Statistiques de base

| Valeur du portefeuille | $ 1 499 639 295 |

| Positions actuelles | 624 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

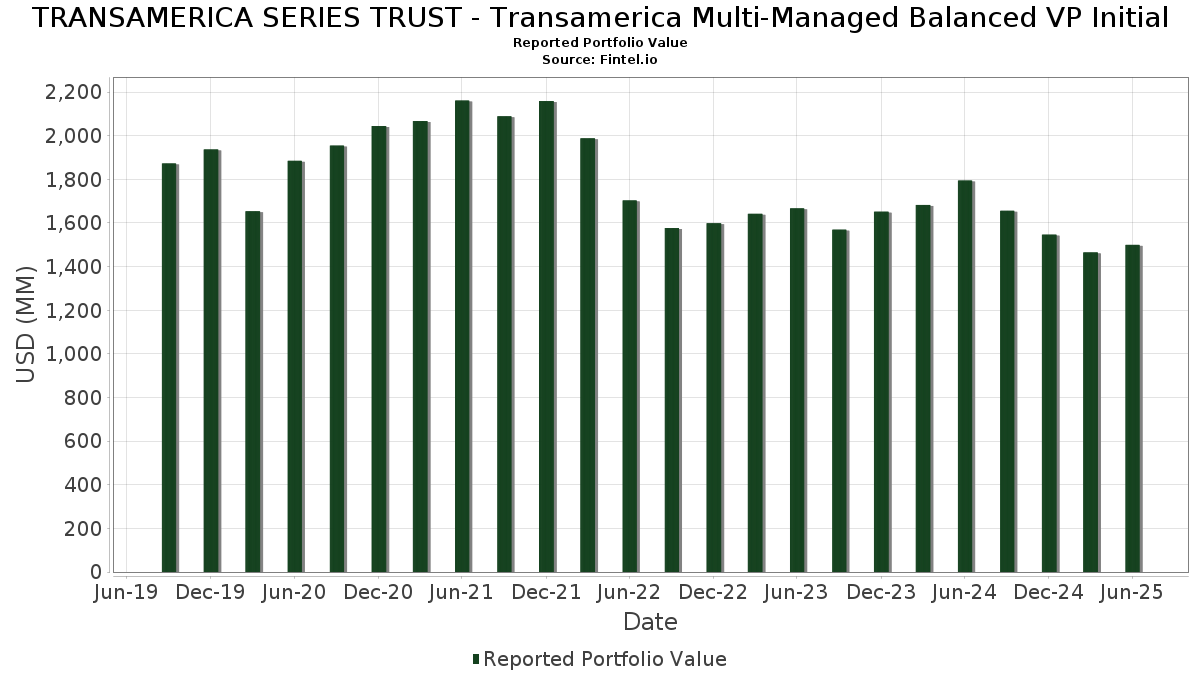

TRANSAMERICA SERIES TRUST - Transamerica Multi-Managed Balanced VP Initial a déclaré un total de 624 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 1 499 639 295 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de TRANSAMERICA SERIES TRUST - Transamerica Multi-Managed Balanced VP Initial sont Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . Les nouvelles positions de TRANSAMERICA SERIES TRUST - Transamerica Multi-Managed Balanced VP Initial incluent Uniform Mortgage-Backed Security, TBA (US:US01F0226757) , UMBS TBA (US:US01F0306781) , Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , Edwards Lifesciences Corporation (US:EW) , and Edwards Lifesciences Corporation (US:EW) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 18,34 | 1,3175 | 1,3175 | ||

| 0,42 | 67,05 | 4,8169 | 1,2882 | |

| 0,14 | 68,87 | 4,9474 | 1,0104 | |

| 11,86 | 0,8521 | 0,8521 | ||

| 0,08 | 20,96 | 1,5056 | 0,5986 | |

| 6,39 | 0,4591 | 0,4591 | ||

| 6,33 | 0,4544 | 0,4544 | ||

| 0,04 | 31,28 | 2,2469 | 0,4153 | |

| 5,58 | 0,4009 | 0,4009 | ||

| 5,58 | 0,4009 | 0,4009 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 0,03 | 2,70 | 0,1938 | -0,5363 | |

| 0,24 | 49,18 | 3,5330 | -0,4647 | |

| 0,02 | 7,03 | 0,5053 | -0,3813 | |

| 16,09 | 1,1558 | -0,2609 | ||

| 4,35 | 0,3128 | -0,2549 | ||

| 2,26 | 0,1627 | -0,2329 | ||

| 1,63 | 0,1172 | -0,2218 | ||

| 0,00 | 1,37 | 0,0984 | -0,2094 | |

| 2,95 | 0,2121 | -0,2015 | ||

| 0,05 | 4,51 | 0,3241 | -0,1785 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-27 pour la période de déclaration 2025-06-30. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | Prix moyen de l'action | Actions (en millions) |

ΔActions (%) |

ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0,14 | -2,39 | 68,87 | 29,34 | 4,9474 | 1,0104 | |||

| NVDA / NVIDIA Corporation | 0,42 | -3,62 | 67,05 | 40,50 | 4,8169 | 1,2882 | |||

| AAPL / Apple Inc. | 0,24 | -1,52 | 49,18 | -9,04 | 3,5330 | -0,4647 | |||

| AMZN / Amazon.com, Inc. | 0,17 | -1,52 | 37,82 | 13,56 | 2,7172 | 0,2544 | |||

| META / Meta Platforms, Inc. | 0,04 | -1,41 | 31,28 | 26,26 | 2,2469 | 0,4153 | |||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 21,68 | -6,14 | 1,5573 | 0,0392 | |||||

| AVGO / Broadcom Inc. | 0,08 | 3,77 | 20,96 | 70,85 | 1,5056 | 0,5986 | |||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 18,34 | 1,3175 | 1,3175 | ||||||

| GOOGL / Alphabet Inc. | 0,10 | -2,95 | 16,99 | 10,60 | 1,2204 | 0,0847 | |||

| US01F0306781 / UMBS TBA | 16,09 | -25,36 | 1,1558 | -0,2609 | |||||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 14,65 | 13,48 | 1,0521 | 0,2038 | |||||

| MA / Mastercard Incorporated | 0,03 | -3,90 | 14,60 | -1,47 | 1,0489 | -0,0468 | |||

| TSLA / Tesla, Inc. | 0,04 | -1,52 | 13,74 | 20,71 | 0,9868 | 0,1454 | |||

| V / Visa Inc. | 0,04 | -6,31 | 13,52 | -5,08 | 0,9714 | -0,0820 | |||

| BRK.B / Berkshire Hathaway Inc. | 0,03 | -1,52 | 12,87 | -10,18 | 0,9249 | -0,1349 | |||

| XOM / Exxon Mobil Corporation | 0,11 | -3,61 | 11,88 | -12,62 | 0,8533 | -0,1519 | |||

| U.S. Treasury Bills / STIV (US912797QE09) | 11,86 | 0,8521 | 0,8521 | ||||||

| BAC / Bank of America Corporation | 0,23 | 7,94 | 10,85 | 22,39 | 0,7792 | 0,1240 | |||

| EW / Edwards Lifesciences Corporation | 10,21 | 50,57 | 0,7335 | 0,2464 | |||||

| EW / Edwards Lifesciences Corporation | 10,16 | -0,48 | 0,7300 | -0,0035 | |||||

| ABBV / AbbVie Inc. | 0,05 | 5,87 | 9,63 | -6,20 | 0,6920 | -0,0673 | |||

| ORCL / Oracle Corporation | 0,04 | 15,59 | 9,56 | 80,77 | 0,6869 | 0,2958 | |||

| WFC / Wells Fargo & Company | 0,12 | 5,43 | 9,39 | 17,66 | 0,6748 | 0,0845 | |||

| GOOG / Alphabet Inc. | 0,05 | -6,45 | 9,23 | 6,23 | 0,6632 | 0,0206 | |||

| US912828Z781 / United States Treasury Note/Bond | 9,03 | -9,45 | 0,6489 | -0,0887 | |||||

| LLY / Eli Lilly and Company | 0,01 | -2,43 | 8,73 | -7,91 | 0,6272 | -0,0738 | |||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 8,24 | 64,96 | 0,5920 | 0,2636 | |||||

| HWM / Howmet Aerospace Inc. | 0,04 | -4,79 | 8,09 | 36,61 | 0,5809 | 0,1432 | |||

| WMT / Walmart Inc. | 0,08 | 217,51 | 7,73 | 253,75 | 0,5556 | 0,3939 | |||

| LOW / Lowe's Companies, Inc. | 0,03 | 4,17 | 7,65 | -0,91 | 0,5498 | -0,0213 | |||

| JNJ / Johnson & Johnson | 0,05 | 8,70 | 7,62 | 0,12 | 0,5475 | -0,0153 | |||

| MCD / McDonald's Corporation | 0,03 | -2,99 | 7,53 | -9,27 | 0,5411 | -0,0727 | |||

| SO / The Southern Company | 0,08 | 0,44 | 7,31 | 0,32 | 0,5249 | -0,0137 | |||

| SCHW / The Charles Schwab Corporation | 0,08 | 59,16 | 7,22 | 85,51 | 0,5189 | 0,2310 | |||

| PEP / PepsiCo, Inc. | 0,05 | 5,10 | 7,17 | -7,45 | 0,5154 | -0,0577 | |||

| CRM / Salesforce, Inc. | 0,03 | -1,52 | 7,15 | 0,07 | 0,5138 | -0,0147 | |||

| UNH / UnitedHealth Group Incorporated | 0,02 | -1,52 | 7,03 | -41,34 | 0,5053 | -0,3813 | |||

| LIN / Linde plc | 0,01 | -1,52 | 7,01 | -0,78 | 0,5036 | -0,0188 | |||

| TT / Trane Technologies plc | 0,02 | -24,16 | 6,88 | -1,53 | 0,4944 | -0,0224 | |||

| NOW / ServiceNow, Inc. | 0,01 | -0,24 | 6,81 | 28,82 | 0,4892 | 0,0983 | |||

| EW / Edwards Lifesciences Corporation | 6,78 | 218,81 | 0,4872 | 0,3299 | |||||

| LRCX / Lam Research Corporation | 0,07 | 59,38 | 6,74 | 113,45 | 0,4844 | 0,2508 | |||

| TXN / Texas Instruments Incorporated | 0,03 | -2,86 | 6,71 | 12,23 | 0,4818 | 0,0400 | |||

| ADI / Analog Devices, Inc. | 0,03 | -3,03 | 6,64 | 14,44 | 0,4772 | 0,0480 | |||

| PGR / The Progressive Corporation | 0,02 | -0,38 | 6,56 | -6,06 | 0,4714 | -0,0451 | |||

| US912810PZ57 / United States Treasury Inflation Indexed Bonds | 6,41 | 0,61 | 0,4603 | -0,0106 | |||||

| NEE / NextEra Energy, Inc. | 0,09 | -2,56 | 6,40 | -4,59 | 0,4599 | -0,0362 | |||

| U.S. Treasury Bills / STIV (US912797QF73) | 6,39 | 0,4591 | 0,4591 | ||||||

| SYK / Stryker Corporation | 0,02 | -2,81 | 6,36 | 3,30 | 0,4568 | 0,0016 | |||

| DNB Bank ASA / STIV (US2332K0UV24) | 6,35 | 1,10 | 0,4564 | -0,0082 | |||||

| TotalEnergies Capital SA / STIV (US89152EW207) | 6,33 | 0,4544 | 0,4544 | ||||||

| Anglesea Funding LLC / STIV (US0347M2UJ32) | 6,29 | 1,13 | 0,4516 | -0,0081 | |||||

| Mont Blanc Capital Corp. / STIV (US6117P4VF45) | 6,21 | 1,09 | 0,4465 | -0,0080 | |||||

| US01F0206791 / UMBS, 30 Year, Single Family | 6,19 | -8,25 | 0,4450 | 0,0012 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0,01 | -0,34 | 6,03 | -18,80 | 0,4329 | -0,1158 | |||

| GTA Funding LLC / STIV (US40060WUW09) | 5,98 | 1,12 | 0,4295 | -0,0077 | |||||

| US55608PBS20 / Macquarie Bank Ltd. | 5,95 | 1,07 | 0,4272 | -0,0079 | |||||

| SWED A / Swedbank AB (publ) | 5,71 | 1,06 | 0,4099 | -0,0075 | |||||

| Liberty Street Funding LLC / STIV (US53127TW258) | 5,71 | 1,10 | 0,4099 | -0,0074 | |||||

| E1MR34 / Emerson Electric Co. - Depositary Receipt (Common Stock) | 5,64 | 1,06 | 0,4052 | -0,0074 | |||||

| Glencove Funding LLC / STIV (US37828VW258) | 5,58 | 0,4009 | 0,4009 | ||||||

| Sheffield Receivables Co. LLC / STIV (US82124LWA69) | 5,58 | 0,4009 | 0,4009 | ||||||

| MDLZ / Mondelez International, Inc. | 0,08 | -2,47 | 5,55 | -3,06 | 0,3988 | -0,0246 | |||

| NFLX / Netflix, Inc. | 0,00 | 53,48 | 5,50 | 120,42 | 0,3948 | 0,2104 | |||

| Ranger Funding Co. LLC / STIV (US75300AWA05) | 5,45 | 0,3916 | 0,3916 | ||||||

| DIS / The Walt Disney Company | 0,04 | 18,45 | 5,41 | 48,84 | 0,3888 | 0,1199 | |||

| NXPI / NXP Semiconductors N.V. | 0,02 | -7,64 | 5,38 | 6,19 | 0,3868 | 0,0119 | |||

| BSX / Boston Scientific Corporation | 0,05 | 1,79 | 5,38 | 8,38 | 0,3866 | 0,0194 | |||

| EOG / EOG Resources, Inc. | 0,04 | 52,49 | 5,35 | 42,25 | 0,3842 | 0,1062 | |||

| STX / Seagate Technology Holdings plc | 0,04 | -1,52 | 5,31 | 67,31 | 0,3813 | 0,1468 | |||

| DE / Deere & Company | 0,01 | -1,56 | 5,26 | 6,66 | 0,3776 | 0,0132 | |||

| RTX / RTX Corporation | 0,04 | 26,97 | 5,21 | 39,98 | 0,3745 | 0,0991 | |||

| US912828Z948 / United States Treasury Note/Bond | 5,05 | 1,59 | 0,3629 | -0,0048 | |||||

| Columbia Funding Co. LLC / STIV (US19767CVD54) | 5,02 | 1,09 | 0,3608 | -0,0065 | |||||

| TDG / TransDigm Group Incorporated | 0,00 | -5,11 | 5,02 | 4,30 | 0,3608 | 0,0048 | |||

| AJG / Arthur J. Gallagher & Co. | 0,02 | 4,60 | 5,00 | -3,02 | 0,3594 | -0,0220 | |||

| US9128284N73 / United States Treasury Note/Bond | 4,99 | 0,87 | 0,3586 | -0,0073 | |||||

| CARR / Carrier Global Corporation | 0,07 | 30,39 | 4,99 | 50,53 | 0,3585 | 0,1134 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0,02 | 17,68 | 4,82 | 37,74 | 0,3462 | 0,0875 | |||

| MDT / Medtronic plc | 0,05 | 8,02 | 4,64 | 4,79 | 0,3334 | 0,0059 | |||

| CMCSA / Comcast Corporation | 0,13 | -1,52 | 4,62 | -4,74 | 0,3319 | -0,0267 | |||

| KO / The Coca-Cola Company | 0,06 | -16,66 | 4,57 | -17,67 | 0,3280 | -0,0821 | |||

| KDP / Keurig Dr Pepper Inc. | 0,14 | 56,91 | 4,54 | 51,57 | 0,3265 | 0,1048 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0,08 | 2,29 | 4,54 | 14,39 | 0,3262 | 0,0327 | |||

| COP / ConocoPhillips | 0,05 | -22,32 | 4,51 | -33,62 | 0,3241 | -0,1785 | |||

| BMY / Bristol-Myers Squibb Company | 0,10 | -0,18 | 4,51 | -24,24 | 0,3238 | -0,1161 | |||

| U.S. Treasury Notes / DBT (US91282CMM00) | 4,35 | -43,30 | 0,3128 | -0,2549 | |||||

| CME / CME Group Inc. | 0,02 | -2,68 | 4,31 | 1,13 | 0,3093 | -0,0055 | |||

| FIS / Fidelity National Information Services, Inc. | 0,05 | 9,21 | 4,27 | 19,05 | 0,3066 | 0,0415 | |||

| YUM / Yum! Brands, Inc. | 0,03 | -1,57 | 4,26 | -7,32 | 0,3059 | -0,0338 | |||

| US9128283W81 / United States Treasury Note/Bond | 4,15 | 0,78 | 0,2979 | -0,0063 | |||||

| US912828ZQ64 / United States Treasury Note/Bond - When Issued | 4,04 | 595,87 | 0,2905 | 0,2475 | |||||

| C / Citigroup Inc. | 0,05 | 12,00 | 4,03 | 34,29 | 0,2898 | 0,0677 | |||

| VST / Vistra Corp. | 0,02 | 262,04 | 4,03 | 497,77 | 0,2895 | 0,2396 | |||

| OTIS / Otis Worldwide Corporation | 0,04 | -2,73 | 4,02 | -6,66 | 0,2891 | -0,0297 | |||

| ROST / Ross Stores, Inc. | 0,03 | -0,77 | 3,99 | -0,94 | 0,2869 | -0,0112 | |||

| PM / Philip Morris International Inc. | 0,02 | 5,47 | 3,98 | 21,03 | 0,2861 | 0,0428 | |||

| CI / The Cigna Group | 0,01 | 27,79 | 3,98 | 28,41 | 0,2861 | 0,0568 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0,05 | -1,52 | 3,94 | 0,43 | 0,2834 | -0,0070 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3,94 | -1,75 | 0,2832 | -0,0134 | |||||

| T / AT&T Inc. | 0,14 | -1,52 | 3,94 | 0,79 | 0,2827 | -0,0060 | |||

| US912828ZZ63 / United States Treasury Inflation Indexed Bonds | 3,90 | 1,33 | 0,2801 | -0,0044 | |||||

| AMP / Ameriprise Financial, Inc. | 0,01 | 14,59 | 3,89 | 26,34 | 0,2795 | 0,0518 | |||

| MU / Micron Technology, Inc. | 0,03 | -9,98 | 3,86 | 27,69 | 0,2773 | 0,0538 | |||

| CPAY / Corpay, Inc. | 0,01 | 5,21 | 3,85 | 0,10 | 0,2766 | -0,0078 | |||

| VTR / Ventas, Inc. | 0,06 | 0,94 | 3,82 | -7,28 | 0,2744 | -0,0302 | |||

| MMM / 3M Company | 0,02 | 22,01 | 3,73 | 26,51 | 0,2681 | 0,0499 | |||

| US3137FWG796 / FHLMC Multifamily Structured Pass-Through Certificates, Series K115, Class A2 | 3,69 | 1,88 | 0,2652 | -0,0028 | |||||

| ETN / Eaton Corporation plc | 0,01 | -1,53 | 3,69 | 29,33 | 0,2648 | 0,0541 | |||

| AON / Aon plc | 0,01 | 5,89 | 3,68 | -5,35 | 0,2643 | -0,0231 | |||

| U.S. Treasury Notes / DBT (US91282CMR96) | 3,65 | 0,2625 | 0,2625 | ||||||

| U.S. Treasury Notes / DBT (US91282CLD10) | 3,64 | 109,01 | 0,2617 | 0,1328 | |||||

| US91282CHE49 / United States Treasury Note/Bond | 3,54 | 0,68 | 0,2544 | -0,0056 | |||||

| UBER / Uber Technologies, Inc. | 0,04 | -39,57 | 3,46 | -22,63 | 0,2489 | -0,0822 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0,01 | -6,92 | 3,38 | -14,55 | 0,2432 | -0,0496 | |||

| FITB / Fifth Third Bancorp | 0,08 | -4,71 | 3,35 | 0,00 | 0,2405 | -0,0071 | |||

| INTU / Intuit Inc. | 0,00 | -6,20 | 3,34 | 20,30 | 0,2398 | 0,0347 | |||

| U.S. Treasury Notes / DBT (US91282CLJ89) | 3,33 | 1,03 | 0,2394 | -0,0045 | |||||

| U.S. Treasury Notes / DBT (US91282CKJ98) | 3,24 | 0,2328 | 0,2328 | ||||||

| US89233FHN15 / Toyota Motor Credit Corporation | 3,19 | 1,11 | 0,2292 | -0,0041 | |||||

| US91282CAE12 / United States Treasury Note/Bond | 3,17 | -23,55 | 0,2279 | -0,0789 | |||||

| AXP / American Express Company | 0,01 | -20,80 | 3,17 | -6,10 | 0,2278 | -0,0219 | |||

| LDOS / Leidos Holdings, Inc. | 0,02 | -1,52 | 3,14 | 15,13 | 0,2258 | 0,0239 | |||

| US912810ST60 / TREASURY BOND | 3,10 | 306,30 | 0,2225 | 0,1661 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3,09 | -3,73 | 0,2223 | -0,0154 | |||||

| BKNG / Booking Holdings Inc. | 0,00 | -17,88 | 3,06 | 3,17 | 0,2196 | 0,0006 | |||

| PLTR / Palantir Technologies Inc. | 0,02 | 13,49 | 3,03 | 83,31 | 0,2178 | 0,0955 | |||

| US912810RS96 / United States Treas Bds Bond | 3,01 | -2,08 | 0,2160 | -0,0111 | |||||

| US91282CGH88 / United States Treasury Note/Bond | 3,00 | 0,60 | 0,2157 | -0,0050 | |||||

| CAT / Caterpillar Inc. | 0,01 | -15,17 | 2,98 | -0,13 | 0,2144 | -0,0066 | |||

| Air Liquide U.S. LLC / STIV (US00912TWC34) | 2,97 | 0,2136 | 0,2136 | ||||||

| Cancara Asset Securitisation LLC / STIV (US13738JXT23) | 2,96 | 0,2124 | 0,2124 | ||||||

| US912810QA97 / United States Treas Bds Bond | 2,95 | -30,30 | 0,2122 | -0,1011 | |||||

| U.S. Treasury Notes / DBT (US91282CJT99) | 2,95 | -47,20 | 0,2121 | -0,2015 | |||||

| UPS / United Parcel Service, Inc. | 0,03 | -13,61 | 2,95 | -20,72 | 0,2117 | -0,0631 | |||

| Concord Minutemen Capital Co. LLC / STIV (US2063C0UM23) | 2,94 | 0,2114 | 0,2114 | ||||||

| EQIX / Equinix, Inc. | 0,00 | 263,21 | 2,87 | 254,70 | 0,2059 | 0,1461 | |||

| U.S. Treasury Notes / DBT (US91282CKT70) | 2,87 | 0,67 | 0,2058 | -0,0046 | |||||

| CHTR / Charter Communications, Inc. | 0,01 | -1,52 | 2,86 | 9,24 | 0,2055 | 0,0119 | |||

| US91282CEP23 / WI TREASURY N/B REGD 2.87500000 | 2,82 | 22,63 | 0,2028 | 0,0550 | |||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0,01 | -1,52 | 2,79 | -18,49 | 0,2005 | -0,0527 | |||

| US91282CCB54 / UST NOTES 1.625% 05/15/2031 | 2,77 | 1,54 | 0,1987 | -0,0027 | |||||

| CAFCO LLC / STIV (US1247P2WA82) | 2,75 | 1,10 | 0,1976 | -0,0036 | |||||

| US06051GLS65 / Bank of America Corp | 2,75 | -14,16 | 0,1973 | -0,0393 | |||||

| USB / U.S. Bancorp | 0,06 | 8,77 | 2,71 | 16,60 | 0,1949 | 0,0228 | |||

| SBAC / SBA Communications Corporation | 0,01 | -1,52 | 2,71 | 5,12 | 0,1948 | 0,0041 | |||

| COF / Capital One Financial Corporation | 0,01 | 100,47 | 2,70 | 138,06 | 0,1941 | 0,1101 | |||

| EW / Edwards Lifesciences Corporation | 0,03 | 17,52 | 2,70 | -73,46 | 0,1938 | -0,5363 | |||

| CCL / Carnival Corporation & plc | 0,10 | 83,64 | 2,69 | 164,47 | 0,1931 | 0,1179 | |||

| EW / Edwards Lifesciences Corporation | 2,67 | -0,85 | 0,1921 | -0,0017 | |||||

| US3132DWHT36 / FEDERAL HOME LOAN MORTGAGE CORP | 2,66 | -2,31 | 0,1912 | -0,0103 | |||||

| WELL / Welltower Inc. | 0,02 | 1,64 | 2,60 | 2,00 | 0,1870 | -0,0017 | |||

| US91282CCS89 / United States Treasury Note/Bond | 2,58 | 1,61 | 0,1856 | -0,0024 | |||||

| US3140QRW661 / Federal National Mortgage Association | 2,54 | -0,86 | 0,1827 | -0,0069 | |||||

| US01F0324768 / Uniform Mortgage-Backed Security, TBA | 2,54 | -1,52 | 0,1822 | 0,0130 | |||||

| U.S. Treasury Bonds / DBT (US912810UC08) | 2,53 | -14,94 | 0,1820 | -0,0382 | |||||

| US3140XKP385 / Fannie Mae Pool | 2,48 | -4,35 | 0,1784 | -0,0135 | |||||

| US91282CFV81 / United States Treasury Note/Bond | 2,42 | 1 349,10 | 0,1739 | 0,1628 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2,40 | -14,00 | 0,1726 | -0,0340 | |||||

| US3140XKUQ16 / Federal National Mortgage Association | 2,39 | -3,43 | 0,1719 | -0,0113 | |||||

| PLD / Prologis, Inc. | 0,02 | -14,48 | 2,37 | -19,57 | 0,1704 | -0,0477 | |||

| EXPE / Expedia Group, Inc. | 0,01 | -1,89 | 2,36 | -1,54 | 0,1694 | -0,0077 | |||

| US3140XKS769 / Federal National Mortgage Association | 2,32 | -2,27 | 0,1667 | -0,0088 | |||||

| BURL / Burlington Stores, Inc. | 0,01 | 22,58 | 2,31 | 19,63 | 0,1660 | 0,0232 | |||

| CDNS / Cadence Design Systems, Inc. | 0,01 | 97,54 | 2,30 | 139,40 | 0,1655 | 0,0943 | |||

| APO / Apollo Global Management, Inc. | 0,02 | 2,29 | 0,1642 | 0,1642 | |||||

| US67740QAH92 / Ohio National Financial Services, Inc. | 2,27 | 0,80 | 0,1634 | -0,0034 | |||||

| US01F0204713 / UMBS 15YR TBA(REG B) 2.0 UMBS TBA 07-01-35 | 2,26 | -62,38 | 0,1627 | -0,2329 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 2,21 | -14,00 | 0,1585 | -0,0312 | |||||

| U.S. Treasury Notes / DBT (US91282CLW90) | 2,20 | 0,32 | 0,1578 | -0,0041 | |||||

| FDX / FedEx Corporation | 0,01 | 20,91 | 2,16 | 12,74 | 0,1552 | 0,0135 | |||

| US3140XKTV20 / Federal National Mortgage Association | 2,13 | -1,39 | 0,1527 | -0,0067 | |||||

| PCAR / PACCAR Inc | 0,02 | 18,15 | 2,11 | 15,33 | 0,1519 | 0,0164 | |||

| PPG / PPG Industries, Inc. | 0,02 | -1,52 | 2,09 | 2,45 | 0,1499 | -0,0007 | |||

| US912810TL26 / TREASURY BOND | 2,03 | -2,50 | 0,1456 | -0,0081 | |||||

| ANET / Arista Networks Inc | 0,02 | -1,52 | 2,02 | 30,06 | 0,1449 | 0,0302 | |||

| US912810RT79 / United States Treas Bds Bond | 1,96 | -2,14 | 0,1410 | -0,0073 | |||||

| BKR / Baker Hughes Company | 0,05 | -1,52 | 1,96 | -14,06 | 0,1410 | -0,0279 | |||

| US912810SF66 / Us Treasury Bond | 1,96 | -2,10 | 0,1409 | -0,0072 | |||||

| US89179JAA43 / Towd Point Mortgage Trust 2020-4 | 1,94 | -3,63 | 0,1394 | -0,0095 | |||||

| FANG / Diamondback Energy, Inc. | 0,01 | -1,52 | 1,91 | -15,39 | 0,1371 | -0,0296 | |||

| US912810TT51 / United States Treasury Note/Bond | 1,90 | -2,57 | 0,1364 | -0,0077 | |||||

| US912810PV44 / United States Treasury Inflation Indexed Bonds | 1,87 | 0,65 | 0,1343 | -0,0031 | |||||

| DASH / DoorDash, Inc. | 0,01 | 10,18 | 1,86 | 48,60 | 0,1336 | 0,0411 | |||

| U.S. Treasury Notes / DBT (US91282CLM19) | 1,85 | 0,98 | 0,1328 | -0,0025 | |||||

| US912810RK60 / United States Treas Bds Bond | 1,84 | -52,91 | 0,1319 | -0,1563 | |||||

| TXT / Textron Inc. | 0,02 | -1,52 | 1,83 | 9,44 | 0,1315 | 0,0078 | |||

| US89181JAA07 / Towd Point Mortgage Trust, Series 2023-1, Class A1 | 1,83 | -2,92 | 0,1315 | -0,0079 | |||||

| STT / State Street Corporation | 0,02 | 1,83 | 0,1311 | 0,1311 | |||||

| MAS / Masco Corporation | 0,03 | -1,52 | 1,82 | -8,87 | 0,1306 | -0,0169 | |||

| US91282CJR34 / United States Treasury Note/Bond - When Issued | 1,81 | 0,78 | 0,1304 | -0,0028 | |||||

| COST / Costco Wholesale Corporation | 0,00 | -58,55 | 1,81 | -56,62 | 0,1299 | -0,1783 | |||

| US91282CDY49 / United States Treasury Note/Bond | 1,80 | 1,35 | 0,1294 | -0,0020 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 1,76 | -2,61 | 0,1262 | -0,0071 | |||||

| US912810TJ79 / United States Treasury Note/Bond | 1,73 | -2,54 | 0,1243 | -0,0070 | |||||

| US912810SH23 / United States Treas Bds Bond | 1,72 | 14,65 | 0,1238 | 0,0127 | |||||

| US12549BAY48 / CIFC Funding 2013-II Ltd | 1,71 | -16,26 | 0,1229 | -0,0281 | |||||

| U.S. Treasury Notes / DBT (US91282CLF67) | 1,70 | 135,08 | 0,1223 | 0,0688 | |||||

| US01F0224778 / UMBS TBA | 1,63 | -68,39 | 0,1172 | -0,2218 | |||||

| MO / Altria Group, Inc. | 0,03 | -1,52 | 1,62 | -3,79 | 0,1167 | -0,0082 | |||

| US12657GAA31 / CSMC 2021-RPL6 Trust | 1,61 | -2,72 | 0,1158 | -0,0067 | |||||

| US912810RN00 / United States Treas Bds Bond | 1,60 | -33,29 | 0,1152 | -0,0625 | |||||

| U.S. Treasury Notes / DBT (US91282CMZ13) | 1,60 | 0,1147 | 0,1147 | ||||||

| MCK / McKesson Corporation | 0,00 | -1,54 | 1,59 | 7,22 | 0,1142 | 0,0046 | |||

| US91282CJN20 / US TREASURY N/B 4.375% 11-30-28 | 1,57 | 0,64 | 0,1129 | -0,0026 | |||||

| Bank of America Corp. / DBT (US06051GMW68) | 1,56 | 0,1123 | 0,1123 | ||||||

| US13645RBF01 / Canadian Pacific Railway Co | 1,56 | 0,1119 | 0,1119 | ||||||

| EFN / Element Fleet Management Corp. | 1,53 | 0,1102 | 0,1102 | ||||||

| US12567RAA86 / CIM Trust 2021-R6 | 1,52 | -3,75 | 0,1089 | -0,0075 | |||||

| TFC / Truist Financial Corporation | 0,04 | -52,35 | 1,51 | -50,23 | 0,1087 | -0,1161 | |||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 1,51 | 0,1085 | 0,1085 | ||||||

| IR / Ingersoll Rand Inc. | 0,02 | -1,52 | 1,51 | 2,38 | 0,1083 | -0,0006 | |||

| HUM / Humana Inc. | 0,01 | 25,95 | 1,50 | 16,38 | 0,1077 | 0,0125 | |||

| US12656TAB44 / CSMC 2021-RPL2Trust | 1,50 | -2,54 | 0,1076 | -0,0061 | |||||

| Columbia Funding Co. LLC / STIV (US19767CUE47) | 1,50 | 1,15 | 0,1076 | -0,0019 | |||||

| US89179YAR45 / TOWD POINT MORTGAGE TRUST 2021-1 VAR 11/25/2061 144A | 1,49 | -5,29 | 0,1069 | -0,0093 | |||||

| US46115HBV87 / INTESA SANPAOLO SPA | 1,49 | 1,09 | 0,1068 | -0,0019 | |||||

| FCX / Freeport-McMoRan Inc. | 0,03 | 1,53 | 1,47 | 18,07 | 0,1056 | 0,0197 | |||

| US91282CFZ95 / TREASURY NOTE | 1,46 | 0,48 | 0,1046 | -0,0025 | |||||

| U.S. Treasury Bonds / DBT (US912810UA42) | 1,44 | -2,70 | 0,1038 | -0,0060 | |||||

| US912810SL35 / United States Treasury Note/Bond | 1,44 | 3,45 | 0,1035 | 0,0005 | |||||

| US01F0304703 / UMBS 15YR TBA(REG B) 3.0 UMBS TBA 07-01-35 | 1,44 | -45,19 | 0,1032 | -0,0690 | |||||

| QTS Issuer ABS I LLC / ABS-O (US74690DAA90) | 1,43 | 0,1030 | 0,1030 | ||||||

| DAL / Delta Air Lines, Inc. | 0,03 | -1,52 | 1,42 | 11,09 | 0,1023 | 0,0075 | |||

| MRK / Merck & Co., Inc. | 0,02 | 51,28 | 1,41 | 33,52 | 0,1013 | 0,0232 | |||

| US89788MAM47 / Truist Financial Corp | 1,41 | -12,99 | 0,1011 | -0,0184 | |||||

| MLM / Martin Marietta Materials, Inc. | 0,00 | -1,54 | 1,40 | 13,06 | 0,1008 | 0,0090 | |||

| US44928XAY04 / ICG US CLO 2014-1 Ltd | 1,40 | -46,15 | 0,1006 | -0,0917 | |||||

| US32113CBY57 / First National Master Note Trust | 1,40 | -0,14 | 0,1005 | -0,0031 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 1,39 | 0,1002 | 0,1002 | ||||||

| US912810TN81 / United States Treasury Note/Bond | 1,39 | -2,52 | 0,0999 | -0,0056 | |||||

| PCG / PG&E Corporation | 0,10 | -51,01 | 1,39 | -60,27 | 0,0997 | -0,1585 | |||

| Hyundai Capital America / DBT (US44891ADX28) | 1,39 | 0,0995 | 0,0995 | ||||||

| TOST / Toast, Inc. | 0,03 | 5,05 | 1,37 | 40,25 | 0,0987 | 0,0263 | |||

| AZO / AutoZone, Inc. | 0,00 | -66,21 | 1,37 | -67,12 | 0,0984 | -0,2094 | |||

| US36262GAD34 / GXO Logistics Inc | 1,37 | -12,95 | 0,0981 | -0,0179 | |||||

| JBS USA Holding Lux SARL/JBS USA Foods Group Holdings, Inc./JBS USA Food Co. / DBT (US472140AE22) | 1,36 | 0,0980 | 0,0980 | ||||||

| US89177BAA35 / Towd Point Mortgage Trust 2019-1 | 1,36 | -3,21 | 0,0974 | -0,0062 | |||||

| Dominican Republic International Bonds / DBT (US25714PEZ71) | 1,35 | 1,20 | 0,0972 | -0,0017 | |||||

| KVUE / Kenvue Inc. | 0,06 | -10,80 | 1,35 | -22,15 | 0,0972 | -0,0313 | |||

| NKE / NIKE, Inc. | 0,02 | -50,29 | 1,35 | -63,06 | 0,0967 | -0,1547 | |||

| Cisco Systems, Inc. / STIV (US17277AV126) | 1,34 | 1,05 | 0,0966 | -0,0018 | |||||

| A1TT34 / The Allstate Corporation - Depositary Receipt (Common Stock) | 1,34 | -13,76 | 0,0964 | -0,0186 | |||||

| U.S. Treasury Bonds / DBT (US912810UL07) | 1,34 | 0,0963 | 0,0963 | ||||||

| US345397B280 / FORD MTR CR CO LLC 3.375% 11/13/2025 | 1,33 | 0,61 | 0,0954 | -0,0023 | |||||

| SHW / The Sherwin-Williams Company | 0,00 | 56,19 | 1,33 | 53,53 | 0,0952 | 0,0314 | |||

| BATBC / British American Tobacco Bangladesh Company Limited | 1,32 | 0,0951 | 0,0951 | ||||||

| LYB / LyondellBasell Industries N.V. | 0,02 | -1,52 | 1,30 | -19,04 | 0,0932 | -0,0253 | |||

| US880591CS97 / Tennessee Valley Auth 5.88% 4/1/36 | 1,29 | 0,47 | 0,0929 | -0,0023 | |||||

| Hudson Yards Mortgage Trust / ABS-MBS (US44855PAA66) | 1,29 | 1,42 | 0,0926 | -0,0014 | |||||

| US78403DAP50 / SBA Tower Trust | 1,29 | 0,86 | 0,0925 | -0,0019 | |||||

| ELS / Equity LifeStyle Properties, Inc. | 0,02 | 20,13 | 1,28 | 11,08 | 0,0922 | 0,0068 | |||

| NNN / NNN REIT, Inc. | 1,28 | 0,0921 | 0,0921 | ||||||

| US912810TW80 / United States Treasury Note/Bond | 1,28 | -1,84 | 0,0920 | -0,0045 | |||||

| GEV / GE Vernova Inc. | 0,00 | 1,28 | 0,0917 | 0,0917 | |||||

| SCF Equipment Trust LLC / ABS-O (US78437DAC48) | 1,28 | 1,03 | 0,0916 | -0,0018 | |||||

| VMC / Vulcan Materials Company | 0,00 | 1,27 | 0,0912 | 0,0912 | |||||

| US912810RY64 / United States Treas Bds Bond | 1,27 | -2,16 | 0,0911 | -0,0047 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RHY36) | 1,26 | 0,64 | 0,0907 | -0,0021 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 1,26 | -13,86 | 0,0907 | -0,0177 | |||||

| RGA Global Funding / DBT (US76209PAF09) | 1,26 | -14,29 | 0,0906 | -0,0181 | |||||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 1,26 | 34,27 | 1,26 | 34,22 | 0,0905 | 0,0211 | |||

| US912810TD00 / United States Treasury Note/Bond | 1,26 | -2,64 | 0,0902 | -0,0052 | |||||

| US9128285M81 / United States Treasury Note/Bond | 1,25 | 0,89 | 0,0899 | -0,0018 | |||||

| Starbird Funding Corp. / STIV (US85520LV446) | 1,24 | -49,47 | 0,0894 | -0,0926 | |||||

| US42806MCA53 / HERTZ VEHICLE FINANCING III LLC SER 2023-3A CL A REGD 144A P/P 5.94000000 | 1,23 | -0,08 | 0,0887 | -0,0027 | |||||

| OBX Trust / ABS-MBS (US67119FAA12) | 1,22 | -9,33 | 0,0880 | -0,0119 | |||||

| RJF / Raymond James Financial, Inc. | 0,01 | -59,73 | 1,22 | -38,50 | 0,0876 | -0,0492 | |||

| US92852LAC37 / Viterra Finance BV | 1,22 | 0,33 | 0,0874 | -0,0023 | |||||

| US12803RAC88 / CaixaBank SA | 1,22 | 0,0874 | 0,0874 | ||||||

| Sierra Timeshare Receivables Funding LLC / ABS-O (US82653CAA99) | 1,21 | -14,95 | 0,0871 | -0,0183 | |||||

| US06738ECC75 / Barclays PLC | 1,21 | -0,66 | 0,0869 | -0,0031 | |||||

| US925650AC72 / VICI Properties LP | 1,21 | -13,34 | 0,0868 | -0,0163 | |||||

| US9128283F58 / United States Treasury Note/Bond | 1,20 | 0,93 | 0,0861 | -0,0018 | |||||

| US46647PCB04 / JPMorgan Chase & Co | 1,20 | -14,15 | 0,0859 | -0,0170 | |||||

| URI / United Rentals, Inc. | 0,00 | -1,50 | 1,19 | 18,43 | 0,0855 | 0,0112 | |||

| EMR / Emerson Electric Co. | 0,01 | 1,18 | 0,0850 | 0,0850 | |||||

| U.S. Treasury Notes / DBT (US91282CKH33) | 1,18 | 0,0846 | 0,0846 | ||||||

| US23338VAD82 / DTE Electric Co. | 1,17 | -8,07 | 0,0843 | -0,0101 | |||||

| Mainbeach Funding LLC / STIV (US56037BV439) | 1,17 | 1,04 | 0,0841 | -0,0015 | |||||

| OBX Trust / ABS-MBS (US67120VAA35) | 1,17 | -5,36 | 0,0837 | -0,0073 | |||||

| US95000U3F88 / Wells Fargo & Co. | 1,15 | -13,45 | 0,0828 | -0,0156 | |||||

| MSI / Motorola Solutions, Inc. | 0,00 | -3,32 | 1,15 | -7,18 | 0,0826 | -0,0090 | |||

| US225401AZ15 / Credit Suisse Group AG | 1,14 | 1,69 | 0,0820 | -0,0010 | |||||

| CHD / Church & Dwight Co., Inc. | 0,01 | -44,57 | 1,14 | -51,63 | 0,0819 | -0,0924 | |||

| US912810RZ30 / United States Treas Bds Bond | 1,13 | -2,08 | 0,0813 | -0,0041 | |||||

| US91087BAE02 / Mexico Government International Bond | 1,12 | 1,08 | 0,0807 | -0,0015 | |||||

| US49177JAH59 / Kenvue Inc | 1,12 | -13,86 | 0,0805 | -0,0156 | |||||

| U.S. Treasury Notes / DBT (US91282CKP58) | 1,12 | 0,54 | 0,0802 | -0,0018 | |||||

| BRO / Brown & Brown, Inc. | 1,12 | 0,0801 | 0,0801 | ||||||

| US45674CAA18 / INFOR INC SR UNSECURED 144A 07/25 1.75 | 1,11 | 0,91 | 0,0801 | -0,0016 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 1,11 | -14,13 | 0,0799 | -0,0159 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 1,11 | 2,21 | 0,0799 | -0,0005 | |||||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 1,11 | -63,42 | 0,0796 | -0,1444 | |||||

| US422806AB58 / HEICO Corp. | 1,10 | -13,28 | 0,0788 | -0,0148 | |||||

| US097023CE35 / Boeing Co/The | 1,09 | -12,70 | 0,0786 | -0,0140 | |||||

| XS1040508167 / Imperial Brands Finance plc | 1,08 | 0,0775 | 0,0775 | ||||||

| US00774MAL90 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 1,08 | -23,18 | 0,0774 | -0,0263 | |||||

| U.S. Treasury Bonds / DBT (US912810UB25) | 1,07 | -1,93 | 0,0768 | -0,0038 | |||||

| Foundry JV Holdco LLC / DBT (US350930AG89) | 1,06 | 2,02 | 0,0762 | -0,0007 | |||||

| US26441CAT27 / Duke Energy Corp | 1,06 | -6,37 | 0,0761 | -0,0075 | |||||

| Expedia Group, Inc. / DBT (US30212PBL85) | 1,06 | -13,56 | 0,0760 | -0,0145 | |||||

| US3132DWGZ05 / Freddie Mac Pool | 1,06 | -2,76 | 0,0759 | -0,0045 | |||||

| US446413AZ96 / Huntington Ingalls Industries Inc | 1,06 | -12,95 | 0,0758 | -0,0138 | |||||

| US682680BG78 / ONEOK INC | 1,06 | -13,88 | 0,0758 | -0,0148 | |||||

| US03938LBE39 / ArcelorMittal SA | 1,05 | -14,70 | 0,0755 | -0,0156 | |||||

| Tyco Electronics Group SA / DBT (US902133BD84) | 1,05 | 0,0753 | 0,0753 | ||||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 1,03 | 0,0741 | 0,0741 | ||||||

| HCA / HCA Healthcare, Inc. | 0,00 | -1,55 | 1,02 | 9,20 | 0,0734 | 0,0042 | |||

| US912810QW18 / United States Treas Bds Bond | 1,02 | -1,55 | 0,0730 | -0,0033 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 1,02 | 0,10 | 0,0730 | -0,0021 | |||||

| US928668BN15 / VOLKSWAGEN GROUP AMER FIN LLC 1.625% 11/24/2027 144A | 1,01 | 1,30 | 0,0727 | -0,0012 | |||||

| Chile Electricity Lux MPC II SARL / DBT (US16882LAA08) | 1,01 | -2,23 | 0,0724 | -0,0038 | |||||

| US38141GYN86 / Goldman Sachs Group Inc/The | 0,99 | -12,71 | 0,0711 | -0,0127 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0,98 | -14,83 | 0,0706 | -0,0147 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 0,97 | -13,36 | 0,0699 | -0,0131 | |||||

| US350930AA10 / Foundry JV Holdco LLC | 0,97 | 1,57 | 0,0699 | -0,0010 | |||||

| Takeda U.S. Financing, Inc. / DBT (US87406BAA08) | 0,96 | 0,0693 | 0,0693 | ||||||

| Dell International LLC/EMC Corp. / DBT (US24703DBQ34) | 0,96 | -13,48 | 0,0692 | -0,0131 | |||||

| US912810SX72 / UNITED STATES TREASURY BOND 2.375% 05/15/2051 | 0,96 | -2,54 | 0,0689 | -0,0038 | |||||

| U.S. Treasury Bonds / DBT (US912810UF39) | 0,96 | -1,85 | 0,0686 | -0,0033 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0,95 | -13,55 | 0,0683 | -0,0130 | |||||

| US806851AK71 / Schlumberger Holdings Corp | 0,95 | -14,17 | 0,0679 | -0,0136 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0,94 | -13,89 | 0,0673 | -0,0131 | |||||

| US64830MAG87 / New Residential Mortgage Loan Trust 2019-5 | 0,93 | -3,23 | 0,0667 | -0,0042 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 0,93 | 0,0665 | 0,0665 | ||||||

| Bunge Ltd. Finance Corp. / DBT (US120568BF69) | 0,91 | -14,12 | 0,0655 | -0,0130 | |||||

| M1GM34 / MGM Resorts International - Depositary Receipt (Common Stock) | 0,91 | 2,84 | 0,0651 | -0,0001 | |||||

| OBX Trust / ABS-MBS (US67118TAA25) | 0,90 | -7,09 | 0,0650 | -0,0070 | |||||

| LEN / Lennar Corporation | 0,01 | -1,51 | 0,90 | -5,06 | 0,0647 | -0,0055 | |||

| HCA, Inc. / DBT (US404119CU12) | 0,90 | -13,00 | 0,0645 | -0,0118 | |||||

| HINNT LLC / ABS-O (US40472QAA58) | 0,89 | -12,11 | 0,0642 | -0,0110 | |||||

| L1CA34 / Labcorp Holdings Inc. - Depositary Receipt (Common Stock) | 0,89 | -13,34 | 0,0640 | -0,0120 | |||||

| US07274NAL73 / Bayer Us Finance Ii Llc 4.375% 12/15/2028 144a Bond | 0,88 | 1,73 | 0,0633 | -0,0007 | |||||

| Safehold GL Holdings LLC / DBT (US785931AA40) | 0,88 | -13,61 | 0,0630 | -0,0121 | |||||

| US548661EH62 / LOW 3 3/4 04/01/32 | 0,88 | -13,10 | 0,0629 | -0,0117 | |||||

| US68389XCK90 / ORACLE CORPORATION | 0,88 | -13,71 | 0,0629 | -0,0121 | |||||

| OBX Trust / ABS-MBS (US67118XAA37) | 0,87 | -7,32 | 0,0628 | -0,0069 | |||||

| US744320BH48 / Prudential Financial Inc | 0,87 | -13,70 | 0,0624 | -0,0121 | |||||

| US962166BY91 / Weyerhaeuser Co | 0,87 | -13,46 | 0,0624 | -0,0119 | |||||

| US64830WAD39 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2019-4 NRZT 2019-4A A1B | 0,86 | -4,33 | 0,0619 | -0,0047 | |||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 0,85 | -13,49 | 0,0613 | -0,0117 | |||||

| U.S. Treasury Bonds / DBT (US912810UE63) | 0,85 | -52,35 | 0,0611 | -0,0709 | |||||

| US826944AA88 / Sierra Timeshare 2023-3 Receivables Funding LLC | 0,85 | -12,37 | 0,0611 | -0,0107 | |||||

| US034863AU41 / Anglo American Capital PLC | 0,85 | 0,60 | 0,0607 | -0,0014 | |||||

| T-Mobile USA, Inc. / DBT (US87264ADF93) | 0,84 | -13,66 | 0,0605 | -0,0116 | |||||

| GILD / Gilead Sciences, Inc. - Depositary Receipt (Common Stock) | 0,84 | -13,80 | 0,0602 | -0,0116 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0,83 | -14,00 | 0,0596 | -0,0117 | |||||

| US912810TR95 / United States Treasury Note/Bond | 0,82 | -2,72 | 0,0591 | -0,0034 | |||||

| M1CH34 / Microchip Technology Incorporated - Depositary Receipt (Common Stock) | 0,82 | -14,02 | 0,0591 | -0,0116 | |||||

| U.S. Treasury Bonds / DBT (US912810TX63) | 0,82 | -38,14 | 0,0588 | -0,0391 | |||||

| US62582PAA84 / MUNICH RE | 0,82 | 0,37 | 0,0588 | -0,0016 | |||||

| US693475BS39 / PNC FINANCIAL SERVICES GROUP INC | 0,82 | -13,19 | 0,0587 | -0,0108 | |||||

| US78403DAT72 / SBA Tower Trust | 0,81 | 0,99 | 0,0584 | -0,0011 | |||||

| US718172CW74 / Philip Morris International Inc | 0,81 | -14,04 | 0,0581 | -0,0115 | |||||

| US294429AV70 / Equifax, Inc. | 0,81 | -14,53 | 0,0580 | -0,0118 | |||||

| US817826AE03 / 7-Eleven Inc | 0,80 | -12,81 | 0,0577 | -0,0104 | |||||

| US92343VFW90 / VERIZON COMMUNICATIONS INC 2.987% 10/30/2056 WI | 0,80 | -14,22 | 0,0577 | -0,0115 | |||||

| US92343VFX73 / Verizon Communications Inc | 0,80 | -13,23 | 0,0575 | -0,0107 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0,79 | -13,22 | 0,0567 | -0,0105 | |||||

| US9128286B18 / United States Treasury Note/Bond | 0,79 | 1,03 | 0,0565 | -0,0010 | |||||

| NUE / Nucor Corporation | 0,01 | -1,52 | 0,78 | 5,99 | 0,0560 | 0,0016 | |||

| US87264ABW45 / T-Mobile USA Inc | 0,78 | -13,44 | 0,0560 | -0,0106 | |||||

| US123919AA08 / BXG Receivables Note Trust 2023-A | 0,78 | -12,96 | 0,0560 | -0,0103 | |||||

| US46617FAA21 / JGWPT XXVIII LLC | 0,78 | -2,39 | 0,0558 | -0,0030 | |||||

| Cargill, Inc. / DBT (US141781CD42) | 0,78 | -13,79 | 0,0557 | -0,0108 | |||||

| Aon North America, Inc. / DBT (US03740MAF77) | 0,77 | -14,24 | 0,0550 | -0,0110 | |||||

| U.S. Treasury Bonds / DBT (US912810UG12) | 0,77 | 0,0550 | 0,0550 | ||||||

| US05565EAH80 / BMW US Capital LLC | 0,75 | -14,25 | 0,0541 | -0,0108 | |||||

| US30303M8M79 / Meta Platforms Inc | 0,75 | -13,91 | 0,0538 | -0,0105 | |||||

| US89175TAA60 / Towd Point Mortgage Trust 2018-4 | 0,74 | -3,77 | 0,0533 | -0,0037 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,74 | -13,43 | 0,0528 | -0,0100 | |||||

| US345397C437 / Ford Motor Credit Co LLC | 0,74 | -0,14 | 0,0528 | -0,0016 | |||||

| US912810FG86 / Usa Treasury 30 Yr 5 1/4% Bonds 02/15/2029 | 0,73 | 0,41 | 0,0527 | -0,0013 | |||||

| COLT Mortgage Loan Trust / ABS-MBS (US12665LAA26) | 0,72 | -10,40 | 0,0521 | -0,0077 | |||||

| US26442UAE47 / Duke Energy Progress LLC | 0,72 | -7,42 | 0,0521 | -0,0058 | |||||

| US11135FBP53 / SR UNSECURED 144A 11/35 3.137 | 0,72 | -13,19 | 0,0520 | -0,0096 | |||||

| Aptiv PLC / EC (JE00BTDN8H13) | 0,01 | -1,51 | 0,72 | 12,97 | 0,0520 | 0,0046 | |||

| US03523TBT43 / Anheuser-Busch InBev Worldwide Inc | 0,72 | -14,88 | 0,0519 | -0,0108 | |||||

| VLTO / Veralto Corporation | 0,71 | -13,77 | 0,0513 | -0,0099 | |||||

| R1OP34 / Roper Technologies, Inc. - Depositary Receipt (Common Stock) | 0,71 | -13,80 | 0,0512 | -0,0099 | |||||

| US49338LAE39 / KEYSIGHT TECHNOLOGIES SR UNSECURED 04/27 4.6 | 0,71 | -14,32 | 0,0512 | -0,0103 | |||||

| US378272BG28 / Glencore Funding LLC | 0,71 | -13,08 | 0,0511 | -0,0094 | |||||

| US337738BD90 / Fiserv Inc | 0,71 | -14,23 | 0,0511 | -0,0103 | |||||

| Hilton Grand Vacations Trust / ABS-O (US43283NAA54) | 0,71 | -11,26 | 0,0510 | -0,0081 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0,71 | 0,0509 | 0,0509 | ||||||

| BRAVO Residential Funding Trust / ABS-MBS (US10569LAA35) | 0,71 | -7,69 | 0,0509 | -0,0058 | |||||

| Rocket Cos., Inc. / DBT (US77311WAA99) | 0,70 | 0,0504 | 0,0504 | ||||||

| WMG / Warner Music Group Corp. | 0,03 | -2,74 | 0,70 | -15,58 | 0,0503 | -0,0110 | |||

| US03027WAK80 / ASSET BACKED 144A 03/48 3.652 | 0,70 | 1,01 | 0,0503 | -0,0009 | |||||

| US694308JG36 / Pacific Gas and Electric Co | 0,70 | -6,20 | 0,0500 | -0,0049 | |||||

| American Homes 4 Rent LP / DBT (US02666TAG22) | 0,70 | -13,23 | 0,0500 | -0,0093 | |||||

| US958667AE72 / Western Midstream Operating LP | 0,70 | -13,77 | 0,0499 | -0,0097 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,69 | -14,36 | 0,0498 | -0,0100 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,69 | -13,62 | 0,0497 | -0,0095 | |||||

| US67448GAA13 / OBX 23-NQM4 A1 144A 6.113% 03-25-63/05-25-27 | 0,68 | -6,69 | 0,0491 | -0,0051 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0,67 | 0,15 | 0,0484 | -0,0014 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 0,67 | -13,70 | 0,0484 | -0,0093 | |||||

| WPC / W. P. Carey Inc. | 0,67 | -13,13 | 0,0481 | -0,0088 | |||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 0,67 | 0,0480 | 0,0480 | ||||||

| US81728UAA25 / Sensata Technologies Inc | 0,67 | 3,42 | 0,0478 | 0,0002 | |||||

| US15135BAV36 / CENTENE CORP 3.375% 02/15/2030 | 0,66 | -13,20 | 0,0478 | -0,0089 | |||||

| HCA, Inc. / DBT (US404119CV94) | 0,66 | -13,20 | 0,0477 | -0,0088 | |||||

| US91282CFM82 / U.S. Treasury Notes | 0,66 | 0,30 | 0,0477 | -0,0012 | |||||

| US69047QAC69 / Ovintiv Inc | 0,66 | -14,60 | 0,0475 | -0,0097 | |||||

| US82650BAA44 / Sierra Timeshare 2023-2 Receivables Funding LLC | 0,66 | -10,84 | 0,0473 | -0,0073 | |||||

| V1MC34 / Vulcan Materials Company - Depositary Receipt (Common Stock) | 0,66 | -13,76 | 0,0473 | -0,0091 | |||||

| US690742AG60 / Owens Corning | 0,66 | -14,32 | 0,0473 | -0,0095 | |||||

| H / Hyatt Hotels Corporation | 0,65 | -13,83 | 0,0470 | -0,0092 | |||||

| XS2066744231 / Carnival PLC | 0,65 | 3,65 | 0,0470 | 0,0003 | |||||

| US05377RDY71 / AESOP_20-2A | 0,65 | 0,77 | 0,0469 | -0,0010 | |||||

| US785592AU04 / Sabine Pass Liquefaction LLC | 0,65 | -14,08 | 0,0465 | -0,0092 | |||||

| U.S. Treasury Bonds / DBT (US912810UJ50) | 0,65 | -1,98 | 0,0464 | -0,0023 | |||||

| US007903BF39 / Advanced Micro Devices Inc | 0,64 | -13,32 | 0,0463 | -0,0087 | |||||

| I1RP34 / Trane Technologies plc - Depositary Receipt (Common Stock) | 0,64 | -13,46 | 0,0462 | -0,0087 | |||||

| US91324PEX69 / UnitedHealth Group Inc | 0,64 | -15,62 | 0,0462 | -0,0101 | |||||

| PXTJ / Petroleos Mexicanos | 0,64 | 4,06 | 0,0461 | 0,0005 | |||||

| NBIX / Neurocrine Biosciences, Inc. | 0,01 | -1,52 | 0,64 | 11,80 | 0,0457 | 0,0037 | |||

| US61762TAH95 / Morgan Stanley Bank of America Merrill Lynch Trust 2013-C11 | 0,63 | -1,11 | 0,0450 | -0,0018 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 0,63 | -13,55 | 0,0449 | -0,0086 | |||||

| Sitios Latinoamerica SAB de CV / DBT (US82983PAA12) | 0,62 | 1,13 | 0,0448 | -0,0009 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAR33) | 0,62 | 2,64 | 0,0448 | -0,0002 | |||||

| US21871XAS80 / Corebridge Financial Inc | 0,62 | -13,49 | 0,0447 | -0,0085 | |||||

| US031162DS61 / Amgen Inc | 0,62 | -14,46 | 0,0442 | -0,0090 | |||||

| US67077MBA53 / Nutrien Ltd | 0,61 | -14,19 | 0,0439 | -0,0088 | |||||

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust / DBT (US00774MBM64) | 0,59 | 1,74 | 0,0422 | -0,0005 | |||||

| US67091TAA34 / OCP SA | 0,59 | 1,04 | 0,0420 | -0,0008 | |||||

| ETR / Entergy Corporation | 0,01 | -1,53 | 0,58 | -4,27 | 0,0419 | -0,0031 | |||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0,58 | 1,23 | 0,0416 | -0,0007 | |||||

| US71654QDC33 / Petroleos Mexicanos | 0,58 | 5,70 | 0,0414 | 0,0011 | |||||

| US78081BAK98 / Royalty Pharma PLC | 0,58 | -12,48 | 0,0413 | -0,0073 | |||||

| Amrize Finance U.S. LLC / DBT (US43475RAD89) | 0,57 | 0,0410 | 0,0410 | ||||||

| US62848PAA84 / MVW LLC | 0,57 | -9,11 | 0,0409 | -0,0054 | |||||

| US369604BH58 / General Electric Co | 0,57 | -13,92 | 0,0409 | -0,0080 | |||||

| NRG / NRG Energy, Inc. | 0,00 | -1,50 | 0,57 | 65,60 | 0,0408 | 0,0155 | |||

| US74762EAF97 / Quanta Services Inc | 0,57 | -12,63 | 0,0408 | -0,0072 | |||||

| US716973AF98 / PFIZER INVESTMENT ENTERPRISES PTE LTD | 0,56 | -14,55 | 0,0406 | -0,0083 | |||||

| Georgia-Pacific LLC / DBT (US37331NAT81) | 0,56 | 0,0403 | 0,0403 | ||||||

| ZF North America Capital, Inc. / DBT (US98877DAG07) | 0,55 | -0,36 | 0,0398 | -0,0013 | |||||

| CAH / Cardinal Health, Inc. - Depositary Receipt (Common Stock) | 0,55 | -13,39 | 0,0395 | -0,0074 | |||||

| SYY / Sysco Corporation - Depositary Receipt (Common Stock) | 0,55 | -13,56 | 0,0394 | -0,0075 | |||||

| Hess Midstream Operations LP / DBT (US428102AG28) | 0,55 | 1,11 | 0,0392 | -0,0007 | |||||

| US432917AA05 / Hilton Grand Vacations Trust, Series 2023-1A, Class A | 0,54 | -11,42 | 0,0391 | -0,0063 | |||||

| US64828MAA53 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2017-3 NRZT 2017-3A A1 | 0,54 | -3,74 | 0,0389 | -0,0027 | |||||

| US90932QAA40 / United Airlines 2014-2 Class A Pass Through Trust | 0,54 | -8,19 | 0,0387 | -0,0047 | |||||

| Corp. Financiera de Desarrollo SA / DBT (US21987DAH70) | 0,54 | 0,0387 | 0,0387 | ||||||

| US020002BK68 / Allstate Corp/The | 0,54 | -13,69 | 0,0385 | -0,0074 | |||||

| US87264ABF12 / CORP. NOTE | 0,53 | -13,45 | 0,0384 | -0,0073 | |||||

| US166756AS52 / Chevron USA Inc | 0,53 | -13,33 | 0,0383 | -0,0072 | |||||

| US698299BF03 / Panama Government International Bond | 0,53 | 2,12 | 0,0382 | -0,0004 | |||||

| MKLC34 / Markel Group Inc. - Depositary Receipt (Common Stock) | 0,53 | -14,98 | 0,0379 | -0,0080 | |||||

| US00109LAA17 / ADT Security Corp. | 0,53 | -53,12 | 0,0378 | -0,0451 | |||||

| Greensaif Pipelines Bidco SARL / DBT (US39541EAD58) | 0,52 | 0,00 | 0,0375 | -0,0012 | |||||

| UPSS34 / United Parcel Service, Inc. - Depositary Receipt (Common Stock) | 0,52 | 0,0373 | 0,0373 | ||||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 0,52 | 0,0372 | 0,0372 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0,51 | -14,21 | 0,0369 | -0,0074 | |||||

| K1RC34 / The Kroger Co. - Depositary Receipt (Common Stock) | 0,51 | -13,24 | 0,0367 | -0,0068 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,51 | -6,08 | 0,0367 | 0,0009 | |||||

| US195325DS19 / Colombia Government International Bond | 0,50 | 1,61 | 0,0362 | -0,0005 | |||||

| GXO / GXO Logistics, Inc. | 0,50 | -12,65 | 0,0362 | -0,0065 | |||||

| US05369AAK79 / Aviation Capital Group LLC | 0,49 | -14,11 | 0,0354 | -0,0070 | |||||

| US29273RAT68 / Energy Transfer Operating LP | 0,49 | -15,92 | 0,0353 | -0,0079 | |||||

| C1DN34 / Cadence Design Systems, Inc. - Depositary Receipt (Common Stock) | 0,49 | -13,40 | 0,0353 | -0,0067 | |||||

| US125523CL22 / Cigna Corp | 0,49 | -13,12 | 0,0352 | -0,0065 | |||||

| US50540RAW25 / Laboratory Corp. of America Holdings | 0,48 | -13,22 | 0,0344 | -0,0064 | |||||

| US00217GAB95 / Aptiv PLC / Aptiv Corp | 0,48 | -12,01 | 0,0342 | -0,0059 | |||||

| US05401AAK79 / Avolon Holdings Funding Ltd | 0,47 | -14,77 | 0,0340 | -0,0070 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,47 | -13,92 | 0,0338 | -0,0066 | |||||

| US501889AF63 / LKQ Corp | 0,47 | -13,38 | 0,0335 | -0,0063 | |||||

| US89180YAA82 / Towd Point Mortgage Trust 2022-4 | 0,45 | -2,59 | 0,0325 | -0,0018 | |||||

| US68389XBZ78 / Oracle Corp | 0,45 | -13,29 | 0,0324 | -0,0060 | |||||

| US29273RAZ29 / Energy Transfer Operating LP | 0,45 | -16,23 | 0,0323 | -0,0074 | |||||

| Eaton Capital ULC / DBT (US27806HAA95) | 0,45 | 0,0322 | 0,0322 | ||||||

| US822582BX94 / Shell International Finance BV | 0,44 | -13,95 | 0,0319 | -0,0063 | |||||

| BAX / Baxter International Inc. | 0,01 | -1,52 | 0,44 | -12,97 | 0,0319 | -0,0058 | |||

| US29273VAP58 / Energy Transfer LP | 0,44 | -14,20 | 0,0317 | -0,0063 | |||||

| CRWD / CrowdStrike Holdings, Inc. | 0,00 | 0,44 | 0,0316 | 0,0316 | |||||

| GM / General Motors Company - Depositary Receipt (Common Stock) | 0,44 | 0,0315 | 0,0315 | ||||||

| Sierra Timeshare Receivables Funding LLC / ABS-O (US826935AA63) | 0,44 | -12,75 | 0,0315 | -0,0057 | |||||

| A2RW34 / Arrow Electronics, Inc. - Depositary Receipt (Common Stock) | 0,44 | -12,80 | 0,0314 | -0,0057 | |||||

| US832696AY47 / J M Smucker Co/The | 0,44 | -15,67 | 0,0313 | -0,0069 | |||||

| US482480AJ99 / KLA CORP REGD 3.30000000 | 0,43 | -14,60 | 0,0312 | -0,0063 | |||||

| US12661PAD15 / CSL UK Holdings Ltd | 0,43 | -15,49 | 0,0310 | -0,0068 | |||||

| US55261FAS39 / M&T Bank Corp | 0,43 | -14,17 | 0,0309 | -0,0061 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0,43 | -14,26 | 0,0307 | -0,0061 | |||||

| LPL Holdings, Inc. / DBT (US50212YAJ38) | 0,43 | -14,63 | 0,0307 | -0,0063 | |||||

| US89788MAQ50 / Truist Financial Corp | 0,43 | -14,46 | 0,0306 | -0,0062 | |||||

| US912810TB44 / T 1 7/8 11/15/51 | 0,43 | -2,74 | 0,0306 | -0,0018 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 0,42 | 2,18 | 0,0303 | -0,0003 | |||||

| US64830GAB23 / New Residential Mortgage Loan Trust 2018-1 | 0,42 | -3,90 | 0,0301 | -0,0022 | |||||

| US17327CAR43 / Citigroup Inc | 0,42 | -12,76 | 0,0300 | -0,0054 | |||||

| US096630AH15 / Boardwalk Pipelines LP | 0,41 | -13,45 | 0,0297 | -0,0056 | |||||

| AIG / American International Group, Inc. - Depositary Receipt (Common Stock) | 0,41 | 0,0295 | 0,0295 | ||||||

| US62954HAY45 / NXP BV / NXP Funding LLC / NXP USA Inc | 0,41 | 1,75 | 0,0294 | -0,0003 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,41 | -13,62 | 0,0292 | -0,0056 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0,40 | 3,59 | 0,0291 | 0,0002 | |||||

| US71654QCB68 / Petroleos Mexicanos | 0,40 | 0,76 | 0,0287 | -0,0006 | |||||

| US369604BF92 / General Electric 4.125% 10/09/42 | 0,40 | -15,96 | 0,0284 | -0,0063 | |||||

| US64829NAA28 / New Residential Mortgage Loan Trust 2017-4 | 0,39 | -3,69 | 0,0281 | -0,0019 | |||||

| Fortitude Group Holdings LLC / DBT (US34966XAA63) | 0,39 | -13,00 | 0,0279 | -0,0051 | |||||

| US3137BLMZ80 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,39 | -85,87 | 0,0277 | -0,1739 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 0,38 | -13,86 | 0,0272 | -0,0053 | |||||

| WDC / Western Digital Corporation | 0,01 | -1,52 | 0,38 | 55,79 | 0,0271 | 0,0092 | |||

| Hilton Grand Vacations Trust / ABS-O (US43283JAA43) | 0,37 | -9,00 | 0,0269 | -0,0035 | |||||

| Ashtead Capital, Inc. / DBT (US045054AS24) | 0,37 | 1,91 | 0,0269 | -0,0003 | |||||

| US63946BAJ98 / NBCUniversal Media LLC | 0,37 | -14,65 | 0,0269 | -0,0055 | |||||

| US3140J6EV59 / Fannie Mae Pool | 0,36 | -2,93 | 0,0262 | -0,0016 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0,36 | -14,22 | 0,0261 | -0,0051 | |||||

| US62954HAN89 / NXP BV / NXP Funding LLC / NXP USA Inc | 0,36 | 0,00 | 0,0260 | -0,0008 | |||||

| US64829JAA16 / New Residential Mortgage Loan Trust 2017-1 | 0,36 | -3,74 | 0,0259 | -0,0018 | |||||

| US161175BT05 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0,36 | -9,11 | 0,0258 | -0,0034 | |||||

| Hilton Grand Vacations Trust / ABS-O (US43283YAA10) | 0,36 | -15,00 | 0,0257 | -0,0054 | |||||

| US64829KBV17 / New Residential Mortgage Loan Trust 2017-2 | 0,35 | -4,07 | 0,0254 | -0,0019 | |||||

| US22003BAL09 / Corporate Office Properties LP | 0,35 | -14,11 | 0,0254 | -0,0050 | |||||

| US031162DA53 / AMGEN INC 2.8% 08/15/2041 | 0,35 | -13,94 | 0,0253 | -0,0050 | |||||

| OBX Trust / ABS-MBS (US67448NAA63) | 0,34 | -8,27 | 0,0247 | -0,0030 | |||||

| K1SG34 / Keysight Technologies, Inc. - Depositary Receipt (Common Stock) | 0,34 | -13,52 | 0,0244 | -0,0047 | |||||

| F2IC34 / Fair Isaac Corporation - Depositary Receipt (Common Stock) | 0,34 | 0,0243 | 0,0243 | ||||||

| W1HR34 / Whirlpool Corporation - Depositary Receipt (Common Stock) | 0,34 | 0,0243 | 0,0243 | ||||||

| US92556VAC00 / CORP. NOTE | 0,34 | -13,37 | 0,0242 | -0,0046 | |||||

| US023765AA88 / American Airlines 2016-2 Class AA Pass Through Trust | 0,34 | -17,24 | 0,0242 | -0,0059 | |||||

| EQT / EQT Corporation | 0,34 | 0,0241 | 0,0241 | ||||||

| WEX / WEX Inc. | 0,00 | -2,69 | 0,33 | -8,99 | 0,0240 | -0,0031 | |||

| US89173UAA51 / Towd Point Mortgage Trust 2017-4 | 0,33 | -10,33 | 0,0237 | -0,0035 | |||||

| US826943AA06 / Sierra Timeshare 2023-1 Receivables Funding LLC | 0,33 | -10,60 | 0,0236 | -0,0036 | |||||

| US808513CE32 / Charles Schwab Corp/The | 0,32 | -80,58 | 0,0230 | -0,0986 | |||||

| US82652QAA94 / Sierra Timeshare Receivables Funding LLC | 0,32 | -10,39 | 0,0229 | -0,0034 | |||||

| US46124HAH93 / Intuit Inc | 0,32 | -14,75 | 0,0229 | -0,0047 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0,32 | -15,47 | 0,0228 | -0,0049 | |||||

| BK / The Bank of New York Mellon Corporation - Depositary Receipt (Common Stock) | 0,31 | -14,21 | 0,0226 | -0,0045 | |||||

| US126650DX53 / CVS Health Corp | 0,31 | -14,05 | 0,0225 | -0,0044 | |||||

| US64829LAA61 / New Residential Mortgage Loan Trust 2016-4 | 0,31 | -2,54 | 0,0221 | -0,0012 | |||||

| Health Care Service Corp. A Mutual Legal Reserve Co. / DBT (US42218SAM08) | 0,30 | -15,36 | 0,0218 | -0,0046 | |||||

| US58933YBM66 / MERCK & CO INC | 0,30 | -14,93 | 0,0217 | -0,0045 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 0,30 | 0,0215 | 0,0215 | ||||||

| ZBH / Zimmer Biomet Holdings, Inc. | 0,00 | 0,30 | 0,0215 | 0,0215 | |||||

| ARE / Alexandria Real Estate Equities, Inc. | 0,00 | -1,53 | 0,30 | -22,80 | 0,0214 | -0,0071 | |||

| US045054AQ67 / Ashtead Capital Inc | 0,30 | 2,07 | 0,0213 | -0,0002 | |||||

| US3137FCJK14 / FHMS K070 A2 (MF) 3.303% 11-25-27 | 0,29 | 0,68 | 0,0212 | -0,0005 | |||||

| BRO / Brown & Brown, Inc. | 0,29 | 0,0208 | 0,0208 | ||||||

| Q1UA34 / Quanta Services, Inc. - Depositary Receipt (Common Stock) | 0,29 | -12,69 | 0,0208 | -0,0037 | |||||

| US747525BJ18 / QUALCOMM Inc | 0,28 | -15,22 | 0,0204 | -0,0043 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 0,27 | -13,02 | 0,0197 | -0,0036 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,27 | -13,33 | 0,0197 | -0,0036 | |||||

| Future / DE (000000000) | 0,27 | 0,0191 | 0,0191 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0,26 | 1,95 | 0,0189 | -0,0002 | |||||

| US64828YAR27 / New Residential Mortgage Loan Trust 2014-2 | 0,26 | -2,61 | 0,0188 | -0,0011 | |||||

| US89175JAA88 / TOWD POINT MORTGAGE TRUST | 0,26 | -9,41 | 0,0187 | -0,0026 | |||||

| US01400EAF07 / ALCON FINANCE CORP | 0,26 | 0,00 | 0,0187 | -0,0006 | |||||

| US31416CCW47 / Fannie Mae Pool | 0,26 | -4,49 | 0,0184 | -0,0014 | |||||

| GMZB / Ally Financial Inc. - Preferred Stock | 0,25 | 0,0181 | 0,0181 | ||||||

| US20030NDU28 / Comcast Corp | 0,24 | -14,49 | 0,0174 | -0,0036 | |||||

| US64829HAD98 / New Residential Mortgage Loan Trust 2016-3 | 0,24 | -2,87 | 0,0171 | -0,0010 | |||||

| Amrize Finance U.S. LLC / DBT (US43475RAK23) | 0,24 | 0,0169 | 0,0169 | ||||||

| Citadel LP / DBT (US17288XAD66) | 0,23 | -13,43 | 0,0167 | -0,0031 | |||||

| US64829VAA44 / New Residential Mortgage Loan Trust 2018-RPL1 | 0,23 | -4,13 | 0,0167 | -0,0013 | |||||

| US37045VAF76 / General Motors Co | 0,22 | -12,65 | 0,0159 | -0,0028 | |||||

| US02364WBE49 / America Movil S.a.b De C.v 4.375% 07/16/42 | 0,21 | 0,48 | 0,0151 | -0,0004 | |||||

| RNR / RenaissanceRe Holdings Ltd. | 0,21 | -58,61 | 0,0151 | -0,0223 | |||||

| US22788CAA36 / CROWDSTRIKE HOLDINGS INC 3% 02/15/2029 | 0,21 | 2,46 | 0,0150 | -0,0000 | |||||

| US3138Y3DW89 / Fannie Mae Pool | 0,19 | -5,94 | 0,0137 | -0,0013 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0,18 | 3,41 | 0,0131 | 0,0001 | |||||

| US46616MAA80 / HENDR_10-3A | 0,18 | -13,88 | 0,0129 | -0,0026 | |||||

| US00439KAA43 / Accelerated 2021-1H LLC | 0,17 | -8,42 | 0,0126 | -0,0015 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0,14 | -13,77 | 0,0104 | -0,0020 | |||||

| US64829GAA76 / New Residential Mortgage Loan Trust 2016-2 | 0,14 | -4,05 | 0,0103 | -0,0007 | |||||

| US3128K83G92 / Freddie Mac Gold Pool | 0,14 | -2,08 | 0,0101 | -0,0005 | |||||

| Albertsons Cos., Inc./Safeway, Inc./New Albertsons LP/Albertsons LLC / DBT (US01309QAB41) | 0,14 | 2,94 | 0,0101 | -0,0000 | |||||

| US64829EAA29 / New Residential Mortgage Loan Trust REMIC | 0,14 | -3,57 | 0,0097 | -0,0006 | |||||

| US36962G3P70 / General Electric Capital 5.875% Senior Notes 1/14/38 | 0,13 | -12,99 | 0,0097 | -0,0018 | |||||

| US89176EAA82 / Towd Point Mortgage Trust 2018-1 | 0,13 | -18,12 | 0,0095 | -0,0024 | |||||

| US55389TAA97 / MVW 2021-1W LLC | 0,13 | -7,75 | 0,0094 | -0,0011 | |||||

| US88576XAA46 / 321 Henderson Receivables VI LLC | 0,13 | -9,66 | 0,0094 | -0,0014 | |||||

| US71654QDD16 / Petroleos Mexicanos | 0,13 | 5,69 | 0,0094 | 0,0002 | |||||

| Shell Finance U.S., Inc. / DBT (US822905AH87) | 0,13 | -14,57 | 0,0093 | -0,0019 | |||||

| US125896BN95 / CMS Energy Corp. | 0,13 | -7,19 | 0,0093 | -0,0010 | |||||

| US570535AT11 / Markel Corp | 0,12 | -14,79 | 0,0088 | -0,0018 | |||||

| US17326QAA13 / Citigroup Mortgage Loan Trust Inc | 0,12 | -13,97 | 0,0084 | -0,0016 | |||||

| US31417SBN99 / Fannie Mae Pool | 0,12 | -1,71 | 0,0083 | -0,0004 | |||||

| US31418MWM09 / Fannie Mae Pool | 0,11 | -2,59 | 0,0082 | -0,0005 | |||||

| US22003BAN64 / Corporate Office Properties LP | 0,09 | -13,00 | 0,0063 | -0,0012 | |||||

| US186108CE42 / Cleveland Electric Illuminating 5.95% Senior Notes 12/15/36 | 0,08 | -6,67 | 0,0061 | -0,0007 | |||||

| US96950FAN42 / WILLIAMS COMPANIES INC SR UNSECURED 03/44 5.4 | 0,08 | -15,38 | 0,0055 | -0,0012 | |||||

| US63861HAA68 / Nationstar Mortgage Loan Trust 2013-A | 0,07 | -2,67 | 0,0053 | -0,0003 | |||||

| US64829DAG16 / New Residential Mortgage Loan Trust REMIC | 0,07 | -2,74 | 0,0052 | -0,0003 | |||||

| US64828AAA16 / New Residential Mortgage Loan Trust 2014-1 | 0,07 | -4,17 | 0,0050 | -0,0003 | |||||

| US31416TL560 / Fannie Mae Pool | 0,06 | -3,03 | 0,0046 | -0,0003 | |||||

| US3138EHAQ53 / Fannie Mae Pool | 0,05 | -1,89 | 0,0038 | -0,0002 | |||||

| US68233JAS33 / Oncor Electric Delivery Co LLC | 0,05 | -9,09 | 0,0036 | -0,0005 | |||||

| US31417MLN10 / Fannie Mae Pool | 0,05 | -1,96 | 0,0036 | -0,0002 | |||||

| US912810SC36 / United States Treas Bds Bond | 0,05 | -2,08 | 0,0034 | -0,0002 | |||||

| US626207YF57 / MUNI ELEC AUTH OF GEORGIA | 0,05 | -4,08 | 0,0034 | -0,0002 | |||||

| US31416CH580 / Fannie Mae Pool | 0,05 | -2,17 | 0,0033 | -0,0001 | |||||

| US3138EH3N08 / Fannie Mae Pool | 0,04 | -2,22 | 0,0032 | -0,0002 | |||||

| US59166EAB11 / METLIFE SECURITIZATION TRUST 2019-1 | 0,04 | -11,36 | 0,0028 | -0,0005 | |||||

| US3138EJEX25 / Fannie Mae Pool | 0,04 | -2,56 | 0,0028 | -0,0002 | |||||

| US3138ELS795 / Fannie Mae Pool | 0,04 | -2,70 | 0,0027 | -0,0001 | |||||

| US3128M9WN87 / Freddie Mac Gold Pool | 0,03 | -2,86 | 0,0025 | -0,0001 | |||||

| US31410DUT52 / Fannie Mae Pool | 0,03 | -2,86 | 0,0025 | -0,0001 | |||||

| US25150MAC01 / Deutsche Alt-A Securities Mortgage Loan Trust Series 2007-RAMP1 | 0,03 | 0,00 | 0,0024 | -0,0001 | |||||

| US31418MY630 / FNMA 6.00% 1/40 #AD0732 | 0,03 | -5,88 | 0,0024 | -0,0002 | |||||

| US31416BMP03 / Fannie Mae Pool | 0,02 | -4,17 | 0,0017 | -0,0001 | |||||

| US3138XKSX31 / Fannie Mae Pool | 0,02 | -10,00 | 0,0013 | -0,0002 | |||||

| US3138EL6E81 / UMBS, 15 Year | 0,02 | -10,00 | 0,0013 | -0,0002 | |||||

| US3138EKTR64 / Fannie Mae Pool | 0,02 | -5,56 | 0,0013 | -0,0001 | |||||

| US3138X4KV17 / Fannie Mae Pool | 0,02 | -15,00 | 0,0013 | -0,0003 | |||||

| US3128LCHR04 / Freddie Mac Gold Pool | 0,01 | 0,00 | 0,0010 | -0,0001 | |||||

| US31414KDN72 / Fannie Mae Pool | 0,01 | 0,00 | 0,0010 | -0,0000 | |||||

| US3128M7FP62 / Freddie Mac Gold Pool | 0,01 | -9,09 | 0,0008 | -0,0000 | |||||

| US3138ELS878 / Fannie Mae Pool | 0,01 | 0,00 | 0,0006 | -0,0000 | |||||

| US3138A5V664 / Fannie Mae Pool | 0,01 | 0,00 | 0,0005 | -0,0000 | |||||

| US31416AWL06 / Fannie Mae Pool | 0,01 | 0,00 | 0,0005 | -0,0000 | |||||

| US31410G4B62 / Fannie Mae Pool | 0,01 | 0,00 | 0,0004 | -0,0000 | |||||

| US31411LXD80 / Fannie Mae Pool | 0,01 | 0,00 | 0,0004 | -0,0000 | |||||

| US31410KXL33 / Fannie Mae Pool | 0,01 | -16,67 | 0,0004 | -0,0000 | |||||

| US3138ELMZ37 / Fannie Mae Pool | 0,01 | -16,67 | 0,0004 | -0,0001 | |||||

| US31410KFF66 / Fannie Mae Pool | 0,01 | 0,00 | 0,0004 | -0,0000 | |||||

| US31419A4H78 / Fannie Mae Pool | 0,00 | 0,00 | 0,0003 | -0,0000 | |||||

| US38378BM710 / Ginnie Mae | 0,00 | 0,00 | 0,0003 | -0,0000 | |||||

| US31410K3K80 / Fannie Mae Pool | 0,00 | 0,00 | 0,0002 | -0,0000 | |||||

| US31410K3E21 / Fannie Mae Pool | 0,00 | 0,00 | 0,0002 | -0,0000 | |||||

| US31410KHE73 / Fannie Mae Pool | 0,00 | 0,00 | 0,0002 | -0,0000 | |||||

| US3138EJCD88 / Fannie Mae Pool | 0,00 | -100,00 | 0,0001 | -0,0001 | |||||

| US31418XDE58 / Fannie Mae Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| SNDK / Sandisk Corporation | 0,00 | -100,00 | 0,00 | -100,00 | -0,0070 | ||||

| MRVL / Marvell Technology, Inc. | 0,00 | -100,00 | 0,00 | -100,00 | -0,0259 |