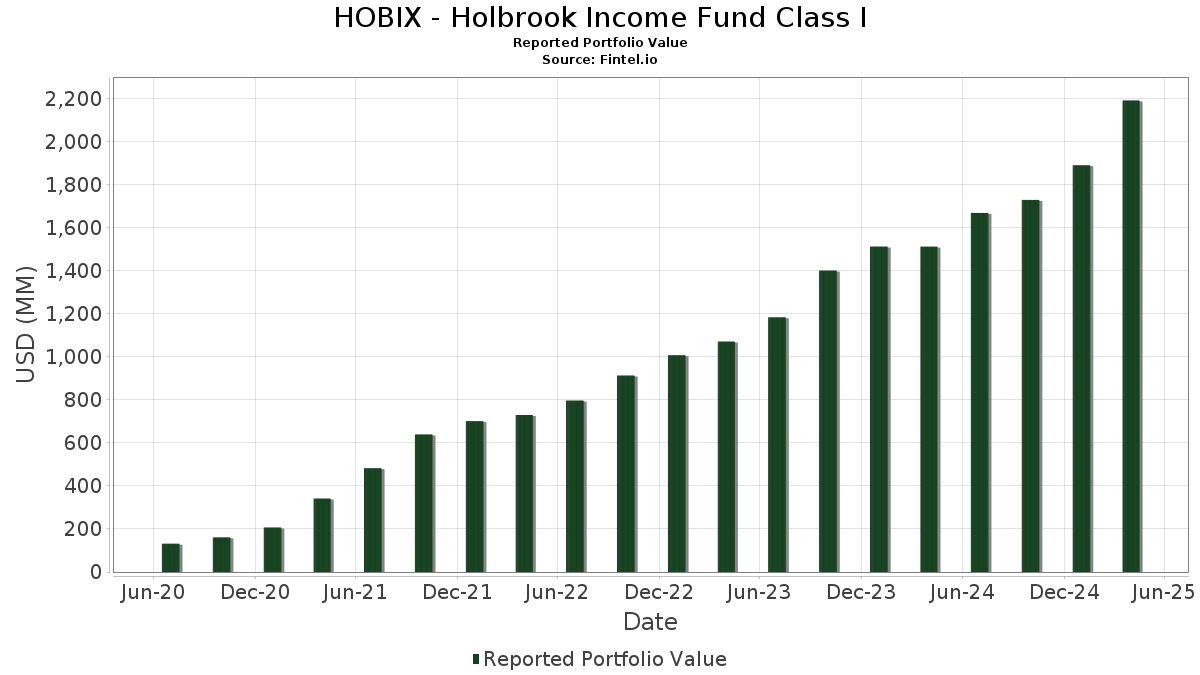

| Valeur du portefeuille | $ 2 192 554 973 |

| Positions actuelles | 246 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

HOBIX - Holbrook Income Fund Class I a déclaré un total de 246 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 2 192 554 973 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de HOBIX - Holbrook Income Fund Class I sont First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , United States Treasury Inflation Indexed Bonds (US:US9128287D64) , United States Treasury Inflation Indexed Bonds (US:US912810PZ57) , Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 (US:US912810FH69) , and Babcock & Wilcox Enterprises, Inc. - Corporate Bond/Note (US:BWSN) . Les nouvelles positions de HOBIX - Holbrook Income Fund Class I incluent First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , United States Treasury Inflation Indexed Bonds (US:US9128287D64) , United States Treasury Inflation Indexed Bonds (US:US912810PZ57) , Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 (US:US912810FH69) , and Kuvare US Holdings Inc (US:US50149XAA28) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 86,00 | 3,9615 | 3,9615 | ||

| 54,42 | 2,5069 | 2,5069 | ||

| 50,07 | 2,3066 | 2,3066 | ||

| 143,93 | 6,6300 | 2,2924 | ||

| 43,23 | 1,9912 | 1,9912 | ||

| 25,00 | 1,1516 | 1,1516 | ||

| 24,50 | 1,1286 | 1,1286 | ||

| 19,95 | 0,9191 | 0,9191 | ||

| 17,64 | 0,8126 | 0,8126 | ||

| 16,48 | 0,7591 | 0,7591 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 0,07 | 0,96 | 0,0444 | -3,5835 | |

| 25,74 | 1,1858 | -1,9854 | ||

| 35,82 | 1,6501 | -0,4324 | ||

| 2,48 | 46,74 | 2,1530 | -0,3603 | |

| 53,38 | 2,4588 | -0,2950 | ||

| 37,53 | 1,7288 | -0,2700 | ||

| 37,89 | 1,7452 | -0,2645 | ||

| 37,87 | 1,7445 | -0,2585 | ||

| 13,96 | 0,6431 | -0,2524 | ||

| 30,24 | 1,3930 | -0,2184 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-06-26 pour la période de déclaration 2025-04-30. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | Prix moyen de l'action | Actions (en millions) |

ΔActions (%) |

ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 143,93 | 76,27 | 6,6300 | 2,2924 | |||||

| RILY 8 01/01/28 / DBT (US05580MAC29) | 86,00 | 3,9615 | 3,9615 | ||||||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 59,94 | 15,41 | 2,7613 | 0,0020 | |||||

| US912810PZ57 / United States Treasury Inflation Indexed Bonds | 54,42 | 2,5069 | 2,5069 | ||||||

| US912810FH69 / Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 | 53,38 | 2,97 | 2,4588 | -0,2950 | |||||

| RDYCAP 9 3/8 03/01/28 / DBT (US755763AE91) | 50,07 | 2,3066 | 2,3066 | ||||||

| BWSN / Babcock & Wilcox Enterprises, Inc. - Corporate Bond/Note | 2,48 | 16,01 | 46,74 | -1,21 | 2,1530 | -0,3603 | |||

| CHRB / Charah Solutions, Inc. - Corporate Bond/Note | 2,17 | 2,48 | 45,46 | 14,56 | 2,0941 | -0,0139 | |||

| US50149XAA28 / Kuvare US Holdings Inc | 43,23 | 1,9912 | 1,9912 | ||||||

| US80349AAD19 / SAR 4 3/8 02/28/26 | 37,89 | 0,14 | 1,7452 | -0,2645 | |||||

| US70806AAA43 / PennantPark Floating Rate Capital Ltd | 37,87 | 0,43 | 1,7445 | -0,2585 | |||||

| US73688FAC68 / PTMN 4 7/8 04/30/26 | 37,53 | -0,26 | 1,7288 | -0,2700 | |||||

| NEXBAN FLOAT PERP / EP (US65341T3059) | 35,82 | -8,62 | 1,6501 | -0,4324 | |||||

| US376535AC46 / Gladstone Capital Corp | 34,37 | 1,35 | 1,5834 | -0,2182 | |||||

| US708062AD65 / PNNT 4 11/01/26 | 31,47 | 10,96 | 1,4499 | -0,0569 | |||||

| US610335AB74 / MRCC 4 3/4 02/15/26 | 31,12 | 3,25 | 1,4333 | -0,1676 | |||||

| US708062AC82 / PNNT 4 1/2 05/01/26 | 30,24 | -0,31 | 1,3930 | -0,2184 | |||||

| US67114QAA22 / OWS Cre Funding I LLC | 28,98 | -0,58 | 1,3352 | -0,2135 | |||||

| US316500AB36 / Fidus Investment Corp | 28,76 | 2,53 | 1,3247 | -0,1653 | |||||

| US896442AG58 / Trinity Capital Inc | 25,80 | 33,78 | 1,1883 | 0,1639 | |||||

| TII 1 5/8 10/15/29 / DBT (US91282CLV18) | 25,74 | -56,88 | 1,1858 | -1,9854 | |||||

| US05614L5066 / BABCOCK and WILCOX ENTERPRISES INC 6.5% PFD 12/31/2026 | 1,62 | 26,66 | 25,66 | -1,64 | 1,1819 | -0,2039 | |||

| EGPNTD Float 04/30/28 / DBT (US26982MAA62) | 25,00 | 1,1516 | 1,1516 | ||||||

| GAINN / Gladstone Investment Corporation - Corporate Bond/Note | 1,00 | 37,58 | 24,93 | 40,05 | 1,1486 | 0,2028 | |||

| EAGLPO Float 11/15/29 / DBT (US269806AA39) | 24,55 | -0,89 | 1,1307 | -0,1849 | |||||

| Synchronoss First Ln TL / LON (N/A) | 24,50 | 1,1286 | 1,1286 | ||||||

| US80349A8027 / SAR 6 | 0,97 | 92,00 | 23,97 | 92,55 | 1,1044 | 0,4429 | |||

| SPLPP / Steel Partners Holdings L.P. - Limited Partnership | 0,88 | 2,42 | 21,14 | 0,95 | 0,9739 | -0,1386 | |||

| ANG.PRB / American National Group Inc. - Preferred Stock | 0,84 | 318,97 | 21,08 | 317,80 | 0,9712 | 0,7031 | |||

| SNDPT 2019-1A CRR / ABS-CBDO (US83611KBA97) | 19,95 | 0,9191 | 0,9191 | ||||||

| FCRX / Crescent Capital BDC, Inc. - Preferred Stock | 0,80 | 56,17 | 19,82 | 58,35 | 0,9129 | 0,2480 | |||

| US67103BAA89 / OFS Capital Corp | 19,78 | 2,23 | 0,9111 | -0,1167 | |||||

| US46090RAA23 / ICMB 4 7/8 04/01/26 | 19,66 | 0,60 | 0,9056 | -0,1325 | |||||

| US896442AH32 / Trinity Capital Inc | 18,80 | 0,59 | 0,8659 | -0,1268 | |||||

| MSC 2024-BPR2 B / ABS-O (US61776EAE32) | 18,55 | 39,96 | 0,8547 | 0,1505 | |||||

| CGMS 2013-3A CR / ABS-CBDO (US14310GAW06) | 17,95 | -0,73 | 0,8268 | -0,1337 | |||||

| US32082CAC10 / First Maryland Capital II | 17,64 | 0,8126 | 0,8126 | ||||||

| GECCO / Great Elm Capital Corp. - Corporate Bond/Note | 0,67 | 4,19 | 16,81 | 5,74 | 0,7745 | -0,0702 | |||

| REG13 2018-2A CR / ABS-CBDO (US75888FAS48) | 16,48 | 0,7591 | 0,7591 | ||||||

| OZLM 2014-6A CT / ABS-CBDO (US67108LBR33) | 16,45 | 229,89 | 0,7575 | 0,4927 | |||||

| NMFC / New Mountain Finance Corporation | 14,99 | 0,6905 | 0,6905 | ||||||

| CBAM 2017-4A D / ABS-CBDO (US12481NAF96) | 14,95 | -0,59 | 0,6886 | -0,1102 | |||||

| MAIN / Main Street Capital Corporation | 14,65 | 0,6748 | 0,6748 | ||||||

| NREF 5 3/4 05/01/26 / DBT (US65342VAB71) | 14,58 | 0,08 | 0,6715 | -0,1023 | |||||

| FASST 2022-S3 A1 / ABS-O (US31739PAA57) | 14,26 | 0,20 | 0,6570 | -0,0991 | |||||

| US83609RAG65 / SNDPT 2017-1A D | 13,96 | -17,18 | 0,6431 | -0,2524 | |||||

| SHLFNS 9 7/8 11/22/28 / DBT (NO0013220285) | 13,93 | 0,6418 | 0,6418 | ||||||

| MSC 2024-BPR2 A / ABS-O (US61776EAA10) | 12,96 | 0,68 | 0,5969 | -0,0868 | |||||

| HTFB / Horizon Technology Finance Corporation - Preferred Security | 0,50 | 44,48 | 12,50 | 44,18 | 0,5760 | 0,1153 | |||

| JEFFM 2015-1A CRR / ABS-CBDO (US47421MBN20) | 12,44 | -0,48 | 0,5732 | -0,0910 | |||||

| US98887VAE39 / ZAIS CLO 7 LTD ZAIS7 2017-2A C | 12,42 | 216,94 | 0,5722 | 0,3640 | |||||

| WOODS 2018-12BA CR / ABS-CBDO (US66858CAS61) | 12,23 | -1,11 | 0,5634 | -0,0936 | |||||

| US00489QAA04 / ACRES Commercial Realty Corp | 12,22 | 1,13 | 0,5629 | -0,0790 | |||||

| WTI / W&T Offshore, Inc. | 12,18 | 0,5611 | 0,5611 | ||||||

| US80349AAF66 / SAR 4.35 02/28/27 | 11,77 | 0,30 | 0,5420 | -0,0811 | |||||

| WINDR 2014-3KRA C / ABS-CBDO (US88390BAG32) | 10,83 | -0,48 | 0,4988 | -0,0792 | |||||

| USG82854AC78 / SOUND POINT CLO V-R LTD | 10,49 | 109,57 | 0,4834 | 0,2174 | |||||

| MAIN / Main Street Capital Corporation | 10,24 | 0,4719 | 0,4719 | ||||||

| UIHC / American Coastal Insurance Corp | 10,21 | 0,4701 | 0,4701 | ||||||

| US14054R1068 / Capitala Finance Corp. | 10,05 | 1,31 | 0,4631 | -0,0640 | |||||

| SNDPT 2015-2A CRRR / ABS-CBDO (US83609GBS30) | 9,99 | 0,4602 | 0,4602 | ||||||

| SCM / Stellus Capital Investment Corporation | 9,98 | 0,4598 | 0,4598 | ||||||

| CIFC 2013-4A DR2 / ABS-CBDO (US12549FCA57) | 9,94 | 0,4580 | 0,4580 | ||||||

| US39808B2060 / GRSDOF 6 3/4 | 0,41 | 0,00 | 9,87 | -0,21 | 0,4548 | -0,0708 | |||

| FDUS / Fidus Investment Corporation | 9,87 | 0,4546 | 0,4546 | ||||||

| SpecialTransportHolding / EC (N/A) | 0,00 | 9,66 | 0,4450 | 0,4450 | |||||

| CSWC / Capital Southwest Corporation | 9,36 | 0,4313 | 0,4313 | ||||||

| US05608BAN01 / BX Commercial Mortgage Trust 2019-IMC | 9,28 | 87,40 | 0,4277 | 0,1645 | |||||

| AWPT 2018-10A DR / ABS-CBDO (US28623CAS08) | 8,93 | 0,4115 | 0,4115 | ||||||

| ZAIS 2018-11A CR / ABS-CBDO (US98887YAS63) | 8,85 | -0,25 | 0,4077 | -0,0636 | |||||

| US316500AC19 / Fidus Investment Corp | 8,69 | 14,76 | 0,4004 | -0,0019 | |||||

| HLA 2018-2A B / ABS-CBDO (US40490AAG58) | 8,65 | -0,23 | 0,3983 | -0,0621 | |||||

| BATLN 2018-12A DRR / ABS-CBDO (US07133RBC88) | 8,45 | 0,3892 | 0,3892 | ||||||

| US83609YAG17 / Sounds Point CLO IV-R, Ltd. | 8,43 | 0,3885 | 0,3885 | ||||||

| US90278W3034 / UIRC-GSA International LLC PREFERRED STOCK | 0,01 | 0,00 | 8,26 | -2,17 | 0,3806 | -0,0681 | |||

| US28852EAE95 / ECLO 2017-2A C | 7,94 | -11,89 | 0,3658 | -0,1130 | |||||

| US50184NAP78 / LCM XV LP | 7,75 | 0,3568 | 0,3568 | ||||||

| HLM 5A-2015 DR3 / ABS-CBDO (US44331DAY58) | 7,33 | 0,3376 | 0,3376 | ||||||

| US14889DAQ16 / Catamaran CLO 2014-1 Ltd | 7,20 | 8,42 | 0,3317 | -0,0211 | |||||

| US98878CAG15 / ZCCP 2018-1A B | 7,02 | 0,3233 | 0,3233 | ||||||

| USG06220AM23 / ATLAS SENIOR LOAN FUND VII SERIES: 16-7A CLASS: CR | 7,01 | -0,47 | 0,3231 | -0,0513 | |||||

| US28852LAJ26 / Ellington Clo III Ltd | 7,00 | 0,3223 | 0,3223 | ||||||

| BCC 2018-2A CR / ABS-CBDO (US05682VAS43) | 6,97 | 0,3209 | 0,3209 | ||||||

| RAD 2019-4A DR / ABS-CBDO (US749984AG53) | 6,70 | 0,3084 | 0,3084 | ||||||

| COMM 2016-COR1 B / ABS-O (US12594MBE75) | 6,48 | 0,2983 | 0,2983 | ||||||

| US78590A6047 / Sachem Capital Corp., 6.000%, due 12/30/2026 Pfd | 0,30 | 19,89 | 6,46 | 19,78 | 0,2974 | 0,0111 | |||

| US50189PAN24 / LCM XXV Ltd | 6,02 | 30,66 | 0,2773 | 0,0325 | |||||

| WINDR 2015-1A DR / ABS-CBDO (US88432FBG37) | 6,01 | -0,50 | 0,2770 | -0,0440 | |||||

| MIDO 2013-2A DR / ABS-CBDO (US59863KAQ04) | 5,99 | 0,2761 | 0,2761 | ||||||

| ATLCZ / Atlanticus Holdings Corporation - Preferred Security | 0,24 | 2,85 | 5,98 | 3,59 | 0,2755 | -0,0312 | |||

| US140501AC12 / Capital Southwest Corp., 3.375%, due 10/01/2026 | 5,92 | 75,21 | 0,2726 | -0,0139 | |||||

| PMTU / PennyMac Mortgage Investment Trust - Corporate Bond/Note | 0,23 | 0,80 | 5,88 | -0,61 | 0,2707 | -0,0434 | |||

| US83608GAS57 / Sound Point CLO II Ltd | 5,49 | -0,42 | 0,2529 | -0,0400 | |||||

| US44422PBW14 / HUDSONS BAY SIMON JV TRUST HBCT 2015 HB10 B10 144A | 5,44 | 3,34 | 0,2506 | -0,0291 | |||||

| US05591VAA35 / BPR 2021-WILL A 6/23 | 5,43 | -1,52 | 0,2503 | -0,0428 | |||||

| US09630AAJ51 / BlueMountain CLO 2018-3 Ltd | 5,10 | -0,22 | 0,2348 | -0,0366 | |||||

| AAIN / Arlington Asset Investment Corp. - Corporate Bond/Note | 0,21 | 0,00 | 5,02 | -1,39 | 0,2314 | -0,0392 | |||

| SHACK 2013-3A CR / ABS-CBDO (US81881QAW69) | 5,01 | -0,22 | 0,2310 | -0,0360 | |||||

| EQUIFY 9 1/2 04/30/30 / DBT (US29446PAA30) | 5,00 | 0,2303 | 0,2303 | ||||||

| NEWT / NewtekOne, Inc. | 5,00 | 0,2302 | 0,2302 | ||||||

| US13877BAC28 / Canyon CLO Ltd., Series 2018-1A, Class B | 5,00 | 0,2302 | 0,2302 | ||||||

| ZAIS 2020-14A DR2 / ABS-CBDO (US98888BBQ86) | 4,99 | 65,97 | 0,2298 | 0,0701 | |||||

| US09628JAS06 / BlueMountain CLO 2015-3 Ltd | 4,98 | 0,2294 | 0,2294 | ||||||

| DRSLF 2017-53A C / ABS-CBDO (US26243EAC57) | 4,98 | -0,66 | 0,2292 | -0,0369 | |||||

| MMPCAP 9 1/2 10/18/29 / DBT (US55330PAA75) | 4,97 | -0,50 | 0,2292 | -0,0364 | |||||

| US691205AG35 / Owl Rock Technology Finance Corp | 4,96 | -1,02 | 0,2286 | -0,0377 | |||||

| US056162AU42 / Babson CLO Ltd 2015-I | 4,89 | 0,2255 | 0,2255 | ||||||

| US69429PAA03 / PDOFMS FLOAT 03/01/25 | 4,88 | -1,51 | 0,2249 | -0,0384 | |||||

| US92914RBC51 / Voya CLO Ltd., Series 2014-4A, Class BR2 | 4,70 | 26,31 | 0,2163 | 0,0188 | |||||

| US55821CAE49 / Atrium IX | 4,65 | -0,30 | 0,2144 | -0,0336 | |||||

| US50190AAT97 / LCM XVII LP, Series 17A, Class CRR | 4,08 | -0,29 | 0,1877 | -0,0294 | |||||

| XCAL 2024-MSD A / ABS-O (US98373XBW92) | 4,01 | 0,15 | 0,1846 | -0,0279 | |||||

| US92329NAU46 / VENTURE XIII CLO Ltd | 4,00 | -0,32 | 0,1842 | -0,0289 | |||||

| US80317EAJ82 / SARANAC CLO VII LTD SRANC 2014-2A CR | 4,00 | -0,17 | 0,1842 | -0,0286 | |||||

| US40417L2051 / HC GOV REALTY | 0,21 | 0,00 | 3,95 | 0,00 | 0,1818 | -0,0279 | |||

| US83611LAG59 / SOUND POINT CLO III-R Ltd. | 3,91 | 95,11 | 0,1802 | 0,0737 | |||||

| US46090UAA51 / INVECO 5 1/8 08/13/26 | 3,86 | 1,53 | 0,1777 | -0,0242 | |||||

| US96524VAB27 / WhiteHorse Finance Inc | 3,85 | 345,43 | 0,1775 | 0,1041 | |||||

| US636190AA82 / NATLFD 5 3/4 08/31/26 | 3,82 | 0,42 | 0,1760 | -0,0261 | |||||

| OZLM 2018-20A B / ABS-CBDO (US67112MAE57) | 3,75 | 113,37 | 0,1728 | 0,0794 | |||||

| US50200YAU29 / LCM 30 Ltd | 3,74 | 0,1725 | 0,1725 | ||||||

| US55320RAL15 / MP CLO VII Ltd., Series 2015-1A, Class CRR | 3,69 | 11,94 | 0,1702 | -0,0051 | |||||

| US40490BAE83 / HLA 2017-2A B | 3,63 | -0,11 | 0,1671 | -0,0258 | |||||

| US92331ABE38 / VENTURE XXVIII CLO LTD VENTR 2017-28A C2R | 3,51 | -0,14 | 0,1618 | -0,0251 | |||||

| SYMP 2015-16A C1RR / ABS-CBDO (US87165VBB45) | 3,50 | 53,13 | 0,1612 | 0,0398 | |||||

| US90278W4024 / UIRCIN 6 1/2 PERP | 0,00 | 0,00 | 3,48 | -2,22 | 0,1601 | -0,0287 | |||

| KKR 2013-1A BR2 / ABS-CBDO (US48249VBA89) | 3,45 | 0,1589 | 0,1589 | ||||||

| US92912VBE48 / Voya CLO 2014-2 Ltd | 3,35 | 32,18 | 0,1544 | 0,0197 | |||||

| ATCLO 2018-11A C / ABS-CBDO (US04941YAL39) | 3,27 | -0,43 | 0,1507 | -0,0238 | |||||

| US583928AG14 / Medallion Financial Corp. 7.24% Due 02/26/2026 | 3,20 | 1,27 | 0,1474 | -0,0204 | |||||

| US46651MAL00 / J.P. MORGAN CHASE COMMERCIAL MORTGAGE SECURITIES T JPMCC 2019-MFP D | 3,19 | 68,98 | 0,1468 | 0,0466 | |||||

| US00176CAU53 / AMMC CLO XII Ltd | 3,10 | -0,35 | 0,1426 | -0,0225 | |||||

| USG8285VAD58 / SOUND POINT CLO 2018-2120311027 FLT | 3,01 | 0,1388 | 0,1388 | ||||||

| US92329NAS99 / VENTR 2013-13A CR | 3,00 | -0,10 | 0,1381 | -0,0213 | |||||

| US553205AJ42 / MP CLO III LTD | 2,99 | 0,1375 | 0,1375 | ||||||

| US98373XAC48 / X-Caliber Funding LLC, Series A | 2,97 | -0,24 | 0,1366 | -0,0213 | |||||

| US691205AE86 / Owl Rock Technology Finance Corp | 2,93 | 0,52 | 0,1348 | -0,0198 | |||||

| US83610KAN37 / Sound Point Clo XVI Ltd | 2,89 | -0,17 | 0,1331 | -0,0206 | |||||

| US98373XBD12 / X-Caliber Funding LLC 11/01/2024 8.580% | 2,87 | -42,78 | 0,1320 | -0,1340 | |||||

| US47049QAC06 / Jamestown CLO XI Ltd | 2,80 | 0,1290 | 0,1290 | ||||||

| US92737L2097 / VINBRK 6 1/2 | 0,12 | 0,00 | 2,79 | -2,17 | 0,1285 | -0,0230 | |||

| US81881JAG76 / SHACKLETON 2014-V-R CLO LTD SHACK 2014-5RA C | 2,75 | -0,43 | 0,1268 | -0,0201 | |||||

| HLM 3A-2014 BR / ABS-CBDO (US40436XAG25) | 2,75 | -0,11 | 0,1266 | -0,0196 | |||||

| US92914NAQ43 / Voya CLO 2015-1 Ltd | 2,74 | -0,36 | 0,1261 | -0,0198 | |||||

| US302635AK33 / FS KKR Capital Corp. | 2,71 | 0,1247 | 0,1247 | ||||||

| US87232BAK89 / TSYMP_17-1A | 2,66 | 300,45 | 0,1223 | 0,0871 | |||||

| US83610HAG56 / SOUND POINT CLO VII-R LTD | 2,50 | 0,1151 | 0,1151 | ||||||

| US92917CAL63 / Voya CLO 2013-1 Ltd | 2,50 | 0,1151 | 0,1151 | ||||||

| US67590YAS90 / Octagon Investment Partners 26 Ltd., Series 2016-1A, Class CR | 2,49 | -0,40 | 0,1148 | -0,0182 | |||||

| ARES 2015-4A CRR / ABS-CBDO (US04015NAU81) | 2,49 | -0,68 | 0,1148 | -0,0185 | |||||

| US75575RAA59 / Ready Capital Mortgage Financing 2023-FL11 LLC | 2,38 | -27,90 | 0,1095 | -0,0657 | |||||

| US09626YAU47 / BlueMountain CLO 2013-2 Ltd | 2,34 | -0,47 | 0,1076 | -0,0171 | |||||

| US09628NAU63 / BlueMountain CLO 2015-4 Ltd | 2,33 | -0,43 | 0,1072 | -0,0170 | |||||

| US07132ACG67 / Battalion CLO VIII Ltd | 2,27 | 0,00 | 0,1044 | -0,0160 | |||||

| US05490AAA16 / BB-UBS Trust, Series 2012-TFT, Class A | 2,19 | -6,86 | 0,1008 | -0,0240 | |||||

| US452763AA32 / IMPRL 22-NQM7 A1 144A 7.369% 11-25-67/26 | 2,13 | -4,75 | 0,0980 | -0,0206 | |||||

| US27830TAG04 / Eaton Vance CLO Ltd., Series 2014-1RA, Class C | 2,11 | -0,28 | 0,0971 | -0,0152 | |||||

| ATCLO 2017-8A C / ABS-CBDO (US04943AAG40) | 2,10 | 91,07 | 0,0967 | 0,0383 | |||||

| US98887HAN44 / ZCLO3 2015-3A BR | 2,08 | -0,33 | 0,0960 | -0,0151 | |||||

| US30289UAU60 / FREMF 2016-K56 Mortgage Trust | 2,08 | 0,53 | 0,0957 | -0,0141 | |||||

| MIDO 2014-3A CR / ABS-CBDO (US59802UAQ22) | 2,05 | -0,19 | 0,0946 | -0,0147 | |||||

| US30259RAM79 / FMMSR 2022-GT1 A | 2,01 | 1,31 | 0,0928 | -0,0128 | |||||

| US98373XAX84 / XCALFD 5 03/01/25 | 1,99 | 0,15 | 0,0919 | -0,0139 | |||||

| US30295DAJ19 / FREMF Mortgage Trust, Series 2016-K57, Class C | 1,98 | 0,71 | 0,0910 | -0,0133 | |||||

| US320808AD01 / First Md Cap I 1.880 1/15/27 Bond | 1,97 | 0,0906 | 0,0906 | ||||||

| US23110AAA43 / Cumulus Media New Holdings Inc | 1,95 | 0,0898 | 0,0898 | ||||||

| US67111VAJ52 / OZLM XXII, Ltd. | 1,94 | -0,92 | 0,0896 | -0,0147 | |||||

| US583928AE65 / MFIN 7 1/2 12/30/27 | 1,93 | 3,54 | 0,0891 | -0,0101 | |||||

| US32050FAA66 / FIHEFI 6 11/15/26 | 1,93 | 0,63 | 0,0889 | -0,0130 | |||||

| US75902UAA25 / REGCAP 6 12/28/26 | 1,93 | 0,68 | 0,0887 | -0,0129 | |||||

| US03761UAH95 / APOLLO INVESTMENT CORP REGD 4.50000000 | 1,90 | 0,0875 | 0,0875 | ||||||

| TIA 2018-1A BR / ABS-CBDO (US88631YAS63) | 1,89 | 274,06 | 0,0870 | 0,0602 | |||||

| US98401JAA51 / XCALI 2020-5 Mortgage Trust | 1,87 | -0,74 | 0,0862 | -0,0140 | |||||

| MSC 2024-BPR2 C / ABS-O (US61776EAG89) | 1,65 | 0,43 | 0,0760 | -0,0113 | |||||

| US67590EBL74 / OCT15_13-1A | 1,58 | 0,0728 | 0,0728 | ||||||

| US81882HAE53 / Shackleton 2013-IV-R CLO Ltd | 1,55 | 210,20 | 0,0715 | 0,0449 | |||||

| US67107KBD72 / OCP CLO 2014-7 Ltd | 1,50 | -0,33 | 0,0691 | -0,0108 | |||||

| US27830KBA16 / Eaton Vance Clo 2015-1 Ltd. | 1,50 | -0,33 | 0,0690 | -0,0109 | |||||

| US26244QAS21 / Dryden 49 Senior Loan Fund, Series 2017-49A, Class CR | 1,50 | -0,33 | 0,0690 | -0,0108 | |||||

| US92331NAG16 / Venture XXX CLO Ltd | 1,50 | -0,33 | 0,0690 | -0,0108 | |||||

| US04016VAG05 / ARES XLVII CLO Ltd 1.99 | 1,49 | 0,0688 | 0,0688 | ||||||

| US85816WAG96 / Steele Creek CLO 2014-1 Ltd | 1,48 | -0,27 | 0,0682 | -0,0107 | |||||

| US85816VAC00 / Steele Creek Clo 2017-1 Ltd | 1,42 | -0,42 | 0,0656 | -0,0103 | |||||

| REG14 2018-3A DR / ABS-CBDO (US75888MAR16) | 1,42 | -0,63 | 0,0654 | -0,0105 | |||||

| US11135BAA89 / Broadmark Realty Capital Inc | 1,41 | 0,64 | 0,0652 | -0,0095 | |||||

| US12550YAS37 / CIFC Funding 2017-II Ltd | 1,35 | -0,44 | 0,0621 | -0,0098 | |||||

| US64830YAA55 / NZES 2020-FNT1 A | 1,30 | -5,33 | 0,0598 | -0,0131 | |||||

| US67112GAE89 / OZLM XVIII Ltd | 1,27 | -0,70 | 0,0587 | -0,0095 | |||||

| US40390PAB40 / HRR 2021-1A B | 1,26 | -10,76 | 0,0581 | -0,0170 | |||||

| US67572YBU55 / Octagon Investment Partners XXII Ltd | 1,25 | 0,0574 | 0,0574 | ||||||

| US87165YAJ29 / Symphony CLO XIX Ltd | 1,24 | 0,0573 | 0,0573 | ||||||

| US39808PAQ90 / Greywolf CLO V Ltd | 1,17 | -0,26 | 0,0541 | -0,0084 | |||||

| US00175MBQ24 / AMMC CLO 15 Ltd., Series 2014-15A, Class BR3 | 1,13 | 0,0519 | 0,0519 | ||||||

| US26245MAJ09 / Dryden 55 CLO Ltd | 1,10 | -0,45 | 0,0506 | -0,0080 | |||||

| OZLM 2014-6A B1T / ABS-CBDO (US67108LBP76) | 1,10 | 0,0505 | 0,0505 | ||||||

| US04966HAG11 / Atrium XIII, Series 13A, Class C | 1,01 | 0,0464 | 0,0464 | ||||||

| US83607EAC66 / Sound Point CLO V-R LTD | 1,00 | 0,0461 | 0,0461 | ||||||

| HLA 2017-1A BR / ABS-CBDO (US40538PAS02) | 1,00 | 0,0461 | 0,0461 | ||||||

| US09628VAS34 / BlueMountain CLO 2016-3 Ltd | 1,00 | 0,0460 | 0,0460 | ||||||

| US09629EAG61 / BlueMountain Fuji US Clo II Ltd | 1,00 | -0,30 | 0,0460 | -0,0072 | |||||

| US36320WAS52 / Galaxy XXI CLO Ltd | 1,00 | -0,60 | 0,0459 | -0,0073 | |||||

| RILYK / B. Riley Financial, Inc. - Corporate Bond/Note | 0,07 | -97,89 | 0,96 | -98,59 | 0,0444 | -3,5835 | |||

| US23422TAA60 / DAKFIN 5 09/30/26 | 0,96 | 0,42 | 0,0443 | -0,0066 | |||||

| US141312AE82 / Carbone Clo Ltd | 0,95 | -0,52 | 0,0437 | -0,0070 | |||||

| VOYA 2018-3A CR2 / ABS-CBDO (US92917KAW45) | 0,95 | 0,0437 | 0,0437 | ||||||

| MDPK 2016-24A CR2 / ABS-CBDO (US55820NBA81) | 0,94 | 0,0432 | 0,0432 | ||||||

| US08763QAE26 / Betony CLO 2 Ltd | 0,90 | -0,44 | 0,0416 | -0,0066 | |||||

| US59802MAE75 / Midocean Credit CLO IX | 0,85 | 0,0394 | 0,0394 | ||||||

| LCM 23A BR / ABS-CBDO (US52111PAK75) | 0,85 | 0,0394 | 0,0394 | ||||||

| WINDR 2019-3A CR2 / ABS-CBDO (US97314JAN54) | 0,78 | 0,0358 | 0,0358 | ||||||

| US14311AAY82 / Carlyle Global Market Strat2014-5RR FLT Due 07/15/2031 | 0,75 | 0,0346 | 0,0346 | ||||||

| US88432FBC23 / THL CREDIT WIND RIVER 2015-1 CLO LTD WINDR 2015-1A C1 | 0,75 | -0,27 | 0,0345 | -0,0054 | |||||

| US36321JAJ34 / Galaxy XVIII CLO Ltd., Series 2018-28A, Class C | 0,73 | -0,41 | 0,0336 | -0,0053 | |||||

| MVEW 2017-2A C / ABS-CBDO (US62432LAE11) | 0,70 | -0,29 | 0,0322 | -0,0050 | |||||

| US12481XAU46 / CBAM 2018-6 Ltd | 0,69 | -0,14 | 0,0318 | -0,0050 | |||||

| US13875LAS79 / Canyon Capital CLO 2014-1, Ltd. | 0,66 | -0,45 | 0,0306 | -0,0048 | |||||

| US64830YAB39 / New Residential Mortgage LLC 2020-FNT2 | 0,65 | -5,68 | 0,0299 | -0,0066 | |||||

| ALLEG 2019-1A CRR / ABS-CBDO (US01750FAW68) | 0,64 | 0,0296 | 0,0296 | ||||||

| HLM 13A-18 CR / ABS-CBDO (US40437LAU61) | 0,56 | -0,53 | 0,0259 | -0,0041 | |||||

| US59802UAN90 / MidOcean Credit CLO III | 0,52 | -18,76 | 0,0242 | -0,0101 | |||||

| US67102SAQ75 / OCP CLO 2014-5 Ltd | 0,50 | -0,59 | 0,0232 | -0,0037 | |||||

| US67590ABV35 / Octagon Investment Partners XIV Ltd | 0,50 | -0,20 | 0,0230 | -0,0036 | |||||

| HARV7 / Harbourview CLO VII Ltd | 0,50 | -0,20 | 0,0230 | -0,0036 | |||||

| US26244KAS50 / Dryden 41 Senior Loan Fund | 0,50 | -0,80 | 0,0229 | -0,0037 | |||||

| US87154EBL39 / Symphony CLO LTD2014-15R3 20320120 FLT | 0,48 | 0,0221 | 0,0221 | ||||||

| BLUEM 2018-2A C / ABS-CBDO (US09629VAG86) | 0,48 | 0,0221 | 0,0221 | ||||||

| US98370LAA70 / XCAL 2019-IL-1 MORTGAGE TRUST SER 2019-1 CL A V/R REGD 144A P/P 0.00000000 | 0,46 | 3,62 | 0,0211 | -0,0024 | |||||

| US924934AA00 / Verus Securitization Trust, Series 2023-5, Class A1 | 0,45 | -8,55 | 0,0207 | -0,0054 | |||||

| PAID 2024-3 A / ABS-O (US69547XAA00) | 0,41 | -15,06 | 0,0187 | -0,0067 | |||||

| ARES 2017-45A DR / ABS-CBDO (US04016QAL05) | 0,37 | 0,0172 | 0,0172 | ||||||

| PAID 2024-2 A / ABS-O (US694961AA13) | 0,37 | -15,65 | 0,0172 | -0,0063 | |||||

| US26244RAC51 / Dryden 54 Senior Loan Fund | 0,36 | -0,28 | 0,0164 | -0,0026 | |||||

| US92539BAA08 / Verus Securitization Trust 2023-1 | 0,34 | -5,85 | 0,0156 | -0,0035 | |||||

| US13887PAM77 / Canyon Capital CLO 2016-1 Ltd | 0,29 | 0,0134 | 0,0134 | ||||||

| FCBSL 2019-2A CR / ABS-CBDO (US34962DAU00) | 0,29 | 0,0133 | 0,0133 | ||||||

| US26252EAE95 / Dryden 70 CLO Ltd., Series 2018-70A, Class B | 0,28 | 0,0129 | 0,0129 | ||||||

| US09629TAJ79 / BlueMountain CLO 2018-1 Ltd | 0,25 | -0,80 | 0,0115 | -0,0019 | |||||

| US33835NAE13 / MORGN 2018 3A CR 144A | 0,25 | 0,0115 | 0,0115 | ||||||

| CGMS 2018-2A B / ABS-CBDO (US14317PAE34) | 0,25 | -0,40 | 0,0115 | -0,0018 | |||||

| VOYA 2016-3A BR2 / ABS-CBDO (US92915HBC60) | 0,25 | 0,0115 | 0,0115 | ||||||

| STCR 2016-1A CR / ABS-CBDO (US858102AZ98) | 0,25 | -0,40 | 0,0115 | -0,0018 | |||||

| US92914NAN12 / Voya CLO 2015-1 Ltd | 0,17 | 0,00 | 0,0079 | -0,0012 | |||||

| US92539GAB77 / VERUS 2023-3 A2 | 0,16 | -6,02 | 0,0072 | -0,0017 | |||||

| US40436XAE76 / HLM 3A-2014 A2R | 0,11 | -88,22 | 0,0053 | -0,0462 | |||||

| B. RILEY FIN 7R WARRANT / DO (N/A) | 0,35 | 0,11 | 0,0051 | 0,0051 | |||||

| US109043AG42 / Briggs & Stratton Corp 6.875% 12/15/20 | 0,01 | 0,00 | 0,0004 | -0,0001 |